The global cable sheath market is experiencing steady expansion, driven by rising demand for reliable power transmission infrastructure, increased investments in renewable energy projects, and the growth of industrial automation. According to Grand View Research, the global electrical wire and cable market size was valued at USD 199.1 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.3% from 2023 to 2030—with cable sheathing materials playing a critical role in ensuring durability, fire resistance, and environmental protection. Similarly, Mordor Intelligence projects a CAGR of over 5.8% for the wire and cable market through 2028, citing urbanization and smart grid deployments as key drivers. As performance requirements evolve, manufacturers of cable sheaths are innovating with halogen-free, low-smoke, and high-temperature-resistant materials to meet stringent safety and regulatory standards. In this competitive landscape, a select group of manufacturers have emerged as leaders in quality, scale, and technological advancement—shaping the future of cable protection systems worldwide.

Top 10 Cable Sheath Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Galaxy Wire & Cable, Inc.

Domain Est. 1998

Website: galaxywire.com

Key Highlights: Assemblies & Harnesses Galaxy Wire & Cable is a leading manufacturer of many different types of cable/wire assemblies, harnesses and related products….

#2 LS CABLE & SYSTEM USA

Domain Est. 2019

Website: lscsusa.com

Key Highlights: LS Cable & System USA is a leading US manufacturer of electrical products for the commercial, industrial, renewable and utility markets….

#3 Dura

Domain Est. 1995

Website: duraline.com

Key Highlights: Our lives depend on clear, consistent, reliable communication. Discover how Dura-Line High, a global manufacturer of HDPE conduits creates what connects us….

#4 Service Wire Company

Domain Est. 1996 | Founded: 1968

Website: servicewire.com

Key Highlights: Since 1968, we’ve built a reputation for safely manufacturing high-quality wire and cable, delivering industry-leading service levels….

#5 to Loos & Co., Inc.

Domain Est. 1997

Website: loosco.com

Key Highlights: Loos and Company manufactures and stocks aircraft cable to commercial and military specifications in stainless steel, galvanized carbon steel, and a variety of ……

#6 Cable Sleeving

Domain Est. 1997

Website: tpcwire.com

Key Highlights: TPC’s cable sleeving options are designed to keep your cable safe from industrial wear and tear, extreme temperature, and other environmental factors….

#7 Prysmian

Domain Est. 2005

Website: prysmian.com

Key Highlights: Welcome to Prysmian: the world leader in cable manufacturer, energy solutions, telecom cables and systems industry. Find out more!…

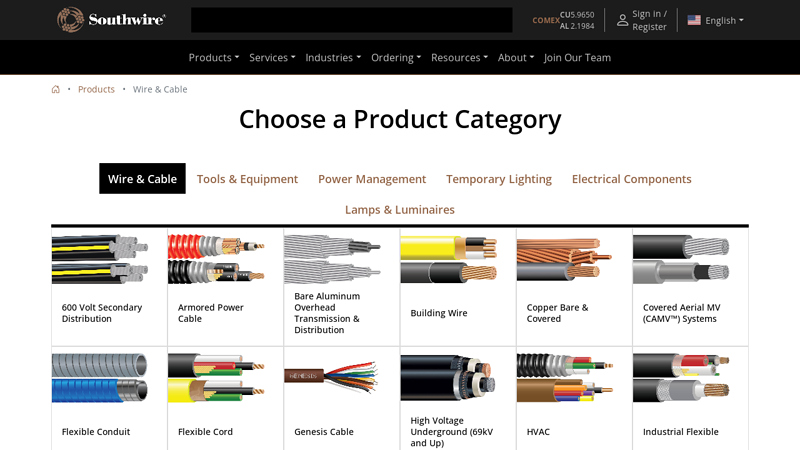

#8 Wire & Cable

Domain Est. 1994

Website: southwire.com

Key Highlights: Choose a Product Category: Wire & Cable, Tools & Equipment, Power Management, Temporary Lighting, Electrical Components, Lamps & Luminaires….

#9 Cables

Domain Est. 1994

Website: commscope.com

Key Highlights: CommScope Cables for Superior Connectivity. CommScope offers an extensive range of high-performance cables to meet your connectivity needs….

#10 Cable Assemblies

Domain Est. 1996

Website: amphenol.com

Key Highlights: Amphenol’s cable assemblies include simple point-to-point cables, custom high-power and high-speed data cable assemblies and complex multi-branch harness ……

Expert Sourcing Insights for Cable Sheath

H2: Analysis of 2026 Market Trends for Cable Sheath

The global cable sheath market is poised for significant transformation by 2026, driven by evolving infrastructure demands, technological advancements, and a growing emphasis on sustainability. Cable sheaths—protective outer layers for electrical and fiber-optic cables—play a critical role in ensuring durability, safety, and performance across industries such as construction, energy, telecommunications, and transportation.

-

Growing Infrastructure Investments

By 2026, increased public and private investments in smart cities, renewable energy projects (especially offshore wind and solar farms), and 5G network rollouts are expected to boost demand for high-performance cable sheaths. Governments in Asia-Pacific (notably China and India), North America, and Europe are prioritizing grid modernization and broadband expansion, directly stimulating the market. -

Shift Toward Sustainable and Eco-Friendly Materials

Environmental regulations and corporate sustainability goals are accelerating the adoption of halogen-free, low-smoke, and flame-retardant (HFFR) sheathing materials. Polyethylene (PE) and polyvinyl chloride (PVC) remain dominant, but bio-based polymers and recyclable thermoplastic elastomers are gaining traction. By 2026, eco-conscious procurement policies are expected to make green cable sheaths a standard in EU and North American markets. -

Rise of High-Temperature and Specialty Sheaths

With the expanding use of electric vehicles (EVs), data centers, and industrial automation, demand for cable sheaths capable of withstanding extreme temperatures, oils, and chemicals is rising. Materials such as cross-linked polyethylene (XLPE), ethylene propylene rubber (EPR), and fluoropolymers are seeing increased adoption. The EV charging infrastructure segment, in particular, is a key growth driver for heat-resistant and abrasion-resistant sheaths. -

Regional Market Dynamics

- Asia-Pacific will remain the largest market due to rapid urbanization and industrial growth, especially in India, Southeast Asia, and Japan.

- Europe is expected to lead in innovation and regulatory compliance, with strong demand for fire-safe and eco-labeled cables.

- North America will see steady growth fueled by infrastructure bills and digital transformation initiatives.

-

Middle East & Africa will experience moderate growth, supported by energy diversification and telecom expansion projects.

-

Technological Integration and Smart Cabling

By 2026, integration of sensors and monitoring systems within cable sheaths—enabling real-time tracking of temperature, stress, and degradation—is expected to emerge in premium applications. This trend, particularly in power transmission and rail sectors, will drive demand for intelligent sheathing solutions. -

Supply Chain Resilience and Material Innovation

Ongoing geopolitical tensions and raw material volatility are prompting manufacturers to diversify sourcing and invest in localized production. Additionally, R&D efforts are focused on nanocomposite sheaths and self-healing polymers to enhance longevity and reduce maintenance costs.

In conclusion, the 2026 cable sheath market will be characterized by material innovation, regulatory influence, and rising demand across high-growth sectors. Companies that prioritize sustainability, adapt to regional requirements, and invest in advanced materials will be best positioned to capture market share in this evolving landscape.

Common Pitfalls Sourcing Cable Sheath (Quality, IP)

Sourcing cable sheaths with the right quality and appropriate Ingress Protection (IP) rating is critical for ensuring the reliability, safety, and longevity of electrical and data cable installations. However, several common pitfalls can compromise performance if not carefully addressed.

Inadequate Material Quality

One of the most frequent issues is selecting cable sheaths made from substandard materials. Low-quality polymers or recycled content may offer short-term cost savings but often lead to premature degradation due to UV exposure, temperature fluctuations, or chemical contact. This can result in cracking, brittleness, or reduced mechanical strength, ultimately compromising cable integrity and safety.

Mismatched IP Rating for Application

A critical oversight is assuming all environments require the same level of protection. Using a cable sheath with an insufficient IP rating (e.g., IP54 in a submersible application requiring IP68) exposes internal conductors to dust, moisture, or water ingress. Conversely, over-specifying (e.g., using IP69K where IP55 suffices) increases costs unnecessarily without added value.

Lack of Certification and Testing Documentation

Many suppliers claim IP ratings without providing verifiable test reports from accredited laboratories. Relying on unverified claims can lead to compliance failures during audits or inspections. Always request and validate third-party test certificates that confirm the sheath’s performance under standardized IP testing conditions.

Poor UV and Weather Resistance

Outdoor or exposed installations often suffer when sheaths lack sufficient UV stabilizers or weather-resistant additives. This results in fading, surface cracking, and reduced mechanical performance over time. Ensure the material is specifically rated for outdoor use and complies with relevant standards (e.g., UL, IEC, or EN).

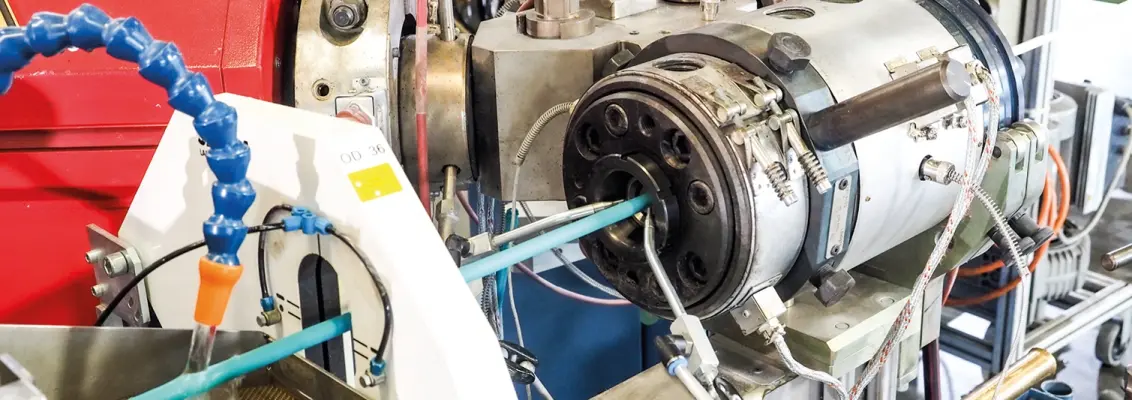

Inconsistent Sheath Thickness and Dimensions

Variations in wall thickness or diameter due to poor manufacturing control can affect the cable’s flexibility, crush resistance, and sealing capability in connectors or glands. This inconsistency may also invalidate the claimed IP rating, especially in press-fit or compression sealing applications.

Ignoring Chemical and Oil Resistance

In industrial environments, exposure to oils, solvents, or cleaning agents can degrade standard sheath materials like PVC. Selecting a sheath without considering chemical resistance (e.g., using PVC instead of PUR or polyethylene) leads to swelling, softening, or disintegration, jeopardizing both mechanical and electrical performance.

Overlooking Long-Term Aging and Flexibility

Some materials perform well initially but degrade under continuous flexing or thermal cycling. For dynamic applications (e.g., robotics or moving machinery), flexible sheaths such as TPE or PUR are essential. Failing to consider flexibility and longevity increases the risk of fatigue cracking and premature failure.

Supplier Reliability and Traceability

Sourcing from unreliable suppliers may result in inconsistent batch-to-batch quality, counterfeit materials, or lack of traceability. This makes it difficult to maintain quality control or respond to field failures. Establish vetted supply chains with documented quality management systems (e.g., ISO 9001) and material traceability.

Avoiding these pitfalls requires thorough technical evaluation, clear specification of requirements, and due diligence in supplier selection—ensuring both quality and correct IP protection are consistently met.

Logistics & Compliance Guide for Cable Sheath

This guide outlines key considerations for the logistics and regulatory compliance associated with the transportation, storage, and handling of cable sheathing materials. Cable sheaths—typically made from polymers like PVC, PE, LSZH, or rubber—are essential for protecting electrical and fiber optic cables, and their safe and compliant management is critical throughout the supply chain.

Material Classification and Handling

Cable sheath materials are generally classified as non-hazardous under international transport regulations when in solid form (e.g., granules, pellets, or fabricated sheathing). However, proper handling procedures must still be followed to prevent contamination, degradation, and workplace hazards. Ensure that all personnel are trained in safe handling practices, including the use of appropriate personal protective equipment (PPE) such as gloves and safety glasses, especially when dealing with raw polymer resins or additives.

Packaging and Storage Requirements

Cable sheath materials—particularly in pellet or powder form—must be stored in sealed, moisture-resistant packaging to prevent hygroscopic absorption and contamination. Store in a cool, dry, well-ventilated area away from direct sunlight and extreme temperatures, as UV exposure and heat can degrade polymer properties. Avoid storing near strong oxidizing agents or flammable materials. Palletized loads should be stacked securely to prevent collapse and ensure warehouse safety.

Transportation Regulations

Domestic and international shipments of cable sheath materials must comply with applicable transportation regulations. While most polymer-based sheathing materials are not classified as dangerous goods (e.g., under ADR, IATA, or IMDG), manufacturers should provide a current Safety Data Sheet (SDS) to confirm classification. If additives (e.g., flame retardants) are present, additional scrutiny may be required. Always label packages clearly with product identification, batch number, net weight, and handling instructions.

Regulatory Compliance

Compliance with environmental and material safety regulations is essential. Key standards include:

– REACH (EU): Ensure that all chemical substances in the sheath materials (e.g., plasticizers, stabilizers) are registered and do not contain substances of very high concern (SVHC) above threshold limits.

– RoHS (EU): Verify that cable sheaths comply with restrictions on hazardous substances such as lead, cadmium, and certain phthalates, especially for electrical applications.

– UL/CSA/IEC Standards: Cable sheaths used in electrical cables must meet flammability, mechanical, and insulation performance standards set by recognized bodies.

– Country-Specific Requirements: Some markets may require additional certifications (e.g., NFPA 79 in the U.S., CCC in China). Confirm local compliance before import or sale.

Environmental and Disposal Considerations

End-of-life cable sheaths may be subject to waste management regulations. Recycling is encouraged, and many polymers (e.g., PE, PP) are recyclable. However, materials containing halogens (e.g., PVC) may require special handling during disposal due to potential dioxin emissions when incinerated. Follow local waste disposal guidelines and maintain records for environmental compliance audits.

Documentation and Traceability

Maintain comprehensive documentation throughout the logistics chain, including:

– Batch-specific certificates of analysis (CoA)

– Safety Data Sheets (SDS) compliant with GHS

– Material compliance declarations (e.g., RoHS, REACH)

– Shipping manifests and customs documentation for international transit

Traceability ensures rapid response in case of non-conformance, recalls, or audits.

Summary

Proper logistics and compliance management for cable sheath materials ensures product integrity, worker safety, and adherence to global regulatory standards. By following best practices in handling, storage, transportation, and documentation, companies can mitigate risks and support sustainable, compliant operations across the supply chain.

Conclusion for Sourcing Cable Sheath:

Sourcing the appropriate cable sheath is a critical decision that directly impacts the performance, safety, durability, and compliance of electrical and data cable systems. Through careful evaluation of material properties—such as flame resistance, UV stability, flexibility, and environmental resilience—along with considerations of application requirements, regulatory standards, and cost-efficiency, an optimal sheathing solution can be identified.

Key factors in successful sourcing include selecting the right material (e.g., PVC, LSZH, PE, or rubber-based compounds), ensuring compliance with international standards (e.g., IEC, UL, RoHS), and partnering with reliable suppliers who maintain consistent quality and provide material traceability. Additionally, sustainability and end-of-life considerations are increasingly influencing sheath material choices, favoring low-smoke zero-halogen (LSZH) and recyclable options.

In conclusion, a strategic and informed approach to sourcing cable sheaths not only enhances product reliability and safety but also supports long-term operational efficiency and environmental responsibility. Continuous collaboration with technical experts and suppliers will ensure adaptability to evolving industry demands and technological advancements.