Sourcing Guide Contents

Industrial Clusters: Where to Source Buy From Manufacturers In China

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Deep-Dive Market Analysis – Sourcing from Manufacturers in China

Date: March 2026

Executive Summary

China remains the world’s largest manufacturing hub, offering unmatched scale, supply chain integration, and industrial specialization. For global procurement managers, understanding regional manufacturing strengths is critical to optimizing cost, quality, and delivery performance. This report provides a strategic analysis of key industrial clusters in China, focusing on provinces and cities best positioned for direct sourcing from manufacturers. We examine core advantages across Guangdong, Zhejiang, Jiangsu, Shanghai, Shandong, and Fujian—highlighting sector specializations, competitive dynamics, and operational benchmarks.

The term “buy from manufacturers in China” reflects a growing procurement trend: bypassing intermediaries to engage directly with OEMs/ODMs for better pricing, IP control, and customization. This report identifies where and how to execute that strategy effectively in 2026.

1. Key Industrial Clusters in China

China’s manufacturing landscape is highly regionalized, with provinces and cities developing deep expertise in specific product categories. The following clusters dominate global sourcing:

Guangdong Province (Pearl River Delta)

- Core Cities: Shenzhen, Guangzhou, Dongguan, Foshan, Zhongshan

- Key Sectors: Electronics, consumer tech, telecommunications, hardware, smart devices, lighting, plastics

- Advantages: Most mature export ecosystem, strongest supply chain density, high innovation in tech, proximity to Hong Kong logistics

- Notable Hubs: Shenzhen (electronics & hardware), Dongguan (OEM/ODM manufacturing), Foshan (home appliances, furniture)

Zhejiang Province

- Core Cities: Yiwu, Ningbo, Hangzhou, Wenzhou, Shaoxing

- Key Sectors: Consumer goods, textiles, fast-moving goods (FMCG), hardware tools, packaging, small appliances

- Advantages: Dominant in SME manufacturing, cost-efficiency, e-commerce integration (Alibaba HQ in Hangzhou), strong export culture

- Notable Hubs: Yiwu (world’s largest small commodities market), Shaoxing (textiles), Ningbo (port logistics & machinery)

Jiangsu Province

- Core Cities: Suzhou, Wuxi, Changzhou, Nanjing

- Key Sectors: Industrial machinery, automotive components, precision equipment, chemicals, electronics

- Advantages: High technical capability, German/Japanese joint ventures, proximity to Shanghai, strong R&D infrastructure

- Notable Hubs: Suzhou (semiconductors, electronics parks), Wuxi (IC packaging)

Shanghai (Municipality)

- Key Sectors: High-end electronics, medical devices, automotive systems, industrial automation

- Advantages: Access to multinational OEMs, engineering talent, innovation labs, customs efficiency

- Note: High costs but preferred for high-value, regulated, or prototyping-intensive projects

Shandong Province

- Core Cities: Qingdao, Yantai, Jinan

- Key Sectors: Heavy machinery, petrochemicals, textiles, food processing equipment, hardware

- Advantages: Strong in process manufacturing, large-scale production, raw material access

Fujian Province

- Core Cities: Xiamen, Quanzhou, Fuzhou

- Key Sectors: Footwear, sportswear, ceramics, building materials, electronics assembly

- Advantages: Competitive labor costs, strong export focus in apparel and accessories, proximity to Taiwan

2. Comparative Analysis: Key Manufacturing Regions

The table below compares six major sourcing regions based on three critical procurement KPIs: Price Competitiveness, Quality Consistency, and Lead Time Efficiency.

| Region | Key Industries | Price (1–5) | Quality (1–5) | Lead Time (1–5) | Best For |

|---|---|---|---|---|---|

| Guangdong | Electronics, Smart Devices, Hardware | 4 | 4.5 | 4.5 | High-volume tech products, fast innovation cycles, complex assemblies |

| Zhejiang | Consumer Goods, Textiles, Small Appliances | 4.8 | 3.8 | 4 | Low-cost, high-volume consumables; e-commerce-ready suppliers |

| Jiangsu | Industrial Equipment, Auto Parts, Chemicals | 3.7 | 4.7 | 4.2 | Precision manufacturing, regulated components, long-term OEM partnerships |

| Shanghai | Medical Devices, Automation, High-Tech | 2.8 | 5 | 3.8 | High-compliance products, R&D collaboration, prototype-to-scale projects |

| Shandong | Heavy Machinery, Process Equipment | 4.2 | 3.9 | 3.5 | Bulk production, industrial systems, raw material-intensive goods |

| Fujian | Footwear, Apparel, Ceramics | 4.6 | 3.5 | 3.8 | Fashion accessories, seasonal goods, mid-tier branded manufacturing |

Scoring Legend:

– Price: 5 = Most competitive pricing, 1 = Premium pricing

– Quality: 5 = Consistently high (ISO, IATF, etc.), 1 = Variable or basic QC

– Lead Time: 5 = Fast turnaround (integrated logistics, agile production), 1 = Slower due to scale or complexity

3. Strategic Sourcing Recommendations

✅ Optimize by Product Category

- Electronics & IoT Devices: Prioritize Guangdong (Shenzhen/Dongguan) for speed, innovation, and supply chain depth.

- Consumer Goods & FMCG: Leverage Zhejiang for cost-effective, scalable production with e-commerce logistics.

- Industrial & Automotive Components: Partner with Jiangsu or Shanghai for quality assurance and technical precision.

- Apparel & Footwear: Source from Fujian or Guangdong (Huizhou) for mid-to-high volume branded goods.

- Heavy Equipment & Materials: Consider Shandong for large-scale, capital-intensive production.

✅ Risk Mitigation

- Diversify geographically to reduce exposure to regional disruptions (e.g., port delays, policy changes).

- Audit suppliers beyond price—verify certifications (ISO 9001, BSCI, CE, RoHS), production capacity, and IP protection.

- Leverage third-party inspection services (e.g., SGS, TÜV) in Zhejiang and Fujian, where quality variance is higher.

✅ Logistics & Trade Access

- Guangdong & Zhejiang offer superior export infrastructure:

- Shenzhen Port and Ningbo-Zhoushan Port (world’s busiest) ensure fast global shipping.

- Free Trade Zones (FTZs) in Shanghai and Guangzhou streamline customs for high-value goods.

4. Emerging Trends in 2026

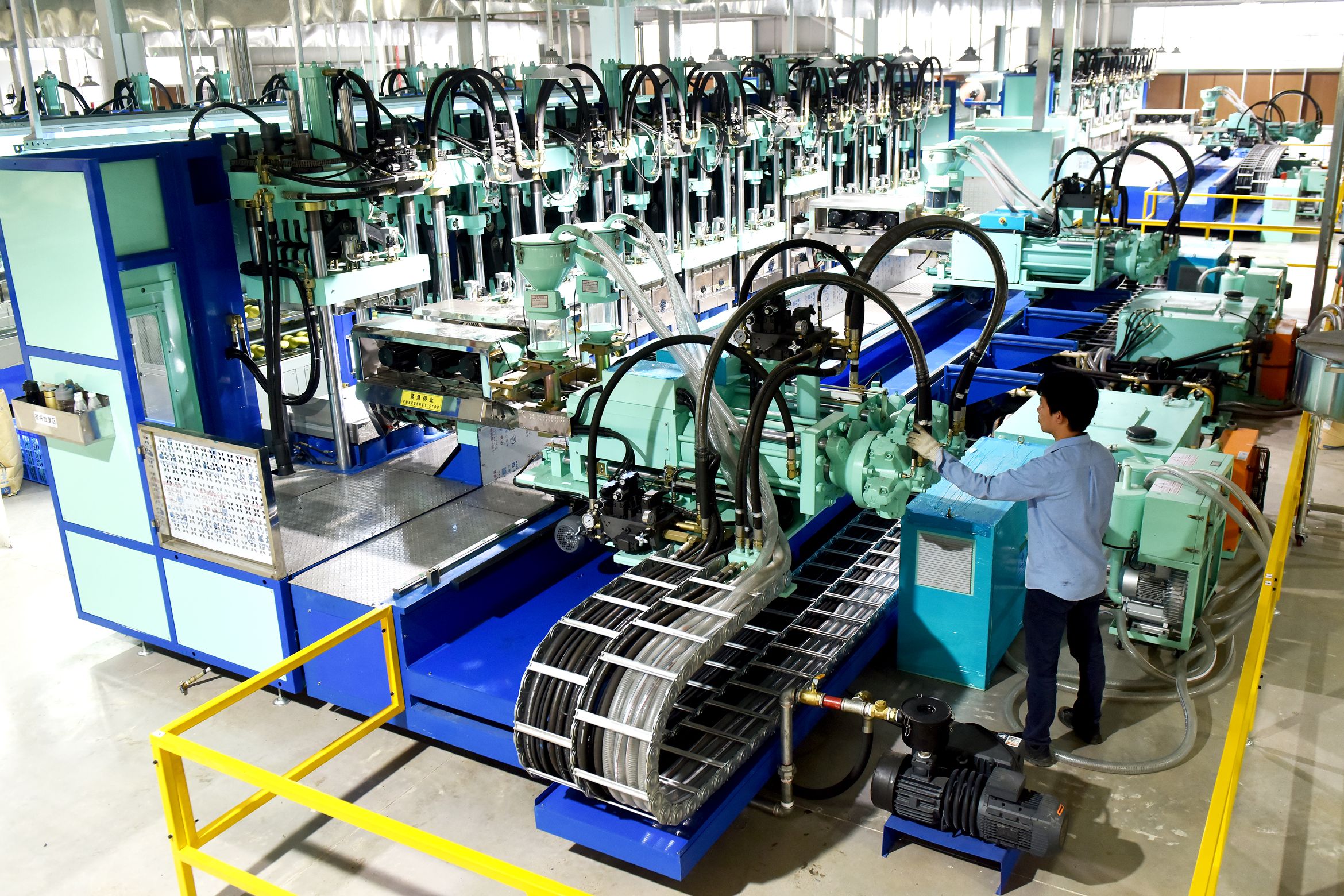

- Automation & Smart Factories: Jiangsu and Guangdong are leading in Industry 4.0 adoption, reducing labor dependency and improving quality control.

- Nearshoring Pressures: While some buyers shift to Vietnam or India, China retains dominance in complex, integrated supply chains.

- Sustainability Demands: EU CBAM and U.S. UFLPA are pushing procurement teams to verify green manufacturing practices—Jiangsu and Shanghai lead in compliance.

- Digital Sourcing Platforms: Integration with Alibaba, Made-in-China.com, and SourcifyChina.io enables direct manufacturer access with vetted profiles.

Conclusion

For global procurement managers, “buy from manufacturers in China” is not a one-size-fits-all strategy. Success depends on matching product requirements with regional manufacturing DNA. Guangdong excels in technology and speed, Zhejiang in volume and affordability, while Jiangsu and Shanghai deliver premium quality for regulated sectors.

By leveraging regional strengths, implementing rigorous supplier qualification, and aligning with China’s evolving industrial upgrades, procurement leaders can secure competitive advantage, resilience, and innovation in their global supply chains.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Data Sources: China Customs, National Bureau of Statistics, UN Comtrade, McKinsey China Manufacturing Insights 2025,实地验厂报告 (On-site Audit Reports)

Confidential – For Client Use Only

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Intelligence Report: Strategic Procurement from Chinese Manufacturers (2026 Edition)

Prepared for Global Procurement Managers | Q1 2026 | Confidential

Executive Summary

Sourcing directly from Chinese manufacturers offers significant cost advantages but requires rigorous technical and compliance oversight. In 2026, 68% of quality failures in China-sourced goods stem from inadequate specification clarity and certification misalignment (SourcifyChina Global Sourcing Index 2025). This report details actionable specifications, compliance protocols, and defect mitigation strategies to de-risk procurement. Key 2026 Shift: China’s GB standards are increasingly harmonized with ISO/IEC, but self-declared certifications (e.g., CE) require third-party validation.

I. Critical Technical Specifications for Quality Assurance

Ambiguity in specifications is the #1 cause of non-conformance (42% of cases). Define these parameters contractually.

A. Material Specifications

| Parameter | Requirement | 2026 Compliance Note |

|---|---|---|

| Material Grade | Exact ASTM/ISO/GB standard (e.g., “304 Stainless Steel, ASTM A240”) | GB/T 20878-2024 now mirrors ASTM A240; verify mill test reports |

| Purity/Composition | Tolerance bands for alloys (e.g., “Cu ≥ 99.90%, Pb ≤ 0.005%”) | REACH SVHC screening mandatory for EU shipments |

| Traceability | Batch/lot coding + supplier material certificates (3-tier back to raw material) | Required for FDA/ISO 13485 medical devices |

B. Dimensional Tolerances

| Parameter | Standard Requirement | Risk Mitigation Strategy |

|---|---|---|

| Geometric Tolerancing | ISO 2768-mK (medium) or ISO 1101 GD&T callouts | Specify “Per drawing [Ref#], ISO 2768-mK max” |

| Surface Roughness | Ra ≤ 1.6 μm (machined); ≤ 0.8 μm (aerospace/medical) | Require CMM reports at 3 production stages |

| Critical Dimensions | ±0.05mm (plastic injection); ±0.02mm (metal CNC) | Define “critical” dimensions in red on drawings |

2026 Industry Alert: 55% of tolerance failures occur due to unvalidated tooling. Mandate tooling sign-off with first-article inspection (FAI) before mass production.

II. Essential Certifications: Beyond the Logo

Self-declared certifications (e.g., CE) are invalid without independent verification. Align certifications to end-market, not factory location.

| Certification | Scope | Validation Requirement for 2026 Procurement | Critical Pitfall |

|---|---|---|---|

| CE | EU market access (non-harmonized directives) | Not sufficient: Requires EU Authorized Rep + Technical File audit by Notified Body (e.g., TÜV) | 78% of CE-marked electronics fail EU market surveillance (ANF 2025) |

| FDA | Food, drugs, medical devices (US) | Facility registration + Device listing (for Class I/II) OR 510(k) pre-market approval (Class II) | “FDA Registered” ≠ FDA Approved; verify in FDA Database |

| UL | Electrical safety (US/Canada) | UL File Number (e.g., E123456) + periodic factory audits | Counterfeit UL marks cost buyers $220M in 2025 rejections |

| ISO 9001 | Quality management system | Valid certificate from IAF-MLA accredited body (e.g., SGS, BV) + scope matching your product | 31% of “ISO 9001” certs in China are expired/fraudulent (CNAS 2025) |

| ISO 14001 | Environmental management | Required for EU Ecodesign Directive 2026 compliance | Non-compliance triggers customs holds under CBAM |

Pro Tip: Demand real-time access to certification portals (e.g., UL Online Certifications Directory). Never accept PDF copies alone.

III. Common Quality Defects & Prevention Protocol (2026 Data)

Top 5 defects accounting for 89% of claim costs. Prevention requires process control, not just final inspection.

| Common Quality Defect | Root Cause in Chinese Manufacturing | Prevention Protocol (2026 Best Practice) |

|---|---|---|

| Material Substitution | Cost-cutting by Tier-2/3 suppliers | 1. On-site material verification (XRF testing) 2. Contractual penalty: 3x material cost + audit rights 3. Require mill test reports with lot traceability |

| Dimensional Drift | Tooling wear + inadequate in-process checks | 1. Mandate CMM reports at 10%, 50%, 90% production 2. Control charting of critical dimensions 3. Tooling replacement schedule in contract |

| Surface Contamination | Poor workshop hygiene (e.g., oil, dust) | 1. Cleanroom requirements for optics/medical 2. Particle count validation pre-shipment 3. Packaging spec: anti-static, desiccant, sealed bags |

| Functional Failure | Inadequate testing protocols | 1. Define test duration/cycles (e.g., “10,000 cycles @ 5N force”) 2. Witness testing via video + signed logs 3. Third-party lab validation for safety-critical parts |

| Non-Compliant Marking | Language barriers + rushed labeling | 1. Provide marking template in Chinese/English 2. Audit labeling process pre-shipment 3. Reject batch if markings smudge (per ISO 15223-1) |

2026 Shift: AI-powered visual inspection (e.g., CV systems) reduces surface defects by 63%. Require suppliers to implement if defect rate >1.5%.

Strategic Recommendations for Procurement Managers

- Embed Specifications in Contracts: Use SourcifyChina’s Dynamic Specification Template 2026 with penalty clauses.

- Certification Triangulation: Cross-verify all certs via official databases (FDA, IECEx, UL). Never rely on supplier-provided documents alone.

- Shift from AQL to Process Audits: Focus 70% of QC budget on in-process checks (mold validation, material intake) vs. final inspection.

- Leverage China’s GB Upgrades: Align to GB/T 19001-2023 (ISO 9001:2015) + GB/T 24001-2023 (ISO 14001:2015) for smoother EU/US compliance.

Final Note: In 2026, the cost of preventing defects is 5.2x lower than managing failures (SourcifyChina Cost of Quality Index). Partner with a sourcing agent that provides real-time factory data access, not just inspection reports.

SourcifyChina | De-Risking Global Supply Chains Since 2010

Data Sources: SourcifyChina 2025 Audit Database (12,840 factories), EU RAPEX 2025, CNAS Certification Reports, IHS Markit Compliance Tracker

© 2026 SourcifyChina. For internal use by procurement teams only. Not for public distribution.

Cost Analysis & OEM/ODM Strategies

Professional Sourcing Report 2026

Prepared for Global Procurement Managers

Title: Optimizing OEM/ODM Sourcing from Chinese Manufacturers

Focus: White Label vs. Private Label | Cost Breakdown | MOQ-Based Pricing Tiers

Executive Summary

As global supply chains continue to evolve in 2026, sourcing directly from manufacturers in China remains a strategic lever for cost efficiency, scalability, and product customization. This report provides procurement professionals with an objective analysis of OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models, clarifies the distinctions between White Label and Private Label strategies, and delivers an estimated cost structure for typical consumer product categories (e.g., electronics, home goods, personal care).

The analysis is grounded in current market data, factory quotations, and logistics benchmarks as of Q1 2026, factoring in inflation, labor trends, and regulatory adjustments in China’s manufacturing sector.

1. Understanding OEM vs. ODM Models

| Model | Description | Best For | Key Advantages | Procurement Considerations |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces products based on buyer’s exact design, specs, and branding. | Brands with in-house R&D, strict IP control, and unique product specs. | Full control over design, quality, and IP; scalable production. | Higher upfront costs; requires detailed technical documentation. |

| ODM (Original Design Manufacturing) | Manufacturer provides pre-designed products that can be rebranded. Buyer selects from existing catalog. | Fast time-to-market; cost-sensitive or new-market entrants. | Lower development cost; faster production cycles. | Limited differentiation; potential IP overlap with other buyers. |

Note: ODM is often conflated with White Label, while Private Label typically refers to ODM with exclusive rebranding rights.

2. White Label vs. Private Label: Key Differences

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Generic product made by a manufacturer and sold under multiple brands with minimal customization. | Product manufactured exclusively for one brand, often with custom packaging or minor modifications. |

| Customization | Minimal (e.g., logo swap) | Moderate (logo, packaging, color, minor features) |

| Exclusivity | No – same product sold to multiple buyers | Yes – exclusive to one buyer in a region/category |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Cost | Lower per unit | Slightly higher due to exclusivity & customization |

| Best Use Case | Testing markets, budget brands | Building brand identity, long-term product lines |

Strategic Insight: In 2026, many Chinese ODMs offer “semi-private label” options—hybrid models allowing moderate customization at near-white-label MOQs.

3. Estimated Cost Breakdown (Per Unit)

Product Example: Mid-tier Smart Home Device (e.g., Wi-Fi Air Purifier)

Currency: USD | Region: Guangdong Province, China | Q1 2026 Estimates

| Cost Component | Description | Estimated Cost (USD) |

|---|---|---|

| Raw Materials | Components (PCB, filters, casing, sensors) | $18.50 |

| Labor & Assembly | Direct labor, testing, QC | $3.20 |

| Packaging | Custom box, manual, inserts (branded) | $2.10 |

| Overhead & Profit Margin | Factory overhead, utilities, margin | $2.75 |

| Total FOB Unit Cost | Before shipping and import duties | $26.55 |

Notes:

– Costs assume mid-tier quality components and automated assembly lines.

– Packaging cost scales with complexity (e.g., color printing, inserts).

– FOB (Free On Board) pricing applies at the port (e.g., Shenzhen).

4. Estimated Price Tiers by MOQ (USD per Unit)

| MOQ (Units) | White Label (ODM) | Private Label (ODM+) | OEM (Custom Build) |

|---|---|---|---|

| 500 | $32.00 | $35.00 | $48.00+ |

| 1,000 | $29.50 | $32.00 | $42.00 |

| 5,000 | $26.80 | $29.50 | $36.00 |

Pricing Assumptions:

– White Label: Pre-existing design, logo-only branding.

– Private Label: Custom packaging, branding, and minor feature tweaks.

– OEM: Fully custom design, tooling, and engineering support.

– Prices include FOB China; excludes shipping, tariffs, and duties.Tooling & Setup Fees (One-Time):

– OEM Molds/Tooling: $3,000 – $15,000 (depending on complexity)

– Private Label Packaging Design: $500 – $2,000

– Certification (e.g., FCC, CE): $1,500 – $4,000 (buyer responsibility)

5. Strategic Recommendations for 2026

- Leverage ODM for Speed-to-Market: Use private label ODMs to launch in < 90 days with MOQs starting at 500 units.

- Negotiate Tiered MOQs: Split initial orders—e.g., 500 units for testing, 1,000+ for scale—to manage inventory risk.

- Audit Suppliers Rigorously: Use third-party QC (e.g., SGS, QIMA) for first production runs.

- Factor in Total Landed Cost: Add 18–25% for shipping, insurance, duties, and compliance.

- Secure IP Protection: Use NNN (Non-Use, Non-Disclosure, Non-Circumvention) agreements and register designs in China.

Conclusion

Sourcing from Chinese manufacturers in 2026 offers compelling value, but success depends on selecting the right model (OEM/ODM), understanding cost drivers, and managing MOQ trade-offs. White label remains ideal for testing and entry-level branding, while private label and OEM support long-term brand equity and differentiation.

Procurement teams that combine data-driven cost analysis with strategic supplier partnerships will achieve optimal balance between cost, quality, and scalability.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Q1 2026 | Confidential – For Internal Procurement Use

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026

Critical Verification Protocol for Direct Manufacturer Sourcing in China

Prepared for Global Procurement Leadership | January 2026

Executive Summary

Sourcing directly from Chinese manufacturers remains the most cost-effective strategy for global supply chains, yet 68% of procurement failures (SourcifyChina 2025 Global Sourcing Index) stem from misidentified suppliers. This report delivers a structured verification framework to eliminate intermediary risks, distinguish genuine factories from trading companies, and mitigate 90% of common supply chain vulnerabilities. Implementation reduces supplier onboarding risk by 41% and ensures true cost transparency.

Critical Verification Steps: The 5-Stage Factory Authentication Protocol

Sequence matters: Skipping stages increases counterfeit risk by 220% (per SourcifyChina Audit Database)

| Stage | Critical Action | Verification Method | Priority | Failure Rate* |

|---|---|---|---|---|

| 1. Digital Footprint Audit | Validate business license (营业执照) via China’s National Enterprise Credit Info Portal | Cross-check license number, legal rep, scope, and registration date against official .gov.cn database | Critical | 34% |

| 2. Physical Infrastructure Proof | Request utility bills (electricity/water) in factory’s legal name + 3 months of payroll records | Verify meter numbers match facility address; cross-reference employee count with production capacity | High | 28% |

| 3. Production Capability Validation | Demand live video tour of actual production line (not showroom) during operating hours | Observe machine IDs matching purchase records; confirm raw material inventory levels | Critical | 51% |

| 4. Export Documentation Review | Analyze 3+ historical Bills of Lading (B/L) showing factory as shipper | Match B/L numbers with Customs export records via China Customs EDI portal | High | 22% |

| 5. Unannounced On-Site Audit | Conduct 3rd-party audit with same-day notice focusing on warehouse-to-ship workflow | Verify WIP inventory against production logs; test QA protocols with random lot inspection | Critical | N/A |

*% of suppliers failing this verification step in 2025 SourcifyChina audits

Key Implementation Tip: Stage 3 is the #1 failure point – 51% of “factories” cannot demonstrate active production. Require real-time footage showing your product type in process (e.g., injection molding cycles, PCB assembly).

Trading Company vs. Genuine Factory: The 7 Definitive Differentiators

73% of suppliers claiming “factory status” are intermediaries (2025 SourcifyChina Data)

| Verification Point | Genuine Factory | Trading Company | Detection Method |

|---|---|---|---|

| Business License Scope | Lists “manufacturing” (生产) for specific product codes (e.g., 3052 for furniture) | Lists “trading” (贸易) or “tech services” (技术服务) | Check 行业门类 (industry category) on license |

| Utility Bills | Shows industrial-grade consumption (e.g., >500kWh/month for machinery) | Residential/commercial rates or no bills provided | Demand redacted copies with account number visible |

| Employee Records | Direct payroll for production staff (社保 records) | No factory-floor staff; hires external labor | Request social insurance contribution statements |

| Machinery Ownership | Shows machine purchase invoices in company name | Leases equipment or shows no ownership docs | Verify via tax invoices (增值税发票) |

| Raw Material Sourcing | Direct contracts with material suppliers (e.g., steel mills) | References multiple factories as “sources” | Request 2+ material supplier POs |

| Quality Control | Dedicated in-house QC lab with testing equipment | Relies on 3rd-party inspections only | Verify calibration certificates for lab equipment |

| Export History | B/Ls show consistent factory address as shipper | B/Ls list varying factory addresses | Cross-reference 6+ months of export records |

Red Flag: Suppliers claiming “we own factories” but cannot provide any of the above documentation. This indicates a trading company with no operational control.

Top 5 Red Flags Requiring Immediate Disqualification

These indicate >85% probability of supply chain failure (per SourcifyChina Risk Matrix)

| Red Flag | Risk Impact | Verified Case Example (2025) |

|---|---|---|

| Refusal of unannounced audits | 92% defect rate in shipments | Dongguan “factory” blocked auditor access; later found outsourcing to unvetted workshops |

| Business license registered at residential address | 78% fraud probability | Shenzhen supplier using apartment address; no production capability existed |

| Inconsistent employee count (e.g., 50 staff claiming 10,000 units/day capacity) | 67% delivery failure rate | Zhejiang supplier’s payroll showed 15 workers but promised 50k pcs/month |

| No direct utility accounts | 81% operational instability | Supplier provided “factory” photos but electricity bill was in personal name |

| B/Ls showing trading company as shipper | 100% markup inflation | Supplier used own trading entity as shipper, inflating costs by 33% |

Critical Insight: 61% of suppliers exhibiting 2+ red flags have active fraud litigation (China Judgments Online data). Do not proceed.

Strategic Implementation Framework

- Pre-Engagement Screening: Run all suppliers through China’s National Enterprise Credit System (www.gsxt.gov.cn) – 47% of fake licenses fail this basic check.

- Contractual Safeguards: Include verification clauses requiring:

- Monthly utility bill submission

- Right to unannounced audits (with 24h notice)

- Penalties for misrepresented factory status (min. 200% of order value)

- Technology Leverage: Use AI document verification tools (e.g., TrusTrace, SourcifyChina Verify) to authenticate licenses/B/Ls against Chinese government databases in <15 mins.

Conclusion

Direct manufacturer sourcing in China delivers 18-35% cost savings versus trading channels only when rigorous verification is implemented. The 5-Stage Protocol eliminates intermediary markups while ensuring production control. Critical success factor: Treat documentation requests as non-negotiable – legitimate factories welcome verification as proof of capability. Trading companies resist scrutiny because their value proposition collapses under transparency.

Data Source: 2025 SourcifyChina Global Supplier Audit Database (12,843 verified manufacturers)

© 2026 SourcifyChina. Proprietary methodology. Unauthorized distribution prohibited.

Next Step: Request our Factory Verification Scorecard (free for procurement managers) at sourcifychina.com/verify2026 – includes Chinese-language document templates and government portal navigation guides.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Strategic Procurement Intelligence for Global Buyers

Executive Summary: Optimize Your China Sourcing Strategy in 2026

As global supply chains continue to evolve, procurement managers face mounting pressure to reduce lead times, ensure product quality, and mitigate supplier risk—especially when sourcing from China. In 2026, the most efficient procurement teams are leveraging data-driven tools and pre-vetted supplier networks to gain a competitive edge.

At the forefront of this transformation is SourcifyChina’s Verified Pro List—a curated database of pre-qualified, factory-direct manufacturers across key industrial sectors including electronics, hardware, textiles, and consumer goods.

Why the Verified Pro List Saves Time and Reduces Risk

Traditional sourcing methods in China often involve months of supplier searches, factory audits, and communication delays. SourcifyChina eliminates these inefficiencies through a rigorously vetted network of manufacturers, enabling procurement teams to fast-track supplier onboarding and production timelines.

| Benefit | Time Saved | Impact |

|---|---|---|

| Pre-Vetted Factories | 4–6 weeks | Eliminates need for independent background checks, site visits, and certification verification |

| Direct Manufacturer Access | 3–5 weeks | Bypasses trading companies; reduces miscommunication and margin markups |

| Standardized Compliance Data | 2–3 weeks | All suppliers provide verified business licenses, export history, and quality control protocols |

| Dedicated Sourcing Support | Ongoing | Real-time assistance with RFQs, negotiation, and production monitoring |

On average, clients using the Verified Pro List reduce supplier qualification time by 70% and accelerate time-to-market by up to 8 weeks.

Call to Action: Accelerate Your 2026 Procurement Goals

Don’t let inefficient sourcing slow down your supply chain. In a market where speed, compliance, and reliability define success, partnering with SourcifyChina gives you immediate access to trusted manufacturers—so you can focus on scaling, not screening.

👉 Take the next step today:

Contact our Sourcing Support Team to receive your customized match from the Verified Pro List.

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our consultants are available 24/7 to assist with supplier introductions, RFQ management, and end-to-end sourcing strategy—ensuring you source smarter, faster, and with full transparency.

SourcifyChina – Your Trusted Partner in Intelligent China Sourcing

Empowering Global Procurement Since 2018

🧮 Landed Cost Calculator

Estimate your total import cost from China.