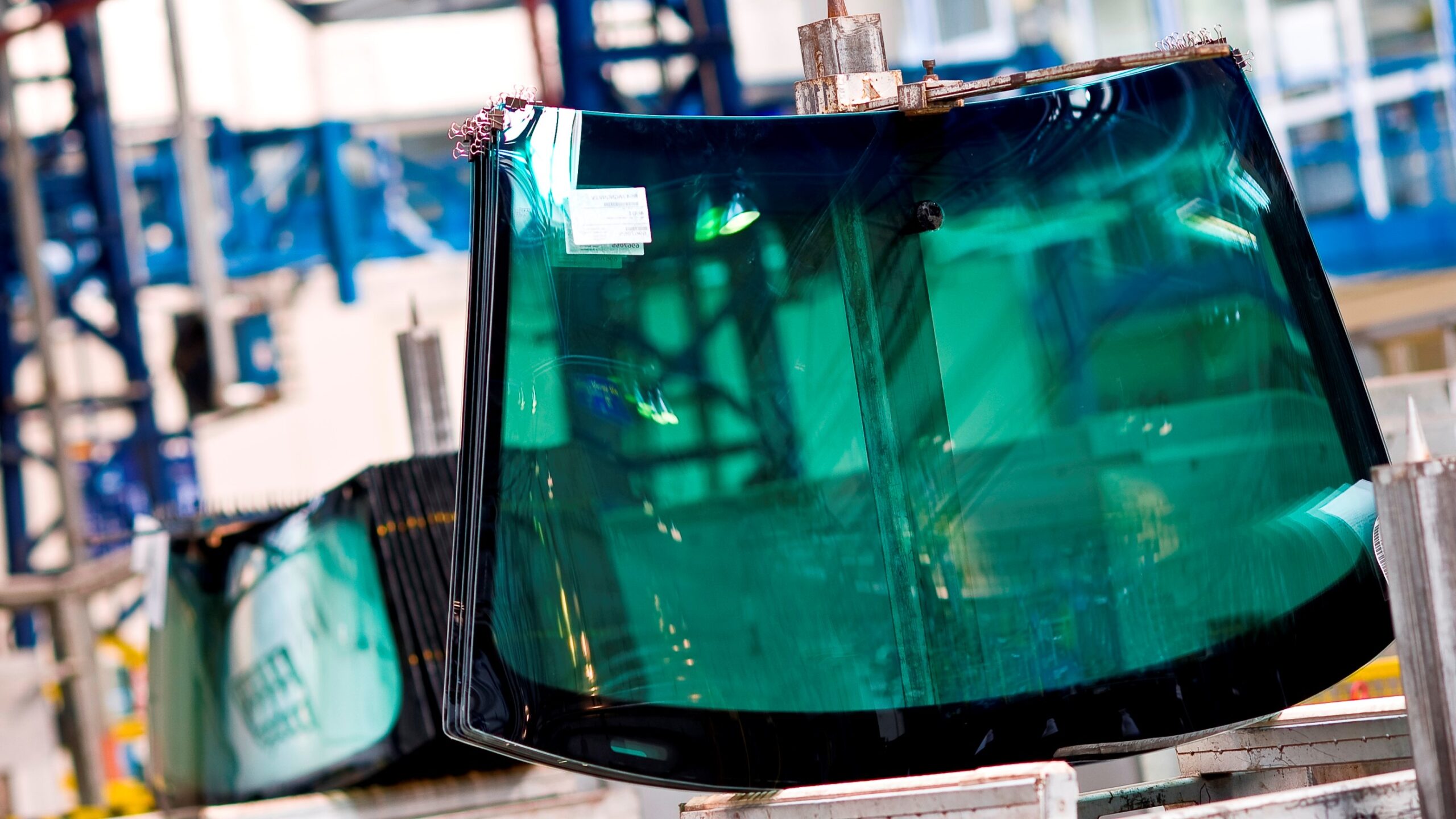

The global automotive glass market is experiencing robust expansion, driven by rising vehicle production, increasing demand for advanced glazing technologies, and stringent safety regulations. According to a report by Mordor Intelligence, the market was valued at USD 38.67 billion in 2023 and is projected to grow at a CAGR of 6.4% from 2024 to 2029. Similarly, Grand View Research highlights accelerating adoption of lightweight and energy-efficient glass solutions in electric vehicles as a key growth catalyst, forecasting the market to exceed USD 60 billion by 2030. Amid this growth, wholesale manufacturers play a pivotal role in supplying high-volume, cost-effective automotive glass solutions to OEMs and aftermarkets worldwide. As demand surges across regions, identifying reliable, scalable, and technologically advanced manufacturers has become critical for stakeholders across the automotive supply chain. Here are the top 9 car glass wholesale manufacturers shaping the industry’s future through innovation, global reach, and production excellence.

Top 9 Car Glass Wholesale Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Fuyao Glass America

Domain Est. 2012

Website: fuyaousa.com

Key Highlights: WE’RE AN OEM GLASS SUPPLIER TO ALL MAJOR AUTO MANUFACTURERS. General Motors, Ford, BMW, Honda, Bentley and more all use Fuyao glass in their newly manufactured ……

#2 Automotive Glass Replacement North America

Domain Est. 1996

Website: pilkington.com

Key Highlights: Pilkington Automotive Glass Replacement (AGR) provides OEM quality glass products to auto glass replacement professionals throughout the United States….

#3 Carlex Glass

Domain Est. 1997

Website: carlex.com

Key Highlights: Carlex Glass America is a premier supplier of original equipment and replacement glass for Original Equipment Manufacturer automakers and aftermarket ……

#4 Xinyi Glass (XYG), leading manufacturer of float glass, auto glass …

Domain Est. 1999

Website: xinyiglass.com

Key Highlights: As one ofthe world’s leading integrated glass manufacturers, Xinyi Glass is committed tothe manufacturing of high-quality float glass, automobile glass ……

#5 XYG

Domain Est. 2015

Website: xygna.com

Key Highlights: XYG is a fully integrated glass manufacturer, excelling in the production of a diverse array of high-quality products. Our reach extends to over 140 countries….

#6 Import Glass Corporation

Domain Est. 2001 | Founded: 1984

Website: importglasscorp.com

Key Highlights: Import Glass Corporation. Your Source for Automotive Replacement Glass. Since 1984. Brand Slide. LOGIN. Email Address. Customer Number. Password…

#7 AGC Automotive

Domain Est. 2003

Website: agc-automotive.com

Key Highlights: AGC Automotive: Our vision is to become the most respected automotive glazing supplier in the world….

#8 PGW Auto Glass

Domain Est. 2009

Website: buypgwautoglass.com

Key Highlights: We Provide Trusted & Best Quality Product. PGW Auto Glass, LLC is the leading supplier of auto glass and shop accessories, with more than 100 distribution ……

#9 Glavista

Domain Est. 2020

Website: glavista.com

Key Highlights: At Glavista, we produce and distribute premium quality automotive glass from the heart of Europe. More about Glavista…

Expert Sourcing Insights for Car Glass Wholesale

2026 Market Trends for Car Glass Wholesale

Rising Demand Driven by Vehicle Proliferation and Accidents

The global car glass wholesale market is projected to experience steady growth by 2026, primarily fueled by the increasing number of vehicles on the road and rising accident rates. As urbanization expands and personal vehicle ownership rises—especially in emerging economies—replacement demand for windshields, side windows, and rear glass continues to climb. Additionally, natural events such as hail, debris, and extreme temperatures contribute to glass damage, further stimulating aftermarket replacements. Wholesalers are expected to benefit from this consistent demand, particularly in regions with aging vehicle fleets.

Advancements in Smart and Safety Glass Technologies

By 2026, the integration of advanced driver-assistance systems (ADAS) and smart glass technologies will significantly influence wholesale dynamics. Modern vehicles increasingly feature windshields with embedded sensors, heads-up displays, and rain-sensing wipers, requiring precise calibration during replacement. This trend drives demand for high-quality, OEM-specification glass and certified installation procedures. Wholesalers will need to adapt by offering technologically advanced products and partnering with suppliers capable of meeting stricter safety and compatibility standards.

Growth in E-Commerce and Digital Distribution Channels

Digital transformation will reshape the car glass wholesale landscape by 2026. Online procurement platforms, integrated inventory systems, and B2B marketplaces are streamlining supply chains, enabling faster order fulfillment and real-time pricing. Wholesalers adopting digital tools—such as inventory management software and automated logistics—will gain a competitive edge. Additionally, direct partnerships with repair chains and fleet operators via digital portals will enhance scalability and customer retention.

Sustainability and Regulatory Pressures

Environmental regulations and sustainability goals will increasingly impact material sourcing and production processes. Glass manufacturers and wholesalers may face pressure to adopt recycled materials, reduce carbon footprints, and comply with regional emissions standards. In markets like the EU and North America, extended producer responsibility (EPR) schemes could require responsible end-of-life glass recycling, influencing wholesale logistics and supply chain practices.

Regional Market Diversification and Competitive Intensification

While North America and Europe remain key markets due to high vehicle density and mature aftermarket ecosystems, Asia-Pacific—particularly China and India—will emerge as high-growth regions by 2026. Expanding automotive industries, rising insurance penetration, and government infrastructure projects support regional demand. This growth will attract new entrants and intensify competition, pushing wholesalers to differentiate through service offerings, just-in-time delivery, and value-added solutions like installation training or warranty support.

Conclusion

By 2026, the car glass wholesale market will be defined by technological innovation, digital integration, and evolving consumer expectations. Wholesalers who invest in smart inventory systems, expand into high-growth regions, and align with sustainability trends will be best positioned to thrive in an increasingly complex and competitive landscape.

Common Pitfalls Sourcing Car Glass Wholesale: Quality and Intellectual Property Risks

Sourcing car glass wholesale can offer significant cost advantages, but it comes with critical risks—particularly concerning product quality and intellectual property (IP) compliance. Overlooking these areas can lead to safety hazards, legal liabilities, reputational damage, and financial losses. Below are the most common pitfalls to avoid.

Poor Quality Control and Substandard Materials

One of the biggest risks in wholesale car glass sourcing is receiving products that fail to meet safety and performance standards. Many suppliers, especially those in low-cost regions, cut corners by using inferior raw materials or outdated manufacturing processes. This can result in glass that is more prone to shattering, has optical distortions, or lacks proper adhesion for windshields—posing serious safety risks. Buyers often assume wholesale pricing equates to value, but without rigorous quality audits and certifications (like ISO, AS1, AS2, or DOT), they may end up with defective or non-compliant glass.

Lack of Compliance with Safety and Regulatory Standards

Car glass must meet strict regulatory requirements depending on the region (such as FMVSS in the U.S., ECE in Europe, or ADR in Australia). When sourcing wholesale, suppliers may claim compliance without providing verifiable documentation. Some may even falsify certifications. Non-compliant glass not only fails inspections but also exposes the buyer to liability in the event of accidents or recalls. Always require test reports and third-party certifications before placing bulk orders.

Counterfeit or Imitation Brand Glass (IP Infringement)

A major intellectual property pitfall is unknowingly purchasing counterfeit or imitation branded glass (e.g., fake OEM parts labeled as “OEM-equivalent”). Some wholesale suppliers sell products that mimic well-known brands like Pilkington, Saint-Gobain, or Fuyao—complete with replicated logos and packaging—without authorization. Distributing such goods constitutes trademark and patent infringement, potentially leading to seizures, fines, or lawsuits. Buyers are often held liable even if they claim ignorance, making due diligence essential.

Unauthorized Use of Patented Glass Technologies

Modern car glass often incorporates patented technologies, such as hydrophobic coatings, antenna-embedded laminates, or ADAS (Advanced Driver Assistance Systems) calibration features. Sourcing wholesale glass that includes these features without proper licensing can lead to IP violations. Suppliers may claim the tech is “generic,” but if it replicates a protected design or process, it may still infringe on existing patents. Always verify whether the product design circumvents or licenses protected technologies.

Inadequate Supplier Vetting and Transparency

Many wholesale buyers fall into the trap of choosing suppliers based solely on price and MOQs (Minimum Order Quantities), neglecting to verify the supplier’s legitimacy. Red flags include lack of physical factory addresses, refusal to provide samples, or inconsistent communication. Without site audits or third-party inspections, buyers risk partnering with middlemen or shell companies that outsource to unqualified manufacturers—compromising both quality and IP integrity.

Weak Contractual Protections and Liability Clauses

Wholesale agreements often lack clear terms on quality assurance, IP indemnification, and recourse for defective or infringing products. Without enforceable contracts, buyers have little legal standing if issues arise. Ensure contracts specify compliance requirements, include warranties, and require the supplier to assume liability for IP violations or safety failures.

Final Thoughts

To mitigate these pitfalls, conduct thorough due diligence: audit suppliers, request certifications, test samples, and consult legal experts on IP matters. Partnering with reputable, transparent suppliers—even at a slightly higher cost—protects your business, customers, and brand in the long run.

Logistics & Compliance Guide for Car Glass Wholesale

Overview of the Car Glass Wholesale Industry

The car glass wholesale sector involves the large-scale distribution of automotive glass products—including windshields, side windows, rear windows, and sunroofs—to auto glass repair shops, dealerships, and installers. Efficient logistics and strict compliance are essential due to the fragile nature of the product, safety regulations, and environmental standards.

Product Handling and Packaging Standards

Car glass must be packaged to prevent breakage during transit. Use sturdy corrugated cardboard, edge protectors, and foam padding. Each piece should be individually wrapped and vertically stored in crates or racks. Label packages clearly with “Fragile,” “This Side Up,” and handling instructions. Avoid stacking heavy items on top.

Transportation and Distribution Logistics

Use specialized carriers experienced in handling glass. Opt for enclosed trucks with climate control and secure tie-down systems to minimize vibration and shifting. Route planning should minimize transit time and avoid rough terrain. Partner with logistics providers offering real-time tracking and temperature monitoring when possible.

Inventory Management and Warehousing

Store glass vertically in racking systems with rubber or foam separators to prevent scratching. Maintain a clean, dry, climate-controlled warehouse to prevent moisture damage and condensation. Implement a first-in, first-out (FIFO) inventory system to reduce the risk of long-term storage issues.

Regulatory Compliance: DOT and FMCSA

Adhere to Department of Transportation (DOT) and Federal Motor Carrier Safety Administration (FMCSA) regulations when transporting glass. Ensure all drivers are licensed, vehicles are inspected, and shipping documentation is accurate. Comply with hours-of-service rules and vehicle weight limits.

Safety Standards and Certification (DOT/ANSI/SAE)

All car glass must meet U.S. Department of Transportation (DOT) standards under Federal Motor Vehicle Safety Standard (FMVSS) 205. Verify that products carry the DOT compliance stamp and conform to ANSI/SAE Z26.1 specifications. Maintain certification records for all glass types distributed.

Environmental and Hazardous Materials Compliance

While automotive glass itself is not hazardous, packaging materials (e.g., adhesives, films) may be regulated. Comply with EPA guidelines for waste disposal and recycling. Report and manage any hazardous components according to RCRA standards. Implement recycling programs for cardboard, plastic, and broken glass.

Import/Export Regulations (If Applicable)

For international trade, comply with U.S. Customs and Border Protection (CBP) requirements. Ensure proper Harmonized System (HS) codes (e.g., 7007.11 for laminated glass) and maintain accurate commercial invoices, packing lists, and certificates of origin. Verify that imported glass meets U.S. safety standards.

Data and Documentation Management

Maintain detailed records of shipments, compliance certifications, quality inspections, and customer transactions. Use warehouse management systems (WMS) and transportation management systems (TMS) to streamline data flow. Ensure all documentation is retained for a minimum of five years for audit purposes.

Risk Management and Insurance

Carry comprehensive insurance covering product liability, cargo damage, and general liability. Conduct regular risk assessments of logistics processes. Train staff on emergency procedures for breakage, spills, and accidents during handling or transit.

Quality Assurance and Customer Compliance

Implement a quality control process for incoming and outgoing glass, including visual inspections and dimensional checks. Provide customers with compliance documentation and installation guidelines. Address recalls promptly in coordination with manufacturers and regulatory bodies.

Sustainability and Industry Best Practices

Optimize packaging to reduce waste and promote recyclability. Explore partnerships with eco-friendly carriers and suppliers. Stay updated on industry trends through organizations like the National Glass Association (NGA) and adhere to best practices in sustainable logistics.

In conclusion, sourcing car glass wholesale requires careful consideration of several key factors to ensure quality, reliability, and cost-efficiency. Establishing relationships with reputable suppliers who comply with industry standards—such as ISO and DOT certifications—is essential for delivering safe and durable products. Conducting thorough due diligence on pricing, minimum order quantities, logistics, and customization options helps optimize procurement and supports business scalability. Additionally, staying informed about market trends, technological advancements in automotive glass, and regulatory requirements enables informed decision-making. By focusing on strategic sourcing practices, businesses can achieve a competitive edge, reduce operational costs, and meet customer demands effectively in the evolving automotive aftermarket.