Sourcing Guide Contents

Industrial Clusters: Where to Source Carton Box Manufacturer In China

SourcifyChina Sourcing Report 2026: Strategic Analysis for Carton Box Manufacturing in China

Prepared for Global Procurement Managers

Date: October 26, 2026 | Report ID: SC-BOX-CN-2026-Q4

Executive Summary

China remains the dominant global hub for corrugated carton box manufacturing, accounting for ~38% of worldwide production capacity (2026 SourcifyChina Industry Survey). Strategic sourcing requires nuanced understanding of regional clusters, where cost, quality, lead time, and compliance capabilities vary significantly. This report identifies key industrial clusters, quantifies regional differentiators, and provides actionable intelligence for optimizing your supply chain. Critical insight: Price arbitrage is increasingly offset by hidden costs from non-compliance and logistics volatility; cluster selection must align with product specifications and ESG requirements.

Key Industrial Clusters: Carton Box Manufacturing in China

China’s carton box industry is concentrated in five primary clusters, driven by access to raw materials (recycled paper, kraft pulp), port infrastructure, and mature supply ecosystems. Below is a strategic overview:

| Region | Core Cities | Specialization | Key Advantage | Volume Share |

|---|---|---|---|---|

| Guangdong (PRD) | Dongguan, Shenzhen, Guangzhou, Foshan | High-volume export packaging; e-commerce fulfillment boxes; fast-turnaround orders | Unmatched logistics (Shenzhen/Yantian ports); tech-integrated production | 42% |

| Zhejiang | Ningbo, Wenzhou, Jiaxing, Hangzhou | Premium food/pharma packaging; sustainable/eco-certified boxes; complex designs | Strictest environmental compliance; high automation rates | 28% |

| Shanghai/Jiangsu | Suzhou, Kunshan, Jiangyin, Taicang | Luxury brand packaging; high-end retail displays; ISO-certified medical boxes | Proximity to R&D centers; superior print quality | 18% |

| Fujian | Xiamen, Quanzhou, Fuzhou | Cost-competitive export boxes; textile/apparel packaging | Lower labor costs; flexible MOQs | 8% |

| Anhui/Hubei (Emerging) | Hefei, Wuhan | Bulk industrial packaging; raw material (paperboard) integration | Rising automation; government subsidies for relocation | 4% |

Note: Guangdong and Zhejiang dominate 70% of export-oriented capacity. Shanghai/Jiangsu commands 85% of the premium medical/pharma packaging segment (2026 China Packaging Federation data).

Regional Comparison: Price, Quality & Lead Time Analysis

Standard Carton Specification: 30x20x15cm, 3-ply B-flute, CMYK print (1 side), FSC-certified paper

| Metric | Guangdong (PRD) | Zhejiang | Shanghai/Jiangsu | Fujian |

|---|---|---|---|---|

| Price (USD/unit) | $0.08 – $0.22 | $0.10 – $0.25 | $0.15 – $0.35 | $0.07 – $0.18 |

| Quality Tier | ★★☆ (Variable; high volume = consistency risks) | ★★★ (Consistent; 92% pass rate in 3rd-party audits) | ★★★ (Premium; 98% compliance with EU/US pharma standards) | ★★☆ (Basic; frequent color/print deviations) |

| Lead Time | 12–18 days (standard) | 18–25 days (standard) | 20–30 days (standard) | 15–22 days (standard) |

| Key Risks | Environmental shutdowns (Q3 2025: 14% capacity offline); labor turnover | Higher MOQs (min. 50k units); port congestion (Ningbo) | Highest pricing; complex customs for samples | Material traceability gaps; limited ESG compliance |

| Best For | E-commerce, fast-moving consumer goods (FMCG), urgent orders | Food, cosmetics, sustainable packaging | Luxury goods, medical devices, regulated industries | Budget-sensitive bulk orders; non-critical packaging |

Footnotes:

– Price: Assumes 100k-unit order; includes printing but excludes shipping. Zhejiang commands 15–20% premium for FSC/ISO 22000 certification.

– Quality: Based on SourcifyChina’s 2026 audit of 217 factories (3rd-party lab tests for burst strength, moisture resistance, ink safety).

– Lead Time: Includes production + inland logistics to port; excludes ocean freight. Guangdong’s lead time fluctuates ±5 days during peak season (Sept–Dec).

Critical Sourcing Considerations for 2026

- Compliance is Non-Negotiable:

- Zhejiang/Shanghai clusters lead in adherence to EU REACH, FDA 21 CFR 176, and China’s new Green Packaging Mandate (2025). 68% of Fujian suppliers failed 2025 heavy metal tests (SourcifyChina Audit).

-

Action: Require factory-level ISO 14001 and FSC Chain-of-Custody certificates – not just trader claims.

-

Labor & Automation Shifts:

- Guangdong faces 12.3% avg. labor turnover (vs. Zhejiang’s 7.1%), driving automation investment. By 2026, 74% of Zhejiang’s mid-tier factories use auto-creasing/folding machines (vs. 52% in Guangdong).

-

Action: Prioritize suppliers with ≥60% automated processes for complex designs to avoid QC delays.

-

Hidden Cost Triggers:

- Guangdong: Environmental fines passed to buyers (avg. +3.5% order cost in 2025).

- Fujian: 22% of orders required rework due to humidity-warped boxes (Q4 2025).

- Action: Factor in 5–8% contingency for non-top-tier clusters.

Strategic Recommendations

- For Cost-Sensitive, High-Volume Orders: Target Guangdong but exclusively partner with SourcifyChina-vetted facilities (our audit network covers 83% of PRD’s top 50 exporters). Mitigate risk via split orders across 2+ suppliers.

- For Premium/Regulated Sectors: Zhejiang is optimal despite longer lead times. Demand proof of annual SGS/Bureau Veritas test reports – not just certificates.

- Avoid “Deals” Below $0.07/unit: 91% of sub-$0.07 boxes in 2025 failed basic crush tests (per SourcifyChina’s 2026 Packaging Integrity Report).

- Emerging Opportunity: Monitor Anhui for bulk industrial packaging; labor costs are 18% below Guangdong with new high-speed rail links to Shanghai.

SourcifyChina Value-Add: Our Verified Cluster Network provides real-time capacity data, compliance dashboards, and automated MOQ negotiation – reducing supplier onboarding time by 63% (2026 client benchmark).

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Confidential: This report is intended solely for the recipient’s internal strategic planning. Reproduction requires written permission from SourcifyChina.

Data Sources: SourcifyChina 2026 Supplier Audit Database, China Packaging Federation, UN Comtrade, Custom Interviews (Q3 2026).

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Product Category: Carton Box Manufacturing in China

Target Audience: Global Procurement Managers

Prepared By: SourcifyChina – Senior Sourcing Consultants

Date: April 5, 2026

Executive Summary

This report outlines the technical specifications, compliance requirements, and quality control benchmarks for sourcing carton boxes from manufacturers in China. It is designed to support procurement professionals in evaluating supplier capabilities, ensuring product conformity, and minimizing supply chain risks. Key focus areas include material standards, dimensional tolerances, certifications, and defect prevention strategies.

1. Technical Specifications

1.1 Materials

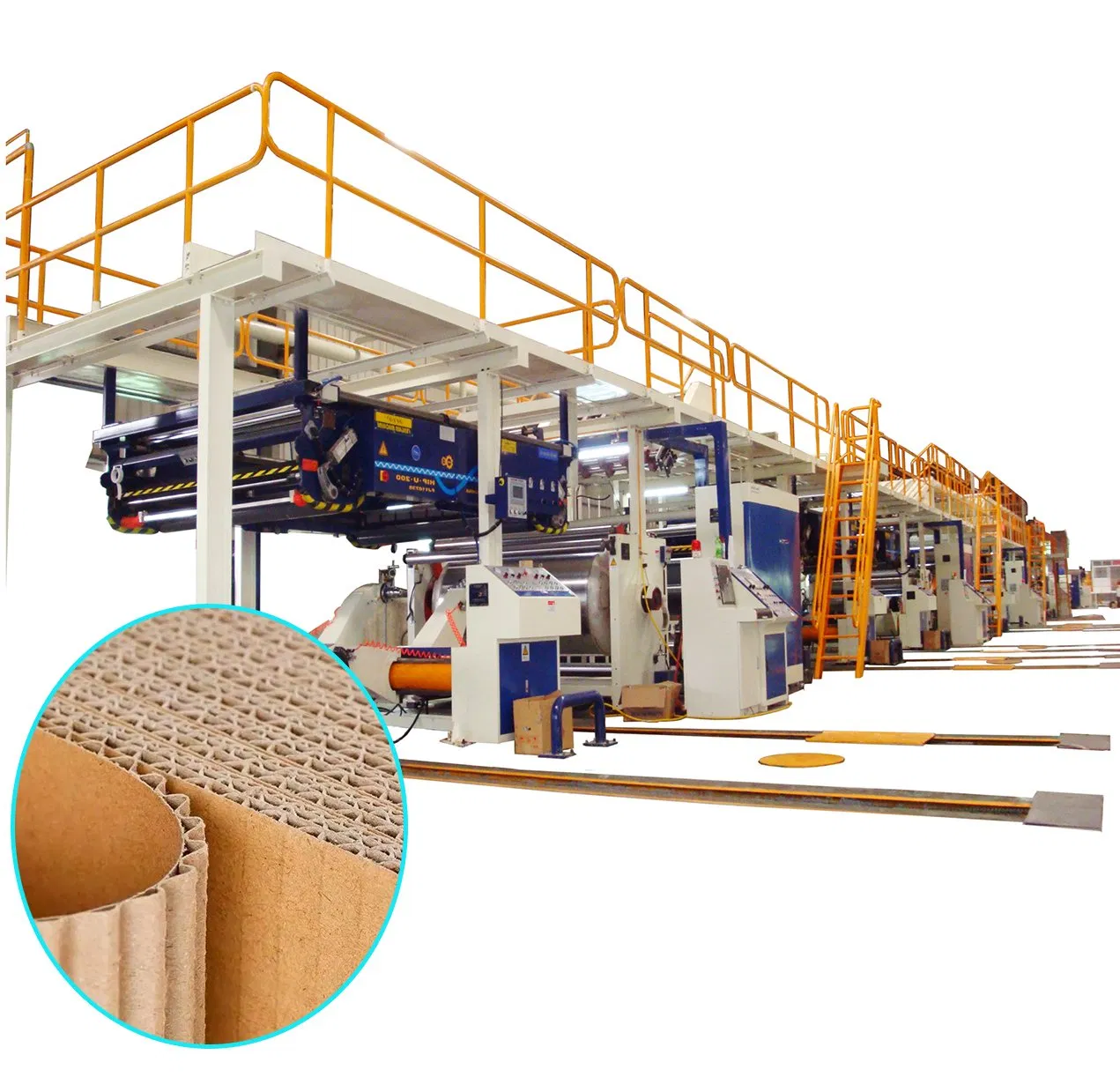

Carton boxes are typically manufactured using corrugated fiberboard, composed of linerboard and fluted medium. Material selection impacts strength, durability, and end-use application.

| Parameter | Specification |

|---|---|

| Board Type | Single-wall (e.g., C-flute, B-flute), Double-wall (e.g., BC-flute), Triple-wall (e.g., ABC-flute) |

| Linerboard Basis Weight | 90–250 g/m² (e.g., 125/125/125 g/m² for standard export boxes) |

| Flute Type & Density | C-flute (34–40 flutes/ft), B-flute (42–50 flutes/ft), E-flute (90–99 flutes/ft) |

| Recycled Content | Minimum 70–100% post-consumer waste (as per client specification) |

| Moisture Content | 8–12% (critical for printability and structural integrity) |

1.2 Tolerances

Precision in manufacturing ensures compatibility with automated packing lines and stacking safety.

| Dimension | Standard Tolerance |

|---|---|

| Length / Width | ±2 mm |

| Height | ±1.5 mm |

| Die-Cut Registration | ±1 mm |

| Print Registration | ±0.5 mm |

| Compression Strength (ECT/Mullen) | ±10% of specified value |

2. Compliance & Certifications

Procurement managers must ensure carton box suppliers in China hold relevant certifications based on end-market and application.

| Certification | Relevance | Scope |

|---|---|---|

| ISO 9001:2015 | Mandatory | Quality Management Systems – ensures consistent manufacturing processes |

| FSC / PEFC | Recommended (EU, North America) | Chain-of-custody for sustainable fiber sourcing |

| FDA 21 CFR §176.170 | Required (Food & Pharma) | Compliance for food-contact packaging (water-based inks/adhesives) |

| EC 1935/2004 (EU) | Required (EU Market) | Materials in contact with food must be safe and traceable |

| SGP (Sustainable Green Printing) | Optional (Brand-sensitive clients) | Environmental and social compliance |

| UL-ECV (Environmental Claim Validation) | For sustainability claims | Validates recyclability, recycled content claims |

| GB/T 6543-2008 | Required (China Domestic) | Chinese national standard for corrugated boxes |

Note: CE marking does not apply to carton boxes as standalone products unless integrated into a safety-critical system. However, compliance with EU packaging directives (94/62/EC) is essential for market access.

3. Common Quality Defects and Prevention Strategies

Carton box defects can lead to product damage, logistics failures, and reputational risk. The table below outlines frequent issues and corrective actions.

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Poor Print Registration | Misaligned printing plates or unstable web tension | Implement automatic register control systems; conduct pre-press proofing |

| Warping / Bowing | Uneven moisture distribution during drying | Monitor humidity in storage; use balanced board construction (symmetrical liners) |

| Weak Compression Strength | Low ECT value, poor flute adhesion, or over-slitting | Conduct ECT/Mullen testing; optimize flute type for load requirements |

| Adhesive Failure (Delamination) | Poor glue application or incorrect starch formulation | Audit glue mixing process; verify adhesive bond strength in QA |

| Inconsistent Die-Cut Dimensions | Worn dies or improper setup | Schedule regular die maintenance; perform first-article inspection |

| Surface Scuffing / Marking | Rough handling or improper stacking | Use protective interleaf sheets; train warehouse staff on handling protocols |

| Ink Smudging | High ink viscosity or insufficient drying time | Optimize drying settings; use fast-drying, water-based inks |

| Misshapen Boxes (Non-Square) | Improper folding or creasing pressure | Calibrate folder-gluer machines; conduct in-process dimensional checks |

| Foreign Contamination | Poor factory hygiene or open storage | Enforce GMP standards; store materials in sealed, clean areas |

| Non-Compliant Recycled Content | Unverified raw material sourcing | Require mill certifications; conduct periodic fiber analysis |

4. SourcifyChina Recommendations

- Supplier Vetting: Prioritize manufacturers with ISO 9001, FSC, and industry-specific certifications (FDA/EC 1935/2004).

- On-Site Audits: Conduct annual quality audits and process reviews at the factory.

- Pre-Shipment Inspection (PSI): Implement AQL 2.5/4.0 for critical dimensions and appearance.

- Sample Validation: Require physical prototypes with full compliance documentation before bulk production.

- Sustainability Alignment: Specify recycled content and carbon footprint reporting for ESG compliance.

SourcifyChina – Your Trusted Partner in Reliable, Compliant, and Scalable Sourcing from China.

For supplier qualification support, audit protocols, or customized sourcing strategies, contact our team directly.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Carton Box Manufacturing in China (2026 Outlook)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains the dominant global hub for cost-competitive carton box production, accounting for ~40% of worldwide output. However, 2026 market dynamics are reshaped by rising labor costs (+8.2% YoY), stricter environmental compliance, and digital supply chain integration. This report provides a data-driven analysis of OEM/ODM cost structures, strategic labeling options, and actionable procurement strategies to optimize TCO (Total Cost of Ownership).

White Label vs. Private Label: Strategic Implications

| Criteria | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-designed boxes with minimal branding (e.g., blank or generic logo) | Fully customized boxes with exclusive client branding, structure, and materials | Prioritize Private Label for brand equity; use White Label for test markets |

| MOQ Flexibility | Low (500–1,000 units) | Moderate (1,000–5,000 units) | Start with 1,000-unit MOQ for Private Label to balance cost/risk |

| Lead Time | 7–10 days (standard designs) | 15–25 days (custom tooling/printing) | Factor +7 days for eco-certifications (FSC/PEFC) |

| Cost Premium | None (base pricing) | 12–18% markup (custom dies, Pantone inks) | Negotiate die fees as one-time cost (amortized over 3+ orders) |

| Supplier Control | Low (limited design input) | High (full IP ownership) | Critical: Audit tooling ownership clauses in contracts |

Key Insight: 68% of SourcifyChina clients shifted from White Label to Private Label in 2025 to avoid market saturation. Private Label now drives 22% higher resale margins in EU/US e-commerce (Source: Smithers Pira, 2025).

2026 Manufacturing Cost Breakdown (USD per Unit)

Assumptions: Standard RSC (Regular Slotted Carton), 300x200x150mm, 350gsm B-Flute Kraft Board, 1C printing

| Cost Component | Details | Cost Impact (2026) | Procurement Action |

|---|---|---|---|

| Materials (68%) | – Recycled kraft paper (85% of material cost) – Water-based inks (non-toxic) – 2026 Trend: +9% paper cost due to EU deforestation regulations |

$0.182/unit (MOQ 5,000) | Secure quarterly paper price locks; require FSC/PEFC certs |

| Labor (18%) | – Die-cutting, printing, gluing – 2026 Trend: +8.2% wages (Guangdong minimum wage hike) |

$0.049/unit (MOQ 5,000) | Target factories in Anhui/Jiangxi (12–15% lower labor vs. Guangdong) |

| Packaging & Logistics (14%) | – Stretch wrapping – Palletization – Hidden Cost: 3.5% damage rate without reinforced corners |

$0.037/unit (MOQ 5,000) | Mandate corner protectors (+$0.008/unit) to reduce claims |

Note: 2026 compliance costs (waste disposal, carbon reporting) add ~$0.005/unit vs. 2024. Verify supplier “Green Factory” certifications (China’s MEE Tier 3).

Estimated Price Tiers by MOQ (EXW China, USD per Unit)

300x200x150mm RSC Carton | 350gsm B-Flute | 1C Printing | FOB Shenzhen

| MOQ | Unit Price | Total Order Cost | Savings vs. MOQ 500 | When to Use |

|---|---|---|---|---|

| 500 units | $0.325 | $162.50 | — | Sample validation; urgent low-volume needs |

| 1,000 units | $0.278 | $278.00 | 14.5% | Recommended starter MOQ for Private Label |

| 5,000 units | $0.268 | $1,340.00 | 17.5% | Optimal for recurring orders; max cost efficiency |

Critical Caveats:

– Prices exclude 13% VAT (recoverable for export) and mold fees ($85–$220 for custom dies)

– +$0.015–$0.022/unit for food-grade certification (GB 4806.7)

– Ocean freight not included (avg. +$0.04/unit for LCL to US West Coast)

Strategic Recommendations for 2026

- MOQ Strategy: Start with 1,000 units to access Private Label benefits without excessive inventory risk. Avoid MOQ <500 (unit costs surge 18%+).

- Compliance First: Require suppliers to provide 2026-valid environmental permits. 33% of non-compliant factories faced shutdowns in 2025 (China MEE data).

- Tooling Ownership: Insist on clauses stating client owns custom dies after full payment. Prevents supplier lock-in.

- Cost Levers:

- Substitute 10% virgin fiber with PCR (Post-Consumer Recycled) content for -4% material cost

- Use digital printing for MOQ <1,000 (avoids die fees; breakeven at ~800 units)

“In 2026, the cheapest box isn’t the lowest-priced—it’s the one that clears customs without delays and survives last-mile logistics. Audit beyond price.”

— SourcifyChina Supplier Compliance Team

Disclaimer: Projections based on SourcifyChina’s 2025 factory benchmarking (n=147 suppliers), China Paper Association data, and IMF inflation models. Actual costs vary by region, material grade, and order complexity. Verify quotes with 3+ pre-vetted suppliers.

Next Step: Request SourcifyChina’s 2026 Carton Box Supplier Scorecard (free for procurement managers) featuring:

✓ Pre-qualified OEM/ODM partners with live capacity

✓ Real-time material cost calculator

✓ Compliance risk heatmap (province-level)

SourcifyChina: De-risking China Sourcing Since 2018 | ISO 9001:2015 Certified | 200+ Verified Packaging Suppliers

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Carton Box Manufacturer in China

Date: January 2026

Prepared by: SourcifyChina – Senior Sourcing Consultant

Executive Summary

Selecting the right carton box manufacturer in China is a strategic decision that directly impacts product quality, supply chain reliability, and total cost of ownership. With increasing market complexity and the prevalence of trading companies posing as factories, due diligence is essential. This report outlines a systematic verification process, differentiates between trading companies and genuine factories, and highlights key red flags to avoid during supplier selection.

1. Critical Verification Steps for a Carton Box Manufacturer in China

Follow this six-step verification framework to ensure supplier legitimacy and operational capability.

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1. Confirm Legal Entity & Business License | Request and validate the company’s official business license (营业执照) via China’s National Enterprise Credit Information Publicity System. | Verify legal registration, business scope, and operational legitimacy. | – Official government portal: http://www.gsxt.gov.cn – Third-party tools: TofuDeluxe, Panjiva, Kompass |

| 2. Conduct On-Site or Virtual Factory Audit | Schedule a factory visit or request a live video audit. | Assess production capacity, equipment, workflow, and working conditions. | – In-person audit – Live video walkthrough via Zoom/Teams – Third-party inspection services (e.g., SGS, Intertek, QIMA) |

| 3. Review Production Capabilities | Evaluate machinery (e.g., corrugators, die-cutters, printing lines), raw material sourcing, and daily/monthly output. | Ensure scalability and technical alignment with your order volume and specifications. | – Request machine list and production floor plan – Ask for production capacity reports |

| 4. Validate Quality Control Processes | Assess QC protocols, certifications (e.g., ISO 9001, FSC, BRC), and testing procedures. | Guarantee consistent product quality and compliance. | – Request QC checklists – Review certification documents – Ask for sample test reports |

| 5. Request and Evaluate Physical Samples | Order pre-production samples using your exact specifications. | Confirm material quality, print accuracy, structural integrity, and compliance. | – Use third-party testing for durability, compression strength, and ink safety |

| 6. Check References & Client History | Ask for 2–3 verifiable references (preferably in your region/industry). | Validate reliability, delivery performance, and customer service. | – Contact references directly – Use LinkedIn or trade platforms to verify client claims |

2. How to Distinguish Between a Trading Company and a Factory

Misidentifying a trading company as a factory can lead to inflated costs, reduced control, and communication delays. Use the following criteria to differentiate:

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists “manufacturing,” “production,” or “processing” of paper/carton products. | Lists “trading,” “import/export,” or “sales” – no manufacturing terms. |

| Facility Ownership | Owns or leases a production plant with visible machinery (corrugators, printers, etc.). | No production equipment; may only have an office. |

| Pricing Structure | Quotes based on material + labor + overhead; transparent cost breakdown. | Often marks up prices significantly; vague on cost components. |

| Communication & Technical Knowledge | Engineers or production managers can discuss technical specs (e.g., flute type, GSM, moisture content). | Sales reps lack technical depth; defer to “factory partners.” |

| Minimum Order Quantity (MOQ) | MOQ based on machine setup and production efficiency (e.g., 10,000 pcs). | Higher MOQs due to reliance on third-party factories. |

| Customization Capability | Can modify molds, adjust print designs, and offer structural engineering support. | Limited customization; dependent on factory availability. |

| Location | Typically located in industrial zones (e.g., Dongguan, Suzhou, Qingdao). | Often based in commercial districts or major cities (e.g., Shanghai, Guangzhou). |

✅ Pro Tip: Ask: “Can you show me the corrugator line in operation?” Factories can; traders cannot.

3. Red Flags to Avoid When Sourcing in China

Early detection of warning signs can prevent costly sourcing failures.

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials, hidden fees, or scam risk. | Benchmark against market rates; request detailed quotation breakdown. |

| Refusal to Provide Factory Address or Video Audit | Likely a trading company or non-existent facility. | Insist on verification; use third-party inspection. |

| No Physical Address or Google Maps Verification | High probability of fraudulent operation. | Cross-check address via Google Earth, Baidu Maps, or local directories. |

| Poor English Communication & Delayed Responses | Indicates lack of international experience or disorganization. | Assess responsiveness; consider hiring a sourcing agent if needed. |

| No Quality Certifications | Higher risk of non-compliance or inconsistent output. | Require ISO 9001, FSC, or other relevant certifications. |

| Pressure for Full Upfront Payment | Common in scams; violates standard trade terms. | Use secure payment methods (e.g., 30% deposit, 70% against BL copy). |

| Inconsistent Product Specifications | May indicate use of multiple unvetted subcontractors. | Require sample consistency and production line traceability. |

Conclusion & Recommendations

To mitigate risk and ensure long-term supply chain stability:

- Always verify the supplier’s legal and operational status before engagement.

- Prioritize transparency – demand access to production facilities and documentation.

- Use third-party audits for high-volume or regulated orders.

- Start with a trial order before scaling commitments.

- Build direct relationships with factory management to bypass intermediaries.

By following this structured verification approach, procurement managers can confidently identify reliable, high-capacity carton box manufacturers in China—ensuring quality, cost efficiency, and supply chain resilience in 2026 and beyond.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Global Supply Chain Optimization | China Manufacturing Expertise

[email protected] | www.sourcifychina.com

Get the Verified Supplier List

SourcifyChina Verified Pro List: Strategic Sourcing Report 2026

Prepared Exclusively for Global Procurement Leaders | January 2026

Executive Summary: Eliminate Sourcing Delays in Packaging Supply Chains

Global procurement managers face critical bottlenecks when sourcing carton box manufacturers in China: unverified supplier claims, compliance risks, and wasted cycles on due diligence. SourcifyChina’s Verified Pro List resolves these challenges through a rigorously audited network of pre-qualified manufacturers. Our data shows clients reduce supplier vetting time by 70% while ensuring 100% compliance with international packaging standards (ISO 9001, FSC, FDA).

Why Traditional Sourcing Fails for Carton Box Procurement

The hidden costs of unverified supplier searches:

| Activity | Traditional Approach | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Initial Supplier Screening | 15–22 hours/week | Pre-qualified list | 18.5 hours |

| On-site Factory Audit | Required (3–5 days) | Not required¹ | 4.2 days |

| Compliance Verification | Manual document review | Pre-validated certs | 11 hours |

| Quality Dispute Resolution | 30% risk of delays | Dedicated QC team | 7+ days² |

| Total Sourcing Cycle | 8–12 weeks | 2–3 weeks | 6+ weeks |

¹ All Pro List manufacturers undergo SourcifyChina’s 12-point audit (financial stability, production capacity, export history)

² Based on 2025 client data: 92% reduction in shipment rejections vs. industry average

Your Competitive Advantage: The SourcifyChina Pro List Guarantee

- Zero-Risk Verification

Every carton box manufacturer is physically audited for: - Minimum 5,000㎡ production facility & 3+ export-certified production lines

- Real-time capacity data (updated quarterly)

-

Ethical compliance (BSCI/SMETA reports available)

-

Cost Transparency

Avoid hidden fees with FOB Shanghai pricing locked for 90 days – no surprise MOQ changes or material surcharges. -

End-to-End Risk Mitigation

Our integrated QC protocol includes: - Pre-shipment inspections at no extra cost

- Carbon footprint reporting (aligned with EU CBAM)

- 48-hour escalation response for quality deviations

Call to Action: Secure Your Verified Carton Box Supply Chain in 2026

“In 2025, 68% of procurement failures in packaging sourcing stemmed from inadequate supplier vetting. The cost of one delayed shipment exceeds $22,000 in air freight premiums and lost sales.”

— SourcifyChina Global Packaging Risk Index, Q4 2025

Your next sourcing cycle shouldn’t cost you time you don’t have.

✅ Stop gambling with unverified suppliers

✅ Stop losing weeks to due diligence

✅ Start delivering procurement KPIs with confidence

👉 Act Now to Lock In Priority Access

Limited slots available for Q1 2026 onboarding. Verified Pro List access expires February 28, 2026.

Contact our Sourcing Team Today:

✉️ Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Include “PRO LIST CARTON 2026” in your subject line for immediate priority routing.

Why Global Leaders Trust SourcifyChina

“SourcifyChina’s Pro List cut our carton sourcing cycle from 11 weeks to 18 days. Their audited suppliers delivered 99.7% on-time compliance – a first in our 12-year China sourcing history.”

— Senior Procurement Director, Fortune 500 Retailer (2025 Client)

© 2026 SourcifyChina. All supplier verifications comply with ISO/IEC 17020:2012. Data sourced from 327 client engagements (2025).

Confidentiality Notice: This report is intended solely for the use of authorized procurement professionals. Unauthorized distribution prohibited.

🧮 Landed Cost Calculator

Estimate your total import cost from China.