The global valves and measurement instruments market is experiencing steady expansion, driven by increasing demand across oil & gas, power generation, water treatment, and industrial manufacturing sectors. According to Mordor Intelligence, the global industrial valves market was valued at USD 77.6 billion in 2023 and is projected to reach USD 107.3 billion by 2029, growing at a CAGR of 5.6% during the forecast period. This growth is bolstered by rising infrastructure investments, stricter regulatory standards for safety and efficiency, and the ongoing modernization of aging industrial systems. In this evolving landscape, Cameron—a Schlumberger company—has emerged as a key player, recognized for its robust valve solutions and advanced measurement technologies engineered for high-pressure and high-temperature environments. As industries prioritize reliability and precision in fluid control systems, the prominence of leading manufacturers like Cameron becomes increasingly critical. The following analysis highlights the top four manufacturers in the Cameron valves and measurement space, evaluated on innovation, market reach, product breadth, and performance reliability.

Top 4 Cameron Valves & Measurement Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Valves and Actuation

Domain Est. 1987

Website: slb.com

Key Highlights: SLB provides valves, actuators, gears, and expert services to meet the diverse and demanding requirements of industrial and energy ……

#2 Cameron Instruments

Domain Est. 1998

Website: cameroninstruments.com

Key Highlights: The best measurement, calibration and test equipment from the world’s leading manufacturers. We operate a state-of-the-art pressure calibration facility. New ……

#3 ORBIT Valves

Domain Est. 2015

Website: orbitvalves.com

Key Highlights: ORBIT rising stem ball valve’s unique tilt-and-turn design reduces seal rubbing and delivers reliable performance….

#4 Cameron Valves

Domain Est. 2020

Website: dresserutility.com

Key Highlights: Cameron is a leading provider of valves, valve automation and measurement systems to the oil and gas industry….

Expert Sourcing Insights for Cameron Valves & Measurement

H2: Market Trends for Cameron Valves & Measurement in 2026

As of 2026, Cameron Valves & Measurement—a Schlumberger (now SLB) company specializing in critical flow control solutions for the oil, gas, and energy industries—is operating within a dynamic and transforming global energy landscape. Several key market trends are shaping demand, innovation, and strategic positioning for the business:

-

Energy Transition Driving Diversified Demand

The global shift toward decarbonization is influencing Cameron’s product portfolio. While traditional oil and gas applications remain strong—especially in deepwater, LNG, and unconventional shale developments—there is growing emphasis on supporting low-carbon energy infrastructure. Cameron is increasingly involved in hydrogen-ready valves and measurement systems, carbon capture, utilization, and storage (CCUS) projects, and offshore wind power substations requiring reliable fluid control. This diversification supports long-term resilience in a transitioning energy market. -

Digitalization and Predictive Maintenance

Cameron’s integrated measurement and automation solutions are benefiting from the broader industry adoption of digital twins, IoT-enabled sensors, and AI-driven analytics. By 2026, demand is rising for smart valves and measurement systems that provide real-time performance data, leak detection, and predictive maintenance insights. Cameron’s digital platforms, such as those integrated with SLB’s broader Nexus™ ecosystem, allow operators to optimize asset integrity, reduce unplanned downtime, and improve safety—key value propositions in competitive markets. -

LNG and Global Gas Infrastructure Expansion

With geopolitical shifts and energy security concerns driving investment in liquefied natural gas (LNG), Cameron is well-positioned due to its leading cryogenic valve technology and measurement systems for LNG liquefaction, regasification, and storage. The expansion of LNG terminals in North America, Asia, and Europe is fueling demand for high-integrity valves capable of withstanding extreme temperatures and pressures—areas where Cameron maintains a technological edge. -

Focus on Emissions Reduction and Regulatory Compliance

Stringent methane emissions regulations (e.g., U.S. EPA Methane Rules, EU Methane Regulation) are pushing operators to upgrade aging infrastructure. Cameron’s low-emission (Low-E) and zero-venting valve technologies are in high demand, especially in upstream production and midstream processing. The company’s measurement systems also support accurate emissions monitoring and reporting, helping clients meet environmental compliance standards. -

Resilience in Upstream Oil & Gas Amid Volatility

Despite energy transition pressures, continued capital discipline and higher oil price stability (averaging $75–$85/barrel in 2026) are supporting moderate upstream investment. Cameron benefits from brownfield upgrades and selective greenfield projects, particularly in regions like the U.S. Permian Basin, Guyana, and the Eastern Mediterranean. Its reliable, high-performance valves are critical in high-pressure, high-temperature (HPHT) and subsea applications. -

Geopolitical and Supply Chain Reconfiguration

Global supply chain localization and nearshoring trends are influencing Cameron’s manufacturing and service strategies. To reduce lead times and enhance resilience, Cameron has expanded regional service centers and localized production of key components in strategic markets (e.g., Middle East, Asia-Pacific, and Latin America). This supports faster deployment and better customer responsiveness. -

Integration with SLB’s Energy Transition Portfolio

As part of SLB, Cameron benefits from cross-portfolio synergy with decarbonization technologies such as electrified compression, hydrogen compression systems, and geothermal solutions. This integration enables bundled offerings that position Cameron not just as a valve supplier, but as a provider of integrated, future-ready energy systems.

In summary, by 2026, Cameron Valves & Measurement is navigating a complex but opportunity-rich environment. Its success hinges on leveraging technological leadership, digital integration, and strategic alignment with SLB’s energy transition roadmap—ensuring relevance across both traditional hydrocarbon and emerging clean energy markets.

Common Pitfalls When Sourcing Cameron Valves & Measurement (Quality, IP)

Sourcing Cameron valves and measurement equipment—known for their use in demanding oil and gas environments—can be complex. While Cameron (a Schlumberger company) maintains high OEM standards, missteps during procurement can lead to quality issues, counterfeit products, and intellectual property (IP) risks. Below are common pitfalls to avoid:

Inadequate Verification of Authorized Distribution Channels

One of the most frequent pitfalls is sourcing from unauthorized or unverified distributors. Cameron products are often counterfeited, and unauthorized sellers may offer substandard replicas or refurbished units misrepresented as new. Always confirm that the supplier is listed as an authorized Cameron distributor through official Schlumberger/Cameron channels.

Accepting Non-OEM or “Compatible” Alternatives Without Due Diligence

Some suppliers market “Cameron-style” or compatible valves as cost-effective alternatives. While these may appear similar, they often lack the rigorous testing, material certifications, and design specifications required for critical applications. Using non-OEM parts can compromise system integrity, violate safety standards, and void warranties.

Overlooking Traceability and Documentation Requirements

Cameron equipment used in regulated industries requires full traceability—mill test reports (MTRs), material certifications (e.g., ISO 10474), and API 6A/6D compliance documentation. Failing to obtain complete and verifiable documentation increases risk of non-compliance, project delays, or rejection during inspection.

Ignoring Intellectual Property and Licensing Risks

Cameron’s designs, trademarks, and technical data are protected under intellectual property laws. Unauthorized reproduction or distribution of Cameron-branded products constitutes IP infringement. Sourcing from counterfeiters not only exposes buyers to legal liability but also undermines product reliability and safety.

Procuring Through Grey Market Channels

The grey market—where genuine Cameron products are sold outside official distribution channels—poses significant quality and warranty risks. Units may be surplus, used, improperly stored, or diverted from original contracts. These products often lack valid warranties and may not meet current API or environmental standards.

Failing to Validate Calibration and Certification for Measurement Equipment

Cameron’s measurement solutions (e.g., flow meters, control systems) require precise calibration and certification. Sourcing units without valid calibration reports or third-party certification (e.g., NIST traceability) can lead to inaccurate readings, operational inefficiencies, and non-compliance with custody transfer regulations.

Not Confirming Regional Compliance and Approvals

Cameron products may be certified for use in specific regions or applications (e.g., ATEX, SIL, PED). Sourcing valves without verifying that they meet local regulatory and safety standards can result in installation rejections or safety hazards.

Conclusion

To mitigate quality and IP risks when sourcing Cameron valves and measurement equipment, always procure through authorized channels, demand complete documentation, and validate certifications. Prioritizing authenticity and compliance ensures operational reliability, regulatory adherence, and protection against counterfeit and substandard products.

Logistics & Compliance Guide for Cameron Valves & Measurement

This guide outlines the essential logistics and compliance procedures for handling Cameron Valves & Measurement products, ensuring safe, efficient, and regulatory-compliant operations throughout the supply chain.

Order Processing & Documentation

All purchase orders must include complete item specifications, quantities, delivery locations, and required compliance certifications. Confirm order accuracy before processing. Required documentation includes packing slips, commercial invoices, bills of lading, and material test reports (MTRs) for applicable products.

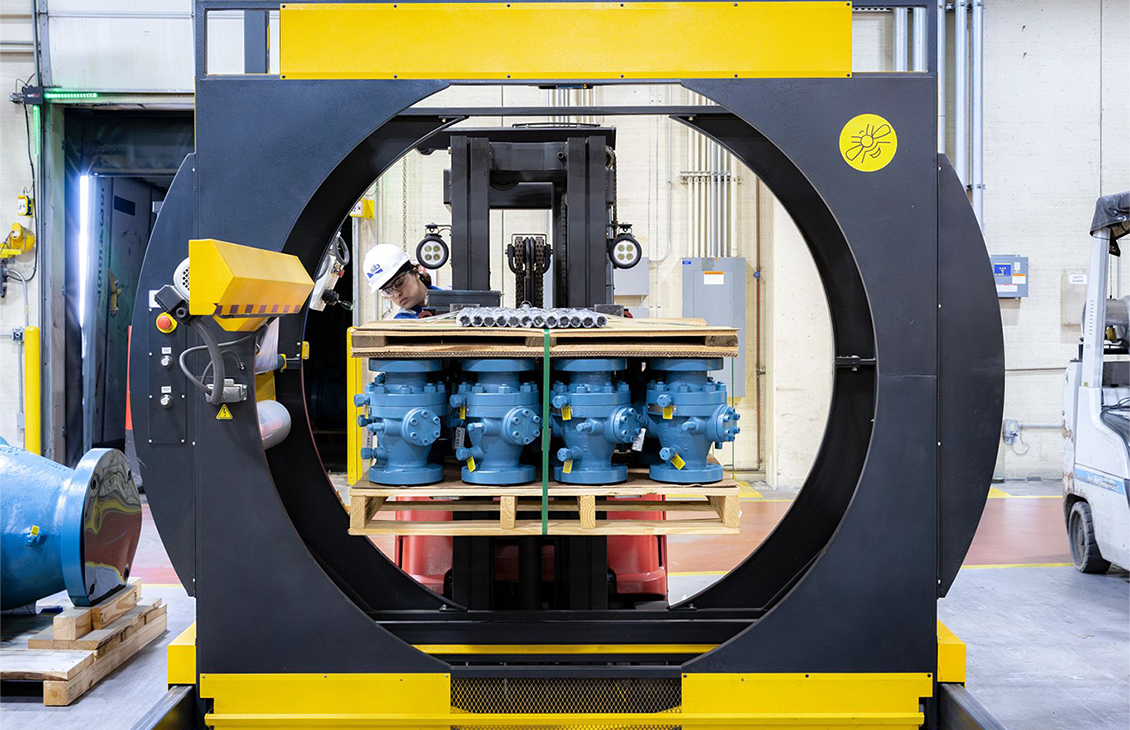

Packaging & Labeling Standards

Products must be packaged according to Cameron’s specifications to prevent damage during transit. Protective measures such as end caps, desiccants, and corrosion inhibitors are mandatory for sensitive components. Labels must include item numbers, serial numbers (if applicable), handling instructions, and hazard warnings per international standards (e.g., UN, OSHA, GHS).

Domestic & International Shipping

Shipments within the U.S. must comply with Department of Transportation (DOT) regulations. International shipments require adherence to International Maritime Dangerous Goods (IMDG) Code, International Air Transport Association (IATA) regulations, and destination country import requirements. Ensure proper Harmonized System (HS) codes and export classifications (e.g., ECCN) are applied.

Export Controls & Trade Compliance

Cameron products may be subject to export control regulations, including the Export Administration Regulations (EAR) administered by the U.S. Department of Commerce. Verify license requirements based on product type, destination, end-user, and end-use. Prohibited parties screening is mandatory prior to shipment.

Customs Clearance Procedures

Provide accurate and complete documentation to customs brokers, including certificates of origin, proforma/commercial invoices, and export declarations (e.g., AES filing for U.S. exports). Coordinate with customs authorities to resolve holds or inspections promptly.

Inventory Management & Traceability

Maintain real-time inventory tracking using approved ERP systems. Ensure full traceability of valves and measurement equipment from manufacturing to delivery, including batch/lot numbers and calibration records where applicable.

Import Compliance & Duties

Ensure compliance with destination country import regulations, including product certification (e.g., CE, CRN, TR CU), conformity assessment, and payment of applicable duties and taxes. Retain all import documentation for minimum of five years.

Handling & Storage Requirements

Store products in dry, temperature-controlled environments when specified. Follow Cameron’s handling guidelines to avoid mechanical damage, especially for precision measurement devices and coated valve components. Rotate stock using FIFO (First In, First Out) principles.

Regulatory Certifications & Standards

Ensure all products meet relevant industry standards such as API 6A, API 6D, ASME B16.34, NACE MR0175/ISO 15156, and ATEX/IECEx where applicable. Maintain up-to-date certification records and provide upon customer request.

Environmental, Health & Safety (EHS) Compliance

Adhere to all EHS regulations during transportation and warehousing. Properly manage hazardous materials (e.g., residual testing fluids) in accordance with RCRA, DOT, and local regulations. Report incidents per corporate EHS policies.

Audit & Record Retention

Prepare for internal and external audits by maintaining organized, accessible records of logistics transactions, compliance certifications, export filings, and training logs. Retain shipping and compliance records for a minimum of seven years unless otherwise specified by regulation.

Training & Accountability

Personnel involved in logistics and compliance must complete regular training on export controls, hazardous materials handling, and regulatory updates. Assign compliance officers at key logistics hubs to oversee adherence to this guide.

Conclusion: Sourcing Cameron Valves & Measurement Equipment

In conclusion, sourcing Cameron valves and measurement equipment offers a reliable and high-performance solution for critical operations in the oil and gas, petrochemical, and industrial sectors. Cameron, as a leading brand under Schlumberger, is recognized globally for its innovation, durability, quality manufacturing standards, and compliance with international regulations, ensuring operational safety and efficiency.

When procuring Cameron products, it is essential to partner with authorized distributors or direct suppliers to guarantee authenticity, access technical support, and ensure after-sales services such as maintenance, calibration, and warranty coverage. Additionally, careful consideration of technical specifications, application requirements, and regulatory compliance will ensure optimal performance and integration within existing systems.

Investing in Cameron valves and measurement solutions not only enhances system reliability and safety but also contributes to long-term cost savings through reduced downtime and extended equipment life. A strategic sourcing approach, emphasizing quality, supplier credibility, and lifecycle support, will maximize the value and effectiveness of these critical components in any industrial application.