The global automotive belt market is experiencing steady growth, driven by rising vehicle production, increased demand for fuel-efficient components, and the expansion of aftermarket services. According to Grand View Research, the global automotive belts market size was valued at USD 5.67 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 4.3% from 2023 to 2030. This growth is fueled by the growing need for reliable power transmission systems in internal combustion engine (ICE) vehicles, as well as hybrid models where auxiliary components still depend on belt-driven mechanisms. Car fan belts—critical for cooling system performance—remain a key segment within this market. With increasing vehicle parc and stricter durability standards, OEMs and aftermarket suppliers are prioritizing high-quality, long-lasting belt solutions. In this evolving landscape, manufacturers that combine innovation, material science, and global supply chain efficiency are leading the charge. Based on market presence, product reliability, and technological advancement, here are the top 10 car fan belt manufacturers shaping the industry today.

Top 10 Car Fan Belt Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Industrial belt manufacturer

Domain Est. 2001

Website: hutchinsontransmission.com

Key Highlights: Industrial belt manufacturer. Hutchinson, Belt drive manufacturer, develops and manufactures complete industrial power transmission systems incorporating ……

#2 Dayco

Domain Est. 1998

Website: dayco.com

Key Highlights: Dayco, a leading engine products and drive systems supplier for the automotive, industrial and aftermarket industries, is the first to bring timing belt in ……

#3 Mitsuboshi Belting Ltd.

Domain Est. 1998

Website: mitsuboshi.com

Key Highlights: We are a comprehensive manufacturer of rubber and plastics, including transmission belts used in automobiles, precision equipment, agricultural machinery, ……

#4 PIX Power Transmission Belts Manufacturer

Domain Est. 1998

Website: pixtrans.com

Key Highlights: PIX Transmissions Ltd is the world’s leading manufacturer of V belts, Timing belts, poly v belts and pulleys for nearly every application in the automotive,…

#5 V

Domain Est. 1999

Website: web.optibelt.com

Key Highlights: High-quality V-belts and timing belts from the german manufacturer Optibelt. We have been setting standards in drive systems with first-class system ……

#6 MBL (USA) Corporation

Domain Est. 2000

Website: mblusa.com

Key Highlights: As the North American division of Mitsuboshi Belting Ltd., we proudly manufacture and distribute premium power transmission belts….

#7 Power Transmission Solutions

Domain Est. 2018

Website: continental-industry.com

Key Highlights: As an expert in the power transmission technology area, Continental is a global leader offering belt drives custom-tailored to customer requirements….

#8 V

Domain Est. 1994

Website: gates.com

Key Highlights: We’ve designed our V-belts for wear, corrosion, and heat resistance with OE quality fit and construction for reliable, long-lasting performance….

#9 Dayco Aftermarket North America

Domain Est. 2010

Website: na.daycoaftermarket.com

Key Highlights: Dayco’s high-quality belts, front end drive system components, hoses and tools are all designed to enhance vehicle performance and ease of installation….

#10 Continental Aftermarket

Domain Est. 2018

Website: continental-engineparts.com

Key Highlights: Continental V-Belts provide higher heat and abrasion resistance in even the toughest under-hood conditions. The result is greater wear resistance for an ……

Expert Sourcing Insights for Car Fan Belt

H2: 2026 Market Trends for Car Fan Belt

The global car fan belt market in 2026 is poised for a period of transformation, driven by evolving automotive technologies, regulatory pressures, and shifting consumer demands. While traditional serpentine and V-belts remain essential for internal combustion engine (ICE) vehicles, the market landscape is being reshaped by the rise of electric vehicles (EVs) and advanced materials. Here’s a detailed analysis of key trends expected to define the 2026 market:

1. Declining Demand in ICE Vehicles, But ICE Still Dominates

Despite the accelerating shift toward electrification, ICE vehicles will still represent the vast majority of vehicles on the road in 2026, especially in emerging markets. This ensures continued demand for fan belts. However, the growth rate of the fan belt market will be muted due to:

– Slower growth in new ICE vehicle production in developed markets.

– Increasing engine efficiency reducing auxiliary load and, consequently, belt stress.

– Long-term structural decline as EV adoption rises.

2. Rise of Electric Vehicles (EVs) Suppresses Fan Belt Demand

The most significant long-term trend is the impact of EVs:

– No Traditional Fan Belts: Battery electric vehicles (BEVs) do not use internal combustion engines and therefore eliminate the need for engine-driven fan belts.

– Reduced Complexity: While EVs may use auxiliary belts for air conditioning compressors or other accessories, the number and complexity are significantly lower than in ICE vehicles.

– Market Pressure: As EV penetration increases—projected to reach 20–30% of global new car sales by 2026—the overall addressable market for traditional fan belts will contract.

3. Shift Toward High-Performance and Long-Life Belt Materials

To meet demands for durability, efficiency, and reduced maintenance, manufacturers are increasingly adopting advanced materials:

– EPDM (Ethylene Propylene Diene Monomer) and HNBR (Hydrogenated Nitrile Butadiene Rubber): These materials offer superior resistance to heat, oil, and ozone compared to traditional neoprene, extending service life.

– Reinforced Fibers: Use of high-tensile cords (e.g., aramid, polyester) improves strength and reduces elongation.

– Market Impact: Premium and luxury vehicles are leading the adoption, but these materials are expected to trickle down, supporting higher ASPs (average selling prices) despite volume pressures.

4. Increased Focus on Aftermarket and Replacement Demand

With the average age of vehicles on the road increasing globally (especially in North America and Europe), the aftermarket segment will remain a critical revenue stream:

– Fan belts are wear-and-tear items requiring replacement every 60,000–100,000 miles.

– Older ICE vehicles will continue to drive steady aftermarket demand through 2026.

– Growth in independent repair shops and e-commerce platforms will facilitate easier access to replacement belts.

5. Regional Divergence in Market Dynamics

- Asia-Pacific (APAC): Remains the largest market due to high vehicle production (especially China and India) and a large ICE fleet. Demand will be sustained, though EV growth in China may begin to offset gains.

- North America & Europe: Mature markets with strong aftermarket demand. However, stricter emissions regulations and high EV adoption rates will slow ICE-related growth.

- Latin America, Middle East, and Africa (LAMEA): Continued reliance on ICE vehicles supports fan belt demand, with used vehicle imports contributing to aftermarket volumes.

6. Consolidation and Innovation Among Suppliers

Market pressures will drive consolidation among belt manufacturers:

– Tier 1 suppliers (e.g., Gates, Continental, Dayco) will focus on innovation, global reach, and integration with broader engine accessory systems.

– Smaller players may struggle with R&D costs and face margin pressure.

– Increased investment in predictive maintenance technologies and smart belts with embedded sensors may emerge, though widespread adoption is likely post-2026.

7. Sustainability and Recycling Initiatives

Environmental regulations will push for greener manufacturing and end-of-life solutions:

– Development of more recyclable belt materials.

– Reduction in production waste and energy consumption.

– OEMs and suppliers increasingly emphasizing circular economy principles.

Conclusion:

By 2026, the car fan belt market will operate in a state of transition. While robust aftermarket demand and continued ICE vehicle dominance—particularly in emerging economies—will sustain the market, long-term structural decline is inevitable due to electrification. Success will depend on manufacturers’ ability to adapt through material innovation, geographic diversification, and strategic positioning in the high-margin aftermarket. Suppliers must prepare for a future where fan belts become a niche component in an increasingly electric automotive ecosystem.

Common Pitfalls Sourcing Car Fan Belts (Quality, IP)

Poor Quality Materials and Construction

Sourcing low-quality fan belts often leads to premature failure, reduced engine efficiency, and potential damage to other components. Cheap belts may use inferior rubber compounds that degrade quickly under heat and oil exposure, or have weak tensile cords that stretch or snap under load. This results in frequent replacements, increased downtime, and higher long-term costs despite a lower initial price.

Lack of Genuine OEM or Certified Aftermarket Parts

Many suppliers offer counterfeit or non-certified replicas that mimic original equipment manufacturer (OEM) branding but fail to meet required performance standards. These imitation belts may appear identical but lack the engineering precision and material integrity of genuine parts, compromising reliability and safety. Buyers risk receiving products with incorrect dimensions, improper tensioning, or substandard durability.

Intellectual Property (IP) Infringement Risks

Sourcing fan belts from unauthorized or unverified suppliers increases the risk of IP violations. Reputable automotive brands often hold trademarks, patents, and design rights on their belt specifications and branding. Purchasing counterfeit or cloned products—even unknowingly—can expose businesses to legal liability, customs seizures, and reputational damage, particularly in regulated markets.

Inadequate Compliance with Industry Standards

Low-cost suppliers may not adhere to international quality standards such as ISO 9001, SAE, or DIN specifications. Belts that do not meet these benchmarks can fail performance tests, leading to warranty issues and safety hazards. Ensuring compliance documentation and traceability is essential to avoid operational and regulatory risks.

Insufficient Supplier Verification and Traceability

Failing to vet suppliers properly increases exposure to inconsistent quality and IP issues. Without clear manufacturing traceability, audit rights, or quality control processes, buyers cannot verify the authenticity or consistency of the product batch. Establishing long-term relationships with transparent, certified suppliers is critical to mitigating these risks.

Logistics & Compliance Guide for Car Fan Belt

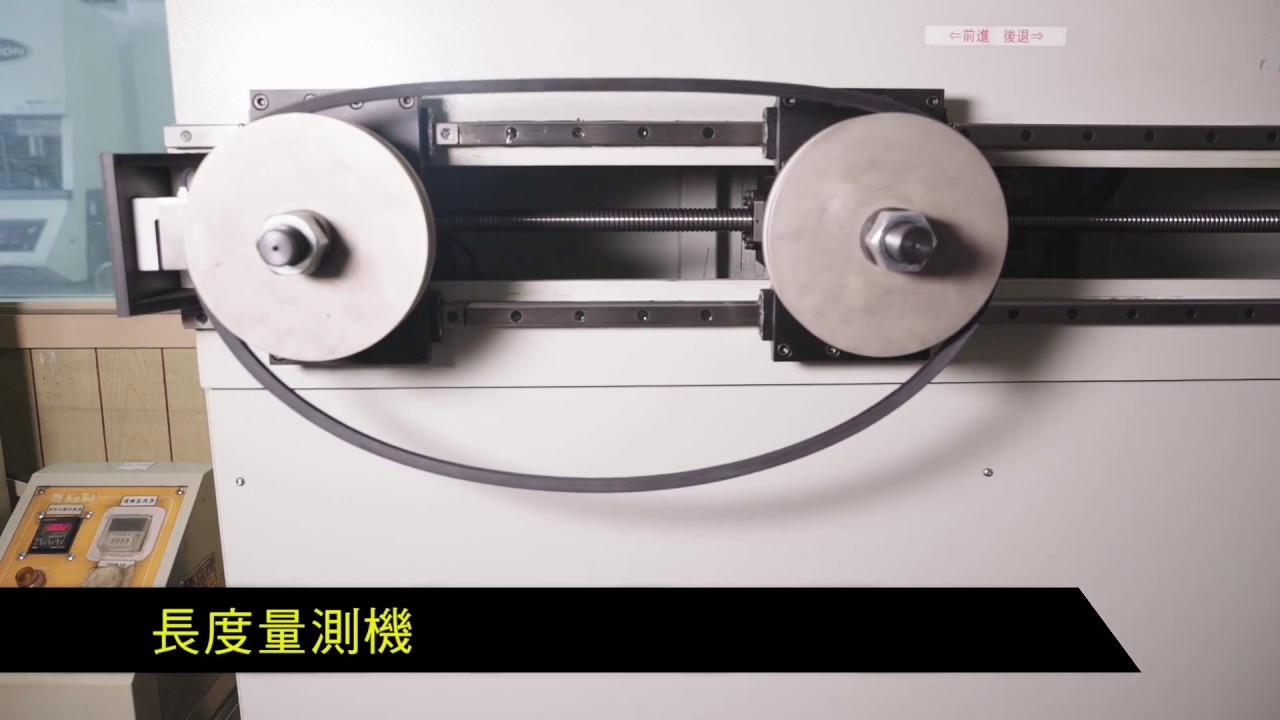

Product Overview

Car fan belts, also known as engine drive belts or V-belts, are essential components in automotive engines that transfer power from the crankshaft to the cooling fan and other accessories such as the alternator and water pump. Ensuring proper logistics handling and regulatory compliance is critical due to the global nature of the automotive supply chain and safety requirements.

Packaging Requirements

Fan belts must be packaged to prevent deformation, exposure to moisture, and contamination. Use sturdy, moisture-resistant packaging such as sealed polyethylene bags inside corrugated cardboard boxes. Label packages clearly with product details (e.g., model number, dimensions, OEM compatibility). Avoid stacking heavy items on top to prevent belt warping during transit.

Storage Conditions

Store fan belts in a cool, dry, and well-ventilated area away from direct sunlight, ozone sources (e.g., electric motors), and extreme temperatures. Ideal storage conditions are between 10°C and 25°C with relative humidity below 65%. Keep belts in their original packaging until ready for use to maintain integrity.

Transportation Guidelines

Use enclosed, temperature-controlled vehicles for long-distance or international shipments. Avoid exposure to rapid temperature fluctuations, which can degrade rubber compounds. Secure loads properly to prevent shifting during transit. For air freight, comply with IATA regulations for non-hazardous goods—fan belts are typically non-regulated but must be declared accurately.

Import/Export Compliance

Ensure compliance with customs regulations in both origin and destination countries. Required documentation typically includes commercial invoices, packing lists, and certificates of origin. Verify whether Harmonized System (HS) code 8708.91 (parts and accessories for engines) applies—confirm local tariff classifications. Some regions may require conformity assessments or technical documentation.

Regulatory Standards

Fan belts must comply with relevant quality and safety standards such as ISO 9001 for manufacturing quality and ISO/TS 16949 (or IATF 16949) for automotive production. In the EU, compliance with REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) is mandatory to ensure restricted substances (e.g., certain phthalates) are not present above threshold levels.

Environmental & Safety Compliance

Adhere to environmental regulations regarding the disposal of packaging materials and end-of-life products. Fan belts may contain rubber and reinforcing fibers that require proper recycling or disposal methods in accordance with local laws (e.g., WEEE or ELV directives in Europe). Provide Safety Data Sheets (SDS) if requested, particularly for bulk industrial shipments.

Labeling & Traceability

Each fan belt or batch should have a unique identifier for traceability, including manufacturing date, batch number, and compliance marks (e.g., CE mark for EU market). Labels must be durable and legible, with multilingual instructions if distributed internationally.

Supplier & Quality Assurance

Source fan belts only from certified suppliers with documented quality control processes. Conduct regular audits and require test reports for key performance metrics such as tensile strength, heat resistance, and elongation. Maintain records for traceability and compliance audits.

Final Recommendations

Proper logistics and compliance management ensures fan belts reach customers in optimal condition while meeting legal and safety requirements. Always stay updated on evolving regulations in target markets and maintain open communication with logistics providers, customs brokers, and regulatory authorities.

Conclusion for Sourcing Car Fan Belt:

In conclusion, sourcing a car fan belt requires careful consideration of several key factors including compatibility with the vehicle make and model, material quality, durability, supplier reliability, and cost-effectiveness. It is essential to prioritize OEM specifications or high-quality aftermarket equivalents to ensure optimal engine performance and longevity. Evaluating suppliers based on certifications, customer reviews, and delivery consistency helps mitigate risks related to counterfeit or substandard products. Additionally, establishing long-term relationships with trusted suppliers can lead to better pricing, inventory availability, and technical support. By implementing a strategic sourcing approach, businesses and maintenance teams can ensure the reliable operation of vehicle cooling systems while minimizing downtime and repair costs.