The global car bumper tape market is experiencing robust growth, driven by rising automotive production, increasing demand for aesthetic customization, and advancements in adhesive technologies. According to a report by Mordor Intelligence, the automotive tapes market—which includes bumper tapes—is projected to grow at a CAGR of over 5.8% from 2023 to 2028. Similarly, Grand View Research valued the global automotive adhesive and sealant market at USD 9.4 billion in 2022, with a projected CAGR of 6.2% through 2030, underscoring the expanding role of specialized tapes in vehicle assembly and trim applications. As both OEMs and aftermarket providers prioritize lightweight materials and seamless design finishes, bumper tape has evolved from a protective film to a critical component in vehicle aesthetics and aerodynamics. This growing demand has propelled innovation among manufacturers, leading to the emergence of high-performance, UV-resistant, and easy-to-apply solutions. In this landscape, eight manufacturers have distinguished themselves through product quality, global reach, and technological advancement—setting the benchmark in the competitive car bumper tape industry.

Top 8 Car Bumper Tape Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Automotive Products and Solutions

Domain Est. 2015

Website: scapaindustrial.com

Key Highlights: Automotive products and solutions for OEMs, converters, and suppliers. Global leader in technical tapes for demanding automotive applications….

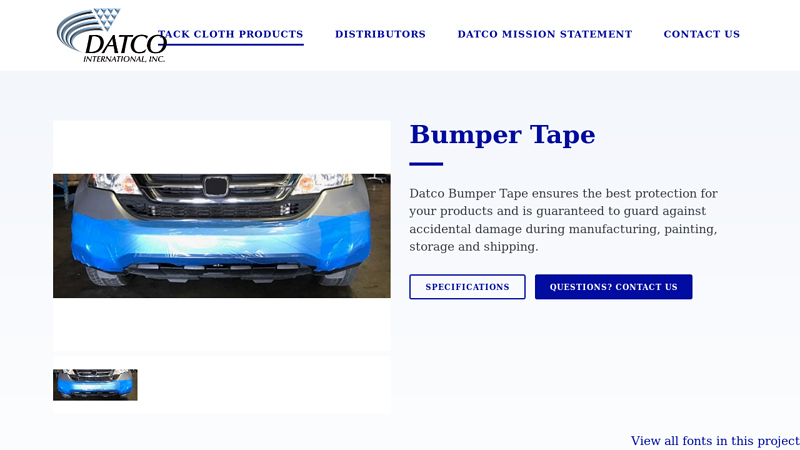

#2 Bumper Tape

Domain Est. 1996

Website: datco.com

Key Highlights: Ensure the best protective for your product with Datco Bumper Tape. Guaranteed to guard against accidental damage during manufacturing, painting & shipping….

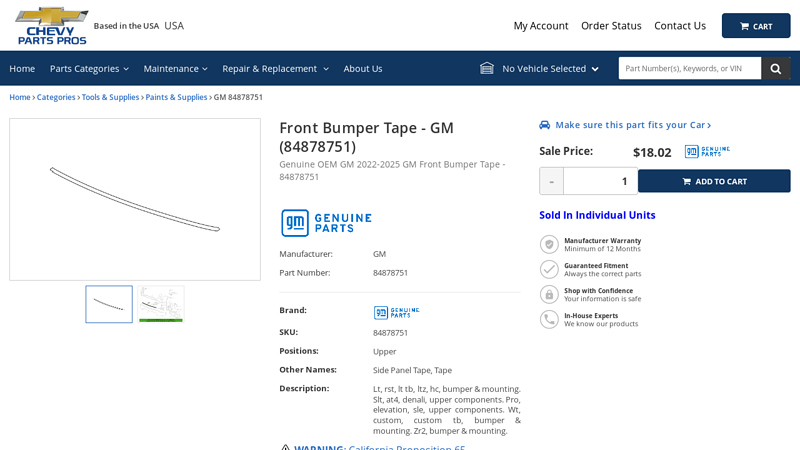

#3 2022

Domain Est. 2022

Website: parts.chevypartspros.com

Key Highlights: In stock 5-day deliveryFront Bumper Tape – GM ( 84878751). Manufacturer: GM. Part Number: 84878751. Guaranteed fit and 12-mo./ Unlimited-Mile Warranty….

#4 3M Tapes for Automotive

Domain Est. 1988

Website: 3m.com

Key Highlights: 3M Tapes for Automotive · Anti-slip & Grip Tapes · Bonding, Mounting & Transfer Tapes · Cloth & Duct Tapes · Electrical Tapes · Filament Tapes · Foam Tapes · Foil ……

#5 Automotive exterior adhesives for a secure attachment

Domain Est. 1997

Website: tesa.com

Key Highlights: Automotive exterior adhesives with various application areas: mounting ✓ seals ✓ glass ✓ mirrors ✓ Discover the right adhesive for your requirements!…

#6 Plastic Repair

Domain Est. 1999

Website: semproducts.com

Key Highlights: Repair Plastic Repair · Backing material perfect for tab repair · Ideal width for holes and larger repairs · Use with all fillers ……

#7 All

Domain Est. 2012

Website: allfitautomotive.com

Key Highlights: Whether you’re looking for wheel protection, bumper defense, or styling upgrades, we have the perfect solutions for you. … Automotive Tape (26 Ft) $179.95 /….

#8 Bumper tapes

Domain Est. 2019

Website: bumper-tec.com

Key Highlights: Protective Bumper-Tape are supplied on a roll with a thick back-side paper, suitable for die-cutting into roll form for automated applications….

Expert Sourcing Insights for Car Bumper Tape

H2: 2026 Market Trends for Car Bumper Tape

The global car bumper tape market is poised for significant transformation by 2026, driven by advancements in automotive design, growing consumer demand for vehicle customization, and the rise of electric and autonomous vehicles. As automakers and aftermarket suppliers adapt to evolving aesthetic and functional requirements, car bumper tape—also known as protective tape, scuff protection tape, or decorative trim tape—has transitioned from a niche accessory to a strategically important component in vehicle aesthetics and protection.

One of the dominant trends shaping the 2026 market is the increasing integration of bumper tape in original equipment manufacturing (OEM) processes. Automotive manufacturers are incorporating high-performance, UV-resistant, and self-adhesive tapes directly into new vehicle production lines to prevent scratches during transport and initial use. This shift reduces warranty claims and enhances customer satisfaction, making bumper tape a cost-effective solution for manufacturers.

Another key driver is the surge in vehicle personalization. Consumers, particularly in North America and Europe, are increasingly using bumper tapes for aesthetic enhancements such as contrast-color trims, brand identification, and sporty styling cues. The aftermarket segment is expanding rapidly, with a proliferation of custom-fit tapes in matte, gloss, carbon fiber, and chrome finishes. Online retail platforms and DIY installation kits are further fueling this trend, making customization accessible to a broader user base.

Technological innovation in materials is also reshaping the market. By 2026, thermoplastic polyurethane (TPU) and polyvinyl chloride (PVC)-based tapes with self-healing properties are expected to dominate. These materials offer superior resistance to abrasion, weathering, and chemical exposure, aligning with the durability demands of modern vehicles. Additionally, eco-friendly and recyclable tapes are gaining traction as sustainability becomes a priority across the automotive supply chain.

The rise of electric vehicles (EVs) presents both challenges and opportunities. EVs often feature smooth, minimalist front and rear fascias where bumper tape can serve both protective and branding roles. Moreover, autonomous vehicles, with their sensor-laden bumpers, require non-interfering, low-profile tapes that do not obstruct radar or camera systems. This has spurred the development of specialized conductive and sensor-compatible tapes.

Regionally, Asia-Pacific is projected to be the fastest-growing market due to expanding automotive production in China, India, and Southeast Asia, coupled with rising middle-class vehicle ownership. Meanwhile, stringent environmental regulations in Europe are pushing manufacturers toward low-VOC adhesives and sustainable production methods.

In summary, the 2026 car bumper tape market will be characterized by increased OEM adoption, aesthetic customization, material innovation, and alignment with electric and autonomous vehicle technologies. Companies that invest in R&D, sustainability, and digital marketing are likely to gain a competitive edge in this dynamic landscape.

Common Pitfalls When Sourcing Car Bumper Tape: Quality and Intellectual Property Risks

Sourcing car bumper tape—used for protective masking during painting or assembly—can seem straightforward, but hidden quality and intellectual property (IP) risks can lead to production delays, rework, reputational damage, and legal liabilities. Being aware of these pitfalls is crucial for procurement and engineering teams.

Poor Adhesive Performance and Substrate Compatibility

One of the most frequent quality issues is selecting a tape that fails under real-world conditions. Low-cost alternatives may use inferior adhesives that either don’t stick properly or leave residue when removed. Additionally, tapes not tested on specific vehicle paint types (e.g., water-based or metallic finishes) can cause surface lifting or staining. Always verify performance under actual application temperatures, humidity, and dwell times.

Inconsistent Tape Dimensions and Backing Material

Inferior manufacturers may have poor quality control, resulting in variations in tape width, thickness, or backing material consistency. This inconsistency can lead to coverage gaps during painting, causing touch-ups or defects. Ensure suppliers provide certified dimensional tolerances and batch traceability.

Lack of Environmental and Regulatory Compliance

Some sourced tapes may not meet regional environmental standards (e.g., REACH, RoHS) or emit volatile organic compounds (VOCs) that compromise paint quality. Non-compliant tapes can result in rejected shipments or regulatory penalties, especially in the EU and North America.

Counterfeit or IP-Infringing Products

A significant risk involves unknowingly sourcing tapes that mimic well-known branded products (e.g., 3M, Tesa) but infringe on trademarks or patented adhesive technologies. Suppliers in certain regions may produce “compatible” tapes that cross into IP violation. Using such products exposes your company to legal action, supply chain disruption, and brand damage.

Absence of Technical Documentation and Testing Data

Reliable suppliers provide detailed technical data sheets (TDS), safety data sheets (SDS), and performance test reports (e.g., adhesion strength, temperature resistance). Sourcing from vendors who cannot supply this documentation increases the risk of unverified performance and accountability gaps.

Overlooking Long-Term Supplier Reliability

Choosing a supplier solely on price without auditing their manufacturing processes or scalability can backfire. Inconsistent inventory, long lead times, or sudden quality drops can disrupt production lines. Always assess supplier stability, certifications (e.g., ISO 9001), and capacity before committing.

By proactively addressing these quality and IP pitfalls, automotive manufacturers and tier suppliers can ensure reliable performance, protect their brand, and maintain compliance throughout their supply chain.

Logistics & Compliance Guide for Car Bumper Tape

Overview

Car bumper tape—commonly used for protection, decoration, or identification on vehicles—must be handled and shipped in compliance with international, national, and carrier-specific regulations. This guide outlines key logistics considerations and compliance requirements to ensure safe, efficient, and legal transportation of car bumper tape across supply chains.

Product Classification & HS Code

Car bumper tape typically falls under the category of automotive accessories or adhesive tapes. Accurate classification is essential for customs clearance and duty assessment.

– Recommended HS Code: 3919.10 (Self-adhesive tapes of plastics, width ≤ 20 cm) or 8708.29 (Other parts and accessories of motor vehicles).

– Verification Tip: Confirm the exact HS code with your local customs authority based on material composition (e.g., PVC, TPU, polyurethane) and adhesive type.

Packaging & Labeling Requirements

Proper packaging ensures product integrity and regulatory compliance during transit.

– Packaging: Use moisture-resistant, durable materials (e.g., shrink-wrapped reels, cardboard boxes). For export, ensure packaging meets ISPM-15 standards if wooden materials are used.

– Labeling: Include product name, batch/lot number, net weight, manufacturer details, country of origin, and compliance marks (e.g., CE, RoHS if applicable).

– Hazard Labels: If the tape contains flammable solvents or restricted substances, classify and label accordingly (e.g., UN 1263 for flammable adhesive).

Transportation Modes

Car bumper tape can be shipped via air, sea, or land, depending on volume, destination, and urgency.

– Air Freight: Suitable for small volumes. Ensure compliance with IATA Dangerous Goods Regulations if applicable. Most bumper tapes are non-hazardous.

– Ocean Freight: Cost-effective for bulk shipments. Use FCL (Full Container Load) or LCL (Less than Container Load) based on volume.

– Ground Transport: Ideal for regional distribution. Follow local road transport regulations (e.g., ADR in Europe).

Customs Documentation

Complete and accurate documentation prevents delays at borders.

– Required Documents:

– Commercial Invoice

– Packing List

– Bill of Lading (B/L) or Air Waybill (AWB)

– Certificate of Origin (for preferential tariffs)

– Import/Export License (if required by destination country)

– Data Accuracy: Clearly describe goods as “Self-adhesive bumper protective tape, non-hazardous, for automotive use” to avoid misclassification.

Regulatory Compliance

Adhere to environmental, safety, and chemical regulations in both origin and destination countries.

– REACH & RoHS (EU): Ensure no restricted substances (e.g., phthalates, lead, cadmium) exceed limits.

– Proposition 65 (California, USA): Disclose if the product contains listed chemicals.

– REACH SVHC: Monitor Substances of Very High Concern; declare if present above 0.1%.

– EPA & DOT (USA): No special restrictions unless tape is classified as hazardous.

Storage Conditions

Maintain product quality during warehousing.

– Environment: Store in a cool, dry place (15–25°C), away from direct sunlight and heat sources.

– Shelf Life: Most adhesive tapes last 12–24 months; rotate stock using FIFO (First In, First Out).

– Handling: Avoid crushing or bending rolls to prevent deformation.

Import Duties & Taxes

Duty rates vary by country and HS code.

– Examples:

– USA: Typically 5.8% under HTSUS 3919.10

– EU: 6.5% under CN 3919 10 90

– FTA Benefits: Leverage free trade agreements (e.g., USMCA, RCEP) if applicable to reduce or eliminate tariffs.

Sustainability & Disposal

Environmental responsibility is increasingly critical.

– Recyclability: Indicate recyclability on packaging (e.g., recyclable plastic film).

– Waste Disposal: Follow local regulations for adhesive waste; do not incinerate if hazardous fumes are produced.

Carrier & Freight Forwarder Selection

Partner with experienced logistics providers familiar with automotive components.

– Criteria:

– Track record in handling adhesive or polymer-based goods

– Customs brokerage expertise

– Global reach and warehousing options

– Compliance with ISO 9001 and ISO 14001 standards

Risk Mitigation

Anticipate and address common logistics risks.

– Supply Chain Delays: Monitor geopolitical issues, port congestion, and weather events.

– Product Damage: Use corner boards and stretch wrap for palletized loads.

– Compliance Audits: Maintain documentation for 5–7 years depending on jurisdiction.

Conclusion

Efficient logistics and strict compliance are vital for the successful distribution of car bumper tape. By adhering to classification rules, packaging standards, and regulatory requirements, businesses can minimize delays, reduce costs, and ensure market access worldwide. Regularly review regulations, especially when entering new markets, and consult with customs experts when in doubt.

In conclusion, sourcing car bumper tape requires a careful evaluation of quality, material specifications, supplier reliability, and cost-effectiveness. It is essential to partner with reputable suppliers who provide durable, weather-resistant, and adhesive-backed tapes that meet industry standards. Conducting thorough due diligence—such as requesting samples, verifying certifications, and assessing lead times—ensures consistent product performance and integration into automotive manufacturing or repair processes. Additionally, considering factors like bulk pricing, minimum order quantities, and logistical capabilities contributes to long-term supply chain efficiency. By prioritizing these elements, businesses can secure a reliable source of bumper tape that enhances vehicle aesthetics, protects against minor impacts, and supports overall customer satisfaction.