The global car paint for plastic market is experiencing robust growth, driven by increasing demand for lightweight automotive components and advancements in durable, eco-friendly coatings. According to Mordor Intelligence, the automotive coatings market is projected to grow at a CAGR of over 6.2% from 2023 to 2028, with plastic substrates gaining prominence due to their role in vehicle weight reduction and fuel efficiency. A key contributor to this trend is the rising use of plastics in exterior trims, bumpers, and grilles—components that require specialized paints offering adhesion, flexibility, and UV resistance. Grand View Research further supports this trajectory, reporting that the global automotive plastic market size was valued at USD 130.6 billion in 2022 and is expected to expand significantly, indirectly fueling demand for high-performance plastic-compatible car paints. As manufacturers seek reliable, scalable solutions tailored to polypropylene, ABS, and other engineered plastics, innovation in paint formulations—including water-based and low-VOC options—is reshaping competitive dynamics. In this evolving landscape, identifying the top manufacturers leading in technology, application efficiency, and environmental compliance becomes critical for OEMs and aftermarket suppliers alike.

Top 10 Car Paint For Plastic Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 U.S. Paint

Domain Est. 1997

Website: uspaint.com

Key Highlights: U.S. Paint is a leading manufacturer of high performance paints, primers, and clearcoats for automotive, power sports, and industrial markets….

#2 Automotive Finishes

Domain Est. 1998

Website: industrial.sherwin-williams.com

Key Highlights: A complete line of advanced technology automotive paint and coating systems. Providing high performance interior and exterior auto coatings….

#3 Endura Paint

Domain Est. 2002

Website: endurapaint.com

Key Highlights: Endura is a manufacturer of high performance polyurethane and epoxy industrial coatings. Product lines include, industrial paint systems, ……

#4 Automotive OEM Coatings, OEM Paint Systems & Color Leaders

Domain Est. 1990

Website: ppg.com

Key Highlights: PPG Automotive OEM Coatings is a global leader in high-performance auto paints and technologies including powder primers, clearcoats, and color leadership….

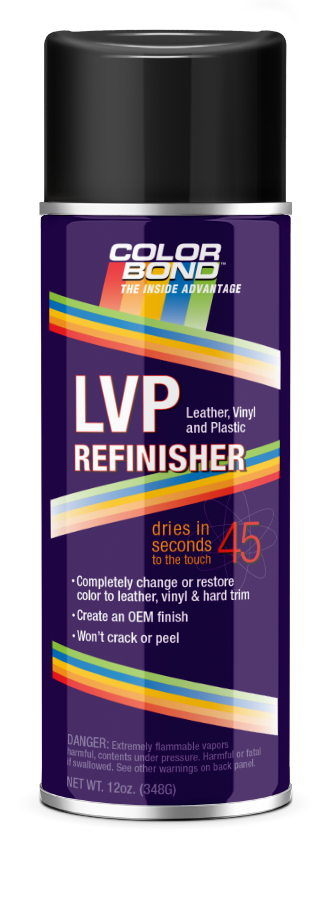

#5 ColorBond: Car Interior Paint

Domain Est. 2013

Website: colorbondpaint.com

Key Highlights: Restore, customize or repair your car at half the cost of a pro with ColorBond Paint. ColorBond products won’t crack, chip, or peel and are OEM certified….

#6 Nippon Paint Automotive Coatings

Website: nipponpaint.eu

Key Highlights: Plastic Coating NPAC offers a full range of automotive OEM paint coatings for integrated plastic parts, including Polypropylene and ABS….

#7 U-POL

Domain Est. 1996

Website: u-pol.com

Key Highlights: U-POL is a World leader in automotive refinishing with a wide range of products specialising in driving surface perfection….

#8 VHT Paint

Domain Est. 2003

Website: vhtpaint.com

Key Highlights: Our very high temperature (VHT) flameproof automotive paint is designed for exterior and interior dress-up application, capable of withstanding temperatures of ……

#9 Tru-Color Paint

Domain Est. 2009 | Founded: 1975

Website: trucolorpaint.com

Key Highlights: This is the best model paint I’ve ever used and I’ve using model paints and an airbrush since 1975! Tried them all, solvent based, acrylics, water based, you ……

#10 Nippon Paint Automotive Americas

Domain Est. 2015

Website: nipponpaintamericas.com

Key Highlights: Nippon Paint Automotive Americas offers a wide range of automotive coating solutions for both body and plastic parts applications….

Expert Sourcing Insights for Car Paint For Plastic

2026 Market Trends for Car Paint for Plastic

The car paint for plastic market is poised for significant evolution by 2026, driven by technological innovation, sustainability imperatives, and shifting consumer and regulatory landscapes. Key trends shaping the industry include:

Advancements in Sustainable and Low-VOC Formulations

Environmental regulations and consumer demand are accelerating the shift towards eco-friendly solutions. By 2026, water-based and high-solids coatings are expected to dominate the market, replacing traditional solvent-based paints. Regulatory bodies like the EPA and EU REACH are tightening VOC (Volatile Organic Compound) emissions standards, compelling manufacturers to invest heavily in low-VOC and zero-VOC technologies. Bio-based resins and renewable raw materials are also emerging, enhancing the sustainability profile of plastic-compatible automotive paints.

Growth in Demand from Lightweight Vehicle Components

The automotive industry’s ongoing push for fuel efficiency and electrification is increasing the use of plastic components in vehicles—especially in bumpers, trims, grilles, and interior parts. As plastic replaces heavier metals, the demand for reliable, durable, and aesthetically superior paint systems tailored to polypropylene, ABS, and other engineering plastics will surge. This trend is particularly strong in electric vehicles (EVs), where weight reduction directly impacts battery range and performance.

Technological Innovations in Adhesion and Durability

Achieving long-term adhesion on low-surface-energy plastics remains a technical challenge. By 2026, expect wider adoption of advanced surface treatments such as plasma activation and chemical primers that improve paint bonding without compromising recyclability. Nanotechnology-enhanced coatings offering superior scratch resistance, UV protection, and color retention will gain traction, meeting consumer expectations for lasting finishes under diverse environmental conditions.

Expansion of Refinish and DIY Markets

The growing popularity of vehicle customization and the need for efficient repair solutions are expanding the refinish segment. OEMs and aftermarket suppliers are developing user-friendly, one-step paint systems for plastic bumpers and trims that simplify repairs. Online retail platforms and DIY kits are making professional-grade plastic paints more accessible to consumers, fueling market growth beyond traditional body shops.

Integration with Smart and Adaptive Coatings

While still in early stages, the integration of smart materials into car paints for plastic is an emerging frontier. By 2026, research into thermochromic, self-healing, or conductive coatings could begin influencing niche applications, particularly in high-end and concept vehicles. These innovations may pave the way for functional finishes that respond to temperature, repair minor scratches, or support sensor integration.

Regional Market Dynamics and Supply Chain Resilience

Asia-Pacific, especially China and India, will remain key growth regions due to expanding automotive production and rising vehicle ownership. Meanwhile, North America and Europe will focus on premium and sustainable product offerings. Supply chain resilience will be critical, with manufacturers diversifying raw material sources and investing in localized production to mitigate geopolitical and logistical risks.

In summary, the 2026 car paint for plastic market will be defined by sustainability, performance innovation, and adaptability to evolving automotive design. Companies that prioritize eco-compliance, technical differentiation, and customer-centric solutions will be best positioned to lead in this dynamic landscape.

Common Pitfalls When Sourcing Car Paint for Plastic (Quality and IP)

Sourcing the right car paint for plastic components involves navigating both quality assurance and intellectual property (IP) risks. Falling into common traps can lead to product failures, legal disputes, and reputational damage. Below are key pitfalls to avoid:

Poor Adhesion and Durability Due to Incorrect Formulation

Many standard automotive paints are designed for metal substrates and fail to bond properly with plastic surfaces. Using incompatible formulations results in peeling, cracking, or bubbling—especially under UV exposure or temperature fluctuations. Sourcing without verifying the paint’s specific compatibility with the plastic type (e.g., PP, ABS, PC) leads to premature coating failure and increased warranty claims.

Lack of UV and Weather Resistance Testing

Plastic exterior parts are exposed to sunlight, rain, and extreme temperatures. Paints not specifically engineered for UV stability can fade, chalk, or degrade quickly. Sourcing from suppliers who do not provide certified weathering test data (e.g., QUV, xenon arc testing) risks short service life and customer dissatisfaction, especially in outdoor applications.

Inadequate Flexibility and Impact Resistance

Plastic components often flex or experience minor impacts. Rigid paints can crack under stress. A common oversight is selecting paints with insufficient elongation properties. Ensure the sourced paint meets OEM specifications for flexibility and impact resistance to prevent cosmetic and structural failures.

Non-Compliance with Environmental and Safety Regulations

Automotive paints must comply with regional regulations such as REACH, RoHS, and VOC limits. Sourcing from non-compliant suppliers—especially in regions with lax enforcement—can result in shipment rejections, fines, or product recalls. Always verify regulatory documentation and material safety data sheets (MSDS).

Intellectual Property Infringement

Using or reverse-engineering proprietary paint formulations without authorization can lead to IP violations. Some suppliers may offer “OEM-equivalent” paints that infringe on patented chemistries or trademarks. Sourcing such products exposes your company to litigation and damages. Always conduct due diligence on the paint’s origin and ensure licensing agreements are in place when required.

Misrepresentation of OEM Approval or Certification

Some suppliers falsely claim that their paints are “OEM-approved” or “factory-match” without proper certification. This misrepresentation can undermine quality assurance processes. Verify approvals directly with OEMs or through official documentation—do not rely solely on supplier claims.

Inconsistent Batch-to-Batch Quality

Low-cost suppliers may lack robust quality control systems, leading to color variation, inconsistent gloss levels, or application issues across batches. This inconsistency complicates manufacturing and repair processes. Audit suppliers for ISO 9001 certification and request batch test reports to ensure reliability.

Overlooking Application Method Compatibility

Paints for plastic may require specific application techniques (e.g., low-bake curing, specialized primers). Sourcing a paint without considering your production line’s capabilities can lead to adhesion problems or increased processing costs. Confirm compatibility with your existing equipment and processes before finalizing a supplier.

Avoiding these pitfalls requires thorough vetting of suppliers, rigorous testing of samples, and clear understanding of both technical specifications and legal constraints. Prioritize partners with proven track records in automotive plastic coatings and transparent IP practices.

Logistics & Compliance Guide for Car Paint for Plastic

Product Classification and Regulatory Overview

Car paint formulated for plastic surfaces is typically classified as a hazardous material due to its chemical composition, which often includes flammable solvents, volatile organic compounds (VOCs), and potentially regulated substances. Understanding the regulatory landscape is crucial for compliance during shipping, storage, and handling.

Hazard Classification and UN Identification

Car paint for plastic generally falls under Class 3 (Flammable Liquids) in the UN Model Regulations. The specific UN number depends on the formulation:

- UN 1263 – PAINT or UN 1139 – TURPENTINE SUBSTITUTE may apply, depending on solvent content.

- Classification is typically Packing Group II or III, indicating medium to low hazard.

- Always refer to the Safety Data Sheet (SDS) provided by the manufacturer for the exact UN number, hazard class, and packing group.

Packaging Requirements

Packaging must comply with international standards such as IMDG (sea), IATA (air), or ADR/RID (road/rail in Europe):

- Use UN-certified, leak-proof containers with proper closures.

- Inner packaging (e.g., metal or plastic cans) must be placed within robust outer packaging (e.g., fiberboard boxes) with sufficient cushioning.

- Ensure packaging is compatible with chemical content—avoid materials that may degrade upon contact.

- Maximum net quantity per package must adhere to modal regulations (e.g., limits for air transport are typically stricter).

Labeling and Marking

Proper labeling is legally required for safe transportation:

- Affix Class 3 Flammable Liquid hazard labels (red diamond with flame symbol).

- Include UN number (e.g., UN 1263), proper shipping name, and packing group.

- Add “Limited Quantity” or “Excepted Quantity” marks if applicable (for small volumes meeting criteria).

- Include orientation arrows and handling instructions (e.g., “Keep Upright”).

- All labels must be durable and clearly visible.

Safety Data Sheet (SDS) Compliance

An up-to-date 16-section SDS in the destination country’s language is mandatory:

- Must be provided to carriers, distributors, and end users.

- Includes hazard identification, composition, first-aid measures, fire-fighting instructions, accidental release measures, handling and storage, and regulatory information.

- SDS must comply with local regulations (e.g., GHS in the U.S. under OSHA HCS, CLP in the EU).

Transport Regulations by Mode

Air Transport (IATA DGR)

- Strict limits on quantity per package and per consignment.

- Often requires “Not Restricted” classification under Special Provision A1/A2 if meeting criteria for consumer commodities (e.g., aerosols in limited amounts).

- Pre-approval from airline may be required.

Sea Transport (IMDG Code)

- Must be declared with correct UN number, class, and packing group.

- Segregation from oxidizers, acids, and foodstuffs is required.

- Vessel stowage must follow IMDG segregation table.

Road Transport (ADR in Europe, DOT in U.S.)

- ADR: Requires orange placards on vehicle, transport documents, and driver training (ADR certificate).

- DOT (49 CFR): Requires hazardous materials shipping papers, placarding for large quantities, and employee training.

Storage and Handling Guidelines

- Store in a well-ventilated, cool, dry area away from direct sunlight and ignition sources.

- Keep containers tightly closed when not in use.

- Use flammable storage cabinets if storing significant quantities.

- Implement spill containment measures (e.g., secondary containment trays).

- Ensure staff are trained in safe handling and emergency response.

Environmental and Disposal Compliance

- Follow local, national, and international regulations for waste disposal (e.g., EPA in U.S., REACH/CLP in EU).

- Do not pour waste paint down drains or into soil.

- Use licensed hazardous waste disposal contractors.

- Consider recycling programs for empty containers where available.

Import/Export Considerations

- Verify customs tariff codes (e.g., HS Code 3208 for synthetic organic pigments).

- Check for import restrictions or permits in destination countries.

- Some countries limit VOC content (e.g., EU Directive 2004/42/EC).

- Ensure packaging and labeling meet destination country standards.

Training and Documentation

- Train personnel involved in handling, storage, and transport on hazard awareness and emergency procedures.

- Maintain records of training, SDS, shipping documents, and compliance audits.

- Use electronic documentation to streamline compliance and traceability.

Conclusion

Compliance in the logistics of car paint for plastic requires strict adherence to hazardous materials regulations across all stages. Partnering with experienced freight forwarders, maintaining accurate documentation, and staying updated on regulatory changes are essential for safe and legal transportation. Always consult the manufacturer’s SDS and local regulatory authorities for product-specific requirements.

In conclusion, sourcing car paint specifically formulated for plastic requires careful consideration of compatibility, durability, and application method. Traditional automotive paints are not suitable for flexible plastic surfaces, which are prone to cracking and peeling. Instead, selecting a paint designed for plastics—such as flexible urethane-based or adhesion-promoting formulas—ensures long-lasting results. Key factors to consider include proper surface preparation (cleaning, sanding, and priming with a plastic primer), choosing reputable suppliers or brands known for plastic adhesion, and determining whether a spray can, aerosol, or professional spray gun system best suits the project. Whether for DIY repairs or commercial use, investing in high-quality paint engineered for plastic components leads to a professional finish and improved resistance to weathering, impact, and UV exposure. Ultimately, the right sourcing strategy balances performance, cost, and ease of application for optimal outcomes in painting automotive plastic parts.