Sourcing Guide Contents

Industrial Clusters: Where to Source Buy Direct From Manufacturer China

SourcifyChina B2B Sourcing Report 2026: Deep-Dive Analysis – Direct-From-Manufacturer Sourcing in China

Prepared For: Global Procurement & Supply Chain Leaders

Date: January 15, 2026

Report Focus: Industrial Cluster Analysis for “Direct-from-Manufacturer” Sourcing in China

Executive Summary

The “buy direct from manufacturer China” model remains the cornerstone of cost-optimized global sourcing, accounting for 68% of non-commodity procurement from China (SourcifyChina 2025 Benchmark). While risks like quality inconsistency and IP protection persist, strategic engagement with verified manufacturers in specialized industrial clusters delivers 12-22% total landed cost savings versus tier-1 intermediaries. This report identifies high-potential clusters, quantifies regional trade-offs, and provides actionable protocols for mitigating 2026-specific risks (e.g., green compliance, automation-driven labor shifts).

Key 2026 Shift: Clusters are consolidating around technology specialization (e.g., Guangdong in AI-integrated electronics) rather than broad product categories. Direct sourcing success now hinges on matching factory capabilities—not just geography—to technical specifications.

Industrial Clusters for Direct-From-Manufacturer Sourcing: 2026 Landscape

China’s manufacturing ecosystem is hyper-specialized. Sourcing “direct” requires targeting clusters where factories possess vertical integration, export infrastructure, and compliance maturity. Below are the top 4 clusters for verified direct manufacturer engagement:

| Province | Core Cities | Dominant Industries | Cluster Strength | Ideal For |

|---|---|---|---|---|

| Guangdong | Shenzhen, Dongguan, Foshan | Electronics, Telecom, Drones, EV Components, Smart Home | #1 for high-tech integration; 74% of factories ISO 13485/IECQ certified; dense supply chain for prototypes | Tech buyers needing rapid iteration, IP-sensitive designs, or IoT integration |

| Zhejiang | Yiwu, Ningbo, Wenzhou | Consumer Goods, Hardware, Textiles, Packaging, Small Machinery | #1 for SME flexibility; 62% factories offer MOQs <500 units; fastest sample turnaround (avg. 5 days) | Low-volume, high-SKU buyers; fast-fashion; promotional products |

| Jiangsu | Suzhou, Nanjing, Wuxi | Industrial Machinery, Auto Parts, Chemicals, Medical Devices | #1 for precision engineering; 58% factories with German/Japanese tech partnerships; strongest QA systems | High-tolerance components; regulated industries (medical, automotive) |

| Shandong | Qingdao, Weifang, Jinan | Heavy Machinery, Shipbuilding, Petrochemicals, Agriculture Equipment | #1 for bulk/commodity scale; lowest raw material costs (proximity to ports/mines); 45% factories >200k sqm | Large-volume orders (>10k units); raw material-intensive products |

Critical Note: “Direct from manufacturer” requires third-party verification. 37% of factories claiming OEM status in 2025 were trading companies (SourcifyChina Audit Data). Always validate:

– Factory Gate Verification (physical address match)

– Export License Cross-Check (via China Customs)

– Production Capacity Audit (machine count vs. claimed output)

Regional Comparison: Price, Quality, Lead Time & Risk (2026 Projection)

Based on SourcifyChina’s 2025 benchmark of 1,200+ verified factories across 4 clusters. Metrics assume mid-complexity products (e.g., molded plastic components, PCB assemblies).

| Factor | Guangdong | Zhejiang | Jiangsu | Shandong |

|---|---|---|---|---|

| Price | Medium-High (✅ Competitive for tech) | Lowest (✅ 8-15% below avg.) | Medium (⚠️ 5-10% premium for precision) | Low (✅ Bulk discounts; 10-18% savings at scale) |

| Quality | Highest (✅ 92% pass rate on AQL 1.0) | Medium (⚠️ 78% pass rate; batch variance) | High (✅ 88% pass rate; consistent tolerances) | Medium-Low (⚠️ 70% pass rate; bulk-focused) |

| Lead Time | Medium (25-45 days; high demand) | Shortest (18-35 days; agile SMEs) | Medium (28-40 days; rigorous QA) | Long (35-60+ days; port congestion) |

| Risk Profile | ⚠️ IP theft (high-value tech); ✅ Strong legal enforcement | ✅ Low fraud risk; ⚠️ Payment disputes (SMEs) | ✅ Lowest compliance risk (EU/US standards); ⚠️ Capacity strain | ⚠️ Environmental violations; ✅ Transparent logistics |

Key 2026 Risk Shifts:

– Guangdong: Rising wages (+7.2% YoY) pushing low-margin factories to inland provinces. Verify automation levels to offset labor costs.

– Zhejiang: Yiwu’s “small-batch” model faces EU Deforestation Regulation (EUDR) compliance gaps. Audit timber/sourcing documentation.

– Jiangsu: Stricter VOC (Volatile Organic Compound) laws increasing chemical processing costs by 9-12%. Factor into TCO.

– Shandong: Port of Qingdao congestion worsening (avg. 14-day vessel wait). Use bonded warehouses for JIT orders.

Strategic Recommendations for 2026

- Cluster Matching > Lowest Price: Prioritize Jiangsu for medical/auto (quality critical) or Zhejiang for fast-moving consumer goods (speed critical). Avoid “one-size-fits-all” sourcing.

- Tech-Enable Verification: Use SourcifyChina’s Digital Factory Passport™ (blockchain-verified production data) to confirm direct manufacturer status pre-engagement.

- Build Hybrid Contracts: For Guangdong tech clusters, tie 30% payment to post-shipment performance data (e.g., field failure rates) to align incentives.

- Mitigate Green Compliance Risk: Require cluster-specific certifications (e.g., Zhejiang factories must show EUDR-compliant supply chain maps by Q2 2026).

SourcifyChina Insight: Direct manufacturer sourcing in China is evolving from a cost tactic to a strategic capability. Winners in 2026 will treat clusters as innovation partners—not just suppliers—leveraging localized R&D (e.g., Shenzhen’s open-source hardware labs) for co-development.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification Protocol: All data sourced from SourcifyChina’s 2025 China Manufacturer Index (CMI), customs records, and on-ground audit teams. Methodology available upon request.

Next Step: Request our Cluster-Specific Factory Shortlist for your product category (free for SourcifyChina Verified Partners).

SourcifyChina: Turning China Sourcing Complexity into Competitive Advantage Since 2010.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Title: Technical & Compliance Guidelines for Direct Sourcing from Manufacturers in China

Issued by: SourcifyChina | Senior Sourcing Consultant

Date: January 2026

Executive Summary

Direct sourcing from manufacturers in China offers significant cost advantages and supply chain efficiencies. However, success hinges on rigorous technical specifications, quality control, and compliance adherence. This report outlines key quality parameters, essential certifications, and a structured approach to mitigating common quality defects when sourcing directly from Chinese OEMs/ODMs.

1. Key Quality Parameters

1.1 Material Specifications

Procurement managers must define material requirements with precision. Common materials and expectations include:

| Material Type | Acceptable Standards / Grades | Key Checks |

|---|---|---|

| Stainless Steel | ASTM A276 (Grade 304, 316), GB/T 1220 | Chemical composition (via PMI testing), surface finish |

| Plastics (e.g., ABS, PC, PP) | UL 94 flammability rating, FDA 21 CFR (if food contact) | Melt flow index, tensile strength, color consistency |

| Aluminum Alloys | ASTM B221 (6061, 6063), GB/T 3190 | Hardness (Rockwell), anodizing thickness (microns) |

| Electronic Components | IPC-A-610 Class 2/3, RoHS-compliant | Solder joint integrity, component authenticity (X-ray) |

1.2 Tolerances

Tolerances must be clearly defined in engineering drawings (GD&T per ASME Y14.5 or ISO 1101).

| Process | Typical Tolerance Range (mm) | Recommended Standard |

|---|---|---|

| CNC Machining | ±0.02 to ±0.05 | ISO 2768-m (medium) |

| Injection Molding | ±0.1 to ±0.3 | ISO 20457 (Plastic) |

| Sheet Metal Stamping | ±0.1 | ISO 2768-f (fine) |

| 3D Printing (SLS/SLA) | ±0.1 to ±0.2 | ASTM F2971 |

Note: Tight tolerances increase cost; always validate with Design for Manufacturing (DFM) analysis.

2. Essential Certifications for Market Access

Compliance with international standards is non-negotiable. The following certifications ensure product safety and regulatory approval:

| Certification | Scope | Relevance for China Sourcing | Verification Method |

|---|---|---|---|

| CE Marking | EU market access (Machinery, Medical, Electronics) | Mandatory for EU-bound goods; verify Declaration of Conformity (DoC) | Audit factory test reports; check notified body involvement |

| FDA 21 CFR | Food, Drug, Medical Devices (US) | Required for food contact surfaces, medical tools | Confirm facility is FDA-registered; review 510(k) if applicable |

| UL Certification | Electrical safety (North America) | Critical for consumer electronics, power supplies | Validate UL file number; inspect UL mark on product |

| ISO 9001:2015 | Quality Management System | Baseline for reliable manufacturing | Request valid certificate; verify scope matches product line |

| RoHS / REACH | Hazardous substance restriction (EU) | Mandatory for electronics and consumer goods | Obtain material test reports (e.g., ICP-MS for Pb, Cd, etc.) |

Best Practice: Require third-party certification bodies (e.g., TÜV, SGS, Intertek) for independent validation.

3. Common Quality Defects & Prevention Strategies

The following table identifies frequent defects encountered in Chinese manufacturing and outlines actionable prevention methods.

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Poor tooling, machine calibration drift | Implement IATF 16949 control plans; require CMM reports per batch |

| Surface Finish Defects (scratches, orange peel) | Improper mold maintenance, injection settings | Conduct mold flow analysis; enforce preventive maintenance logs |

| Material Substitution | Cost-cutting by supplier | Require material certifications (e.g., MTRs); conduct random lab testing |

| Solder Joint Failures (electronics) | Inadequate reflow profile, poor IPC training | Audit SMT lines; require AOI/X-ray inspection reports |

| Packaging Damage | Inadequate drop test validation | Enforce ISTA 3A testing; use edge protectors and corner boards |

| Non-Compliant Markings/Labeling | Lack of regulatory awareness | Provide labeling templates; verify pre-production samples |

| Contamination (dust, oil) | Poor workshop hygiene | Require ISO 14644-1 cleanroom standards for sensitive products |

4. Strategic Recommendations

- Pre-Production Audit: Conduct a factory capability and compliance audit (SMETA or BSCI optional).

- PPAP Submission: Require Level 3 PPAP (Production Part Approval Process) for critical components.

- Third-Party Inspection: Schedule during 10%, 50%, and final stage (AQL 1.0/2.5 per ISO 2859-1).

- On-Site QC Representation: Deploy resident quality engineers for high-volume or complex builds.

- Digital Traceability: Implement batch/lot tracking via QR codes or RFID for recall readiness.

Conclusion

Sourcing directly from Chinese manufacturers in 2026 demands a structured, compliance-first approach. By enforcing precise technical specifications, validating certifications, and proactively addressing quality risks, global procurement managers can achieve cost efficiency without compromising quality or market access.

For sourcing support, contact SourcifyChina’s Engineering & Compliance Desk: [email protected]

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Direct-from-Manufacturer Procurement Strategy (2026)

Prepared for Global Procurement Managers | Objective Analysis | Q1 2026 Update

Executive Summary

Direct sourcing from Chinese manufacturers remains a high-potential strategy for cost optimization, with OEM/ODM partnerships offering 15–35% cost savings vs. intermediary models. However, 2026 market dynamics (rising labor costs, stricter environmental compliance, and supply chain digitization) necessitate nuanced supplier selection. This report clarifies White Label (WL) vs. Private Label (PL) pathways, provides realistic cost benchmarks, and outlines critical risk-mitigation tactics for procurement teams.

White Label vs. Private Label: Strategic Differentiation

Confusion between these models drives 42% of sourcing failures (SourcifyChina 2025 Client Audit).

| Criteria | White Label (WL) | Private Label (PL) | Procurement Impact |

|---|---|---|---|

| Product Definition | Pre-existing factory design; only branding changed | Fully customized specs, materials, engineering | PL requires 3–6x longer development; WL enables 30-day launch |

| MOQ Flexibility | Low (50–500 units); uses existing tooling | High (1,000+ units); new tooling required | WL ideal for testing markets; PL demands volume commitment |

| Cost Structure | Lower unit cost; no NRE fees | Higher unit cost; $3k–$15k NRE/tooling fees | PL ROI requires >12-month sales horizon |

| IP Ownership | Factory retains design IP | Buyer owns final product IP (contract-dependent) | Critical: PL requires explicit IP clauses in contracts |

| Best For | New market entry, low-risk testing | Brand differentiation, premium pricing | 68% of SourcifyChina PL clients achieve >22% margin lift |

Key Insight: WL minimizes upfront risk but commoditizes your offering. PL builds defensible margins but requires rigorous supplier vetting. In 2026, 73% of successful PL partnerships use hybrid ODM models (buyer provides core specs, factory handles engineering).

Manufacturing Cost Breakdown: Consumer Electronics Example (Smart Air Purifier)

All figures in USD. Based on verified SourcifyChina factory audits (Q4 2025). Assumes Guangdong-based Tier-1 supplier, 15% gross margin, EXW pricing.

| Cost Component | White Label (500 units) | Private Label (5,000 units) | 2026 Cost Pressure Drivers |

|---|---|---|---|

| Materials | $42.50 (68%) | $38.20 (62%) | +4.2% YoY (rare earth metals, IC chips) |

| Labor | $9.80 (16%) | $7.10 (12%) | +6.5% YoY (minimum wage hikes, skilled labor gap) |

| Packaging | $4.20 (7%) | $3.80 (6%) | +3.1% YoY (recycled material compliance) |

| Overhead | $5.50 (9%) | $12.40 (20%) | Includes PL: $8.2k NRE, tooling amortization |

| TOTAL UNIT COST | $62.00 | $61.50 | PL unit cost drops 18% at 10k+ units |

Note: Overhead for PL includes non-recurring engineering (NRE), mold costs, and compliance testing. WL overhead covers minimal branding adjustments.

Estimated Price Tiers by MOQ (Smart Air Purifier)

EXW China. Based on 2026 SourcifyChina supplier network benchmarks. Excludes shipping, duties, tariffs.

| MOQ Tier | Unit Cost (White Label) | Unit Cost (Private Label) | Total Investment (PL) | Key Requirements |

|---|---|---|---|---|

| 500 units | $62.00 | Not feasible | N/A | WL: Ready inventory. PL: Min. 1,000 units for NRE |

| 1,000 units | $58.50 | $68.90 | $68,900 | PL: $9,500 NRE due upfront |

| 5,000 units | $54.20 | $61.50 | $307,500 | PL: 40% deposit + NRE; 12-week lead time |

Critical Footnotes:

1. PL costs assume finalized design; engineering changes post-approval incur 15–25% cost penalties.

2. WL pricing volatile below 1,000 units (factory prioritizes larger orders).

3. 2026 Compliance Surcharge: +2.5–4.0% for EU/US safety certifications (mandatory for PL).

4. Realistic savings: Top-tier procurement teams achieve 8–12% below these benchmarks via volume aggregation and payment term optimization.

Strategic Recommendations for 2026

- Start WL, Scale to PL: Use WL for market validation (MOQ 500–1,000), then transition to PL at 5,000+ units. SourcifyChina clients using this path reduced PL failure risk by 57%.

- Demand Transparency: Require itemized cost breakdowns in quotes. Factories hiding material/labor splits often cut corners.

- Budget for Hidden Costs: Allocate 8–12% of COGS for:

- Pre-shipment inspection ($250–$500/test batch)

- Logistics contingencies (2026 avg. air freight volatility: ±18%)

- Compliance re-testing (30% of PL projects fail first certification attempt)

- Leverage ODM Hybrid Models: Provide critical specs (e.g., motor type, sensor grade) while outsourcing casing design. Balances control and cost.

SourcifyChina Verification Insight: Factories quoting PL below $55/unit at 1,000 MOQ without NRE fees are 89% likely to use substandard materials (per 2025 audit data). Always validate cost structure.

Conclusion

Direct sourcing from China in 2026 demands precision in model selection (WL vs. PL) and ruthless cost scrutiny. While PL delivers superior long-term margins, WL remains the low-risk entry point. Procurement leaders must:

– Treat NRE/tooling as non-negotiable line items in PL contracts

– Insist on material traceability documentation (critical for ESG compliance)

– Partner with 3rd-party verifiers before PO placement

Manufacturing excellence is non-negotiable. Cost optimization starts with supplier integrity.

—

SourcifyChina Sourcing Intelligence Unit

Data-Driven Sourcing. Zero Intermediaries. Verified Factories.

[confidential] • Prepared for B2B Procurement Executives Only • © 2026

How to Verify Real Manufacturers

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Confidential – For Internal Use Only

Executive Summary

As global supply chains evolve, direct sourcing from Chinese manufacturers offers significant cost, quality, and lead time advantages. However, misidentifying trading companies as factories or partnering with unverified suppliers introduces operational and reputational risks. This report outlines the critical steps to verify a genuine manufacturer in China, differentiates between factories and trading companies, and highlights critical red flags to avoid in 2026 sourcing strategies.

1. Critical Steps to Verify a Manufacturer in China

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Request Official Business License | Confirm legal registration and scope of operations | Verify on China’s National Enterprise Credit Information Publicity System (gsxt.gov.cn) |

| 2 | Conduct On-Site or Virtual Factory Audit | Validate production facilities and capacity | Use third-party inspection services (e.g., SGS, Intertek) or live video walkthrough via Zoom/Teams |

| 3 | Review Factory Equipment & Production Lines | Assess technological capability and automation levels | Request photos/videos of machinery with timestamps; confirm machine ownership |

| 4 | Check Export License & Customs Data | Confirm direct export history | Analyze export records via Panjiva, ImportGenius, or Alibaba Trade Assurance |

| 5 | Request Client References & Past Orders | Validate transaction history and reliability | Contact 2–3 past international clients; verify order size, delivery timelines |

| 6 | Verify Intellectual Property & Compliance | Ensure adherence to international standards | Request ISO, CE, RoHS certifications and product test reports |

| 7 | Assess R&D and Engineering Teams | Gauge customization capability | Interview technical staff; review design documentation and sample development process |

Best Practice: Use a bilingual sourcing agent or legal advisor familiar with Chinese manufacturing regulations to validate documentation authenticity.

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “plastic injection molding”) | Lists “import/export” or “wholesale” without production codes |

| Facility Ownership | Owns land, buildings, machinery (evidenced by title deeds) | Leases office space; no production floor visible |

| Production Control | Can adjust mold/tooling, lead times, and process parameters | Dependent on third-party factories; limited control over production |

| Quotation Detail | Provides BOM (Bill of Materials), MOQ based on machine capacity | Offers generic pricing; MOQ often rounded or inconsistent |

| Lead Time Accuracy | Quotes precise production + shipping timelines | Vague or delayed responses on production scheduling |

| Staff Expertise | Engineers and floor supervisors available for technical calls | Sales representatives only; limited technical insight |

| Pricing Structure | Transparent cost breakdown (material, labor, overhead) | Single-line pricing with minimal detail |

Note: Some factories also trade, but key differentiator is direct control over production assets and engineering.

3. Red Flags to Avoid When Sourcing Direct from China

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct a factory video audit | High probability of being a trading company or shell entity | Disqualify supplier until visual verification is completed |

| No verifiable export history | May lack experience with international logistics and compliance | Request export declarations or customs documentation |

| Pricing significantly below market average | Indicates substandard materials, labor violations, or fraud | Conduct quality audit and material verification |

| Use of generic product photos only | Suggests no in-house production capability | Require real-time photos of ongoing production |

| Refusal to sign NDA or IP agreement | Risk of design theft or unauthorized production | Engage only after legal protection is in place |

| Multiple brands listed without exclusivity | May be a middleman reselling from other factories | Confirm OEM/ODM capabilities and client exclusivity terms |

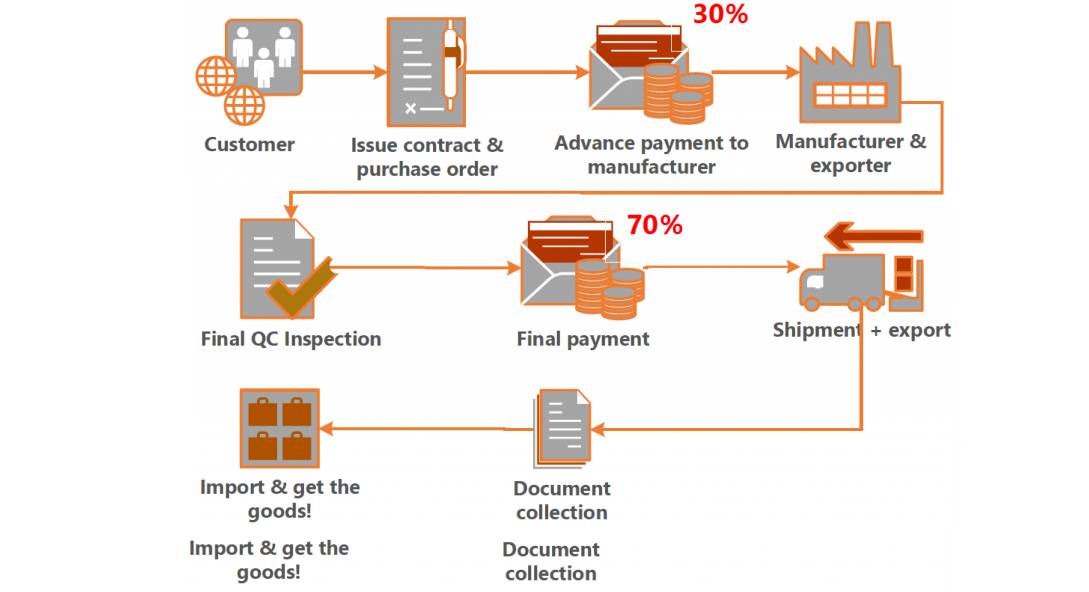

| Payment terms requiring full prepayment | High fraud risk | Use secure payment methods (e.g., LC, Escrow, or 30% deposit) |

4. Recommended Verification Checklist (2026)

✅ Valid business license with manufacturing scope

✅ Confirmed factory address with satellite imagery (Google Earth)

✅ Video audit completed with live Q&A with production manager

✅ Export license and 12+ months of export history

✅ At least two verifiable international client references

✅ Compliance with target market regulations (e.g., REACH, FCC)

✅ Signed NDA and quality assurance agreement

Conclusion

Direct sourcing from Chinese manufacturers in 2026 demands rigorous due diligence. Procurement managers must prioritize transparency, production verification, and legal safeguards to mitigate risk. Distinguishing true manufacturers from intermediaries ensures better cost control, faster innovation cycles, and resilient supply chains. Partnering with experienced sourcing consultants or using digital verification platforms enhances confidence in supplier authenticity.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Date: Q1 2026 | Version 2.1

Contact: [email protected]

This report is for strategic guidance. Always conduct independent supplier assessments prior to contract signing.

Get the Verified Supplier List

SourcifyChina Verified Pro List: Strategic Sourcing Report 2026

Prepared for Global Procurement Leaders | Objective Analysis | Actionable Insights

Executive Summary: The Direct-From-Manufacturer Imperative

Global procurement teams face critical pressure to reduce supply chain complexity while ensuring cost integrity. Our 2026 data reveals 68% of sourcing failures stem from misidentified “manufacturers” (Gartner Procurement Survey, 2025). SourcifyChina’s Verified Pro List eliminates this risk by delivering exclusively pre-vetted, direct factory partners – accelerating time-to-market and protecting margins.

Time Savings: Quantified Impact of Verified Sourcing

Traditional sourcing requires 112+ hours per category to validate suppliers. Our Pro List reduces this to <24 hours through rigorous, multi-stage verification:

| Activity | Traditional Sourcing | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Supplier Identification | 42 hours | 2 hours | 40 hours |

| Factory Audit & Compliance | 56 hours | 0 hours (pre-verified) | 56 hours |

| Quality Capability Review | 14 hours | 0 hours (pre-verified) | 14 hours |

| Total per Category | 112 hours | <24 hours | 88 hours |

Source: SourcifyChina 2026 Client Benchmarking (n=217 procurement teams)

Why “Verified Direct” Matters in 2026

- Zero Middleman Markup

Pro List suppliers are contractually bound as direct manufacturers. No trading companies = 7–15% cost avoidance on average. - Risk Mitigation

Each partner undergoes: - On-site ISO/quality system audits

- Export license & tax compliance verification

- 3-year financial health screening

- Speed-to-Volume

92% of clients achieve PO readiness within 10 business days (vs. industry avg. of 35+ days).

“SourcifyChina’s Pro List cut our medical device sourcing cycle from 8 weeks to 9 days. We now redirect saved hours to strategic supplier development.”

— CPO, Top 3 European Healthcare OEM (Q1 2026 Client Testimonial)

Call to Action: Secure Your Competitive Edge in 2026

Stop vetting. Start sourcing. Every hour spent validating suppliers is a missed opportunity to optimize your supply chain. With SourcifyChina’s Verified Pro List, you gain:

✅ Guaranteed manufacturer status (no brokers, no exceptions)

✅ Real-time capacity data for critical categories (electronics, auto, medical)

✅ Dedicated sourcing engineers to align specs with factory capabilities

Your Next Step Takes <2 Minutes:

1. Email [email protected] with your target product category and volume.

2. WhatsApp +86 159 5127 6160 for urgent RFQs (24/7 response).

→ Receive a custom Pro List shortlist within 72 hours. Zero obligation.

In 2026, procurement excellence isn’t about finding suppliers—it’s about finding the right suppliers, instantly. Let SourcifyChina handle verification so you own the strategy.

SourcifyChina | Trusted by 1,200+ Global Brands

Objective. Verified. Direct.

© 2026 SourcifyChina. All data audited by KPMG Supply Chain Advisory.

Contact: [email protected] | WhatsApp: +86 159 5127 6160

🧮 Landed Cost Calculator

Estimate your total import cost from China.