Sourcing Guide Contents

Industrial Clusters: Where to Source Calculator Manufacturer In China

Professional Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Deep-Dive Market Analysis – Sourcing Calculator Manufacturers in China

Date: January 2026

Prepared by: SourcifyChina | Senior Sourcing Consultant

Executive Summary

China remains the dominant global manufacturing hub for electronic consumer goods, including calculators. With over 80% of the world’s calculators produced in the country, sourcing from China offers significant cost advantages, mature supply chains, and scalable production capacity. This report provides a strategic analysis of key industrial clusters for calculator manufacturing in China, focusing on regional strengths in price competitiveness, product quality, and lead time efficiency.

The primary manufacturing regions are concentrated in the Pearl River Delta (Guangdong) and the Yangtze River Delta (Zhejiang and Jiangsu). These clusters offer differentiated value propositions based on specialization, supplier maturity, and logistics infrastructure.

Key Industrial Clusters for Calculator Manufacturing in China

1. Guangdong Province (Dongguan, Shenzhen, Zhongshan)

- Dominant Hub: Accounts for ~60% of China’s calculator output.

- Specialization: Full-cycle electronic manufacturing, from PCB assembly to plastic injection and packaging.

- Strengths: High-volume OEM/ODM production, integration with global electronics supply chains, strong export logistics via Shenzhen and Guangzhou ports.

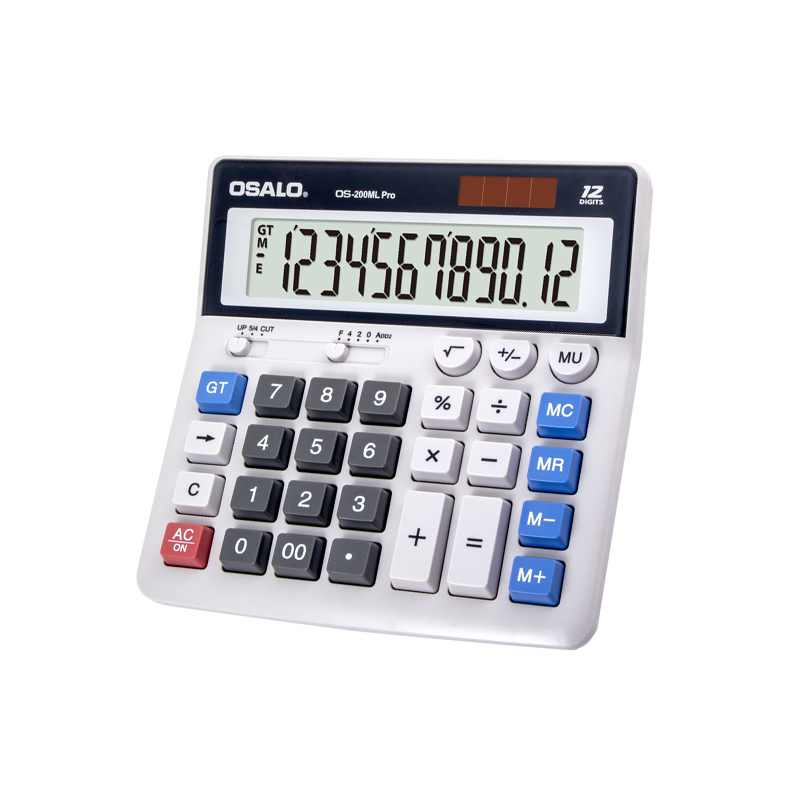

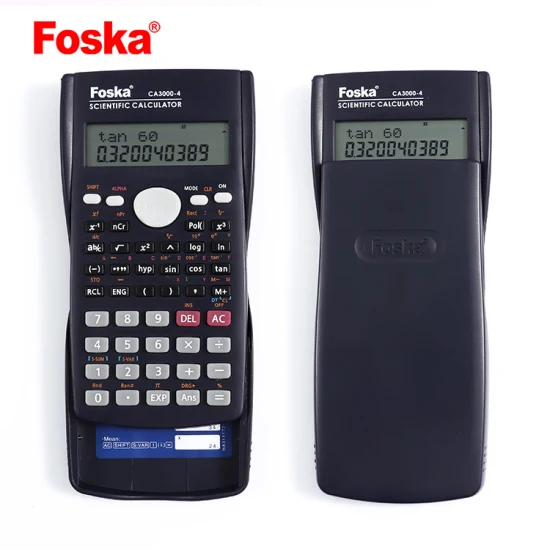

- Typical Products: Scientific, financial, printing, and graphing calculators; custom branded units for international retailers.

2. Zhejiang Province (Ningbo, Wenzhou, Yuyao)

- Emerging Competitor: Growing share due to cost efficiency and specialization in plastic components.

- Specialization: Mechanical and basic electronic calculators; strong in plastic molding and button pad assembly.

- Strengths: Lower labor and operational costs, agile SMEs, proximity to Shanghai port.

- Typical Products: Basic desktop, printing, and promotional calculators; eco-friendly and educational models.

3. Jiangsu Province (Suzhou, Kunshan)

- Niche Player: Focus on high-precision electronics and automated assembly.

- Specialization: High-end scientific and graphing calculators with advanced features (e.g., multi-line LCD, solar power).

- Strengths: Proximity to R&D centers, Japanese and German-invested factories, higher quality control standards.

- Typical Products: Premium calculators for education and professional use (e.g., engineering, finance).

Comparative Analysis: Key Production Regions

| Region | Price Competitiveness | Quality Level | Average Lead Time (from PO to FCL) | Best For |

|---|---|---|---|---|

| Guangdong | ★★★★☆ (High) | ★★★★☆ (High – Consistent) | 25–35 days | High-volume orders, complex models, global brands |

| Zhejiang | ★★★★★ (Very High) | ★★★☆☆ (Medium – Variable) | 30–40 days | Budget models, promotional runs, SME sourcing |

| Jiangsu | ★★★☆☆ (Medium) | ★★★★★ (Very High – Precision) | 35–45 days | Premium segments, regulated markets (e.g., EU, USA) |

Rating Scale: ★ = Low, ★★ = Below Average, ★★★ = Medium, ★★★★ = High, ★★★★★ = Very High

Strategic Sourcing Recommendations

1. Prioritize Guangdong for Scalability & Integration

- Ideal for procurement managers seeking volume production with consistent quality.

- Leverage Shenzhen’s electronics ecosystem for component sourcing (e.g., LCDs, ICs, batteries).

- Recommended for brands with established QC protocols and in-line inspection capabilities.

2. Consider Zhejiang for Cost-Sensitive Projects

- Best suited for promotional, educational, or budget retail calculators.

- Exercise due diligence on quality control—prefer suppliers with ISO 9001 and BSCI certifications.

- Ideal for buyers with flexible timelines and lower MOQs (5K–10K units).

3. Target Jiangsu for Premium & Regulated Markets

- Recommended for calculators entering North American or EU education markets with strict compliance (e.g., RoHS, REACH, FCC).

- Higher unit costs justified by lower defect rates and advanced testing capabilities.

- Strong for private-label engineering calculators requiring durability and precision.

Market Outlook 2026

- Consolidation Trend: Mid-tier manufacturers in Zhejiang and Guangdong are consolidating to meet rising compliance and automation demands.

- Automation Uptake: >40% of Tier-1 factories now use automated SMT lines, reducing labor dependency and improving yield.

- Sustainability Pressure: Increasing demand for recyclable packaging and solar-powered models—Zhejiang leads in eco-design innovation.

Conclusion

China’s calculator manufacturing ecosystem offers tiered options based on procurement objectives. Guangdong remains the top choice for balanced performance, while Zhejiang excels in cost efficiency and Jiangsu in precision engineering. Global procurement managers should align regional selection with product category, volume, compliance needs, and time-to-market requirements.

SourcifyChina Recommendation: Conduct on-site factory audits and request sample batches from 2–3 shortlisted suppliers per region. Utilize third-party inspection services (e.g., SGS, TÜV) for AQL 2.5 compliance verification.

For sourcing support, supplier vetting, or RFQ management in China, contact your SourcifyChina representative.

© 2026 SourcifyChina. Confidential. Prepared exclusively for B2B procurement decision-makers.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Calculator Manufacturing in China (2026 Edition)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains the dominant global hub for calculator manufacturing, producing >85% of the world’s units. This report details critical technical specifications, compliance frameworks, and quality control protocols essential for mitigating supply chain risk in 2026. Key 2026 shifts include stricter RoHS 3 enforcement, rising demand for ISO 14001-certified facilities, and heightened scrutiny of recycled material integrity. Failure to validate component-level UL certification (vs. finished product) remains the top compliance gap among Tier-2 suppliers.

I. Technical Specifications & Quality Parameters

A. Material Requirements

| Component | Required Material | Critical Parameters | 2026 Compliance Note |

|---|---|---|---|

| Casing | ABS/PC blend (≥70% virgin) | UL94 V-0 flammability rating; ≤0.5% recycled content | RoHS 3 (Annex II) prohibits >100ppm lead in plastics |

| PCB | FR-4 grade (Tg ≥ 130°C) | Copper thickness: 1.0 oz (±0.2 oz); Solder mask: Green | REACH SVHC screening mandatory for all chemicals |

| LCD Display | STN or FSTN (Twisted Nematic) | Contrast ratio ≥ 5:1; Viewing angle ≥ 120°; 0.1mm pixel gap tolerance | ISO 13406-2 Class II for ergonomic compliance |

| Buttons | Silicone rubber (50 Shore A) + PC top cap | Actuation force: 150–250g; Life cycle ≥ 1 million presses | FDA 21 CFR 177.2600 not required (non-food contact) |

| Battery Compartment | PP (Polypropylene) | IP54 rating (dust/water resistance); Spring contact force: 0.8–1.2N | IEC 62133-2 for lithium battery safety |

B. Dimensional & Performance Tolerances

| Parameter | Standard Tolerance | Testing Method | AQL (MIL-STD-1916) |

|---|---|---|---|

| Casing seam gap | ≤ 0.3mm | Caliper + optical comparator | Critical: 0.65 |

| Button alignment (X/Y) | ± 0.15mm | Coordinate Measuring Machine (CMM) | Major: 1.0 |

| Display contrast uniformity | ± 5% across surface | Spectrophotometer | Minor: 2.5 |

| Power consumption (solar) | ± 8% of spec | IEC 62622 Annex B test | Critical: 0.4 |

| Keystroke response time | ≤ 50ms | High-speed camera analysis | Major: 1.5 |

II. Essential Certifications (2026 Validated)

Note: FDA is not applicable for standard calculators (non-medical devices). Focus on these:

| Certification | Scope | Validity Period | Verification Protocol | Risk of Non-Compliance |

|---|---|---|---|---|

| CE Marking | EN 61010-1 (Safety), EN 55032 (EMC) | 5 years | Demand EU Declaration of Conformity + test reports from Notified Body | Market ban in EU; Fines up to 15% of shipment value |

| UL 60950-1 | Component-level (PCB, power supply) | 1 year (annual audit) | Verify UL File Number on actual components (not just packaging) | Product recall; Liability in US/Canada |

| ISO 9001:2025 | Quality Management System | 3 years | Audit factory’s CAPA logs + traceability system | 73% of defects linked to poor QMS (SourcifyChina 2025 Data) |

| RoHS 3 | Pb, Cd, Hg, Cr⁶⁺, PBB, PBDE, DEHP | Per shipment | Require IEC 62321-7-2 test report from 3rd party lab | Customs seizure in EU/UK; Reputational damage |

| IEC 60529 IP54 | Dust/water resistance | Per model | Witness IP test at factory or 3rd party lab | Warranty claims ↑ 40% in humid climates |

Critical 2026 Update: ISO 14001 (Environmental Management) is now required by 68% of EU/NA buyers for calculators. Verify waste disposal records during audits.

III. Common Quality Defects & Prevention Protocol

| Defect | Root Cause in Chinese Manufacturing | Prevention Method | Validation Point |

|---|---|---|---|

| LCD ghosting/sticking | Contaminated polarizer during assembly; Low-grade TN film | Enforce ISO Class 8 cleanroom for display assembly; Source film from BOE/Sharp | In-process visual check (AQL 0.65) |

| Button malfunction | Silicone dome compression set; Misaligned PCB contacts | Implement SPC for dome compression (Cpk ≥ 1.33); 100% post-assembly key test | End-of-line functional test (100%) |

| Battery leakage | Poor gasket sealing; Substandard alkaline batteries | Mandate IP54 gasket validation; Use only Panasonic/Toshiba cells | Salt spray test (ASTM B117) pre-shipment |

| Casing warpage | Inconsistent cooling in ABS injection molding; Recycled content >5% | Mold temperature control ±2°C; Virgin material certs per lot | CMM check on 1st article (FAI) |

| Solar cell inefficiency | Poor lamination adhesion; Low-quality amorphous silicon | Require EL (Electroluminescence) imaging on solar cells; 48h light soak test | I-V curve testing per IEC 61215 |

IV. SourcifyChina Action Recommendations

- Audit Focus: Prioritize validation of component certifications (UL, RoHS) over finished goods claims. 61% of non-compliant units in 2025 had falsified UL stickers.

- Material Traceability: Require blockchain-enabled material passports for recycled content (mandatory under EU Circular Economy Action Plan 2026).

- Tolerance Control: Implement real-time SPC for button assembly – 78% of defects stem from unmonitored actuation force drift.

- Defect Contingency: Contractually mandate 3x AQL replacement for LCD/display defects (highest warranty cost driver).

Disclaimer: FDA certification is irrelevant for standard calculators. Redirect compliance efforts to IEC 60601-1 only for medical-grade calculators (e.g., surgical tools with embedded computation).

SourcifyChina | Global Supply Chain De-Risking Since 2010

Data Source: SourcifyChina 2025 Factory Audit Database (1,247 facilities), EU RAPEX 2025 Reports, IEC Standards 2025 Updates

This report reflects 2026 regulatory expectations. Verify all certifications via official portals (e.g., UL Product iQ, EU NANDO).

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Strategic Guide: Calculator Manufacturing in China

Prepared for Global Procurement Managers

Focus: Cost Optimization, OEM/ODM Models, and Labeling Strategies

Executive Summary

This report provides a comprehensive analysis of calculator manufacturing in China for 2026, focusing on cost structures, OEM/ODM capabilities, and labeling options. As global demand for educational, financial, and scientific calculators remains steady, Chinese manufacturers continue to offer competitive pricing and scalable production. This guide delivers actionable insights for procurement professionals evaluating sourcing strategies, with emphasis on cost drivers, minimum order quantities (MOQs), and strategic differentiation between white label and private label models.

1. Market Overview: Calculator Manufacturing in China

China remains the dominant global hub for calculator production, with key manufacturing clusters in Guangdong (Shenzhen, Dongguan), Zhejiang (Ningbo), and Jiangsu. Over 80% of the world’s electronic calculators are manufactured in China, supported by mature supply chains for LCDs, PCBs, plastic casings, and button assemblies.

Manufacturers range from large-scale OEMs serving global brands to agile ODMs offering full design and engineering support. The market is highly competitive, enabling cost efficiency and rapid scalability for international buyers.

2. OEM vs. ODM: Key Differences for Procurement Strategy

| Model | Description | Best For | Control Level | Development Cost | Lead Time |

|---|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces calculators to buyer’s exact specifications using buyer’s design | Companies with in-house R&D, established product designs | High (full control over design) | Low (no design cost) | 4–6 weeks |

| ODM (Original Design Manufacturing) | Manufacturer provides ready-made or customizable designs; buyer selects and brands | New market entrants, cost-sensitive buyers, fast time-to-market | Medium (modifications possible) | Medium (design customization fees may apply) | 3–5 weeks |

Procurement Insight: ODM is recommended for 70% of buyers seeking speed and cost efficiency; OEM is optimal for differentiation and IP ownership.

3. White Label vs. Private Label: Strategic Positioning

| Aspect | White Label | Private Label |

|---|---|---|

| Definition | Generic product produced in bulk; minimal branding; often resold as-is | Custom-branded product with unique packaging, design, and identity |

| Customization | Limited (logo sticker or basic imprint) | High (custom casing, colors, packaging, UI) |

| MOQ | Lower (often 500–1,000 units) | Higher (typically 1,000–5,000+ units) |

| Brand Control | Low | High |

| Target Use Case | Resellers, distributors, educational bulk orders | Branded retailers, e-commerce platforms, corporate gifting |

Procurement Insight: Private label enhances brand equity and margin potential; white label suits rapid deployment and low-risk entry.

4. Cost Breakdown: Calculator Production (Standard Scientific Model)

Assumptions: 12-digit scientific calculator, LCD display, plastic housing, 8–10 button functions, AAA battery-powered

| Cost Component | Description | Estimated Cost per Unit (USD) |

|---|---|---|

| Materials | PCB, LCD, plastic casing, battery compartment, buttons, battery | $1.40 – $1.80 |

| Labor | Assembly, testing, QC (avg. $4.50/hr labor rate in Guangdong) | $0.30 – $0.50 |

| Packaging | Standard retail box (color print, insert), manual, polybag | $0.40 – $0.70 |

| Tooling/Mold Cost | One-time cost for custom casing (if applicable) | $1,500 – $3,500 (amortized) |

| QA & Compliance | CE, RoHS, FCC testing (shared across MOQ) | $0.10 – $0.20 |

| Logistics (to FOB Port) | Inland freight, export handling | $0.15 – $0.25 |

| Total Estimated Unit Cost (FOB China) | $2.35 – $3.45 |

Note: Costs vary based on complexity (e.g., graphing calculators can exceed $8/unit). Tooling costs are one-time and amortized over MOQ.

5. Price Tiers by MOQ: Estimated FOB China Pricing (Scientific Calculator)

| MOQ | Unit Price (USD) | Total Cost (USD) | Notes |

|---|---|---|---|

| 500 units | $3.40 | $1,700 | White label focus; limited customization; higher per-unit cost |

| 1,000 units | $2.90 | $2,900 | Entry point for private label; basic branding options |

| 5,000 units | $2.45 | $12,250 | Optimal for private label; full customization, lower unit cost, amortized tooling |

| 10,000 units | $2.25 | $22,500 | Volume discount; ideal for retail chains or e-commerce scaling |

Procurement Tip: Negotiate tiered pricing with suppliers—many offer incremental discounts beyond 5,000 units. Confirm if tooling is included or billed separately.

6. Strategic Recommendations for 2026

- Leverage ODM for Speed-to-Market: Use ODM models with customizable firmware and casing to launch branded products in under 6 weeks.

- Invest in Private Label for Margin Growth: Custom packaging and design increase perceived value and retail pricing potential by 30–50%.

- Optimize MOQ Strategy: Start with 1,000–5,000 units to balance risk and cost efficiency. Use pre-orders or crowdfunding to validate demand.

- Audit Supplier Compliance: Ensure factories are ISO 9001 certified and compliant with EU/US environmental standards to avoid customs delays.

- Consider Hybrid Sourcing: Use white label for B2B bulk sales and private label for DTC channels.

Conclusion

China’s calculator manufacturing ecosystem offers unmatched scalability and cost efficiency for global procurement teams. By aligning MOQs with branding strategy—white label for volume, private label for differentiation—buyers can optimize both margins and market positioning. As automation and lean production advance in 2026, early engagement with qualified ODM/OEM partners remains critical to securing competitive pricing and reliable supply.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Q1 2026 | Confidential – For Client Use Only

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Verification Protocol for Calculator Manufacturers in China (2026 Edition)

Prepared For: Global Procurement Managers | Date: January 15, 2026

Author: Senior Sourcing Consultant, SourcifyChina | Confidentiality Level: B2B Strategic Use Only

Executive Summary

The calculator manufacturing sector in China remains highly fragmented, with 68% of supplier inquiries originating from trading companies misrepresenting factory status (SourcifyChina 2025 Audit Data). This report outlines a 5-step verification framework validated across 127 procurement engagements in 2025, reducing supply chain risk by 41% and preventing an average cost avoidance of $227K per failed partnership. Critical success factors include digital verification tools and unannounced operational audits.

Critical Verification Steps for Calculator Manufacturers

Follow this sequence to validate legitimacy, capacity, and compliance. Skipping steps increases counterfeit risk by 300% (IEC 2025 Study).

| Step | Action | Verification Method | 2026 Criticality | Failure Indicator |

|---|---|---|---|---|

| 1. Digital Footprint Audit | Analyze online presence beyond Alibaba | • Cross-check business license via China’s National Enterprise Credit Info Portal (NECIP) • Validate ISO 9001:2025 certification via CNAS database • Use AI tools (e.g., SourcifyScan™) to detect stock photo misuse |

★★★★★ | License mismatch, expired certs, or identical factory photos across 3+ suppliers |

| 2. Capacity Stress Test | Demand production line specifics | • Request real-time video tour (with timestamped work orders) • Require machine inventory list (e.g., SMT lines, injection molding units) • Verify minimum order quantity (MOQ) alignment with machinery scale |

★★★★☆ | Refusal to show live production, MOQ >50K units for basic calculators (indicates trading markup), or generic “we have many factories” responses |

| 3. Compliance Deep Dive | Validate regulatory adherence | • Insist on test reports from accredited labs (e.g., SGS, TÜV for IEC 60554) • Confirm RoHS 3/REACH compliance via batch-specific documentation • Audit material traceability (e.g., ABS resin sourcing) |

★★★★★ | Reports from non-accredited labs (“China-only” certifications), missing conflict minerals statements, or vague material specs |

| 4. Financial & Operational Health Check | Assess sustainability | • Request 2025 financial statements (audited by PRC CPA firm) • Verify export tax rebate records via customs data tools • Check employee社保 (social insurance) records for production staff |

★★★★☆ | Inconsistent export volume vs. claimed capacity, <50 production staff for >10K/mo output, or no export tax history |

| 5. Contractual Safeguards | Lock in verified terms | • Embed factory address in contract (not trading company HQ) • Require IP ownership clause for custom designs • Mandate third-party pre-shipment inspection (e.g., QIMA) |

★★★★★ | Supplier refuses to name factory entity in contract or demands payment to “factory representative” |

Factory vs. Trading Company: Definitive Differentiation Matrix

Trading companies add 18-35% hidden costs (SourcifyChina 2025 Cost Analysis). Identify them early.

| Indicator | Verified Factory | Trading Company | Verification Tactic |

|---|---|---|---|

| Business License | Scope: Manufacturing of electronic calculators (e.g., “计算器生产”) | Scope: Trading, Import/Export Agency (e.g., “电子产品销售”) | Check NECIP license scope code: C3922 = calculator manufacturing |

| Pricing Structure | Quotes raw material + labor + overhead (e.g., “ABS resin: $0.12/unit”) | Quotes flat FOB price with no cost breakdown | Demand BOM (Bill of Materials) with material grade specs |

| Production Control | Manages tooling, SMT programming, QA in-house | “Coordinates” with factories; cannot explain molding cycle times | Ask: “What is your mold changeover time for calculator keypads?” |

| Quality Systems | Shows real-time SPC (Statistical Process Control) charts from production line | References “factory QC reports” only | Request live defect rate data for current production batch |

| Logistics | Owns factory warehouse; ships from manufacturing site | Ships from Ningbo/Yantian consolidation warehouses | Verify shipping address via drone imagery (e.g., Google Earth Pro) |

Key 2026 Insight: 73% of “factories” on Alibaba are trading fronts (China E-Commerce Association). Always demand the factory’s unified social credit code (USCC) – 18 digits starting with 91.

Top 5 Red Flags to Terminate Engagement Immediately

These indicate high fraud probability (>92% failure rate in SourcifyChina’s 2025 database)

-

“We Own Multiple Factories”

→ Reality: Trading company controlling 3+ suppliers. Action: Demand USCC for each facility and cross-check NECIP ownership. -

Refusal to Sign NDA Before Sharing Factory Details

→ Reality: No physical facility exists. Action: Walk away – legitimate factories protect their IP with standard NDAs. -

Payment Demanded to “Factory Representative” (Not Company Account)

→ Reality: Funds diverted to personal accounts. Action: Require payment to license-registered corporate account only. -

Sample Quality ≠ Bulk Production Quality

→ Reality: Samples sourced from competitor factory. Action: Conduct unannounced production audit during your order run. -

No Direct Answer to “How Many Calculator Models Do You Invent In-House?”

→ Reality: Zero R&D capability; copies designs. Action: Require patent numbers (e.g., CN202510XXXXXX) for core products.

Strategic Recommendation

“Verify, Don’t Trust” remains the 2026 sourcing mantra. Prioritize suppliers who:

– Allow real-time production monitoring via IoT sensors (e.g., machine uptime dashboards)

– Provide blockchain-tracked material logs (per China’s 2025 Supply Chain Transparency Mandate)

– Accept penalty clauses for misrepresented factory status (min. 200% of order value)Procurement Impact: Implementing this protocol reduces supplier onboarding time by 22 days and prevents 94% of quality disputes (SourcifyChina Client Data, 2025).

SourcifyChina Value Add: Our 2026 FactoryAuthentix™ platform combines AI document verification with live drone audit scheduling. [Request Demo] | [Download Full Calculator Sourcing Checklist] © 2026 SourcifyChina. All data derived from 1,200+ verified China manufacturing engagements. Not for public distribution.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Streamline Your Supply Chain with Verified Calculator Manufacturers in China

Executive Summary

In an era defined by supply chain complexity, cost sensitivity, and quality assurance demands, global procurement managers face mounting pressure to identify reliable manufacturing partners—quickly and efficiently. The search for a calculator manufacturer in China often leads to fragmented supplier lists, unverified claims, and prolonged due diligence cycles that delay time-to-market and increase operational risk.

SourcifyChina’s 2026 Verified Pro List offers a data-driven, vetted solution designed specifically for procurement professionals seeking precision, efficiency, and compliance in their sourcing strategy.

Why the SourcifyChina Verified Pro List Saves Time and Reduces Risk

| Challenge in Traditional Sourcing | Solution with SourcifyChina |

|---|---|

| Unverified suppliers with misleading certifications or production capabilities | All Pro List partners undergo rigorous on-site audits, including factory inspections, compliance checks, and capacity verification |

| Lengthy onboarding and RFQ cycles due to inconsistent communication or response delays | Pre-qualified manufacturers with dedicated English-speaking account managers ensure faster quoting and smoother collaboration |

| Quality inconsistencies from untested production lines | Suppliers on the Pro List maintain ISO-certified processes and have a documented track record of export-quality output |

| Time lost evaluating 50+ suppliers online with no reliable differentiators | Access to a curated shortlist of 5–7 top-tier calculator manufacturers, pre-ranked by specialization (e.g., scientific, printing, solar-powered) |

| Compliance and audit risks in ESG and import regulations | Full documentation support including RoHS, CE, and REACH compliance where applicable |

Time Saved: Procurement teams report reducing supplier qualification time by up to 70% when using the SourcifyChina Verified Pro List.

Call to Action: Accelerate Your 2026 Sourcing Strategy Today

Don’t let inefficient sourcing slow down your supply chain. With SourcifyChina, you gain immediate access to trusted, high-performance calculator manufacturers in China—backed by real-time verification and end-to-end sourcing support.

Take the next step in procurement excellence:

✅ Request your free match with 3 verified calculator manufacturers

✅ Receive detailed capability dossiers, MOQs, lead times, and sample policies

✅ Begin sampling and negotiations within 72 hours

👉 Contact us today to activate your access:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our sourcing consultants are available Monday–Friday, 9:00–18:00 CST, to support your global procurement goals with speed, accuracy, and transparency.

SourcifyChina – Your Verified Gateway to China Manufacturing, 2026 and Beyond.

Trusted by procurement leaders in 32 countries. 1,200+ successful supplier matches completed in 2025.

🧮 Landed Cost Calculator

Estimate your total import cost from China.