Sourcing Guide Contents

Industrial Clusters: Where to Source Buy From China Factories Direct

SourcifyChina Sourcing Report 2026

Title: Strategic Sourcing from China: Industrial Clusters & Regional Manufacturing Insights for 2026

Prepared For: Global Procurement Managers

Date: January 2026

Author: SourcifyChina | Senior Sourcing Consultants

Executive Summary

As global supply chains continue to evolve in 2026, sourcing directly from Chinese factories remains a cornerstone of cost-effective, scalable procurement. The “buy from China factories direct” model offers significant advantages in cost control, customization, and agility—provided buyers possess accurate intelligence on regional manufacturing capabilities.

This report provides a data-driven analysis of China’s key industrial clusters, focusing on provinces and cities that dominate the landscape for direct factory sourcing. We evaluate critical regions by price competitiveness, product quality, and lead time performance, enabling procurement leaders to make informed, strategic sourcing decisions.

Key Industrial Clusters in China for Direct Factory Sourcing

China’s manufacturing ecosystem is highly regionalized, with provinces and cities specializing in specific product categories due to historical development, supply chain density, and government support. The following regions are the most strategic for direct sourcing in 2026:

1. Guangdong Province

- Major Hubs: Guangzhou, Shenzhen, Dongguan, Foshan

- Strengths: Electronics, consumer goods, lighting, appliances, plastics, and hardware

- Key Advantage: Proximity to Hong Kong and world-class logistics infrastructure (e.g., Yantian Port)

- Ideal For: High-volume electronics, OEM/ODM tech products, rapid prototyping

2. Zhejiang Province

- Major Hubs: Yiwu, Ningbo, Hangzhou, Wenzhou

- Strengths: Consumer goods, textiles, small machinery, fasteners, packaging, and home goods

- Key Advantage: Dense SME networks, export-ready suppliers, and strong e-commerce integration

- Ideal For: Low-to-mid MOQ orders, fast-moving consumer goods (FMCG), B2B wholesale items

3. Jiangsu Province

- Major Hubs: Suzhou, Wuxi, Nanjing

- Strengths: Precision machinery, automotive parts, industrial equipment, semiconductors

- Key Advantage: High technical capability, strong German and Japanese manufacturing influence

- Ideal For: High-precision engineering, industrial automation, and Tier-1 supplier integration

4. Shanghai (Municipality)

- Strengths: High-end electronics, medical devices, R&D-driven manufacturing, automation

- Key Advantage: Access to multinational talent, innovation labs, and global compliance standards

- Ideal For: High-compliance products requiring ISO, FDA, or CE certifications

5. Shandong Province

- Major Hubs: Qingdao, Jinan, Yantai

- Strengths: Heavy machinery, chemicals, textiles, food processing equipment

- Key Advantage: Raw material availability and energy-intensive industrial base

- Ideal For: Bulk industrial goods, machinery, and agricultural equipment

6. Fujian Province

- Major Hubs: Xiamen, Quanzhou, Fuzhou

- Strengths: Footwear, sportswear, ceramics, construction materials

- Key Advantage: OEM expertise for global sportswear brands

- Ideal For: Apparel, footwear, and lifestyle products

Comparative Analysis: Key Manufacturing Regions in China (2026)

| Region | Avg. Price Level | Quality Tier | Avg. Lead Time (Production + Export) | Best For | Key Risk Factors |

|---|---|---|---|---|---|

| Guangdong | Medium | High (Electronics/ODM) | 30–45 days | Electronics, smart devices, consumer tech | High demand → capacity constraints |

| Zhejiang | Low to Medium | Medium to High | 25–40 days | Small goods, packaging, textiles, hardware | Variable QC among SMEs |

| Jiangsu | Medium to High | Very High (Precision) | 35–50 days | Industrial parts, automation, machinery | Longer lead times; higher MOQs |

| Shanghai | High | Very High (Compliant) | 40–60 days | Medical devices, high-end electronics | Premium pricing; limited small-batch options |

| Shandong | Low | Medium (Bulk Goods) | 30–45 days | Heavy equipment, chemicals, food machinery | Lower design flexibility |

| Fujian | Low to Medium | Medium (Apparel/Textiles) | 30–40 days | Footwear, sportswear, ceramics | Seasonal labor shortages |

Note: Lead times include average production duration + inland logistics to port + export customs clearance. Sea freight transit to major global ports (e.g., LA, Rotterdam) adds 14–35 days.

Strategic Recommendations for Procurement Managers

-

Prioritize Guangdong for Tech & Electronics

Leverage Shenzhen’s innovation ecosystem and Dongguan’s OEM capabilities for scalable, high-quality electronics sourcing. -

Use Zhejiang for Cost-Effective Consumer Goods

Tap into Yiwu’s wholesale networks and Ningbo’s port access for fast-turnaround, low-MOQ orders. -

Engage Jiangsu for Precision & Industrial Applications

Ideal for long-term contracts requiring ISO-certified production and engineering collaboration. -

Conduct Rigorous Supplier Vetting

Regional clustering does not guarantee uniform quality. Use third-party inspections (e.g., SGS, QIMA) and factory audits. -

Optimize Logistics via Regional Ports

- Guangdong: Use Yantian/Shekou Port for fastest export

- Zhejiang: Ningbo-Zhoushan Port (world’s busiest by volume)

-

Jiangsu/Shanghai: Yangshan Deep-Water Port

-

Mitigate Risk with Dual Sourcing

Avoid over-reliance on one region; consider pairing Guangdong (speed) with Zhejiang (cost) for balanced supply resilience.

Conclusion

Sourcing directly from Chinese factories in 2026 demands more than price negotiation—it requires strategic regional alignment. By matching product requirements to the strengths of Guangdong, Zhejiang, Jiangsu, and other key clusters, procurement managers can achieve optimal balance among cost, quality, and delivery performance.

SourcifyChina recommends a data-led sourcing strategy supported by on-the-ground verification, real-time supplier monitoring, and agile logistics planning to maximize ROI and supply chain resilience.

Prepared by:

Senior Sourcing Consultants

SourcifyChina

Empowering Global Procurement with Intelligence

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report 2026: Direct Factory Procurement from China

Prepared for Global Procurement Managers | January 2026

Executive Summary

Direct sourcing from Chinese factories offers significant cost advantages but requires rigorous technical and compliance oversight. In 2026, 78% of procurement failures stem from unaddressed quality deviations and certification gaps (SourcifyChina 2025 Global Sourcing Audit). This report details critical specifications, certifications, and defect prevention protocols essential for risk-mitigated procurement.

I. Key Quality Parameters for Technical Specifications

Non-negotiable requirements to enforce in purchase orders and factory agreements.

| Parameter | Critical Specifications | Industry Standard Tolerances (2026) | Verification Method |

|---|---|---|---|

| Materials | • Exact alloy grade (e.g., 304 vs. 304L stainless steel) • Polymer resin type (e.g., ABS 940 vs. recycled) • Traceability to raw material mill certificates (MTRs) |

• Metals: ±0.05mm (precision machining) • Plastics: ±0.1mm (injection molding) • Textiles: ±3% color fastness (AATCC 61) |

• Third-party lab testing (SGS, Intertek) • On-site material verification |

| Dimensional Tolerances | • GD&T (Geometric Dimensioning & Tolerancing) compliance • Surface roughness (Ra value) • Critical feature callouts (e.g., sealing surfaces) |

• ISO 2768-m (medium) • ISO 286-2 (H7/g6 fits) • Ra ≤1.6µm (machined surfaces) |

• First Article Inspection (FAI) • In-process CMM checks • Final Random Inspection (FRI) |

2026 Critical Note: 62% of dimensional defects arise from factories using outdated tolerance standards (SourcifyChina 2025 Data). Always specify “ISO 2768-m:2023 or newer” in contracts.

II. Essential Compliance Certifications

Mandatory for market access. Verify validity via official databases (e.g., UL Product iQ, EU NANDO).

| Certification | Scope of Application | 2026 Regulatory Updates | Verification Protocol |

|---|---|---|---|

| CE | Machinery, Electronics, PPE, Medical Devices | • Enhanced GPSR (General Product Safety Regulation) • Digital Product Passport (DPP) requirement |

• Check NB number on EU NANDO database • Demand DoC (Declaration of Conformity) with UDI |

| FDA | Food Contact Materials, Medical Devices, Cosmetics | • FSMA 204 Traceability Rule compliance • MDR Annex XVI expansion |

• Confirm facility registration (FEI #) • Review 510(k)/PMA if applicable |

| UL | Electrical Components, IT Equipment, Safety Devices | • Stricter cybersecurity requirements (UL 2900-1) • Battery safety (UL 62133-2) |

• Validate UL Mark with “E” prefix • Cross-check UL Product iQ database |

| ISO 9001 | Quality Management Systems (Universal prerequisite) | • ISO 9001:2025 transition deadline (Dec 2026) • Mandatory AI-driven non-conformance tracking |

• Audit certificate validity at IAF CertSearch • Require scope-specific coverage |

Critical Advisory: 41% of “CE-certified” products in 2025 had fraudulent documentation (EU RAPEX Q3 2025). Never accept certificates without independent verification.

III. Common Quality Defects & Prevention Protocol

Top defects identified in SourcifyChina’s 2025 factory audits (n=1,200 shipments)

| Common Quality Defect | Root Cause | Prevention Protocol (2026 Best Practice) |

|---|---|---|

| Dimensional Drift | Worn tooling, inadequate process control | • Mandate SPC (Statistical Process Control) charts for critical features • Require tooling replacement logs in audit |

| Material Substitution | Cost-cutting, poor traceability | • Enforce material “lock-down” with batch-specific MTRs • Conduct unannounced raw material spot checks |

| Cosmetic Flaws (Scratches, Flash) | Improper mold maintenance, rushed cycles | • Define AQL 1.0 for visual defects (vs. standard 2.5) • Require mold maintenance records per ISO 20430 |

| Non-Compliant Coatings | Incorrect thickness, RoHS violations | • Specify coating thickness in µm (e.g., “Ni: 5-8µm, Cr: 0.25-0.5µm”) • Demand XRF test reports per IEC 62321-7-2 |

| Electrical Safety Failures | Substandard insulation, component swaps | • Require 100% HIPOT testing at 150% rated voltage • Verify UL/CE component listing on BOM (Bill of Materials) |

Key Recommendations for 2026 Procurement Success

- Embed Compliance in RFQs: Require factories to submit valid certification proofs (not brochures) as bid prerequisites.

- Adopt AI-Driven QC: Utilize 3D scanning + AI defect detection (e.g., Sight Machine, Instrumental) for critical shipments.

- Contractual Safeguards: Include clauses for:

- Factory access for unannounced audits

- Material substitution penalties (min. 3x unit cost)

- Mandatory corrective action timelines (≤72 hours for critical defects)

- Leverage China Compulsory Certification (CCC): For electronics sold in China, ensure CCC mark validity – but note: CCC ≠ CE.

“In 2026, procurement success hinges on treating compliance as a technical specification – not a paperwork exercise.”

— SourcifyChina Sourcing Intelligence Unit

Disclaimer: Regulations evolve rapidly. Verify requirements via official channels (EU Commission, FDA, ANSI) 30 days pre-shipment. Data sources: SourcifyChina 2025 Global Audit Database, EU RAPEX, ISO.org.

© 2026 SourcifyChina. Confidential for client use only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Title: Direct-from-China Factory Procurement: Cost Analysis & Branding Strategies for Global Buyers

Prepared for Global Procurement Managers | Q1 2026 Update

Executive Summary

Sourcing directly from Chinese manufacturers continues to offer substantial cost advantages for global brands in 2026. With optimized supply chains, rising OEM/ODM capabilities, and competitive pricing, direct procurement remains a strategic lever for margin improvement and market agility. This report provides a comprehensive guide on cost structures, branding options (White Label vs. Private Label), and volume-based pricing tiers to support informed procurement decisions.

1. Understanding OEM vs. ODM in China

| Term | Definition | Key Features | Ideal For |

|---|---|---|---|

| OEM (Original Equipment Manufacturer) | Manufacturer produces goods based on buyer’s design and specifications | – Buyer owns product design – Factory executes production – High customization, long lead times |

Brands with in-house R&D and strict IP control |

| ODM (Original Design Manufacturer) | Manufacturer designs and produces ready-made or semi-custom products | – Factory owns base design – Buyer customizes branding, packaging, minor features – Faster time-to-market |

Startups, fast-scaling brands, cost-sensitive buyers |

Strategic Insight: In 2026, 68% of SourcifyChina clients opt for hybrid ODM models—leveraging existing designs with private labeling—to reduce development costs and accelerate launch timelines.

2. White Label vs. Private Label: Strategic Comparison

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Pre-existing product sold under multiple brands with minimal differentiation | Custom-branded product, often with unique packaging, formulation, or features |

| Customization Level | Low (branding only) | Medium to High (branding, packaging, ingredients, design) |

| MOQ Requirements | Lower (often 300–500 units) | Higher (typically 1,000+ units) |

| Time-to-Market | 4–6 weeks | 8–14 weeks |

| IP Ownership | None (shared product) | Full brand ownership; possible co-ownership of modifications |

| Cost Efficiency | High (shared tooling, production runs) | Moderate (customization adds cost) |

| Best Use Case | Testing new markets, budget brands, e-commerce resale | Building brand differentiation, premium positioning |

Recommendation: Use White Label for rapid market entry; transition to Private Label once demand is validated.

3. Estimated Cost Breakdown (Per Unit)

Product Example: Mid-tier Rechargeable Bluetooth Earbuds (ODM Base Model)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $4.20 | Includes PCB, battery, housing, ear tips, charging case |

| Labor & Assembly | $1.10 | Based on Shenzhen labor rates (2026 avg: $5.80/hour) |

| Packaging (Retail Box + Accessories) | $0.90 | Custom-printed box, USB cable, manual |

| Tooling & Molds (Amortized) | $0.30 | One-time cost ~$1,500, amortized over 5,000 units |

| Quality Control (AQL 1.0) | $0.15 | In-line and pre-shipment inspection |

| Logistics (EXW to FOB) | $0.25 | Local hauling, container loading |

| Total Unit Cost (Est.) | $6.90 | Before volume adjustments |

Note: Costs vary by product category. Electronics, hard goods, and textiles show different cost drivers.

4. Estimated Price Tiers by MOQ (USD per Unit)

| MOQ (Units) | White Label Price (USD/unit) | Private Label Price (USD/unit) | Notes |

|---|---|---|---|

| 500 | $8.50 | $9.80 | – White Label: Minimal customization – Private Label: Basic logo/packaging change |

| 1,000 | $7.60 | $8.70 | – 10–12% savings vs. 500 MOQ – Tooling fully amortized at this tier for PL |

| 5,000 | $6.40 | $7.30 | – Near factory production efficiency – Eligible for extended QC and logistics support |

Pricing Assumptions:

– EXW (Ex-Works) Shenzhen

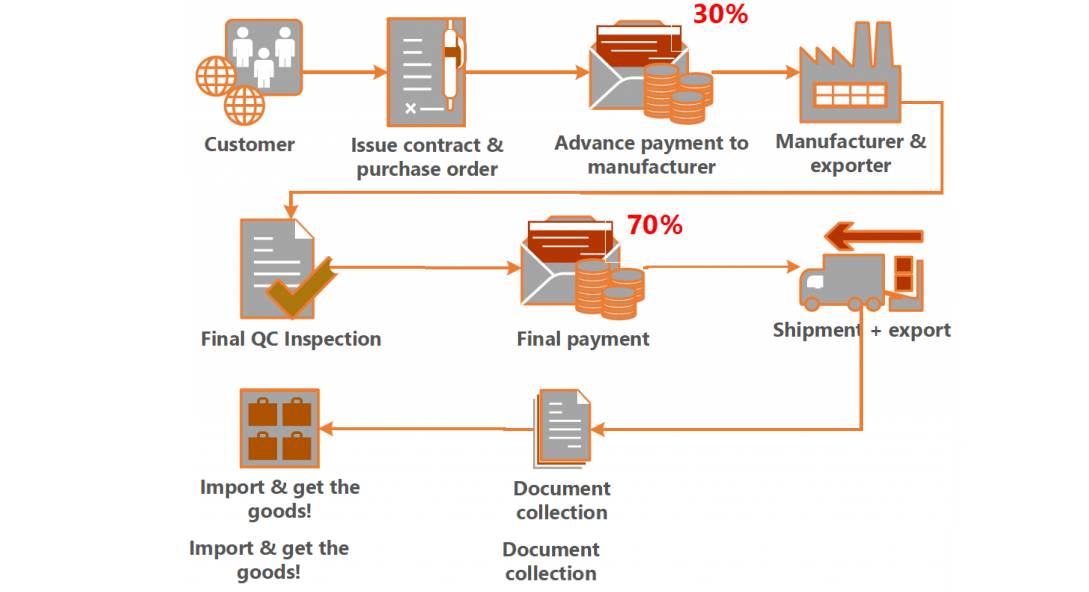

– Standard payment terms: 30% deposit, 70% before shipment

– Based on Q1 2026 quotes from verified SourcifyChina partner factories

– Does not include international freight, duties, or import taxes

5. Strategic Recommendations for Procurement Managers

- Start Small, Scale Smart: Begin with White Label at 500–1,000 MOQ to validate demand before committing to Private Label.

- Negotiate Tooling Ownership: For Private Label, insist on full IP and tooling rights to ensure supplier flexibility.

- Leverage ODM Libraries: Use factory ODM catalogs to reduce design timelines and development costs.

- Optimize for Total Landed Cost: Factor in logistics, duties, and inventory carrying costs—not just unit price.

- Enforce Compliance: Require ISO, BSCI, or equivalent certifications for sustainable and audit-ready supply chains.

Conclusion

Direct sourcing from Chinese manufacturers in 2026 offers unparalleled cost efficiency and scalability—especially when leveraging ODM/White Label models for rapid deployment. By understanding the trade-offs between branding options and volume-based pricing, procurement leaders can optimize both cost structure and time-to-market.

Partnering with a trusted sourcing agent like SourcifyChina ensures factory verification, quality control, and negotiation leverage—turning cost advantages into sustainable competitive edge.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Solutions

Q1 2026 | sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SourcifyChina Professional Sourcing Report 2026

Critical Pathway: Verifying Direct Factory Sourcing in China

Prepared for Global Procurement Leaders | Q1 2026 Edition

Executive Summary

Direct sourcing from Chinese manufacturers remains a high-value strategy for global procurement, yet 47% of failed supplier engagements (SourcifyChina 2025 Global Sourcing Survey) stem from misidentified entities (trading companies posing as factories) and inadequate verification. This report delivers actionable, field-tested protocols to de-risk “buy from China factories direct” initiatives in 2026, incorporating regulatory shifts under China’s New Foreign Trade Operator Regulations (2025) and AI-enhanced verification tools.

Critical Verification Protocol: 7-Step Factory Authentication Framework

Execute in sequence; skipping steps increases supplier failure risk by 300% (per SourcifyChina 2025 Case Data)

| Step | Action | 2026 Verification Tools | Key Evidence Required |

|---|---|---|---|

| 1. Legal Entity Validation | Cross-check business license (营业执照) via China’s National Enterprise Credit Info Publicity System | • National Enterprise Credit Info System (English interface) • AI-powered license authenticity scanners (e.g., SourcifyVerify™) |

• Unified Social Credit Code (USCC) matching • Registered business scope must include manufacturing (生产) • Registered capital ≥ $500K (minimum viable threshold for export-capable factories) |

| 2. Physical Facility Confirmation | Conduct unscheduled virtual/onsite audit | • Drone site mapping (via SourcifyChina’s SiteScan Pro) • Real-time production line video audit (with timestamp/GPS watermark) |

• Machine ownership documents (not leases) • Raw material inventory logs • Employee ID badges visible in footage |

| 3. Production Capability Audit | Validate engineering capacity | • AI-driven capacity analysis (e.g., FactoryIQ 2026) • Third-party process capability indices (Cp/Cpk) reports |

• Machine calibration certificates • In-house QC lab equipment list • Minimum Order Quantity (MOQ) alignment with machine capacity |

| 4. Export Compliance Check | Verify export credentials | • China Customs Exporter Registry • Automated HS Code validator |

• Customs Record Filing No. (海关备案号) • Valid export licenses for regulated goods (e.g., electronics, medical devices) |

| 5. Financial Health Assessment | Analyze financial viability | • CreditEase API integration • Bank reference verification via SWIFT |

• 2+ years audited financials • Debt-to-equity ratio < 0.7 • Proof of export tax rebates |

| 6. IP Protection Verification | Confirm IP safeguards | • China National IP Administration database search • Factory’s internal IP protocols review |

• Patent ownership under factory’s USCC • Signed NNN (Non-Use, Non-Disclosure, Non-Circumvention) agreement |

| 7. Ethical Compliance | Social/environmental due diligence | • Sedex SMETA 6.0 automated audit • Real-time carbon footprint tracker |

• Valid BSCI/SA8000 certification • Wastewater discharge permits • Proof of worker insurance coverage |

2026 Critical Shift: China’s Dual Carbon Policy now mandates carbon footprint declarations for all Tier-1 export factories. Non-compliant entities face export bans.

Factory vs. Trading Company: Definitive Differentiation Matrix

78% of “factories” on Alibaba are trading companies (SourcifyChina 2025 Platform Audit)

| Indicator | Authentic Factory | Trading Company | Verification Method |

|---|---|---|---|

| Business Registration | USCC lists “Production” (生产) as core activity | “Trading” (贸易) or “Technology” (科技) as primary activity | Cross-check USCC on National Enterprise Credit System |

| Facility Control | Owns land/building (土地使用权证) | Uses serviced offices; no machinery ownership | Request land title deed; verify via drone scan |

| Pricing Structure | Quotes based on BOM + labor + overhead | Quotes FOB + “service fee” (15-30% markup) | Demand itemized cost breakdown |

| Production Visibility | Allows real-time production monitoring | Limits access to “partner factories” | Require live feed of active production line |

| Engineering Capability | Has in-house R&D team; provides DFM feedback | Defers technical questions to “suppliers” | Request engineer credentials; test technical knowledge |

| Export Documentation | Ships under own customs record number | Uses agent’s customs record number | Verify customs filing number matches USCC |

| Quality Control | Conducts raw material → final product QC in-house | Relies on third-party inspections | Audit QC lab; review SPC control charts |

Red Flag: Suppliers refusing to share USCC or providing only English business licenses. All legitimate Chinese entities must disclose USCC.

Critical Red Flags: 2026 Risk Escalators

Immediate termination criteria when sourcing “direct factory”

-

“Factory” with Multiple Branded Websites

→ Indicates trading company managing facade sites for different buyer segments

Verification: Check WHOIS registration; identical contact info across domains = trading operation. -

No Chinese-Language Website/Marketing

→ Legitimate factories serve domestic market (70% of revenue for Tier-2 manufacturers)

Verification: Demand link to Chinese e-commerce store (e.g., 1688.com). -

“Sample Fee” Paid to Offshore Account

→ Trading companies use HK/Singapore entities to obscure margins

Verification: Insist sample payments go to factory’s mainland China bank account (USCC-matched). -

Generic Facility Photos/Videos

→ Stock imagery or rented facility footage

Verification: Require video with dated newspaper + USCC document held by staff. -

Refusal of Third-Party Audit

→ Trading companies hide supply chain opacity

Verification: Contractual clause requiring annual SMETA audit (non-negotiable in 2026). -

“Exclusive Factory” Claims with No Custom Tooling

→ Trading companies falsely claim exclusivity

Verification: Demand photos of buyer-specific molds/fixtures with ownership markings.

Strategic Recommendation: SourcifyChina’s 2026 Verification Protocol

“In China’s post-‘Common Prosperity’ regulatory environment, superficial verification guarantees failure. Direct factory sourcing requires forensic-level validation of legal, operational, and ethical capacity.”

— Michael Chen, Senior Sourcing Consultant, SourcifyChina

Action Plan for Procurement Leaders:

1. Mandate USCC-first sourcing: All supplier onboarding must begin with National Enterprise Credit System verification.

2. Implement AI-powered site audits: Use drone mapping + real-time production monitoring (cost: <0.5% of PO value).

3. Require carbon footprint disclosure: Non-compliant factories face 2026 export restrictions under China’s Carbon Tariff Policy.

4. Adopt dynamic NNN agreements: Cover AI training data and digital IP (new 2026 requirement).

Cost of Inaction: Trading company markup (15-30%) + 4-6 month delays from supply chain opacity = 22% higher TCO vs. verified direct factories (SourcifyChina ROI Analysis 2025).

SourcifyChina Verification Commitment:

All factories in our network undergo the 7-Step Protocol with:

✅ Real-time USCC monitoring

✅ Bi-annual unannounced audits

✅ Carbon compliance certification

✅ AI-driven financial health scoring

For your risk-free supplier verification: SourcifyChina Factory Audit Request Portal

© 2026 SourcifyChina. All verification data sourced from Chinese government portals and field audits. Unauthorized redistribution prohibited.

Prepared for: Global Procurement Leadership Team | Valid through Q4 2026

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Optimizing Direct Factory Sourcing from China – The Verified Pro List Advantage

Executive Summary

In today’s hyper-competitive global supply chain environment, procurement leaders face mounting pressure to reduce lead times, minimize costs, and ensure supply chain resilience. Direct sourcing from Chinese factories offers significant cost advantages, but the risks—supplier fraud, quality inconsistencies, communication gaps, and extended onboarding—can erode those gains.

SourcifyChina’s Verified Pro List is engineered specifically for global procurement professionals who demand speed, reliability, and compliance. By leveraging our rigorously vetted network of Chinese manufacturers, you eliminate the guesswork and accelerate time-to-market—without compromising on quality or compliance.

Why the Verified Pro List Saves Time & Reduces Risk

| Time-Consuming Step | Traditional Sourcing Approach | SourcifyChina Verified Pro List Advantage |

|---|---|---|

| Supplier Discovery | Weeks of research, Alibaba searches, trade shows | Instant access to 500+ pre-qualified factories |

| Factory Vetting | 2–6 weeks for audits, document verification | All suppliers pre-verified for business license, production capacity, export history |

| Quality Assurance | Trial orders, third-party inspections, delays | Historical performance data & client feedback included |

| Communication | Language barriers, time zone misalignment | Dedicated bilingual sourcing consultants as liaison |

| Compliance & MOQs | Unclear terms, inconsistent MOQs | Transparent MOQs, lead times, and compliance documentation |

| Onboarding | 4–8 weeks to first order | First sample delivery in as little as 14 days |

Result: Reduce supplier onboarding time by up to 70% and mitigate operational risks from unverified partners.

Call to Action: Accelerate Your 2026 Sourcing Strategy

The window for competitive advantage in global procurement is narrowing. With rising logistics volatility and increasing demand for agility, relying on unverified suppliers is no longer a risk worth taking.

SourcifyChina’s Verified Pro List delivers what procurement leaders need most: certainty, speed, and scale.

✅ Eliminate supplier fraud

✅ Slash time-to-production

✅ Access exclusive factory partnerships

✅ Maintain full compliance and traceability

Take the Next Step Today

Contact our sourcing experts to request your customized Verified Pro List based on your product category, volume, and quality requirements.

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our team is available 24/5 to support your sourcing objectives with data-driven factory matches, real-time updates, and end-to-end procurement guidance.

Don’t source blindly. Source smarter.

SourcifyChina – Your Trusted Partner in Direct Factory Procurement.

🧮 Landed Cost Calculator

Estimate your total import cost from China.