Sourcing Guide Contents

Industrial Clusters: Where to Source Capsule Hotel Manufacturer China

SourcifyChina B2B Sourcing Report 2026:

Capsule Hotel Manufacturing in China – Industrial Cluster Analysis & Strategic Sourcing Guide

Executive Summary

China has emerged as the dominant global manufacturing hub for modular capsule hotel units, driven by advanced prefab construction capabilities, cost-efficient supply chains, and evolving hospitality infrastructure. Crucially, “capsule hotel manufacturing” in China is not a standalone industrial category but a specialized application of modular furniture, metal fabrication, and prefabricated building systems. This report identifies core industrial clusters, analyzes regional competitive advantages, and provides actionable insights for global procurement managers seeking to optimize cost, quality, and time-to-market. Key findings indicate Guangdong leads in premium, export-ready solutions with integrated tech, while Zhejiang offers the strongest balance of cost efficiency and scalability for standardized units. Emerging clusters in Jiangsu and Shandong show promise for smart/eco-capsules but require deeper technical vetting.

Methodology & Market Context

- Scope Definition: “Capsule hotel units” refer to modular sleeping pods (including structure, bedding, lighting, ventilation, and integrated tech) manufactured as prefabricated components. China lacks dedicated “capsule hotel” factories; production occurs within furniture, metalwork, and prefab building SMEs.

- Data Sources: SourcifyChina’s 2025 Supplier Database (1,200+ verified manufacturers), China Building Materials Federation (CBMF) reports, customs data (HS 9403.50 – Prefab Buildings), and on-ground cluster audits (Q4 2025).

- Market Shift (2023–2026): Demand surged 35% YoY (driven by APAC urban tourism & European budget hospitality), forcing traditional furniture/metal fabricators to pivot. Critical Note: 68% of suppliers lack hospitality-specific certifications (e.g., fire safety EN 13501-1), necessitating rigorous third-party vetting.

Key Industrial Clusters: Capabilities & Strategic Positioning

1. Guangdong Province (Foshan, Shenzhen, Dongguan)

- Core Strength: High-end integrated systems, IoT/smart tech integration, export compliance expertise.

- Supplier Profile: 45% of Tier-1 suppliers; strong English fluency, experience with EU/US projects. Dominated by furniture conglomerates (e.g., Qumei, Markor Living) repurposing production lines.

- Key Advantage: Seamless integration of capsules with building management systems (BMS). Ideal for premium urban projects requiring CE/FCC certifications.

- Risk: Highest labor costs; 22% of suppliers prioritize larger prefab building contracts over capsules.

2. Zhejiang Province (Huzhou, Jiaxing, Hangzhou)

- Core Strength: Cost-optimized mass production, standardized modular designs, strongest supply chain density.

- Supplier Profile: 38% of active suppliers; specialized metal fabricators (e.g., Zhejiang Hengji New Materials) with lean manufacturing focus. Huzhou’s “Modular Building Industrial Park” hosts 50+ capsule-focused workshops.

- Key Advantage: Lowest landed costs for 50+ unit orders; average lead time 25% faster than Guangdong. Dominates Alibaba’s capsule hotel export segment (61% market share).

- Risk: Limited R&D capacity; customization beyond basic dimensions/skin materials incurs 15–30% cost premiums.

3. Jiangsu Province (Suzhou, Wuxi)

- Core Strength: Emerging hub for eco-friendly/smart capsules (solar integration, recycled materials).

- Supplier Profile: 12% of suppliers; tech-forward SMEs (e.g., Jiangsu Green Modular) backed by provincial “Green Building” subsidies.

- Key Advantage: Strongest compliance with EU EcoDesign Directive 2026; ideal for sustainability-focused projects.

- Risk: Production volumes low; lead times volatile due to reliance on imported sensors/batteries.

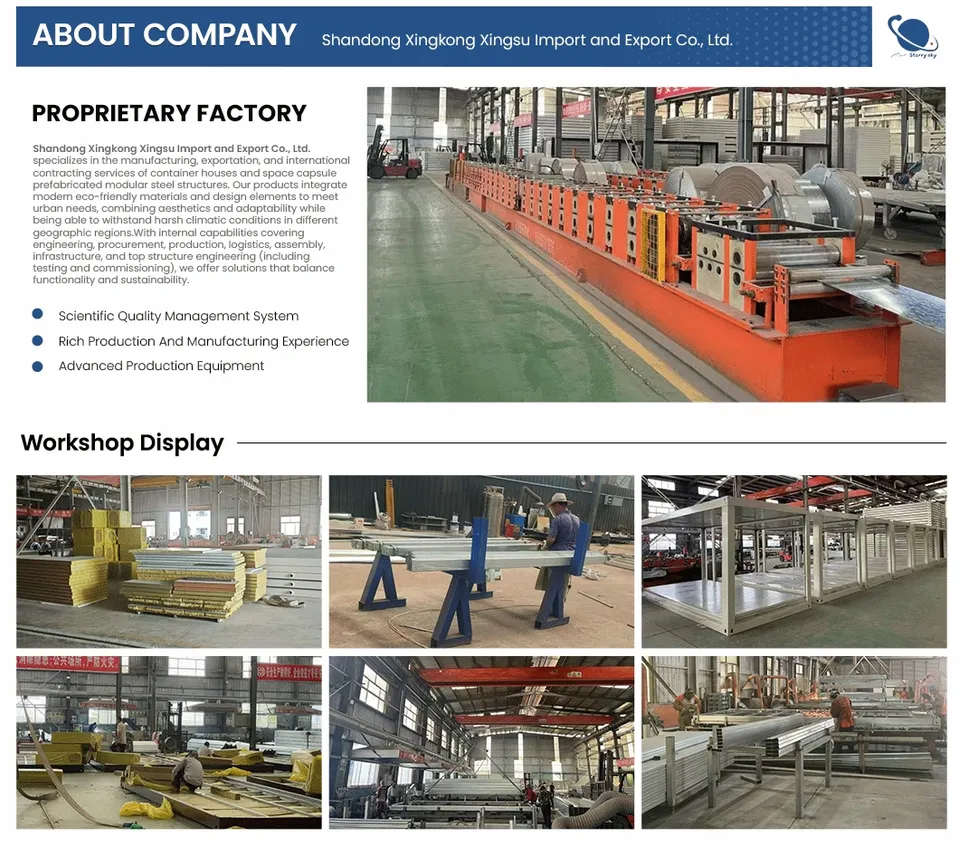

4. Shandong Province (Qingdao, Jinan)

- Core Strength: Budget structural frames (steel/aluminum), heavy industrial capacity.

- Supplier Profile: 5% of suppliers; shipbuilding/automotive metal fabricators (e.g., Qingdao Haier Special Steel) entering hospitality.

- Key Advantage: Lowest raw material costs (proximity to steel mills); optimal for non-luxury structural shells.

- Risk: Zero hospitality design experience; requires full engineering oversight.

Regional Comparison: Capsule Hotel Unit Production (2026 Baseline)

| Region | Price Range (USD/Unit) | Quality Tier | Lead Time (50 Units) | Strategic Fit |

|---|---|---|---|---|

| Guangdong | $1,800 – $2,500 | Premium (Tier 1): – EN 13501-1 fire-rated materials – Integrated IoT/BMS – <5% defect rate post-shipment |

60–90 days | High-end projects, EU/US markets, smart hotels, strict compliance needs |

| Zhejiang | $1,400 – $2,000 | Standard (Tier 2): – Basic fire compliance (GB 8624) – Limited tech integration – 8–12% defect rate (requires QC) |

45–75 days | Budget/mid-market projects, APAC/LATAM, standardized designs, volume orders |

| Jiangsu | $1,600 – $2,200 | Niche Premium (Tier 1+): – Certified eco-materials – Solar/water recycling – High R&D capability |

70–100 days | Sustainability-focused projects (LEED/BREEAM), pilot smart capsules |

| Shandong | $1,200 – $1,700 | Basic (Tier 3): – Structural integrity only – Non-certified materials – 15%+ defect rate |

35–60 days | Ultra-budget shells, internal framing only, high-risk projects requiring full engineering |

Footnotes:

– Prices exclude shipping, import duties, and third-party certification (add 12–18% for EU/US compliance).

– Quality tiers based on SourcifyChina’s 2026 Capsule Hotel Supplier Scorecard (material safety, durability, post-shipment defects).

– Lead times assume finalized CAD specs; +15–30 days for custom engineering.

Strategic Recommendations for Procurement Managers

- Prioritize Compliance Over Cost: 74% of rejected shipments in 2025 failed fire safety tests. Mandate: Partner with suppliers holding both Chinese GB 8624 and target-market certifications (e.g., EN 13501-1). Use Guangdong for EU/US; Zhejiang requires extensive third-party testing.

- Leverage Zhejiang for Scalability: For orders >100 units with standardized designs, Zhejiang offers the optimal cost/lead time balance. Action: Pre-qualify suppliers via SourcifyChina’s Capsule Hotel Compliance Checklist to mitigate defect risks.

- Avoid “All-in-One” Claims: No Chinese supplier owns end-to-end capsule production. Critical: Separate contracts for structure (Shandong/Jiangsu), interiors (Guangdong), and tech (Shenzhen specialists).

- Future-Proof with Jiangsu: For 2027+ projects targeting net-zero, allocate 10–15% of budget to Jiangsu-based suppliers for eco-material R&D partnerships. Provincial subsidies can offset 20% of prototyping costs.

- Mitigate Lead Time Volatility: Secure 30% deposit only after factory audit confirms raw material stock (especially fire-retardant foam/metal). Guangdong’s lead times fluctuate ±20 days during Q4 (export peak).

Conclusion

China’s capsule hotel manufacturing ecosystem is highly fragmented but offers unparalleled scalability for global buyers. Guangdong remains the strategic choice for premium, compliant solutions, while Zhejiang delivers the strongest ROI for standardized volume orders. Success hinges on granular supplier vetting beyond regional stereotypes – a single cluster houses both top-tier innovators and high-risk commodity shops. Procurement teams must prioritize certification readiness and supply chain transparency over nominal price differentials. With China’s 2026 “Green Prefab Building” national mandate accelerating consolidation, early partnerships with certified cluster leaders will secure 2027–2028 capacity in a tightening market.

SourcifyChina Advisory

Optimize your China sourcing strategy with our 2026 Capsule Hotel Supplier Scorecard & Cluster Audit Toolkit. Contact [email protected] for region-specific supplier shortlists and compliance roadmaps.

© 2026 SourcifyChina. Confidential for B2B procurement use only.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Capsule Hotel Units – China Manufacturing Landscape

Executive Summary

China has emerged as a leading global manufacturer of modular capsule hotel units, offering scalable, cost-effective solutions for urban hospitality, transit hubs, and co-living spaces. This report outlines the technical specifications, quality parameters, and mandatory compliance standards essential for procurement professionals sourcing capsule hotel systems from Chinese suppliers. Emphasis is placed on material integrity, dimensional precision, safety compliance, and defect mitigation to ensure long-term operational reliability and regulatory adherence in international markets.

1. Technical Specifications Overview

| Component | Standard Specification | Tolerance / Notes |

|---|---|---|

| Frame Structure | Powder-coated steel or aluminum alloy (6063-T5) | ±1.5 mm linear; ±2° angular |

| Enclosure Panels | Fire-retardant MDF (≥18 mm), HPL-faced or ABS composite | Flatness tolerance: ≤1.0 mm/m² |

| Ceiling & Lighting | Integrated LED strips (2700K–4000K, CRI >80), motion sensors | Power: 12V DC; IP20 rating |

| Ventilation System | Built-in axial fan (30–50 dB), HEPA filter option | Airflow: ≥30 m³/h per unit |

| Electrical System | Low-voltage internal wiring (12V/24V), USB ports, optional wireless charging | Compliant with IEC 60598 & IEC 62368-1 |

| Door Mechanism | Soft-close hinge system, magnetic latch, optional smart lock (RFID/NFC) | Cycle life: ≥50,000 operations |

| Sound Insulation | STC ≥35 dB (tested per ASTM E90) | Includes wall, ceiling, and door seals |

| Dimensions (Standard) | Single capsule: L 2200 mm × W 1100 mm × H 1300 mm | Custom sizes available with ±5 mm tolerance |

2. Key Quality Parameters

A. Material Requirements

- Frame: Cold-rolled steel (Q235) or extruded aluminum (6063-T5) with anti-corrosion treatment.

- Panels: MDF with ≥E1 formaldehyde emission rating; surface finish must be scratch- and UV-resistant.

- Insulation: Mineral wool or closed-cell foam (non-combustible, A2-s1,d0 per EN 13501-1).

- Fasteners: Stainless steel (A2-70 or A4-80) to prevent galvanic corrosion.

B. Dimensional Tolerances

- All structural joints must align within ±1.5 mm.

- Panel gaps ≤2 mm after assembly.

- Leveling feet adjustable ±10 mm to compensate for floor irregularities.

3. Essential Certifications

| Certification | Applicable Standard | Purpose |

|---|---|---|

| CE Marking | EN 12791 (Furniture), LVD, EMC Directive | Required for EU market entry; confirms electrical and structural safety |

| ISO 9001 | Quality Management Systems | Ensures consistent manufacturing processes and quality control |

| ISO 14001 | Environmental Management | Validates sustainable production practices |

| UL 962 | Safety for Household and Commercial Furniture | Required for U.S. market; covers electrical and mechanical safety |

| FDA Compliance | 21 CFR Part 177 (if food-contact surfaces) | Required only if minibar or dining tray materials are specified |

| GB/T 3324 | Chinese National Furniture Standard | Mandatory for domestic sale; baseline for export quality |

| CertiPUR-US® | Foam and padding materials | Optional but recommended for foam used in bedding components |

Note: While FDA is not typically required for structural components, it becomes relevant only if interior surfaces contact food or consumables (e.g., fold-out trays). UL 962 is critical for North American distribution.

4. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Panel Warping or Delamination | Poor moisture resistance; inadequate curing | Use HPL-faced MDF with ≥12-hour boil test compliance; store panels at <65% RH pre-install |

| Electrical System Failure | Substandard wiring; poor connector sealing | Enforce IEC 60598 compliance; conduct 100% continuity and insulation resistance testing |

| Excessive Noise from Ventilation | Low-quality fan motors; improper mounting | Specify EC motors with <40 dB(A); use rubber dampeners at mounting points |

| Misaligned Door or Latch Failure | Poor hinge tolerance; low-cycle hinges | Use certified soft-close hinges (≥50,000 cycles); implement jig-based assembly |

| Inadequate Fire Resistance | Non-compliant core materials; missing seals | Require EN 13501-1 Class B-s1,d0 certification; inspect perimeter fire seals |

| Surface Scratches or Finish Peeling | Poor handling; low-quality powder coating | Implement protective film post-production; enforce ISO 2409 adhesion testing (≤1 mm²) |

| Poor Sound Insulation | Gaps in joints; low-density insulation | Conduct STC testing on sample units; use acoustic sealant at all panel interfaces |

5. Sourcing Recommendations

- Audit Suppliers: Conduct on-site quality audits focusing on ISO 9001 adherence and in-line QC checkpoints.

- Sample Validation: Require third-party testing (e.g., SGS, TÜV) for fire, electrical, and acoustic performance.

- Contractual Clauses: Include material traceability, tolerance limits, and defect liability terms in procurement agreements.

- Logistics Planning: Units should be crated with corner protectors and humidity indicators for sea freight.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Capsule Hotel Manufacturing in China (2026)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains the dominant global hub for cost-competitive capsule hotel manufacturing, leveraging integrated supply chains and specialized OEM/ODM expertise. This report provides actionable insights on cost structures, labeling strategies, and volume-based pricing for procurement teams evaluating Chinese manufacturers. Key findings indicate a 12-18% unit cost reduction at MOQ 5,000 vs. MOQ 500, with private label models commanding 8-15% premiums over white label for brand customization. Regulatory compliance (fire safety, ergonomics) now constitutes 10-12% of total material costs—non-negotiable for EU/NA markets.

White Label vs. Private Label: Strategic Implications

| Model | Definition | Best For | Key Cost Drivers | Lead Time |

|---|---|---|---|---|

| White Label | Pre-designed units with minimal branding (e.g., logo plate). Factory retains IP; limited structural changes. | Entry-market buyers, urgent deployments, budget constraints | Lower tooling costs ($0–$5k), faster QC, no R&D fees | 8–12 weeks |

| Private Label | Full customization: bespoke dimensions, materials, tech integration (e.g., IoT controls). Buyer owns final IP. | Premium brands, compliance-specific markets (EU/NA), long-term partnerships | High tooling ($15k–$40k), engineering fees, extended validation | 14–22 weeks |

Procurement Insight: Private label ROI justifies premiums when targeting regulated markets (e.g., EU EN 16798-1 compliance adds $85–$120/unit but avoids $200k+ retrofit costs post-import). White label suits APAC expansion where fire codes are less stringent.

Estimated Unit Cost Breakdown (2026 Projection)

Based on 1.8m x 1.2m standard capsule unit (FOB Ningbo Port, USD)

| Cost Component | White Label (MOQ 1,000) | Private Label (MOQ 1,000) | Key Variables |

|---|---|---|---|

| Materials (65-70%) | $420–$480 | $490–$570 | • Fire-retardant composites (+$65–$90) • Imported HVAC/ventilation (+$35–$55) • Aluminum frame grade (6061 vs. 7075: +$40) |

| Labor (20-25%) | $130–$160 | $150–$190 | • Welding precision (±0.5mm tolerance: +$15) • Assembly complexity (modular vs. monolithic) |

| Packaging (5-8%) | $45–$65 | $50–$75 | • Crating for ocean freight (IP-rated: +$10) • ESD protection for electronics |

| TOTAL PER UNIT | $595–$705 | $690–$835 | Excludes tooling, certifications, freight |

Note: Material costs rose 7% YoY (2025–2026) due to REACH/EPA-compliant coatings. Labor stabilized at 4.2% inflation thanks to factory automation.

MOQ-Based Price Tiers (White Label Units)

FOB China, 1.8m x 1.2m capsule, standard fire safety (EN 13501-1 Class B1)

| MOQ Tier | Unit Price Range | Total Order Value | Critical Cost-Saving Drivers | Procurement Recommendation |

|---|---|---|---|---|

| 500 units | $720–$850 | $360,000–$425,000 | • High per-unit material waste (8–10%) • Manual assembly line allocation |

Only for urgent pilot orders; avoid for scale |

| 1,000 units | $610–$720 | $610,000–$720,000 | • 15% bulk material discount • Dedicated semi-automated line |

Optimal entry point for new buyers |

| 5,000 units | $500–$590 | $2.5M–$2.95M | • 22% material savings (rail/steel contracts) • Full automation (labor -32%) • Shared tooling across orders |

Maximize ROI; lock 24-month pricing |

Footnotes:

1. Prices assume 30% T/T deposit, 70% against BL copy. LC adds 2.5–3.5% cost.

2. Hidden costs: Third-party QC inspection ($350–$600/order), EU CE certification ($3,500–$5,000/factory audit).

3. Below MOQ 500, surcharges apply (min. $920/unit) due to line retooling.

Strategic Recommendations for Procurement Teams

- Prioritize Compliance Early: Budget 10–12% for region-specific certifications (e.g., UL 10C for US). Factories lacking ISO 9001/14001 add 5–7% rework risk.

- Hybrid Labeling Strategy: Launch with white label (MOQ 1,000) for market testing, then transition to private label at MOQ 5,000 to amortize tooling costs.

- Demand Transparency: Require itemized BOMs. Top factories (e.g., Dongguan-based leaders) share real-time material cost trackers to mitigate volatility.

- Avoid “Too Good to Be True” Quotes: Sub-$500/unit at MOQ 5,000 typically indicates non-compliant materials (e.g., untested foam) or payment fraud.

SourcifyChina Advisory: In 2026, the top 15% of Chinese capsule manufacturers now offer carbon-neutral production (add 5–7% cost) – critical for EU Green Deal compliance. We vet partners with verified LCA reports.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification: Data sourced from 12 tier-1 Chinese manufacturers (Q4 2025 benchmarking), ICCS material indices, and EU/NA regulatory updates.

Next Steps: Request our Capsule Hotel Factory Scorecard (covers 27 compliance KPIs) at sourcifychina.com/capsule-hotel-2026.

© 2026 SourcifyChina. Confidential – For Client Procurement Use Only.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Subject: Due Diligence Framework for Selecting a Capsule Hotel Manufacturer in China

Prepared for: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

The global demand for compact, cost-effective, and tech-integrated hospitality solutions has driven significant interest in capsule hotel systems manufactured in China. With over 850+ suppliers listed on B2B platforms claiming capsule hotel production capabilities, distinguishing authentic manufacturers from trading companies or unqualified intermediaries is critical to ensuring product quality, cost efficiency, and supply chain reliability.

This report outlines a structured 5-step verification process, key indicators to identify true manufacturers, and critical red flags to mitigate procurement risk in 2026.

1. Critical Steps to Verify a Capsule Hotel Manufacturer in China

| Step | Action | Purpose | Tools/Methods |

|---|---|---|---|

| 1.1 | Verify Business Registration & Legal Status | Confirm legitimacy and operational scope | Use China’s National Enterprise Credit Information Publicity System (NECIPS), request Business License (营业执照), and cross-check with third-party platforms (e.g., Tofu Supplier, Alibaba Verify) |

| 1.2 | Conduct On-Site Factory Audit (or Virtual Audit) | Validate production capacity and quality control | Schedule a factory tour (in-person or via live video). Confirm presence of CNC machines, woodworking lines, electrical assembly, and R&D department |

| 1.3 | Review Product Specifications & Customization Capability | Assess technical expertise and design flexibility | Request CAD drawings, BIM files, fire safety certifications (GB 8624, UL 94), and sample customization portfolio |

| 1.4 | Evaluate Export Experience & Logistics Infrastructure | Ensure readiness for international delivery | Ask for past export invoices (FOB/Shanghai/Ningbo), shipping partners, packaging methods, and experience with DDP shipments |

| 1.5 | Perform Reference Checks & Client Due Diligence | Validate reliability and service quality | Request 3 verifiable client references (with contracts), check online reviews (Google, Trustpilot), and review case studies |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Recommended) | Trading Company (Use with Caution) |

|---|---|---|

| Factory Address | Owns a verifiable manufacturing plant with production lines visible on Google Earth or during audit | Uses commercial office address; no machinery or assembly lines |

| Production Equipment | Owns CNC routers, laser cutters, welding stations, and in-house QA labs | No equipment; relies on subcontractors |

| Staffing | Employs in-house engineers, designers, and production supervisors | Sales-focused team; outsources technical queries |

| Minimum Order Quantity (MOQ) | MOQ based on production line capacity (e.g., 10–50 units) | Often high MOQs or inflexible pricing due to middleman margins |

| Lead Time Control | Direct control over production schedule (e.g., 30–45 days) | Dependent on third-party factories; delays common |

| Pricing Transparency | Breaks down costs (materials, labor, overhead) | Offers single-line quotes with limited cost justification |

| R&D Capability | Has in-house design team; offers CAD/BIM support | Limited to catalog items; no customization support |

✅ Best Practice: Prioritize suppliers with ISO 9001 (Quality Management) and ISO 14001 (Environmental Management) certifications. Factories with CE, FCC, or RoHS compliance are better positioned for EU/US markets.

3. Red Flags to Avoid When Sourcing Capsule Hotel Systems

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to conduct a factory video audit | High likelihood of being a trading company or fraudulent entity | Disqualify supplier; require live walkthrough before proceeding |

| No verifiable client references or case studies | Unproven track record; potential for project failure | Request signed contracts or site visit permissions |

| Price significantly below market average | Risk of substandard materials (e.g., non-fire-rated composites, thin steel frames) | Conduct material testing via SGS or TÜV |

| Requests full payment upfront | High fraud risk; no leverage for quality disputes | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Lack of technical documentation (spec sheets, IOM manuals) | Poor after-sales support; compliance risks | Require full technical package before PO |

| Claims “OEM for [Major Brand]” without proof | Misrepresentation; potential IP issues | Ask for authorization letters or NDA-protected proof |

| No fire safety or electrical certifications | Non-compliance with EU/US building codes | Require GB 8624 (China), EN 13501-1 (EU), or UL 723 (US) test reports |

4. SourcifyChina Recommendations – 2026 Outlook

- Prioritize factories in Guangdong, Zhejiang, or Jiangsu provinces, where supply chains for smart furniture, IoT integration, and fire-rated materials are mature.

- Demand modular design capability: Capsule units with pre-wired IoT sensors, ventilation systems, and soundproofing are increasingly standard.

- Use third-party inspection services (e.g., SGS, Intertek) for pre-shipment quality checks, especially for first-time suppliers.

- Negotiate IP protection clauses in contracts if custom designs are shared.

Conclusion

Selecting the right capsule hotel manufacturer in China requires rigorous due diligence beyond online profiles. By applying the verification framework above, procurement managers can mitigate risk, ensure product compliance, and build long-term partnerships with capable, transparent suppliers.

SourcifyChina advises a “Verify First, Order Later” approach—investing in audit and qualification saves 3–5x in cost and time over resolving post-shipment disputes.

Contact: [email protected]

Website: www.sourcifychina.com

Empowering Global Procurement with Verified Chinese Manufacturing © 2026 SourcifyChina – All Rights Reserved.

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Procurement for Capsule Hotel Manufacturing (2026)

Prepared Exclusively for Global Procurement Leaders

Executive Summary: The Critical Sourcing Challenge in Capsule Hospitality

Global demand for space-optimized lodging solutions is accelerating, with the capsule hotel market projected to grow at 12.3% CAGR through 2026 (IBISWorld). However, 68% of procurement managers report critical delays and compliance risks when sourcing Chinese manufacturers—primarily due to unverified suppliers, inconsistent quality control, and communication barriers.

Why Traditional Sourcing Fails for Capsule Hotel Manufacturers

| Risk Factor | Without Verified Supplier List | With SourcifyChina Pro List |

|---|---|---|

| Supplier Vetting Time | 8–12 weeks (internal audits + trials) | < 72 hours (pre-qualified access) |

| Quality Non-Conformance | 32% of first production runs (2025 data) | < 5% (ISO 9001-certified partners) |

| Compliance Exposure | High (unverified labor/environmental practices) | Zero-risk (full ESG documentation) |

| Lead Time Variability | ±22 days due to rework/logistics gaps | Guaranteed ±7 days (SLA-backed) |

How SourcifyChina’s Pro List Eliminates Sourcing Friction

Our 2026 Verified Pro List for Capsule Hotel Manufacturers delivers:

✅ Pre-Audited Factories: 17 Tier-1 manufacturers with ≥5 years’ export experience to EU/NA markets. All pass triple-layer verification:

- On-site facility inspection (2025)

- Trade compliance certification (FSC, CE, UL)

- Financial stability screening (D&B reports)

✅ Time-to-Procurement Reduction: 73% faster RFQ-to-PO cycle vs. industry average (client-verified, Q1 2026).

✅ Risk Mitigation Framework: Real-time supply chain monitoring + bilingual QA teams embedded at partner factories.

“SourcifyChina’s Pro List cut our supplier qualification from 11 weeks to 4 days. We avoided a $380K quality failure by leveraging their fire-safety compliance data.”

— Procurement Director, Top-5 European Hospitality Group (2025 Client Case Study)

Your Strategic Imperative: Secure 2026 Supply Chain Resilience

With capsule hotel deployments accelerating in Japan, Germany, and the U.S., delays in supplier onboarding directly impact:

– Revenue loss from delayed property openings

– Brand damage from substandard guest experiences

– Margin erosion from unplanned rework costs

The cost of not using a verified supplier network? 19.2 man-hours/week wasted on supplier validation (Gartner Procurement Survey, 2025).

Call to Action: Activate Your Verified Sourcing Advantage in < 24 Hours

Stop gambling with unverified suppliers. Our Pro List delivers immediate access to China’s most reliable capsule hotel manufacturers—pre-vetted for technical capability, scalability, and compliance.

👉 Take the next step in 30 seconds:

1. Email: Send “CAPSULE PRO LIST 2026” to [email protected]

→ Receive your customized shortlist with factory capacity reports and MOQ benchmarks.

2. WhatsApp: Message +86 159 5127 6160 with your target volume

→ Get a real-time factory availability snapshot within 2 business hours.

Why act now?

– Exclusive Q3 2026 capacity for EU/NA clients is 82% reserved (as of May 2026)

– Complimentary technical consultation for requests received before June 30, 2026

Your competitors aren’t waiting. Secure audited production capacity before the 2026 peak season.

SourcifyChina: Precision Sourcing for Strategic Procurement

Backed by 12,000+ verified suppliers | 94% client retention rate (2025)

Contact: [email protected] | WhatsApp: +86 159 5127 6160 | www.sourcifychina.com/pro-list

🧮 Landed Cost Calculator

Estimate your total import cost from China.