The global automotive paint tools market is experiencing robust growth, driven by rising vehicle production, increasing demand for refinish solutions, and advancements in coating technologies. According to Grand View Research, the global automotive refinish coatings market was valued at USD 11.5 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 4.8% from 2023 to 2030. This expanding demand fuels the need for high-performance paint tools, including spray guns, paint mixing systems, compressors, and surface preparation equipment. As manufacturers prioritize efficiency, precision, and eco-friendly solutions, innovation in paint application tools has become a competitive differentiator. In this landscape, a select group of manufacturers has emerged as leaders, combining technological expertise with global reach to serve OEMs and repair shops alike. Based on market presence, product innovation, and customer adoption, the following are the top 10 car paint tools manufacturers shaping the industry’s future.

Top 10 Car Paint Tools Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Dupli-Color has perfect color match for your vehicle

Domain Est. 1997

Website: duplicolor.com

Key Highlights: Dupli-Color is the only brand with colors tested and approved by vehicle manufacturers for a perfect match to your original factory finish. Vehicle; Color Code….

#2 U.S. Paint

Domain Est. 1997

Website: uspaint.com

Key Highlights: U.S. Paint is a leading manufacturer of high performance paints, primers, and clearcoats for automotive, power sports, and industrial markets….

#3 Automotive Finishes

Domain Est. 1998

Website: industrial.sherwin-williams.com

Key Highlights: A complete line of advanced technology automotive paint and coating systems. Providing high performance interior and exterior auto coatings….

#4 Automotive OEM Coatings, OEM Paint Systems & Color Leaders

Domain Est. 1990

Website: ppg.com

Key Highlights: PPG Automotive OEM Coatings is a global leader in high-performance auto paints and technologies including powder primers, clearcoats, and color leadership….

#5 HMG Paints Limited

Domain Est. 1998 | Founded: 1930

Website: hmgpaint.com

Key Highlights: Established in 1930 HMG has grown to become the UK’s Leading Independent Paint Manufacturer. Offering innovative and compliant paints and coatings to a variety ……

#6 Tamco Paint

Domain Est. 2005

Website: tamcopaint.com

Key Highlights: Looking for high quality automotive paint? Check out or Epoxies, Primers, Sealers, Clearcoats, Custom Colors, OEM paint, Custom Candies, European Line and ……

#7 Valspar Automotive

Domain Est. 2012

Website: valsparauto.com

Key Highlights: From the lab to the body shop, Valspar Automotive combines cutting-edge refinish technology with expert guidance to deliver premium finishes every time….

#8 LKQ Refinish

Domain Est. 2024

Website: lkq-refinish.com

Key Highlights: LKQ Refinish is the leading national distributor of paint, coatings, and related materials for the automotive and industrial finishing industries….

#9 Paint Solutions Specially Formulated for the Pro

Domain Est. 2004

Website: ppgpaints.com

Key Highlights: PPG provides high-quality paint products, color services, and support to professional painters, contractors, designers, architects, and specifiers….

#10 LiME LiNE Paint Supply

Domain Est. 2021

Website: limelinepaintsupply.com

Key Highlights: 6–9 day delivery · 30-day returns…

Expert Sourcing Insights for Car Paint Tools

2026 Market Trends for Car Paint Tools

The car paint tools market is poised for significant transformation by 2026, driven by technological advancements, sustainability demands, and evolving consumer expectations. As the automotive industry embraces electrification, automation, and eco-conscious practices, the tools used in vehicle painting and refinishing are also undergoing rapid innovation. This analysis explores key trends shaping the car paint tools sector in 2026, including digital integration, eco-friendly solutions, demand for precision, and shifts in end-user behavior.

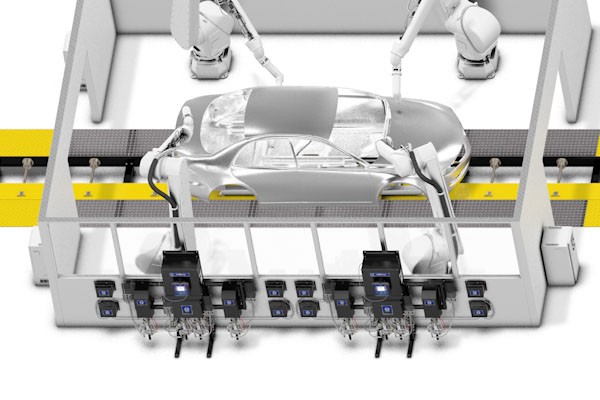

Technological Integration and Smart Tools

A dominant trend in 2026 is the integration of smart technology into car paint tools. Manufacturers are increasingly embedding sensors, IoT connectivity, and AI-driven analytics into spray guns, mixing systems, and application monitors. These smart tools enable real-time feedback on paint thickness, viscosity, and coverage, reducing waste and improving finish quality. For example, AI-powered spray guns can automatically adjust airflow and pressure based on surface contours, enhancing efficiency in both OEM and aftermarket environments.

Additionally, augmented reality (AR) is being used in training and quality control, allowing technicians to visualize paint layers and detect imperfections before final curing. This digital transformation not only boosts productivity but also reduces rework, a major cost factor in auto refinishing.

Sustainability and Eco-Friendly Products

Environmental regulations and consumer demand for greener solutions are pushing the car paint tools market toward sustainable innovation. By 2026, waterborne paint systems are expected to dominate, replacing solvent-based alternatives due to lower VOC emissions. This shift necessitates specialized tools designed for water-based coatings, including corrosion-resistant spray guns and precise humidity-controlled drying systems.

Manufacturers are also focusing on recyclable materials in tool construction and energy-efficient designs. Airless and HVLP (High Volume Low Pressure) spray systems are gaining popularity for their reduced overspray and lower environmental impact. Furthermore, companies are introducing closed-loop paint mixing and recovery systems to minimize waste and comply with tightening environmental standards globally.

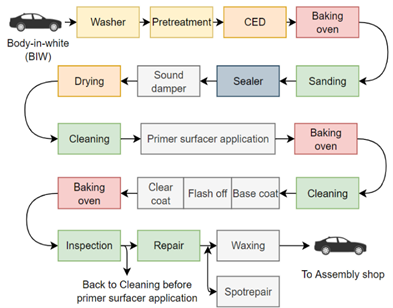

Growth in Electric Vehicle (EV) Manufacturing

The rise of electric vehicles is reshaping paint shop requirements. EVs often feature lighter materials like aluminum and composites, requiring more delicate and precise painting techniques. Specialized tools that minimize heat and static buildup are in higher demand, as traditional methods can damage sensitive EV components.

Moreover, EV production lines are increasingly automated, driving demand for robotic-compatible paint tools that integrate seamlessly with assembly systems. By 2026, modular and programmable tools capable of adapting to multiple vehicle platforms will be essential for OEMs striving to maintain flexibility and scalability.

Expansion of the Aftermarket and DIY Segment

While OEMs adopt advanced automation, the aftermarket and DIY sectors are experiencing growth due to rising vehicle ownership and consumer interest in customization. Portable, user-friendly paint tools—such as compact spray systems, touch-up pens with precision nozzles, and cordless HVLP guns—are becoming increasingly popular among hobbyists and independent repair shops.

E-commerce platforms are accelerating this trend by offering affordable, high-quality tools with detailed instructional content. In 2026, expect to see more brands offering subscription-based tool kits or rental models tailored to small workshops and mobile detailers, further democratizing access to professional-grade equipment.

Emphasis on Ergonomics and Worker Safety

With labor shortages and increased focus on occupational health, ergonomics is a critical factor in tool design. By 2026, car paint tools will feature lighter materials, better weight distribution, and vibration-reducing mechanisms to minimize fatigue during prolonged use. Smart tools with built-in usage analytics can also help monitor technician workload and prevent repetitive strain injuries.

Enhanced safety features—such as automatic shut-off, improved filtration systems, and integrated PPE compatibility—are also becoming standard, aligning with global workplace safety regulations.

Regional Market Dynamics

The Asia-Pacific region, particularly China and India, is expected to lead market growth due to expanding automotive production and rising middle-class vehicle ownership. North America and Europe will remain strong markets, driven by stringent environmental laws and high demand for premium refinishing services. Localized manufacturing of paint tools is on the rise to reduce supply chain vulnerabilities and meet regional compliance standards.

Conclusion

By 2026, the car paint tools market will be defined by smart, sustainable, and adaptable solutions tailored to both industrial and consumer needs. Technological innovation, environmental responsibility, and evolving automotive technologies will continue to drive product development and market competition. Companies that invest in R&D, embrace digital transformation, and prioritize sustainability will be best positioned to capture value in this dynamic landscape.

Common Pitfalls When Sourcing Car Paint Tools: Quality and Intellectual Property Risks

Sourcing car paint tools—such as spray guns, paint mixing systems, color match lamps, and calibration devices—can be fraught with challenges, especially concerning quality consistency and intellectual property (IP) protection. Organizations that overlook these pitfalls may face operational inefficiencies, legal exposure, and reputational damage. Below are key risks to consider:

Inconsistent Tool Quality Leading to Paint Defects

Many suppliers, particularly low-cost manufacturers, may offer car paint tools that appear identical to premium brands but are constructed with inferior materials and substandard engineering. This can result in inconsistent spray patterns, inaccurate color mixing, or poor durability. Tools that fail to maintain precise tolerances compromise paint finish quality, leading to rework, increased waste, and customer dissatisfaction.

Use of Counterfeit or Clone Tools Infringing IP Rights

A significant risk in sourcing is inadvertently procuring counterfeit or reverse-engineered tools that mimic patented designs or protected branding from established manufacturers (e.g., SATA, Devilbiss, or Dupli-Color). These clones often violate intellectual property rights, exposing the buyer to legal liability, customs seizures, or forced product recalls—even if the buyer was unaware of the infringement.

Lack of Certification and Compliance with Industry Standards

Reputable car paint tools must meet specific technical and safety standards (e.g., ISO, CE, or ATEX for explosive environments). Sourcing tools without valid certifications can lead to non-compliance with workplace safety regulations or incompatibility with OEM repair specifications. This not only affects paint quality but may also void warranties or certifications at repair shops.

Inadequate Documentation and Traceability

Suppliers may fail to provide comprehensive technical documentation, calibration records, or traceability data for tools. This lack of transparency makes it difficult to verify authenticity, ensure proper maintenance, or defend against IP allegations. It also complicates quality audits and compliance with automotive repair network requirements.

Supply Chain Transparency and Unauthorized Subcontracting

Some suppliers outsource production to third-party factories without the buyer’s knowledge, increasing the risk of IP leakage and quality deviations. Without clear oversight, proprietary tool designs or specifications can be copied or sold to competitors, undermining competitive advantage and brand integrity.

Failure to Conduct IP Due Diligence

Buyers often neglect to perform IP audits or trademark searches before finalizing supplier agreements. This oversight can result in purchasing tools that bear logos, names, or designs resembling protected IP. Even minor design similarities can trigger legal disputes, especially in jurisdictions with strong IP enforcement.

Overreliance on Price Over Long-Term Value

Focusing solely on upfront cost often leads to sourcing decisions that sacrifice reliability and IP safety. Cheap tools may require frequent replacement, increase downtime, and pose legal risks—ultimately costing more than investing in genuine, high-quality tools from authorized distributors or IP-compliant manufacturers.

To mitigate these risks, companies should vet suppliers rigorously, require proof of IP ownership or licensing, prioritize certified products, and include IP indemnification clauses in procurement contracts.

Logistics & Compliance Guide for Car Paint Tools

Product Classification & Regulation Overview

Car paint tools—including spray guns, paint mixing cups, masking tape, paint booths, and related accessories—are subject to various international, national, and regional regulations. These items may contain or come into contact with hazardous materials (e.g., solvents, flammable components), which influence transport, storage, and compliance requirements. Classification under Harmonized System (HS) codes, Dangerous Goods Regulations (e.g., IATA, IMDG), and environmental standards (e.g., VOC regulations) is essential for legal distribution.

Packaging & Labeling Requirements

Ensure all car paint tools are packaged to prevent contamination, leakage, and physical damage during transit. Tools used with paints or solvents must comply with packaging standards for potentially hazardous materials, even if shipped empty. Labels must include:

– Product name and manufacturer details

– HS code and country of origin

– Applicable hazard symbols (if applicable, e.g., flammable residue)

– Compliance marks (e.g., CE, UKCA, RoHS where relevant)

– Barcodes and batch/lot numbers for traceability

Use tamper-evident and moisture-resistant packaging, especially for precision tools like spray nozzles and filters.

Hazardous Materials Considerations

While the tools themselves may not be classified as dangerous goods, residual chemicals or accompanying accessories (e.g., solvent-cleaning kits, aerosol lubricants) may be. Evaluate each product and accessory under:

– IATA DGR for air transport

– IMDG Code for sea freight

– ADR for road transport in Europe

Clean tools thoroughly if they have contained flammable or toxic substances. Ship with proper documentation, including Safety Data Sheets (SDS) when required.

Import/Export Documentation

Prepare accurate documentation for cross-border shipments:

– Commercial invoice with detailed product descriptions and values

– Packing list specifying quantities, weights, and dimensions

– Certificate of Origin (for preferential tariffs)

– Bill of Lading or Air Waybill

– SDS for any tool with chemical exposure risk

Verify tariff classifications (HS codes)—common codes include 8424.81 (spray guns) and 9027.80 (measuring devices for paint viscosity).

Regulatory Compliance by Region

United States:

– Comply with EPA VOC regulations (e.g., SCAQMD Rule 1133 for automotive refinishing)

– OSHA standards for workplace safety if tools are used in commercial settings

– FCC rules if tools include electronic components

European Union:

– REACH and RoHS compliance for materials in tool construction

– CE marking required for applicable machinery and electrical components

– Adherence to EU VOC Directive 2004/42/EC for paint application equipment

United Kingdom:

– UKCA marking post-Brexit (with CE still accepted until 2025 in most cases)

– Compliance with UK REACH and Environmental Permitting Regulations

Other Markets (e.g., Canada, Australia):

– Check local environmental and safety certifications (e.g., CSA in Canada, AS/NZS in Australia)

Storage & Handling Best Practices

- Store tools in dry, temperature-controlled environments to prevent corrosion or material degradation

- Segregate tools that may retain chemical residues from food-grade or sensitive goods

- Implement inventory rotation (FIFO) to maintain product integrity

- Train personnel in proper handling, especially for pressurized or precision equipment

Sustainability & Environmental Compliance

- Follow WEEE directives for disposal of electronic paint tools (e.g., digital mixers, electrostatic sprayers)

- Offer recycling programs for plastic components and metal parts

- Minimize single-use plastics in packaging; use recyclable or biodegradable materials where possible

- Monitor evolving regulations on single-use items and extended producer responsibility (EPR)

Audit & Recordkeeping

Maintain records for at least five years, including:

– SDS and compliance certifications

– Customs filings and import/export declarations

– Audit reports and supplier compliance documentation

– Product traceability logs (batch numbers, shipment details)

Regular internal audits ensure ongoing compliance with changing regulations and reduce the risk of shipment delays or penalties.

Conclusion

Successfully managing the logistics and compliance of car paint tools requires understanding both physical distribution challenges and regulatory frameworks. Proactive classification, accurate documentation, and adherence to regional standards ensure smooth global operations while minimizing legal and environmental risks.

In conclusion, sourcing car paint tools requires careful consideration of quality, reliability, compatibility, and cost-effectiveness to ensure optimal performance and long-term value. Whether purchasing for a professional auto body shop or DIY projects, it’s essential to evaluate suppliers based on reputation, product range, warranty options, and after-sales support. Sourcing from reputable manufacturers or suppliers who offer durable, industry-standard tools—such as spray guns, sanders, mixing systems, and safety equipment—contributes to consistent, high-quality paint finishes. Additionally, staying informed about technological advancements and taking advantage of bulk purchasing or trusted online marketplaces can lead to better pricing and availability. Ultimately, investing in the right car paint tools from reliable sources enhances efficiency, improves work quality, and supports successful paint repair and refinishing operations.