The global cashew powder market is experiencing robust growth, driven by rising demand for plant-based protein sources, clean-label ingredients, and convenience foods. According to Grand View Research, the global cashew market size was valued at USD 5.8 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.2% from 2023 to 2030, with increasing applications in food processing, confectionery, and dairy alternatives propelling demand for value-added products like cashew powder. Similarly, Mordor Intelligence projects steady growth in nut-based ingredient markets, citing health consciousness and the surge in vegan and gluten-free diets as key drivers. As manufacturers scale production and enhance processing technologies to meet quality and sustainability standards, the competitive landscape has intensified. Based on production capacity, certifications, export footprint, and industry reputation, we profile the top 9 cashew powder manufacturers leading innovation and supply in this expanding market.

Top 9 Cashew Powder Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 China Cashew Nut Powder Manufacturers Suppliers Factory

Domain Est. 2022

Website: xatihealth.com

Key Highlights: We’re professional cashew nut powder manufacturers and suppliers in China. Please rest assured to wholesale bulk cashew nut powder in stock here from our ……

#2 Cashew Co., LTD.

Website: cashew.co.jp

Key Highlights: Cashew strives to be an innovative company that is in harmony with society by addressing various challenges and promoting group corporate activities….

#3 Affordable Cashew Nuts and Cashew Powder from Panruti …

Website: rrcashews.com

Key Highlights: KSL Cashews is a renowned manufacturer, supplier, and trader based in Panruti, Tamil Nadu, India. Specializing in high quality Cashews Powder and Cashews Nut….

#4 Kerala Cashew Products

Domain Est. 2005

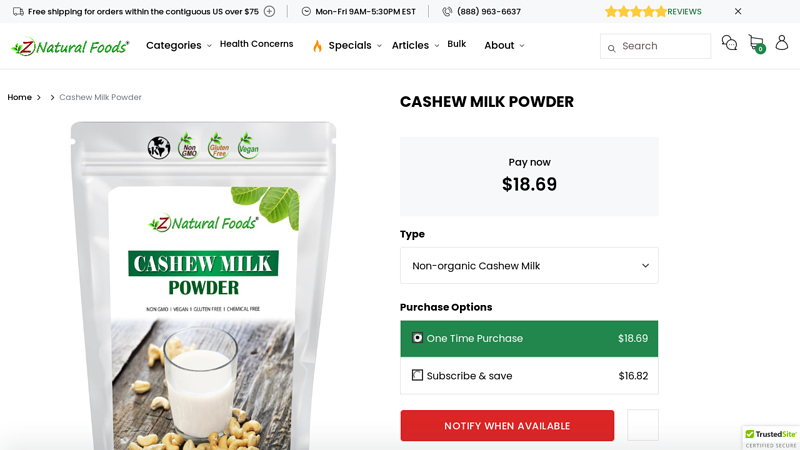

#5 Cashew Milk Powder

Domain Est. 2008

Website: znaturalfoods.com

Key Highlights: In stock Rating 4.8 24 Cashew Milk Powder is a dairy-free alternative made from finely ground cashew nuts, offering a naturally creamy texture and mild, nutty flavor….

#6 Cashew Exporters Kollam

Domain Est. 2009

Website: kailascashew.com

Key Highlights: Sale Products · Proper Pepper · World Favourite Plain · Dry Roast Cashew · Chilly & Garlic Cashew · High Honey · Royally Roasted Cashew · All Products….

#7 TRV Cashews

Domain Est. 2013 | Founded: 1952

Website: trvcashews.com

Key Highlights: WE TRV CASHEWS COMPANY. Since 1952. We Have More Than 9 Branches In All Over IndiaIn 1952, our company was commenced at the hands of T.R. Venkatachalam ……

#8 Bulk Cashew Powder Supplier

Domain Est. 2016

Website: jeevaorganic.com

Key Highlights: Rating 4.5 (89) Shop our Cashew powder with all certificates at the most affordable price in bulk. Visit us now to know more….

#9 Bulk Organic Cashew Flour

Domain Est. 2018

Website: beyondthenut.com

Key Highlights: Free deliveryCashew flour allows for baking and thickening like traditional flour while also adding nutritional benefits not present in the typical bag of white all-purpose ……

Expert Sourcing Insights for Cashew Powder

H2: 2026 Market Trends for Cashew Powder

The global cashew powder market is poised for significant growth and transformation by 2026, driven by shifting consumer preferences, advancements in food processing technologies, and expanding applications across industries. As a nutrient-dense, plant-based ingredient, cashew powder is gaining traction beyond traditional culinary uses, positioning itself as a key player in the health and wellness and clean-label food movements.

-

Rising Demand for Plant-Based and Allergen-Friendly Ingredients

Cashew powder is increasingly favored in plant-based diets due to its creamy texture, high protein and healthy fat content, and hypoallergenic properties (especially compared to dairy and some nuts like peanuts). With the plant-based food market projected to grow steadily through 2026, cashew powder is being adopted in dairy alternatives such as non-dairy cheeses, yogurts, and milk. Its neutral flavor profile allows for versatility in both sweet and savory applications, making it ideal for clean-label formulations. -

Expansion in Functional Food and Nutraceutical Applications

By 2026, cashew powder is expected to see increased use in functional foods and dietary supplements. Rich in magnesium, copper, antioxidants, and monounsaturated fats, it aligns with consumer demand for natural ingredients that support heart health, immunity, and energy metabolism. Manufacturers are likely to fortify health bars, protein powders, and infant nutrition products with cashew powder to enhance nutritional profiles without artificial additives. -

Growth in Emerging Markets and Supply Chain Developments

West Africa and South Asia—key cashew-producing regions—are investing in local processing infrastructure to move beyond raw nut exports. This shift enables higher-value production of cashew powder, reducing dependency on international processors and improving profit margins for local economies. Countries like Côte d’Ivoire, India, and Vietnam are expected to increase domestic processing capacity, thereby stabilizing supply and reducing costs by 2026. -

Sustainability and Ethical Sourcing as Market Drivers

Consumers and retailers are placing greater emphasis on sustainability and ethical sourcing. By 2026, traceability, fair labor practices, and eco-friendly processing will be critical for brand differentiation. Companies offering certified organic, non-GMO, and fair-trade cashew powder are likely to capture premium market segments, particularly in North America and Europe. -

Innovation in Product Formats and Applications

Innovations such as micronized cashew powder, spray-dried variants, and blends with other plant proteins (e.g., pea or almond) are expected to emerge, enhancing solubility and functionality in beverages and baked goods. Additionally, the gluten-free and keto diet trends will continue to boost demand for cashew powder as a low-carb flour alternative in gluten-free baking and paleo recipes. -

Competitive Landscape and Market Consolidation

The market may witness consolidation among processors and increased partnerships between cashew suppliers and food tech companies. Major food ingredient suppliers are anticipated to expand their plant-based portfolios to include specialized cashew powder grades tailored for specific applications—such as instant thickeners or emulsifiers—further driving industrial adoption.

In summary, by 2026, the cashew powder market will be shaped by health consciousness, sustainability, and innovation. Its role as a versatile, nutritious, and clean-label ingredient positions it for sustained growth across food, beverage, and supplement sectors worldwide.

Common Pitfalls Sourcing Cashew Powder (Quality, IP)

Sourcing cashew powder involves navigating several critical quality and intellectual property (IP) challenges. Overlooking these pitfalls can lead to product inconsistency, regulatory issues, reputational damage, and legal risks.

Poor or Inconsistent Quality

One of the most frequent issues is receiving cashew powder that fails to meet required quality standards. This includes variations in color, particle size, moisture content, and the presence of contaminants like aflatoxins, pathogens (e.g., Salmonella), or foreign matter. Inconsistent sourcing from different batches or suppliers can lead to formulation instability in end products.

Adulteration and Substitution

Cashew powder is sometimes adulterated with cheaper fillers such as cassava, cornstarch, or peanut flour—especially in regions with less stringent oversight. This not only compromises product quality and nutritional value but poses serious allergen risks, particularly for consumers with peanut allergies.

Lack of Traceability and Origin Verification

Without proper traceability, it becomes difficult to verify the geographic origin of the cashews. This undermines quality assurance, as cashews from different regions (e.g., Vietnam, India, Ivory Coast) vary in flavor, oil content, and suitability for powdering. It also increases the risk of sourcing from regions with poor labor practices or unsustainable farming.

Insufficient Food Safety and Processing Standards

Many suppliers may lack certifications such as HACCP, ISO 22000, FSSC 22000, or organic certifications. Poor processing conditions—such as inadequate sanitation, improper drying, or cross-contamination—can lead to microbial load issues and shorten shelf life.

Intellectual Property (IP) Risks

Using cashew powder in proprietary formulations (e.g., dairy alternatives, meat substitutes) can expose companies to IP risks if the supplier uses patented processes or if the final product inadvertently infringes on existing patents. Additionally, co-developed formulations with suppliers may lead to disputes over ownership if contracts do not clearly assign IP rights.

Mislabeling and Regulatory Non-Compliance

Suppliers may mislabel the product regarding allergens, organic status, or processing aids. This can result in non-compliance with food regulations in target markets (e.g., FDA, EU regulations), leading to recalls, fines, or market access denial.

Inadequate Packaging and Shelf Life Management

Improper packaging—such as non-barrier materials or insufficient nitrogen flushing—can expose cashew powder to moisture and oxygen, leading to rancidity, clumping, and microbial growth. This reduces shelf life and affects sensory properties.

Unreliable Supply Chain and Scalability

Relying on small or unproven suppliers may result in inconsistent supply volumes, especially during off-seasons. This can disrupt production planning and scalability, particularly for growing brands.

To mitigate these pitfalls, buyers should conduct thorough supplier audits, request third-party lab testing, secure clear contractual terms on quality and IP, and ensure compliance with international food safety standards.

Logistics & Compliance Guide for Cashew Powder

Product Overview

Cashew powder is a finely ground product derived from cashew nuts, commonly used in food processing, confectionery, and culinary applications. It is sensitive to environmental conditions and subject to various food safety and trade regulations due to its organic nature and allergen status.

Classification & HS Code

The Harmonized System (HS) code for cashew powder may vary slightly by country but generally falls under:

HS Code: 1207.99 – “Oil seeds and oleaginous fruits; other than those of heading 1207.10 to 1207.91, including groundnut, sesame, sunflower, safflower, and cashew; other, including waste from their treatment.”

Note: Some countries may classify processed cashew products under 1212 or 2008. Confirm with local customs authorities.

Regulatory Compliance

Food Safety Standards

Cashew powder must comply with food safety regulations in both the exporting and importing countries. Key standards include:

– Codex Alimentarius guidelines for nut products

– FDA (U.S.) – Compliance with 21 CFR Part 117 (Current Good Manufacturing Practice)

– EU Regulation (EC) No 178/2002 – General Food Law, including traceability and labeling

– FSSAI (India) – For products exported from India, adherence to FSSAI standards is mandatory

Allergen Labeling

Cashew is a tree nut and a major allergen. Labeling must comply with local requirements:

– U.S.: Must declare “Contains: Cashews” per the Food Allergen Labeling and Consumer Protection Act (FALCPA)

– EU: Must highlight “Cashew” in the ingredient list per EU Regulation 1169/2011

– Other Markets: Many countries follow Codex or have specific allergen labeling laws – always verify destination requirements

Packaging Requirements

- Use food-grade, moisture-resistant packaging (e.g., multi-wall paper bags with polyethylene lining or vacuum-sealed pouches)

- Ensure protection against contamination, pests, and light exposure

- Include batch numbers, production date, expiration date, and storage instructions on packaging

- For bulk shipments, use sealed containers with desiccants to control humidity

Storage & Handling

- Store in a cool, dry, and well-ventilated area (ideal temperature: 15–20°C; relative humidity <60%)

- Avoid exposure to direct sunlight and strong odors

- Use FIFO (First In, First Out) inventory system to minimize spoilage

- Monitor for rancidity, insect infestation, and microbial growth

Transportation & Logistics

Land, Sea, and Air Freight

- Sea Freight: Most cost-effective for bulk shipments; use dry, ventilated containers

- Air Freight: Suitable for smaller, time-sensitive orders; ensure proper packaging for pressure changes

- Land Transport: Refrigerated or insulated trucks recommended in hot climates

Temperature Control

- Not typically refrigerated, but temperature fluctuations should be minimized to prevent oil separation and rancidity

- Avoid transit through extreme heat or humidity zones when possible

Documentation

Required shipping documents include:

– Commercial Invoice

– Packing List

– Certificate of Origin

– Phytosanitary Certificate (if required by importing country)

– Certificate of Analysis (CoA) – showing moisture content, microbial load, and absence of contaminants

– Fumigation Certificate (if applicable)

Import Requirements by Key Markets

United States

- Prior Notice submission to FDA via the Prior Notice System Interface (PNSI)

- Registration of foreign food facility with FDA

- Compliance with FSMA (Food Safety Modernization Act) preventive controls

European Union

- Notification via TRACES NT (Trade Control and Expert System)

- Registered establishment in an approved country list

- Health certificate may be required for certain consignments

United Kingdom (Post-Brexit)

- Import notification via the Import of Products, Animals, Food and Feed System (IPAFFS)

- Phytosanitary certificate required for non-EU imports

Canada

- Must meet CFIA (Canadian Food Inspection Agency) standards

- Bilingual labeling (English and French) required

Shelf Life & Expiry

- Typical shelf life: 12–18 months when stored properly

- Rotate stock regularly and monitor for off-odors, discoloration, or clumping

Sustainability & Certification (Optional but Recommended)

- Organic certification (e.g., USDA Organic, EU Organic)

- Fair Trade, Rainforest Alliance, or other ethical sourcing certifications

- Non-GMO Project verification (if applicable)

Emergency & Recalls

- Maintain traceability from raw material to finished product (batch tracking)

- Have a recall plan in place aligned with local regulatory requirements

- Report any contamination or safety issues immediately to relevant authorities

Conclusion

Successful logistics and compliance for cashew powder require attention to food safety, proper labeling, allergen declaration, and adherence to international trade regulations. Regular audits, documentation control, and collaboration with certified suppliers and logistics partners are key to ensuring smooth import/export operations.

In conclusion, sourcing cashew powder requires a strategic approach that balances quality, cost, sustainability, and supply chain reliability. It is essential to partner with reputable suppliers who adhere to food safety standards, offer consistent product quality, and provide transparency in their sourcing and processing methods. Factors such as origin, processing technique (roasted vs. raw, fine vs. coarse grind), and packaging play a significant role in determining the suitability of cashew powder for specific applications, whether in food manufacturing, culinary use, or health-focused products.

Additionally, considering ethical sourcing practices, environmental impact, and certifications such as organic, fair trade, or non-GMO can enhance brand value and consumer trust. Conducting thorough due diligence, obtaining samples for testing, and establishing long-term relationships with suppliers contribute to a stable and efficient supply chain. Ultimately, a well-considered sourcing strategy ensures a high-quality cashew powder supply that meets both operational needs and market demands.