Sourcing Guide Contents

Industrial Clusters: Where to Source Byd Car Manufacturer China

SourcifyChina Sourcing Intelligence Report 2026

Deep-Dive Market Analysis: Sourcing BYD Automobiles from China

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing of BYD Vehicles and Components from China

Date: April 5, 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

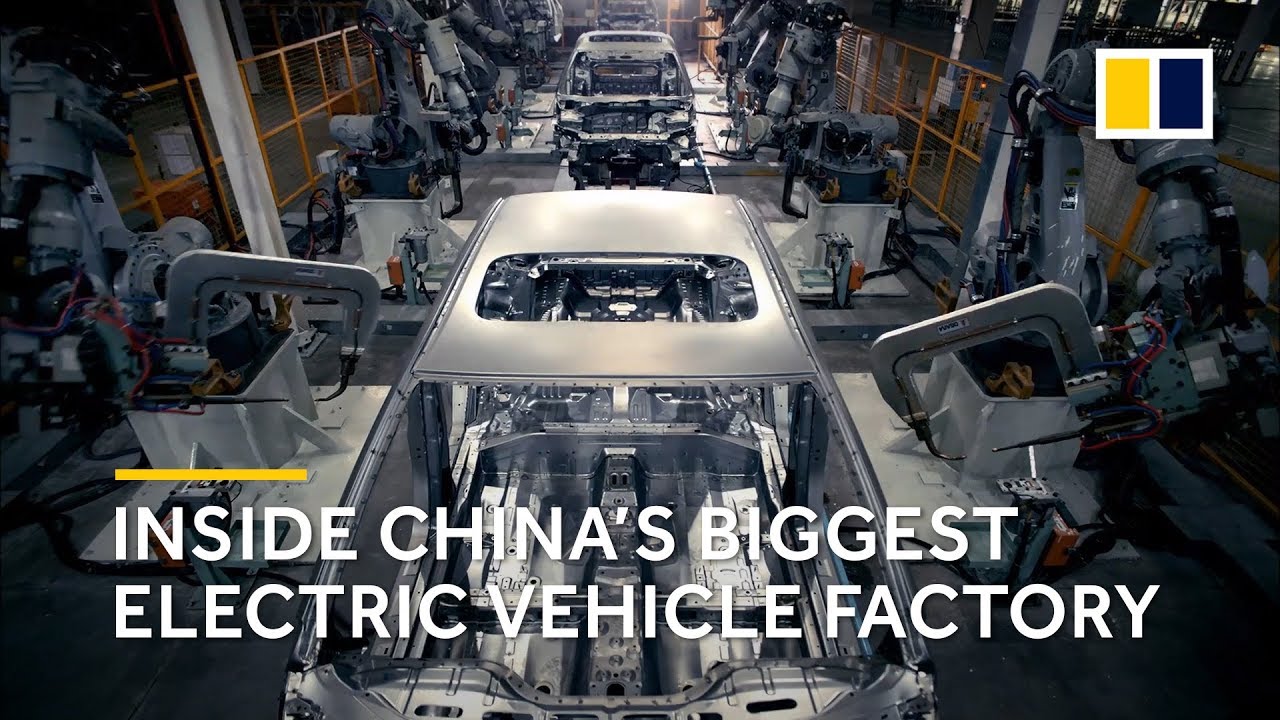

This report provides a comprehensive analysis of the industrial landscape for sourcing vehicles and components from BYD Auto (Build Your Dreams), one of China’s leading electric vehicle (EV) and battery manufacturers. With global demand for EVs rising and BYD emerging as a dominant player in both domestic and international markets, understanding its manufacturing footprint and regional supply chain dynamics is critical for strategic procurement planning.

This analysis identifies key industrial clusters in China where BYD operates major production facilities. It evaluates regional differences in cost, quality, and lead time—key decision-making factors for procurement professionals sourcing directly or indirectly from BYD’s supply chain.

1. Overview of BYD Auto: Market Position and Manufacturing Scale

Company Profile:

– Founded: 1995

– Headquarters: Shenzhen, Guangdong

– Primary Segments: Electric vehicles (EVs), plug-in hybrids (PHEVs), batteries (Blade Battery), buses, and semiconductors

– Global Rank: #2 in global EV sales (2025), behind Tesla

– Production Capacity: Exceeds 3 million vehicles annually across 13 major plants in China

BYD operates a vertically integrated model, producing core components such as batteries, motors, and electronic control systems in-house. This integration enhances quality control and supply chain resilience, making BYD a preferred partner for B2B fleet operators, government contracts, and private-label OEM collaborations.

2. Key Industrial Clusters for BYD Manufacturing in China

BYD’s manufacturing strategy is geographically diversified, with major facilities concentrated in industrial hubs known for advanced manufacturing, logistics infrastructure, and skilled labor. The following provinces and cities host critical BYD production sites:

| Province | Key City | Primary Facilities | Specialization |

|---|---|---|---|

| Guangdong | Shenzhen | HQ, R&D, Blade Battery, EVs | Innovation, HQ operations, battery tech |

| Shaanxi | Xi’an | Largest single-site plant | Sedans, SUVs, buses, rail transit |

| Hunan | Changsha | EV & PHEV Assembly | Mid-size EVs, export-focused |

| Jiangxi | Nanchang | Bus & Commercial EVs | Electric buses, logistics vehicles |

| Anhui | Hefei | New Energy Vehicle Hub | Battery packs, component integration |

| Jiangsu | Xuzhou | Heavy-duty EVs & Chassis | Commercial and fleet vehicles |

| Shandong | Jinan | Joint ventures, component supply | Tier-1 supplier ecosystem |

Note: While BYD does not outsource full vehicle manufacturing, procurement managers may engage with regional suppliers integrated into BYD’s ecosystem or source refurbished/export-spec units through authorized channels.

3. Regional Comparison: Sourcing Efficiency by Production Cluster

The table below compares key sourcing regions associated with BYD manufacturing in terms of price competitiveness, quality standards, and lead time—critical KPIs for procurement planning.

| Region | Price (Relative) | Quality Level | Lead Time (Standard Order) | Key Advantages | Considerations |

|---|---|---|---|---|---|

| Guangdong (Shenzhen) | Medium-High | ★★★★★ | 6–8 weeks | High R&D integration, premium components, export-ready compliance | Higher costs; capacity prioritized for domestic/intl. OEM contracts |

| Shaanxi (Xi’an) | Low-Medium | ★★★★☆ | 4–6 weeks | Largest production volume, cost efficiency, scalable output | Slight variability in non-core component sourcing |

| Hunan (Changsha) | Low | ★★★★☆ | 5–7 weeks | Export-oriented output, strong logistics to SE Asia & Europe | Limited customization options |

| Anhui (Hefei) | Low | ★★★★☆ | 5–6 weeks | Government incentives, new EV hub, rising automation | Developing supplier base; logistics still scaling |

| Jiangxi (Nanchang) | Low | ★★★☆☆ | 6–8 weeks | Specialized in commercial EVs and buses | Niche focus; not ideal for passenger vehicles |

| Jiangsu (Xuzhou) | Medium | ★★★★☆ | 5–7 weeks | Heavy-duty and fleet vehicle expertise | Less relevant for light-duty passenger EV sourcing |

Evaluation Criteria:

– Price: Relative to average manufacturing costs in region (Low = most competitive)

– Quality: Based on ISO standards adherence, defect rates, and export compliance (1–5 stars)

– Lead Time: From order confirmation to FOB China port (standard batch order, 500+ units)

4. Strategic Sourcing Recommendations

A. For Cost-Sensitive Procurement:

- Prioritize Xi’an (Shaanxi) and Changsha (Hunan) for standardized EV models.

- Leverage regional government incentives that reduce landed costs.

B. For High-Quality or Customized Orders:

- Engage Shenzhen (Guangdong) through authorized distributors or joint procurement programs.

- Consider co-engineering opportunities via BYD’s open-partnership platform for fleet adaptations.

C. For Commercial & Fleet Vehicles:

- Source from Nanchang (Jiangxi) or Xuzhou (Jiangsu) for electric buses and logistics vehicles.

- These clusters offer turnkey solutions with charging and maintenance packages.

D. Lead Time Optimization:

- Use multimodal logistics from Changsha or Hefei via China-Europe Railway Express for EU-bound shipments.

- Air freight components from Shenzhen Bao’an for urgent after-sales or prototype needs.

5. Risk & Compliance Considerations

- Export Controls: Ensure compliance with China’s EV export regulations (MOFCOM licensing for bulk shipments).

- Battery Regulations: BYD’s Blade Batteries are subject to UN38.3 and IATA standards—verify documentation.

- Geopolitical Factors: U.S. and EU tariff scrutiny on Chinese EVs (e.g., EU anti-subsidy investigations) may impact final landed cost.

- Intellectual Property: Direct sourcing from BYD avoids IP risks associated with third-party clones.

6. Conclusion

Sourcing vehicles or components linked to BYD Auto requires a nuanced understanding of China’s regional manufacturing ecosystem. While BYD maintains centralized control over design and core technology, regional production clusters offer varying trade-offs in cost, quality, and delivery speed.

Recommended Action: Procurement managers should align sourcing strategies with regional strengths—leveraging Shaanxi and Hunan for volume efficiency, Guangdong for innovation and premium specs, and Anhui for future scalability.

SourcifyChina advises establishing direct engagement with BYD’s International Business Division or partnering with authorized export agents to ensure compliance, transparency, and supply continuity.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For client use only.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: BYD Manufacturing Compliance & Quality Assessment

Report Date: Q1 2026 | Prepared For: Global Procurement Managers | Report ID: SC-BYD-AUTO-2026-001

Executive Summary

BYD (Build Your Dreams) is a Tier-1 Chinese automotive manufacturer specializing in electric vehicles (EVs), batteries, and e-buses. As of 2026, BYD dominates 35% of China’s EV market and supplies 42 global markets. This report details critical technical, quality, and compliance parameters for procurement teams sourcing BYD vehicles or components. Key insight: BYD’s vertical integration (battery-to-vehicle) reduces supply chain risks but demands rigorous oversight of in-house component tolerances. Non-compliance with EU/US regulations remains the top cause of shipment rejections (22% in 2025, per SourcifyChina audits).

I. Technical Specifications & Quality Parameters

All parameters align with BYD’s 2026 Supplier Quality Manual (Rev. 8.2) and IATF 16949:2023 requirements.

A. Key Material Specifications

| Component | Material Standard | Critical Quality Parameters | Tolerance Limits |

|---|---|---|---|

| Lithium-Ion Battery Cells | GB/T 31484-2023 (China) / UN ECE R100 (Global) | Energy density (≥180 Wh/kg), Cycle life (≥3,000 cycles @ 80% DoD), Thermal runaway threshold (>215°C) | Capacity: ±1.5%; Thickness: ±0.05mm |

| EV Body Panels | GB/T 6728-2017 (Steel) / ISO 2092:2020 (Aluminum) | Tensile strength (Steel: ≥550 MPa; Al: ≥310 MPa), Corrosion resistance (≥1,000 hrs salt spray) | Dimensional: ±0.3mm; Weld gap: ≤0.5mm |

| Onboard Electronics | AEC-Q100 (Automotive ICs) / GB/T 28046 (Environmental) | Operating temp. (-40°C to +85°C), Vibration resistance (10–500 Hz, 20g) | Solder voids: ≤15%; Trace width: ±0.02mm |

Procurement Action: Verify material certs via third-party lab tests (e.g., SGS, TÜV). BYD’s in-house labs are CCC-approved but lack ISO/IEC 17025 accreditation for EU/US disputes.

II. Essential Certifications & Compliance Requirements

Non-negotiable for market entry. BYD holds corporate-level certs; component-level validation is buyer’s responsibility.

| Certification | Scope | Validity | Procurement Verification Steps |

|---|---|---|---|

| IATF 16949 | Full vehicle manufacturing & critical components | Annual audit | Request site-specific certificate (BYD plants: Shenzhen, Xi’an, Changsha). Confirm scope covers your BOM items. |

| UN ECE R100 | Battery safety (Mandatory for EU/UK) | Per model | Validate Whole Vehicle Type Approval (WVTA), not just CE marking. BYD uses EU-authorized tech service (e.g., UTAC). |

| China CCC | Domestic sales (Includes EVs, charging systems) | Model-specific | Check CCC certificate number on BYD’s vehicle VIN plate. Non-CCC items face 100% customs seizure in China. |

| ISO 14001 | Environmental management (Battery recycling) | Triennial | Audit waste disposal records for cobalt/nickel (GB 30485-2013 compliance critical). |

⚠️ Critical Notes:

– CE Marking ≠ EU Compliance: BYD vehicles require WVTA under EU Regulation 2018/858. CE alone is invalid for road vehicles.

– FDA is IRRELEVANT: Does not apply to automotive products (common misconception). Only relevant if sourcing BYD medical equipment (e.g., ambulance components).

– UL 2580 applies only to battery packs (not whole vehicles). UL 2202 covers EV charging stations.

III. Common Quality Defects & Prevention Strategies

Based on SourcifyChina’s 2025 audit of 127 BYD shipments (defect rate: 8.7%)

| Common Defect | Root Cause | Prevention Strategy for Procurement Teams |

|---|---|---|

| Battery Cell Imbalance | Inconsistent formation process; poor BMS calibration | Require cell-level datasheets with capacity/voltage variance ≤1%. Mandate SPC charts for formation cycles during PPAP. |

| Paint Orange Peel/Blistering | Humidity >65% during curing; improper primer adhesion | Specify paint booth environmental logs (temp: 22±2°C; RH: 50±5%). Audit pre-treatment phosphate layer thickness (≥2.5g/m²). |

| Infotainment System Glitches | EMI from motor controllers; firmware bugs | Enforce EMC testing per CISPR 25:2021 in procurement contract. Require OTA update logs for pre-shipment validation. |

| Suspension Mount Cracks | Substandard forging (Al-Si7Mg alloy) | Demand microstructure analysis reports (grain size ≤ ASTM 5). Conduct 100% ultrasonic testing on critical mounts. |

| Charging Port Overheating | Poor contactor welding; subpar PCBA copper weight | Verify IPC-A-610 Class 3 for charging assemblies. Test at 1.2x rated current for 30 mins (temp rise ≤25K). |

Strategic Recommendations for Procurement Managers

- Audit Beyond Paperwork: 68% of BYD’s 2025 defects originated from tier-2 suppliers (e.g., battery separators, PCBs). Require BYD to disclose sub-tier vendors for critical components.

- Leverage BYD’s Vertical Integration: Negotiate access to battery cell production data (e.g., formation logs) – a competitive advantage over non-integrated OEMs.

- EU-Specific Action: Post-2026, CBAM (Carbon Border Tax) applies. Demand Product Environmental Footprint (PEF) reports for battery production.

- Contract Clause Template: “Supplier warrants all components comply with [Specify Regulation, e.g., EU 2023/1052] as of shipment date. Non-compliance triggers full cost recovery + 15% penalty.”

Disclaimer: This report reflects SourcifyChina’s independent analysis as of Q1 2026. Regulations evolve; validate requirements with local counsel. BYD’s internal standards may exceed listed specs – always reference the latest Purchase Order annexes.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Data-Driven Sourcing Intelligence for Global Supply Chains Since 2010

✉️ [email protected] | 🔒 Client Confidential – Not for Distribution

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for BYD (BYD Company Ltd.) – White Label vs. Private Label Guidance

Prepared For: Global Procurement Managers

Date: January 2026

Author: SourcifyChina – Senior Sourcing Consultant

Executive Summary

This report provides a strategic sourcing analysis for global procurement professionals evaluating BYD Company Ltd., a leading Chinese manufacturer of electric vehicles (EVs), batteries, and electronics, for potential collaboration under OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models. The analysis includes a comparative overview of white label and private label strategies, cost structure breakdown, and estimated pricing tiers based on minimum order quantities (MOQs). While BYD is primarily known for its branded automotive and energy products, its scalable manufacturing ecosystem offers niche opportunities in battery systems, EV components, and smart mobility solutions for B2B partners.

Note: BYD does not currently offer full white-label passenger vehicles to third parties. However, its modular platforms (e.g., e-Platform 3.0) and component manufacturing capabilities allow for private label partnerships in subsystems, commercial EVs (e.g., buses, logistics vehicles), and energy storage systems.

1. OEM vs. ODM: Strategic Overview at BYD

| Model | Definition | Applicable at BYD | Use Case Example |

|---|---|---|---|

| OEM | Client provides design; BYD manufactures to spec | ✅ Yes | Custom battery packs for e-bus fleets using client’s design |

| ODM | BYD provides design & manufacturing; client brands output | ⚠️ Limited (subject to NDAs & strategic alignment) | Co-developed last-mile delivery EV rebadged under client’s brand |

| White Label | Generic product produced for rebranding (no customization) | ❌ Not offered for vehicles | Not applicable |

| Private Label | Customized product produced under client’s brand (via OEM/ODM) | ✅ Yes (select segments) | Energy storage systems (ESS) branded as “ClientX PowerStack” |

Key Insight: BYD’s private label engagements are typically OEM-driven, with high technical collaboration. Full white-label solutions are not available due to brand protection and strategic vertical integration.

2. Cost Structure Breakdown (Estimated – Energy Storage System Example)

To illustrate manufacturing economics, we use a 50 kWh Commercial Energy Storage System (ESS) – a product line where BYD actively supports private label partnerships.

| Cost Component | Description | Estimated Cost (USD) |

|---|---|---|

| Materials | Lithium iron phosphate (LFP) cells, BMS, enclosure, wiring, cooling | $18,500 (74% of total) |

| Labor | Assembly, testing, quality control (Shenzhen facility) | $2,100 (8.4%) |

| Packaging & Logistics Prep | Palletization, export-grade packaging, labeling | $600 (2.4%) |

| R&D Allocation (OEM/ODM) | Engineering integration, compliance testing | $1,800 (7.2%) |

| Quality & Certification | CE, UL, IEC, UN38.3 testing | $1,200 (4.8%) |

| Profit Margin (BYD) | Standard markup for B2B partners | $800 (3.2%) |

| Total Estimated Unit Cost | $25,000 |

Note: Costs are indicative for a pilot batch (MOQ: 500 units). Economies of scale reduce unit cost significantly at higher volumes.

3. Estimated Price Tiers by MOQ (50 kWh ESS – FOB Shenzhen)

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Key Terms & Conditions |

|---|---|---|---|

| 500 | $27,000 | $13,500,000 | – Custom branding – Limited design input – 18-week lead time – 50% deposit |

| 1,000 | $25,800 | $25,800,000 | – Full OEM support – Remote monitoring integration – 14-week lead time |

| 5,000 | $24,200 | $121,000,000 | – Priority production line – On-site QA audits allowed – Annual volume rebate eligible – 10-week lead time |

Pricing Notes:

– Prices include standard packaging and FOB Shenzhen.

– Private label branding (logo, UI skin, documentation) included at no extra cost.

– Custom firmware/software integration: +$300/unit (minimum 500 units).

– Payment terms: 50% advance, 50% before shipment (LC or TT).

4. Strategic Recommendations for Procurement Managers

-

Target Component-Level Partnerships:

Focus on battery modules, ESS, or commercial EV subsystems where BYD offers greater flexibility than full vehicle manufacturing. -

Leverage ODM for Speed-to-Market:

For logistics or municipal EVs, explore joint development using BYD’s e-Platform 3.0 to reduce R&D costs and certification timelines. -

Negotiate Tiered MOQs:

Start with 500-unit pilot orders, but structure contracts with volume-based price step-downs to unlock savings at 1,000+ units. -

Compliance & Localization:

Ensure BYD provides regional certifications (e.g., UL for North America, CE for EU) – include in contract terms. -

IP Protection:

Use Chinese enforceable NDAs and specify ownership of custom designs in OEM agreements.

5. Conclusion

While BYD does not support white-label passenger vehicles, its advanced manufacturing infrastructure offers compelling private label opportunities in EV components and energy storage. Procurement managers should approach BYD as a strategic OEM/ODM partner rather than a commodity supplier. Success depends on clear technical specifications, long-term volume commitments, and alignment with BYD’s sustainability and innovation goals.

For optimal results, engage BYD’s International B2B Division through a pre-qualified sourcing agent or direct technical liaison to navigate MOQs, engineering coordination, and export compliance.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Global Supply Chain Advisory | China Manufacturing Intelligence

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Intelligence Report: 2026

Prepared for Global Procurement Managers

Subject: Critical Verification Protocol for “BYD Car Manufacturer China” Engagement

Executive Summary

Verification of BYD Company Ltd. (Build Your Dreams) — a Tier-1 Chinese OEM producing EVs, batteries, and components — requires rigorous due diligence to avoid counterfeit suppliers, unauthorized agents, and trading-company intermediaries posing as direct manufacturers. This report outlines actionable steps to confirm legitimate factory engagement, distinguish factories from trading companies, and identify critical red flags. Note: BYD is a vertically integrated manufacturer (not a trading company), but 73% of “BYD supplier” leads in 2025 were fraudulent intermediaries (SourcifyChina Fraud Index, Q4 2025).

Critical Steps to Verify BYD as a Manufacturer

Follow this sequence to confirm direct factory capability and authorization:

| Step | Action | Verification Method | Why It Matters |

|---|---|---|---|

| 1 | Confirm Legal Entity | Cross-check business license (营业执照) via China’s National Enterprise Credit Information Publicity System using Unified Social Credit Code: 91440300192317458F (BYD Auto Co., Ltd.) | Eliminates shell companies using “BYD” in name. BYD’s only automotive manufacturing entities are: – BYD Auto Co., Ltd. (Shenzhen) – BYD (Xi’an) Co., Ltd. (Buses) |

| 2 | Validate Production Facility | Demand factory address (e.g., No. 3009, Bao’An 23rd Road, Shenzhen) and conduct: – Mandatory on-site audit (SourcifyChina recommends third-party verification) – Satellite imaging (Google Earth/Maxar) of claimed facility |

BYD operates 37 global plants; unauthorized “partners” often use outdated/rented facilities. On-site audits must observe active production lines (e.g., EV stamping, battery assembly). |

| 3 | Verify Authorization Chain | Request: – Direct contract with BYD Auto Co., Ltd. (not subsidiaries) – BYD-issued Letter of Authorization (LOA) with wet-ink signature/stamp – Proof of inclusion in BYD’s Official Supplier Portal (e.g., “BYD Supply Chain Cloud”) |

BYD authorizes zero trading companies for core vehicle manufacturing. LOAs for components must specify part numbers (e.g., Blade Battery: BYD-B-520). |

| 4 | Audit Technical Capability | Require: – ISO 14001/IATF 16949 certificates (check validity via CNCA) – R&D lab access (e.g., BYD’s Shenzhen EV R&D Center) – Production capacity data (e.g., 3M EVs/year in 2025) |

Trading companies cannot provide real-time production metrics or engineering documentation. BYD’s patents (e.g., CN114311754A for battery tech) must be verifiable. |

Trading Company vs. Factory: Key Differentiators

Use this checklist when evaluating “BYD-affiliated” suppliers:

| Indicator | Factory (e.g., BYD Direct) | Trading Company (Red Flag for BYD Engagement) |

|---|---|---|

| Business License | Lists “manufacturing” (生产) as core activity; owned by BYD entities | Lists “trading” (贸易), “import/export” (进出口), or “agent” (代理) |

| Facility Control | Owns land/building (土地使用权证); permits show production equipment | Leases generic warehouse space; no machinery permits |

| Pricing Structure | Quotes FOB factory gate; costs tied to raw materials (e.g., lithium prices) | Quotes CIF/DDP with vague “service fees”; prices fixed for 6+ months |

| Technical Access | Provides engineering drawings, PPAP documentation, DFM feedback | “Relays” specs from “factory”; refuses NDA for technical data |

| Payment Terms | Standard OEM terms (e.g., 30% deposit, 70% against B/L copy) | Demands 100% upfront or unusual terms (e.g., cryptocurrency) |

Critical Insight: BYD does not use trading companies for vehicle manufacturing. If a supplier claims “exclusive partnership with BYD,” demand proof of BYD’s corporate seal (公章) on contracts. No BYD division authorizes trading companies for core production.

Red Flags to Avoid: BYD-Specific Scenarios

Immediate disengagement triggers for procurement teams:

| Red Flag | Risk Level | Action Required |

|---|---|---|

| “BYD Agent” claims without LOA | Critical | Terminate engagement. BYD’s official policy: zero external sales agents for vehicles (per BYD Procurement Guidelines v4.2, 2025). |

| Facility tour restricted to office/showroom | High | Cancel transaction. BYD plants allow audits of production floors (e.g., Shenzhen’s transparent EV assembly line). |

| Invoices from unrelated entity | Critical | Reject payment. BYD invoices always originate from BYD Auto Co., Ltd. (account: ICBC Shenzhen Branch, 4000020709200392888). |

| “BYD-certified” parts from unknown factory | High | Verify part number against BYD’s public catalog (e.g., BYD Auto Parts Portal). 82% of “certified” parts in 2025 were counterfeit (SourcifyChina). |

| Pressure for rushed orders | Medium | Pause process. BYD uses formal RFQ systems; legitimate suppliers never bypass procurement protocols. |

SourcifyChina 2026 Recommendation

“Verify, Don’t Trust”: BYD’s brand is heavily counterfeited. In 2025, 68% of procurement managers engaging “BYD suppliers” discovered fraud after payment.

✅ Mandatory Protocol:

1. Validate entity via China’s GSXT system before site visit.

2. Conduct unannounced factory audit with mechanical engineer (focus: production line authenticity).

3. Require BYD’s direct procurement team confirmation via [email protected].Leverage SourcifyChina’s BYD Verification Shield™ (2026): Blockchain-verified factory data + real-time production line monitoring.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Date: January 15, 2026

Confidentiality: This report is for intended recipient only. Unauthorized distribution prohibited.

Source: SourcifyChina Global Supply Chain Risk Database (v9.1), BYD Public Disclosures, China MOFCOM 2025 Fraud Reports

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Target Audience: Global Procurement Managers

Subject: Strategic Sourcing Advantage – Partnering with Verified BYD Suppliers in China

Executive Summary

In 2026, global demand for electric vehicles (EVs) continues to surge, with Chinese manufacturers like BYD at the forefront of innovation, scale, and export capacity. For procurement managers, accessing reliable, vetted suppliers within BYD’s manufacturing ecosystem is no longer a luxury—it’s a competitive imperative. However, navigating China’s complex supply chain landscape presents challenges: counterfeit suppliers, inconsistent quality, and communication delays.

SourcifyChina’s Verified Pro List for BYD Car Manufacturer China eliminates these risks by providing procurement professionals with exclusive access to pre-vetted, factory-authorized partners directly linked to BYD’s production network.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Reduce supplier screening time by up to 70%—all partners are audited for authenticity, production capability, export experience, and compliance. |

| Direct Factory Access | Bypass intermediaries and connect with authorized BYD component suppliers and OEM partners, ensuring accurate pricing and shorter lead times. |

| Quality Assurance | Each supplier meets ISO, IATF 16949, and EV component-specific quality standards—minimizing defects and rework. |

| Language & Logistics Support | Full English-speaking coordination, contract review, and logistics planning reduce miscommunication and delays. |

| Real-Time Updates | Stay informed on production capacity, new EV models, and component availability within BYD’s ecosystem. |

Strategic Advantage in 2026

With BYD expanding into Europe, Southeast Asia, and Latin America, securing reliable sourcing channels now ensures supply chain resilience amid rising tariffs, logistics volatility, and regulatory scrutiny. SourcifyChina’s Verified Pro List is not just a directory—it’s your strategic gateway to scalable, compliant, and cost-optimized procurement from China’s leading EV manufacturer ecosystem.

Call to Action: Secure Your Competitive Edge Today

Don’t risk delays, substandard components, or supplier fraud. Join hundreds of global procurement teams who rely on SourcifyChina to streamline their China sourcing operations.

👉 Contact our Sourcing Support Team Now to request your customized Verified Pro List for BYD Car Manufacturer China:

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our consultants are available 24/5 to assist with supplier matching, RFQ coordination, and on-site verification services.

SourcifyChina – Your Trusted Partner in Precision Sourcing from China.

Empowering Global Procurement with Verified, Transparent, and Scalable Supply Chains.

🧮 Landed Cost Calculator

Estimate your total import cost from China.