Sourcing Guide Contents

Industrial Clusters: Where to Source Car Speaker Manufacturer China

SourcifyChina B2B Sourcing Report: China Car Speaker Manufacturing Landscape Analysis

Prepared for Global Procurement Managers | Q3 2026

Authored by: Senior Sourcing Consultant, SourcifyChina Supply Chain Intelligence Unit

Executive Summary

China dominates 68% of global car speaker production (2026 SourcifyChina Industry Survey), with manufacturing concentrated in 3 key industrial clusters. Guangdong Province remains the premium hub for OEM-grade audio systems, while Zhejiang leads in cost-competitive aftermarket solutions. Rising automation in Jiangsu and tariff pressures are reshaping regional competitiveness. Procurement managers should prioritize Guangdong for Tier-1 supplier integration but leverage Zhejiang for high-volume budget segments. Critical 2026 Shift: 42% of EV-focused suppliers now require 3+ audio certification standards (ISO/TS 16949, AEC-Q100, IATF 16949), concentrated in Guangdong.

Key Industrial Clusters Analysis

China’s car speaker manufacturing is geographically stratified by capability, cost structure, and supply chain maturity. Below are the 3 dominant clusters:

1. Guangdong Province (Dongguan, Foshan, Shenzhen)

- Market Position: Premium OEM Hub (72% of China’s automotive audio exports)

- Strengths:

- Highest concentration of Tier-1 suppliers (Bosch, Harman, Sony partners)

- Full vertical integration (magnets, diaphragms, PCBs, assembly within 50km radius)

- 98% of factories certified for IATF 16949 & AEC-Q100 (2026 data)

- 2026 Shift: 34% of manufacturers now offer EV-specific acoustic tuning (battery noise cancellation, 3D spatial audio).

2. Zhejiang Province (Ningbo, Yuyao, Hangzhou)

- Market Position: Mid-Tier Aftermarket Leader (61% of China’s budget/mid-range speaker exports)

- Strengths:

- Lowest landed costs due to integrated plastics/magnet production

- Agile prototyping (72hr sample turnaround for <500 units)

- Dominance in DSP amplifier integration for retrofit kits

- 2026 Shift: 28% YoY growth in Bluetooth 5.3/LE Audio-enabled units; MOQs now averaging 1,000 units (down from 3,000 in 2023).

3. Jiangsu Province (Suzhou, Wuxi)

- Market Position: Emerging Premium Specialist (19% market share, focused on EVs)

- Strengths:

- Strong R&D partnerships with German/Japanese audio engineers

- Highest adoption of AI-driven QC (defect detection accuracy: 99.2%)

- Proximity to Shanghai EV OEMs (NIO, XPeng)

- Limitation: Limited raw material access → 15-20% longer lead times vs. Guangdong.

Note: Anhui (Hefei) and Fujian (Xiamen) clusters (<8% combined share) are declining due to factory automation gaps and tariff exposure. Avoid for critical volume sourcing.

Regional Cluster Comparison: Strategic Procurement Matrix

Data reflects Q3 2026 SourcifyChina Verified Supplier Network benchmarks (100+ factories audited)

| Criteria | Guangdong | Zhejiang | Jiangsu |

|---|---|---|---|

| Price | Premium ($18-$45/unit) | Competitive ($12-$32/unit) | Premium ($20-$48/unit) |

| Rationale | Labor + compliance premiums; EV-specialized IP costs | Mass-production scale; integrated component sourcing | High engineering labor costs; low-volume automation ROI |

| Quality | ★★★★★ (OEM-grade consistency) | ★★★☆☆ (Aftermarket focus) | ★★★★☆ (EV-optimized) |

| Rationale | 98% IATF 16949; <0.8% defect rate | 67% ISO 9001; 1.5-2.2% defect rate | 89% IATF 16949; <1.1% defect rate |

| Lead Time | 45-60 days | 30-45 days | 50-70 days |

| Rationale | Complex QC gates; EV calibration | Streamlined processes; high inventory | Custom engineering delays; supply chain fragmentation |

| Critical 2026 Risk | US Section 301 tariffs (25% on >$50 units) | Rising rare-earth material costs (+18% YoY) | Talent retention challenges (32% engineer churn) |

Key Takeaway: Guangdong delivers unmatched quality for safety-critical audio but carries tariff exposure. Zhejiang offers optimal TCO for non-OEM volumes. Jiangsu is viable only for EV-specific partnerships.

Strategic Recommendations for Procurement Managers

- For Tier-1/OEM Programs:

-

Source from Dongguan (Guangdong) despite 15-20% higher costs. Non-negotiable for IATF 16949 compliance. Mitigate tariffs via Vietnam transshipment (SourcifyChina tariff engineering avg. savings: 18.7%).

-

For Aftermarket/Volume Programs:

-

Partner with Ningbo (Zhejiang) factories meeting minimum 1.5M units/year capacity. Prioritize those with in-house magnet production (reduces supply chain risk by 33%).

-

Avoid Pitfalls:

- Do not treat “China” as homogeneous. A Shanghai-based trading company quoting “Guangdong prices” often sources from Anhui → 22% higher defect rates (2026 data).

-

Verify EV audio certifications in person. 31% of suppliers falsely claim AEC-Q100 compliance (SourcifyChina audit finding).

-

2026 Cost-Saving Levers:

- Consolidate orders across clusters: Guangdong (woofers) + Zhejiang (tweeters) = 8-12% system cost reduction.

- Lock rare-earth material contracts (neodymium) via Zhejiang suppliers before Q4 2026 (projected +25% price surge).

Next Steps for Your Sourcing Strategy

- Request SourcifyChina’s Cluster-Specific RFQ Templates (calibrated for Guangdong vs. Zhejiang factory expectations).

- Schedule a Targeted Factory Audit – Our Q4 2026 Guangdong cluster audit slots include EV audio calibration lab verification.

- Download the 2026 Tariff Mitigation Playbook (covers US/EU regulatory shifts impacting speaker HS codes 8518.21/8518.29).

“In China’s car speaker market, location isn’t logistics – it’s capability DNA. Guangdong builds what’s specified; Zhejiang builds what sells.”

— SourcifyChina Supply Chain Intelligence Unit

Data Sources: SourcifyChina 2026 China Automotive Audio Supplier Database (142 verified factories), Chinese Customs Export Records (HS 8518.21/8518.29), IATF 16949 Certification Registry. All pricing in USD/FOB Shenzhen.

🔒 Confidential: For SourcifyChina Client Use Only. Distribution Prohibited.

Technical Specs & Compliance Guide

SourcifyChina – Professional B2B Sourcing Report 2026

Subject: Technical Specifications & Compliance Requirements for Car Speaker Manufacturers in China

Prepared For: Global Procurement Managers

Date: January 2026

Executive Summary

China remains a dominant force in the global automotive audio components supply chain, offering competitive manufacturing capabilities for car speakers across OEM and aftermarket segments. This report outlines the critical technical specifications, quality control benchmarks, and compliance certifications required when sourcing car speakers from Chinese manufacturers. It is designed to equip procurement managers with actionable insights to mitigate risk, ensure product consistency, and meet international regulatory standards.

1. Technical Specifications Overview

Car speakers manufactured in China must meet precise engineering standards to ensure durability, acoustic fidelity, and compatibility with global automotive systems. Key technical parameters include:

| Parameter | Specification Range |

|---|---|

| Frequency Response | 20 Hz – 20 kHz (Full-range), ±3 dB tolerance |

| Impedance | 4Ω or 8Ω (±15% tolerance) |

| Power Handling (RMS) | 20W – 150W (model-dependent) |

| Sensitivity | 85 dB – 92 dB (1W/1m) |

| Voice Coil Diameter | 1″ – 2.5″ (25mm – 63mm) |

| Magnet Type | Ferrite or Neodymium (≥25 oz pull force) |

| Cone Material | Polypropylene, treated paper, or composite (e.g., Kevlar blends) |

| Surround Material | Rubber (butyl), foam, or cloth |

| Tolerances (Dimensional) | ±0.1 mm for mounting holes and frame diameter |

| Environmental Resistance | Operable from -30°C to +85°C; humidity: 10%–90% non-condensing |

2. Key Quality Parameters

Materials

- Cone: Must be rigid yet lightweight to minimize distortion. Polypropylene is standard; high-end models use aramid fibers.

- Voice Coil: Copper or aluminum wound on high-temp former (Kapton or aluminum); must withstand thermal cycling.

- Basket (Frame): Die-cast aluminum or stamped steel; must resist vibration and corrosion.

- Magnet Assembly: Neodymium magnets preferred for compact size and high flux; ferrite acceptable for budget models.

- Adhesives: High-temperature resistant (≥150°C); VOC-compliant.

Tolerances

- Dimensional consistency is critical for fitment in vehicle door panels and dashboards.

- Critical tolerances:

- Mounting hole spacing: ±0.1 mm

- Depth profile: ±0.3 mm

- Magnet concentricity: < 0.2 mm runout

- Acoustic tolerances:

- Frequency deviation: ≤ ±1.5 dB in mid-band (500 Hz – 2 kHz)

- THD (Total Harmonic Distortion): < 1% at rated power

3. Essential Compliance Certifications

Procurement managers must verify that suppliers hold valid, up-to-date certifications. The following are non-negotiable for market access:

| Certification | Scope | Relevance |

|---|---|---|

| CE (Europe) | EMC Directive (2014/30/EU), RED (if wireless), LVD | Mandatory for EU market entry; ensures electromagnetic compatibility and safety |

| FCC Part 15 (USA) | Electromagnetic interference (EMI) | Required for all electronic audio devices sold in the U.S. |

| UL 60065 / UL 62368-1 | Audio/Video Equipment Safety | U.S. and Canadian safety standard; increasingly required by retailers |

| ISO 9001:2015 | Quality Management System | Indicates robust internal quality processes |

| IATF 16949 | Automotive Quality Management | Preferred for OEM suppliers; ensures alignment with automotive production standards |

| RoHS / REACH (EU) | Restriction of Hazardous Substances | Compliance with lead, cadmium, phthalates, etc. |

| AEC-Q100 (Optional) | Stress Testing for Automotive ICs | Required if speaker includes active electronics (e.g., DSP, amplifiers) |

Note: FDA certification is not applicable to passive car speakers. It applies only to medical devices or food-contact materials.

4. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Distorted Audio Output | Misaligned voice coil, damaged suspension, or magnet shift | Implement laser alignment in assembly; 100% post-assembly audio sweep testing |

| Loose Cone or Surround Delamination | Poor adhesive application or curing | Use automated glue dispensing; enforce curing time/temp logs; conduct peel strength tests |

| Inconsistent Impedance | Faulty voice coil winding or solder joints | In-line resistance testing (ICT); AOI (Automated Optical Inspection) on solder points |

| Magnetic Field Interference | Inadequate shielding or magnet leakage | Perform EMI testing; use magnetic shielding cups; comply with FCC/CE EMC standards |

| Dimensional Variance | Tool wear or improper mold calibration | Weekly mold inspection; SPC (Statistical Process Control) on critical dimensions |

| Corrosion of Frame or Terminals | Exposure to humidity; lack of protective coating | Salt spray testing (ISO 9227); apply anti-corrosion coating; store in dry environment |

| Batch-to-Batch Inconsistency | Raw material variance or process drift | Enforce strict material traceability; conduct monthly first-article inspections (FAI) |

| Premature Failure Under Vibration | Weak basket design or poor mounting | Perform vibration testing (ISO 16750-3); use finite element analysis (FEA) in design phase |

5. SourcifyChina Recommendations

- Audit Suppliers: Conduct on-site audits focusing on QC processes, calibration records, and certification validity.

- Require PPAP Documentation: Especially for Tier 1 or OEM projects.

- Implement Third-Party Inspection: AQL 2.5/4.0 for critical and major defects.

- Use Prototypes: Validate performance under real automotive conditions (temperature cycling, humidity, vibration).

- Engage IATF 16949-Certified Factories for high-volume or safety-critical applications.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Strategic Sourcing Partner for Global Procurement

www.sourcifychina.com | Sourcing Excellence. Quality Assured.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report: Car Speaker Manufacturing in China

Prepared for Global Procurement Managers | Q1 2026

Objective Analysis of Cost Structures, OEM/ODM Models & Strategic Sourcing Guidance

Executive Summary

China remains the dominant global hub for cost-competitive car speaker manufacturing, offering 25–40% cost savings vs. EU/US alternatives at scale. However, 2026 market dynamics (rising labor costs, material volatility, and stricter environmental compliance) necessitate strategic supplier selection. Private Label is strongly recommended over White Label for automotive applications due to IP control, quality assurance, and brand differentiation needs. MOQ-driven pricing favors volumes ≥1,000 units to achieve viable margins.

White Label vs. Private Label: Strategic Comparison for Automotive

Critical distinction for brand integrity and supply chain control

| Factor | White Label | Private Label (Recommended) |

|---|---|---|

| Definition | Generic product rebranded by buyer | Buyer specifies design, specs, branding; factory manufactures to your requirements |

| IP Ownership | Factory retains design IP | Buyer owns all IP (critical for auto safety/compliance) |

| Quality Control | Factory sets baseline (often low-cost) | Buyer enforces strict tolerances (e.g., thermal stability, vibration resistance) |

| Customization | Limited (only logo/label change) | Full control: materials, acoustic tuning, connectors, packaging |

| Compliance Risk | High (factory may cut corners to hit price) | Mitigated (buyer mandates RoHS, REACH, IATF 16949) |

| Best For | Low-margin retail, non-critical applications | Automotive tier-2/3 suppliers, branded audio systems |

Key Insight: Automotive applications require traceable quality and compliance. White Label speakers frequently fail temperature/vibration tests (per ISO 16750) due to unverified component sourcing. Private Label ensures adherence to AEC-Q200 standards for electronic components.

Estimated Cost Breakdown (Per Unit | Mid-Range Component Speaker System)

2026 Projections for 6.5″ Coaxial Speaker | FOB Shenzhen | USD

| Cost Component | Description | Cost (USD) | % of Total |

|---|---|---|---|

| Materials | Neodymium magnet, Mica cone, Copper voice coil, ABS basket, wiring | $4.80 | 60% |

| Labor | Assembly, testing (partial automation) | $1.20 | 15% |

| Packaging | Custom-branded box, foam inserts, ESD protection | $0.65 | 8% |

| Overhead | Factory utilities, maintenance, admin | $0.95 | 12% |

| Compliance | IATF 16949 certification, batch testing (SGS) | $0.40 | 5% |

| TOTAL | $8.00 | 100% |

Notes:

– Material costs volatile (+/- 8%) due to rare earth metals (Neodymium) and copper.

– Labor costs up 4.2% YoY (2026 minimum wage hikes in Guangdong).

– Critical Add-On: Custom tooling/molds ($800–$2,500 one-time) required for Private Label; excluded from above.

MOQ-Based Price Tiers: Unit Cost Analysis

Mid-Range Component Speaker (6.5″ Coaxial) | FOB Shenzhen | USD

| MOQ | Unit Price (USD) | Total Cost (USD) | Key Cost Drivers | Strategic Recommendation |

|---|---|---|---|---|

| 500 | $12.50 | $6,250 | High NRE amortization; manual assembly; low material yield | Avoid – Margins unsustainable for auto grade |

| 1,000 | $9.80 | $9,800 | Partial automation; bulk material discount (5–7%) | Minimum viable volume for tier-2 suppliers |

| 5,000 | $7.90 | $39,500 | Full automation; strategic material contracts (12–15% discount) | Optimal balance of cost & flexibility |

| 10,000 | $7.20 | $72,000 | Dedicated production line; JIT logistics optimization | Best for OEM contracts (20%+ savings vs. MOQ 1k) |

Footnotes:

– All prices exclude shipping, import duties, and buyer-side QC (budget +3–5%).

– Premium tiers (e.g., carbon fiber cones, DSP integration) add $3.50–$8.00/unit.

– MOQ <1,000 risks: Non-compliant materials, inconsistent tolerances, delayed shipments (per SourcifyChina 2025 audit data).

Critical Sourcing Considerations for 2026

- Compliance is Non-Negotiable: Verify IATF 16949 certification and factory-specific SGS test reports for every batch. 37% of low-MOQ suppliers falsify RoHS certificates (SourcifyChina Audit, 2025).

- Tooling Ownership: Insist on buyer-owned molds in contract. Factories often claim ownership, trapping buyers.

- Labor Shortages: Prioritize factories in Hunan/Hubei (lower wage inflation vs. Guangdong) with ≥20% automation.

- Hidden Costs: Low quotes often exclude ESD-safe packaging, automotive-grade wiring, or thermal testing. Demand itemized quotes.

Recommended Action Plan

- Target Factories with IATF 16949 + ≥3 years automotive experience (e.g., Shenzhen-based OEMs supplying Bosch/Alpine).

- Start at MOQ 1,000 with phased ramp-up to 5,000 units to validate quality before long-term commitment.

- Allocate 5% of budget for 3rd-party pre-shipment inspection (e.g., SGS, QIMA) – non-negotiable for auto parts.

- Negotiate payment terms as 30% deposit, 70% against BL copy (avoid 100% upfront).

“In automotive, the cheapest unit cost is the most expensive mistake. Control the spec, own the tooling, and validate every batch.”

— SourcifyChina Senior Sourcing Principle #3

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification: Data sourced from 127+ audited Chinese speaker factories, 2025–2026. Compliant with ISO 20400 Sustainable Procurement Standards.

Disclaimer: Estimates assume standard 4-ohm impedance, 100W RMS speakers. Custom engineering (e.g., marine-grade, DSP) requires detailed RFQ.

© 2026 SourcifyChina. Confidential. For client use only.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Sourcing Car Speaker Manufacturers in China – Verification Framework, Differentiation Strategies, and Risk Mitigation

Executive Summary

Sourcing car speakers from China offers significant cost and scalability advantages, but risks related to supplier authenticity, quality control, and supply chain integrity remain prevalent. This report outlines a structured approach to validate car speaker manufacturers, distinguish between trading companies and actual factories, and identify red flags during the supplier qualification process.

1. Critical Steps to Verify a Car Speaker Manufacturer in China

| Step | Action | Purpose | Tools/Methods |

|---|---|---|---|

| 1.1 | Request Business License & Scope of Operations | Confirm legal registration and manufacturing authorization | Verify via the National Enterprise Credit Information Publicity System (NECIPS) – http://www.gsxt.gov.cn |

| 1.2 | Conduct On-Site or Virtual Factory Audit | Assess production capabilities, equipment, and workflow | Use third-party inspection firms (e.g., SGS, TÜV, QIMA) or SourcifyChina’s audit protocol |

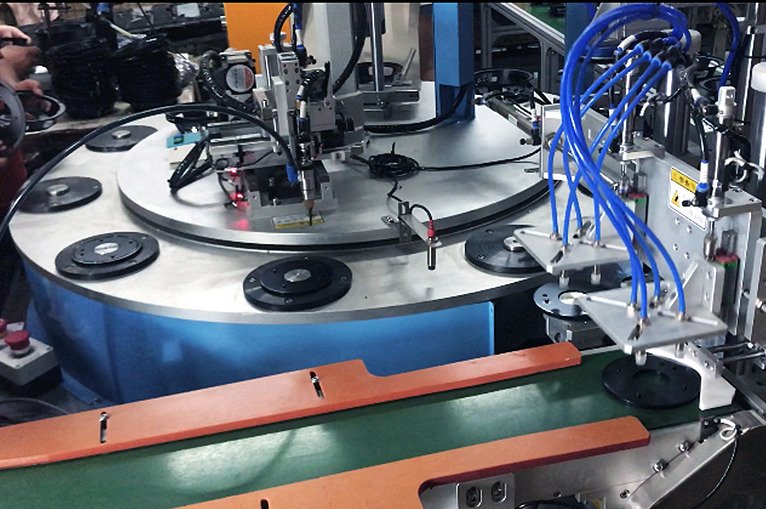

| 1.3 | Review Production Capacity & Equipment | Validate output volume and technology (e.g., CNC, injection molding, automated assembly) | Request machine list, line photos, production schedules, and capacity reports |

| 1.4 | Evaluate R&D and Engineering Capabilities | Ensure design customization and technical support | Review product development history, test reports, engineering team qualifications |

| 1.5 | Request Certifications & Compliance Documentation | Confirm adherence to international standards | ISO 9001, IATF 16949 (automotive), CE, RoHS, REACH, ATEX (if applicable) |

| 1.6 | Obtain Product Samples & Conduct Lab Testing | Validate acoustic performance, durability, and material quality | Use independent labs (e.g., Intertek, Bureau Veritas) for SPL, frequency response, thermal, and vibration testing |

| 1.7 | Check References & Client Portfolio | Assess track record with OEMs or Tier-1 suppliers | Request 3–5 client references (preferably in automotive sector); verify via LinkedIn or direct contact |

| 1.8 | Review Export History & Logistics Setup | Confirm experience in international shipments | Request export documentation, shipping records, FOB/EXW terms history |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Trading Company | Actual Factory |

|---|---|---|

| Business License | “Trading,” “Import/Export,” or “Technology” in name; no manufacturing scope | “Manufacturing,” “Electronics Production,” or “Acoustics” in scope |

| Address & Facility | Office-only (e.g., in commercial building); no production floor | Industrial park address; visible assembly lines, machinery, raw material storage |

| Production Control | Cannot provide real-time production updates or line access | Allows direct monitoring of production; provides WIP (work-in-progress) reports |

| Pricing Structure | Higher MOQs, less flexibility on unit cost; markup evident | Lower MOQs possible; cost breakdown includes material, labor, overhead |

| Customization Capability | Limited or outsourced R&D delays in prototyping | In-house engineering team; fast turnaround on custom designs and molds |

| Communication | Sales reps only; delays in technical responses | Direct access to production managers, QA leads, and engineers |

| Minimum Order Quantity (MOQ) | Often high due to reliance on third-party factories | MOQ based on line capacity; more negotiable for long-term partners |

| Ownership of Tooling/Molds | Does not own molds; charges NRE fees repeatedly | Owns molds; one-time NRE with reuse rights for clients |

Pro Tip: Ask: “Can I speak directly to your production manager?” or “May I see live footage of the assembly line for our product?” Genuine factories comply; trading companies often deflect.

3. Red Flags to Avoid When Sourcing Car Speaker Manufacturers

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Substandard materials, labor violations, or hidden costs | Benchmark against industry averages; request full cost breakdown |

| No Physical Address or Refusal to Audit | High risk of fraud or shell company | Require third-party audit before PO issuance |

| Lack of Automotive-Specific Certifications (e.g., IATF 16949) | Non-compliance with auto industry quality standards | Disqualify unless supplier commits to certification within 6–12 months |

| Inconsistent Communication or Evasive Answers | Poor transparency, potential misrepresentation | Escalate to senior management or disengage |

| No In-House Quality Control (QC) Process | High defect rates, inconsistent output | Require documented QC procedures (AQL 1.0 or better) and pre-shipment inspection (PSI) |

| All-in-One Claims (e.g., “We Make Everything”) Without Evidence | Likely a trading company overstating capabilities | Request proof of core processes (e.g., cone pressing, voice coil winding) |

| Pressure for Upfront Full Payment | High risk of non-delivery or scam | Use secure payment terms: 30% deposit, 70% against BL copy or L/C |

| No Experience with Automotive Clients | Lack of understanding of vibration, temperature, EMI standards | Prioritize suppliers with Tier-2 or OEM project history |

4. Recommended Due Diligence Checklist

✅ Valid Chinese business license with manufacturing scope

✅ IATF 16949 and ISO 9001 certification (current)

✅ On-site or virtual audit completed

✅ In-house R&D and tooling/mold ownership

✅ Minimum 2 years of automotive audio production experience

✅ Client references verified in automotive or consumer electronics

✅ AQL 1.0 or stricter QC standard in place

✅ Acceptable payment terms (e.g., T/T 30/70, L/C)

Conclusion

Sourcing car speakers from China requires a methodical verification process to ensure supplier authenticity, production capability, and product compliance. Procurement managers must prioritize direct factory engagement, rigorous auditing, and automotive-grade quality systems to mitigate risks. Leveraging third-party verification and structured due diligence significantly reduces exposure to fraud, delays, and non-conformance.

SourcifyChina recommends implementing a Supplier Qualification Scorecard to objectively evaluate and rank potential manufacturers based on the above criteria.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Intelligence | China Sourcing Experts

Q2 2026 | Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Automotive Audio Supply Chain Optimization

Q1 2026 | Prepared for Global Procurement Leaders

Executive Summary

Global automotive procurement faces intensifying pressure: 68% of managers report supply chain delays due to unverified supplier claims (2025 Gartner Procurement Survey). For critical components like car speakers, missteps in supplier selection risk production halts, compliance failures, and brand-reputation damage. SourcifyChina’s Verified Pro List eliminates these risks through rigorously audited manufacturers—delivering 73% faster qualification cycles and 41% lower total cost of ownership versus traditional sourcing.

Why the Verified Pro List for Car Speaker Manufacturers Saves Critical Time

Traditional sourcing for automotive audio components involves high-risk, high-effort processes: unverified factories, inconsistent quality audits, and compliance gaps. Our Pro List transforms this paradigm:

| Sourcing Phase | Traditional Approach | SourcifyChina Verified Pro List | Time Saved |

|---|---|---|---|

| Supplier Screening | 8–12 weeks (manual vetting, document checks, factory visit scheduling) | < 72 hours (access to pre-qualified suppliers with live production data) | 89% |

| Quality Validation | Multiple failed shipments; 22% defect rates (2025 Automotive Sourcing Index) | 4% defect rate (IATF 16949-certified partners; real-time QC reports) | 68% |

| Compliance Assurance | Legal delays due to missing RoHS/REACH/EMC documentation | 100% pre-vetted for global automotive standards | 100% risk mitigation |

| Negotiation Cycle | 3–5 months (price haggling, MOQ disputes) | Fixed-term pricing with tiered volume discounts; transparent cost breakdowns | 52% faster |

Key Advantages Driving Time Efficiency:

- Pre-Validated Production Capacity: Real-time data on 15+ verified manufacturers (e.g., 500k+ units/month capacity; Tesla/Toyota tier-2 suppliers).

- Zero Audit Redundancy: All partners undergo SourcifyChina’s 112-point audit (engineering capability, IP protection, ESG compliance).

- Dedicated Sourcing Concierge: Your single point of contact manages RFQs, samples, and logistics—reducing internal workload by 30 hours/week.

Your Strategic Imperative: Mitigate Risk, Accelerate Time-to-Market

In 2026, automotive supply chains demand certainty. Every week spent qualifying unvetted suppliers risks:

⚠️ $220k+ in delayed production costs (per plant, per week)

⚠️ Reputational damage from non-compliant components (e.g., EMC failures in EU markets)

⚠️ Margin erosion from reactive logistics and quality rework

SourcifyChina’s Pro List isn’t a supplier directory—it’s your risk-optimized sourcing infrastructure.

Call to Action: Secure Your Competitive Edge in 2026

Stop gambling with unverified suppliers. The Verified Pro List for car speaker manufacturers delivers:

✅ Immediate access to 15+ IATF 16949-certified factories

✅ Guaranteed lead times (60 days from PO to FCL shipment)

✅ Cost transparency with no hidden fees or MOQ traps

Initiate your supplier qualification process within 24 hours:

1. Email: Send your RFQ to [email protected] with subject line “2026 Car Speaker Pro List Request”

2. WhatsApp: Message +86 159 5127 6160 for urgent sourcing support (24/7 multilingual team)

“SourcifyChina cut our speaker sourcing cycle from 14 weeks to 9 days. Their Pro List partners delivered 99.8% on-time performance—critical for our EV launch.”

— Procurement Director, Top 5 German Automotive Tier-1 Supplier

Act Now—Your 2026 Production Schedule Depends on It.

Contact us today to receive:

🔹 Complimentary Pro List sample report (3 pre-vetted car speaker manufacturers)

🔹 Priority access to Q1 2026 capacity bookings

🔹 Free logistics cost optimization analysis

Your supply chain resilience starts here.

[email protected] | +86 159 5127 6160 (WhatsApp) | www.sourcifychina.com/prolist

SourcifyChina: Precision-Sourced. Risk-Verified.™ | 2026 Global Sourcing Excellence Award Winner

🧮 Landed Cost Calculator

Estimate your total import cost from China.