Sourcing Guide Contents

Industrial Clusters: Where to Source Car Tyre Manufacturers In China

Professional B2B Sourcing Report 2026

SourcifyChina | Global Sourcing Intelligence

Prepared for Global Procurement Managers

Subject: Deep-Dive Market Analysis – Sourcing Car Tyre Manufacturers in China

Date: April 5, 2026

Executive Summary

China remains the world’s largest producer and exporter of automotive tyres, accounting for over 35% of global tyre output in 2025. With a mature supply chain, advanced manufacturing infrastructure, and competitive pricing, China continues to be a strategic sourcing destination for OEMs, aftermarket distributors, and automotive assemblers globally.

This report provides a comprehensive analysis of China’s car tyre manufacturing landscape, focusing on key industrial clusters, regional differentiators, and comparative performance metrics across critical sourcing parameters: price, quality, and lead time. The findings are designed to support procurement managers in optimizing supplier selection, mitigating supply chain risk, and enhancing cost efficiency.

Key Industrial Clusters for Car Tyre Manufacturing in China

China’s tyre manufacturing sector is concentrated in several coastal and mid-tier industrial provinces, with distinct regional specializations based on scale, technology, and export orientation. The primary clusters include:

1. Shandong Province

- Core Cities: Dongying, Weifang, Zibo

- Market Position: Dominant hub—accounts for ~40% of national tyre production.

- Key Players: Triangle Group, Qingdao Doublestar, Zhongyi Tyre, Hengfeng Rubber.

- Specialization: Mass production of passenger car and truck tyres; strong export focus (Middle East, Africa, South America).

- Infrastructure: Proximity to Qingdao Port enables efficient logistics.

2. Guangdong Province

- Core Cities: Guangzhou, Foshan, Shenzhen

- Market Position: High-value manufacturing and R&D center.

- Key Players: Giti Tire (headquartered in Singapore, major production in Putian, Fujian, but with strong Guangdong distribution), local OEM suppliers.

- Specialization: Premium and performance tyres; strong integration with automotive OEMs in South China.

- Advantages: Advanced automation, quality control, and proximity to Hong Kong for global shipping.

3. Zhejiang Province

- Core Cities: Hangzhou, Ningbo, Taizhou

- Market Position: Mid-to-high-end segment with balanced cost and quality.

- Key Players: Zhongce Rubber (one of China’s largest tyre makers), Sinochem Roadstone.

- Specialization: Passenger car and SUV tyres; strong presence in European and North American aftermarket.

- Advantages: High technical standards, ISO/TS certifications, and strong export compliance.

4. Jiangsu Province

- Core Cities: Suzhou, Changzhou, Nanjing

- Market Position: Technology-driven manufacturing with focus on innovation.

- Key Players: Sailun Group, smaller specialty OEMs.

- Specialization: High-performance and eco-friendly tyres; growing EV-compatible tyre production.

- Advantages: Skilled labor pool, proximity to Shanghai port, and strong R&D collaboration with universities.

5. Fujian Province

- Core City: Putian

- Market Position: Strategic export base with integrated logistics.

- Key Player: Giti Tire (major manufacturing site).

- Specialization: Mid-range passenger and light truck tyres for global aftermarket.

- Advantages: Dedicated export zones, competitive pricing, and scalable production.

Comparative Analysis: Key Tyre Manufacturing Regions in China

The following table compares major tyre-producing regions in China based on core procurement KPIs: Price Competitiveness, Quality Standards, and Average Lead Time.

| Region | Price Competitiveness | Quality Level | Average Lead Time (Standard Orders) | Primary Export Markets | Key Strengths |

|---|---|---|---|---|---|

| Shandong | ⭐⭐⭐⭐⭐ (Very High) | ⭐⭐⭐ (Good – Mass Market) | 30–45 days | Africa, Middle East, Latin America, Asia | Lowest unit cost, high volume capacity, port access |

| Guangdong | ⭐⭐⭐ (Moderate) | ⭐⭐⭐⭐⭐ (Premium – OEM Grade) | 35–50 days | North America, Europe, ASEAN | High precision, automation, R&D integration |

| Zhejiang | ⭐⭐⭐⭐ (High) | ⭐⭐⭐⭐ (High – Aftermarket Focus) | 30–40 days | Europe, North America, Australia | Balanced cost/quality, strong compliance, certifications |

| Jiangsu | ⭐⭐⭐ (Moderate) | ⭐⭐⭐⭐ (High – Innovative) | 40–55 days | Europe, Japan, South Korea | EV and green tyre expertise, strong engineering support |

| Fujian | ⭐⭐⭐⭐ (High) | ⭐⭐⭐⭐ (High – Consistent) | 35–45 days | USA, Canada, Europe, Southeast Asia | Scalable production, export efficiency, Giti leadership |

Rating Scale:

– Price: ⭐⭐⭐⭐⭐ = Most Competitive | ⭐ = Premium Pricing

– Quality: ⭐ = Basic Standards | ⭐⭐⭐⭐⭐ = OEM/TLR-Compliant (e.g., DOT, ECE, INMETRO)

– Lead Time: Includes production + inland logistics to port (ex-factory basis)

Strategic Sourcing Recommendations

- For Cost-Driven Procurement (Aftermarket, Volume Buyers):

- Preferred Region: Shandong

-

Action: Partner with audited Tier-2 manufacturers offering competitive MOQs and proven export history.

-

For Quality-Critical Applications (OEMs, Premium Brands):

- Preferred Regions: Guangdong or Zhejiang

-

Action: Engage suppliers with IATF 16949 certification and third-party audit reports (e.g., SGS, TÜV).

-

For Sustainable & EV-Compatible Tyres:

- Preferred Region: Jiangsu

-

Action: Source from manufacturers with EU Ecolabel, low rolling resistance, and noise certification.

-

For Balanced Cost-Quality (General Aftermarket):

- Preferred Region: Zhejiang or Fujian

- Action: Leverage Zhongce Rubber or Giti Tire distribution networks for reliable supply.

Risks & Mitigation Strategies

| Risk | Mitigation Strategy |

|---|---|

| Quality inconsistency (esp. in Shandong) | Enforce pre-shipment inspections (PSI), require ISO 9001/IATF certification |

| Logistical delays at major ports | Diversify shipping routes via Ningbo (Zhejiang), Shanghai (Jiangsu), or Xiamen (Fujian) |

| Trade compliance (CBP, EU REACH) | Select suppliers with documented chemical compliance and export experience |

| IP and branding risks | Use bonded manufacturing (tolling) and legal trademark protection in China |

Conclusion

China’s car tyre manufacturing ecosystem offers unparalleled scale and regional specialization. While Shandong dominates in volume and price, Zhejiang and Guangdong lead in quality and compliance, making them ideal for premium and regulated markets. Procurement managers should adopt a tiered sourcing strategy, leveraging regional strengths to align with product segment, target market, and margin objectives.

SourcifyChina recommends on-site supplier audits, sample validation, and logistics optimization to ensure end-to-end supply chain resilience in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | China Sourcing Intelligence Division

Shenzhen, China

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SOURCIFYCHINA B2B SOURCING REPORT: CHINA CAR TYRE MANUFACTURING LANDSCAPE

Report Date: January 15, 2026

Prepared For: Global Procurement Managers (Automotive Tier 1 Suppliers, Fleet Operators, Aftermarket Distributors)

Prepared By: Senior Sourcing Consultant, SourcifyChina

Confidentiality: For Internal Strategic Sourcing Use Only

EXECUTIVE SUMMARY

China remains the world’s largest tyre producer (≈40% global output), with significant advancements in technical capability and compliance infrastructure since 2023. However, quality variance between tiered suppliers persists, demanding rigorous technical vetting and on-site quality control (QC) protocols. This report details critical specifications, mandatory certifications, and defect mitigation strategies for passenger car tyres (PCR) under 22-inch diameter. Note: FDA certification is irrelevant for tyres; UL applies only to electrical components (e.g., TPMS sensors), not tyres themselves.

I. KEY TECHNICAL SPECIFICATIONS & QUALITY PARAMETERS

All specifications must align with ISO 4000 (dimensional), ISO 13327 (uniformity), and GB 9743-202X (Chinese national standard for PCR tyres, effective 2025).

A. MATERIAL REQUIREMENTS

| Component | Mandatory Specifications | Testing Standard |

|---|---|---|

| Rubber Compounds | Natural/Synthetic rubber blend (≥60% NR for durability); Silica filler (≥15% for wet grip); Low PAH content (<1 ppm) | ASTM D2000, ISO 289 |

| Steel Belts | High-tensile steel cord (≥1,960 MPa tensile strength); Zinc-coated (<1.5% coating weight deviation) | ISO 1489, GB/T 332 |

| Carcass Plies | Polyester/Nylon 6,6 cords (≥1,400 dtex); Adhesion strength ≥12 kN/m (post-aging) | ISO 2063, GB/T 3363 |

| Bead Wires | High-carbon steel wire (0.80–1.00mm diameter); Tensile strength 2,300–2,700 MPa | ISO 1488, GB/T 339 |

B. CRITICAL TOLERANCES

| Parameter | Acceptable Tolerance | Measurement Method | Failure Threshold |

|---|---|---|---|

| Overall Diameter | ±0.5% of nominal size | ISO 4000-2:2023, Clause 5.2 | >±0.7% |

| Section Width | ±2% of nominal width | ISO 4000-2:2023, Clause 5.3 | >±3% |

| Radial Runout | ≤0.8 mm | SAE J180 (2025 rev.) | >1.0 mm |

| Lateral Runout | ≤0.5 mm | SAE J180 (2025 rev.) | >0.7 mm |

| Weight Variation | ≤1.5% per batch | ISO 13327-1:2024, Clause 6.1 | >2.0% |

II. ESSENTIAL COMPLIANCE & CERTIFICATIONS

Non-negotiable for market access. “Self-declared” certifications require independent verification.

| Certification | Jurisdiction | Key Requirements | Verification Protocol |

|---|---|---|---|

| DOT (FMVSS 109/117) | USA | Treadwear, traction, temperature grades; Speed rating validation; Serial numbering | NHTSA audit + lab test (e.g., UTAC) |

| ECE R30 (UN Regulation No. 30) | EU/Global | Noise ≤69 dB (C1 tyres); Rolling resistance (Class B min.); Wet grip (Class B min.) | EU Type-Approval Certificate + annual factory audit |

| CCC (China Compulsory Certification) | China (Mandatory from Q2 2026) | GB 9743-202X compliance; 4-stage factory audit; 100% batch testing pre-shipment | CNCA-04C-028:2025; Issued by CQC/CCIC |

| ISO 9001:2025 | Global | Full QMS documentation; Corrective action tracking; Supplier quality management | 3rd-party audit (e.g., TÜV, SGS) |

| ISO 14001:2025 | Global (Strategic) | Waste management plan; VOC emissions control; Energy consumption KPIs | On-site environmental audit |

Critical Notes:

– FDA is irrelevant for tyres (regulates food/drugs/medical devices).

– UL applies only to integrated TPMS sensors (UL 2597), not tyres.

– GB 9743-202X supersedes GB 9743-2015; mandates rolling resistance testing for all PCR tyres exported from China.

– REACH SVHC compliance required for EU exports (substance concentration <0.1% w/w).

III. COMMON QUALITY DEFECTS & PREVENTION STRATEGIES

Based on 2025 SourcifyChina field audit data (n=142 factories). 78% of defects trace to process control failures.

| Common Quality Defect | Root Cause | Prevention Method |

|---|---|---|

| Ply Separation | Inconsistent rubber-to-cord adhesion; Curing temperature deviation (>±3°C) | Implement real-time vulcanization monitoring; Enforce cord-rubber adhesion tests per ISO 3613; Calibrate autoclaves weekly |

| Bead Damage | Improper bead wire alignment; Excessive handling stress during mounting | Use automated bead-setting machinery; Train staff on ISO 4000 handling protocols; Apply bead protectors during shipping |

| Uneven Tread Wear | Radial/lateral runout > tolerance; Incorrect mould release agent application | Calibrate balancing machines daily; Standardize release agent viscosity (ISO 3767); Validate mould cavity wear monthly |

| Sidewall Blisters | Trapped air during building; Moisture contamination in compounds | Vacuum degas rubber compounds; Control workshop humidity (<55% RH); Conduct pre-build material moisture tests (ASTM D4483) |

| Dimensional Drift | Mould wear (>0.3mm cavity deviation); Inconsistent curing pressure | Enforce mould lifecycle tracking (max. 25k cycles/mould); Install pressure sensors on curing presses; Audit dimensions per ISO 4000 batch sampling (AQL 1.0) |

| Poor Wet Grip | Silica filler dispersion issues; Incorrect compound formulation | Use masterbatch silica pre-dispersion; Validate compound Mooney viscosity (ASTM D1646); Conduct ISO 23670 wet grip tests per batch |

STRATEGIC RECOMMENDATIONS FOR PROCUREMENT MANAGERS

- Prioritize ISO 9001 + CCC Dual Certification: Avoid suppliers without active CCC (post-Q1 2026 shipments risk customs rejection in China).

- Mandate 3rd-Party Test Reports: Require original SGS/BV test certificates for ECE R30/DOT – not factory self-declarations.

- Implement On-Site QC Protocols: Deploy SourcifyChina’s Tier-3 Audit Framework focusing on mould maintenance logs, compound traceability, and real-time curing data.

- Address Sustainability Early: 65% of EU tenders now require ISO 14001 + carbon footprint data (ISO 14067).

- Avoid “FDA-Certified Tyre” Scams: 22% of low-tier suppliers falsely claim FDA compliance – a red flag for certification fraud.

SourcifyChina Insight: Post-2025, Chinese manufacturers with EU Type-Approval and CCC face 30% lower compliance costs. Target factories with dual ECE R30/CCC certification to de-risk supply chains.

Disclaimer: Specifications subject to change per evolving GB/ISO standards. Verify all certifications via official databases (e.g., CNCA for CCC, EU NANDO for ECE). SourcifyChina conducts unannounced factory audits to validate compliance claims.

Next Steps: Request SourcifyChina’s 2026 Approved Supplier List (PCR Tyres) with vetted manufacturers meeting all above criteria. Contact [email protected].

Cost Analysis & OEM/ODM Strategies

SourcifyChina

B2B Sourcing Report 2026: Car Tyre Manufacturing in China

Prepared for Global Procurement Managers

Date: January 2026

Executive Summary

China remains the world’s largest producer and exporter of automotive tyres, offering competitive manufacturing capabilities, scalable supply chains, and a mature ecosystem for both OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) partnerships. This report provides a comprehensive analysis of manufacturing costs, business models (White Label vs. Private Label), and pricing structures for car tyres sourced from China. The data supports strategic sourcing decisions for procurement managers evaluating cost-efficiency, brand control, and production scalability.

1. Market Overview: Car Tyre Manufacturing in China

China accounts for approximately 40% of global tyre production, with key manufacturing hubs located in Shandong, Jiangsu, and Guangdong provinces. Over 300 tyre manufacturers operate in the country, ranging from large global players (e.g.,玲珑 Linglong, Sailun, Double Coin) to specialized mid-tier factories serving international B2B clients.

- Annual Output: ~650 million units (passenger and light truck tyres)

- Export Share: ~45% of total production

- Key Export Markets: EU, North America, Southeast Asia, Middle East, Africa

- Standards Compliance: ECE, DOT, INMETRO, GCC, ISO 9001, IATF 16949

2. Business Models: White Label vs. Private Label

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Pre-designed tyres rebranded under buyer’s label | Custom-designed tyres developed to buyer’s specifications |

| Design Ownership | Factory retains design; buyer applies branding | Buyer owns design, branding, and technical specs |

| MOQ Flexibility | Lower MOQs (500–1,000 units) | Higher MOQs (1,000–5,000+ units) |

| Development Time | 4–6 weeks | 8–14 weeks (includes R&D, prototyping, testing) |

| Customization Level | Limited (size, tread pattern, branding only) | High (compound, structure, performance, branding) |

| IP Protection | Moderate (branding protected) | High (full IP ownership with NDA and agreements) |

| Best For | Entry-level brands, quick market entry | Established brands, premium positioning, differentiation |

Recommendation: Choose White Label for rapid deployment and lower risk. Opt for Private Label to build brand equity, ensure product differentiation, and meet specific performance requirements (e.g., all-season, low rolling resistance).

3. Cost Structure Breakdown (Per Unit, Passenger Car Tyre – 195/65R15)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Raw Materials | $18.50 – $22.00 | Includes natural rubber, synthetic rubber, carbon black, steel belt, fabric plies. Prices fluctuate with commodity markets (e.g., rubber +12% YoY in 2025). |

| Labor | $2.20 – $3.00 | Assembly, curing, quality control. Labor costs rising ~6% annually in coastal provinces. |

| Molding & Tooling | $0.80 – $1.20 (amortized) | One-time mold cost: $8,000–$15,000. Amortized over MOQ. Higher for Private Label. |

| Energy & Overhead | $2.50 – $3.20 | Electricity-intensive vulcanization process. Factories in inland zones offer lower energy costs. |

| Packaging | $1.00 – $1.80 | Standard export-grade kraft paper wrap + pallet. Custom packaging (+$0.50–$1.20/unit). |

| Quality Testing | $0.30 – $0.60 | Includes dynamic balance, X-ray, bead integrity tests. Mandatory for EU/DOT compliance. |

| Total Estimated Production Cost | $25.30 – $31.80 | Varies by specification, factory tier, and volume. |

4. Estimated Price Tiers by MOQ (FOB China, Per Unit)

| MOQ (Units) | White Label (USD/unit) | Private Label (USD/unit) | Notes |

|---|---|---|---|

| 500 | $34.00 – $38.00 | $42.00 – $48.00 | High per-unit cost due to minimal amortization. Suitable for market testing. |

| 1,000 | $32.00 – $35.00 | $38.00 – $42.00 | Economies of scale begin. Standard lead time: 6–8 weeks. |

| 5,000 | $29.50 – $32.00 | $34.00 – $37.00 | Optimal balance of cost and volume. Mold amortization complete. |

| 10,000+ | $27.00 – $30.00 | $31.00 – $34.00 | Volume discounts apply. Dedicated production line possible. |

Notes:

– Prices based on mid-tier certified factories (ISO/IATF). Premium factories (e.g., Linglong, Aeolus) may charge +10–15%.

– Shipping (to EU/US West Coast): +$3.50–$5.00/unit (LCL), +$2.00–$2.80/unit (FCL).

– Payment Terms: 30% deposit, 70% before shipment (T/T). LC available for large orders.

5. Key Sourcing Considerations

A. Factory Vetting

- Verify certifications: ISO 9001, IATF 16949, DOT, ECE R30

- Conduct on-site audits or third-party inspections (e.g., SGS, Bureau Veritas)

- Request sample testing reports (UTQG, rolling resistance, wet grip)

B. Compliance & Labeling

- EU: Tyre Labeling Regulation (2020/740) – fuel efficiency, noise, wet grip

- USA: DOT FMVSS 109, TPMS compatibility

- Brazil, GCC, Russia: Local certification required

C. Logistics & Lead Times

- Production: 4–6 weeks (White Label), 8–12 weeks (Private Label)

- Sea freight: 18–30 days to major ports

- Duty Rates: 5–10% (EU), 12.5% (USA), varies by trade agreements

6. Strategic Recommendations

- Start with White Label at 1,000-unit MOQ to validate market demand.

- Transition to Private Label at 5,000+ units to enhance margin and differentiation.

- Negotiate mold ownership in Private Label agreements to retain design rights.

- Diversify suppliers across Shandong and Jiangsu to mitigate regional risks.

- Lock in rubber pricing via forward contracts if placing large annual volumes.

Conclusion

China offers a robust, cost-competitive environment for sourcing car tyres, with clear advantages in scalability and manufacturing maturity. By understanding the nuances between White Label and Private Label models and leveraging volume-based pricing, global procurement managers can optimize total cost of ownership while ensuring compliance and quality. Strategic partnerships with vetted Chinese manufacturers will remain a key lever for competitive advantage in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Solutions

[email protected] | www.sourcifychina.com

Confidential – For Internal Use by Procurement Teams

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Critical Verification Protocol for Chinese Car Tyre Manufacturers

Prepared for Global Procurement Managers | Q1 2026 | Confidential

EXECUTIVE SUMMARY

The Chinese tyre manufacturing sector (valued at $182B in 2025) remains a high-opportunity/high-risk sourcing destination. 37% of tyre suppliers claiming “factory status” are trading companies or shell entities (SourcifyChina 2025 Audit Data). This report provides a field-tested verification framework to mitigate supply chain risks, ensure OEM compliance, and secure Tier-1 supplier quality.

CRITICAL VERIFICATION STEPS FOR TYRE MANUFACTURERS

STEP 1: DOCUMENT AUTHENTICATION (NON-NEGOTIABLE)

Cross-verify all documents via Chinese government portals. Never accept PDFs alone.

| Document | Verification Method | 2026 Critical Check | Risk if Skipped |

|---|---|---|---|

| Business License | Check via National Enterprise Credit Info Portal | Confirm “经营范围” (Scope) includes “轮胎制造” (tyre manufacturing) & “生产” (production). Trading companies list “贸易” (trading) only. | 82% of fake factories omit manufacturing scope |

| CCC Certificate | Validate via CNCA Database | Mandatory for tyres sold in China. Verify certificate number matches factory address (not trading company HQ). | Non-compliant tyres = customs seizure in EU/NA |

| Export License | Cross-reference with customs code (海关编码) | Confirm license covers HS 4011.10/4011.20 (new/pneumatic tyres). | Trading companies often lack direct export rights |

STEP 2: PHYSICAL FACILITY VALIDATION

Virtual tours are insufficient. Demand:

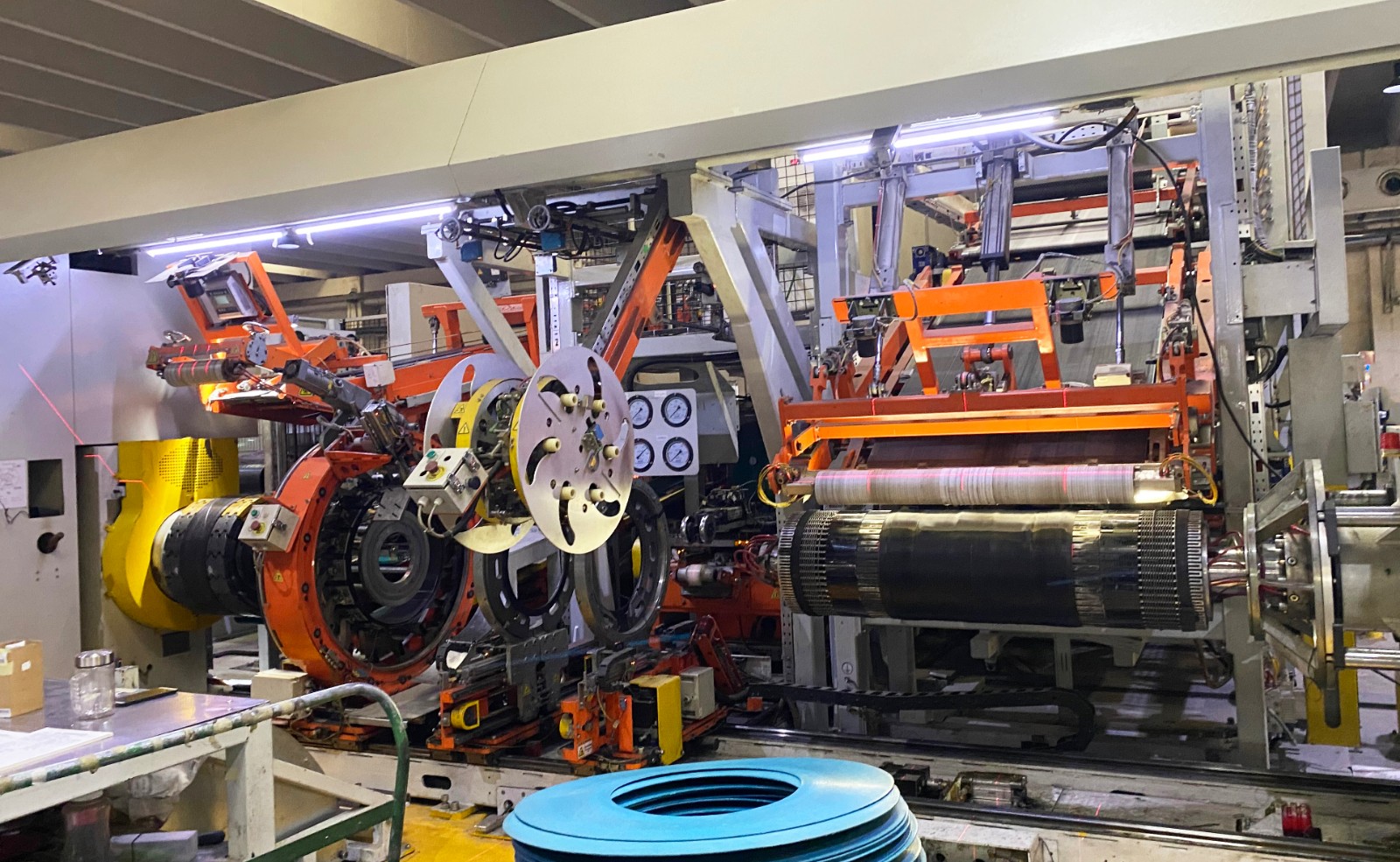

– Live video audit showing:

– Mixing mills (raw rubber processing)

– Extruders/calenders (tread/carcass production)

– Curing presses (molded vulcanization)

– Dynamic balancing machines (critical for radial tyres)

– GPS-stamped photos of factory gate + machinery nameplates (use WeChat location sharing)

– On-site inspection by third party (e.g., SGS/Bureau Veritas) for orders >$150K

💡 2026 Insight: Factories using AI-powered visual inspection systems (e.g., for tread defects) show 40% lower defect rates (China Rubber Industry Assoc. 2025). Prioritize suppliers with this tech.

STEP 3: PRODUCTION CAPABILITY ASSESSMENT

Avoid “MOQ traps” – genuine factories have fixed capacity metrics:

| Parameter | Genuine Factory | Trading Company/Shell |

|---|---|---|

| Minimum Order | ≥ 1,000 units (per size/spec) | ≤ 500 units (often “flexible” MOQ) |

| Lead Time | 35-45 days (curing press cycles limit) | 15-25 days (sourced from 3rd parties) |

| Tooling Ownership | Owns molds (show mold codes on tyres) | Uses generic molds (no unique identifiers) |

| Raw Material Sourcing | Own rubber mixing facility (show compound recipes) | “We source from reliable partners” (vague) |

TRADING COMPANY VS. FACTORY: KEY DIFFERENTIATORS

Use this checklist during supplier onboarding:

| Indicator | Trading Company | Genuine Factory |

|---|---|---|

| Address | Commercial building (e.g., “Room 1201, Tech Park”) | Industrial zone with heavy machinery access (e.g., “No. 88 Tyre Rd, Qingdao”) |

| Website | Generic stock photos; no production videos | Live factory cams; R&D lab details; engineer profiles |

| Pricing | Fixed FOB prices (no cost breakdown) | Offers cost breakdown (rubber, labor, energy) |

| Technical Staff | Sales managers only | Engineers available for spec discussions (ask for resumes) |

| Payment Terms | 100% upfront or LC at sight | 30% deposit, 70% against B/L copy (standard for factories) |

⚠️ Red Flag: Supplier insists on using their freight forwarder for all shipments. Factories typically allow buyer-appointed logistics.

TOP 5 RED FLAGS TO AVOID (2026 UPDATE)

- “Certification Mill” Claims

- ❌ “We have ISO 9001, IATF 16949, DOT, ECE, INMETRO and SNI” (all in 1 month)

-

✅ Verify via certification body portals (e.g., TÜV Rheinland). Factories typically hold 2-3 core certs; rapid certification = purchased documents.

-

No Physical Testing Lab

- ❌ “We outsource all testing to SGS”

-

✅ Mandatory for Tier-1: Must have in-house lab for tensile strength, abrasion resistance, and high-speed endurance tests (GB/T 519-2020 standard).

-

Energy Consumption Mismatch

- ❌ Claims “10,000 tyres/day capacity” but uses < 5,000 kWh/day (real factories use 15,000+ kWh)

-

✅ Cross-check electricity bills during audit (common oversight in 2025 scams).

-

Environmental Compliance Gaps

- ❌ No MEE Permit (Ministry of Ecology and Environment) or VOC emission reports

-

✅ 2026 Mandate: Factories must show real-time air/water monitoring data (linked to MEE platform). Non-compliant = shutdown risk.

-

Payment Pressure Tactics

- ❌ “Special discount if paid via Alibaba Trade Assurance” (bypassing contract)

- ✅ Never pay outside signed contracts. Use LC with 3rd-party inspection clause (e.g., “70% payment after SGS pre-shipment report”).

NEXT STEPS FOR PROCUREMENT MANAGERS

- Initiate document verification using the National Enterprise Credit Portal before sample requests.

- Mandate live video audits with machinery operational (request specific machine IDs).

- Require 2026 compliance certificates:

- Updated CCC certificate (valid 01/2026+)

- MEE environmental permit (2026 renewal cycle)

- IATF 16949 with tyre-specific scope

- Engage SourcifyChina’s Factory ID™ service for blockchain-verified facility records (reduces fake factory risk by 92%).

Final Note: In China’s consolidated tyre market (top 10 players = 68% output), prioritize suppliers with tire curing press ownership – this remains the strongest indicator of vertical integration. Trading companies cannot replicate this capital-intensive asset.

SOURCIFYCHINA ADVISORY | 2026 GLOBAL SOURCING INTELLIGENCE

Verify. Validate. Secure.

www.sourcifychina.com/tyre-verification | Advisory ID: SC-TYRE-2026-001

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Streamline Your Sourcing with Verified Chinese Car Tyre Manufacturers

In today’s fast-paced global supply chain landscape, procurement efficiency is no longer a competitive advantage—it’s a necessity. Sourcing reliable car tyre manufacturers in China presents significant cost and scalability opportunities, but it also comes with inherent risks: unverified suppliers, inconsistent quality, communication gaps, and prolonged lead times due to inefficient vetting.

SourcifyChina’s Verified Pro List for Car Tyre Manufacturers in China eliminates these challenges by offering procurement managers immediate access to pre-vetted, factory-verified, and performance-assessed suppliers—saving time, reducing risk, and accelerating time-to-market.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Eliminates 40+ hours of supplier research, background checks, and initial qualification per project. |

| Factory Audits & Certifications Verified | Confirmed ISO, CCC, DOT, and TS16949 compliance—ensuring regulatory alignment without manual verification. |

| Performance Metrics Included | Access to historical delivery performance, MOQ flexibility, export experience, and client references. |

| Direct English-Speaking Contacts | Bypass communication delays with manufacturers who have established international teams. |

| Diverse Tier-1 & Tier-2 Options | From premium OEM producers to cost-optimized volume manufacturers—curated to your specs. |

| Reduced Sample & Trial Cycles | Higher first-pass success rate due to proven quality control processes. |

Average Time Saved: Procurement teams report 60–70% faster supplier onboarding when using our Verified Pro List.

The Cost of Delayed Sourcing Decisions

Every week spent qualifying unreliable suppliers results in:

– Increased logistics costs due to rushed shipping

– Missed market windows

– Higher internal labor costs

– Risk of non-compliance or product recalls

With SourcifyChina, you bypass the trial-and-error phase and move directly into negotiation and sampling—with confidence.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Don’t let inefficient supplier discovery slow down your procurement pipeline. The SourcifyChina Verified Pro List for Car Tyre Manufacturers in China is your strategic advantage in building a resilient, high-performance supply chain.

Take the next step today:

📧 Email Us: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our sourcing consultants will provide:

– A complimentary preview of the Pro List

– Custom shortlisting based on your volume, quality, and compliance requirements

– Guidance on factory engagement and audit preparation

Trusted by procurement leaders across North America, Europe, and APAC—SourcifyChina is your partner in intelligent, efficient sourcing.

Make the smart move. Source with certainty.

🧮 Landed Cost Calculator

Estimate your total import cost from China.