The global butterfly valve market, valued at USD 8.2 billion in 2023, is projected to grow at a CAGR of 5.4% through 2030, according to Grand View Research. This steady expansion is driven by rising demand across oil & gas, water treatment, chemical processing, and power generation industries, where efficient flow control and compact valve designs are critical. Mordor Intelligence further highlights the Asia-Pacific region as a key growth hub, fueled by industrial automation and infrastructure development. With increasing emphasis on energy efficiency and system reliability, butterfly valves have become a preferred choice for medium- to large-diameter pipelines. As competition intensifies, a select group of manufacturers are leading innovation through advanced materials, smart actuation, and compliance with international standards. Below are the top 9 butterfly valve manufacturers shaping the industry through technological leadership, global reach, and consistent performance.

Top 9 Butterfly Valve Types Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Butterfly Valves

Domain Est. 1996

Website: dezurik.com

Key Highlights: DeZURIK is a leading manufacturer of buttery valves throughout the world. Find butterfly valves for pump stations, industrial wastewater, cooling towers, ……

#2 Powell Valves: Industrial Valve Manufacturer

Domain Est. 1998

Website: powellvalves.com

Key Highlights: Powell Valves fabricates double offset high performance and resilient seated butterfly valves with the highest standards to deliver customer satisfaction. Learn ……

#3 Val Matic Valve Manufacturer

Domain Est. 1999

Website: valmatic.com

Key Highlights: Located in Elmhurst, Illinois, Val-Matic Valve & Manufacturing makes quality valves for municipal and industrial applications. We are a valve manufacturer ……

#4 Industrial Butterfly Valves Products

Domain Est. 1997

Website: flowserve.com

Key Highlights: Flowserve’s Butterfly Valves product portfolio is one of the most comprehensive in the flow control industry. Explore a wide range of Butterfly Valves ……

#5 Butterfly Valves Manufacturer, Types Of Butterfly Valves

Domain Est. 2009

Website: wsv-valve.com

Key Highlights: WSV Valve offers different high performance butterfly valve types in different materials. Our manual butterfly valves are widely used in chemical industry, ……

#6 Butterfly Valves

Domain Est. 1995

Website: emerson.com

Key Highlights: Butterfly Valves · Keystone Model ParaSeal Butterfly Valves · Keystone Figure 55 Butterfly Valve (Discontinued) · Keystone Figure 56 Resilient ……

#7 Butterfly Valves

Domain Est. 1996

Website: henrypratt.com

Key Highlights: We offer a full line of Pratt butterfly valves including bonded seat, rubber seat and buried service, available in varying sizes from 3 to 162 inches….

#8 Butterfly Valves Archives

Domain Est. 1997

Website: milwaukeevalve.com

Key Highlights: Our high performance butterfly valves are available in sizes ranging from 2-1/2′′ to 24′′ for class 150 ratings, and 2-1/2′′ to 16′′ for class 300….

#9 Butterfly Valves

Domain Est. 2013

Website: cranecpe.com

Key Highlights: Butterfly Valves · Double Offset Butterfly Valves · High Performance Butterfly Valves · Resilient Seated Butterfly Valves · Triple Offset Butterfly Valves….

Expert Sourcing Insights for Butterfly Valve Types

H2: 2026 Market Trends for Butterfly Valve Types

The global butterfly valve market is poised for significant transformation by 2026, driven by technological advancements, increasing industrial automation, and growing demand across key sectors such as water and wastewater treatment, oil and gas, power generation, and HVAC. As industries prioritize energy efficiency, cost-effectiveness, and process reliability, the adoption of specific butterfly valve types is evolving. Below is an analysis of the key trends shaping the demand and development of butterfly valve types in the 2026 market landscape.

-

Rising Preference for High-Performance Butterfly Valves (HPBV)

High-performance butterfly valves are expected to dominate the market by 2026 due to their ability to handle higher pressures and temperatures compared to resilient-seated valves. With superior sealing capabilities and extended service life, HPBVs are increasingly replacing traditional gate and globe valves in critical applications. Industries such as chemical processing and offshore oil & gas are driving this shift, seeking durable, low-maintenance solutions. -

Growth in Triple-Offset Butterfly Valves (TOBV)

The triple-offset butterfly valve segment is projected to witness the highest compound annual growth rate (CAGR) through 2026. TOBVs offer metal-to-metal sealing and bubble-tight shut-off, making them ideal for high-pressure, high-temperature environments in power plants and petrochemical facilities. Innovations in materials—such as super duplex stainless steel and Inconel—are enhancing corrosion resistance and thermal stability, further expanding their application scope. -

Resilient-Seated Butterfly Valves Remain Strong in Municipal Applications

Despite the rise of high-performance variants, resilient-seated butterfly valves continue to hold a substantial market share, particularly in water and wastewater management. Their cost efficiency, ease of installation, and reliable performance in low-pressure systems make them a preferred choice for municipal infrastructure projects. The global push for smart water networks and pipeline rehabilitation is expected to sustain demand through 2026. -

Smart and Actuated Butterfly Valves Gain Traction

Integration with Industrial Internet of Things (IIoT) platforms is a defining trend. By 2026, smart butterfly valves equipped with position sensors, remote monitoring, and predictive maintenance capabilities will see increased adoption, especially in automated process plants. Electric and pneumatic actuated valves are being optimized for faster response times and energy efficiency, aligning with Industry 4.0 initiatives. -

Sustainability and Material Innovation

Environmental regulations are pushing manufacturers to develop lightweight, corrosion-resistant butterfly valves using advanced polymers and eco-friendly coatings. Reduced material usage and longer lifecycle performance contribute to lower carbon footprints, appealing to ESG-conscious buyers. Recyclable components and modular designs are also emerging as competitive differentiators. -

Regional Market Dynamics

Asia-Pacific, led by China, India, and Southeast Asia, will remain the fastest-growing region due to rapid urbanization and industrial expansion. North America and Europe will focus on valve retrofitting and digitalization, supporting demand for intelligent butterfly valve systems. The Middle East continues to invest in oil & gas infrastructure, favoring robust triple-offset designs.

In conclusion, the 2026 butterfly valve market will be characterized by a shift toward high-performance and intelligent valve solutions, with product differentiation driven by application-specific needs, material science, and digital integration. Manufacturers who innovate in durability, efficiency, and connectivity will be best positioned to capture emerging opportunities.

Common Pitfalls Sourcing Butterfly Valve Types (Quality, IP)

Sourcing butterfly valves requires careful evaluation to ensure reliability, compliance, and long-term performance. Below are common pitfalls related to quality and Intellectual Property (IP) concerns that buyers often encounter.

Poor Quality Materials and Construction

One of the most frequent issues is receiving butterfly valves made from substandard materials or with poor workmanship. Low-cost suppliers may use inferior grades of ductile iron, stainless steel, or elastomers, leading to premature failure, leaks, or corrosion. Valves that do not meet industry standards (e.g., ISO, API, DIN) can compromise system integrity, especially in high-pressure or corrosive environments.

Inadequate Certification and Testing Documentation

Many suppliers fail to provide full certification (e.g., material test reports, pressure test records, or third-party inspections). Without proper documentation, it’s difficult to verify that the butterfly valves meet required quality standards. This lack of traceability increases project risk and may result in non-compliance during audits or inspections.

Misrepresentation of IP Ratings (Ingress Protection)

Suppliers sometimes exaggerate or inaccurately state the IP rating of actuated butterfly valves—especially for electric or pneumatic variants. An incorrect IP67 claim, for example, may mislead buyers into thinking the valve is fully dust-tight and waterproof, when in reality, it may only offer minimal protection. This can lead to equipment failure in outdoor or harsh environments.

Counterfeit or Non-Genuine Products

In global supply chains, there is a risk of receiving counterfeit valves that mimic well-known brands. These replicas often lack the engineering precision, durability, and safety features of authentic products. They may also infringe on intellectual property rights, exposing the buyer to legal and operational risks.

Lack of IP Protection in Designs and Technology

When sourcing custom or proprietary butterfly valve designs, buyers may overlook IP ownership clauses in contracts. Suppliers could retain rights to design modifications, limiting the buyer’s ability to replicate or service the valve independently. This dependency can lead to higher lifecycle costs and reduced flexibility.

Insufficient Due Diligence on Suppliers

Failing to audit suppliers’ manufacturing processes, quality control systems, or IP compliance practices increases the risk of receiving non-conforming products. Without on-site inspections or third-party verification, buyers may inadvertently partner with vendors who cut corners or lack technical expertise.

Avoiding these pitfalls requires thorough supplier vetting, clear technical specifications, and contractual safeguards around quality assurance and intellectual property rights.

Logistics & Compliance Guide for Butterfly Valve Types

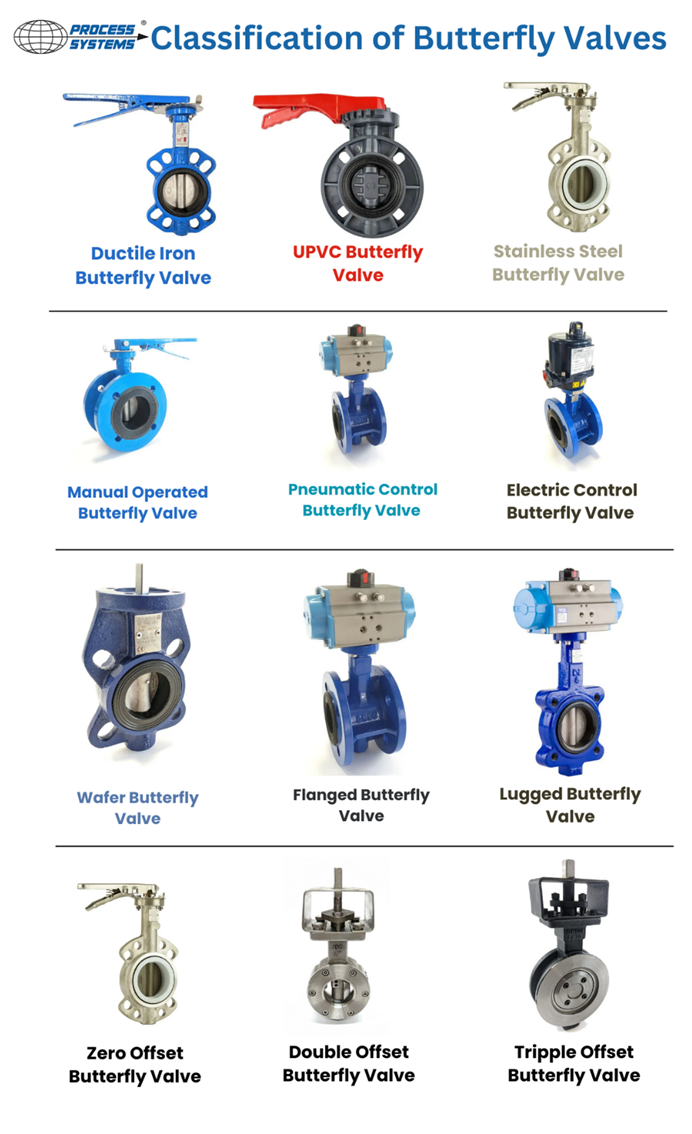

Overview of Butterfly Valve Types

Butterfly valves are quarter-turn valves used to regulate or isolate flow in piping systems. Common types include:

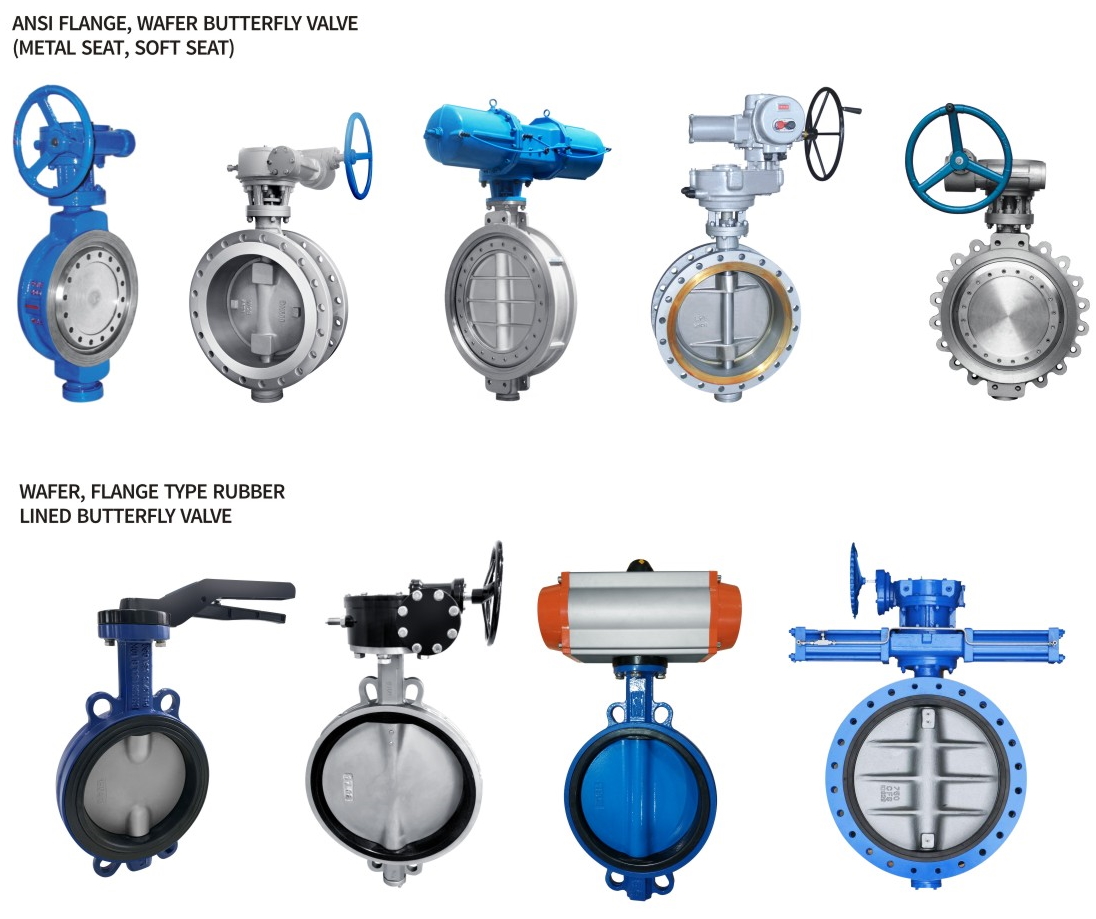

– Concentric (Rubber-lined) Butterfly Valves

– Double Offset (High-Performance) Butterfly Valves

– Triple Offset (Triple Eccentric) Butterfly Valves

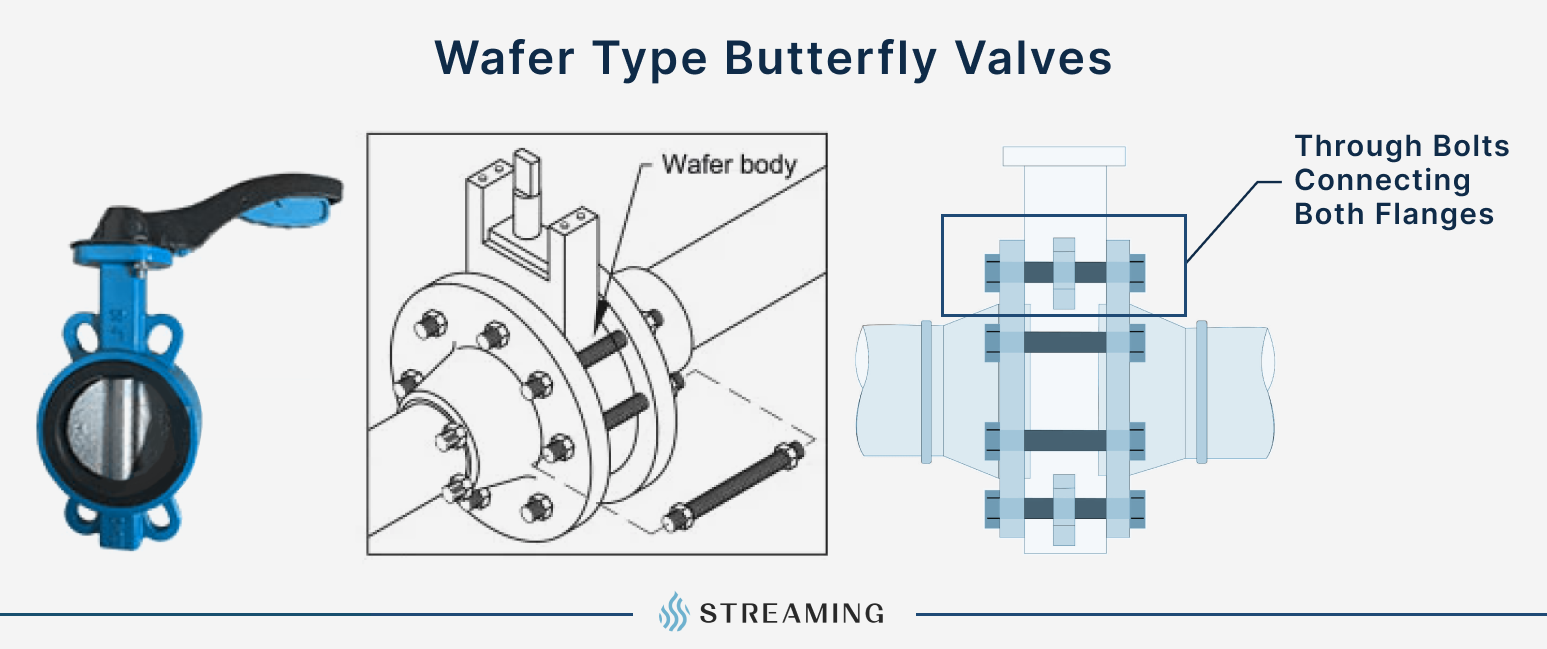

– Lug-Style vs. Wafer-Style vs. Flanged-End Designs

Each type has distinct material, pressure, temperature, and application characteristics affecting logistics and compliance.

International Shipping and Customs Compliance

- Harmonized System (HS) Codes: Butterfly valves typically fall under HS Code 8481.80 (Valves for pipes, boiler shells, tanks, etc.). Accurate classification is essential to avoid customs delays and incorrect duties.

- Country-Specific Regulations: Some countries impose import restrictions or require pre-shipment inspections (e.g., SONCAP for Nigeria, SASO for Saudi Arabia). Verify destination requirements before dispatch.

- Export Controls: High-performance or metal-seated valves used in oil & gas or chemical applications may be subject to export controls (e.g., ITAR or EAR in the U.S.). Confirm jurisdiction and licensing needs.

Material and Environmental Compliance

- REACH & RoHS (EU): Ensure valve materials (especially elastomers, coatings, and alloys) comply with REACH (Registration, Evaluation, Authorization of Chemicals) and RoHS (Restriction of Hazardous Substances) directives. Provide compliance documentation upon request.

- Drinking Water Approvals: For valves used in potable water systems, certifications such as NSF/ANSI 61 (U.S.), WRAS (UK), or DVGW (Germany) are mandatory. Verify certification status before shipping to regulated markets.

- Environmental Sealing Standards: Triple offset valves used in volatile service must meet fugitive emission standards like ISO 15848 or TA-Luft.

Pressure Equipment Directive (PED) and ASME Compliance

- EU PED 2014/68/EU: Valves placed on the EU market must be CE marked based on fluid group, pressure, and size. Butterfly valves above specified thresholds require conformity assessment (e.g., Module H or Module D).

- ASME B16.34 & MSS SP-67/SP-68: In North America, valves must comply with ASME standards for pressure-temperature ratings, dimensions, and testing. Triple offset valves often follow MSS SP-68. Ensure documentation includes certified test reports (e.g., hydrostatic, pneumatic).

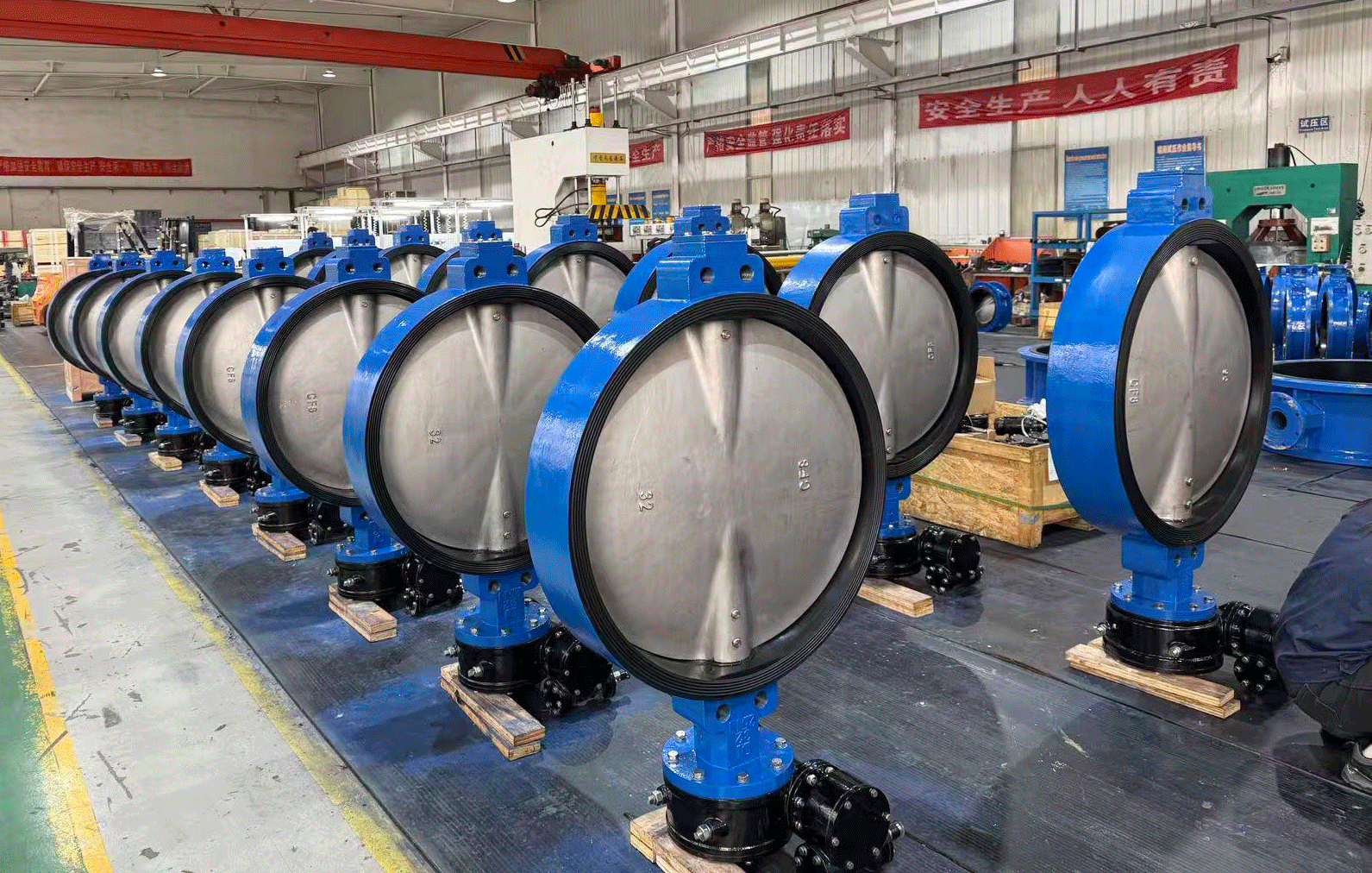

Packaging and Handling Requirements

- Corrosion Protection: Use VCI (Vapor Corrosion Inhibitor) paper or dry air sealing for metal components, especially for offshore or humid environments.

- Secure Crating: Valves should be crated in wooden or metal frames with cushioning to prevent damage. Lug-style valves must be protected from lateral stress on bolt holes.

- Orientation Labeling: Clearly mark “Do Not Invert” or “Keep Upright” if required by design (e.g., lined valves with gravity-dependent seals).

Documentation and Traceability

- Material Test Reports (MTRs): Provide MTRs per EN 10204 Type 3.1 or 3.2 for critical applications.

- Certification Packages: Include compliance certificates (CE, CRN, FM, ATEX), test records, and assembly instructions.

- Traceability: Maintain lot and heat numbers for all components to support quality audits and recalls.

Special Considerations for Hazardous Locations

- ATEX & IECEx Certification: Butterfly valves used in explosive atmospheres (e.g., chemical plants) must be certified under ATEX (EU) or IECEx (international). Verify equipment group and temperature class.

- Fire-Safe Design: Valves in hydrocarbon service may require API 607 or API 6FA fire testing certification. Confirm test results are available.

Conclusion

Proper logistics and compliance for butterfly valves depend on accurate classification, adherence to regional standards, and thorough documentation. Always consult with regulatory experts and use certified suppliers to ensure seamless global distribution and operational safety.

Conclusion on Sourcing Butterfly Valve Types

In conclusion, selecting and sourcing the appropriate butterfly valve type requires careful consideration of several critical factors, including application requirements, operating conditions, material compatibility, pressure and temperature ratings, and industry standards. The three main types—wafer, lug, and flanged—each offer distinct advantages depending on the system’s design, maintenance needs, and cost constraints.

Wafer-style valves are cost-effective and lightweight, ideal for space-constrained applications with unidirectional flow. Lug-style valves allow for downstream disassembly and are best suited for systems requiring frequent maintenance or isolation. Flanged valves provide robust connections and are recommended for high-pressure or critical service applications where leak-tight integrity is paramount.

Additionally, material selection—such as ductile iron, carbon steel, or stainless steel—and the choice between resilient-seated and high-performance (double/triple eccentric) designs further influence performance and longevity.

Effective sourcing involves partnering with reputable suppliers who comply with international standards (e.g., API, ANSI, ISO) and offer proper certification, technical support, and warranty coverage. Conducting a thorough evaluation of total cost of ownership—not just initial purchase price—is essential for long-term reliability and operational efficiency.

Ultimately, aligning the butterfly valve type with the specific system requirements ensures optimal performance, safety, and sustainability in a wide range of industrial, water treatment, HVAC, and process applications.