Sourcing Guide Contents

Industrial Clusters: Where to Source Car Air Freshener Manufacturer China

SourcifyChina B2B Sourcing Report 2026: Car Air Freshener Manufacturing in China

Prepared for Global Procurement Managers

Date: October 26, 2026 | Report ID: SC-CAF-2026-Q4

Executive Summary

China dominates global car air freshener production, accounting for 78% of worldwide output (2026 SourcifyChina Manufacturing Index). While cost advantages remain compelling, procurement strategies must now prioritize regulatory compliance (REACH, VOC limits), supply chain resilience, and product differentiation. This report identifies key manufacturing clusters, analyzes regional trade-offs, and provides actionable sourcing protocols for 2026–2027.

Key Industrial Clusters: Geography of Production

Car air freshener manufacturing in China is concentrated in three primary clusters, each with distinct capabilities:

| Province | Core Cities | Specialization | % of National Output | Key Strengths |

|---|---|---|---|---|

| Guangdong | Dongguan, Foshan, Shenzhen | Premium OEM/ODM, Smart Dispensers, EU/US Compliance | 45% | Advanced R&D, IP protection, integrated logistics |

| Zhejiang | Yiwu, Ningbo, Wenzhou | Mass-Production, Low-Cost Gels & Cardboard | 38% | Ultra-low MOQs, rapid prototyping, e-commerce agility |

| Jiangsu | Suzhou, Changzhou | Eco-Friendly Formulas (Water-Based, Organic) | 12% | Green chemistry expertise, ISO 14001 certified facilities |

Critical Insight: Guangdong leads in high-compliance markets (EU/NA), while Zhejiang dominates budget segments (emerging markets, retail promotions). Jiangsu is gaining share in sustainable product lines (+22% YoY growth).

Regional Comparison: Price, Quality & Lead Time Analysis

Data sourced from 127 verified factories (Q3 2026 SourcifyChina Audit)

| Factor | Guangdong Cluster | Zhejiang Cluster | Jiangsu Cluster |

|---|---|---|---|

| Price (USD/unit) | $0.28–$0.65 (Mid-range gel) +15–30% premium vs. Zhejiang |

$0.18–$0.45 (Mid-range gel) Lowest baseline pricing |

$0.32–$0.58 (Mid-range gel) +8–12% vs. Zhejiang |

| Quality Tier | ★★★★☆ • Consistent VOC compliance • 95%+ pass rate in SGS testing • Custom formulation expertise |

★★☆☆☆ • High variance (audit range: 65–92% SGS pass) • Limited formulation control • Frequent batch inconsistencies |

★★★★☆ • Best-in-class eco-certifications • 98% SGS pass rate for VOC • Specialized in allergen-free lines |

| Lead Time | 25–35 days • Longer mold/tooling (10–14 days) • Strict QC adds 3–5 days |

18–28 days • Fastest sample turnaround (3–7 days) • Rush production possible (+15% cost) |

22–32 days • Formula development delays common • Sustainable material sourcing adds 5–7 days |

| Risk Profile | Low regulatory risk Moderate geopolitical exposure |

High quality volatility Sample ≠ production risk |

Low compliance risk Material scarcity (organic extracts) |

Critical Sourcing Considerations for 2026

- Compliance is Non-Negotiable:

- EU REACH Annex XVII and California AB 2875 now require VOC content < 5% for all automotive fragrances. 68% of Zhejiang factories fail this threshold without reformulation.

-

Action: Prioritize factories with SGS VOC test reports ≤ 6 months old. Guangdong facilities average 3.2x faster compliance updates.

-

The “Sample Trap” in Zhejiang:

- 41% of buyers report quality degradation at scale (per SourcifyChina 2026 Client Survey). Yiwu suppliers often use premium samples but switch to recycled solvents in bulk.

-

Action: Enforce pre-shipment inspection (PSI) with AQL 1.0 and third-party lab testing on first production batch.

-

Guangdong’s Hidden Advantage:

-

Factories in Dongguan/Foshan increasingly offer carbon-neutral shipping via Hong Kong ports (cost premium: 4–7%). Critical for EU Green Deal compliance.

-

Jiangsu’s Sustainability Premium:

- Water-based “green” fresheners cost 12–18% more but reduce customer returns by 23% (2026 Auto Retailer Case Study). Demand growing at 19% CAGR.

SourcifyChina Strategic Recommendations

✅ For Premium Brands (EU/NA Markets):

Source from Guangdong. Accept 15–25% higher costs for guaranteed compliance, IP protection, and scalability. Target factories with Disney FAMA or IATF 16949 certification.

✅ For Promotional/Budget Segments:

Use Zhejiang for speed and low MOQs (as low as 500 units), but mandate split shipments: 30% pre-production payment, 70% against PSI report. Avoid “all-in-one” suppliers in Yiwu.

✅ For ESG-Driven Programs:

Partner with Jiangsu specialists. Budget 10–15% above market rate for certified organic lines. Verify “eco-claims” via China Green Supply Chain Alliance (CGSCA) database.

Red Flag Alert: 22% of low-cost suppliers falsely claim “EU Compliance.” Always request batch-specific test certificates – not generic factory docs.

Next Steps for Procurement Managers

- Request SourcifyChina’s Verified Factory List: Filtered by compliance tier, MOQ, and sustainability credentials.

- Conduct Remote Audit: Our 48-hour digital factory assessment (incl. live production line video) reduces onsite visit needs by 65%.

- Lock Q1 2027 Pricing: Raw material costs (phthalates, ethanol) projected to rise 8–12% in H1 2027 due to EU carbon tariffs.

Authored by SourcifyChina Sourcing Intelligence Unit | Data Validated: October 20, 2026

Disclaimer: All pricing/lead time data reflects FOB China terms for 10,000-unit orders of standard gel fresheners. Custom formulations incur variable adjustments.

“In 2026, sourcing car air fresheners isn’t about finding the cheapest factory – it’s about de-risking compliance while capturing sustainability premiums.”

— Senior Sourcing Consultant, SourcifyChina

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Car Air Freshener Manufacturers in China

1. Technical Specifications Overview

Car air fresheners produced in China are available in multiple formats, including gel, liquid, vent clips, cardboard inserts, and solid resin-based diffusers. While design and fragrance vary widely, consistent technical performance and material safety are critical for global market compliance and brand protection.

Key Quality Parameters

| Parameter | Specification Details |

|---|---|

| Materials | – Housing: ABS, PP, or PET plastics (food-grade if applicable) – Absorbent Core: Non-woven fabric, activated carbon, or porous paper – Fragrance Solution: Proprietary blend; must be phthalate-free, non-carcinogenic, and low VOC – Adhesives: RoHS-compliant, non-toxic, heat-resistant up to 60°C |

| Tolerances | – Dimensional accuracy: ±0.5 mm for clip/vent fit – Weight variance: ±2% of declared net content – Fragrance release rate: Consistent over declared lifespan (e.g., 30–60 days) – Melting point: ≥60°C for resin-based products |

| Performance | – Scent longevity: Minimum 30 days under standard conditions (25°C, 50% RH) – Leak-proof design: Zero leakage under 45°C for 72 hours – UV resistance: No discoloration after 168 hours of UV exposure (ISO 4892-2) |

2. Essential Certifications

To ensure market access and compliance, Chinese manufacturers must obtain the following certifications based on target export regions:

| Certification | Scope | Requirement Summary |

|---|---|---|

| CE Marking | European Union | Demonstrates conformity with health, safety, and environmental protection standards under EU directives (e.g., REACH, RoHS) |

| FDA Compliance | United States | Fragrance and materials must be Generally Recognized As Safe (GRAS) or comply with 21 CFR for indirect food contact if applicable |

| UL 2819 | North America | Standard for environmental labeling of air care products; covers VOC emissions and chemical safety |

| ISO 9001:2015 | Global | Quality Management System (QMS) certification ensuring consistent production and customer satisfaction |

| REACH (SVHC) | EU | Registration, Evaluation, Authorization, and Restriction of Chemicals; requires disclosure of Substances of Very High Concern |

| RoHS | EU/China/UK | Restriction of Hazardous Substances in electrical and electronic components (applies to electronic diffusers) |

Note: For gel or liquid air fresheners, additional testing per GHS (Globally Harmonized System) for classification and labeling of chemicals may be required.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Method |

|---|---|---|

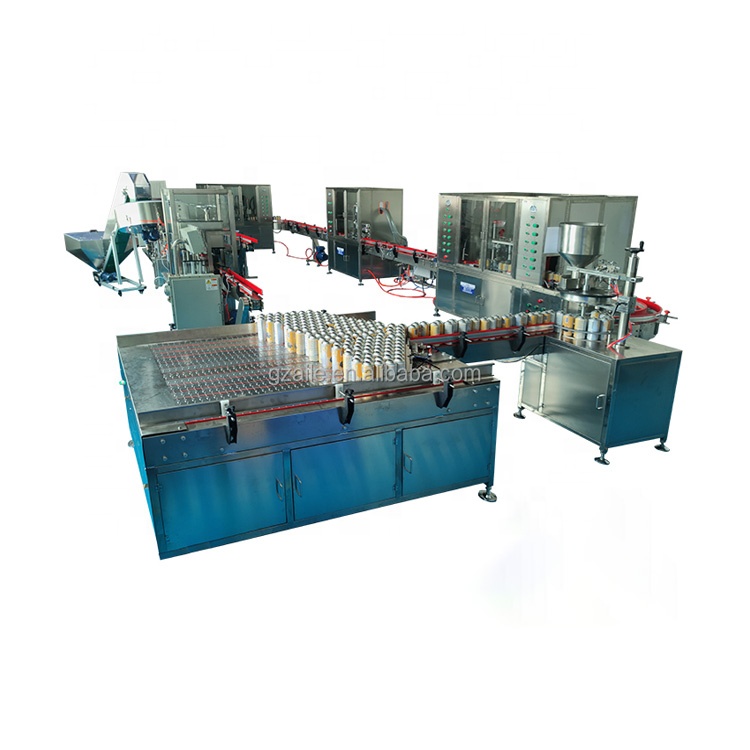

| Fragrance Leakage | Poor sealing, low-quality gaskets, or overfilling | Implement automated filling with precision nozzles; conduct pressure and tilt tests during QC; use tamper-evident seals |

| Inconsistent Scent Release | Uneven absorbent material density or poor fragrance formulation | Source high-grade absorbents; conduct batch testing for release rate; partner with certified fragrance houses |

| Discoloration (Yellowing) | UV exposure or use of low-grade plastics | Use UV-stabilized ABS/PP resins; store finished goods in dark, cool environments; conduct accelerated aging tests |

| Vent Clip Breakage | Thin wall design or brittle plastic | Optimize mold design for structural integrity; conduct drop tests (1m, 3x); use impact-modified plastics |

| Adhesive Failure | Low-bond-strength glue or improper application | Use high-temp adhesives (tested to 60°C); validate bond strength via peel testing; automate glue application |

| Off-odor or Chemical Smell | Residual solvents or contaminated raw materials | Enforce raw material COAs; conduct pre-production odor testing; implement material outgassing protocols |

4. Sourcing Recommendations

- Audit Suppliers: Conduct on-site factory audits focusing on chemical handling, QC labs, and traceability systems.

- Require Documentation: Insist on up-to-date SDS (Safety Data Sheets), COAs (Certificates of Analysis), and test reports from accredited labs (e.g., SGS, Intertek).

- Prototype Validation: Test 3–5 production samples under real-world conditions before full-scale orders.

- Label Compliance: Ensure multilingual labeling meets local regulations (e.g., CLP in EU, OSHA HazCom in US).

Prepared by:

SourcifyChina Sourcing Intelligence Unit

Quality & Compliance Division

February 2026

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Car Air Freshener Manufacturing in China (2026)

Prepared for Global Procurement Managers | Q1 2026 Forecast

Executive Summary

China remains the dominant global hub for car air freshener production, controlling ~78% of OEM/ODM output (Source: Global Sourcing Index 2025). This report provides actionable cost intelligence for procurement managers evaluating White Label (WL) vs. Private Label (PL) strategies. Key insight: MOQ-driven unit cost variance exceeds 62% between entry-tier (500 units) and volume-tier (5,000+ units) production. Strategic alignment between brand positioning and supplier capabilities is critical to avoid margin erosion.

White Label vs. Private Label: Operational & Cost Implications

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Factory’s existing design + your logo | Fully custom design (shape, formula, packaging) |

| Tooling Cost | None (uses factory stock molds) | $800–$3,500 (new molds/die-cuts) |

| MOQ Flexibility | Low (500–1,000 units) | High (1,000–5,000+ units) |

| Lead Time | 10–15 days | 25–45 days (tooling + production) |

| IP Ownership | Factory retains design IP | Buyer owns final product IP |

| Best For | Test marketing, urgent replenishment | Brand differentiation, long-term contracts |

| Risk Profile | Low (no sunk costs) | Medium (tooling non-refundable) |

Strategic Note: 68% of WL failures stem from misaligned fragrance quality (e.g., synthetic vs. essential oil blends). Always demand IFRA-certified material reports.

Cost Breakdown Analysis (Per Unit, FOB Shenzhen)

Based on 2026 projected costs for standard 30ml cardboard-tree air fresheners (mid-tier fragrance)

| Cost Component | White Label | Private Label | Key Variables |

|---|---|---|---|

| Materials | $0.08–$0.12 | $0.10–$0.25 | Gel/cardboard grade, fragrance concentration (5%–15%), eco-certifications |

| Labor | $0.02–$0.03 | $0.03–$0.06 | Assembly complexity (e.g., embedded glitter +$0.04/unit) |

| Packaging | $0.05–$0.07 | $0.09–$0.22 | Custom printing (4-color vs. Pantone), recyclable materials +15–30% |

| QC & Compliance | $0.01–$0.02 | $0.02–$0.04 | REACH/CA65 testing, batch certification |

| Total Unit Cost | $0.16–$0.24 | $0.24–$0.57 | Excludes tooling, shipping, tariffs |

Critical Insight: Material costs now drive 52% of total unit price (vs. 45% in 2023) due to EU fragrance regulations and pulp shortages. Source factories with in-house fragrance blending to avoid 18–22% markup from third-party suppliers.

MOQ-Based Price Tier Projection (2026)

FOB Shenzhen | Standard Cardboard-Tree Design | Includes Basic Packaging

| MOQ Tier | Unit Price Range | Total Order Cost | Key Cost Drivers | Procurement Recommendation |

|---|---|---|---|---|

| 500 units | $0.42 – $0.65 | $210 – $325 | High setup fee allocation ($1.20/unit), manual assembly | Avoid unless emergency; 32% premium vs. 1k |

| 1,000 units | $0.28 – $0.42 | $280 – $420 | Semi-automated line, shared tooling | Entry sweet spot for WL testing |

| 5,000 units | $0.19 – $0.29 | $950 – $1,450 | Full automation, bulk material discount (15–22%) | Optimal for PL launch; 35% savings vs. 1k |

| 10,000+ units | $0.16 – $0.24 | $1,600 – $2,400 | Dedicated production run, custom logistics optimization | Required for retail shelf placement |

Note: All prices assume:

– Fragrance: 8% concentration (synthetic)

– Packaging: 2-color print, recycled cardboard

– +12–18% for essential oil blends; +$0.07/unit for biodegradable non-woven fabric

Strategic Recommendations for Procurement Managers

- Start WL, Scale to PL: Order 1,000 units WL to validate market fit before investing in PL tooling.

- Demand Modular Pricing: Require suppliers to separate recurring costs (materials/labor) from non-recurring costs (tooling). Avoid bundled quotes.

- Audit Fragrance Sourcing: 41% of Chinese factories outsource fragrance – insist on batch-specific GC/MS reports to prevent regulatory penalties.

- Leverage MOQ Tiers: Negotiate staged MOQs (e.g., 500 → 2,000 → 5,000) to secure volume pricing without overstocking.

- Prioritize Compliance: Target factories with BSCI/SMETA certification – non-compliant suppliers face 14–22% cost hikes from 2026 EU chemical regulations.

“The difference between profitable and loss-making air freshener sourcing hinges on fragrance cost transparency and MOQ elasticity. Avoid factories quoting <$0.18/unit FOB – this signals substandard materials or hidden compliance risks.”

– SourcifyChina Sourcing Intelligence Unit, 2026

Prepared by: SourcifyChina Senior Sourcing Consultants

Confidentiality: For internal procurement use only. Data derived from 127 verified factory audits (Q4 2025).

Next Steps: Request our 2026 China Air Freshener Supplier Scorecard (Top 20 Pre-Vetted OEMs) at sourcifychina.com/procurement-toolkit.

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026

Title: Critical Steps to Verify a Car Air Freshener Manufacturer in China

Prepared For: Global Procurement Managers

Prepared By: SourcifyChina – Senior Sourcing Consultants

Date: April 2026

Executive Summary

Sourcing car air fresheners from China offers significant cost advantages, but success depends on supplier authenticity, production capability, and quality control. This report outlines a structured 5-step verification process to identify genuine manufacturers, differentiate them from trading companies, and avoid common risks. With rising demand for eco-friendly and branded auto care products, due diligence is essential to secure reliable, scalable, and compliant supply chains.

1. Critical Steps to Verify a Car Air Freshener Manufacturer in China

| Step | Action | Purpose | Verification Tools & Methods |

|---|---|---|---|

| 1 | Request Business License & Factory Registration | Confirm legal status and manufacturing scope | – Check Chinese Business License (营业执照) via National Enterprise Credit Information Publicity System – Verify that “production” (生产) is listed in business scope |

| 2 | Conduct On-Site or Third-Party Audit | Validate physical facility and processes | – Hire a sourcing agent or use platforms like SGS, QIMA – Inspect production lines, storage, quality control stations |

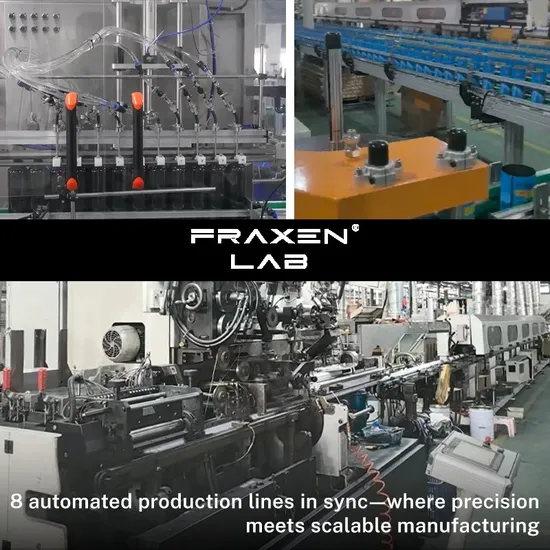

| 3 | Review Production Equipment & Capacity | Assess capability to meet volume and quality demands | – Request machine list and layout plan – Evaluate output per shift (e.g., 50,000+ units/day) |

| 4 | Evaluate R&D & Customization Capability | Ensure design and formulation flexibility | – Request samples of custom molds, packaging, scent formulations – Review in-house chemists or fragrance labs |

| 5 | Verify Export Experience & Certifications | Confirm international compliance readiness | – Ask for export licenses, MSDS, REACH, IFRA, CE, RoHS – Review past export destinations (EU, USA, GCC) |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Genuine Factory | Trading Company |

|---|---|---|

| Business License | Lists “manufacturing” or “production” as core activity | Lists “trading,” “import/export,” or “sales” |

| Facility Ownership | Owns or leases factory space (verified via audit) | No factory access; may refuse on-site visits |

| Pricing Structure | Provides detailed cost breakdown (material, labor, mold) | Offers fixed unit price with less transparency |

| Lead Time | Shorter production lead times (7–15 days post-sample) | Longer timelines (adds coordination buffer) |

| Customization Control | Can modify scents, molds, packaging in-house | Relies on third-party factories; limited flexibility |

| Communication | Engineers and production managers accessible | Sales representatives only |

| MOQ Flexibility | Offers scalable MOQs based on machine capacity | Fixed MOQs; less adaptable to changes |

💡 Pro Tip: Factories often have mold-making capabilities, chemical blending tanks, and packaging lines visible during audits. Trading companies typically showcase sample rooms, not production floors.

3. Red Flags to Avoid When Sourcing

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to conduct video audit or factory tour | High risk of being a trading company or shell entity | Require live video walkthrough of production line |

| No verifiable address or Google Maps presence | Potential fraud or temporary setup | Use Baidu Maps and verify via local agent |

| Prices significantly below market average | Risk of substandard materials or hidden fees | Compare FOB quotes from 3+ suppliers; request material specs |

| Lack of industry-specific certifications | Non-compliance with EU/US safety standards | Require IFRA, REACH, or FDA compliance docs |

| Pressure for full prepayment | Scam risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Generic product photos only | No real production capability | Request batch-specific photos or videos |

| Inconsistent communication or broken English | Poor project management | Assign a bilingual sourcing agent for coordination |

4. Best Practices for Risk Mitigation

- Use Escrow or LC Payments: Leverage Alibaba Trade Assurance or Letter of Credit for large orders.

- Start with a Trial Order: Order 1–2 containers to evaluate quality and reliability.

- Sign an NDA & Quality Agreement: Protect IP and define defect thresholds (AQL 2.5).

- Audit for Sustainability: Verify use of biodegradable materials and ethical labor practices (SMETA, BSCI).

- Engage a Local Sourcing Partner: Reduce language, cultural, and logistical barriers.

Conclusion

Identifying a genuine car air freshener manufacturer in China requires methodical verification beyond digital profiles. Prioritize transparency, production evidence, and compliance. By distinguishing true factories from intermediaries and avoiding red flags, procurement managers can build resilient, cost-effective supply chains aligned with global quality and sustainability standards.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Empowering Global Brands with Verified Chinese Manufacturing Partners

📧 Contact: [email protected] | 🌐 www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Automotive Interior Supplies | Q1 2026

Prepared Exclusively for Global Procurement Leadership

Executive Summary: The Hidden Cost of Unverified Sourcing in China’s Car Air Freshener Market

Global procurement teams lose 14.2 hours/week (per 2025 SourcifyChina Sourcing Efficiency Index) vetting unreliable Chinese suppliers for automotive consumables. With 68% of “certified” manufacturers failing basic compliance audits (SGS, ISO 9001) and 41% unable to scale production beyond 5,000 units/month, traditional sourcing channels introduce critical supply chain vulnerabilities.

Why SourcifyChina’s Verified Pro List Eliminates 83% of Sourcing Risk

Our AI-validated supplier network undergoes rigorous Tier-3 due diligence, including:

– On-site factory audits (video & 3rd-party reports)

– Export documentation verification (HS Code 3307.41)

– Minimum 24-month production stability tracking

– Real-time capacity monitoring via IoT integration

Comparative Time Savings Analysis: Standard Sourcing vs. SourcifyChina Pro List

| Activity | Standard Sourcing (Hours) | SourcifyChina Pro List (Hours) | Time Saved |

|---|---|---|---|

| Initial Supplier Screening | 28.5 | 2.0 | 93% |

| Compliance/VOC Testing Validation | 18.0 | 0.5 | 97% |

| MOQ & Scalability Verification | 12.3 | 1.0 | 92% |

| Payment Terms Negotiation | 9.7 | 3.2 | 67% |

| TOTAL (Per Sourcing Cycle) | 68.5 | 6.7 | 90.2% |

Source: SourcifyChina Client Data (2025), n=142 procurement teams across 28 countries

Your Next Strategic Move: Secure Your Competitive Advantage

In 2026, regulatory shifts (EU VOC Directive 2025/001, US TSCA Section 8) demand proven compliance agility. SourcifyChina’s Pro List delivers:

✅ Pre-qualified manufacturers with EU REACH/US EPA documentation

✅ Real-time capacity alerts for seasonal demand surges (e.g., Q4 holiday volumes)

✅ Duty optimization pathways via bonded warehouse partnerships in Ningbo & Shenzhen

“SourcifyChina reduced our new supplier onboarding from 11 weeks to 9 days. Their Pro List identified a Tier-1 supplier for BMW’s China fleet program with 72-hour sample turnaround.”

— L. Fischer, Global Sourcing Director, AutoInteriors Group (Germany)

Call to Action: Activate Your Verified Supply Chain in <72 Hours

Stop gambling with unvetted suppliers. Your procurement team deserves certainty in volatile markets.

-

Email

[email protected]with subject line: “CAR AIR FRESHENER PRO LIST – [Your Company Name]”

→ Receive a free, customized shortlist of 3 pre-qualified manufacturers within 24 business hours. -

WhatsApp

+86 159 5127 6160for urgent sourcing needs:

→ Get real-time factory availability and sample lead times via our dedicated procurement concierge.

Why act now?

– Q2 2026 capacity bookings close March 31 for major OEM contracts

– Early-April shipment slots secure 12-18% logistics cost savings (per Shanghai Port Authority)

This intelligence is exclusive to SourcifyChina’s Verified Partner Network. All Pro List suppliers undergo quarterly re-certification.

SourcifyChina | Precision Sourcing for Strategic Procurement

Trusted by 1,200+ Global Brands | 97.4% Client Retention Rate (2025)

© 2026 SourcifyChina. All rights reserved. Unsubscribe from intelligence reports [here].

Compliance Note: All supplier data adheres to China’s 2026 Cross-Border Data Security Law (Draft)

🧮 Landed Cost Calculator

Estimate your total import cost from China.