The global automotive grommet market is experiencing steady growth, driven by increasing vehicle production, rising demand for noise, vibration, and harshness (NVH) reduction solutions, and the expansion of electric vehicle (EV) manufacturing. According to Grand View Research, the global automotive rubber and plastic parts market—of which grommets are a critical component—was valued at USD 86.7 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. A key contributor to this trend is the growing need for sealing, insulation, and protective components in complex wiring and tubing systems, especially as vehicles become more electronically sophisticated. Mordor Intelligence also highlights a CAGR of approximately 5.2% for the automotive electrical components market through 2028, further underscoring the rising demand for precision parts like car grommets. With OEMs prioritizing durability, thermal resistance, and material efficiency, grommet manufacturers are innovating with advanced polymers and automated production techniques. In this evolving landscape, the following nine companies have emerged as leaders in quality, scalability, and technological advancement in automotive grommet manufacturing.

Top 9 Car Grommet Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Viton O

Domain Est. 1999

Website: gmors.com

Key Highlights: GMORS has served as the leading rubber component manufacturer in Taiwan. Known for innovation and continuous improvement, GMORS products have been approved for ……

#2 Grommet Edging, Seals & Edge Protection for Vital Equipment

Domain Est. 2000

Website: devicetech.com

Key Highlights: We have an extensive range of wire and equipment protection solutions for OEMs. Spring-Fast Grommet Edging 49% installation saving vs. the old glue-in grommets….

#3 Leading Rubber Grommet Manufacturers

Domain Est. 2002

Website: rubbermolding.org

Key Highlights: Locate rubber grommet companies providing both custom product formulations and a wide range of standard, stable products that are resistant to temperatures….

#4 Rubber grommets automotive SBR EPDM electrical grommet

Domain Est. 2015

Website: product.etol-rubber.com

Key Highlights: We are a rubber grommet manufacturer, which specialized on producing custom parts according to your drawings or samples. We got our own mold department and ……

#5 Rubber Grommet Manufacturer

Domain Est. 2018

Website: kinkongseal.com

Key Highlights: KinKong a rubber grommet manufacturer that produces custom rubber gaskets for all industries and applications. we have the ability to design and manufacture ……

#6 Custom Rubber Grommets

Domain Est. 2019

Website: onisrubber.com

Key Highlights: The rubber grommets are a kind of accessories to protect or cover through holes. JHAO YANG RUBBER is a specialized rubber molded manufacturer and supplier ……

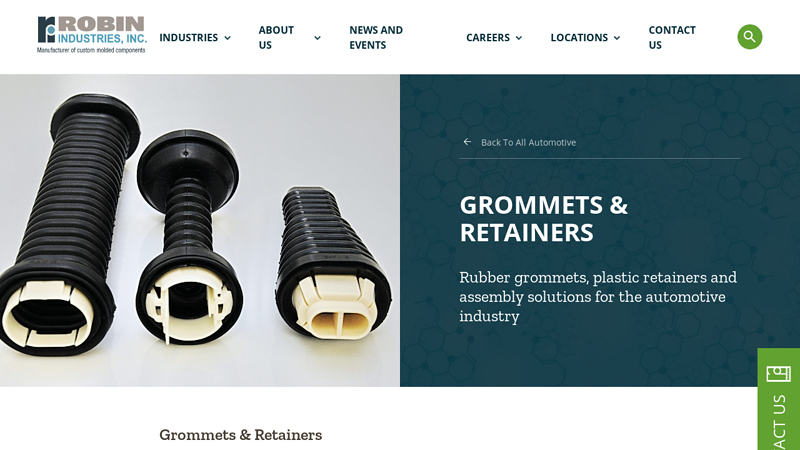

#7 Grommets & Retainers

Domain Est. 1998

Website: robin-industries.com

Key Highlights: Robin Industries is recognized as a world leader in design and manufacture of grommets and retainers for automotive wiring….

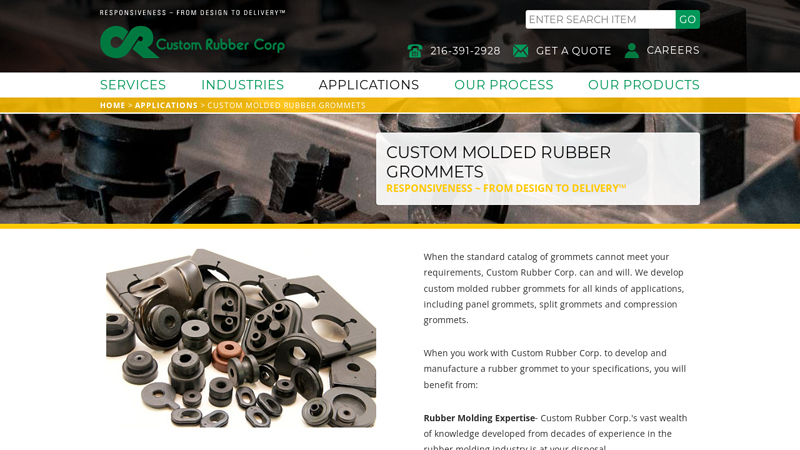

#8 Custom Molded Rubber Grommets

Domain Est. 1998

Website: customrubbercorp.com

Key Highlights: We develop custom molded rubber grommets for all kinds of applications, including panel grommets, split grommets and compression grommets….

#9 Custom Grommets

Domain Est. 2019

Website: rubber-grommet.com

Key Highlights: These custom grommets are amazing for those who want a personalized design for their equipment or automobile. Custom grommets are the best option for any ……

Expert Sourcing Insights for Car Grommet

H2 2026 Market Trends for Car Grommets: Innovation, Electrification, and Sustainability Driving Growth

The car grommet market in H2 2026 is poised for significant transformation, driven by the accelerating shift towards electric vehicles (EVs), heightened focus on vehicle performance and comfort, and stringent sustainability regulations. While remaining a seemingly minor component, grommets are becoming increasingly sophisticated and critical to modern automotive design and manufacturing. Here’s an analysis of the key trends shaping the market in the second half of 2026:

-

Dominance of Electrification & High-Voltage Requirements:

- High-Voltage (HV) Grommet Boom: The rapid adoption of EVs will make HV grommets a primary growth driver. These specialized grommets, designed for battery packs, power electronics (inverters, converters), and high-voltage cabling, require superior electrical insulation, thermal stability (resisting heat from batteries/motors), and robust sealing against moisture and contaminants. Demand will surge as EV production scales.

- Material Innovation: Standard rubber (EPDM, NBR) will be increasingly supplemented or replaced by advanced materials like:

- Thermoplastic Elastomers (TPEs): Offering better processability, recyclability, and consistent performance.

- Silicones: For extreme temperature resistance (especially near batteries and motors).

- Fluorinated Elastomers (FKM/FKM): For exceptional chemical and thermal resistance in demanding underhood EV components.

- EMI/RFI Shielding Integration: Grommets for HV and sensitive electronic harnesses will increasingly incorporate conductive fillers or be designed to work with conductive backshells to mitigate electromagnetic interference (EMI) and radio frequency interference (RFI), crucial for EV safety and sensor reliability.

-

Heightened Focus on NVH (Noise, Vibration, Harshness) Reduction:

- Acoustic Performance as a Key Metric: With EVs being inherently quieter, eliminating unwanted noise from vibrations transmitted through body panels, doors, and floorboards becomes paramount. Grommets will be engineered with advanced damping properties.

- Multi-Material & Hybrid Designs: Expect wider adoption of grommets combining rigid structural components (often plastic) with precisely engineered soft elastomeric sealing/damping elements. This allows for optimized stiffness for structural integrity while maximizing vibration isolation at the seal point.

- Customized Damping Profiles: Suppliers will offer grommets with tunable damping characteristics tailored to specific vehicle locations and frequencies, moving beyond one-size-fits-all solutions.

-

Sustainability and Circularity Imperative:

- Material Shift Towards Recyclability: Pressure from regulations (EU End-of-Life Vehicle Directive) and OEM sustainability goals will accelerate the shift from traditional thermoset rubbers (difficult to recycle) to thermoplastics (TPEs, specific TPVs) that can be melted and reprocessed.

- Bio-Based & Renewable Materials: Development and limited commercialization of grommets using bio-based polymers or renewable raw materials will gain momentum, though cost and performance parity remain challenges.

- Design for Disassembly: Grommets will be designed to be easily removable during vehicle recycling, facilitating material separation and recovery. Simpler, demountable designs will be favored.

- Reduced Material Usage: “Right-sizing” and optimized geometries will minimize material waste without compromising function.

-

Advanced Manufacturing and Supply Chain Dynamics:

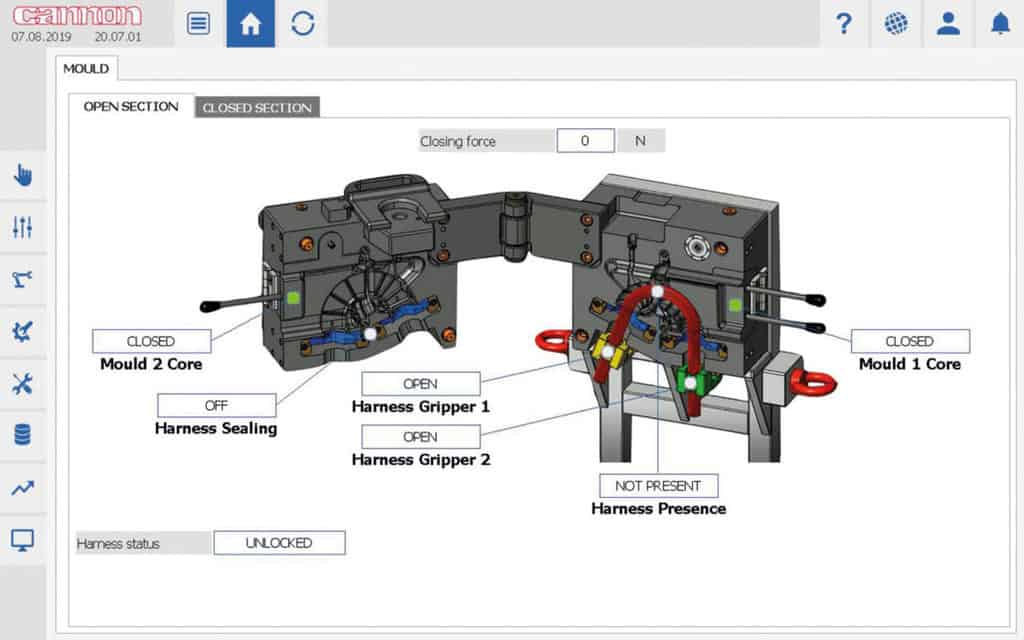

- Increased Automation: High-volume EV production demands highly automated grommet insertion processes. Grommets will be designed for easier robotic handling and installation (e.g., features aiding alignment, snap-fits).

- Nearshoring/Resilience: Supply chain disruptions experienced earlier in the decade will lead to continued investment in regional manufacturing (especially in North America and Europe) for critical components like HV grommets to ensure security of supply for EV programs.

- Digital Twin & Simulation: Extensive use of simulation software for NVH performance, sealing integrity, and durability will become standard, reducing physical prototyping and accelerating development cycles for new models.

-

Consolidation and Value-Added Services:

- Supplier Consolidation: The need for complex, high-performance solutions (especially HV) will favor larger Tier 1 suppliers with strong R&D and manufacturing capabilities, potentially leading to further market consolidation.

- From Component to System Solutions: Leading suppliers will move beyond selling individual grommets to offering integrated sealing and mounting systems, including assembly guidance, testing protocols, and lifecycle support, becoming true engineering partners to OEMs.

Conclusion:

H2 2026 will see the car grommet market evolve from a commodity-focused industry to one defined by high-value engineering. Electrification is the paramount driver, demanding grommets with enhanced electrical, thermal, and EMI performance. Simultaneously, sustainability mandates and the pursuit of superior NVH in quiet EVs are pushing innovation in materials (recyclable TPEs, silicones) and design (multi-material, optimized damping). Suppliers who can deliver reliable, sustainable, high-performance solutions, particularly for the booming EV segment, and offer integrated engineering support, will be best positioned for success. The humble grommet will remain essential, but its role and complexity will be significantly elevated.

Common Pitfalls When Sourcing Car Grommets (Quality and IP)

Sourcing car grommets may seem straightforward, but overlooking key quality and intellectual property (IP) concerns can lead to significant issues down the line, including product failures, safety risks, and legal liabilities. Here are common pitfalls to avoid:

Poor Material Quality and Durability

Many suppliers offer grommets made from substandard rubber or plastic compounds that degrade quickly when exposed to heat, UV light, or automotive fluids. This can result in cracking, hardening, or shrinking, compromising the seal and potentially damaging wiring. Always verify material specifications (e.g., EPDM, silicone, or TPE) and request test reports for temperature resistance, ozone resistance, and longevity.

Inconsistent Dimensional Accuracy

Grommets must fit precisely into designated cutouts and snugly around cables. Poor manufacturing tolerances lead to loose fits or difficulty in installation, which can allow moisture, dust, or vibration damage. Ensure suppliers provide detailed dimensional drawings and conduct first-article inspections (FAI) before mass production.

Lack of Environmental and Safety Certifications

Automotive components often require compliance with standards like UL, RoHS, REACH, or specific OEM specs (e.g., Ford, GM, or Toyota standards). Sourcing grommets without proper certifications can result in rejected shipments or non-compliance in end-use applications. Confirm that suppliers can provide valid, up-to-date compliance documentation.

Inadequate IP Due Diligence

Many grommet designs—especially custom or branded ones—are protected by patents or design rights. Sourcing from suppliers who replicate OEM or proprietary designs without authorization exposes your company to intellectual property infringement claims. Always verify that the grommet design is either licensed, in the public domain, or developed as an original design.

Copying Proprietary OEM Designs

A common IP risk is sourcing grommets that mimic original equipment manufacturer (OEM) parts. Even if functionally similar, copying the exact shape, texture, or branding may violate design patents or trade dress rights. Work with suppliers who can offer functionally equivalent but legally distinct alternatives.

Supplier Misrepresentation of Qualifications

Some suppliers claim compliance or certifications they do not possess. This is especially prevalent in online marketplaces or low-cost regions. Conduct supplier audits, request samples for third-party testing, and verify certifications through official channels to avoid counterfeit or misrepresented products.

Overlooking Long-Term Supply Reliability

Even if initial quality is acceptable, unreliable suppliers may fail to maintain consistency over time. Establish quality agreements, require batch testing, and consider dual sourcing to mitigate risks related to supply chain disruptions or quality drift.

Avoiding these pitfalls requires thorough vetting, clear specifications, and proactive IP risk assessment—ensuring that sourced car grommets are both high-performing and legally safe for use.

Logistics & Compliance Guide for Car Grommet

Car grommets—rubber or plastic seals used to protect wires, cables, and hoses passing through metal panels in vehicles—are essential components in automotive manufacturing and aftermarket applications. Efficient logistics and strict compliance with industry standards are crucial to ensure product quality, safety, and timely delivery. This guide outlines key considerations in the logistics and compliance processes for car grommets.

Product Classification & HS Code

Correct product classification is essential for international shipping and customs clearance. Car grommets are typically classified under the Harmonized System (HS) Code:

- HS Code: 8708.29.50 (Other parts and accessories of motor vehicles, not elsewhere specified)

- Note: Classification may vary by country and material (e.g., rubber vs. plastic). Verify with local customs authorities or a trade compliance expert.

Packaging & Labeling Standards

Proper packaging ensures product integrity during transit and meets regulatory requirements.

- Packaging Requirements:

- Use moisture-resistant, durable packaging to prevent deformation or contamination.

- Organize grommets in sealed plastic bags or trays to avoid tangling or damage.

- Use corrugated cardboard boxes with adequate cushioning for bulk shipments.

- Labeling:

- Include product name, part number, material type (e.g., EPDM rubber, TPE), quantity, batch/lot number, and date of manufacture.

- Add handling symbols (e.g., “Fragile,” “Do Not Stack,” “Keep Dry”).

- Include supplier name and contact information.

- For export, add country of origin and any required regulatory markings (e.g., CE, RoHS).

Transportation & Storage

Optimize logistics to maintain product quality and meet delivery timelines.

- Transportation:

- Use enclosed, temperature-controlled vehicles when shipping in extreme climates.

- Avoid exposure to direct sunlight, moisture, and ozone (especially for rubber grommets).

- Stack pallets securely; limit stack height to prevent crushing.

- Storage:

- Store in a cool, dry environment (recommended: 15–25°C, <65% humidity).

- Keep away from heat sources, chemicals, and UV radiation.

- Follow FIFO (First In, First Out) inventory management to minimize aging.

Regulatory Compliance

Car grommets must meet various international and regional standards depending on application and market.

- Material Compliance:

- REACH (EU): Ensure no restricted substances (e.g., SVHCs) are present.

- RoHS (EU): Comply with restrictions on hazardous substances (lead, cadmium, etc.).

- ELV Directive (EU): Meet End-of-Life Vehicle requirements for recyclability and labeling.

- Flammability & Safety:

- FMVSS 302 (USA): Flammability standards for interior components may apply if grommets are used in passenger compartments.

- UL 94 (Global): Flammability ratings for plastic components (e.g., V-0, V-2).

- Automotive Standards:

- ISO/TS 16949 (Now IATF 16949): Quality management system for automotive suppliers.

- VDA 6.3 (Germany): Process audit standard often required by OEMs.

- OEM-Specific Requirements: Follow technical specifications from automakers (e.g., Ford, GM, Toyota).

Documentation & Traceability

Maintain accurate records to support compliance and supply chain transparency.

- Required Documents:

- Certificate of Conformity (CoC)

- Material Safety Data Sheet (MSDS/SDS)

- Test reports (e.g., flammability, aging, chemical resistance)

- Batch traceability logs

- Traceability:

- Implement a system to track raw materials, production batches, and finished goods.

- Enable recall readiness in case of non-conformance.

Import & Export Considerations

Ensure smooth cross-border movement of goods.

- Customs Documentation:

- Commercial invoice

- Packing list

- Bill of lading or air waybill

- Certificate of Origin (preferential or non-preferential, e.g., EUR.1, Form A)

- Duties & Tariffs:

- Check applicable duty rates under free trade agreements (e.g., USMCA, RCEP, EU-UK TCA).

- Apply for Authorized Economic Operator (AEO) status to expedite customs clearance.

Sustainability & Environmental Responsibility

Growing emphasis on eco-friendly practices impacts logistics and compliance.

- Recyclability:

- Design grommets for disassembly and recyclability.

- Label materials clearly (e.g., “EPDM” or “TPE”) to support recycling.

- Packaging:

- Use recyclable or biodegradable materials where possible.

- Minimize packaging volume to reduce carbon footprint.

Conclusion

Effective logistics and compliance for car grommets require coordination across packaging, transportation, regulatory standards, and documentation. By adhering to industry best practices and maintaining strict compliance, suppliers can ensure product reliability, meet customer expectations, and avoid delays or penalties in global markets. Regular audits and updates to regulatory changes are recommended to stay compliant.

In conclusion, sourcing car grommets effectively requires a thorough understanding of technical specifications, material requirements, and application environments. It is essential to partner with reliable suppliers who maintain consistent quality, adhere to industry standards (such as ISO/TS 16949), and offer competitive pricing and timely delivery. Conducting proper due diligence—including evaluating supplier capabilities, requesting samples, and performing quality inspections—ensures that the grommets meet performance expectations for durability, vibration dampening, and environmental resistance. Additionally, considering factors like customization options, scalability, and long-term supply chain stability contributes to a successful sourcing strategy. With careful planning and supplier management, sourcing car grommets can support improved vehicle assembly efficiency and overall product reliability.