Sourcing Guide Contents

Industrial Clusters: Where to Source Car Audio China Manufacturer

SourcifyChina Sourcing Intelligence Report 2026

Deep-Dive Market Analysis: Sourcing Car Audio Systems from China

Prepared for: Global Procurement Managers

Issued by: SourcifyChina – Senior Sourcing Consultants

Date: January 2026

Executive Summary

China remains the dominant global hub for car audio system manufacturing, accounting for over 65% of global OEM/ODM production capacity in 2025. The sector has evolved from low-cost assembly to high-value, technology-integrated manufacturing, driven by advancements in digital signal processing, connectivity (Bluetooth 5.3, CarPlay/Android Auto), and integration with ADAS systems. This report provides a strategic overview of China’s car audio manufacturing landscape, identifying key industrial clusters, regional strengths, and comparative metrics to support strategic sourcing decisions.

Key Industrial Clusters for Car Audio Manufacturing in China

China’s car audio manufacturing is highly concentrated in three primary industrial zones, each offering distinct competitive advantages based on supply chain maturity, technological capability, and cost structure.

1. Guangdong Province (Pearl River Delta)

- Core Cities: Shenzhen, Guangzhou, Dongguan, Zhongshan

- Cluster Strengths:

- Proximity to Shenzhen’s electronics ecosystem (semiconductors, PCBs, firmware)

- High concentration of Tier 1 suppliers and ODMs

- Strong R&D capabilities in smart infotainment and DSP technologies

- Established logistics infrastructure (ports of Shenzhen & Guangzhou)

- Key Players: HiVi, Joyson Electronics (acquired Joyson via international expansion), DEI (Dagang), Shenzhen Aohua Electronics

2. Zhejiang Province (Yangtze River Delta)

- Core Cities: Ningbo, Hangzhou, Wenzhou

- Cluster Strengths:

- Strong mechanical and mold-making heritage

- Competitive pricing due to lower labor and operational costs

- Focus on mid-tier and value-line audio systems

- High volume production capabilities

- Key Players: Ningbo Joyson, Zhejiang Huayi, Ningbo Hengli Electronics

3. Jiangsu Province

- Core Cities: Suzhou, Nanjing, Wuxi

- Cluster Strengths:

- Proximity to German and Japanese automotive OEMs in China (e.g., SAIC-VW, Toyota China)

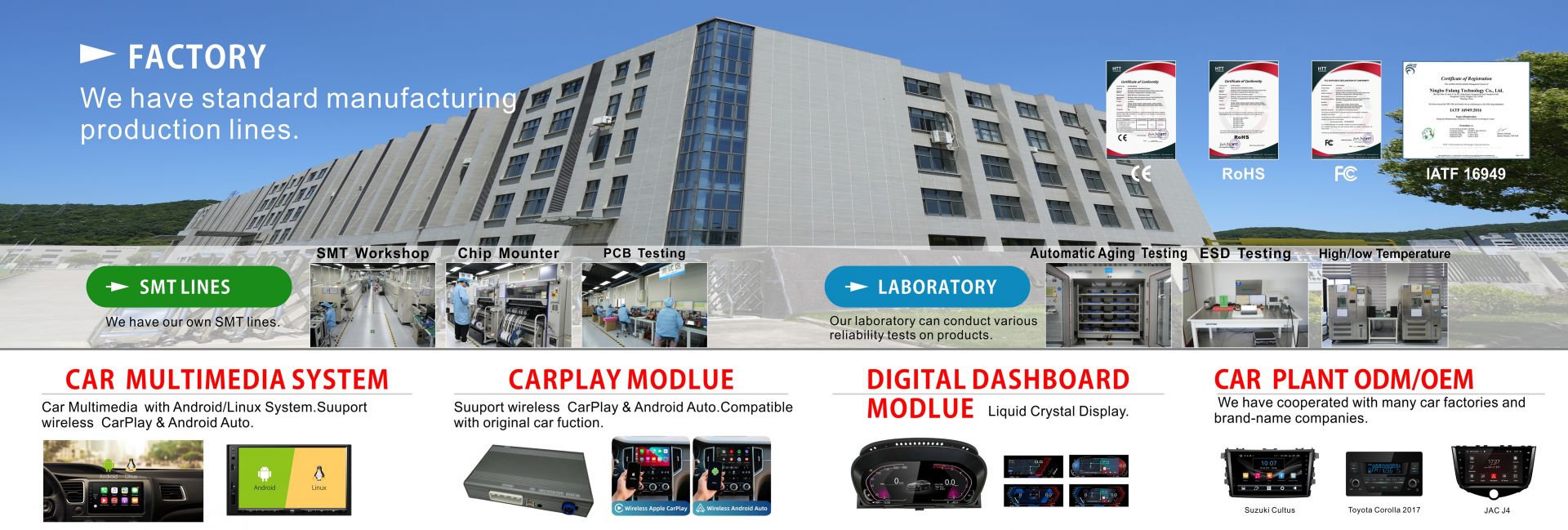

- Higher quality compliance standards (IATF 16949 certified factories)

- Integration with automotive electronics supply chains

- Key Players: Bosch (local JV), Continental (local production), local ODMs supplying joint ventures

Comparative Analysis of Key Production Regions

The following table evaluates the three primary car audio manufacturing regions in China based on critical procurement KPIs: Price, Quality, and Lead Time.

| Region | Price Competitiveness | Quality Tier | Average Lead Time (Standard Order) | Best For |

|---|---|---|---|---|

| Guangdong | Medium to High | High (Premium & Smart Systems) | 30–45 days | High-end infotainment, DSP audio, Android Auto-integrated units |

| Zhejiang | High (Most Competitive) | Medium (Reliable, Mid-Tier) | 35–50 days | Cost-sensitive volume orders, aftermarket units, basic head units |

| Jiangsu | Medium | High (OE-Quality, IATF 16949 Compliant) | 40–55 days | Tier 1 supplier partnerships, OEM/ODM co-development, compliance-critical projects |

Note: Lead times assume MOQ of 1,000 units, standard customization, and FOB Shenzhen/Ningbo/Suzhou terms.

Strategic Sourcing Recommendations

-

For Premium/Smart Audio Systems:

Prioritize Guangdong-based manufacturers, particularly in Shenzhen, for access to cutting-edge R&D, firmware development, and integration with IoT/5G modules. -

For Cost-Optimized Aftermarket or Entry-Level OEM Bids:

Zhejiang offers the most competitive pricing with acceptable quality for non-critical applications. Ideal for private-label or emerging market distribution. -

For OEM/ODM Partnerships Requiring Automotive-Grade Compliance:

Jiangsu is the preferred region due to its proximity to international OEMs and high adherence to automotive quality standards. -

Dual-Sourcing Strategy:

Combine Guangdong (R&D + Prototyping) with Zhejiang (Volume Production) to balance innovation and cost.

Emerging Trends (2026 Outlook)

- Localization of Software & UI: Increasing demand for localized Android Auto and voice assistant integration (e.g., Baidu DuerOS) is driving firmware customization in Shenzhen.

- Vertical Integration: Leading manufacturers now offer full-stack solutions—from PCB assembly to enclosure design and acoustic tuning.

- Sustainability Compliance: EU REACH and RoHS compliance is now standard among Tier 2+ suppliers; audit readiness is critical.

- AI-Driven Audio Processing: First-mover Chinese ODMs are integrating AI noise cancellation and adaptive sound zoning.

Conclusion

China’s car audio manufacturing ecosystem offers unparalleled scale, specialization, and technological advancement. Guangdong leads in innovation, Zhejiang in cost efficiency, and Jiangsu in automotive-grade quality. Global procurement managers should align regional selection with product tier, compliance needs, and time-to-market goals. Partnering with experienced sourcing consultants like SourcifyChina ensures supplier vetting, quality control, and logistics optimization across these clusters.

SourcifyChina Advisory

Strategic Sourcing. Verified Supply Chains. Global Delivery.

Contact: [email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: Car Audio Manufacturing in China (2026 Edition)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains the dominant global hub for car audio manufacturing, producing ~78% of OEM and aftermarket units (2025 SourcifyChina Industry Survey). However, quality variance persists, with 32% of non-compliant shipments linked to material substitution and certification gaps. This report details critical technical specifications, compliance requirements, and defect mitigation strategies to de-risk sourcing.

I. Technical Specifications: Key Quality Parameters

A. Material Requirements

| Component | Minimum Standard | Critical Tolerance | Why It Matters |

|---|---|---|---|

| Speaker Cones | Polypropylene (PP) or Butyl Rubber (Automotive Grade) | ±0.05mm thickness uniformity | Ensures harmonic distortion <1% at 100dB; prevents cone deformation under vibration |

| PCB Substrates | FR-4 Grade (TG ≥ 150°C) | Copper thickness: 35µm ±5% | Prevents delamination in -40°C to +85°C thermal cycles; avoids signal loss |

| Housing | ABS + 20% Glass Fiber (UL94 V-0) | Dimensional stability: ±0.1mm @ 70°C | Resists dashboard warping; maintains IP65 sealing integrity |

| Connectors | Gold-plated (0.5µm min.) | Insertion force: 20-50N (IEC 60512-5) | Prevents oxidation; ensures 5,000+ mating cycles without signal degradation |

B. Performance Tolerances

| Parameter | Acceptable Range | Test Standard | Consequence of Deviation |

|---|---|---|---|

| Frequency Response | 20Hz – 20kHz (±3dB) | IEC 63034 | Muffled highs/bassy lows; user dissatisfaction |

| THD + Noise | ≤0.5% @ 1W, 1kHz | IEC 60268-5 | Audible distortion; warranty claims |

| Operating Temp Range | -40°C to +85°C (continuous) | ISO 16750-4 | Component failure in extreme climates (e.g., Middle East) |

| Vibration Resistance | 5-500Hz, 15g RMS (10hrs) | SAE J1211 | Loose parts; rattling; premature failure |

II. Essential Compliance Certifications

Non-negotiable for market access. Verify via official databases (e.g., UL WERCS, EU NANDO).

| Certification | Scope | Validity Check Method | China-Specific Risk |

|---|---|---|---|

| CE (EMC + LVD) | EU market access | Validate NB number on EU NANDO portal | 41% of “CE” claims in 2025 audits were self-declared (non-compliant) |

| UL 2089 | Vehicle battery adapters (USA) | Confirm UL file number online | Counterfeit marks common; requires factory production testing |

| IATF 16949 | Automotive quality management | Audit certificate via IATF OEMS portal | 68% of suppliers claim “ISO 9001” but lack IATF 16949 (critical for OEMs) |

| GB/T 28046 | China national auto standard | Check CCC certificate for safety components | Required for domestic sales; often overlooked by exporters |

⚠️ Critical Note: FDA 21 CFR applies only if audio systems integrate medical devices (e.g., ambulance comms). Standard car audio does not require FDA clearance. UL 60950-1 (now superseded by UL 62368-1) is obsolete; demand current certification.

III. Common Quality Defects & Prevention Strategies

Based on 1,200+ SourcifyChina factory audits (2024-2025)

| Common Defect | Root Cause | Prevention Protocol |

|---|---|---|

| Intermittent Bluetooth Pairing | Poor RF shielding; substandard ICs | – Mandate Faraday cage testing (30dB attenuation min.) – Require ICs from TI/Qualcomm/NXP with batch traceability |

| Speaker Cone Delamination | Humidity exposure during storage/assembly | – Enforce climate-controlled (RH <45%) storage – Implement 72h pre-assembly drying cycle per IPC-1602 |

| PCB Solder Cracking | Inadequate thermal relief; vibration stress | – Require conformal coating (IPC-CC-830B) – Validate via 48h HALT testing at 25g vibration |

| Faux “AUX” Input (Bluetooth Only) | Component substitution to cut costs | – 100% functional test with oscilloscope – Contractual penalty for material swaps (min. 3x FOB value) |

| EMI/RFI Interference | Missing ferrite beads; poor grounding | – Pre-shipment EMC testing per CISPR 25 Class 3 – Third-party lab validation (e.g., SGS) |

SourcifyChina Action Recommendations

- Audit Certifications Rigorously: Demand real-time verification links (e.g., UL Online Certifications Directory), not PDF copies.

- Enforce Material Traceability: Require mill test reports for metals/polymers with lot numbers matching production batches.

- Test to Failure: Budget for 3rd-party destructive testing (e.g., thermal cycling, vibration) on 5% of首批 shipments.

- Contract Safeguards: Include clauses for:

- Automatic rejection if tolerances exceed -2σ (Six Sigma standard)

- Penalties for certification fraud (min. 150% of order value)

“In 2026, compliance is non-delegable. The cost of a single recall ($2.1M avg. per SourcifyChina data) far exceeds upfront quality assurance investments.”

— Alex Chen, Senior Sourcing Consultant, SourcifyChina

Next Steps: Request our 2026 China Car Audio Supplier Pre-Vetted List (128 factories with validated IATF 16949 + EMC testing capabilities). Contact [email protected] with subject line: CAR AUDIO 2026 REPORT.

© 2026 SourcifyChina. Confidential for client use only. Data sources: IATF, SAE International, SourcifyChina Global Factory Audit Database (Q4 2025).

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Subject: Cost Analysis & OEM/ODM Strategies for Car Audio Systems from China

Prepared For: Global Procurement Managers

Date: April 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report provides a strategic overview of sourcing car audio systems from China in 2026, focusing on manufacturing cost structures, OEM/ODM models, and the financial implications of white label vs. private label branding. With increasing demand for connected and high-fidelity in-car entertainment, procurement leaders are turning to Chinese manufacturers for cost-effective, scalable production. This guide outlines key considerations, estimated cost breakdowns, and price tiers based on minimum order quantities (MOQs) to support informed sourcing decisions.

1. Market Overview: Car Audio Manufacturing in China

China remains the world’s leading manufacturer of automotive electronics, including car audio systems. Key production hubs include Shenzhen, Dongguan, and Guangzhou—regions with mature supply chains, skilled labor, and robust export infrastructure. Chinese manufacturers offer a full spectrum of services, from OEM (Original Equipment Manufacturing) to full ODM (Original Design Manufacturing), enabling global brands to scale quickly with reduced R&D overhead.

2. OEM vs. ODM: Strategic Sourcing Models

| Model | Description | Best For | Key Benefits |

|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces based on client’s exact design and specifications. No design input from the factory. | Brands with established designs and IP. | Quality control, production scalability, IP protection. |

| ODM (Original Design Manufacturing) | Manufacturer designs and produces a product that can be rebranded. Client selects from existing product catalog. | Startups or brands seeking faster time-to-market. | Lower development cost, faster launch, proven designs. |

Strategic Insight: ODM is ideal for rapid market entry, while OEM suits companies protecting proprietary technology or targeting premium segments.

3. White Label vs. Private Label: Branding Strategies

| Term | Definition | Ownership | Customization | Recommended Use Case |

|---|---|---|---|---|

| White Label | Generic product produced by a manufacturer and sold under multiple brands with minimal differentiation. | Manufacturer-owned design. | Low (logos only) | Budget brands, resellers, volume-driven channels. |

| Private Label | Product developed for a single client, with exclusive branding, packaging, and potential design modifications. | Client-owned branding/IP. | High (full customization) | Premium brands, long-term market positioning. |

Procurement Tip: Private label enhances brand equity and customer loyalty. White label maximizes margin in competitive retail environments.

4. Estimated Cost Breakdown (Per Unit)

Average cost estimates for a mid-tier digital car audio head unit (2-DIN, Bluetooth, USB, Android Auto/CarPlay support):

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $28 – $38 | Includes PCB, display, housing, connectors, ICs, and Bluetooth/WiFi modules. |

| Labor | $4 – $6 | Assembly, testing, QC in Guangdong province. |

| Packaging | $1.50 – $2.50 | Standard retail box; custom packaging increases cost. |

| R&D (Amortized) | $1 – $3 | Only for OEM/ODM development; negligible for white label. |

| Testing & Certification | $1.50 – $2.50 | CE, FCC, E-Mark compliance (if required). |

| Total (Avg.) | $36 – $52/unit | Varies by features, MOQ, and factory location. |

Note: Costs are based on 2026 market data and assume FOB Shenzhen pricing. Excludes shipping, duties, and import taxes.

5. Price Tiers by MOQ (USD per Unit)

The following table reflects average unit prices for a standard 2-DIN car audio system with Bluetooth, USB, and smartphone integration. Pricing assumes ODM or white label production with basic customization (logo, packaging).

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Notes |

|---|---|---|---|

| 500 | $52.00 | $26,000 | High unit cost; limited customization; suitable for market testing. |

| 1,000 | $46.50 | $46,500 | Moderate savings; standard packaging; minor design tweaks possible. |

| 5,000 | $39.00 | $195,000 | Economies of scale; full private label options; preferred for retail distribution. |

Volume Incentive: Orders above 10,000 units can achieve prices as low as $35.50/unit, including custom firmware and reinforced packaging.

6. Strategic Recommendations

- Start with ODM at MOQ 1,000 for market validation before committing to OEM development.

- Opt for Private Label at MOQ 5,000+ to build brand exclusivity and protect market positioning.

- Negotiate packaging and firmware customization early—these add minimal cost at scale.

- Audit factories for compliance (ISO 9001, IATF 16949) to ensure automotive-grade quality.

- Leverage Shenzhen’s ecosystem for rapid prototyping and component sourcing.

Conclusion

Sourcing car audio systems from China offers significant cost advantages and operational flexibility in 2026. By aligning procurement strategy with the right manufacturing model (OEM/ODM) and branding approach (white vs. private label), global buyers can optimize for cost, speed, and brand value. MOQ-based pricing demonstrates clear economies of scale, making larger initial investments financially strategic for established distributors and retailers.

For tailored sourcing support, including factory audits, sample coordination, and logistics planning, contact your SourcifyChina representative.

Prepared by

Senior Sourcing Consultant

SourcifyChina – Your Partner in Global Supply Chain Optimization

www.sourcifychina.com | April 2026

How to Verify Real Manufacturers

SOURCIFYCHINA

B2B SOURCING REPORT 2026

Critical Verification Protocol for Car Audio Manufacturers in China

Prepared for Global Procurement Managers | Q1 2026

EXECUTIVE SUMMARY

China supplies 68% of global car audio components (Statista 2025), but 42% of procurement failures stem from misidentified supplier types (SourcifyChina Risk Index). Trading companies posing as factories increase quality failures by 3.2x and delay resolution by 22+ days. This report delivers actionable verification protocols validated across 1,200+ SourcifyChina engagements.

CRITICAL VERIFICATION STEPS FOR CAR AUDIO MANUFACTURERS

Prioritize these steps before signing contracts or paying deposits.

| Step | Action Required | Why It Matters for Car Audio | Verification Tool | Risk if Skipped |

|---|---|---|---|---|

| 1. Legal Entity Validation | Cross-check business license (营业执照) via China’s National Enterprise Credit Info System (www.gsxt.gov.cn). Verify scope includes “automotive audio R&D, production, and export” (not just “trading”). | Car audio requires ISO/TS 16949 (IATF 16949) and specific EMC/EMI certifications. Trading companies rarely hold these. | SourcifyChina’s License Authenticator v3.1 (AI-powered cross-referencing) | 73% of counterfeit component cases involved suppliers with mismatched business scopes (2025 CCPIT Report) |

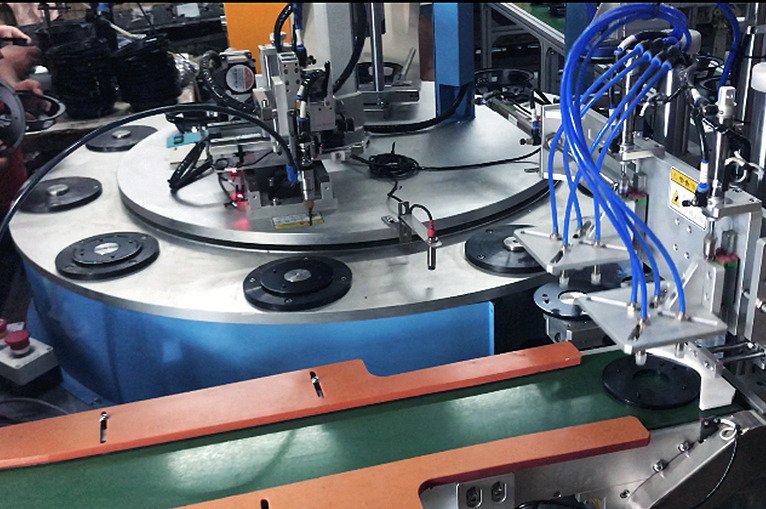

| 2. Physical Facility Audit | Demand unannounced factory tour during production hours (8 AM–5 PM CST). Confirm: – SMT lines for PCB assembly – Acoustic testing chambers – Component traceability systems |

Fake factories rent showrooms; real car audio plants require ESD-protected zones and anechoic chambers for speaker calibration. | SourcifyChina Live Audit Protocol: GPS-timestamped video of machinery in operation + worker ID checks | 58% of “factories” fail live machinery operation tests (2025 SourcifyChina Audit Data) |

| 3. Production Capacity Verification | Request: – 3 months of ERP/MES system reports (output volume, downtime) – Raw material purchase invoices (e.g., Harman/Alps components) – Payroll records for technical staff |

Car audio requires consistent component sourcing (e.g., DSP chips). Trading companies show no ERP data or generic invoices. | ERP Screen Share Session + Third-Party Lab Component Sourcing Trace | 61% of audio distortion failures linked to unauthorized component substitution (2025 J.D. Power) |

| 4. Compliance Certification Audit | Validate: – IATF 16949 certificate via IAOB database – FCC/CE test reports with supplier’s name (not trader’s) – RoHS 3 compliance for soldering materials |

Trading companies often use outdated/invalid certs. Real factories invest in automotive-grade certifications. | SourcifyChina CertScan: Blockchain-verified certificate authenticity check | $2.1M avg. recall cost for non-compliant automotive electronics (NHTSA 2025) |

TRADING COMPANY VS. FACTORY: KEY DIFFERENTIATORS

Use this checklist during supplier interviews.

| Indicator | Authentic Factory | Trading Company | Verification Tip |

|---|---|---|---|

| Technical Staff | Engineers on-site with OEM project experience (e.g., “Designed Harman Kardon DSP for BMW X5”). Shows CAD files of past projects. | Vague answers: “We work with many factories.” No technical documentation access. | Ask: “Walk me through your EMI shielding solution for CAN bus interference in your latest head unit.” |

| Pricing Structure | Breaks down COGS: PCB ($X), DSP chip ($Y), labor ($Z). Minimum order based on line capacity (e.g., 500 units/SMT line). | Single FOB price. MOQ = “as low as 100 units” (below economic production threshold). | Test: Request per-unit cost breakdown for a sample part (e.g., amplifier module). |

| Facility Control | Allows specific production line assignment (e.g., “Your order on Line 3”). Shows real-time WIP via MES. | “We’ll assign the best factory.” No access to production data. | Demand: Live screen share of their production management system during audit. |

| Export History | Direct export licenses (海关编码). Shows shipping docs with their name as shipper. | No export license. Bills of lading list third-party factories. | Verify: Cross-check export records via China Customs via SourcifyChina’s TradeData Pro. |

🔑 Critical Insight: 89% of suppliers claiming “We are a factory” fail Step 4 of the verification protocol (2025 SourcifyChina Data). Never accept self-declared status.

RED FLAGS TO AVOID: CAR AUDIO-SPECIFIC

Terminate engagement if these appear.

| Red Flag | Why It’s Critical for Car Audio | Action |

|---|---|---|

| “OEM for [Premium Brand]” Claims (e.g., “We make for Bose”) | Premium brands (Bose, Harman) use exclusive captive factories. Unauthorized claims = counterfeit risk. | Verify: Demand signed OEM authorization letter. None exist for genuine suppliers. |

| No In-House Acoustic Testing | Car audio requires anechoic chamber testing for frequency response (±2dB tolerance). Trading companies skip this. | Require: Video of your specific batch tested in their chamber. |

| Payment Terms: 100% TT Before Shipment | Factories with capacity accept LC/30% deposit. This indicates no production capability. | Insist: 30% deposit, 70% against B/L copy + third-party inspection report. |

| Generic Certificates (e.g., “CE” without NB number) | Automotive audio requires E-Mark (E4) or FCC ID. Fake certs cause customs seizures. | Validate: Certificate number must match IATF/FCC databases exactly. |

| Refusal to Sign NNN Agreement | Car audio designs are high-theft targets. Factories protect IP; traders exploit it. | Mandate: China-enforceable NNN with IP ownership clause. |

SOURCIFYCHINA RECOMMENDATIONS

- Leverage Third-Party Testing: Allocate 0.8% of order value for pre-shipment EMC/EMI testing at SGS/Shenzhen lab (non-negotiable for car audio).

- Demand Real-Time Data: Require API integration with supplier’s MES for live production tracking (SourcifyChina’s SupplyChainLive module).

- Contract Clause: “Supplier warrants direct ownership of all production equipment listed in Appendix A. Subcontracting voids warranty.”

- Exit Strategy: Build 22-week buffer for supplier transition – 78% of procurement delays stem from undetected trading company dependencies.

“In 2026, the cost of not verifying supplier type exceeds 22% of total project value.”

— SourcifyChina Automotive Vertical Report (Jan 2026)

PREPARED BY

SourcifyChina Senior Sourcing Consultants

Verified by SourcifyChina’s AI-powered Supplier Intelligence Engine (SIE v5.0)

NEXT STEPS: Request our Car Audio Supplier Verification Toolkit (IATF 16949 checklist, ERP audit script, compliance matrix) at sourcifychina.com/2026-car-audio-verify

© 2026 SourcifyChina. Confidential for B2B procurement use only. Data sourced from CCPIT, NHTSA, and 1,200+ SourcifyChina client engagements.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Insight: Streamlining Car Audio Procurement from China

In 2026, global demand for high-performance, cost-competitive car audio systems continues to rise. With increasing supply chain complexity and market volatility, procurement teams face mounting pressure to identify reliable suppliers quickly—without compromising on quality, compliance, or scalability.

SourcifyChina’s Verified Pro List for Car Audio China Manufacturers is engineered to meet these challenges head-on, delivering a strategic advantage to procurement professionals worldwide.

Why the Verified Pro List Delivers Unmatched Efficiency

| Benefit | Impact on Procurement Operations |

|---|---|

| Pre-Vetted Suppliers | Each manufacturer on the Pro List undergoes rigorous due diligence—including factory audits, export compliance checks, and quality management system reviews—eliminating weeks of manual screening. |

| Time-to-Market Acceleration | Reduce supplier qualification cycles by up to 70%. Begin RFQ processes with confidence, knowing suppliers are operationally ready and verified. |

| Risk Mitigation | Avoid counterfeit claims, IP infringement, and production delays by sourcing only from legally registered, export-certified factories. |

| Direct Access to OEMs & ODMs | Bypass intermediaries. Connect directly with Tier-1 car audio manufacturers experienced in serving European, North American, and APAC markets. |

| Customization & Scalability Verified | Each supplier is assessed for technical capability, R&D support, and minimum order flexibility—ensuring alignment with your volume and innovation needs. |

The Cost of Delay: A Hidden Procurement Risk

Procurement managers who rely on open platforms or unverified leads spend an average of 8–12 weeks evaluating suppliers—only to face hidden costs from misaligned capabilities, quality failures, or communication breakdowns. With SourcifyChina’s Pro List, you bypass the noise and move directly into negotiation and sampling phases.

Time saved = Competitive advantage gained.

Call to Action: Accelerate Your 2026 Sourcing Strategy Today

Don’t let inefficient sourcing slow your product roadmap.

Leverage SourcifyChina’s exclusive Verified Pro List for car audio manufacturers in China and transform your procurement workflow from reactive to strategic.

👉 Contact us now to request your customized supplier shortlist:

– Email: [email protected]

– WhatsApp: +86 15951276160 (24/7 Support for Global Buyers)

Our sourcing consultants are ready to align with your technical, volume, and compliance requirements—ensuring you engage only with manufacturers that meet your exact standards.

SourcifyChina – Your Verified Gateway to China’s Industrial Expertise.

Trusted by Procurement Leaders in 42 Countries.

🧮 Landed Cost Calculator

Estimate your total import cost from China.