The global fuel tank manufacturing market is experiencing steady expansion, driven by rising demand across automotive, aerospace, and industrial sectors. According to Grand View Research, the global fuel tank market size was valued at USD 38.7 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.2% from 2023 to 2030. This growth is fueled by increasing vehicle production, stricter emissions regulations, and the shift toward lightweight and high-performance materials such as high-density polyethylene (HDPE) and composite tanks. Additionally, Mordor Intelligence projects continued demand in emerging economies, where infrastructure development and transportation modernization are accelerating procurement cycles. As industries seek reliable, scalable, and compliant fuel storage solutions, a select group of manufacturers have emerged as leaders in capacity, innovation, and global reach—shaping the future of fuel tank supply chains worldwide.

Top 10 Capacity Fuel Tank Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Highland Tank

Domain Est. 1996

Website: highlandtank.com

Key Highlights: Manufacturing high-quality steel storage tank products accommodating commercial and industrial customers. Proven manufacturing and exceptional quality….

#2 Transfer Flow, Inc.

Domain Est. 1997

Website: transferflow.com

Key Highlights: Transfer Flow offers a range of fuel tanks manufactured in the USA, using durable American-made steel….

#3 IFH Group: Trust in Every Tank

Domain Est. 1998

Website: ifhgroup.com

Key Highlights: We’re proud to be one of the country’s largest manufacturers of fuel tanks … Capacities up to 300 gallons for both hydraulic and fuel reservoirs ……

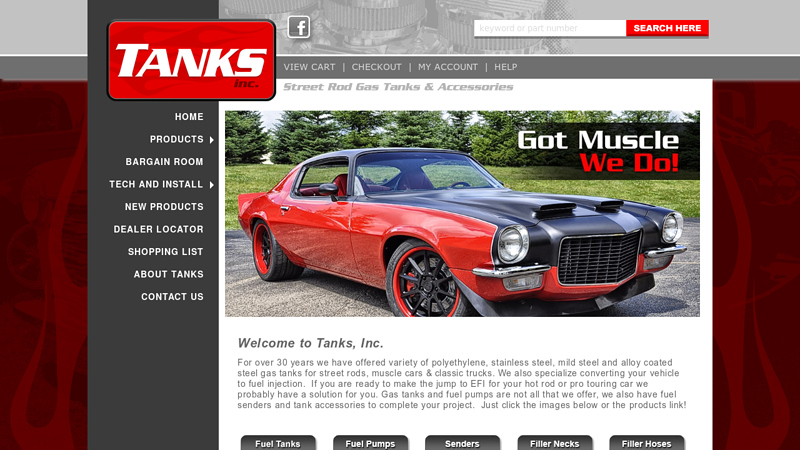

#4 TANKS Inc. gas tanks for street rods, muscle cars, custom cars and …

Domain Est. 1999

Website: tanksinc.com

Key Highlights: Tanks, Inc. manufactures fuel system components and polyethylene, steel and stainless steel gas tanks for street rods and special interest vehicles….

#5 Fuel Storage Solutions & Tanks

Domain Est. 2013

Website: western-global.com

Key Highlights: Fuel storage solutions from the experts at Western Global – world-leading manufacturers of safe & secure fuel tanks including renewable diesel tanks….

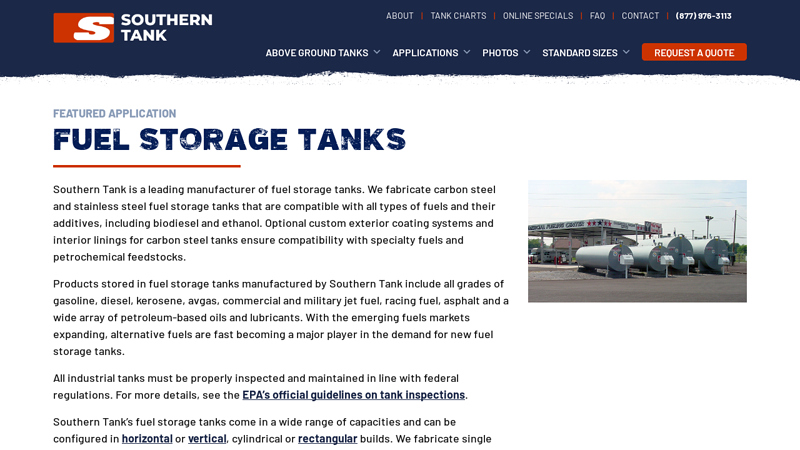

#6 Fuel Storage Tanks for Diesel & Gasoline

Domain Est. 2000

Website: southerntank.net

Key Highlights: Southern Tank’s fuel storage tanks come in a wide range of capacities and can be configured in horizontal or vertical, cylindrical or rectangular builds. We ……

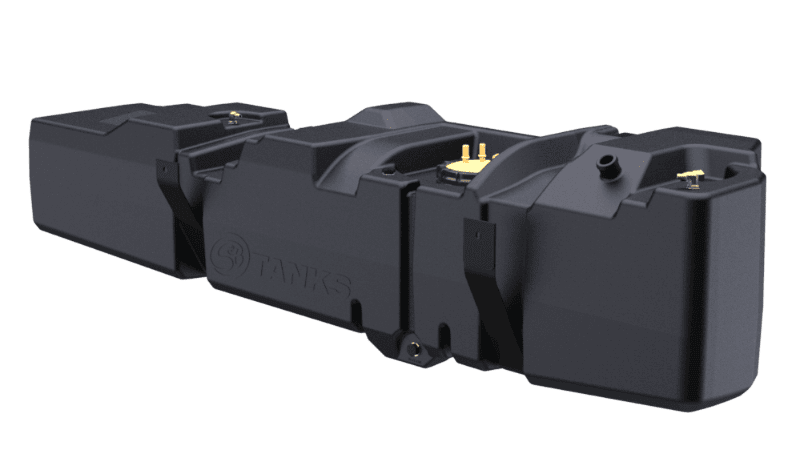

#7 Fuel Tanks

Domain Est. 2000

Website: moellermarine.com

Key Highlights: Our off-the-shelf permanent tanks for below-deck installation—42 different models in all—range in capacity from 12 to 150 gallons. View our selection of ……

#8 S&B Diesel Fuel Tanks

Domain Est. 2003

Website: sbfilters.com

Key Highlights: Fuel your journey with S&B’s high-capacity replacement truck fuel tanks. Designed for Ford, GM, and Ram trucks, our tanks give you more fuel, fewer stops….

#9 TITAN Fuel Tanks

Domain Est. 2004 | Founded: 2003

Website: titanfueltanks.com

Key Highlights: Welcome to Titan Fuel Tanks, your ultimate destination for durable high-capacity fuel solutions that are proudly made in the U.S.A. Founded in 2003, Titan Fuel ……

#10 Custom Stainless Steel Fuel Tanks

Domain Est. 2009

Website: rickstanks.com

Key Highlights: Rick’s Tanks specializes in crafting custom stainless steel fuel tanks for many different mediums including classic and custom cars….

Expert Sourcing Insights for Capacity Fuel Tank

H2: Projected 2026 Market Trends for Capacity Fuel Tanks

As the global energy and transportation sectors evolve, the market for capacity fuel tanks—large-volume storage systems used in automotive, aerospace, marine, industrial, and emerging clean energy applications—is poised for significant transformation by 2026. Driven by regulatory mandates, technological innovation, and shifts in consumer demand, the following key trends are expected to shape the capacity fuel tank industry:

-

Increased Demand for Alternative Fuel Storage Solutions

By 2026, there will be a pronounced shift toward capacity fuel tanks designed for alternative fuels such as hydrogen, liquefied natural gas (LNG), and compressed natural gas (CNG). Governments worldwide are tightening emissions standards, accelerating the adoption of hydrogen-powered vehicles and LNG-fueled marine vessels. This transition is driving demand for high-capacity, lightweight, and high-pressure tanks made from advanced composites (e.g., carbon fiber-reinforced polymers) to ensure safety and efficiency. -

Growth in Hydrogen Infrastructure and Mobility

The hydrogen economy is expected to gain momentum by 2026, especially with national hydrogen strategies in the EU, U.S., Japan, and South Korea. Capacity fuel tanks for hydrogen storage—particularly Type III and Type IV tanks—will see increased deployment in fuel cell electric vehicles (FCEVs), heavy-duty trucks, and rail applications. Innovations in cryogenic hydrogen storage and solid-state hydrogen technologies may also begin influencing tank design and material selection. -

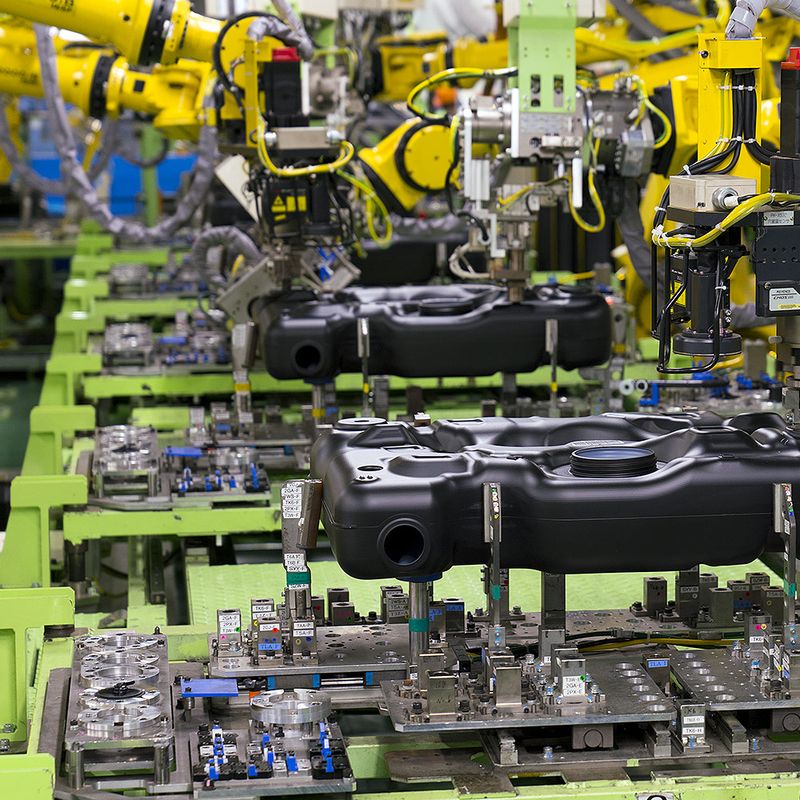

Advancements in Lightweight and Composite Materials

To improve fuel efficiency and extend range, manufacturers are investing heavily in lightweight composite materials for capacity fuel tanks. By 2026, carbon fiber and thermoplastic liners are expected to dominate high-performance applications. Cost reductions in carbon fiber production and recycling technologies will enhance the commercial viability of these advanced tanks. -

Expansion in Renewable and Stationary Energy Storage

Beyond transportation, capacity fuel tanks are being adapted for stationary energy storage, particularly in power-to-gas systems and renewable energy buffering. Large-scale hydrogen storage tanks will play a critical role in balancing grid supply from intermittent sources like wind and solar, contributing to market growth in utility and industrial sectors. -

Stringent Safety and Regulatory Standards

As fuel tank capacities and operating pressures increase, global safety standards (e.g., ISO 15869, UN GTR 13, and regional codes like ASME and ECE R134) will become more rigorous. Certification processes for high-capacity tanks will be streamlined, but compliance will remain a key differentiator among manufacturers. This will drive investment in testing, monitoring systems (e.g., embedded sensors), and digital twin technologies for predictive maintenance. -

Regional Market Divergence and Supply Chain Localization

Asia-Pacific—led by China, Japan, and South Korea—is expected to dominate the capacity fuel tank market by 2026 due to aggressive clean energy policies and strong automotive manufacturing bases. Europe and North America will follow, with growing investments in hydrogen refueling infrastructure. Localization of supply chains, especially for critical materials like carbon fiber and high-barrier liners, will be prioritized to reduce dependency and improve resilience. -

Integration with Digital and Smart Technologies

Smart fuel tanks equipped with IoT sensors for real-time monitoring of pressure, temperature, and structural health will become more common by 2026. These digital capabilities will improve safety, enable predictive maintenance, and support fleet management in commercial transport and logistics. -

Sustainability and Circular Economy Focus

End-of-life management and recyclability of composite fuel tanks will gain regulatory and consumer attention. By 2026, manufacturers are expected to adopt design-for-recycling principles and invest in closed-loop recycling technologies to meet sustainability goals and comply with emerging environmental regulations.

Conclusion

By 2026, the capacity fuel tank market will be reshaped by the global push for decarbonization, advances in material science, and the rise of hydrogen and other clean fuels. Companies that innovate in lightweight design, embrace digital integration, and align with sustainability trends will be best positioned to capture growth in this dynamic and increasingly strategic sector.

When sourcing a Capacity Fuel Tank for Hydrogen (H₂), several common pitfalls can arise—particularly concerning quality and intellectual property (IP). These challenges can significantly impact project timelines, safety, performance, and legal compliance. Below is a detailed breakdown of these pitfalls and how to mitigate them:

1. Quality-Related Pitfalls

a. Material Incompatibility with Hydrogen

- Pitfall: Hydrogen can cause embrittlement in certain metals (e.g., carbon steel), leading to cracking and catastrophic failure.

- Mitigation: Ensure tanks use hydrogen-compatible materials (e.g., stainless steel, aluminum liners with carbon fiber reinforcement). Verify compliance with standards like ISO 11119 or DOT/UN regulations.

b. Inadequate Pressure Rating

- Pitfall: Hydrogen is stored at high pressures (350–700 bar). Tanks rated below operational needs risk overpressure failure.

- Mitigation: Confirm pressure ratings (including safety factors) and validate through third-party testing. Look for certification to ISO 15869 or CGH2R standards.

c. Poor Quality Control in Manufacturing

- Pitfall: Inconsistent winding tension in composite tanks or poor liner quality leads to leaks or reduced lifespan.

- Mitigation: Audit supplier manufacturing processes (e.g., filament winding, curing cycles) and require NDT (Non-Destructive Testing) logs and batch traceability.

d. Lack of Environmental & Durability Testing

- Pitfall: Tanks may fail under thermal cycling, vibration, or impact if not tested adequately.

- Mitigation: Require test data for:

- Thermal cycling (-40°C to +85°C)

- Drop tests

- Fire resistance (per ISO 13984)

- Long-term cyclic fatigue

e. Inadequate Certification & Compliance

- Pitfall: Sourcing from vendors without proper certification leads to regulatory rejection.

- Mitigation: Ensure tanks are type-approved by notified bodies (e.g., TÜV, KIWA) and comply with:

- PED (Pressure Equipment Directive) in EU

- ASME BPVC Section X in the US

- GTR 13 (Global Technical Regulation)

2. Intellectual Property (IP) Pitfalls

a. Infringement of Patented Designs

- Pitfall: Using tank designs (e.g., liner geometry, winding patterns) protected by third-party patents can lead to litigation.

- Mitigation:

- Conduct freedom-to-operate (FTO) analysis before procurement.

- Work with legal counsel to screen suppliers’ IP status.

- Prefer suppliers with licensed or proprietary IP they can legally transfer or sublicense.

b. Unclear IP Ownership in Custom Designs

- Pitfall: If co-developing a tank, unclear contracts may leave your organization without rights to modifications.

- Mitigation:

- Define IP ownership upfront in contracts.

- Specify that custom designs, tooling, and data belong to your organization unless otherwise agreed.

c. Reverse Engineering Risks

- Pitfall: Some low-cost suppliers may reverse-engineer leading H₂ tank designs, exposing buyers to IP liability.

- Mitigation:

- Avoid suppliers with questionable reputations.

- Include IP indemnification clauses in contracts.

- Perform due diligence on supplier design origins.

d. Trade Secret Exposure

- Pitfall: Sharing detailed specs or integration requirements may expose your system-level innovations.

- Mitigation:

- Use NDAs before technical discussions.

- Share only the minimum necessary data.

- Consider modular interface specs (e.g., flange type, pressure) without revealing full system architecture.

Best Practices Summary

| Area | Recommendation |

|——|—————-|

| Supplier Selection | Choose vendors with proven H₂ tank experience, certifications, and audit trails. |

| Quality Assurance | Demand full test reports, material certifications, and third-party validation. |

| Standards Compliance | Ensure adherence to ISO, ASME, DOT, and regional safety codes. |

| IP Protection | Conduct FTO analysis, secure IP rights in contracts, use NDAs. |

| Contractual Safeguards | Include warranties, indemnification, and audit rights. |

Conclusion

Sourcing H₂ fuel tanks requires balancing technical rigor and legal diligence. Prioritizing certified, reputable suppliers with transparent quality processes and clear IP frameworks reduces risk significantly. Always involve cross-functional teams—engineering, procurement, legal, and compliance—early in the sourcing process to avoid costly delays or liabilities.

Certainly! Below is a comprehensive Logistics & Compliance Guide for transporting and handling a Capacity Fuel Tank designed to store and transport Hydrogen (H₂). This guide covers key aspects including safety, regulatory compliance, transportation logistics, storage, and emergency response protocols.

Logistics & Compliance Guide: Capacity Fuel Tank (Hydrogen – H₂)

1. Overview

This document outlines the safe handling, transportation, storage, and regulatory compliance requirements for large-capacity hydrogen fuel tanks. These tanks are typically used in industrial, transportation (e.g., hydrogen vehicles), or energy storage applications and may include high-pressure gaseous (CGH₂), cryogenic liquid (LH₂), or solid-state hydrogen storage systems.

2. Hydrogen Properties & Hazards

Understanding hydrogen is critical for safe logistics:

| Property | Detail |

|——–|——–|

| Chemical Symbol | H₂ |

| State | Gas (commonly stored as compressed gas or cryogenic liquid) |

| Flammability | Highly flammable (4%–75% concentration in air) |

| Ignition Energy | Very low (0.02 mJ) |

| Odor & Color | Odorless, colorless, tasteless |

| Density | Lighter than air (rapidly disperses upward) |

| Boiling Point | -252.8°C (-423°F) for liquid H₂ |

| Auto-ignition Temp | ~500°C (932°F) |

⚠️ Key Hazards:

– Explosion risk in confined spaces

– Embrittlement of metals

– Cryogenic burns (for liquid H₂)

– Rapid phase transition (RPT) in LNG-compatible facilities

3. Regulatory Compliance Framework

3.1 International Standards

- ISO 11114-3: Compatibility of cylinder materials with hydrogen

- ISO 13984: Hydrogen fuel systems for road vehicles

- ISO 16111: Transportable gas storage devices – Hydrogen absorbed in reversible metal hydrides

- ISO 19880 (series): Gaseous hydrogen fueling stations

3.2 United States (DOT, OSHA, PHMSA)

- 49 CFR Parts 100–185 (PHMSA): Hazardous Materials Regulations (HMR)

- H₂ classified as Hazard Class 2.1 (Flammable Gas)

- UN 1049 – Hydrogen, Compressed

- Proper Shipping Name: “Hydrogen”

- DOT 3AL, 3E, or UN-approved composite cylinders for transport

- Pipeline and Hazardous Materials Safety Administration (PHMSA): Certification and inspection of transport tanks

- OSHA 29 CFR 1910.103: Hydrogen standard (ventilation, electrical classification)

3.3 European Union (ADR, PED, TPED)

- ADR 2023: Agreement on the International Carriage of Dangerous Goods by Road

- Class 2.1, UN 1049

- Requires ADR-certified vehicles, drivers with training (ADR certificate)

- Pressure Equipment Directive (PED) 2014/68/EU: Design and manufacturing standards

- Transportable Pressure Equipment Directive (TPED) 2010/35/EU: Periodic inspection and certification

3.4 Other Regions

- Canada: TDG Regulations (Transportation of Dangerous Goods)

- Japan: High Pressure Gas Safety Act

- China: TSG 23-2021 (Safety Technical Specification for Gas Cylinders)

4. Tank Specifications & Certification

Ensure fuel tanks meet the following:

| Criteria | Requirement |

|——–|————-|

| Design Standard | ISO 11439, ISO 15577, or equivalent |

| Material | Carbon fiber-reinforced polymer (Type IV), stainless steel (Type III), or metal hydride |

| Pressure Rating | 350 bar or 700 bar (for gaseous H₂) |

| Certification | TPED, DOT, or Kitemark (UK), CRN (Canada) |

| Markings | Permanent: Manufacturer, serial #, test pressure, date, working pressure, standard |

✅ All tanks must have valid periodic inspection certificates (typically every 3–5 years depending on region and type).

5. Transportation Logistics

5.1 Modes of Transport

| Mode | Requirements |

|——|————–|

| Road (Truck) | ADR/DOT-compliant vehicle, fire extinguisher, grounding strap, hazard labels (Class 2.1), driver training |

| Rail | In accordance with RID (Europe) or 49 CFR (US); securement and venting |

| Sea (IMDG Code) | UN 1049, H2 Compressed; stowage away from heat, oxidizers; segregation requirements |

| Air (IATA DGR) | Generally prohibited for large-capacity tanks; exceptions for small quantities under special provisions |

5.2 Loading & Securing

- Tanks must be upright and securely fastened to prevent movement or impact

- Use cradles, straps, or frames rated for H₂ tanks

- Valves must be protected with caps or guards

- No smoking, open flames, or electrical equipment near loading zones

5.3 Labeling & Documentation

- Placards: Class 2.1 Flammable Gas (red diamond)

- Labels: “Hydrogen,” “Flammable Gas,” “Do Not Drop”

- Shipping Papers: Include:

- Proper shipping name

- UN Number (1049)

- Hazard Class

- Quantity

- Emergency contact

- Transport Index (if applicable)

6. Storage & Handling

6.1 Storage Requirements

- Ventilation: Well-ventilated, outdoor or open-air storage preferred

- Separation: At least 20 ft (6 m) from oxidizers, ignition sources, and occupied buildings

- Fire Protection: Automatic sprinklers, gas detectors (H₂ sensors), fire-rated barriers

- Temperature: Avoid exposure to temperatures >50°C or direct sunlight

- Cryogenic LH₂: Store in vacuum-insulated tanks; monitor for boil-off

6.2 Handling Procedures

- Use non-sparking tools

- Ground all equipment before connecting/disconnecting

- Leak testing required before filling (soap solution or H₂ detector)

- PPE: Flame-resistant clothing, face shield, cryogenic gloves (for LH₂), safety goggles

7. Emergency Response Plan

7.1 Leak Response

- Evacuate area immediately

- Eliminate ignition sources (shut off equipment)

- Ventilate area (if safe)

- Stop leak only if safe to do so

- Use H₂-specific gas detector to monitor concentration

7.2 Fire Response

- DO NOT extinguish flame unless leak can be stopped (risk of explosion)

- Cool surrounding tanks with water spray

- Use fog nozzles; keep distance

- Notify fire department: “Hydrogen fire – high flame visibility, low radiant heat”

7.3 Spill (LH₂)

- Evacuate 50+ meters

- Prevent entry into confined spaces

- Allow to vaporize and disperse (do not confine)

7.4 Emergency Contacts

- Include local fire department, hazmat team, manufacturer, and regulatory body on all documentation.

8. Maintenance & Inspection

| Activity | Frequency |

|——–|———–|

| Visual inspection | Before each use |

| Leak test | Monthly or after transport |

| Pressure relief device test | Annually |

| Hydrostatic test | Every 3–5 years (per regulation) |

| TPED/DOT requalification | As per jurisdiction |

🔧 Only trained personnel should perform maintenance.

9. Training & Personnel

- Required Training:

- HAZMAT handling

- Emergency response

- Use of PPE and gas detectors

- ADR/DOT certification (for drivers)

- Recordkeeping: Maintain training logs for audits

10. Environmental & Sustainability Considerations

- H₂ is zero-carbon at point of use, but lifecycle emissions depend on production method (gray vs. green H₂)

- Recycle or dispose of tanks via certified facilities

- Report any leaks > reportable quantities (e.g., 100 lbs in US under CERCLA)

11. Summary Checklist

| Task | Completed? |

|——|————|

| Confirm tank certification (TPED/DOT) | ☐ |

| Verify proper labeling and placards | ☐ |

| Ensure transport vehicle is compliant | ☐ |

| Train personnel on H₂ hazards | ☐ |

| Install H₂ gas detectors at storage sites | ☐ |

| Review emergency procedures | ☐ |

| Conduct pre-transport inspection | ☐ |

12. Resources

- NFPA 2: Hydrogen Technologies Code

- IEA Hydrogen Tracking Report

- Clean Hydrogen Partnership (EU)

- U.S. DOE Hydrogen and Fuel Cell Technologies Office

🛑 Disclaimer: This guide is for informational purposes. Always consult local regulations, tank manufacturer specifications, and a qualified safety officer before handling or transporting hydrogen fuel tanks.

Let me know if you need a version tailored to a specific country, tank type (e.g., Type IV 700 bar), or application (e.g., hydrogen refueling stations).

Conclusion for Sourcing Capacity of Fuel Tank:

In conclusion, assessing and securing the sourcing capacity for a fuel tank involves a comprehensive evaluation of supplier reliability, manufacturing capabilities, material quality, lead times, cost efficiency, and compliance with industry standards and regulatory requirements. A robust sourcing strategy ensures not only the availability of fuel tanks that meet technical and safety specifications but also supports long-term operational efficiency and supply chain resilience. By selecting qualified suppliers with proven track records and scalable production capacity, organizations can mitigate risks related to delays, quality defects, and supply disruptions. Ultimately, an effective sourcing plan for fuel tanks contributes significantly to project success, cost optimization, and the overall sustainability of operations.