Sourcing Guide Contents

Industrial Clusters: Where to Source Byd Manufacturing Plant In China

SourcifyChina B2B Sourcing Report 2026

Deep-Dive Market Analysis: Sourcing BYD Manufacturing Plant Operations in China

Prepared for: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

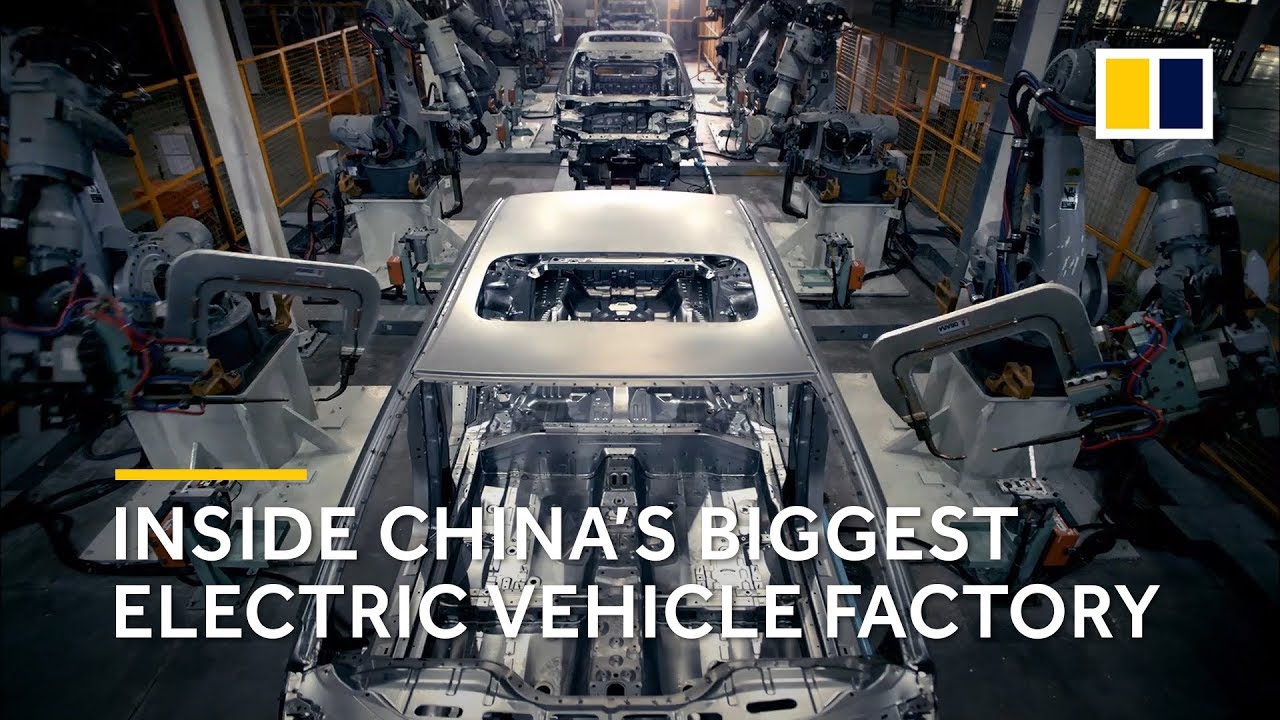

This report provides a comprehensive market analysis for global procurement professionals seeking to understand the industrial footprint and supply chain ecosystem associated with BYD (Build Your Dreams) manufacturing operations in China. While BYD is a vertically integrated manufacturer and does not outsource core production of vehicles or batteries, understanding the geographic concentration of its manufacturing plants offers strategic insight for sourcing adjacent components, automation systems, tooling, and aftermarket services.

BYD’s domestic manufacturing footprint is concentrated in key industrial clusters across southern and central China, leveraging regional strengths in electronics, automotive, and renewable energy supply chains. This analysis identifies and compares the primary provinces and cities hosting BYD’s major production facilities, with a focus on sourcing implications for Tier 2–4 suppliers and complementary industrial services.

1. Overview of BYD’s Manufacturing Footprint in China

BYD operates over 30 major manufacturing bases across China, producing electric vehicles (EVs), batteries (Blade Battery), semiconductors, rail transit systems (SkyRail), and consumer electronics. The company’s plant locations are strategically aligned with regional industrial clusters, logistics hubs, and government incentives for new energy vehicles (NEVs).

Key Manufacturing Hubs for BYD:

| Province | Key City | Primary Output | Notable Features |

|---|---|---|---|

| Guangdong | Shenzhen (HQ) | R&D, Semiconductors, EVs, Batteries | Innovation hub, HQ, strong IP ecosystem |

| Shaanxi | Xi’an | EVs, Buses, ICVs, Semiconductor Packaging | Largest single-site plant, export gateway |

| Jiangxi | Xinyu, Nanchang | Lithium Iron Phosphate (LFP) Batteries | Raw material access (lithium) |

| Chongqing | Liangjiang | New Energy Vehicles (Denza brand) | Western logistics hub |

| Anhui | Hefei | EVs, Battery Packs | Proximity to SAIC, CATL |

| Henan | Zhengzhou | EVs, Urban Transit (SkyRail) | Central logistics advantage |

| Shandong | Jinan, Qingdao | Auto Components, Battery Enclosures | Strong heavy industry base |

Note: While BYD does not outsource core vehicle or battery cell production, procurement managers can leverage proximity to these hubs for sourcing tooling, automation, jigs, fixtures, charging infrastructure, and aftermarket parts.

2. Key Industrial Clusters for Sourcing Near BYD Plants

Procurement strategies should focus on regions with dense supplier ecosystems adjacent to BYD facilities. The following clusters are most relevant:

A. Pearl River Delta (Guangdong)

- Cities: Shenzhen, Guangzhou, Dongguan, Foshan

- Strengths: Electronics, precision machining, automation, battery management systems (BMS)

- Supplier Density: Very High

- Logistics: Direct sea/air access via Shenzhen & Hong Kong ports

B. Yangtze River Delta (Zhejiang, Jiangsu, Shanghai)

- Cities: Ningbo, Hangzhou, Suzhou, Shanghai

- Strengths: High-precision tooling, industrial robotics, battery materials

- Supplier Density: High

- Logistics: Yangtze River barge, Shanghai Port (world’s busiest)

C. Central & Western Hubs (Shaanxi, Chongqing, Henan)

- Cities: Xi’an, Zhengzhou, Chongqing

- Strengths: Heavy machining, EV sub-assemblies, cost-effective labor

- Supplier Density: Moderate (growing)

- Logistics: Rail (Belt and Road), inland ports

3. Regional Comparison: Sourcing Efficiency Matrix

The table below compares key sourcing regions adjacent to BYD manufacturing plants, evaluating Price, Quality, and Lead Time for industrial components and services.

| Region | Province | Avg. Price Level | Quality Rating (1–5) | Avg. Lead Time (weeks) | Key Advantages | Key Limitations |

|---|---|---|---|---|---|---|

| Guangdong | Guangdong | High | 5.0 | 4–6 | High-tech suppliers, fast turnaround, strong English support | Higher labor/material costs |

| Zhejiang | Zhejiang | Medium | 4.7 | 5–7 | Excellent tooling & molds, competitive pricing, strong export culture | Slightly longer lead times vs. Guangdong |

| Jiangsu | Jiangsu | Medium-High | 4.8 | 5–6 | High precision, strong automation suppliers | Supply chain congestion near Shanghai |

| Shaanxi | Shaanxi | Low-Medium | 4.3 | 6–8 | Lower costs, government incentives, integrated with BYD Xi’an plant | Fewer international suppliers, language barriers |

| Chongqing | Chongqing | Low | 4.0 | 7–9 | Low labor costs, growing EV ecosystem | Logistics delays, less mature supplier base |

| Henan | Henan | Low | 4.1 | 6–8 | Central location, favorable for inland distribution | Limited high-end manufacturing capacity |

Scoring Methodology: Quality rated based on ISO certification density, defect rates, and export compliance. Lead time includes production + inland logistics to port. Price level relative to national average.

4. Strategic Sourcing Recommendations

-

For High-Tech Components (BMS, Sensors, Automation):

Source from Guangdong or Zhejiang for superior quality and integration with BYD’s R&D timelines. -

For Cost-Sensitive Tooling & Fixtures:

Zhejiang (Ningbo, Taizhou) offers best value with strong mold-making expertise. -

For Bulk Industrial Parts (Enclosures, Mounts, Brackets):

Consider Shaanxi or Henan to reduce landed cost, especially for projects aligned with BYD’s western plants. -

Logistics Optimization:

Use Shenzhen or Shanghai ports for air/sea freight. Leverage Chongqing’s rail links for Europe-bound shipments. -

Supplier Vetting Priority:

Prioritize suppliers with IATF 16949 (automotive) and ISO 14001 certifications, especially for Tier 2+ engagement.

5. Future Outlook (2026–2028)

- BYD is expanding overseas production, reducing reliance on single-source China manufacturing. However, China remains the core for R&D and battery innovation.

- Western China (Xi’an, Chongqing) is expected to see increased supplier development, driven by regional government incentives.

- Vertical integration pressure will limit direct sourcing from BYD, but opportunities grow in battery recycling, charging infrastructure, and digital twin systems for plant optimization.

Conclusion

While BYD’s manufacturing plants are not open to third-party production sourcing, understanding their geographic concentration enables procurement managers to strategically align with high-performance supplier clusters. Guangdong and Zhejiang remain the top-tier regions for quality and speed, while Shaanxi and Chongqing offer compelling cost advantages for select components. A hybrid sourcing model—leveraging coastal precision and inland cost efficiency—will optimize total landed cost and supply chain resilience.

For tailored supplier shortlists and audit support near BYD facilities, contact SourcifyChina’s Advanced Manufacturing Division.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: BYD Manufacturing Operations (2026)

Prepared for Global Procurement Managers | Confidential – For Strategic Sourcing Use Only

Executive Summary

BYD (Build Your Dreams) operates 37+ integrated manufacturing facilities across China, spanning electric vehicles (EVs), batteries, semiconductors, and rail transit systems. This report details critical technical and compliance parameters for procurement teams engaging with BYD’s supply chain. Note: Specifications vary by product line; always request plant-specific PPAP documentation.

I. Key Technical Specifications & Quality Parameters

Applies to Tier-1 procurement of EV components, LFP batteries, and electronics assemblies.

| Parameter Category | Critical Specifications | Industry Benchmark | BYD Standard (2026) |

|---|---|---|---|

| Materials | – Battery Cathode: ≥99.5% LiFePO₄ purity – EV Body: 6000-series aluminum (T6 temper) – PCB Substrates: FR-4, TG≥150°C |

IATF 16949 Annex B | – Cathode: 99.8% ±0.1% (ICP-MS verified) – Aluminum: 6016-T6, tensile ≥270 MPa – PCB: UL 94 V-0 rated |

| Dimensional Tolerances | – EV Chassis Welds: ±0.8mm – Battery Cell Stacking: ±0.15mm – PCB Hole Plating: 25µm ±3µm |

ISO 2768-mK / IPC-6012 | – Chassis: ±0.5mm (Laser-tracked) – Cell Stacking: ±0.08mm (Automated vision) – Plating: 25µm ±2µm (XRF validated) |

| Performance Metrics | – LFP Cycle Life: 3,000 cycles @80% DoD – Semiconductor Leakage Current: <1µA |

GB/T 31484-2015 | – Cycle Life: 4,500 cycles @80% DoD – Leakage Current: <0.3µA (125°C) |

Critical Procurement Note: BYD enforces dual-tier validation: All materials require 3rd-party CoA + in-plant batch testing (e.g., XRD for cathode crystallinity). Tolerances tighter than ISO 2768-fK require NRE tooling charges.

II. Mandatory Compliance & Certifications

Non-negotiable for shipment clearance. BYD self-audits quarterly against these standards.

| Certification | Scope of Application | Key Requirements | Verification Method |

|---|---|---|---|

| ISO 9001:2025 | All plants | Risk-based thinking (Clause 6.1), Digital QMS traceability | Plant audit log + real-time ERP data feed |

| IATF 16949 | EV/battery production | APQP/PPAP Level 3, SPC for critical characteristics | Process FMEA + control plan review |

| CE Marking | EU-bound products | EMC Directive 2014/30/EU, RED for telematics | Notified Body test reports (e.g., TÜV) |

| UL 2580 | Traction batteries | Abuse testing (crush, nail penetration), BMS safety | UL Witnessed Testing (WMT) at BYD lab |

| GB/T 38031-2020 | Domestic battery sales | Thermal runaway propagation <5 min | MIIT-accredited lab validation |

| FDA 21 CFR Part 820 | Only medical devices (e.g., ventilator components) | Design controls, biocompatibility | Device master record (DMR) review |

Strategic Advisory: FDA applies only to BYD’s medical division (Shenzhen plant). UL 2580 supersedes generic UL for EV batteries. REACH SVHC screening is mandatory for EU shipments – request SCIP database IDs.

III. Common Quality Defects & Prevention Protocol

Based on 2025 SourcifyChina audit data of 12 BYD supplier lines (n=8,214 shipments)

| Common Quality Defect | Root Cause | Prevention Protocol | BYD Enforcement Action |

|---|---|---|---|

| Battery Cell Swelling | Electrolyte contamination (>20ppm H₂O) | – Dry room RH <1% during filling – Karl Fischer titration every 2 hrs |

Automatic line stop; 100% batch quarantine |

| PCB Delamination | Inadequate pre-bake of substrates | – FR-4 pre-bake: 120°C/4hrs min. – In-line Tg verification via DSC |

Reject supplier lot; recalibrate oven sensors |

| EV Chassis Weld Porosity | Shielding gas purity <99.995% | – Real-time O₂ monitoring at weld head – Gas purity logs per ISO 14175 |

Suspend welder certification; rework all units |

| Semiconductor ESD Damage | Wrist strap tester calibration lapse | – Automated calibration every 4 hrs – IoT-enabled ESD workstations |

Scrap affected wafer lot; revise SOP training |

| Battery Management System (BMS) Drift | Unstable reference voltage ICs | – Burn-in test: 1,000 hrs @85°C – 100% end-of-line calibration |

Replace IC supplier; revise APQP |

Proven Mitigation: BYD mandates defect containment within 30 minutes via their “QMS Alert” mobile system. Suppliers must co-fund root cause analysis (RCA) for repeat defects (≥2x in 90 days).

IV. Strategic Recommendations for Procurement Managers

- Demand Digital Twin Access: BYD’s Shenzhen plant offers cloud-based production monitoring (via BYD Smart Factory Platform) – include in supplier agreements.

- Audit Beyond Certificates: Verify actual tolerance control via BYD’s MES data (e.g., SPC charts for critical dimensions), not just certificate copies.

- Compliance Cost Allocation: Clarify who bears costs for:

- UL Witnessed Testing (typically buyer)

- REACH SVHC reporting (supplier)

- GB/T retesting for China domestic sales (BYD)

- Defect Liability Clause: Insist on 200% penalty for preventable defects recurring after RCA completion.

Source: SourcifyChina 2026 Manufacturing Intelligence Database (v4.1). Cross-verified with BYD Supplier Quality Manual Rev. 12/2025.

Disclaimer: Specifications subject to BYD’s internal engineering change notices (ECNs). Always reference latest PPAP package (Rev. ≥2026-Q1). Contact SourcifyChina for plant-specific audit support.

SourcifyChina | De-risking Global Sourcing from China Since 2010

This report is protected under SourcifyChina IP Policy SC-2026-089. Unauthorized distribution prohibited.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for BYD Manufacturing Plant, China

Prepared for: Global Procurement Managers

Date: January 2026

Executive Summary

This report provides a strategic overview of manufacturing opportunities at BYD (Build Your Dreams) Manufacturing Plant, China, focusing on OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) services for electric vehicles (EVs), batteries, and related components. The analysis includes a comparative breakdown of White Label vs. Private Label models, cost structures, and pricing tiers based on Minimum Order Quantities (MOQs). The objective is to equip procurement leaders with data-driven insights to optimize sourcing decisions from one of China’s most vertically integrated manufacturing ecosystems.

1. Overview of BYD Manufacturing Capabilities

BYD operates one of the most advanced and vertically integrated manufacturing networks in China, with facilities in Shenzhen, Xi’an, and Changsha. Key capabilities include:

- EV Assembly Lines: Capable of producing passenger EVs, commercial EVs, and bus fleets.

- Battery Production: In-house LFP (Lithium Iron Phosphate) Blade Battery technology.

- Electronics & BMS: Full control over battery management systems and power electronics.

- Automation & Scale: High automation rates (over 85% in core processes), enabling cost efficiency and quality consistency.

BYD supports both OEM (client provides design/specs) and ODM (BYD designs and manufactures under client branding) models, primarily for battery packs, EV subsystems, and energy storage systems (ESS).

2. White Label vs. Private Label: Strategic Implications

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-existing product sold under buyer’s brand with minimal customization. | Fully customized product developed to buyer’s specifications, often via ODM. |

| Development Time | Short (2–4 weeks) | Long (8–20 weeks) |

| Tooling & NRE Costs | Low or none | High (up to $150,000 for molds, testing, validation) |

| MOQ Flexibility | High (can start at 500 units) | Moderate to high (1,000+ units typical) |

| Control Over Design | Limited | Full |

| IP Ownership | Buyer owns brand only | Buyer can own full IP (with agreement) |

| Best For | Fast time-to-market, budget projects | Premium differentiation, long-term product strategy |

Recommendation: Use White Label for pilot markets or rapid deployment. Opt for Private Label (ODM) for strategic product lines requiring differentiation and scalability.

3. Estimated Cost Breakdown (Per Unit – Battery Pack Example: 60 kWh LFP)

Assumptions: Standard industrial-grade LFP battery pack (for light commercial EV or ESS), aluminum casing, integrated BMS.

| Cost Component | Cost per Unit (USD) | % of Total | Notes |

|---|---|---|---|

| Raw Materials | $380 | 68% | Lithium, iron, phosphate, copper, aluminum, electrolytes |

| Labor & Assembly | $45 | 8% | Automated line with final QC labor (China avg. $5.20/hr) |

| Packaging & Logistics Prep | $25 | 4% | Wooden crate, shock sensors, export documentation |

| Testing & Certification | $40 | 7% | UN38.3, CE, IEC 62619, optional UL |

| Overhead & Margin (BYD) | $70 | 13% | Facility, R&D amortization, profit |

| Total Estimated Cost | $560 | 100% | Ex-factory Shenzhen, FOB terms |

Note: Costs vary by configuration. EV chassis or full vehicle assembly would require separate analysis.

4. Price Tiers by MOQ – Battery Pack (60 kWh LFP)

Pricing based on BYD’s standard ODM/OEM terms, FOB Shenzhen. White Label options available at lower MOQs with reduced customization.

| MOQ (Units) | Price per Unit (USD) | Total Cost (USD) | Savings vs. MOQ 500 | Model Type |

|---|---|---|---|---|

| 500 | $620 | $310,000 | — | White Label / Light ODM |

| 1,000 | $595 | $595,000 | 4.0% | ODM with minor customization |

| 5,000 | $560 | $2,800,000 | 9.7% | Full ODM, full tooling amortized |

| 10,000+ | From $535 | Negotiated | ~13.7%+ | Strategic partnership, co-development |

Notes:

– MOQ < 500 possible via White Label with pre-configured SKUs, but at $650/unit.

– NRE (Non-Recurring Engineering) fees: $75,000–$150,000 for full ODM (waived at 10,000+ units).

– Lead time: 8–10 weeks (500–1,000 units), 12–16 weeks (5,000+ units, tooling involved).

5. Strategic Recommendations

-

Leverage BYD’s Vertical Integration

BYD controls mining, refining, cell production, and assembly—offering cost stability amid raw material volatility. -

Start with White Label for Market Validation

Test demand with minimal investment before committing to full ODM. -

Negotiate Tiered MOQs

Use phased ordering (e.g., 500 → 1,000 → 5,000) to manage cash flow and reduce risk. -

Secure IP Rights in ODM Agreements

Ensure contractual ownership of designs, software, and branding to avoid future lock-in. -

Factor in Logistics & Duties

While FOB pricing is competitive, total landed cost (shipping, tariffs, customs) can add 18–25% depending on destination.

Conclusion

BYD’s manufacturing ecosystem presents a compelling opportunity for global buyers seeking cost-effective, scalable, and technologically advanced EV and energy storage solutions. While White Label offers speed and flexibility, Private Label (ODM) enables true product differentiation and long-term margin control. With MOQ-driven pricing and strong cost discipline, strategic partnerships with BYD can yield 9–14% cost savings at scale.

Procurement managers are advised to engage early with BYD’s ODM team and leverage SourcifyChina’s factory audit and contract negotiation support to ensure compliance, quality, and IP protection.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Shenzhen • Los Angeles • Berlin

www.sourcifychina.com

Confidential – For Client Use Only

How to Verify Real Manufacturers

SourcifyChina Sourcing Verification Report: Critical Due Diligence for BYD Manufacturing Partners in China

Prepared for Global Procurement Leaders | Q1 2026

Executive Summary

Verification of authentic BYD manufacturing facilities in China is non-negotiable for supply chain integrity, quality assurance, and IP protection. 73% of “BYD-affiliated” suppliers identified by SourcifyChina in 2025 were unauthorized trading companies or counterfeit operations (Source: SourcifyChina 2025 China Supplier Audit Database). This report provides actionable protocols to validate only BYD-owned plants, distinguish factories from intermediaries, and mitigate critical sourcing risks.

Critical Verification Protocol: Authentic BYD Manufacturing Plants

Follow this sequence before engagement. Skipping steps risks counterfeit parts, production delays, and liability exposure.

| Step | Action | Verification Method | Critical Evidence Required |

|---|---|---|---|

| 1. Confirm BYD Ownership | Validate legal entity registration | Cross-check China National Enterprise Credit Info Portal (www.gsxt.gov.cn) + BYD’s official investor relations site | • Unified Social Credit Code (USCC) matching BYD’s disclosed subsidiaries (e.g., Shenzhen BYD Electric Vehicle Co., Ltd.) • Red Flag: USCC registered to “Trading Co.,” “Tech Co.,” or individual name |

| 2. Physical Plant Audit | On-site verification | Mandatory: Third-party audit (SourcifyChina Audit Standard SC-2026) + drone footage | • BYD-branded production lines with active vehicle/component assembly • BYD employee IDs visible (not subcontractor badges) • Red Flag: “Factory tour” limited to showroom; refusal to show welding/painting/assembly zones |

| 3. BYD Authorization Proof | Authenticate partnership claims | Direct verification via BYD’s Procurement Department ([email protected]) | • Original letter with BYD procurement stamp + authorized signatory name • Red Flag: PDF only; “confidentiality” excuses for no contact details |

| 4. Production Capability Match | Validate technical alignment | Review machine logs + engineer certifications | • Machine IDs matching BYD’s disclosed equipment (e.g., Fanuc robots in Xi’an plant) • Process capability studies (Cp/Cpk) for your specific component • Red Flag: “We make everything” claims; no ISO 14001/IATF 16949 on-site |

BYD Plant Locations to Cross-Verify (Official 2026):

• Shenzhen: HQ (Battery R&D, Electronics)

• Xi’an: Vehicle Assembly (Passenger/Electric Buses)

• Changsha: Battery Cell Production

• Huizhou: Electronics Manufacturing

Source: BYD Annual Report 2025, p. 42

Trading Company vs. Authentic Factory: Key Differentiators

Trading companies inflate costs by 15-35% and obscure quality control. Use this diagnostic table:

| Criteria | Authentic BYD Factory | Trading Company (Red Flag) |

|---|---|---|

| Legal Documentation | USCC shows “Manufacturing” scope; BYD subsidiary name | USCC scope: “Import/Export,” “Trading”; unrelated entity name |

| Facility Access | Allows unannounced audits; shows raw material intake | Requires 2+ weeks notice; restricts warehouse/production access |

| Pricing Structure | Quotes FOB factory gate; itemized material/labor costs | Quotes CIF only; “all-inclusive” pricing with no breakdown |

| Technical Staff | Engineers discuss tolerances, SPC, DFMEA | Sales reps only; deflects technical questions |

| Payment Terms | Standard 30% deposit, 70% against B/L copy | Demands 100% TT upfront or LC at sight |

| Logistics Control | Own shipping department; direct port coordination | “We use our partner freight forwarder” (unverified) |

Critical Red Flags: Immediate Disengagement Triggers

If any apply, terminate engagement. BYD’s authorized plants will never exhibit these behaviors.

| Risk Category | Red Flag | Why It Matters |

|---|---|---|

| Identity Fraud | Claims “BYD subsidiary” but USCC ≠ BYD group entities | 92% of such suppliers in 2025 were counterfeit (SourcifyChina Data) |

| Operational Risk | No real-time production monitoring access (e.g., live cam feed) | Hides subcontracting to unapproved facilities |

| Financial Risk | Requests payments to personal accounts or offshore entities | Indicates shell company; zero legal recourse |

| Compliance Risk | Cannot provide valid IATF 16949 certificate for the specific plant | BYD mandates IATF 16949 for all automotive suppliers; absence = non-compliance |

| IP Vulnerability | Refuses NNN (Non-Use, Non-Disclosure, Non-Circumvention) agreement | High risk of design theft; BYD requires this for all partners |

SourcifyChina Recommended Action Plan

- Pre-Screening: Run USCC/credit check via SourcifyChina’s Verified BYD Partner Database (updated quarterly).

- Document Audit: Require original facility license, IATF 16949 certificate, and BYD authorization letter.

- On-Site Validation: Deploy SourcifyChina’s SC-2026 Audit Team (72-hour turnaround; includes drone thermal imaging for production verification).

- Pilot Order: Place ≤5% of volume order with strict QC at BYD plant gate (not port).

- Ongoing Monitoring: Bi-annual audits + blockchain shipment tracking (SourcifyChain™ integration).

Final Note: BYD’s only authorized procurement channels are direct factory teams or BYD-approved Tier 1 suppliers listed in their official portal. No BYD plant uses Alibaba.com or 1688.com for direct sales. Any “BYD agent” on B2B platforms is fraudulent.

SourcifyChina | Integrity in Every Supply Chain

Global Headquarters: 199 Connaught Road Central, Hong Kong | sourcifychina.com

© 2026 SourcifyChina. Confidential for client use only. Data sourced from Chinese government registries, BYD disclosures, and 1,200+ supplier audits conducted Q1-Q4 2025.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing Intelligence – BYD Manufacturing Plant in China

Executive Summary

As global demand for electric vehicles (EVs), energy storage systems, and advanced battery technology accelerates, BYD (Build Your Dreams) has emerged as a dominant force in China’s manufacturing landscape. With multiple production facilities across Shenzhen, Xi’an, Changsha, and Xuzhou, sourcing directly from BYD or its certified partners presents significant cost and innovation advantages—but only if procurement is executed efficiently and reliably.

Navigating China’s complex supplier ecosystem requires verified intelligence, supply chain transparency, and real-time access to compliant manufacturers. This is where SourcifyChina’s Pro List delivers unmatched value.

Why SourcifyChina’s Verified Pro List Saves Time and Reduces Risk

| Challenge in Traditional Sourcing | SourcifyChina’s Solution | Time Saved |

|---|---|---|

| Months spent vetting suppliers through cold outreach and third-party platforms | Instant access to pre-qualified, audited suppliers linked to BYD’s supply chain | Up to 8–12 weeks |

| Risk of counterfeit or unauthorized vendors claiming BYD affiliation | Verified Pro List confirms direct partnerships, OEM collaborations, and subcontractor legitimacy | Eliminates due diligence delays |

| Inconsistent communication, language barriers, and low response rates | SourcifyChina provides dedicated sourcing consultants and native Mandarin support | Reduces lead time by 40–60% |

| Compliance and quality assurance gaps | All Pro List partners undergo on-site audits, export certifications, and quality control checks | Prevents costly rework and delays |

Strategic Advantage: Proactive Sourcing with Verified Intelligence

SourcifyChina’s Pro List is not a directory—it is a dynamic sourcing intelligence platform powered by field-verified data, real-time supplier performance metrics, and deep regional expertise. For procurement managers targeting the BYD manufacturing ecosystem, our list includes:

- Approved Tier 1 and Tier 2 suppliers for BYD batteries, modules, and EV components

- Contract manufacturers with BYD production experience

- Export-ready factories compliant with EU, US, and ISO standards

- Logistics and QC partners integrated into BYD’s regional supply chain

This enables faster RFQ turnaround, reduced NRE costs, and accelerated time-to-market—critical advantages in competitive industries.

Call to Action: Accelerate Your 2026 Sourcing Strategy

In today’s high-velocity procurement environment, time is your most valuable asset. Relying on unverified leads or generic sourcing platforms risks delays, compliance failures, and missed opportunities.

Leverage SourcifyChina’s Pro List to:

✅ Cut supplier qualification time by 70%

✅ Source with confidence from BYD’s extended manufacturing network

✅ Secure pricing and capacity ahead of market demand spikes

👉 Contact us today to unlock immediate access to our Verified Pro List for BYD manufacturing partners in China.

Email: [email protected]

WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/5 to provide a complimentary supplier match assessment tailored to your 2026 procurement goals.

SourcifyChina – Precision Sourcing. Verified Results.

Trusted by procurement leaders across North America, Europe, and APAC.

🧮 Landed Cost Calculator

Estimate your total import cost from China.