The global car audio system market is experiencing steady expansion, driven by rising consumer demand for advanced infotainment features, increased vehicle production, and the growing adoption of connected and smart audio technologies. According to a report by Mordor Intelligence, the car audio market was valued at USD 14.8 billion in 2023 and is projected to grow at a CAGR of over 5.2% from 2024 to 2029. This growth is further amplified by trends such as the integration of voice assistants, smartphone connectivity (e.g., Apple CarPlay and Android Auto), and the shift toward electric and premium vehicles equipped with high-end audio systems. As automakers and aftermarket suppliers scale production to meet this demand, sourcing directly from reliable wholesale manufacturers has become critical for distributors and retailers aiming to offer competitive, high-quality products. With Asia-Pacific emerging as a dominant manufacturing hub—thanks to cost-efficient production and strong electronics supply chains—the importance of identifying top-tier car stereo OEMs has never been greater. Based on production capacity, global reach, product innovation, and compliance with international quality standards, we’ve compiled a data-informed list of the top 10 car stereo wholesale manufacturers shaping the industry.

Top 10 Car Stereo Wholesale Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Metra Electronics

Domain Est. 1999

Website: metraonline.com

Key Highlights: Metra is the “Installer’s Choice®” for 12volt aftermarket audio, lighting, and safety installation accessories, with a U.S. based team that engineers OEM- ……

#2 Android Car Stereo Manufacturer & Wholesaler

Domain Est. 2021

Website: ustopdisplay.com

Key Highlights: As a professional Android car stereo manufacturer, we specialize in producing high-quality car radios and in-dash multimedia systems for global automotive ……

#3 Soundstream Technologies

Domain Est. 1995

Website: soundstream.com

Key Highlights: Discover Soundstream’s full lineup of car and marine audio gear – amplifiers, subwoofers, speakers, and more built for power and precision….

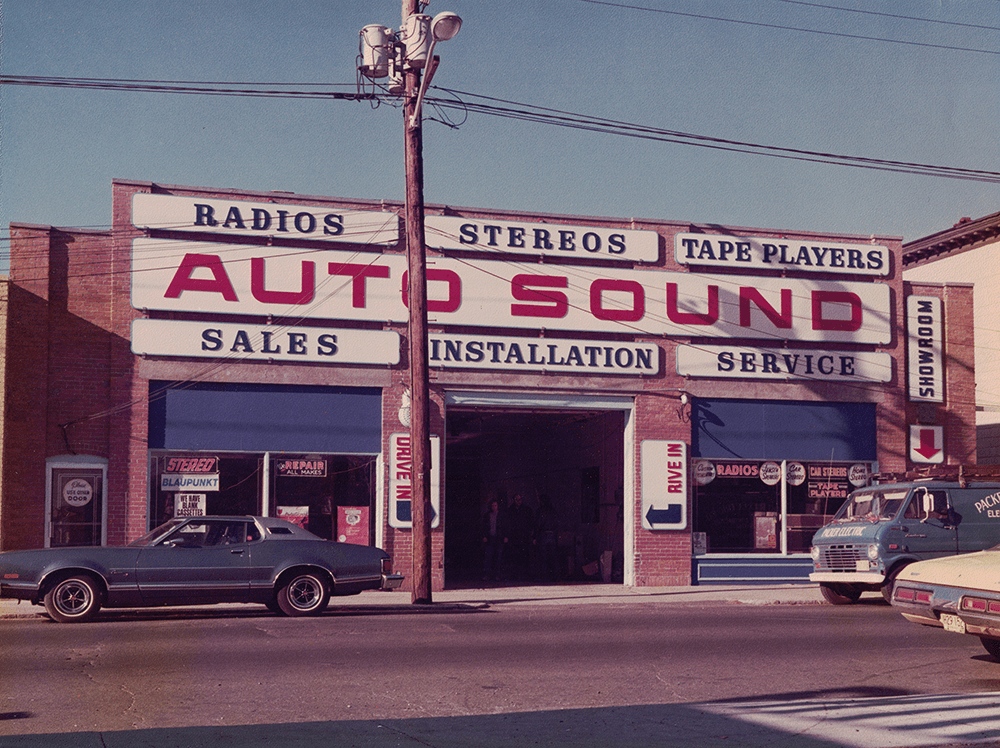

#4 Auto Sound Company Inc

Domain Est. 1996

Website: autosound.com

Key Highlights: From simple remote starters and radios, to top quality custom leather interiors and power moon roofs, we have lots of great products to customize your car….

#5 SSR Distributors

Domain Est. 2001

Website: ssrdistributors.com

Key Highlights: SSR Distributors – Audio, Visual, Electronics, & Automotive Wholesale Distribution….

#6 Buy Wholesale Car Audios, Car Radio, Car Stereo

Domain Est. 2006

Website: szklyde.com

Key Highlights: We offer you a wide collection of wholesale car audio systems that fit in your car. Along with this, we will help you to select a perfect pair for your vehicle….

#7 T-Spec

Domain Est. 2012

Website: tspeconline.com

Key Highlights: T-Spec’s goal is to bring innovation and value to every product in this revolutionary line of car audio accessories….

#8 Pioneer Car Audio

Domain Est. 2018

Website: pioneercarentertainment.com

Key Highlights: Pioneer – Get the best car audio & video system accessories stereo, radio, speakers, subwoofers, analog & digital Amplifiers, receivers, tv tuners & reverse ……

#9 Woofer Electronics

Domain Est. 2018

Website: woofered.com

Key Highlights: Woofer Electronics has since grown to be one of the largest wholesale mobile electronics distributors in the Midwestern United States….

#10 The Wholesale House

Domain Est. 1997

Website: twhouse.com

Key Highlights: The Wholesale House has a solution to help you. Become a Customer Call Today (419) 542-7739 ABOUT US CUSTOMER SERVICE INFORMATION CONTACT…

Expert Sourcing Insights for Car Stereo Wholesale

2026 Market Trends for Car Stereo Wholesale

The car stereo wholesale market is poised for significant transformation by 2026, driven by evolving consumer preferences, technological advancements, and shifts in the automotive landscape. Wholesalers must adapt to these trends to remain competitive and capitalize on emerging opportunities.

Rising Demand for Advanced Infotainment and Connectivity

By 2026, consumers will increasingly expect car audio systems to mirror the seamless connectivity and functionality of their smartphones. Wholesalers can expect heightened demand for units featuring full Android Auto and Apple CarPlay integration, wireless connectivity (Bluetooth 5.0+, Wi-Fi), and support for over-the-air (OTA) updates. Voice assistant compatibility with Siri, Google Assistant, and Amazon Alexa will become standard, not a premium feature. Wholesalers should prioritize inventory that emphasizes seamless smartphone mirroring and hands-free operation to meet mainstream expectations.

Growth of Aftermarket Solutions for Older and Non-Luxury Vehicles

Despite the proliferation of factory-installed infotainment systems, a large base of older vehicles and budget-friendly models will continue to lack advanced audio features. This creates a robust aftermarket opportunity. Wholesalers will see sustained demand for retrofit head units that offer modern capabilities like touchscreens, navigation, and app integration in vehicles originally sold without them. Emphasis will be on plug-and-play solutions with vehicle-specific harnesses and mounting kits to simplify installation for both professionals and DIY customers.

Integration with Vehicle Diagnostics and Telematics

Car stereos are evolving beyond entertainment to become central information hubs. By 2026, wholesale demand will grow for units that can integrate with vehicle diagnostic systems (OBD-II), displaying real-time engine data, maintenance alerts, and fuel efficiency metrics. Additionally, basic telematics features like GPS tracking and remote alerts may be bundled into higher-end aftermarket units. Wholesalers should stock systems that offer value-added features enhancing vehicle management and safety.

Increased Focus on Audio Quality and Customization

While connectivity is paramount, audiophiles and enthusiasts will continue to drive demand for superior sound. Wholesalers should anticipate growth in high-fidelity components, including digital signal processors (DSPs), multi-channel amplifiers, and premium speakers. There will be a rising interest in customizable sound profiles and acoustic tuning. Bundling head units with compatible amplifiers and speakers could become a strategic wholesale offering for specialty retailers targeting performance-oriented customers.

Expansion of E-commerce and Omnichannel Distribution

Online sales channels will dominate the wholesale-to-retailer segment by 2026. Wholesalers must invest in robust e-commerce platforms with detailed product specifications, compatibility databases, and real-time inventory visibility. Integration with retailers’ inventory management systems (APIs) will be essential. Additionally, omnichannel models—such as wholesale partnerships with online marketplaces or B2B platforms like Alibaba and Faire—will be critical for reaching a broader retail base efficiently.

Sustainability and Supply Chain Resilience

Environmental regulations and consumer awareness will push demand for eco-friendly manufacturing and packaging. Wholesalers may face pressure to source from suppliers with sustainable practices and transparent supply chains. Simultaneously, geopolitical factors and past disruptions emphasize the need for diversified sourcing and resilient logistics. Wholesalers who can offer reliable delivery times and mitigate supply chain risks will gain a competitive edge.

Impact of Electric and Autonomous Vehicle Trends

While fully autonomous vehicles are not mainstream by 2026, the rise of electric vehicles (EVs) influences audio preferences. EVs’ quieter cabins highlight audio quality, increasing demand for immersive sound systems. Furthermore, as vehicles incorporate more driver-assistance features, audio systems may integrate with navigation and safety alerts more deeply. Wholesalers should monitor OEM trends in EVs and ADAS to anticipate aftermarket needs.

In conclusion, the 2026 car stereo wholesale market will be defined by connectivity, aftermarket adaptability, integration, and distribution innovation. Success will depend on wholesalers’ ability to anticipate technological shifts, offer comprehensive solutions, and maintain agile, customer-focused operations.

Common Pitfalls When Sourcing Car Stereo Wholesale: Quality and Intellectual Property Risks

Sourcing car stereos wholesale can be a profitable venture, but it comes with significant risks—particularly concerning product quality and intellectual property (IP) violations. Avoiding these pitfalls is essential for building a sustainable and legally compliant business.

Poor Product Quality and Inconsistent Performance

One of the most frequent challenges in wholesale sourcing is receiving car stereos that fail to meet advertised specifications or durability standards. Low-cost suppliers, especially from regions with lax manufacturing oversight, may cut corners on materials, circuitry, and software, resulting in units with poor sound quality, frequent malfunctions, or short lifespans. Inconsistent batch quality can further complicate inventory management and damage your brand reputation when customers receive defective or subpar units.

Counterfeit or Infringing Products

Many wholesale car stereos, particularly those resembling well-known branded models, may be counterfeit or unauthorized replicas. These products often mimic the design, logos, or packaging of reputable brands like Pioneer, Sony, or Alpine without proper licensing. Distributing such items exposes your business to legal action for trademark and copyright infringement, fines, shipment seizures, and potential liability for damages.

Misrepresentation of Features and Compatibility

Suppliers may exaggerate or falsify product capabilities—such as Bluetooth range, audio output, compatibility with specific vehicle models, or support for advanced features like Apple CarPlay or Android Auto. This misrepresentation leads to customer dissatisfaction, high return rates, and negative reviews. Always verify technical specifications through independent testing or trusted third-party certifications.

Lack of Regulatory Compliance

Wholesale car stereos must meet regional safety and electromagnetic compatibility standards (e.g., FCC in the U.S., CE in Europe). Some suppliers bypass these requirements to reduce costs, putting buyers at risk of non-compliant products that cannot be legally sold. Ensure your supplier provides documentation proving compliance with relevant regulations.

Inadequate Warranty and After-Sales Support

Many low-cost wholesalers offer little to no warranty or technical support. When issues arise, resolving customer complaints becomes your responsibility. Without a reliable support system from the supplier, you may face increased costs for replacements, repairs, or refunds—eroding profit margins and customer trust.

Hidden Costs and Minimum Order Quantity (MOQ) Traps

While initial prices may seem attractive, hidden costs such as shipping, import duties, or mandatory high MOQs can impact profitability. Some suppliers pressure buyers into large orders of low-quality or obsolete inventory, increasing financial risk and storage challenges.

Conclusion

To mitigate these risks, conduct thorough due diligence on suppliers, request product samples, verify IP rights, and ensure compliance with local regulations. Partnering with reputable, transparent wholesalers—even at a slightly higher cost—protects your business from legal exposure and builds long-term customer trust.

Logistics & Compliance Guide for Car Stereo Wholesale

Supply Chain Management

Efficient supply chain management is essential for maintaining inventory levels and meeting customer demand. Begin by establishing reliable relationships with manufacturers and suppliers, preferably those with proven quality control and timely delivery records. Implement just-in-time (JIT) inventory practices where feasible to reduce holding costs while ensuring product availability. Utilize inventory management software to track stock levels, forecast demand, and automate reordering processes.

Transportation & Distribution

Choose transportation methods based on cost, speed, and product sensitivity. For domestic wholesale operations, ground freight via LTL (Less-Than-Truckload) or full truckload services is common. For international imports, consider sea freight for large volumes and air freight for urgent shipments. Always use secure packaging to prevent damage during transit. Partner with reputable logistics providers that offer real-time tracking, insurance, and reliable delivery windows.

Warehousing & Storage

Maintain organized, climate-controlled warehouse facilities to protect electronic components from moisture, heat, and dust. Implement a barcode or RFID system for accurate inventory tracking. Store car stereos on shelves with adequate spacing to prevent physical damage and allow for easy access. Regularly audit stock to reconcile physical inventory with digital records and identify discrepancies early.

Import/Export Compliance

Ensure compliance with international trade regulations when sourcing or distributing globally. Obtain necessary import/export licenses and classify products correctly under the Harmonized System (HS) codes—typically under 8518.40 for car audio systems. Prepare accurate commercial invoices, packing lists, and bills of lading. Comply with customs regulations in both origin and destination countries, including payment of tariffs and adherence to trade agreements.

Product Safety & Certification

Car stereos must meet safety and electromagnetic compatibility (EMC) standards. In the U.S., comply with FCC Part 15 regulations to minimize radio frequency interference. In the EU, ensure CE marking per the Radio Equipment Directive (RED) and Low Voltage Directive (LVD). Other regions may require certifications such as KC (Korea), RCM (Australia), or INMETRO (Brazil). Maintain documentation of all testing and certifications for audit purposes.

Labeling & Packaging Requirements

Adhere to regional labeling laws, including language requirements, safety warnings, and manufacturer information. Include required compliance marks (e.g., FCC ID, CE mark) on product labels or user manuals. Packaging must be durable and include necessary documentation like user guides, warranty information, and regulatory compliance statements. Avoid misleading claims on packaging related to compatibility or performance.

Warranty & Returns Management

Establish a clear returns policy compliant with consumer protection laws in your operating regions. For B2B wholesale, define terms for defective units, dead-on-arrival (DOA) items, and warranty claims. Maintain a reverse logistics process to efficiently handle returns, test products, and determine whether to repair, replace, or dispose. Keep records of all warranty claims for quality control and manufacturer accountability.

Environmental & E-Waste Regulations

Comply with electronic waste (e-waste) disposal laws such as the EU’s WEEE Directive, which requires producers to fund the recycling of electronic goods. In regions with take-back programs, ensure your business is registered and fulfills collection and recycling obligations. Use recyclable packaging materials and communicate eco-friendly practices to enhance brand reputation and meet regulatory expectations.

Data Security & GDPR Considerations

If car stereos include Bluetooth, GPS, or data storage features, ensure compliance with data protection regulations like the GDPR (EU) or CCPA (California). Minimize data collection, secure stored information, and provide users with transparency and control over their data. Update firmware to address security vulnerabilities and disclose privacy practices in user manuals and online.

Recordkeeping & Audit Preparedness

Maintain comprehensive records of all logistics and compliance activities, including shipping documents, customs filings, safety certifications, warranty claims, and communications with regulatory bodies. Conduct periodic internal audits to verify compliance and prepare for potential third-party or government inspections. Store records securely for the legally required retention period, typically 5–7 years depending on jurisdiction.

In conclusion, sourcing car stereo wholesale suppliers requires a strategic approach that balances cost-efficiency, product quality, reliability, and long-term partnership potential. By conducting thorough market research, evaluating suppliers based on certifications, manufacturing capabilities, and customer reviews, businesses can identify trustworthy partners that meet their specific needs. Factors such as minimum order quantities, pricing structures, logistics, and after-sales support should be carefully assessed to ensure smooth operations and customer satisfaction. Additionally, building strong relationships with suppliers and considering diversification can mitigate risks and enhance supply chain resilience. Ultimately, a well-executed sourcing strategy not only maximizes profitability but also strengthens competitive advantage in the dynamic automotive electronics market.