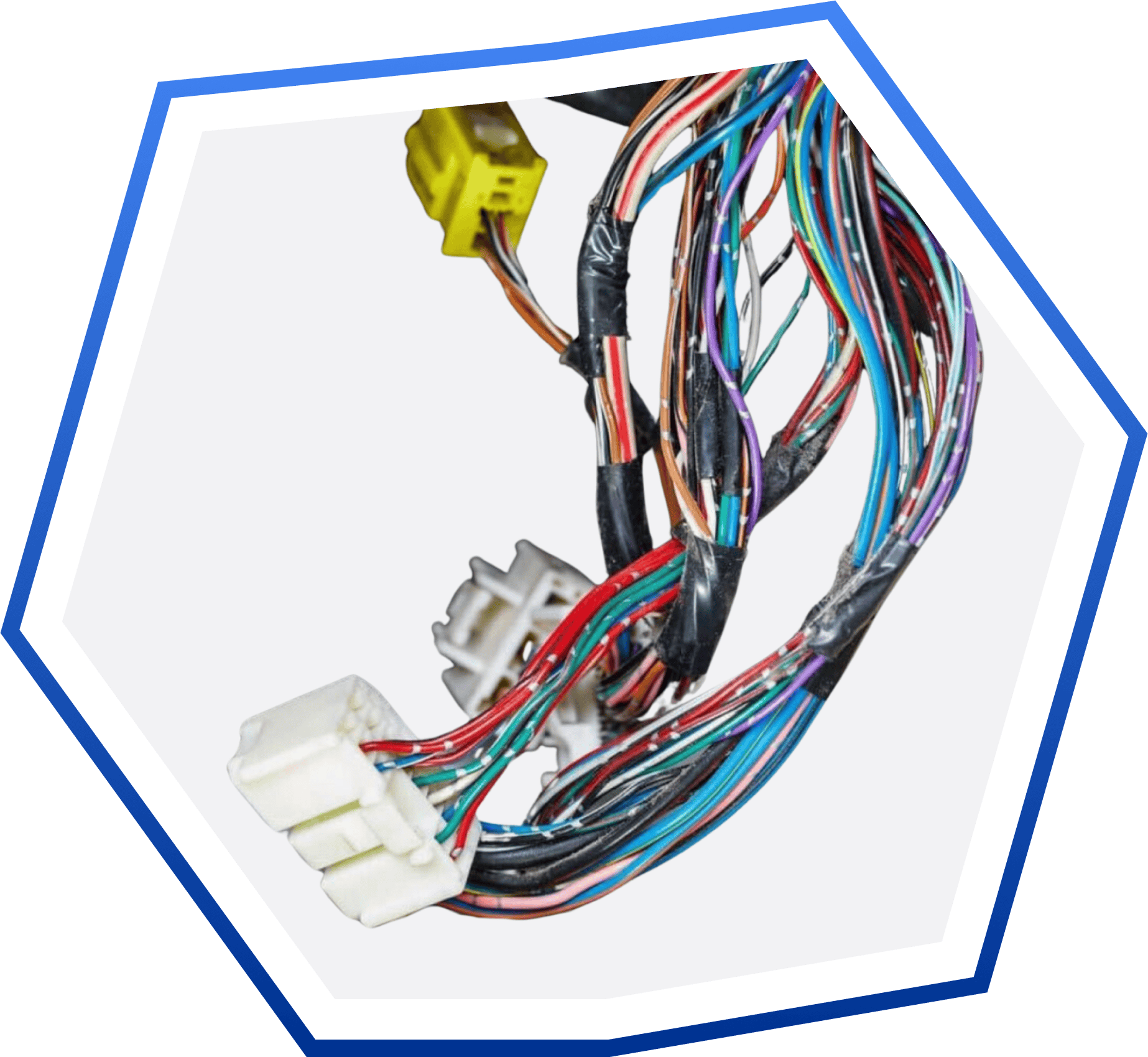

The global automotive wiring harness market is experiencing robust growth, driven by rising vehicle production, increasing electrification, and the surge in advanced driver-assistance systems (ADAS) and electric vehicles (EVs). According to a report by Mordor Intelligence, the market was valued at USD 62.45 billion in 2023 and is projected to reach USD 89.73 billion by 2029, growing at a CAGR of approximately 6.2% during the forecast period. This expansion underscores the critical role wiring harnesses play as the central nervous system of modern vehicles. As demand for lighter, more efficient, and reliable electrical architectures intensifies, manufacturers are innovating to meet stringent safety and performance standards. In this evolving landscape, nine key players have emerged as leaders, combining global reach, technological expertise, and strategic partnerships to dominate the supply chain.

Top 9 Car Wiring Harness Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Automotive Wire Harness Manufacturing

Domain Est. 2004

Website: carrmfg.com

Key Highlights: Carr Manufacturing Inc. is the leading automotive wire harness manufacturer that can fabricate wire harnesses according to your specific needs and requirements….

#2 Wiring Harness Manufacturer’s Association

Domain Est. 1995

Website: whma.org

Key Highlights: The Wiring Harness Manufacturer’s Association is the ONLY trade association exclusively representing the cable and wiring harness manufacturing industry ……

#3 Wiring Harness

Domain Est. 1997

Website: motherson.com

Key Highlights: The company is one of the largest manufacturers of wiring harnesses and electrical components globally and is a complete solutions provider to all its customers ……

#4 Wire Harness

Domain Est. 1999

Website: yazaki-group.com

Key Highlights: Yazaki Group began producing wire harnesses in 1939, and they have now been adopted by all domestic automobile manufacturers….

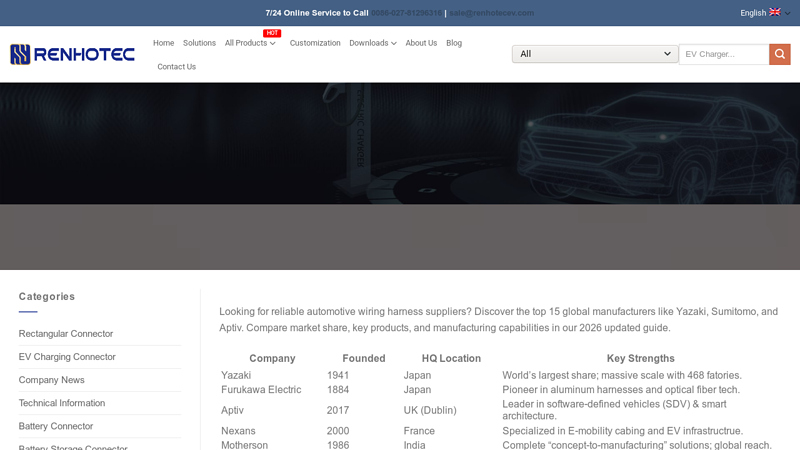

#5 The Top 15 Automotive Wiring Harness Manufacturers and …

Domain Est. 2021

Website: renhotecev.com

Key Highlights: Looking for reliable automotive wiring harness suppliers? Discover the top 15 global manufacturers like Yazaki, Sumitomo, and Aptiv. Compare market share, key ……

#6 Peterson: A World

Domain Est. 2021

Website: petersonlightsandharness.com

Key Highlights: Peterson Manufacturing innovates vehicle safety lighting and wiring harness systems that improve performance and reduce operational costs….

#7 Page

Domain Est. 1996

Website: sewsus.com

Key Highlights: SEWS has grown to be a global leader in the automotive wiring systems industry. We continue to build our customer base by providing the very best products….

#8 Painless Performance

Domain Est. 1999

Website: painlessperformance.com

Key Highlights: All our harnesses are made out of high-grade TXL wiring and labeled every 12-inches to make installation as Painless as possible….

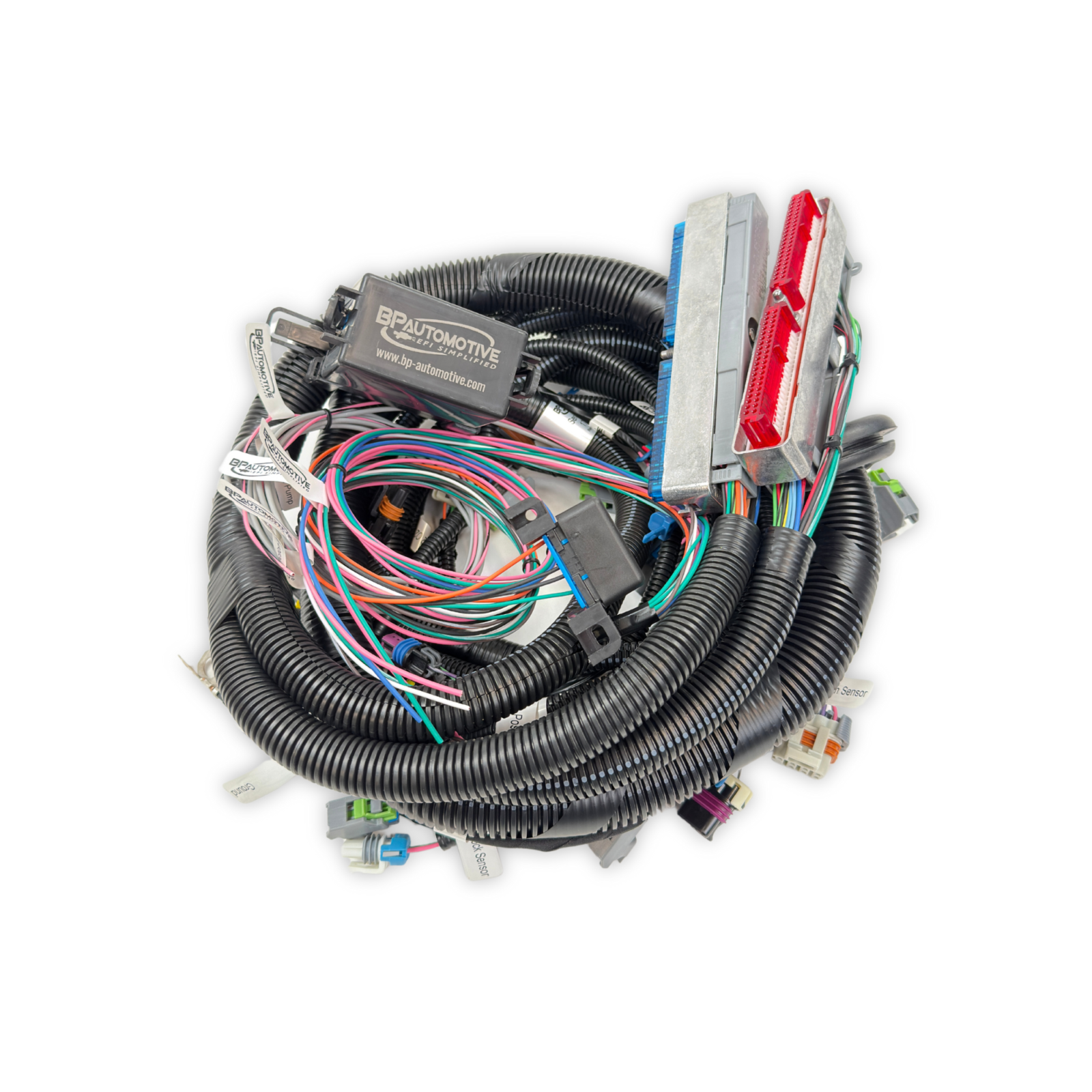

#9 BP Automotive

Domain Est. 2012

Website: bp-automotive.com

Key Highlights: BP Automotive is the go to source for all of your LS Swap needs! We build standalone harnesses for GM engines from 1992 to present day!…

Expert Sourcing Insights for Car Wiring Harness

2026 Market Trends for Car Wiring Harness

The global car wiring harness market is poised for significant transformation by 2026, driven by the rapid evolution of automotive technology, increasing electrification, and growing demand for advanced vehicle functionalities. Wiring harnesses—critical components that connect electrical systems within vehicles—are becoming increasingly complex and integral to modern automotive design. This analysis explores key trends shaping the car wiring harness market in 2026.

Rising Demand for Electric Vehicles (EVs)

One of the most influential drivers of change in the wiring harness market is the global shift toward electric vehicles. EVs require more sophisticated and heavier wiring systems compared to internal combustion engine (ICE) vehicles due to high-voltage battery systems, power electronics, and regenerative braking. By 2026, as EV adoption accelerates—fueled by government regulations, falling battery costs, and consumer demand—wiring harness manufacturers will need to scale production of high-voltage harnesses capable of handling 400V to 800V systems. This shift increases material requirements and design complexity, particularly in insulation, shielding, and thermal management.

Lightweighting and Material Innovation

To improve vehicle efficiency—especially in EVs where weight impacts battery range—the industry is focusing on lightweight wiring solutions. By 2026, manufacturers are expected to increasingly adopt aluminum wiring and high-strength, low-weight materials to replace traditional copper. While aluminum presents challenges in conductivity and durability, advancements in coating technologies and connector design are mitigating these issues. Additionally, miniaturization of wires and connectors, along with optimized routing, will help reduce overall harness weight and improve fuel or energy efficiency.

Increased Complexity from ADAS and Connectivity

The proliferation of Advanced Driver Assistance Systems (ADAS), infotainment systems, and vehicle-to-everything (V2X) communication is dramatically increasing the number of sensors, cameras, and control units in vehicles. This complexity demands more data transmission capability, leading to a surge in high-speed data cables (e.g., Ethernet, coaxial) within wiring harnesses. By 2026, car wiring harnesses will not only carry power but also support high-bandwidth communication, requiring improved electromagnetic interference (EMI) protection and signal integrity. Harness designs will become modular and zonal to simplify assembly and maintenance.

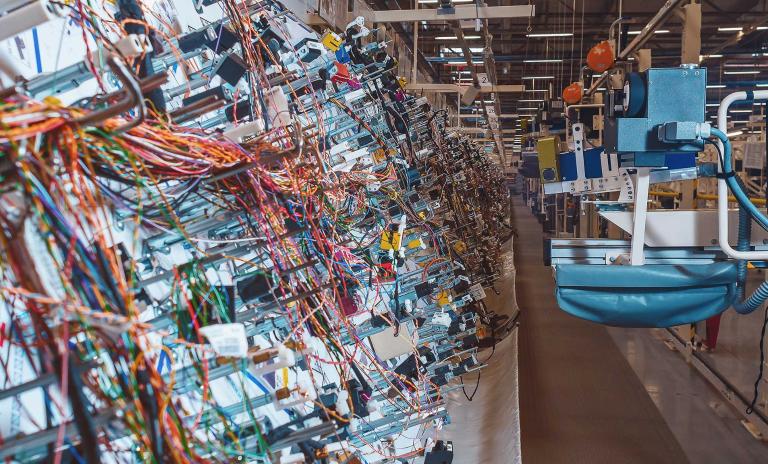

Automation and Smart Manufacturing

To meet growing demand and reduce production costs, wiring harness manufacturing is increasingly adopting automation and Industry 4.0 technologies. By 2026, smart factories equipped with robotics, AI-driven quality control, and digital twin simulations will dominate production. These technologies enhance precision, reduce labor costs, and minimize defects—critical in an industry where harness faults can lead to major safety recalls. Additionally, digitalization enables real-time tracking of components and predictive maintenance of manufacturing equipment.

Regional Shifts and Supply Chain Resilience

Geopolitical factors and supply chain disruptions have prompted automakers and suppliers to reevaluate global sourcing strategies. By 2026, regionalization of wiring harness production is expected to continue, with increased investment in North America, Eastern Europe, and Southeast Asia to reduce dependency on single sources. Nearshoring and vertical integration will improve response times and reduce logistics costs. Moreover, sustainability pressures will push companies to adopt greener manufacturing processes and recyclable materials.

Consolidation and Strategic Partnerships

The wiring harness market is witnessing consolidation as smaller suppliers struggle with R&D costs and technological demands. Major players like Yazaki, Sumitomo Electric, and Lear are expanding through acquisitions and joint ventures to secure technological leadership and global reach. In 2026, strategic partnerships between harness makers and semiconductor or software firms are expected to grow, enabling integrated solutions for next-generation electrical/electronic (E/E) architectures.

Conclusion

By 2026, the car wiring harness market will be defined by electrification, digitalization, and sustainability. As vehicles evolve into software-defined platforms, wiring harnesses will transition from passive components to intelligent, high-performance systems. Manufacturers that innovate in materials, design, and production will lead the market, while those unable to adapt risk obsolescence. The future of automotive wiring lies in smarter, lighter, and more resilient systems capable of supporting the vehicles of tomorrow.

Common Pitfalls When Sourcing Car Wiring Harnesses (Quality & IP)

Sourcing car wiring harnesses involves navigating complex technical, quality, and intellectual property (IP) challenges. Overlooking these can lead to costly delays, product failures, or legal disputes. Below are key pitfalls to avoid:

Poor Quality Control and Inconsistent Manufacturing

One of the most frequent issues is inconsistent quality from suppliers, especially those lacking robust manufacturing processes. Defects such as loose crimps, incorrect wire gauging, poor insulation, or substandard connector molding can compromise vehicle safety and reliability. Relying solely on visual inspections or minimal testing increases the risk of undetected flaws entering production.

Inadequate Environmental and Mechanical Testing

Car wiring harnesses must endure extreme conditions—temperature fluctuations, humidity, vibration, and chemical exposure. Sourcing harnesses that haven’t undergone rigorous testing (e.g., IP67/IP69K for dust and water resistance, thermal cycling, or abrasion resistance) can result in premature failures, especially in under-hood or exterior applications.

Lack of Traceability and Documentation

High-reliability automotive applications require full traceability of components, materials, and assembly processes. Suppliers that fail to provide batch records, Certificates of Conformance (CoC), or material declarations (e.g., RoHS, REACH) pose compliance and recall risks. This is critical for quality audits and failure analysis.

Intellectual Property (IP) Infringement Risks

Using reverse-engineered or cloned harness designs without proper licensing can expose companies to legal action. Many OEM-specific wiring harness designs are protected by patents, copyrights, or trade secrets. Sourcing from unauthorized manufacturers—even if they offer lower prices—can lead to IP violations, supply chain disruptions, and reputational damage.

Non-Compliance with Automotive Standards

Harnesses must meet industry standards such as ISO 6722 (cable performance), ISO 16750 (environmental conditions), or USCAR-2 (connector performance). Suppliers unfamiliar with these standards may deliver products that fail vehicle-level testing or certification, delaying time-to-market.

Insufficient Supplier Qualification

Choosing suppliers based solely on cost without auditing their facilities, quality management systems (e.g., IATF 16949 certification), or track record in automotive applications increases the likelihood of defects. A lack of engineering support or responsiveness during development also hampers problem resolution.

Poor Design and Engineering Collaboration

Sourcing off-the-shelf harnesses without involving the supplier early in the design phase can lead to integration issues. Misunderstandings about routing, connector types, or signal integrity may result in rework, fitment problems, or electromagnetic interference (EMI).

Hidden Costs from Rework and Warranty Claims

Low upfront pricing can be misleading if harnesses require frequent rework, field repairs, or generate warranty claims. The total cost of ownership rises significantly when factoring in downtime, logistics, and customer dissatisfaction due to reliability issues.

Conclusion

To mitigate these pitfalls, conduct thorough supplier audits, enforce strict quality agreements, ensure IP rights are respected, and demand comprehensive testing and documentation. Close collaboration with qualified, certified suppliers is essential for reliable, compliant, and legally secure car wiring harness sourcing.

Logistics & Compliance Guide for Car Wiring Harness

Overview

Car wiring harnesses are critical components in automotive manufacturing, integrating electrical circuits throughout vehicles. Their logistics and compliance requirements are stringent due to safety, quality, and regulatory considerations. This guide outlines key logistics practices and compliance standards essential for the safe and efficient handling, transportation, and certification of automotive wiring harnesses.

Packaging and Handling Requirements

Proper packaging ensures the integrity of wiring harnesses during storage and transit.

– Use anti-static materials to prevent electrostatic discharge (ESD) damage.

– Secure harnesses in custom-designed containers or trays to avoid tangling or physical damage.

– Label packages with handling instructions (e.g., “Fragile,” “This Side Up,” “Protect from Moisture”).

– Implement barcoding or RFID tagging for traceability across the supply chain.

Storage Conditions

Environmental controls are essential to maintain product quality.

– Store in a dry, temperature-controlled environment (typically 15–25°C, 30–60% RH).

– Avoid direct sunlight and exposure to chemicals or corrosive substances.

– Use first-in, first-out (FIFO) inventory management to prevent aging of materials.

Transportation Logistics

Ensure safe and timely delivery to OEMs or assembly plants.

– Use enclosed, climate-controlled vehicles for long-distance transport.

– Secure loads to prevent movement and vibration damage during transit.

– Coordinate just-in-time (JIT) or sequenced delivery to align with production schedules.

– Partner with certified logistics providers experienced in automotive parts handling.

Regulatory and Industry Compliance

Compliance with global and regional standards is mandatory.

– ISO 9001: Quality management systems for consistent manufacturing processes.

– IATF 16949: Automotive-specific quality standard for component suppliers.

– REACH & RoHS: Compliance with restrictions on hazardous substances (e.g., lead, cadmium).

– UL/CSA Certification: Required for wiring safety and flammability in certain markets.

– IMDS Reporting: Submission of material data to the International Material Data System for vehicle traceability.

Country-Specific Import Requirements

Customs regulations vary by destination.

– Prepare accurate commercial invoices, packing lists, and certificates of origin.

– Comply with local automotive safety standards (e.g., FMVSS in the U.S., ECE in Europe).

– Ensure proper HS code classification (typically 8544.42 or 8708.29 for wiring harnesses).

– Obtain necessary import permits or type approvals where required.

Traceability and Documentation

Full traceability supports quality control and recalls.

– Maintain batch/lot tracking from raw materials to finished goods.

– Keep records of inspections, test results, and compliance certifications.

– Support OEM audit requirements with digital documentation systems.

Risk Management and Contingency Planning

Mitigate disruptions in the supply chain.

– Qualify multiple suppliers for critical components (e.g., connectors, wires).

– Establish backup logistics routes and alternate warehousing options.

– Implement robust quality checks at production and pre-shipment stages.

Conclusion

Effective logistics and compliance management for car wiring harnesses ensures product reliability, regulatory adherence, and on-time delivery. By following industry best practices and maintaining strict quality controls, suppliers can support seamless integration into automotive production lines and meet global market demands.

In conclusion, sourcing car wiring harness suppliers requires a strategic and comprehensive approach that balances quality, cost, reliability, and long-term partnership potential. Given the critical role wiring harnesses play in vehicle performance, safety, and compliance, selecting the right supplier is vital for maintaining production standards and ensuring customer satisfaction. Key considerations include technical capabilities, adherence to industry standards (such as ISO/TS 16949), production scalability, geographic location, and robust quality control processes.

Developing strong relationships with suppliers through clear communication, audits, and ongoing collaboration helps mitigate risks related to supply chain disruptions, defects, and delivery delays. Additionally, leveraging global sourcing opportunities while considering local market dynamics can optimize costs and logistics. Ultimately, a well-vetted and diversified supplier base enhances operational resilience and supports innovation in increasingly complex automotive electrical systems. By prioritizing supplier excellence and supply chain transparency, automotive manufacturers and Tier 1 suppliers can ensure reliable, high-quality wiring harness integration and maintain a competitive edge in the evolving automotive industry.