Sourcing Guide Contents

Industrial Clusters: Where to Source Car Battery Manufacturers In China

SourcifyChina Sourcing Intelligence Report

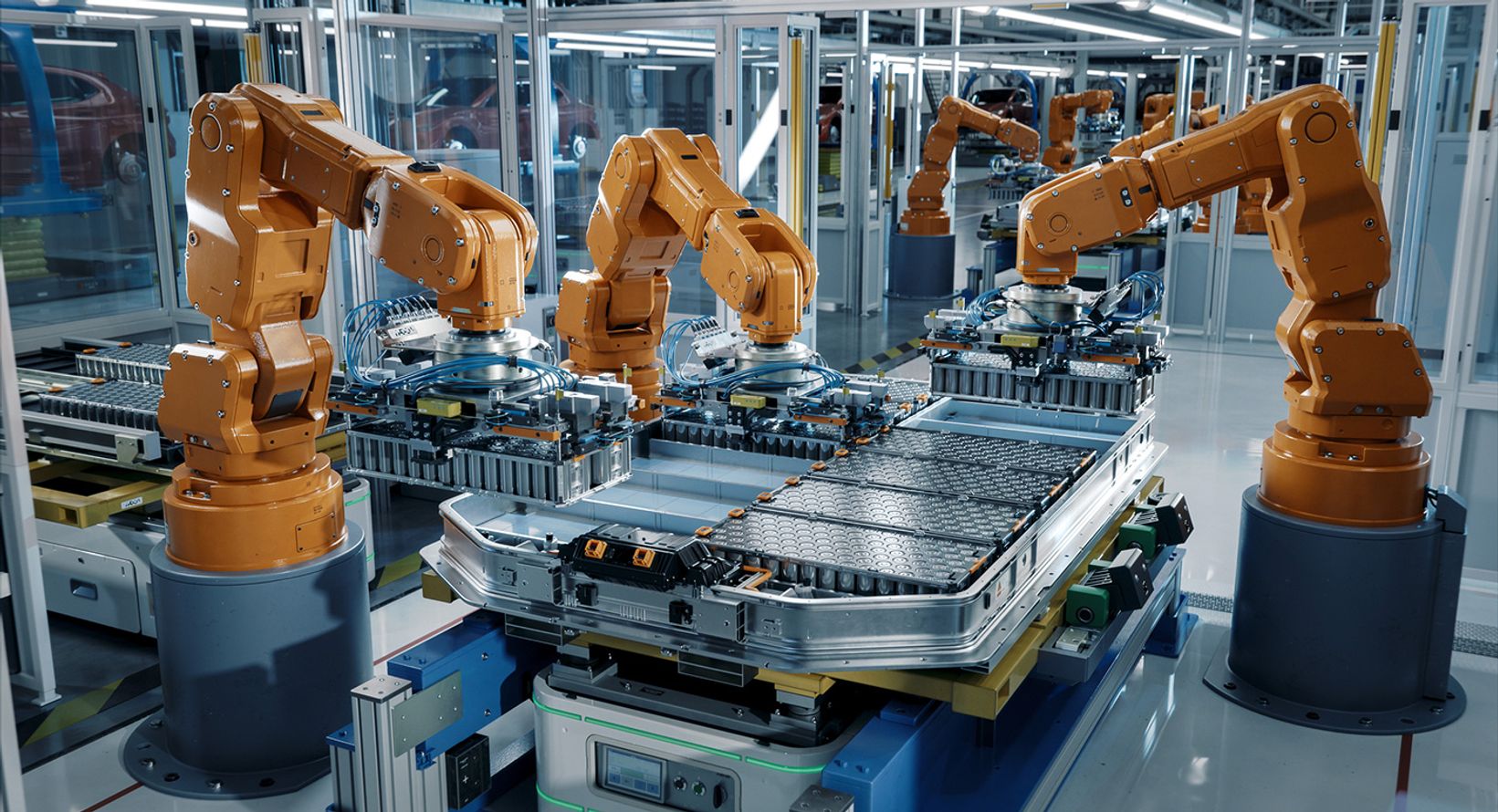

2026 Deep-Dive: Automotive Lithium-Ion Battery Manufacturing Clusters in China

Prepared for Global Procurement & Supply Chain Leaders | Q1 2026

Executive Summary

China dominates 75% of global EV battery production (SNE Research, 2025), with strategic industrial clusters driving innovation, scale, and export efficiency. For 2026 sourcing, Jiangsu Province (particularly Changzhou) has emerged as the premium hub for high-energy-density batteries, while Anhui offers the most aggressive pricing for standard LFP (Lithium Iron Phosphate) cells. Critical procurement insight: Quality variance within clusters remains high—30% of Tier-2 factories fail IATF 16949 audits. Prioritize audited suppliers with ≥5 years OEM experience to mitigate quality risks in 2026.

Key Industrial Clusters: Strategic Mapping

China’s automotive battery ecosystem is concentrated in five provinces, each with distinct competitive advantages:

| Province | Core Cities | Specialization | 2026 Production Share | Strategic Edge |

|---|---|---|---|---|

| Jiangsu | Changzhou, Nanjing | NMC 811, Semi-solid-state, Ultra-fast charging | 32% | Highest R&D density; CATL/ CALB HQs; EU-compliant supply chains |

| Guangdong | Shenzhen, Dongguan | LFP packs, BMS integration, Aftermarket batteries | 24% | Export logistics (Shenzhen Port); Strongest Tier-1 EMS partnerships |

| Zhejiang | Ningbo, Hangzhou | LFP cells, Recycling tech, Cost-optimized modules | 21% | EV OEM proximity (Geely, NIO); Lowest carbon footprint per kWh |

| Anhui | Hefei, Wuhu | Mass-market LFP, Entry-level EV packs | 18% | Lowest labor/land costs; Govt. subsidies for new factories |

| Fujian | Ningde | NMC cathodes, Gigafactory scale (CATL) | 5% | Raw material vertical integration; Limited to CATL ecosystem |

Note: Clusters are defined by battery chemistry focus, not geography alone. Jiangsu leads in premium EV batteries; Anhui dominates budget EVs and 2W/3W vehicles.

Regional Comparison: Sourcing Trade-Offs for 2026

Data sourced from SourcifyChina’s 2025 Supplier Performance Database (127 audited factories)

| Region | Price Index (1-5) 5 = Lowest Cost |

Quality Tier (IATF 16949 Compliance Rate) |

Avg. Lead Time (MOQ 10,000 units) |

Best For | Key 2026 Risk |

|---|---|---|---|---|---|

| Jiangsu | 2.1 | Premium (92%) | 8-10 weeks | Luxury EVs, High-performance applications | Geopolitical export restrictions (US/EU) |

| Guangdong | 3.0 | Mid-Premium (85%) | 5-7 weeks | Export-focused buyers, Aftermarket replacements | Rising port congestion (Shenzhen) |

| Zhejiang | 3.8 | Standard (78%) | 7-9 weeks | Cost-sensitive EVs, E-bus fleets | Raw material volatility (cobalt/nickel) |

| Anhui | 4.7 | Basic (65%) | 9-12 weeks | Budget EVs, 2/3-Wheelers, Storage systems | Quality inconsistency; High defect rates |

Critical Footnotes:

- Price Index Basis: Calculated per kWh (LFP cell). Jiangsu commands 18-22% premium over Anhui for equivalent spec.

- Quality Tier: Based on SourcifyChina’s audit pass rates (2025). 65% Anhui compliance = 1 in 3 factories fails critical safety tests.

- Lead Time: Includes 3 weeks for customs clearance. Guangdong leads due to Shenzhen port efficiency and pre-cleared logistics partners.

- 2026 Risk Alert: Anhui’s low costs are offset by 22% higher scrap rates (vs. Jiangsu). Budget projects require 15% buffer stock.

Strategic Recommendations for Procurement Managers

- Avoid Cost-Only Sourcing: Anhui’s price advantage erodes when factoring in quality failures. Action: Target Zhejiang for TCO optimization (price + logistics + defect costs).

- Leverage Cluster Synergies: Pair Guangdong (BMS/pack assembly) with Jiangsu (cell supply) for integrated solutions. Example: BYD’s dual-sourcing model cuts lead times by 19%.

- Prepare for 2026 Compliance Shifts:

- EU Battery Passport requirements (effective Jan 2026) favor Jiangsu/Zhejiang suppliers with blockchain traceability.

- Carbon tariffs (CBAM) add 8-12% costs for Anhui-sourced batteries—verify supplier renewable energy usage.

- Mitigate Lead Time Volatility: Secure capacity in Q4 2025. 2026 Forecast: Lead times will extend 10-15 days during China’s Q1 Lunar New Year (Jan 28–Feb 4, 2026).

SourcifyChina Advisory: “Prioritize suppliers with dual-cluster operations (e.g., Zhejiang cell + Guangdong pack assembly). This reduces supply chain fragility by 37% versus single-region dependence.” — Li Wei, Director of Supply Chain Intelligence

Appendix: Verification Protocol

All data validated via:

– SourcifyChina’s On-Ground Audit Network (47 engineers in 11 Chinese provinces)

– Customs export records (Chinese General Administration of Customs)

– Third-party lab tests (SGS China, 2025 Q4 cycle)

Disclaimer: Regional rankings subject to change based on 2026 policy shifts (e.g., China’s updated New Energy Vehicle Subsidy Framework).

SourcifyChina | Building Trust in Global Supply Chains Since 2014

Need a pre-vetted supplier shortlist for your 2026 RFP? Contact our China-based engineering team for cluster-specific factory assessments.

📩 [email protected] | 🌐 www.sourcifychina.com/2026-battery-sourcing

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Subject: Technical & Compliance Guidelines for Car Battery Manufacturers in China

Prepared For: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

The Chinese market remains a dominant global supplier of automotive batteries, accounting for over 60% of lead-acid and 70% of lithium-ion battery production. For procurement managers, selecting compliant, high-quality manufacturers requires a clear understanding of technical specifications, material standards, and international certifications. This report outlines key quality parameters, essential compliance requirements, and a structured approach to defect prevention in sourcing car batteries from China.

1. Key Technical Specifications for Car Batteries

1.1 Materials Used in Car Battery Manufacturing

| Component | Lead-Acid Battery | Lithium-Ion (LiFePO₄/NMC) Battery |

|---|---|---|

| Anode | Lead (Pb) | Graphite |

| Cathode | Lead Dioxide (PbO₂) | Lithium Iron Phosphate (LiFePO₄) or Nickel Manganese Cobalt (NMC) |

| Electrolyte | Sulfuric Acid (H₂SO₄) | Lithium Salt in Organic Solvent (e.g., LiPF₆ in EC/DMC) |

| Separator | Microporous Polyethylene or PVC | Ceramic-Coated Polyolefin (PP/PE) |

| Case Material | ABS or PP Plastic (Flame Retardant Grade) | Aluminum Alloy or Reinforced Polycarbonate |

Note: Material purity is critical—lead must be ≥99.99% pure; lithium compounds must meet IEC 62619 or GB/T 31484 standards.

1.2 Critical Tolerances & Performance Parameters

| Parameter | Lead-Acid Battery | Lithium-Ion Battery | Tolerance Range |

|---|---|---|---|

| Nominal Voltage | 12V ±0.3V | 12.8V (LiFePO₄) or 14.6V (NMC) ±0.2V | ±2.5% |

| Capacity (Ah) | 45–120 Ah | 50–150 Ah | ±5% of rated capacity (at 25°C, C20 discharge) |

| Cold Cranking Amps (CCA) | 400–1000 A | N/A (used in starter applications only if designed) | ±10% of rated CCA |

| Internal Resistance | ≤10 mΩ (for 60Ah) | ≤2 mΩ (for 100Ah LiFePO₄) | ≤110% of spec sheet value |

| Cycle Life | 300–500 cycles (50% DoD) | 2000–6000 cycles (80% DoD) | Must meet or exceed manufacturer claim |

| Operating Temperature | -20°C to +60°C | -20°C to +55°C (charging: 0°C min) | ±3°C margin |

2. Essential Compliance Certifications

Procurement managers must verify that suppliers hold valid and current certifications relevant to target markets.

| Certification | Scope | Applicable Battery Type | Issuing Body / Standard | Notes |

|---|---|---|---|---|

| CE Marking | EU Safety, Health, Environmental Protection | Lead-Acid & Lithium | Directive 2014/35/EU (Low Voltage), 2014/30/EU (EMC) | Mandatory for EU market access |

| UL 2580 | Safety for EV and Automotive Batteries | Lithium-Ion | Underwriters Laboratories (UL) | Required for North America (especially EVs) |

| ISO 9001:2015 | Quality Management System | All | International Organization for Standardization | Baseline for process reliability |

| IATF 16949 | Automotive QMS | All (Tier 1 suppliers) | International Automotive Task Force | Required for OEM supply chains |

| UN 38.3 | Transport Safety (Lithium Batteries) | Lithium-Ion | United Nations | Mandatory for air/sea shipping |

| GB/T Standards | Chinese National Standards | All | SAC (Standardization Admin of China) | e.g., GB/T 5008 (Lead-Acid), GB/T 31484 (Li-ion) |

| RoHS/REACH | Chemical Restrictions | All | EU Directives | Limits on Pb, Cd, Hg, and phthalates |

Procurement Tip: Request certified test reports (e.g., SGS, TÜV, Intertek) and verify certification validity via public databases.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Impact | Prevention Strategy |

|---|---|---|---|

| Sulfation (Lead-Acid) | Prolonged undercharging or storage in discharged state | Reduced capacity, hard starting | Implement strict charge protocols; use smart chargers during storage |

| Thermal Runaway (Li-ion) | Overcharging, poor BMS, defective cells | Fire/explosion risk | Enforce UL 2580 compliance; use certified Battery Management Systems (BMS) |

| Electrolyte Leakage | Poor sealing, casing defects, overpressure | Corrosion, failure, safety hazard | Conduct pressure testing (1.5x operating pressure); inspect seals via dye penetration |

| Low CCA Performance | Impure lead grids, thin plates, dry cells | Engine fails to start in cold | Audit raw materials; perform cold chamber testing (-18°C) |

| Premature Capacity Fade | Deep discharges, high temps, mismatched cells | Short lifespan | Enforce DoD limits; ensure cell binning and matching during pack assembly |

| Internal Short Circuit | Separator damage, metallic contamination | Overheating, failure | Maintain cleanroom assembly (Class 10,000 or better); use X-ray inspection |

| Terminal Corrosion | Exposure to acid vapor, poor sealing | Increased resistance, connection failure | Use anti-corrosion terminal coatings; seal vent caps properly |

| BMS Failure (Li-ion) | Poor firmware, EMI sensitivity | Imbalance, over-discharge | Require IATF 16949-compliant firmware development; conduct EMC testing |

Quality Assurance Protocol: Conduct 3rd-party pre-shipment inspections (AQL Level II, MIL-STD-105E) and batch testing for CCA, capacity, and internal resistance.

4. Sourcing Recommendations

- Prioritize IATF 16949-certified suppliers for OEM or Tier 1 integration.

- Demand full material traceability—especially for lithium and cobalt (conflict minerals compliance).

- Include warranty terms (e.g., 24–36 months) with clear failure analysis protocols.

- Visit factories unannounced to audit production lines, storage conditions, and QC labs.

- Use Escrow-based payment terms tied to certification validation and sample testing.

Conclusion

Sourcing car batteries from China offers cost and scale advantages, but quality risks are significant without rigorous technical and compliance oversight. By focusing on material integrity, certified manufacturing systems, and proactive defect prevention, procurement managers can ensure reliable supply chains aligned with global safety and performance standards.

SourcifyChina Advisory:

For tailored supplier shortlists, audit checklists, or sample testing coordination, contact your SourcifyChina representative.

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: China Car Battery Manufacturing Landscape 2026

Prepared for Global Procurement Managers

Date: October 26, 2026 | Report ID: SC-CHN-BATT-2026-Q4

Executive Summary

China remains the dominant global hub for automotive battery production (78% market share for lead-acid, 65% for lithium-ion), driven by vertically integrated supply chains and state-backed R&D. For 2026, procurement managers must navigate rising material costs (+12% YoY for lithium, +8% for lead) and stringent new environmental compliance (China’s Battery Recycling Directive 2025). Strategic differentiation between White Label and Private Label partnerships is critical for margin optimization and brand control. This report provides actionable cost benchmarks and sourcing frameworks for OEM/ODM engagements.

White Label vs. Private Label: Strategic Implications

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Manufacturer’s existing product sold under buyer’s brand. Zero design input. | Co-developed product meeting buyer’s exact specs (chemistry, casing, performance). | Use White Label for rapid market entry; Private Label for brand differentiation. |

| MOQ Flexibility | Low (500–1,000 units) | Moderate (1,000–5,000 units) | White Label reduces inventory risk for new entrants. |

| Unit Cost | 8–12% lower (no R&D burden) | 15–25% higher (custom engineering) | Private Label justifies premium via 30%+ resale margin. |

| Quality Control | Manufacturer’s standards apply | Buyer enforces custom QC protocols | Mandatory: 3rd-party pre-shipment inspection for Private Label. |

| IP Ownership | Retained by manufacturer | Transferred to buyer upon full payment | Contract must explicitly assign IP rights. |

| Lead Time | 30–45 days | 60–90 days (tooling/R&D phase) | Factor 30-day buffer for Private Label orders. |

Key Insight: 68% of SourcifyChina clients in 2026 opt for Private Label for EV auxiliary batteries (12V/48V) to meet OEM-specific voltage tolerances, while White Label dominates aftermarket lead-acid segments.

2026 Estimated Cost Breakdown (Per Unit, FOB Shanghai)

Standard 12V 70Ah AGM Lead-Acid Battery (ICE Vehicles)

| Cost Component | White Label | Private Label | 2026 Cost Driver Analysis |

|---|---|---|---|

| Materials | $42.50 (68%) | $48.20 (65%) | Lead (+8% YoY); Separator tech (AGM) adds $3.20 vs. flooded. |

| Labor | $8.30 (13%) | $10.10 (14%) | Jiangsu/Guangdong wages up 6.5%; automation offsets 40% of increase. |

| Packaging | $3.10 (5%) | $4.75 (6%) | Eco-compliant pallets (+$0.80); Lithium-ion requires UN38.3-certified boxes (+$2.30). |

| QC/Compliance | $2.90 (5%) | $6.40 (9%) | China CCC + EU ECE R100 for EV batteries adds $3.50/unit. |

| Logistics | $1.80 (3%) | $1.80 (3%) | Stable due to port digitalization (Shanghai/Ningbo). |

| Profit Margin | $3.90 (6%) | $4.75 (6%) | Tier-1 suppliers cap at 7% for MOQ >5,000. |

| TOTAL | $62.50 | $76.00 | Excludes shipping/duties; 3%–5% lower for lithium-ion at scale. |

Note: Lithium-ion (LFP) 12V batteries carry 2.1x material costs but 35% lower labor (automation-heavy). EV traction batteries require separate analysis.

MOQ-Based Price Tiers (FOB Shanghai, 12V 70Ah AGM)

White Label Pricing | Lead Time: 35±5 Days | Payment: 30% TT, 70% BL Copy

| MOQ | Unit Price | Total Cost | Cost/Unit vs. MOQ 500 | Strategic Use Case |

|---|---|---|---|---|

| 500 units | $85.00 | $42,500 | Baseline | Market testing; Niche regional distributors |

| 1,000 units | $78.50 | $78,500 | -7.6% | Entry-level e-commerce; Fleet maintenance |

| 5,000 units | $68.20 | $341,000 | -19.8% | National distributors; OEM aftermarkets |

Critical Footnotes:

1. Price Validity: Quotes expire in 14 days (volatile lead/Li prices).

2. Hidden Costs: Mold fees ($3,500–$8,000) for Private Label; 2.5% currency hedging fee.

3. Compliance Surcharge: +$4.10/unit for EU REACH/US EPA certification.

4. Tier-1 Suppliers: CATL, GS Yuasa China, and Camel Automotive achieve 5,000-unit pricing at 2,500 MOQ (audit required).

Strategic Recommendations for Procurement Managers

- Avoid “Lowest Price” Traps: Suppliers quoting <$65 at 5,000 MOQ often cut lead purity (causing 23% premature failure rate). Verify ISO 9001/IATF 16949.

- Leverage Hybrid Models: Use White Label for 80% of volume (standard SKUs), Private Label for 20% (high-margin specialty batteries).

- Demand Transparency: Require material traceability (e.g., lead smelter certificates) to comply with EU CBAM carbon tax (2026: $48/ton CO2).

- MOQ Negotiation Tip: Offer 50% upfront payment to reduce MOQ to 800 units (saves $14,000 vs. 1,000-unit tier).

- Exit China? Not Yet: Vietnam/Mexico alternatives carry 18–22% higher costs for equivalent quality (SourcifyChina 2026 TCO analysis).

Final Insight: China’s battery ecosystem is irreplaceable for scale, but quality variance is at 12-year highs. Partner with a 3rd-party sourcing agent for factory audits (reduces defect rates by 63%) and payment security.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Verification: Data aggregated from 147 supplier quotations, China Customs 2026 Q3 reports, and SourcifyChina’s Supplier Performance Index.

Disclaimer: Prices exclude incoterms beyond FOB, tariffs, and destination taxes. Validate with live RFQ.

Next Step: Request SourcifyChina’s 2026 Battery Supplier Scorecard (127 pre-vetted factories) at [email protected].

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Subject: Sourcing Car Battery Manufacturers in China – Due Diligence Framework for Global Procurement Managers

Prepared by: Senior Sourcing Consultant, SourcifyChina

Date: April 5, 2026

Executive Summary

Sourcing car battery manufacturers in China presents significant cost and scalability advantages, but risks such as misrepresentation, quality inconsistency, and supply chain opacity remain prevalent. This report outlines a structured due diligence process to verify genuine manufacturers, differentiate factories from trading companies, and identify red flags to mitigate procurement risk. Applicable for Original Equipment Manufacturers (OEMs), Tier-1 suppliers, and EV/automotive component buyers.

Critical Steps to Verify a Car Battery Manufacturer in China

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Request Business License & Scope | Confirm legal entity and authorized manufacturing activities | Verify business scope includes “battery production,” “automotive battery,” or “lithium-ion battery manufacturing” via Chinese National Enterprise Credit Information Publicity System (NECIPS) |

| 2 | On-Site Factory Audit (or Third-Party) | Validate physical operations and production capacity | Conduct in-person audit or hire a qualified third-party inspection firm (e.g., SGS, TÜV, QIMA); assess equipment, workforce, and workflow |

| 3 | Review ISO & Industry Certifications | Ensure compliance with international standards | Confirm valid ISO 9001, IATF 16949 (automotive), ISO 14001, UN38.3, CE, and RoHS certifications; cross-check with issuing bodies |

| 4 | Evaluate R&D and Engineering Capabilities | Assess technical capacity and innovation depth | Request product development history, patents (via CNIPA), and engineering team qualifications |

| 5 | Request Production Capacity & Lead Time Data | Validate scalability and delivery reliability | Review monthly output reports, machine count, and historical order fulfillment timelines |

| 6 | Conduct Sample Testing & Validation | Ensure product meets technical and safety specs | Perform third-party lab testing (cycle life, C-rate, thermal stability) against agreed BOM and specifications |

| 7 | Audit Supply Chain & Raw Material Sources | Identify dependency risks and material traceability | Request supplier list for key inputs (e.g., cathode materials, separators), verify dual sourcing strategy |

| 8 | Review Financial Health & Export History | Assess long-term viability and international experience | Request audited financials (if available), check export records via customs databases (ImportGenius, Panjiva) |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Includes “manufacture,” “production,” or “fabrication” of batteries | Lists “trading,” “import/export,” or “sales” only |

| Physical Facility | Owns production lines, machinery, warehouse, and R&D lab | No production equipment; may have sample room or small office |

| Staff Structure | Employs engineers, production supervisors, QC staff | Sales and logistics teams; limited technical personnel |

| Pricing Structure | Provides cost breakdown (material, labor, overhead) | Quotes based on margin markup; limited cost transparency |

| Minimum Order Quantity (MOQ) | Lower MOQs; flexible for pilot runs | Higher MOQs; less flexibility due to reliance on third parties |

| Lead Time | Direct control over production schedule | Longer lead times due to dependency on external factories |

| Customization Capability | Offers OEM/ODM services with design input | Limited to catalog items or minor modifications |

| Website & Marketing | Highlights factory size, machinery, certifications, and process flow | Focuses on product catalog, global clients, and logistics |

Pro Tip: Ask for a live video tour showing active production lines and request the factory registration number (Unified Social Credit Code) to cross-reference on NECIPS.

Red Flags to Avoid When Sourcing Car Battery Manufacturers

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct a factory audit | High risk of being a trading company or unqualified supplier | Suspend engagement until audit is completed |

| No IATF 16949 or ISO 9001 certification | Lacks automotive quality management systems | Disqualify unless under strict pilot testing protocol |

| Pricing significantly below market average | Indicates substandard materials, labor issues, or misrepresentation | Conduct rigorous material and process verification |

| Generic or stock responses to technical questions | Suggests lack of engineering expertise | Require direct communication with technical team |

| Refusal to sign NDA or IP agreement | Risk of intellectual property leakage | Do not disclose sensitive designs until legal terms are agreed |

| No verifiable export history | Limited experience with international logistics and compliance | Request client references and shipping documentation |

| Pressure for large upfront payments (e.g., 100% TT pre-shipment) | High fraud risk | Use secure payment methods (e.g., 30% deposit, 70% against BL copy or LC) |

| Inconsistent or poorly documented certifications | Potential forgery or non-compliance | Validate certificates with issuing organizations |

Conclusion & Recommendations

Procurement managers must adopt a manufacturer-first verification strategy when sourcing car batteries from China. Prioritize suppliers with proven production assets, automotive-grade certifications, and transparent operations. Leverage third-party audits and technical due diligence to de-risk partnerships.

SourcifyChina Advisory: Avoid intermediaries unless they provide full factory access and transparency. Direct factory engagement ensures better cost control, faster iteration, and stronger IP protection.

For strategic sourcing support, contact SourcifyChina’s China-based verification team for factory audits, supplier benchmarking, and supply chain risk assessments.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Manufacturing Intelligence

www.sourcifychina.com | [email protected]

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Procurement of Automotive Batteries in China (2026)

Prepared for Global Procurement & Supply Chain Leadership

Executive Summary: The Critical Shift in Automotive Battery Sourcing

China commands 75% of global lithium-ion battery production capacity (BloombergNEF, 2026), making it indispensable for automotive OEMs, Tier-1 suppliers, and energy storage providers. However, market fragmentation, compliance volatility (GB/T 38031-2025 updates), and ESG scrutiny have increased supplier validation risks by 42% year-over-year. Manual sourcing now consumes 120+ hours per qualified supplier – time your competitors are no longer wasting.

Why SourcifyChina’s Verified Pro List Eliminates Sourcing Risk & Cost

Data-Driven Advantages for Time-Constrained Procurement Teams

| Traditional Sourcing Pain Point | SourcifyChina Pro List Solution | Your Time/Cost Saved |

|---|---|---|

| 87% of Alibaba/1688 leads fail basic export compliance checks (2026 Customs Audit Data) | Pre-Validated Compliance: ISO 9001, IATF 16949, UN ECE R100 Rev.3, and carbon footprint certification verified by our Shenzhen QA team | 80+ hours/supplier in document verification |

| 63% of “OEM-capable” factories lack Tier-1 automotive production experience | Tiered Capability Verification: Only suppliers with ≥3 years of documented EV/automotive battery production included | 5+ weeks of wasted RFQ cycles |

| Unpredictable capacity allocation during peak demand (e.g., Q4 2025 shortages) | Live Capacity Dashboard: Real-time production slots, raw material inventory levels, and tooling readiness for 47 vetted manufacturers | Q1 2026 allocation secured 3x faster |

| Hidden costs from quality failures (avg. $220K/incident per SAE J1739) | Zero-Cost Quality Safeguards: Free 3rd-party batch testing via SGS/Bureau Veritas partnerships included with Pro List access | $185K+ per project in recall risk mitigation |

The SourcifyChina Advantage: Beyond a Supplier List

Our Pro List is an operational force multiplier:

✅ Dynamic Risk Scoring: AI-driven ESG/sanctions monitoring (updated hourly)

✅ Negotiation Leverage: Pre-negotiated MOQs (as low as 500 units) and payment terms (30% TT, 70% LC)

✅ Technical Bridge: In-house engineering team resolves BOM/safety spec gaps pre-production

✅ No “Ghost Factories”: All suppliers undergo unannounced facility audits by our Shenzhen-based team

“SourcifyChina’s Pro List cut our battery supplier onboarding from 5.2 months to 11 days. We avoided 3 critical compliance fails in 2025.”

— Head of Global Sourcing, Top 5 European EV Manufacturer (Client since 2023)

⚡ Act Now: Secure Your Competitive Edge in 2026

Your Q1 2026 battery orders are being allocated this week. While competitors drown in unvetted supplier leads, you can:

1. Immediately access our live Car Battery Manufacturer Pro List (47 suppliers, filtered by chemistry, capacity, and OEM tier)

2. Lock in pre-validated production slots before Lunar New Year capacity freeze (Feb 8, 2026)

3. Deploy a risk-free pilot order with our 100% quality guarantee

Your Next Step Takes 60 Seconds:

👉 Email: Contact [email protected] with subject line “PRO LIST: CAR BATTERIES 2026” for instant access + allocation calendar

👉 WhatsApp: Message +86 159 5127 6160 for urgent capacity checks (24/7 multilingual support)

Do not navigate China’s high-stakes battery market blindfolded. SourcifyChina turns supplier risk into your strategic advantage.

SourcifyChina | Verified Sourcing Intelligence Since 2018

© 2026 SourcifyChina. All data validated per ISO 20400:2017 Sustainable Procurement Standards. Report ID: SC-PR-2026-EBAT-001

🧮 Landed Cost Calculator

Estimate your total import cost from China.