The global market for cold-formed steel sections, including C-channel products, has experienced steady growth driven by rising demand in construction, infrastructure, and industrial applications. According to Grand View Research, the global cold-formed steel market was valued at USD 68.3 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. Increasing urbanization, the shift toward sustainable building materials, and the growing preference for prefabricated structures are key factors fueling this expansion, creating strong demand for high-quality C-channel steel sections. As structural frameworks in residential, commercial, and industrial buildings increasingly rely on standardized, durable components, leading manufacturers have scaled production capacities and adopted advanced rolling technologies to meet evolving specifications. This data-driven landscape sets the stage for identifying the top nine C-channel size manufacturers excelling in precision, scalability, and global supply chain integration.

Top 9 C-Channel Sizes Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

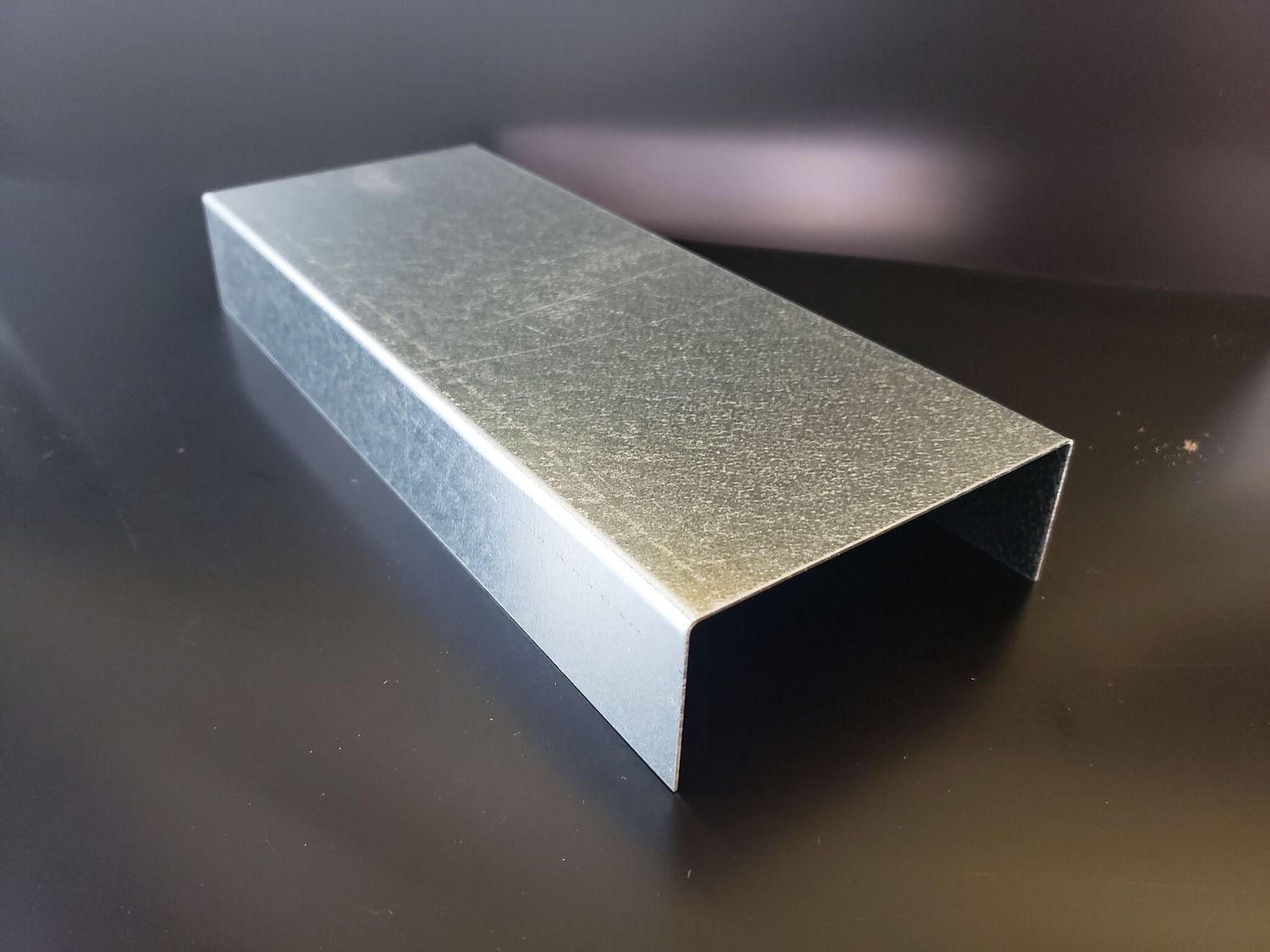

#1 Buy Galvanized Steel C Channel

Domain Est. 2015

Website: westernstatesmetalroofing.com

Key Highlights: Galvanized Steel C Channel is available in a 14 gauge thickness. Buy manufacturer direct & save. Call 877-PURLINS for a quote. Delivery throughout the USA….

#2 Standard Steel Channels Supplier

Domain Est. 1996

Website: saginawpipe.com

Key Highlights: Standard Channel (C Channel): Saginaw carries 3” – 15”; Misc. Channel (MC Channel): 3” – 18”; Bar Size Channel: 3/4” – 2-1/2”. Request A Quote. Channels ……

#3 AISC Page

Domain Est. 1997

Website: aisc.org

Key Highlights: A not-for-profit structural steel technical institute, partners with the AEC community to develop safe and efficient steel specifications and codes….

#4 Standard, Miscellaneous, & Bar Steel Channel

Domain Est. 1997

Website: metalsusa.com

Key Highlights: Metals USA carries a wide variety of material including miscellaneous channel, standard channel, and bar channel. Channels are C-shaped structural ……

#5 A36, A572

Domain Est. 1997

Website: sss-steel.com

Key Highlights: Triple-S Steel is a steel channel supplier that offers a diverse range of steel channel designed to meet various structural and miscellaneous requirements….

#6 Channels

Domain Est. 1999

Website: pennstainless.com

Key Highlights: Penn Stainless Products supplies stainless channels in 304/304L and 316/316L. Larger channels in excess of 24′′ can be manufactured utilizing laser fusion ……

#7 Shop Structural Steel Channel Products

Domain Est. 1999

Website: industrialmetalsupply.com

Key Highlights: 30-day returnsIMS Handles Any Size ASTM Steel Channel Order Quantity. At IMS, we provide unsurpassed C channel steel next-day delivery or same-day will ……

#8 Metal C

Domain Est. 2004 | Founded: 1948

Website: johnsonrollforming.com

Key Highlights: Since 1948, Johnson Brothers has manufactured Metal channels including C Channels & Box Channels. We also specialize in Open Seam Tubing….

#9 Stainless steel channels

Domain Est. 2005

Website: stainless-structurals.com

Key Highlights: We produce and distribute hot rolled and laser fused stainless steel channels throughout the world in both imperial and metric sizes….

Expert Sourcing Insights for C-Channel Sizes

H2: Market Trends for C-Channel Sizes in 2026

As we approach 2026, the global market for C-channel steel sections—widely used in construction, automotive, logistics, and industrial applications—reflects evolving demands driven by technological innovation, sustainability mandates, and shifts in manufacturing and infrastructure development. Below are key trends shaping the C-channel sizes market in 2026:

-

Increasing Demand for Lighter and High-Strength Grades

Manufacturers are prioritizing high-strength low-alloy (HSLA) steel C-channels to reduce weight while maintaining structural integrity. This trend is especially prominent in the automotive and transportation sectors, where fuel efficiency and emission standards are pushing demand for lightweight yet durable materials. In 2026, C-channels in smaller dimensions (e.g., 2–6 inches) with higher yield strengths (550 MPa and above) are seeing accelerated adoption. -

Growth in Modular and Prefabricated Construction

The construction industry’s shift toward modular and off-site building techniques is boosting demand for standardized C-channel profiles. Mid-sized C-channels (6–10 inches) are widely used in framing systems, mezzanines, and support structures. By 2026, precision-engineered, galvanized C-channels with consistent tolerances are preferred for rapid assembly and durability in prefabricated buildings. -

Regional Infrastructure Expansion Driving Volume

Government-led infrastructure projects in Asia-Pacific, North America, and parts of Africa are major demand drivers. In the U.S., the Infrastructure Investment and Jobs Act continues to stimulate construction activity, increasing the need for C-channels in bridges, warehouses, and utility structures. In India and Southeast Asia, urbanization and industrial park development are favoring larger C-channel sizes (8–12 inches) for heavy-duty applications. -

Sustainability and Recycled Content Standards

Environmental regulations are pushing steel producers to increase recycled content and reduce carbon emissions. By 2026, green building certifications (e.g., LEED, BREEAM) are influencing procurement decisions, with contractors favoring C-channels made from recycled steel and produced via electric arc furnaces (EAF). This trend is reshaping supply chains and favoring manufacturers with transparent sustainability reporting. -

Digitalization and Customization via Industry 4.0

Advancements in digital design (BIM) and automated fabrication allow for greater customization of C-channel dimensions and lengths. In 2026, just-in-time manufacturing and direct integration with CAD systems enable structural engineers to specify non-standard sizes with minimal lead time, reducing waste and improving project efficiency. -

Competitive Pricing Pressures and Supply Chain Resilience

Ongoing geopolitical tensions and fluctuating raw material costs (especially iron ore and scrap) are prompting buyers to seek regional suppliers to mitigate logistics risks. This is leading to a rise in localized production hubs and long-term supply contracts. Price volatility is also encouraging the use of alternative materials in non-critical applications, though C-channel steel remains dominant due to its cost-performance balance. -

Technological Innovations in Coatings and Corrosion Resistance

Demand for long-lasting, low-maintenance C-channels is driving innovation in protective coatings. In 2026, aluminized and zinc-aluminum-magnesium (ZAM) coated C-channels are gaining market share, especially in coastal and corrosive environments. These advanced coatings extend service life, reducing lifecycle costs in infrastructure and industrial applications.

Conclusion:

The C-channel sizes market in 2026 is characterized by a dual focus on performance efficiency and sustainability. While standard sizes remain in high demand, there is growing segmentation based on application-specific requirements. Manufacturers who invest in high-strength materials, eco-friendly production, and digital integration are best positioned to lead in this evolving landscape.

Common Pitfalls When Sourcing C-Channel Sizes (Quality, IP)

Sourcing C-channel steel sections—commonly used in construction, manufacturing, and structural applications—can present several challenges, particularly concerning material quality and intellectual property (IP) considerations. Being aware of these pitfalls helps ensure project integrity, compliance, and long-term performance.

Quality-Related Pitfalls

1. Inconsistent Material Specifications

One of the most frequent issues is receiving C-channel sections that do not meet specified standards (e.g., ASTM A36, A572, or EN 10219). Suppliers may substitute lower-grade materials or fail to provide mill test certificates (MTCs), leading to compromised structural integrity.

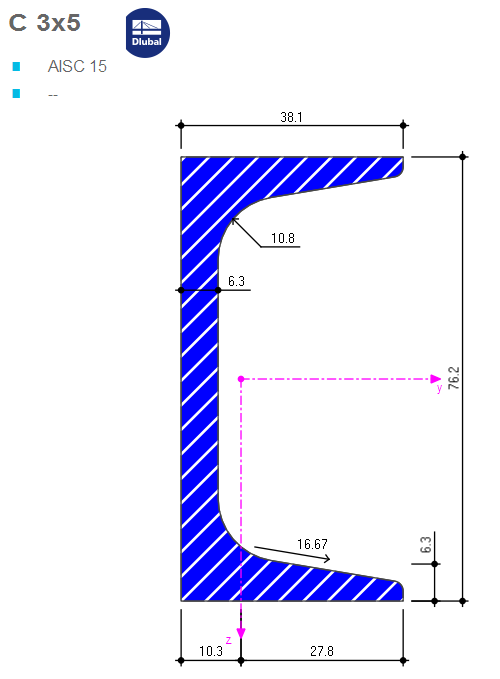

2. Dimensional Inaccuracies

C-channels must adhere to precise dimensional tolerances. Poor-quality suppliers may deliver products with variations in flange width, web thickness, or overall depth, affecting fitment and load-bearing performance in assemblies.

3. Poor Surface Finish and Corrosion Resistance

Low-quality C-channels often exhibit surface defects such as scale, cracks, or inconsistent galvanization. This reduces corrosion resistance and longevity, especially in outdoor or high-moisture environments.

4. Lack of Traceability and Certification

Reputable projects require full traceability of materials. Sourcing from suppliers who do not provide heat numbers, test reports, or compliance documentation increases risk and may lead to rejection during inspections.

5. Counterfeit or Recycled Material Misrepresentation

Some suppliers may pass off recycled or downgraded steel as virgin, high-strength material. Without proper verification, this can result in premature failure and safety hazards.

Intellectual Property (IP) Pitfalls

1. Unauthorized Use of Proprietary Designs

Some C-channel profiles are part of patented structural systems (e.g., proprietary framing systems in modular construction). Sourcing generic versions that mimic protected designs can lead to IP infringement claims, especially in patented building technologies.

2. Copying Patented Section Profiles

Certain manufacturers develop C-channels with optimized geometries (e.g., improved load-to-weight ratios) protected by design or utility patents. Replicating these profiles without licensing can expose end-users or fabricators to legal action.

3. Misuse of Branding and Specifications

Using branded specifications (e.g., quoting a specific manufacturer’s product) while substituting a generic or unlicensed alternative may violate trademark or contractual agreements, especially in public or government projects requiring brand-equivalency justification.

4. Lack of Due Diligence in Design Integration

Engineers and contractors may unknowingly integrate C-channel profiles into designs without verifying whether the profile or its application is covered by third-party IP. This becomes problematic in mass-produced products or patented construction methods.

Best Practices to Avoid Pitfalls

- Always source from certified suppliers with documented quality management systems (e.g., ISO 9001).

- Request and verify mill test reports and material certifications.

- Audit suppliers periodically for consistency and compliance.

- Conduct dimensional and metallurgical inspections upon delivery.

- Consult legal or IP experts when replicating or substituting branded or patented profiles.

- Clearly define material specifications in procurement documents to avoid ambiguity.

By addressing these quality and IP concerns proactively, organizations can mitigate risks and ensure the performance, legality, and durability of their structural systems using C-channel sections.

Logistics & Compliance Guide for C-Channel Sizes

This guide outlines key considerations for the logistics and regulatory compliance associated with transporting and handling standard C-channel steel sections. Proper planning ensures safe, efficient delivery and adherence to industry and legal standards.

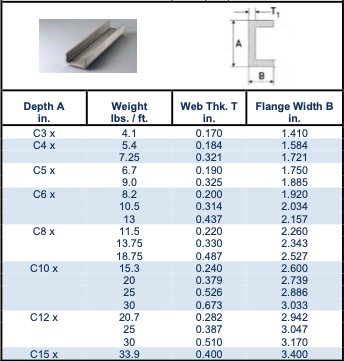

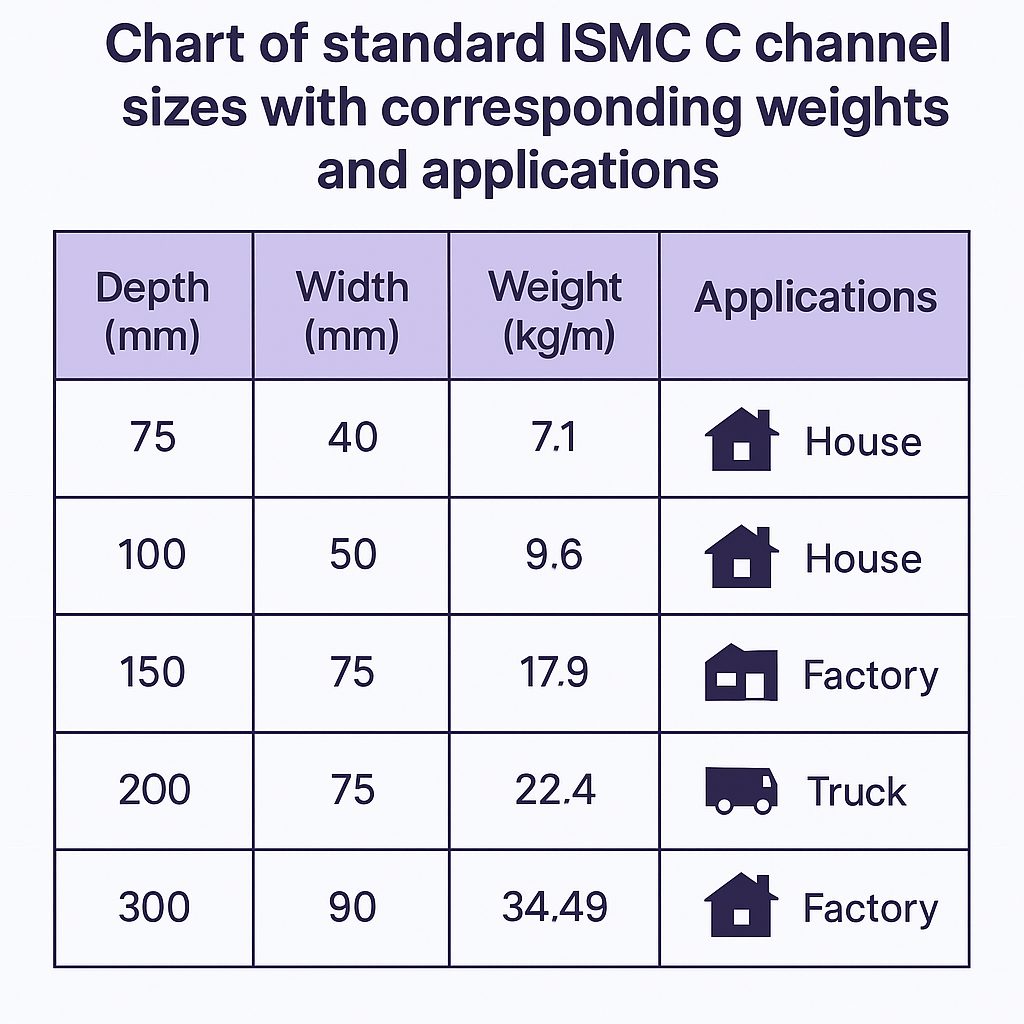

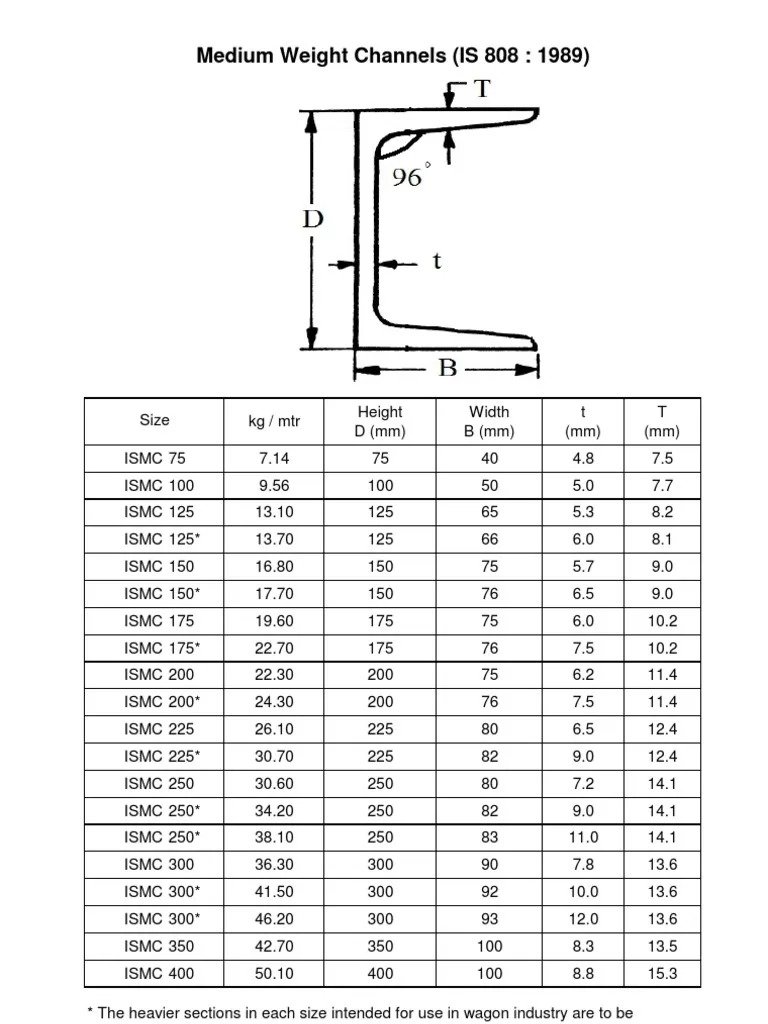

Standard C-Channel Dimensions and Weight Considerations

C-channels are structural steel shapes with a “C” cross-section, commonly used in construction, manufacturing, and infrastructure. They are available in a range of sizes defined by:

- Depth (height): Typically ranges from 1 inch to 15 inches.

- Flange width: Usually between 1 inch and 3.5 inches.

- Web thickness: Varies from 0.125 inches to over 0.6 inches.

- Length: Standard mill lengths are 20, 40, or 60 feet; custom cuts available.

Weight per foot increases with size and material grade (e.g., A36, A572). Accurate weight calculations are crucial for load planning and transportation compliance.

Transportation and Load Securing Requirements

Transporting C-channels requires adherence to:

- FMCSA (Federal Motor Carrier Safety Administration) Load Securement Rules (49 CFR Part 393): Steel beams must be secured using tiedowns, cradles, or blocking to prevent shifting.

- Minimum tiedowns: One tiedown for loads up to 5 ft; additional tiedowns required for longer or heavier loads (typically one per 10 ft or 5,000 lbs).

- Edge protection: Use softeners or dunnage to prevent tiedown damage from sharp edges.

Over-dimensional loads (exceeding 8.5 ft width, 13.5 ft height, or 53 ft length) require special permits, route planning, and signage.

International Shipping and Customs Compliance

For cross-border or overseas shipments:

- HS Code Classification: Steel C-channels generally fall under HS 7216.31 or 7216.33, depending on specification and finish.

- CO (Certificate of Origin): Required by many countries for tariff determination.

- ISPM 15: Wooden dunnage or pallets must be heat-treated and stamped.

- RoHS/REACH (EU): Verify material compliance if used in regulated applications.

Proper documentation (commercial invoice, packing list, bill of lading) must reflect exact dimensions, grade, and quantity.

Handling and On-Site Safety Protocols

On-site handling must follow OSHA and ANSI standards:

- Lifting equipment: Use slings, spreader bars, or magnetic lifters rated for the load.

- PPE: Workers must wear gloves, steel-toed boots, and eye protection.

- Storage: Store on level ground with dunnage to prevent moisture corrosion and maintain straightness.

Avoid dragging or dropping C-channels to prevent deformation and safety hazards.

Environmental and Material Compliance

Ensure C-channel materials meet regulatory standards:

- AISC (American Institute of Steel Construction): Verifies structural integrity.

- ASTM Standards: Confirm material properties (e.g., ASTM A36 for general use).

- Recyclability: Steel C-channels are 100% recyclable; document recycling compliance if required.

Projects under LEED or green building standards may require recycled content documentation.

Final Inspection and Documentation

Before shipment or installation:

- Verify cut lengths, hole patterns, and surface finish per specifications.

- Retain mill test reports (MTRs) for traceability.

- Confirm compliance with project-specific requirements (e.g., SSPC paint standards, galvanization).

Maintaining accurate logs supports quality assurance and regulatory audits.

By following this guide, logistics managers, contractors, and compliance officers can ensure safe, lawful, and efficient handling of C-channel structural members across the supply chain.

Conclusion on Sourcing C-Channel Sizes:

In conclusion, sourcing the appropriate C-channel sizes requires a careful balance between structural requirements, material availability, cost efficiency, and application-specific needs. Standard C-channel sizes are widely available in common dimensions and gauges from major steel and metal suppliers, making them accessible for a variety of construction, automotive, and industrial applications. However, specialty or custom sizes may require direct coordination with manufacturers, leading to longer lead times and increased costs.

To effectively source C-channel sections, it is essential to:

- Define project specifications clearly, including load requirements, length, thickness (gauge), material type (e.g., carbon steel, aluminum), and finish.

- Leverage supplier catalogs and online databases from reputable metal distributors to compare available standard sizes.

- Consider local availability and lead times, especially for urgent projects, to avoid delays.

- Evaluate cost versus performance, recognizing that while standard sizes are more economical, non-standard dimensions may offer better structural efficiency.

- Engage with suppliers early—especially when custom sizes are needed—to confirm feasibility and optimize manufacturing and delivery timelines.

Ultimately, aligning design requirements with market availability ensures efficient sourcing of C-channel sections, supporting both structural integrity and project cost-effectiveness.