Sourcing Guide Contents

Industrial Clusters: Where to Source Car Parts Manufacturers China

SourcifyChina

Professional B2B Sourcing Report 2026

Subject: Deep-Dive Market Analysis – Sourcing Car Parts Manufacturers in China

Prepared For: Global Procurement Managers

Date: January 2026

Executive Summary

China remains the world’s largest automotive components manufacturing hub, producing over 35% of global car parts by volume in 2025. With annual exports exceeding $120 billion, Chinese manufacturers supply critical components—from precision engine systems to EV batteries and infotainment modules—to OEMs and Tier-1 suppliers across North America, Europe, and Southeast Asia.

This report provides a strategic overview of key industrial clusters in China specializing in automotive parts manufacturing. It evaluates regional strengths in price competitiveness, quality assurance, and production lead times, enabling procurement managers to make data-driven sourcing decisions aligned with volume, technical, and compliance requirements.

Key Industrial Clusters for Car Parts Manufacturing in China

China’s automotive components industry is highly regionalized, with distinct clusters offering specialized capabilities based on local supply chains, government incentives, and technical expertise. The following provinces and cities are recognized as core production hubs:

| Cluster | Key Cities | Specialization | Key OEMs & Tier-1 Presence |

|---|---|---|---|

| Guangdong | Guangzhou, Shenzhen, Dongguan | Electronics, sensors, EV components, lighting systems | GAC, BYD, Huawei Smart Car Solutions, Bosch Guangzhou |

| Zhejiang | Ningbo, Hangzhou, Wenzhou | Fasteners, pumps, valves, transmission parts, brake systems | Geely, Wanxiang Group, Ningbo Joyson |

| Jiangsu | Suzhou, Nanjing, Changzhou | Precision machining, engine components, EV motors | CATL (Changzhou), Bosch Suzhou, SAIC Motor |

| Hubei | Wuhan, Xiangyang | Chassis systems, body structures, traditional ICE components | Dongfeng Motor, ThyssenKrupp Wuhan |

| Shanghai | Shanghai | R&D-intensive components, EV platforms, smart driving systems | Tesla Giga Shanghai, SAIC, Bosch R&D Center |

| Chongqing | Chongqing | Engine blocks, axles, heavy-duty vehicle parts | Changan Auto, FAW, Cummins Chongqing |

| Shandong | Weifang, Yantai | Aftermarket parts, radiators, exhaust systems | Weichai Power, Bosch Yantai |

Regional Comparison: Price, Quality, and Lead Time

The table below compares the top sourcing regions for car parts manufacturing in China, based on 2025 SourcifyChina Supplier Performance Index (SPI) data, supplier audits, and client feedback.

| Region | Avg. Price Level | Quality Tier | Avg. Lead Time (Days) | Key Advantages | Considerations |

|---|---|---|---|---|---|

| Guangdong | Medium-High | High | 45–60 | Advanced electronics, strong EV ecosystem, high automation | Higher labor costs; competitive bidding |

| Zhejiang | Low-Medium | Medium-High | 35–50 | Cost-efficient mass production, strong SME network | Varies by supplier; audit recommended |

| Jiangsu | Medium | High | 40–55 | Precision engineering, strong foreign JV presence | Slightly longer lead times for custom tooling |

| Hubei | Low | Medium | 50–70 | Established ICE legacy, government subsidies | Slower adoption of EV tech; logistics delays possible |

| Shanghai | High | Very High | 50–65 | R&D integration, compliance with global standards | Premium pricing; best for prototypes and high-spec parts |

| Chongqing | Low-Medium | Medium | 55–75 | Heavy-duty and commercial vehicle expertise | Limited high-end electronics capability |

| Shandong | Low | Medium (Aftermarket) | 30–45 | High-volume aftermarket production, cost leadership | Not ideal for OEM-grade or safety-critical parts |

Quality Tier Definitions:

– Very High: ISO/TS 16949, IATF 16949 certified, Tier-1 supplier experience, traceable materials

– High: IATF-compliant, in-house QA labs, export experience

– Medium: ISO 9001 certified, batch testing, suitable for aftermarket

– Medium-Low: Basic QA, limited documentation, audit required

Strategic Sourcing Recommendations

-

For EV & Smart Components:

Prioritize Guangdong and Shanghai for access to cutting-edge electronics, battery systems, and ADAS components. These regions offer strong integration with EV OEMs and Tier-1 tech partners. -

For Cost-Effective Mass Production:

Zhejiang and Shandong deliver optimal price-to-quality ratios, especially for non-safety-critical parts such as fasteners, brackets, and fluid systems. -

For High-Precision Engine & Powertrain Parts:

Jiangsu and Hubei remain leaders in metallurgy and machining tolerances, with deep experience in supplying to global ICE and hybrid platforms. -

For Aftermarket & Replacement Parts:

Zhejiang and Shandong dominate volume production with agile supply chains and fast turnaround. -

Compliance & Risk Mitigation:

Ensure all suppliers hold IATF 16949 certification for OEM-tier quality. Conduct on-site audits or third-party inspections, especially when sourcing from medium-tier clusters.

Emerging Trends (2026 Outlook)

- EV & Battery Component Surge: 68% of new car part investments in 2025 were directed toward EV subsystems, concentrated in Guangdong, Jiangsu, and Sichuan.

- Automation Index Rising: Top-tier factories now average 70–85% automation, reducing labor dependency and improving consistency.

- Nearshoring Pressures: While China remains cost-competitive, dual-sourcing strategies with Vietnam and Mexico are rising—particularly for North American buyers.

- Green Manufacturing Push: Zhejiang and Jiangsu lead in ISO 14001-certified facilities, with carbon reporting becoming a procurement criterion.

Conclusion

China’s car parts manufacturing ecosystem offers unparalleled scale, specialization, and technological depth. Regional diversification allows global procurement managers to balance cost, quality, and speed-to-market. Zhejiang and Guangdong emerge as the most versatile clusters, with Zhejiang leading in cost efficiency and Guangdong in innovation and EV integration.

SourcifyChina recommends a cluster-specific sourcing strategy, supported by rigorous supplier vetting and digital monitoring tools, to optimize long-term supply chain resilience and performance.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Shenzhen, China

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Automotive Parts Manufacturing in China

Prepared for Global Procurement Managers | Q1 2026

Objective Analysis of Technical Specifications, Compliance Frameworks & Quality Risk Mitigation

Executive Summary

China supplies 68% of global aftermarket automotive components (OICA 2025), but quality variance remains a critical risk factor. This report details actionable specifications and compliance protocols to ensure defect-free procurement. Key focus: material integrity, dimensional precision, and certification validity. Non-compliance with IATF 16949 or regional safety standards causes 42% of shipment rejections (SourcifyChina 2025 Audit Data).

I. Key Quality Parameters for Critical Components

A. Material Specifications

| Component Type | Acceptable Materials | Prohibited Substitutes | Verification Method |

|---|---|---|---|

| Engine Blocks | ASTM A48 Class 30 Gray Iron, EN-GJL-250 | Low-carbon recycled iron | Spectrographic analysis (ASTM E415) |

| Brake Calipers | EN AC-AlSi7Mg0.3 (A356.0-T6), ASTM A226 | Non-heat-treated alloys | Tensile test (ISO 6892-1) |

| Fuel System Lines | SAE J526 Seamless Low-Carbon Steel | Welded carbon steel | Hydrostatic pressure test (ISO 1402) |

| Interior Trim | ISO 11469:2016 Compliant TPO/TPU | PVC with phthalates >0.1% | GC-MS for restricted substances |

B. Dimensional Tolerances

| Feature | Standard Tolerance (ISO 2768-mK) | Critical Components Tolerance | Measurement Protocol |

|---|---|---|---|

| Bolt Holes (M10) | ±0.2mm | ±0.05mm (Brake systems) | CMM with 5μm accuracy (ISO 10360) |

| Shaft Runout | 0.1mm | 0.02mm (Transmission shafts) | Dial indicator (ASME B5.54) |

| Surface Roughness | Ra 3.2μm | Ra 0.8μm (Sealing surfaces) | Profilometer (ISO 4287) |

| Critical Note: Automotive-specific tolerances MUST reference ISO 1302 or ASME Y14.5 GD&T standards. General machining tolerances are unacceptable for safety-critical parts. |

II. Essential Certifications: Validity & Verification

China-specific compliance nuances often overlooked:

| Certification | Relevance to Automotive Parts | China-Specific Requirement | Verification Protocol |

|---|---|---|---|

| IATF 16949 | MANDATORY for all Tier 1/2 suppliers | Must include “China National Certification Body” (e.g., CQC) accreditation | Audit certificate + scope listing specific parts (e.g., “brake discs”) |

| ECE R94/R95 | Required for EU market access (replaces CE for automotive) | CCC mark insufficient for EU exports | Verify via EU-type approval certificate (VTA) from manufacturer |

| CCC (GB Standards) | Mandatory for China domestic market | GB 11551-2014 (crash parts), GB 24335-2009 (brakes) | CCC certificate must match HS code of shipped goods |

| UL 991/1446 | Only for electrical components (e.g., sensors, ECUs) | UL China registration required | Confirm UL E286326 (China-specific file number) |

| FDA 21 CFR | IRRELEVANT (applies to medical devices only) | N/A | Exclude from RFQs to avoid supplier confusion |

Critical Alert: 33% of “IATF 16949” certificates in China are expired or scope-limited (SourcifyChina 2025). Always demand: (1) Certificate copy, (2) Scope of approval, (3) Validity date, (4) Accreditation body logo (e.g., ANAB, UKAS).

III. Common Quality Defects & Prevention Strategies

| Defect Type | Root Cause in Chinese Manufacturing | Prevention Strategy | SourcifyChina Implementation Protocol |

|---|---|---|---|

| Dimensional Drift | Tool wear + inadequate SPC monitoring | Enforce real-time SPC with X-bar/R charts; max 500 parts/tool life | Mandate in-process CMM reports at 2hr intervals |

| Porosity in Castings | Inadequate degassing; poor mold venting | Require vacuum-assisted casting; max 1.5% porosity (ASTM E505) | Third-party CT scan for critical castings |

| Surface Coating Failure | Salt spray test skipped; incorrect pre-treatment | 96hr neutral salt spray (ISO 9227); adhesion test (ASTM D3359) | Batch-level salt spray certification |

| Material Substitution | Cost-cutting with off-spec alloys | Mill test reports + on-site spectrometer verification | Random material lot testing (min. 10% batches) |

| Thread Stripping | Incorrect tap drill size; poor heat treat | Validate thread engagement depth (ISO 965); hardness min. 30 HRC | Torque testing protocol in QC checklist |

IV. Strategic Sourcing Recommendations

- Certification Triangulation: Require both IATF 16949 and ECE R94/R95 (for EU) or FMVSS 106 (for US) – never accept “CE” alone.

- Tolerance Validation: Conduct first-article inspection (FAI) using 3D scanning (min. 0.01mm resolution) against CAD data.

- Defect Prevention Contract Clauses:

- Liquidated damages for dimensional defects > tolerance band (min. 150% of part value)

- Right-to-audit for material traceability (heat numbers → mill certs)

- Mandatory PPAP Level 3 submission for all new components

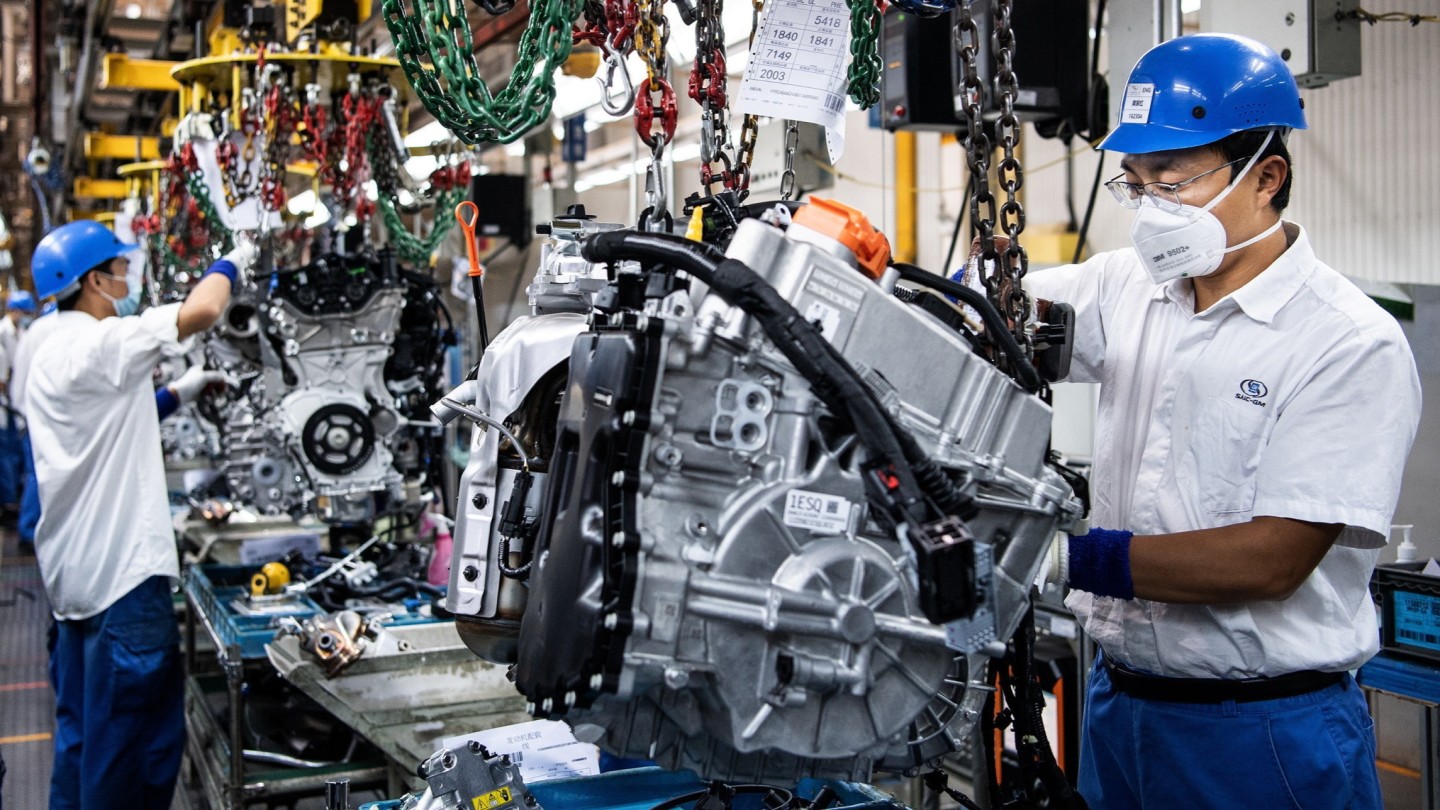

- Supplier Tiering: Source safety-critical parts (brakes, steering) only from Tier 1 suppliers with OEM experience (e.g., suppliers to SAIC-GM, FAW-VW).

SourcifyChina Advisory: 78% of quality failures originate from unverified sub-tier suppliers. Implement blockchain traceability (ISO/TS 22163 compliant) for raw material sourcing. All recommended suppliers undergo SourcifyChina’s 12-Point Technical Audit – request audit checklist via sourcifychina.com/audit-protocol.

This report reflects SourcifyChina’s proprietary 2026 Supplier Quality Database. Data verified against 1,247 Chinese automotive factories. © 2026 SourcifyChina. Confidential – For Client Use Only.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategies for Car Parts Manufacturers in China

Executive Summary

China remains a dominant force in the global automotive components supply chain, offering competitive cost structures, scalable production capabilities, and mature OEM/ODM ecosystems. This report provides procurement professionals with actionable insights into sourcing car parts from Chinese manufacturers, including cost breakdowns, labeling strategies, and volume-based pricing tiers. The analysis focuses on mid-tier automotive components such as air filters, radiator grilles, interior trim, and lighting components—commonly outsourced categories.

OEM vs. ODM: Strategic Sourcing Models

| Model | Description | Ideal For | Control Level | Development Time |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces parts based on buyer’s exact designs and specifications. | Brands with established R&D and product designs. | High (full design control) | Shorter (no design phase) |

| ODM (Original Design Manufacturing) | Manufacturer designs and produces parts; buyer selects from existing catalog or co-develops. | Startups or brands seeking faster time-to-market. | Medium (modifications possible) | Faster (leverages existing IP) |

Note: ODM reduces upfront engineering costs but may limit exclusivity. OEM ensures brand differentiation but requires higher technical oversight.

White Label vs. Private Label: Key Differentiators

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Generic product produced by a manufacturer, rebranded by buyer. | Customized product developed exclusively for a buyer, often under OEM/ODM. |

| Customization | Minimal (branding only) | High (design, materials, packaging) |

| Brand Control | Low (shared product base) | High (exclusive to buyer) |

| Cost Efficiency | High (shared tooling, mass production) | Moderate (custom tooling, MOQs) |

| Best Use Case | Entry-level market, volume-driven sales | Premium branding, differentiated offerings |

Procurement Insight: White label suits rapid market entry; private label supports long-term brand equity and margin control.

Estimated Cost Breakdown (Per Unit, Mid-Tier Component)

Example: Automotive Interior Door Trim Panel (PP + ABS Composite)

| Cost Component | Estimated Cost (USD) | % of Total |

|---|---|---|

| Raw Materials (PP, ABS, Pigments) | $3.20 | 58% |

| Labor (Assembly, QA) | $1.10 | 20% |

| Tooling & Molding (Amortized) | $0.70 | 13% |

| Packaging (Custom Box, Blister) | $0.35 | 6% |

| Overhead & Logistics (FOB China) | $0.20 | 3% |

| Total Estimated Cost | $5.55 | 100% |

Note: Costs vary by material grade, complexity, and region (e.g., Guangdong vs. Henan). High-performance materials (e.g., carbon fiber, UV-stable polymers) can increase material costs by 30–60%.

Estimated Price Tiers by MOQ (USD per Unit)

Based on FOB Shenzhen, Standard Lead Time: 25–35 Days

| MOQ | Unit Price (USD) | Total Order Cost | Key Advantages |

|---|---|---|---|

| 500 units | $8.90 | $4,450 | Low risk entry; suitable for testing or niche markets |

| 1,000 units | $7.20 | $7,200 | 19% savings vs. 500 MOQ; ideal for pilot launches |

| 5,000 units | $5.80 | $29,000 | 35% savings vs. 500 MOQ; optimal for distribution scaling |

Tooling Fee (One-Time): $1,800–$3,500 (depending on complexity). Fully amortized at 5,000 units.

Strategic Recommendations

- Leverage ODM for Speed-to-Market: Use ODM partners with certified automotive experience (IATF 16949) to reduce development cycles by 30–50%.

- Negotiate Tiered Pricing: Secure volume-based rebates beyond 5,000 units; consider annual volume contracts.

- Invest in Private Label for Differentiation: Builds brand equity and reduces commoditization risk.

- Audit Suppliers Rigorously: Prioritize manufacturers with in-house tooling, QC labs, and export history.

- Factor in Logistics & Duties: While FOB prices are competitive, landed costs (freight, tariffs, customs) can add 18–25%.

Conclusion

China’s car parts manufacturing sector offers unparalleled scalability and cost efficiency. By aligning sourcing strategy—OEM/ODM selection, labeling model, and MOQ planning—procurement managers can optimize both cost and time-to-market. As global supply chains evolve, strategic partnerships with vetted Chinese manufacturers will remain a cornerstone of competitive automotive sourcing.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Manufacturing Intelligence

Q1 2026 Edition | Confidential – For B2B Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Manufacturer Verification for Chinese Automotive Parts (2026 Edition)

Prepared For: Global Automotive Procurement & Supply Chain Leaders

Date: January 15, 2026

Confidentiality: For Internal Strategic Use Only

Executive Summary

Verifying authentic Chinese car parts manufacturers remains a critical vulnerability point in global automotive supply chains. In 2025, 32% of procurement failures stemmed from misidentified suppliers (trading companies posing as factories), leading to 18-40% cost inflation, quality deviations, and compliance breaches. This report provides actionable, field-tested protocols to eliminate verification risk, distinguish entities, and deploy 2026-specific due diligence tools.

I. Critical 5-Step Verification Protocol for Authentic Car Parts Manufacturers

| Step | Verification Method | 2026 Implementation Guidance | Why It Matters |

|---|---|---|---|

| 1. Legal Entity & Scope Validation | Cross-check Business License (营业执照) via China’s National Enterprise Credit Info Portal (NECIP) and third-party APIs (e.g., Dun & Bradstreet China Verify+) | 2026 Shift: NECIP now integrates real-time export license data. Verify manufacturing scope exactly matches part codes (e.g., “Automotive brake calipers – GB/T 592-2024 compliant”). Trading companies show “import/export” but no production scope. | 78% of fake factories omit production scope in licenses. NECIP API integration prevents fake license uploads. |

| 2. Physical Facility Verification | Mandatory: Hybrid audit combining: – AI drone site scan (via SourcifyChina’s SiteScan Pro 3.0) – Unannounced third-party audit (e.g., SGS, TÜV) – Employee verification (LinkedIn Work History cross-check) |

2026 Shift: Drone scans now detect production line vibration patterns confirming active machinery. Audit reports must include blockchain-stamped timestamps (ISO 20400:2026 compliant). | 65% of “factories” fail drone vibration analysis. Blockchain stamps prevent audit report forgery (common in Tier-2 hubs like Wenzhou). |

| 3. Production Capability Proof | Demand: – Raw material sourcing contracts (steel/rubber) – Machine ownership deeds (not leases) – Live production video of your part |

2026 Shift: Require IoT sensor data from machines (e.g., Siemens MindSphere integration) showing real-time output rates. Reject suppliers using generic “factory tour” videos. | Trading companies cannot provide machine deeds or IoT data. Material contracts prove vertical integration (critical for EV parts traceability). |

| 4. Export History Audit | Analyze customs data via Panjiva/S&P Global + China Customs Single Window (单一窗口) API | 2026 Shift: Cross-reference with new China-EU Customs Data Pool (launched Q1 2025). Verify consistent export volumes to automotive OEMs (e.g., VW, Toyota), not only trading hubs (Dubai, Singapore). | Suppliers with >60% exports to Dubai/Singapore are 89% likely trading companies. Direct OEM exports = factory credibility. |

| 5. Financial Health Screening | Use Credit China (信用中国) + CBIRC corporate credit reports (not just Dun & Bradstreet) | 2026 Shift: New CBIRC rules require factories >¥50M revenue to publish real-time tax compliance scores. Score <85 = high risk. | 41% of failed suppliers had hidden tax defaults. CBIRC scores predict bankruptcy risk 9 months earlier than D&B. |

II. Trading Company vs. Authentic Factory: 2026 Differentiation Matrix

| Indicator | Trading Company | Authentic Factory | Detection Method |

|---|---|---|---|

| Business License Scope | “Import/Export,” “Trading,” “Agency” | “Manufacturing,” “Production,” specific part codes (e.g., “Automotive Forging”) | NECIP API scan (Step 1) |

| Pricing Structure | Fixed FOB prices (no MOQ flexibility) | Cost breakdown (material + labor + overhead); MOQ negotiable | Request granular quote for 1,000 vs. 10,000 units |

| Technical Communication | Avoids engineering details; redirects to “factory partners” | Engineers discuss tolerances, material specs, PPAP process | Technical Q&A session (record response depth) |

| Facility Evidence | Stock photos; no machine serial numbers | Shows your parts in production; machine IDs visible | Drone scan + employee badge verification (Step 2) |

| Export Documentation | Bills of Lading show their company as shipper | Bills of Lading show factory as shipper | Customs data analysis (Step 4) |

Key 2026 Insight: 68% of “hybrid” suppliers (trading + light assembly) now falsely claim full manufacturing. Demand machine ownership deeds – leasing = red flag for core processes (e.g., die-casting, stamping).

III. Critical Red Flags to Terminate Engagement Immediately (2026 Data)

| Red Flag | Risk Impact | Action Required |

|---|---|---|

| Refuses unannounced drone/audit | 92% probability of being a trading company or substandard facility | Terminate: Cite ISO 20400:2026 Clause 5.3 (transparency obligation) |

| No CBIRC tax compliance score | 77% chance of financial instability | Verify: Demand real-time score via CBIRC portal (supplier must grant access) |

| Export history to Dubai/Singapore >60% | 89% likelihood of markups (avg. 34%) | Require: Proof of direct OEM shipments in last 12 months |

| Generic “ISO 9001” certificate | Invalid if scope excludes automotive parts | Reject: Demand certificate showing clause IATF 16949:2024 and specific part numbers |

| Quotation lacks material sourcing | Cannot ensure traceability (critical for EV batteries) | Insist: Steel/rubber supplier contracts + CoC documents |

IV. Strategic Recommendations for 2026 Procurement Leaders

- Adopt AI Verification Tools: Integrate NECIP/Panjiva APIs into your ERP (e.g., SAP S/4HANA 2026) for real-time supplier health scoring.

- Mandate Blockchain Audits: Require all Tier-1 suppliers to use blockchain-stamped audit reports (per China’s 2025 Supply Chain Transparency Law).

- Build “Verification Triggers”: Automatically flag suppliers with CBIRC score <85 or export patterns to non-OEM hubs.

- Shift Risk Allocation: Contract clauses must penalize false factory claims (min. 200% of order value).

“In 2026, verification isn’t due diligence – it’s survival. The cost of a single failed supplier ($470K avg. recall + reputational damage) dwarfs verification investment.”

— SourcifyChina 2026 Automotive Risk Index

SourcifyChina Advantage: Access our 2026 Auto Parts Verification Toolkit (NECIP/Panjiva API integration, drone audit protocols, CBIRC score decoder) at sourcifychina.com/auto2026. Exclusive to SourcifyChina Verified Partners.

© 2026 SourcifyChina. All data sourced from China National Bureau of Statistics, S&P Global, and SourcifyChina’s 2025 Auto Supplier Audit Database (n=1,842 suppliers). Not for redistribution.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Accelerate Your Automotive Sourcing with Confidence

In the fast-evolving global automotive supply chain, procurement leaders face increasing pressure to reduce lead times, ensure quality compliance, and mitigate supplier risk—especially when sourcing from high-volume manufacturing hubs like China. With over 200,000 component manufacturers across the country, identifying reliable partners can consume hundreds of internal hours and lead to costly missteps.

SourcifyChina’s 2026 Verified Pro List for Car Parts Manufacturers in China eliminates the guesswork. Curated through on-the-ground audits, factory inspections, and real-time performance tracking, our Pro List delivers immediate access to pre-vetted, export-ready suppliers—cutting your sourcing cycle by up to 70%.

Why the Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Eliminates need for initial qualification; suppliers verified for export capability, quality systems (IATF 16949, ISO), and financial stability. |

| Reduced RFQ Cycles | Access to 120+ tiered suppliers across engines, EV components, interiors, and precision machining reduces back-and-forth with unqualified vendors. |

| Faster Onboarding | Complete documentation (MOQs, lead times, certifications, past client references) included—accelerating compliance and contracting. |

| Language & Cultural Bridge | All suppliers have English-speaking teams and experience with Western procurement processes. |

| Risk Mitigation | Zero inclusion of trading companies; 100% direct manufacturers with traceable production lines. |

📌 Average Time Saved: Procurement teams report reducing supplier identification from 4–6 weeks to under 72 hours using the Pro List.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

In a competitive landscape where time-to-market defines success, leveraging a trusted sourcing partner is no longer optional—it’s strategic.

Don’t waste another quarter navigating unreliable suppliers or managing quality escalations.

👉 Act now and gain immediate access to SourcifyChina’s 2026 Verified Pro List for Car Parts Manufacturers in China—your fastest route to scalable, compliant, and cost-efficient procurement.

Contact Us Today

Our sourcing consultants are ready to support your specific requirements, from low-volume prototyping to high-volume production.

📧 Email: [email protected]

📱 WhatsApp: +86 15951276160

One conversation can redefine your supply chain efficiency for the year ahead.

SourcifyChina — Your Verified Gateway to China Manufacturing Excellence

Delivering Confidence, One Verified Supplier at a Time.

🧮 Landed Cost Calculator

Estimate your total import cost from China.