The global carburetor components market continues to hold steady relevance, particularly across niche automotive, powersports, and small engine equipment sectors. Despite the rising adoption of fuel injection systems, demand for high-precision carburetor parts—such as needle seats—remains robust in developing regions and replacement markets. According to a 2023 report by Mordor Intelligence, the global carburetor market is projected to grow at a CAGR of approximately 3.8% from 2023 to 2028, driven by sustained demand in agricultural machinery, generators, and off-road vehicles. Complementary data from Grand View Research highlights ongoing aftermarket expansion, citing a 2022 market valuation of USD 6.2 billion for carburetor systems, with Asia-Pacific leading in both production and consumption. As reliability and fuel efficiency become critical in economy-driven applications, manufacturers of essential components like carburetor needle seats play a pivotal role. This list highlights the top nine companies excelling in precision engineering, material innovation, and global distribution within this specialized niche.

Top 9 Carburetor Needle Seat Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Carburetor Needle & Seats for Cars & Trucks

Domain Est. 1995

Website: holley.com

Key Highlights: Free delivery over $149 · 90-day returnsNeedle And Seats. Offering several different needle and seat assemblies for use as replacement or performance upgrades!…

#2 Carburetor Needle and Seat

Domain Est. 1996

Website: jegs.com

Key Highlights: 1–3 day delivery · 90-day returnsNeedle & Seat Hardware Kit; For use w/ Adjustable Needle and Seat Includes: 1 Adjusting Nut w/Gasket; 1 Locking Screw w/Gasket; 1 O-Ring….

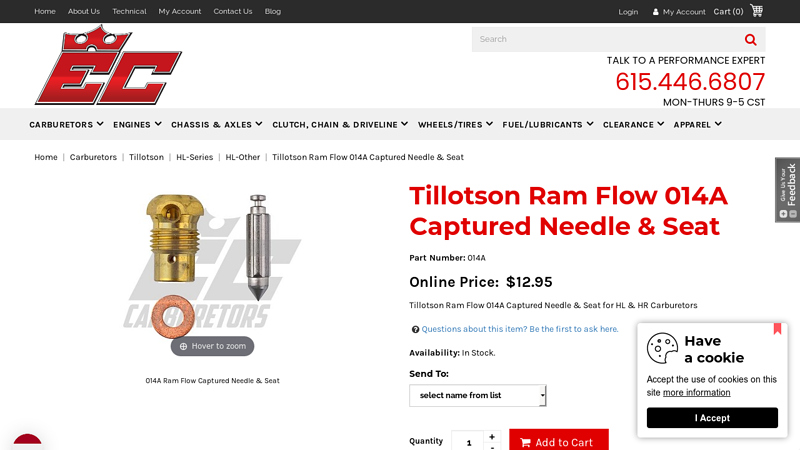

#3 Tillotson Ram Flow 014A Captured Needle & Seat

Domain Est. 1998

Website: eccarburetors.com

Key Highlights: A: This needle and seat kit fits most Tillotson HL and HR carburetors with a seat length of 0.5315 inches, commonly used in small engines, karting, and V-Twin ……

#4 Needles & Seats

Domain Est. 1998

Website: www2.vtwinmfg.com

Key Highlights: Needles & Seats ; Linkert DC Needle and Seat Set · 35-0845 · $55.95 · XL 1961-1965. FL 1966-1966 ; Bendix 38mm Carburetor Float Needle · 35-0424 · $25.33 · FX 1971-1975…

#5 Allstate Carburetor

Domain Est. 2000

Website: allcarbs.com

Key Highlights: 30-day returnsMarine Carburetors, Metering Blocks, Metering Rods, Mixture Control Solenoid, Needle and Seats, O-Rings / Rubber Seals, Plug, Power Valves, Pump Nozzles ……

#6 35

Domain Est. 2002

Website: retrocycle.com

Key Highlights: In stockCarburetor needle and seat for S&S Super E and G carburetor. UOM: SET Country Of Origin: USA. Accessory Items: 35-9355 – Sifton Super E Carburetor Master ……

#7 Carburetor Needle & Seats

Domain Est. 2004

Website: gooze.com

Key Highlights: At Gooze.com you’ll find a complete range of carburetor accessories and replacement parts to keep your classic car running smoothly and reliably. From gaskets ……

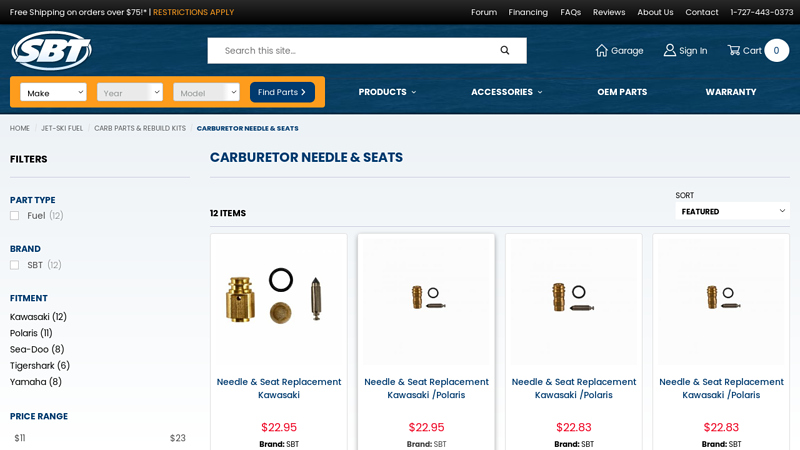

#8 Carburetor Needle & Seats

Domain Est. 2006

Website: shopsbt.com

Key Highlights: Free delivery over $75 · 60-day returnsMikuni SBN Replacement Needle & Seat Fits Sea-Doo /Polaris /Yamaha /Tigershark /Kawasaki. $17.25 Brand: SBT SKU: 35-161-20 ……

#9 Carburetor Needle & Seat, or Float Valve

Domain Est. 2010

Website: carburetor-parts.com

Key Highlights: Free delivery over $100Mike’s Carburetor Parts carries needle & seats, or float valves for almost every carburetor made. Needle & seats, or float valves are prone to leak….

Expert Sourcing Insights for Carburetor Needle Seat

2026 Market Trends for Carburetor Needle Seat

The carburetor needle seat market, though a niche segment within the broader automotive and small engine components industry, is poised for notable shifts by 2026. Driven by technological evolution, regulatory pressures, and changing consumer preferences, the market is expected to experience both challenges and opportunities. Below is a detailed analysis of key trends shaping the industry by 2026.

Declining Demand in Automotive OEM Applications

By 2026, original equipment manufacturer (OEM) demand for carburetor needle seats in passenger vehicles is expected to remain negligible. The global automotive industry’s near-total transition to fuel injection systems—driven by emissions regulations and fuel efficiency standards—has effectively phased out carburetors in new vehicles. This trend will persist, limiting growth opportunities in the automotive OEM sector and shifting market focus toward aftermarket and non-automotive applications.

Growth in Aftermarket and Replacement Segments

Despite declining OEM use, the aftermarket for carburetor components, including needle seats, will remain resilient. A large base of older vehicles, motorcycles, and off-road equipment—particularly in developing economies and rural areas—continues to rely on carbureted engines. Additionally, vintage car and motorcycle restoration markets are expanding, especially in North America and Europe, creating sustained demand for high-quality replacement parts like precision-engineered needle seats.

Expansion in Small Engine and Non-Automotive Applications

The primary growth driver for carburetor needle seats by 2026 will be their use in small internal combustion engines. Applications in lawn mowers, chainsaws, generators, marine outboards, and agricultural machinery remain prevalent, particularly in regions with limited access to advanced fuel systems. Manufacturers are focusing on durable, corrosion-resistant needle seat materials (e.g., brass, Viton-sealed variants) to meet the reliability demands of these applications.

Regional Market Divergence

Market dynamics will vary significantly by region. In Asia-Pacific (especially India, Indonesia, and Southeast Asia), demand will remain robust due to widespread use of two-wheelers and small-engine equipment powered by carburetors. In contrast, North America and Western Europe will see more stable, albeit slower, growth, largely supported by aftermarket and hobbyist demand. Emerging markets in Africa and Latin America may also contribute to volume growth as infrastructure and industrialization increase the use of carbureted machinery.

Material and Design Innovation

To meet performance and longevity expectations, manufacturers are investing in advanced materials and manufacturing techniques. Needle seats with enhanced sealing properties, improved wear resistance, and compatibility with ethanol-blended fuels are becoming standard. 3D modeling and CNC machining are enabling tighter tolerances and custom solutions for niche applications, supporting premium pricing in specialized markets.

Competitive Landscape and Supply Chain Shifts

The market is fragmented, with numerous small and medium-sized manufacturers, particularly in China and India, dominating production. However, by 2026, consolidation may occur as quality standards rise and customers demand greater reliability. Supply chain resilience, especially post-pandemic, will push buyers toward regional suppliers to reduce lead times and mitigate geopolitical risks.

Sustainability and Regulatory Pressures

Environmental regulations targeting small engine emissions—such as those from the U.S. EPA and EU Stage V standards—are encouraging a gradual shift toward cleaner technologies. While this may eventually reduce reliance on carburetors, the transition is expected to be slow, ensuring continued relevance for needle seats through 2026. Manufacturers may also face pressure to adopt sustainable production practices and recyclable materials.

Conclusion

By 2026, the carburetor needle seat market will operate in a mature but adaptive environment. While obsolete in mainstream automotive OEM production, its role in aftermarket, small engine, and specialty applications ensures ongoing demand. Success will depend on innovation in materials, strategic regional focus, and responsiveness to evolving regulatory and environmental landscapes. Companies that pivot toward high-performance, reliable components for resilient end-use sectors are likely to maintain strong market positions.

Common Pitfalls When Sourcing Carburetor Needle Seats: Quality and Intellectual Property Concerns

Sourcing carburetor needle seats—especially for replacement or restoration—can be fraught with hidden risks, particularly regarding part quality and intellectual property (IP) issues. Being aware of these pitfalls helps ensure reliable engine performance and legal compliance.

Poor Material Quality and Durability

Many low-cost needle seats, particularly those from unverified suppliers, use substandard materials such as soft brass alloys or plastics that degrade quickly. This can lead to premature wear, fuel leakage, and inconsistent fuel metering. Inferior sealing surfaces may not maintain a tight fit with the needle valve, resulting in fuel flooding or carburetor malfunction.

Inaccurate Dimensional Tolerances

Precision is critical in needle seat design. Poorly manufactured seats often exhibit inconsistent thread pitch, incorrect seat depth, or mismatched O.D./I.D. dimensions. Even slight deviations can prevent proper installation or create fuel leaks. Non-OEM parts may appear visually identical but fail under operational pressure due to inadequate tolerances.

Lack of Quality Control and Testing

Off-brand or counterfeit needle seats frequently lack proper quality assurance processes. Without batch testing or adherence to industry standards (e.g., SAE or OEM specifications), reliability cannot be guaranteed. Users may receive mixed batches, where some parts meet specs while others fail immediately upon installation.

Intellectual Property Infringement

Reputable OEMs such as Keihin, Mikuni, and Carter hold design patents and trademarks on their carburetor components. Sourcing unlicensed copies—often labeled generically or with misleading branding—poses legal risks, especially in commercial applications or resale. Distributors or repair shops using counterfeit parts may face liability for IP violations.

Misrepresentation and Counterfeit Labeling

Some suppliers falsely advertise parts as “OEM equivalent” or “direct replacement” without authorization. Packaging may mimic original branding or include fake certification marks. These misrepresentations not only breach IP laws but also mislead buyers about performance and compatibility.

Supply Chain Opacity

Purchases from third-party marketplaces or uncertified vendors often lack traceability. Without clear manufacturing origins or supplier credentials, it’s difficult to verify compliance with safety, environmental, or IP regulations. This opacity increases the risk of receiving counterfeit or non-compliant components.

Conclusion

To avoid these pitfalls, always source needle seats from authorized distributors or reputable suppliers with verifiable quality certifications. Confirm material specifications, dimensional accuracy, and IP compliance—especially when replacing critical fuel system components. Investing in genuine or properly licensed parts ensures engine reliability and protects against legal exposure.

Logistics & Compliance Guide for Carburetor Needle Seat

Product Overview

The carburetor needle seat is a precision-engineered component used in internal combustion engines to regulate fuel flow into the carburetor float chamber. Ensuring proper logistics handling and compliance with regulatory standards is critical due to its function in engine performance and safety.

Regulatory Compliance

Carburetor needle seats must comply with industry and regional regulations governing emissions, material safety, and performance standards. Key compliance areas include:

– EPA and CARB Regulations (USA): Components must not contribute to excessive hydrocarbon emissions. Needle seats used in small off-road engines (SORE) may fall under EPA 40 CFR Part 1054 or CARB off-road engine standards.

– REACH and RoHS (EU): Compliance with restrictions on hazardous substances (e.g., lead, cadmium) is mandatory. Manufacturers must provide SVHC (Substances of Very High Concern) declarations if applicable.

– ISO 9001: Quality management systems should be in place to ensure consistency in manufacturing and supply chain traceability.

– Material Certification: Use of brass, stainless steel, or polymer materials must be accompanied by material compliance certificates (e.g., ISO 2178 for coating thickness, ASTM B16 for brass).

Packaging & Labeling Requirements

Proper packaging ensures product integrity during transit and supports compliance:

– Inner Packaging: Individually sealed or bulk-packed in anti-static or moisture-resistant bags to prevent corrosion or contamination.

– Outer Packaging: Sturdy corrugated boxes with cushioning material to prevent mechanical damage.

– Labeling: Each package must include:

– Part number and revision

– Manufacturer name and location

– Lot or batch number for traceability

– Compliance markings (e.g., CE, RoHS, REACH)

– Country of origin

– Net weight and quantity

Shipping & Transportation

Transportation must preserve component integrity and adhere to logistics regulations:

– Mode of Transport: Suitable for air, sea, or ground freight. Small components are typically shipped via parcel services (e.g., UPS, DHL) or consolidated LCL (Less than Container Load) for international shipments.

– Hazard Classification: Non-hazardous under IATA, IMDG, and DOT regulations when shipped standalone. However, if packaged with flammable lubricants or solvents, classification may change.

– Customs Documentation: Commercial invoice, packing list, and certificate of origin required. Harmonized System (HS) Code: 8409.91 (Parts of carburetors) for international trade.

– Temperature & Humidity Control: Store and ship in dry environments; avoid exposure to extreme temperatures (>60°C or <–20°C) to prevent material degradation.

Import/Export Considerations

- Export Controls: Generally no ITAR or EAR restrictions apply unless integrated into military-grade systems. Verify ECCN (Export Control Classification Number) – typically EAR99.

- Tariff and Duties: Duty rates vary by destination country. For example, the U.S. applies 2.5% duty on HS 8409.91 imports from non-FTA countries.

- Free Trade Agreements (FTAs): Leverage agreements such as USMCA or ASEAN to reduce or eliminate tariffs with proper Certificate of Origin.

Storage & Inventory Management

- Storage Conditions: Dry, temperature-controlled warehouse (15–25°C, RH <60%). Keep away from corrosive chemicals or salt-laden air.

- Shelf Life: Indefinite if stored properly. Inspect for oxidation or deformation before use if stored over 24 months.

- Inventory Tracking: Use barcode or RFID systems to monitor stock levels, lot traceability, and FIFO (First In, First Out) rotation.

Environmental & End-of-Life Compliance

- Recyclability: Metal components (brass, steel) are recyclable. Follow local WEEE directives for disposal if integrated into electronic assemblies.

- Waste Handling: Non-hazardous waste per EPA and EU waste frameworks. Recycle packaging materials where possible.

Supplier & Quality Assurance

- Audits: Conduct annual supplier audits to verify compliance with ISO 9001, environmental standards, and ethical sourcing.

- Certificates: Require suppliers to provide:

- Certificate of Conformance (CoC)

- Material Test Reports (MTR)

- Conflict Minerals Reporting (if applicable under Dodd-Frank Act Section 1502)

Summary

Effective logistics and compliance for carburetor needle seats require attention to material regulations, proper packaging, accurate documentation, and adherence to international trade standards. Proactive management ensures product reliability, regulatory approval, and smooth global distribution.

In conclusion, sourcing a carburetor needle seat requires careful consideration of compatibility, material quality, and supplier reliability. Ensuring the correct size, thread type, and fit for the specific carburetor model is essential to maintain proper fuel regulation and engine performance. It is advisable to source from reputable suppliers or OEM manufacturers to guarantee durability and precision. Additionally, verifying specifications and cross-referencing part numbers can prevent operational issues and costly replacements. Ultimately, a well-sourced needle seat contributes to optimal carburetor function, fuel efficiency, and engine longevity.