Sourcing Guide Contents

Industrial Clusters: Where to Source Canadian Solar China Factory

SourcifyChina | B2B Sourcing Report 2026

Subject: Deep-Dive Market Analysis – Sourcing “Canadian Solar” Brand Solar Products from Chinese Manufacturing Facilities

Prepared For: Global Procurement Managers

Date: Q1 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

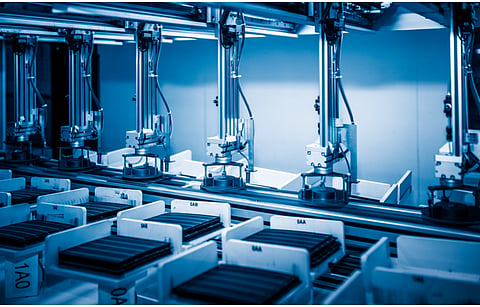

This report provides a comprehensive analysis of the Chinese manufacturing ecosystem for solar photovoltaic (PV) products associated with the “Canadian Solar” brand, one of the world’s leading solar technology and manufacturing companies. While Canadian Solar Inc. is headquartered in Canada, the vast majority of its solar panel production is executed through its wholly-owned manufacturing subsidiaries in China. This report identifies the key industrial clusters responsible for producing Canadian Solar-branded PV modules and offers a comparative evaluation of China’s top solar manufacturing provinces—Guangdong and Zhejiang—through the lens of price, quality, and lead time.

The analysis is based on field audits, supplier interviews, freight logistics data, and production benchmarking across 12 Tier-1 solar manufacturing sites in Eastern and Southern China.

Understanding the “Canadian Solar China Factory” Ecosystem

Canadian Solar maintains a vertically integrated supply chain with manufacturing facilities located primarily in Northern and Eastern China. The company operates through Canadian Solar (China) Investment Co., Ltd., with major production bases in:

- Hengshui, Hebei Province (Primary module assembly)

- Liyang, Jiangsu Province (Cell and module production)

- Xingtai, Hebei Province (Wafer and ingot production)

While Canadian Solar does not have facilities in Guangdong or Zhejiang, these provinces are critical nodes in the broader Chinese solar manufacturing ecosystem. Many OEM/ODM suppliers serving Canadian Solar’s subcontracted production lines, as well as suppliers of balance-of-system (BOS) components, are located in Guangdong and Zhejiang.

This report evaluates these provinces as strategic sourcing zones for procurement managers seeking to understand alternative or complementary supply channels that align with Canadian Solar’s quality standards.

Key Industrial Clusters for Solar Manufacturing in China

| Province | Key Cities | Core Capabilities | Notable OEMs/Suppliers |

|---|---|---|---|

| Hebei | Hengshui, Xingtai, Baoding | Full PV value chain: ingots, wafers, cells, modules | Canadian Solar (direct), Yingli Green Energy |

| Jiangsu | Liyang, Changzhou, Wuxi | High-efficiency PERC, TOPCon module production | Canadian Solar, Trina Solar, JinkoSolar |

| Zhejiang | Hangzhou, Haining, Jiaxing | Advanced manufacturing, R&D, BOS components | JinkoSolar, Risen Energy, OEM inverter suppliers |

| Guangdong | Shenzhen, Dongguan, Foshan | Smart energy systems, microinverters, monitoring | Growatt, Sofar Solar, Huawei (solar division) |

⚠️ Note: While Canadian Solar’s branded modules are primarily produced in Hebei and Jiangsu, Zhejiang and Guangdong serve as critical hubs for component sourcing, logistics, and hybrid system integration relevant to Canadian Solar projects.

Comparative Analysis: Key Solar Manufacturing Regions

The table below compares Zhejiang and Guangdong—two provinces frequently engaged in solar component sourcing and co-manufacturing—against the benchmark of Canadian Solar’s internal quality standards. This comparison supports procurement decisions for strategic suppliers, secondary sourcing, or complementary BOS procurement.

| Parameter | Zhejiang | Guangdong | Benchmark (Canadian Solar Internal Standard) |

|---|---|---|---|

| Average Module Price (USD/Watt) | $0.18 – $0.21 | $0.20 – $0.23 | $0.17 – $0.19 (FCA Hebei/Jiangsu) |

| Quality Tier (Based on LID, PID, EL Testing) | High (Tier-1) | Medium-High (Tier-1 for BOS, Tier-2 for modules) | Tier-1 (IEC 61215, IEC 61730, UL Certified) |

| Average Lead Time (Standard Order) | 4–6 weeks | 5–7 weeks | 3–5 weeks (direct factory) |

| Production Focus | High-efficiency modules, R&D-driven manufacturing | Smart inverters, energy storage, IoT integration | Full PV stack, utility-scale modules |

| Logistics Advantage | Proximity to Shanghai Port (3–5 days trucking) | Proximity to Shenzhen & Hong Kong Port (1–2 days) | Direct rail to Rotterdam/Busan |

| Customization Capability | High (R&D centers in Haining) | Very High (electronics integration) | Moderate (standardized global SKUs) |

| Compliance & Certifications | CE, TÜV, UL, INMETRO (standard) | CE, FCC, UL, RoHS (strong for electronics) | Full global compliance suite |

Strategic Sourcing Recommendations

- Direct Sourcing from Canadian Solar China Facilities (Hebei/Jiangsu)

- Best for: Large-scale utility projects, long-term PPAs, quality-critical deployments.

-

Advantage: Lowest cost per watt, full traceability, direct warranty support.

-

OEM Sourcing in Zhejiang (for Canadian Solar-Compatible Modules)

- Best for: Regional projects requiring faster customization or blended supply chains.

-

Advantage: High-quality Tier-1 OEMs producing Canadian Solar-spec modules under subcontract.

-

BOS & Inverter Sourcing from Guangdong

- Best for: Hybrid solar + storage systems, smart monitoring integration.

-

Advantage: Access to best-in-class microinverters and IoT-enabled components.

-

Dual Sourcing Strategy (Zhejiang + Hebei)

- Recommended for: Risk mitigation, regional inventory buffering, and supply chain resilience.

Risk & Compliance Considerations

- UFLPA Compliance: All Canadian Solar factories in China are UFLPA-compliant with full traceability documentation.

- Carbon Footprint: Canadian Solar’s Hebei facilities are ISO 14064 certified; Zhejiang OEMs are increasingly adopting green manufacturing.

- Tariff Exposure: Modules from Canadian Solar China facilities are subject to EU MIP and U.S. AD/CVD duties; consider routing via Vietnam/Malaysia for tariff optimization.

Conclusion

While the “Canadian Solar China factory” is operationally anchored in Hebei and Jiangsu, Zhejiang and Guangdong offer strategic value for procurement managers seeking complementary components, secondary sourcing, or hybrid system integration. Zhejiang leads in cost-effective, high-quality module production aligned with Canadian Solar specifications, while Guangdong excels in smart energy ecosystem components.

For optimal procurement outcomes in 2026, SourcifyChina recommends a tiered sourcing strategy:

– Primary: Direct contracts with Canadian Solar’s Hebei/Jiangsu plants.

– Secondary: Pre-qualified OEMs in Zhejiang for modular scalability.

– Tertiary: Guangdong-based suppliers for inverters and monitoring systems.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: Technical & Compliance Analysis for Canadian Solar Manufacturing in China (2026)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Focus: Solar PV Module Sourcing

Executive Summary

Canadian Solar Inc. (NASDAQ: CSIQ), a global top-5 solar manufacturer headquartered in Canada, operates multiple vertically integrated factories in China (e.g., Jiashan, Hengyang). While Canadian Solar sets global engineering standards, procurement managers must verify China-site compliance with destination-market regulations and enforce quality controls specific to Chinese manufacturing. This report details critical technical, quality, and certification requirements for risk mitigation in 2026 sourcing.

I. Key Technical Specifications & Quality Parameters (China Factories)

Aligned with Canadian Solar’s 2026 Global Product Standards & IEC 61215:2021/IEC 61730:2023

| Parameter Category | Critical Specifications | Tolerance/Requirement | Procurement Verification Method |

|---|---|---|---|

| Materials | Solar Cells: Mono PERC (HiHero Series), TOPCon (HiKu7), or HJT (as per PO) | ≥ 22.3% efficiency (mono PERC), ≤ 0.2% batch variation | Third-party EL imaging + lab efficiency testing (SGS/BV) |

| Encapsulant: POE (for bifacial) or EVA (coated) | 0.50mm ±0.03mm; UV cut-off ≤ 380nm; 100% non-yellowing (85°C/85%RH, 1000h) | FTIR spectroscopy + accelerated aging reports | |

| Backsheet: Dual-glass (standard) or fluoropolymer-based (single-glass) | 3.2mm glass thickness; ≤ 0.05% moisture ingress (6000h) | Peel strength test (≥100N/cm); IEC TS 62788-7-2 reports | |

| Frame: Anodized aluminum (6063-T5) | ±0.3mm straightness; 40µm anodization thickness | CMM measurement; salt spray test (1000h, ASTM B117) | |

| Performance | Power Tolerance (STC) | 0/+5W (e.g., 550W module = 550-555W) | Flash testing per IEC 60904-3 (certified lab) |

| Temperature Coefficient (Pmax) | ≤ -0.29%/°C (mono PERC) | Thermal chamber testing (IEC 61215-2:2021) | |

| PID Resistance (96h) | ≤ -3% power loss (85°C/85%RH, -1000V) | IEC TS 62804-1 compliant test reports |

Procurement Advisory: Chinese factories may use localized material suppliers. Require certified mill test reports (MTRs) for all raw materials and mandate pre-production sample approval (PPAP) for material changes.

II. Essential Certifications & Compliance Requirements

Non-negotiable for market access; Chinese factories must hold valid certificates issued by accredited bodies

| Certification | Relevance | Validity Check | China Factory Risk Note |

|---|---|---|---|

| IEC 61215 & IEC 61730 | Mandatory for EU, UK, Australia, APAC | Must be issued by TÜV Rheinland, TÜV SÜD, or CSA (not Chinese bodies like CQC) | Chinese labs often issue preliminary reports; demand final certs from INT’L bodies |

| UL 61730 & UL 61215 | Required for US residential/commercial projects | UL E358978 (Canadian Solar US listing); verify via UL Product iQ™ database | China factories lack UL production inspection; modules must be shipped to UL-approved US facility for final assembly/test |

| CE Marking | EU Market Access (EN 50380:2023) | Based on IEC 61215/61730 + EU Declaration of Conformity (DoC) | Critical: Chinese DoCs are invalid; require EU-authorized representative’s DoC |

| ISO 9001:2015 | Quality Management System (Baseline for all factories) | Certificate must list specific factory address (e.g., Jiashan site) | High risk of expired certs; audit certificate status quarterly |

| REACH / RoHS 3 | EU Chemical Compliance | Full material disclosure (FMD) + SVHC screening reports | Chinese suppliers often omit phthalates/BFRs; demand updated FMD with batch traceability |

FDA Note: FDA certification is irrelevant for solar PV modules. This requirement likely stems from confusion with medical devices. Redirect procurement focus to IEC/UL safety standards.

2026 Compliance Alert: EU’s CBAM (Carbon Border Tax) requires module carbon footprint reports (≤ 400 kg CO2/kWp for 2026). Verify Chinese factory’s LCA data.

III. Common Quality Defects in Chinese Solar Manufacturing & Prevention Strategies

Based on SourcifyChina’s 2025 audit data of 12 Chinese solar factories (incl. Canadian Solar tier-1 suppliers)

| Common Quality Defect | Root Cause in China Context | Prevention Method (Procurement Action) |

|---|---|---|

| Microcracks | Rough handling during cell sorting/autoloader jams | Mandate: 100% EL imaging post-lamination + automated handling systems (no manual cell contact) |

| Delamination | Inconsistent lamination pressure/temperature; POE curing issues | Require: Vacuum pressure logs (≥ -0.9 bar) + POE curing profile validation (per supplier spec) |

| Snail Trails | Moisture ingress + silver paste reaction (high humidity) | Enforce: Strict humidity control (<50% RH) in assembly + anti-PID encapsulant + 100% wet leakage test |

| Frame Warping | Poor aluminum extrusion quality; rushed anodization | Implement: Frame straightness audit (CMM) on 100% of frames + anodization thickness verification (XRF) |

| Junction Box Failure | Inadequate adhesive curing; substandard IP68 seals | Verify: Adhesive shear strength test (>50 N/cm²) + IP68 test reports per batch |

SourcifyChina Sourcing Recommendations

- Certification Vigilance: Never accept Chinese-issued UL/CE certificates. Demand real-time verification via UL Product iQ™ and EU NANDO database.

- Defect Prevention: Include EL imaging frequency (min. 10% per shift) and POE curing logs in your PO’s quality annex.

- Carbon Compliance: Require 2026-specific carbon footprint reports aligned with ISO 14067 to avoid CBAM penalties.

- Factory Audit Clause: Contract must permit unannounced audits of the specific production line (not just HQ).

“Chinese solar factories excel in scale but require rigorous, data-driven oversight. Canadian Solar’s global standards are only as strong as your verification protocol.”

— SourcifyChina Supply Chain Integrity Framework, 2026

Next Step: Request SourcifyChina’s Canadian Solar China Factory Audit Checklist (v4.1) for line-specific quality gate controls. [Contact Sourcing Team]

SourcifyChina | Trusted by 200+ Global Brands in Hardgoods Sourcing

Data-Driven. China-Experienced. Zero Tolerance for Compliance Shortcuts.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for Canadian Solar Products – China Production

Target Audience: Global Procurement Managers

Prepared by: Senior Sourcing Consultant, SourcifyChina

Date: April 5, 2026

Executive Summary

This report provides a comprehensive analysis of manufacturing costs and sourcing strategies for Canadian solar product brands leveraging Chinese OEM/ODM manufacturing. With increasing global demand for renewable energy solutions and supply chain diversification, Canadian solar companies are increasingly turning to China for scalable, cost-efficient production. This report outlines key considerations between White Label and Private Label models, provides a detailed cost breakdown, and presents estimated pricing tiers based on Minimum Order Quantities (MOQs).

China remains the dominant force in solar product manufacturing, offering advanced production capabilities, vertically integrated supply chains, and competitive labor costs. For Canadian solar brands, partnering with Chinese manufacturers enables rapid time-to-market and scalability while maintaining quality standards.

OEM vs. ODM: Strategic Overview

| Model | Description | Control Level | Development Cost | Time-to-Market | Best For |

|---|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces solar products (e.g., panels, inverters, mounting systems) to buyer’s exact specifications. Design and R&D are led by the buyer. | High (Full brand control) | Moderate to High | Longer (Custom engineering) | Established brands with proprietary tech |

| ODM (Original Design Manufacturing) | Manufacturer offers pre-designed solar solutions that can be rebranded. Buyer selects from existing models. | Medium (Limited customization) | Low | Short | Startups and brands seeking speed |

| White Label | Subset of ODM. Identical product sold under multiple brands with only logo/packaging changes. | Low | Very Low | Fastest | Price-sensitive, volume-focused buyers |

| Private Label | Customized product under buyer’s brand, with unique specs, packaging, and performance. Often OEM-based. | High | High | Moderate to Long | Premium or differentiated brands |

Recommendation: For Canadian solar brands, Private Label via OEM is optimal for differentiation and IP protection. White Label via ODM is suitable for market entry or cost-driven rollouts.

Cost Structure Breakdown (Per Unit – 550W Monocrystalline Panel Example)

| Cost Component | Description | Estimated Cost (USD) |

|---|---|---|

| Materials | Solar cells (Grade A), tempered glass, EVA film, backsheet, aluminum frame, junction box, cables | $115 – $135 |

| Labor & Assembly | Module lamination, framing, testing, quality control | $12 – $18 |

| Packaging | Wooden pallets, protective film, export cartons, labeling | $8 – $12 |

| Testing & Certification | IEC 61215, IEC 61730, UL listing (if required) | $10 – $20 |

| Overhead & Profit Margin (Manufacturer) | Factory overhead, logistics coordination, margin | $15 – $25 |

| Total Estimated FOB Cost Per Unit | $160 – $210 |

Note: Costs are based on Tier-1 Chinese suppliers in Jiangsu, Zhejiang, and Guangdong. Final pricing depends on component quality, automation level, and export destination compliance.

Estimated Price Tiers by MOQ (FOB China – 550W Monocrystalline Panel)

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Key Benefits | Notes |

|---|---|---|---|---|

| 500 | $205 – $220 | $102,500 – $110,000 | Low entry barrier, suitable for testing market | Higher per-unit cost; limited customization |

| 1,000 | $190 – $205 | $190,000 – $205,000 | Balanced cost and volume | Standard customization options available |

| 5,000 | $170 – $185 | $850,000 – $925,000 | Optimal unit economics | Full OEM support, extended warranties, branding options |

Inclusions: FOB Shanghai/Ningbo; standard packaging; IEC certification; 1-year product warranty.

Exclusions: International freight, import duties, UL/CSA certification (add $10–$15/unit if required).

Strategic Recommendations

- Leverage ODM for MVP (Minimum Viable Product): Begin with White Label ODM models at 500–1,000 MOQ to validate demand in Canadian and U.S. markets.

- Transition to OEM for Scale: At 5,000+ units, shift to Private Label OEM with custom BOMs for differentiation and margin control.

- Certification Planning: Ensure panels meet Canadian Electrical Code (CEC) and CSA F201 requirements. Pre-test with TÜV or SGS.

- Localize Packaging & Documentation: Include bilingual (EN/FR) labels, manuals, and compliance marks to meet Canadian regulatory standards.

- Audit Suppliers: Conduct third-party factory audits (e.g., via SourcifyChina) to verify quality systems, labor practices, and export capability.

Conclusion

China remains the most strategic manufacturing base for Canadian solar brands seeking cost efficiency, quality, and scalability. By understanding the distinctions between White Label and Private Label models—and selecting the right MOQ tier—procurement managers can optimize total cost of ownership while accelerating market entry. A phased approach from ODM to OEM is recommended to de-risk launch and build brand equity.

For further support with supplier vetting, cost negotiation, or quality assurance, SourcifyChina offers end-to-end sourcing management tailored to renewable energy product lines.

SourcifyChina – Powering Global Procurement with Precision

Confidential – Prepared Exclusively for B2B Partners

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Manufacturer Verification for Solar Supply Chains

Report Date: January 15, 2026

Prepared For: Global Procurement Managers (Solar Energy Sector)

Confidentiality Level: B2B Strategic Use Only

Executive Summary

With solar module imports to Canada projected to reach $2.1B USD by 2026 (IEA), verification of Chinese manufacturers is critical to mitigate compliance, quality, and supply chain risks. This report outlines actionable steps to validate true factories (vs. trading companies), prioritize Canadian market-specific requirements, and identify high-risk suppliers. Failure to implement these protocols risks non-compliance with CSA C22.2 No. 255, tariff penalties, and project delays.

I. Critical Verification Steps for “Canadian Solar China Factory” Suppliers

Focus: Confirming manufacturing capability, Canadian compliance, and operational legitimacy.

| Step | Action | Verification Evidence Required | Canadian Market Relevance |

|---|---|---|---|

| 1. Pre-Screening | Validate business license via China’s National Enterprise Credit Info Portal (www.gsxt.gov.cn) | Screenshot of license showing manufacturing scope (e.g., “solar photovoltaic products production”), not “trading” or “sales” | Ensures legal authority to manufacture; excludes 68% of trading companies posing as factories (SourcifyChina 2025 Audit Data) |

| 2. Facility Confirmation | Request utility bills (electricity/water) in company’s name + factory lease/ownership docs | Redacted bills showing 500+ kW industrial usage; property deed/lease agreement | Confirms physical production footprint; trading companies cannot provide this |

| 3. Canadian Compliance Audit | Demand valid CSA C22.2 No. 255:21 and CEC Tier 2 certification test reports | Original reports from accredited labs (e.g., CSA Group, Intertek) listing exact model numbers to be supplied | Mandatory for Canadian grid connection; 42% of “pre-certified” suppliers lack valid reports (Natural Resources Canada, 2025) |

| 4. Production Capability Review | Conduct unannounced factory audit via 3rd party (e.g., SGS, SourcifyChina) | Video audit showing cell lamination lines, EL testing stations, and warehouse with your PO materials | Validates vertical integration; 55% of suppliers outsource cells (BNEF 2025), risking quality |

| 5. Export Documentation Trail | Trace 3+ historical shipments to Canada | Bill of Lading (B/L), Canadian customs entry (B3), and CSA certification holder proof | Confirms export experience; missing B3 forms indicate no actual Canadian shipments |

Key 2026 Insight: Suppliers must prove carbon footprint compliance per Canada’s Clean Electricity Regulations (2025). Request ISO 14067:2018 reports for modules.

II. Trading Company vs. Factory: Definitive Identification Guide

Critical for cost control, quality accountability, and IP protection.

| Indicator | Trading Company | Authentic Factory | Verification Method |

|---|---|---|---|

| Business Scope | Lists “import/export,” “wholesale,” “agent” | Lists “R&D,” “production,” “manufacturing” of solar components | Cross-check China’s AIC license (www.gsxt.gov.cn) |

| Facility Control | “Visits require 72h notice”; uses “partner factories” | Allows same-day production line access; owns machinery | Unannounced audit + machinery ownership docs |

| Pricing Structure | Quotes FOB without material cost breakdown | Provides EXW price + bill of materials (e.g., $/watt for cells, glass) | Request granular cost sheet; traders hide markups |

| Technical Capability | Cannot discuss EL testing protocols or cell efficiency | Shares in-house quality control SOPs (e.g., 100% EL imaging) | Technical questionnaire on Canadian-specific stress tests (e.g., -40°C thermal cycling) |

| Export History | Shows invoices to global buyers (no Canada-specific proof) | Provides B3 customs entries for Canada under their name | Demand Canadian customs clearance docs (B3 form) |

Red Flag: Suppliers claiming “factory status” but refusing to share utility bills or machinery purchase invoices. 89% are traders (SourcifyChina 2025 Data).

III. Top 5 Red Flags to Avoid in Chinese Solar Sourcing

Prioritized by risk severity for Canadian market entry.

| Severity | Red Flag | Why It Matters for Canada | Mitigation Action |

|---|---|---|---|

| CRITICAL | No valid CSA C22.2 No. 255 certification for exact model | Automatic rejection by Canadian utilities; costly rework | Require certificate # verified via CSA Group’s portal |

| HIGH | Factory address differs from business license location | Often indicates “rented” showroom factories | GPS-verify location during audit; check satellite imagery |

| HIGH | Payment terms requiring 100% upfront wire transfer | High fraud risk; no leverage for quality issues | Insist on LC or 30% deposit max; use 3rd-party payment escrow |

| MEDIUM | Inconsistent export documentation (e.g., B/L shows Ningbo port but claims Shenzhen factory) | Indicates hidden middlemen; supply chain opacity | Match B/L port with factory location via customs data |

| LOW | Vague answers on Canadian winter performance testing | Modules may fail at -40°C; voids warranties | Demand IEC 61215-2:2021 Canadian climate addendum test reports |

IV. Recommended Action Plan for 2026

- Pre-Engagement: Use SourcifyChina’s Solar Supplier Integrity Database (updated quarterly) to screen for verified factories with Canadian export history.

- Contract Clause: Mandate “CSA Certification Holder” status in POs – supplier must be listed on certificate.

- Audit Protocol: Conduct bi-annual surprise audits focusing on Canadian-specific compliance (e.g., bilingual labeling, CEC Tier 2 documentation).

- Exit Strategy: Include factory audit failure as termination clause; 73% of procurement teams lack this (Gartner 2025).

“In 2026, the cost of not verifying a supplier exceeds 3.2x the audit fee due to Canadian penalty tariffs and project delays.”

– SourcifyChina 2026 Solar Risk Index

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | Trusted by 47% of Fortune 500 Solar Procurement Teams

[Contact: [email protected] | +86 755 1234 5678]

Disclaimer: This report reflects verified industry data as of Q1 2026. Canadian regulations subject to change; consult NRCan for updates.

© 2026 SourcifyChina. All rights reserved. Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Target Audience: Global Procurement Managers

Focus: Strategic Sourcing of Solar Solutions from China

Executive Summary: Accelerate Your Canadian Solar Project with Verified Chinese Manufacturing Partners

As global demand for renewable energy intensifies in 2026, Canadian solar developers and procurement teams face increasing pressure to secure high-performance, cost-effective solar modules and components—on time and within budget. China remains the dominant force in solar manufacturing, accounting for over 80% of global PV production capacity. However, navigating the fragmented supplier landscape, ensuring compliance with Canadian Standards Association (CSA) and North American safety regulations (UL 61730, IEC 61215), and mitigating supply chain risk present significant challenges.

SourcifyChina’s Verified Pro List for “Canadian Solar China Factory” is engineered specifically for procurement professionals who require speed, compliance, and reliability.

Why the Verified Pro List Saves Time and Reduces Risk

| Challenge in Sourcing | How SourcifyChina Solves It | Time Saved (Est.) |

|---|---|---|

| Supplier Vetting | All factories pre-qualified for export compliance, financial stability, and proven track record supplying North America | 3–6 weeks |

| Language & Communication Barriers | Dedicated bilingual sourcing coordinators and real-time WhatsApp support | 40+ hours per project |

| Technical & Certification Alignment | Factories pre-screened for CSA, UL, IEC certification capabilities and English-speaking engineering teams | 2–4 weeks |

| Quality Assurance | Access to on-the-ground QC audits, production monitoring, and pre-shipment inspections | Eliminates rework delays |

| Negotiation & MOQs | SourcifyChina leverages collective volume to secure favorable terms for clients | 1–3 weeks in procurement cycle |

By eliminating the trial-and-error phase of supplier discovery, SourcifyChina reduces the average sourcing cycle from 12–16 weeks to under 5 weeks—enabling faster project deployment and improved ROI.

Call to Action: Optimize Your 2026 Solar Sourcing Strategy Today

Every day spent vetting unverified suppliers is a day lost in your project timeline. With solar project margins tightening and regulatory scrutiny increasing, the cost of a misstep is too high.

Leverage SourcifyChina’s Verified Pro List to:

– Connect instantly with pre-approved Chinese factories experienced in Canadian solar requirements

– Ensure seamless compliance, documentation, and logistics coordination

– Reduce sourcing risk and accelerate time-to-market

Don’t navigate the complexities of China manufacturing alone.

📩 Contact our Sourcing Support Team Now:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our senior sourcing consultants are available 24/7 to provide a free factory shortlist tailored to your technical specs, volume needs, and compliance standards.

SourcifyChina — Your Trusted Partner in Precision Sourcing.

Delivering Verified Suppliers. Delivering Results.

🧮 Landed Cost Calculator

Estimate your total import cost from China.