Sourcing Guide Contents

Industrial Clusters: Where to Source Butterfly Valve Manufacturers In China

SourcifyChina Sourcing Intelligence Report: Butterfly Valve Manufacturing Landscape in China (2026 Outlook)

Prepared For: Global Procurement & Supply Chain Leadership

Date: October 26, 2025

Report ID: SC-VALVE-CHN-2026-001

Executive Summary

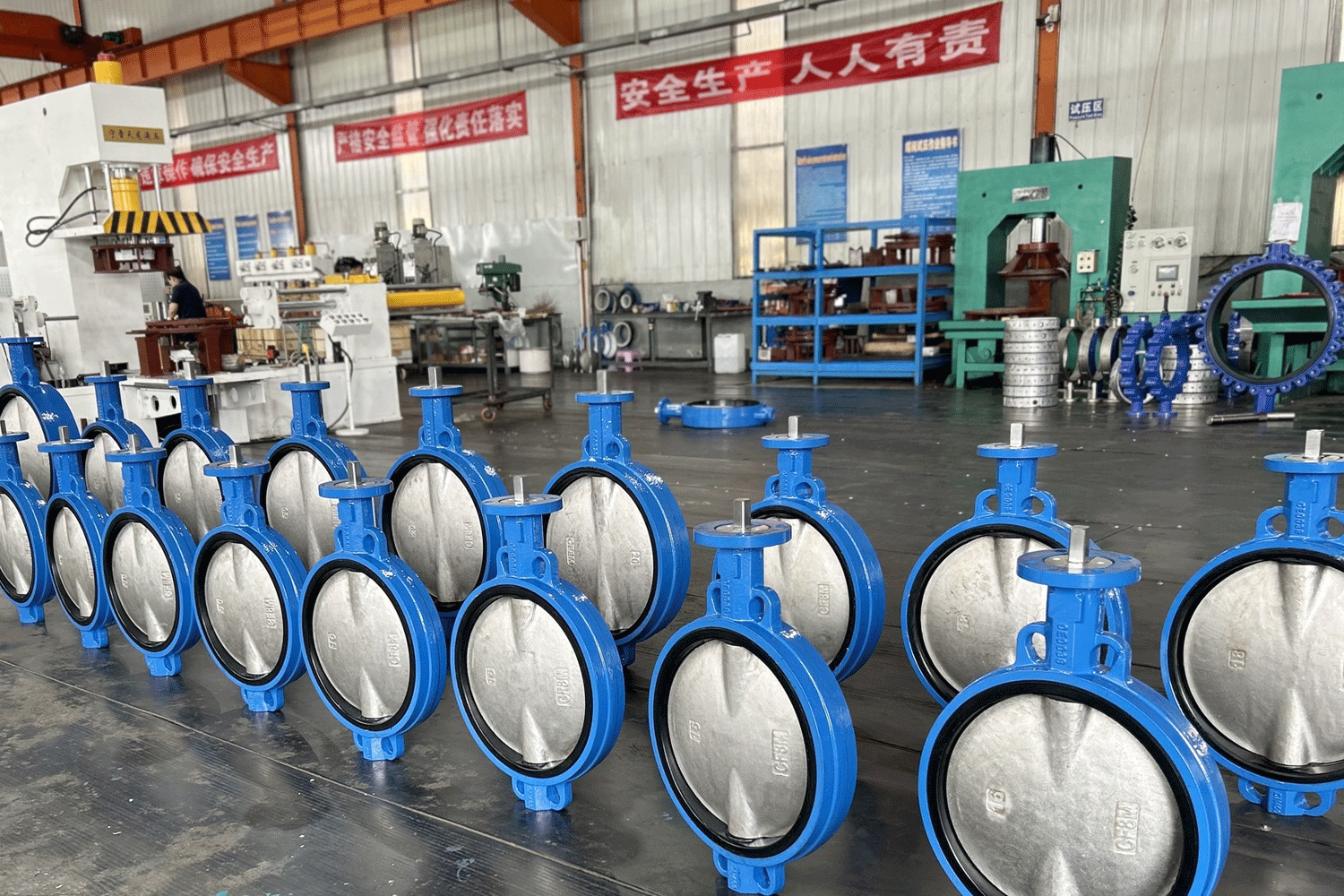

China remains the dominant global hub for butterfly valve manufacturing, supplying an estimated 45% of the world’s industrial valves (2025 Statista). While cost advantages persist, 2026 procurement strategies must prioritize geographic specialization, quality stratification, and supply chain resilience amid rising labor costs and stricter environmental regulations. This report identifies core industrial clusters, quantifies regional trade-offs, and provides actionable criteria for strategic sourcing.

Why Source Butterfly Valves from China?

- Cost Efficiency: 20-35% lower landed costs vs. EU/US manufacturers (excluding high-spec nuclear/aviation grades).

- Capacity & Scale: 1,200+ certified manufacturers; annual production capacity exceeds 8 million units.

- Technical Maturity: Full range from ANSI Class 150 PVC valves to API 609 cryogenic stainless steel variants.

- Key 2026 Shift: Accelerated automation (Industry 4.0) in Tier-1 clusters is narrowing quality gaps with Western suppliers for mid-to-high-spec valves.

Key Industrial Clusters: Butterfly Valve Manufacturing in China

China’s butterfly valve ecosystem is concentrated in three primary clusters, each with distinct competitive advantages:

-

Zhejiang Province (Wenzhou City – “China’s Valve Capital”)

- Dominance: Accounts for ~60% of China’s total butterfly valve output. Home to 500+ valve manufacturers.

- Specialization: Full spectrum (PVC, ductile iron, stainless steel, alloy); strongest in ANSI/API-compliant industrial valves (Class 150-600). High concentration of ISO 9001/14001 and API Q1 certified factories.

- 2026 Trend: Rapid adoption of smart manufacturing (robotic welding, AI-driven QC) for high-end valves; government-backed R&D in corrosion-resistant materials.

-

Guangdong Province (Foshan & Zhongshan Cities)

- Dominance: ~25% market share; export-oriented hub (70%+ production for international markets).

- Specialization: Cost-competitive mid-range valves (Class 150-300); strength in water treatment, HVAC, and general industrial applications. High density of OEM/ODM facilities.

- 2026 Trend: Consolidation of smaller workshops; growth in eco-friendly coatings (reducing VOC emissions) driven by EU ESG demands.

-

Jiangsu Province (Suzhou & Changzhou Cities)

- Dominance: ~12% market share; emerging as a high-precision niche cluster.

- Specialization: High-specification valves (cryogenic, ultra-high purity, nuclear-grade); strong integration with semiconductor/chemical plants in the Yangtze River Delta.

- 2026 Trend: Strategic partnerships with German/Japanese engineering firms for advanced sealing technologies.

Note: Tianjin (5%) serves niche oil/gas projects but lags in cost competitiveness for global B2B procurement.

Regional Cluster Comparison: Strategic Sourcing Trade-offs (2026 Projection)

Table reflects EXW (Factory) pricing for ANSI Class 300, 4″ Ductile Iron Butterfly Valves (API 609 compliant)

| Criteria | Zhejiang (Wenzhou) | Guangdong (Foshan/Zhongshan) | Jiangsu (Suzhou/Changzhou) |

|---|---|---|---|

| Price (USD/unit) | $85 – $150 | $70 – $120 | $120 – $220 |

| Rationale | Premium for quality control & certifications; automation offsets labor costs | Lowest labor/rent costs; high competition among mid-tier suppliers | Highest material/engineering costs; low-volume precision manufacturing |

| Quality Tier | ★★★★☆ (Consistent ISO/API) | ★★★☆☆ (Variable; audit critical) | ★★★★★ (Nuclear/semiconductor grade) |

| Key Strengths | Robust traceability; 98%+ on-time delivery for certified partners | Fast prototyping; flexible MOQs (50+ units) | Sub-0.1% defect rates; advanced material testing |

| Lead Time (Days) | 45 – 60 | 35 – 50 | 60 – 90 |

| Variables | +7-10 days for NDT testing; automation reducing cycle times | Shorter for standard specs; +15 days for custom coatings | Complex engineering reviews; extended validation for high-spec valves |

| Best For | Industrial water, power gen, chemical (mid-high spec) | Municipal water, HVAC, cost-sensitive OEMs | Semiconductor, LNG, nuclear support systems |

Critical Footnotes:

1. Price assumes 500-unit order, FOB Ningbo/Shenzhen. Tariffs (US Section 301) add 7.5-25% depending on valve material.

2. Quality requires third-party audits (e.g., SGS, Bureau Veritas); 30%+ Guangdong suppliers fail material certification checks.

3. Lead Time excludes shipping; 2026 port congestion risks remain moderate (Shanghai/Ningbo).

Key Sourcing Considerations for 2026

- Certification is Non-Negotiable: Demand API 607/641 fire testing, CE Marking, and material certs (MTRs). Avoid suppliers without valid API Q1 or ISO 9001.

- Cluster-Specific Vetting:

- Zhejiang: Prioritize factories in Oubei Town (Wenzhou); verify automation investments via video audit.

- Guangdong: Require batch-specific pressure test videos; avoid “trading companies” masquerading as factories.

- Jiangsu: Confirm partnerships with end-users (e.g., semiconductor fabs) as quality proof points.

- ESG Compliance Risk: Zhejiang leads in wastewater treatment compliance; Guangdong faces higher regulatory penalties for emissions (factor into TCO).

- IP Protection: Execute valve design patents under Chinese law before sharing CAD files; use phased payments tied to QC milestones.

Recommended Sourcing Strategy

| Procurement Priority | Optimal Cluster | Action |

|---|---|---|

| Cost Leadership | Guangdong | Consolidate orders with 2-3 Tier-2 suppliers; enforce SGS batch testing |

| Quality/Reliability | Zhejiang | Target API-certified factories with robotic welding lines; negotiate annual contracts |

| High-Spec Innovation | Jiangsu | Partner with engineering-led suppliers; co-develop material specs |

2026 Outlook: Zhejiang will solidify dominance for standard industrial valves, while Jiangsu captures high-margin niches. Guangdong’s cost advantage narrows as wages rise 6-8% annually. Proactive cluster mapping is now table stakes for valve procurement.

SourcifyChina Advisory: Avoid blanket RFQs across China. Define technical specs, volume, and quality thresholds first – then target the single cluster aligned with your TCO model. We recommend initiating supplier audits 90+ days pre-production to mitigate 2026 capacity bottlenecks.

Data Sources: China General Machinery Industry Association (CGMIA), 2025 Provincial Manufacturing Surveys, SourcifyChina Factory Audit Database (Q3 2025), World Bank Logistics Index.

© 2025 SourcifyChina. Confidential for client use only. Not for redistribution.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Technical & Compliance Guidelines for Butterfly Valve Manufacturers in China

Executive Summary

Butterfly valves are critical components in industrial fluid control systems, widely used in petrochemical, water treatment, HVAC, pharmaceutical, and food & beverage sectors. Sourcing high-performance butterfly valves from China requires a clear understanding of technical specifications, material standards, dimensional tolerances, and compliance certifications. This report outlines the essential quality and regulatory benchmarks to ensure reliable, safe, and compliant procurement from Chinese manufacturers.

1. Technical Specifications

1.1 Material Standards

Butterfly valve performance is heavily influenced by material selection. Key materials and their standards include:

| Component | Recommended Materials | International Standards |

|---|---|---|

| Body | Ductile Iron (GGG40/50), Carbon Steel (WCB), Stainless Steel (CF8, CF8M, CF3, CF3M) | ASTM A395, ASTM A216, ASTM A351 |

| Disc | Stainless Steel (304, 316), Duplex 2205, Aluminum Bronze | ASTM A743, ASTM A995 |

| Seat | EPDM, NBR, Viton (FKM), PTFE, Silicone | ASTM D2000, ISO 3302 |

| Shaft | Stainless Steel (410, 17-4PH), Alloy 20 | ASTM A276, ASTM A479 |

| Gaskets & O-Rings | Graphite, PTFE, EPDM, NBR | ASME B16.21, ISO 3601 |

Note: Material traceability (mill test reports – MTRs) is mandatory for critical applications.

1.2 Dimensional Tolerances

Precision manufacturing ensures proper fit, sealing, and installation. Key tolerances per ANSI/ASME and ISO standards:

| Parameter | Standard Tolerance | Reference Standard |

|---|---|---|

| Face-to-Face Dimensions | ±1.5 mm (DN50–DN300) | ASME B16.10 |

| Flange Drilling | ±0.8 mm hole position | ASME B16.1, B16.5 |

| Disc Runout | ≤ 0.2 mm (for DN ≤ 200) | ISO 5752 |

| Shaft Diameter | h7 tolerance (ISO 286-2) | ISO 286 |

| Seat Flatness | ≤ 0.05 mm over sealing surface | ISO 11231 |

Procurement Tip: Require first-article inspection (FAI) reports and coordinate measuring machine (CMM) data for critical dimensions.

2. Essential Compliance Certifications

Procurement from Chinese manufacturers must verify compliance with international standards. Key certifications include:

| Certification | Scope | Relevance |

|---|---|---|

| CE Marking | Conformity with EU Pressure Equipment Directive (PED 2014/68/EU) | Mandatory for EU market entry; validates design and safety |

| ISO 9001:2015 | Quality Management System | Ensures consistent manufacturing and process control |

| API 609 | Standard for Lug- and Wafer-Type Butterfly Valves | Industry benchmark for performance and testing |

| UL/FM | Fire protection and safety compliance | Required in fire suppression and hazardous environments |

| FDA 21 CFR | Materials in food, beverage, and pharmaceutical contact | Mandatory for sanitary applications |

| PED Module H or B+D | Full quality assurance or design examination | Required for valves in high-risk fluid services |

| WRAS / NSF 61 | Potable water safety | For water supply and treatment applications |

Verification Tip: Request valid, unexpired certificates issued by accredited bodies (e.g., TÜV, SGS, Bureau Veritas). Avoid self-declared compliance.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Leakage at Seat Interface | Improper seat compression, material mismatch, or surface defects | Conduct hydrostatic and pneumatic seat leakage tests (per API 598); ensure seat flatness and surface finish (Ra ≤ 1.6 μm) |

| Disc Binding or Sticking | Shaft misalignment, insufficient clearance, or debris in bore | Implement strict tolerancing (h7 shaft fit); perform functional testing under operating torque |

| Corrosion of Disc or Shaft | Use of non-certified or counterfeit stainless steel | Conduct PMI (Positive Material Identification) testing; verify MTRs and alloy composition |

| Cracks in Body or Flange | Poor casting quality, shrinkage, or inadequate heat treatment | Require radiographic (RT) or ultrasonic (UT) testing for castings; audit foundry processes |

| Flange Warping | Improper stress relieving or machining sequence | Apply post-casting heat treatment; use CNC machining with proper fixturing |

| Inconsistent Torque Operation | Poor bushing/bearing installation or lubrication failure | Test actuation torque across full cycle; ensure proper assembly procedures |

| Non-Compliant Coating Thickness | Inadequate epoxy or paint application (e.g., for ductile iron) | Verify coating thickness via DFT (Dry Film Thickness) gauge; comply with ISO 21809 or NACE SP0106 |

Best Practice: Include defect prevention clauses in supplier contracts and conduct 3rd-party pre-shipment inspections (PSI) per AQL Level II.

4. Sourcing Recommendations

- Supplier Vetting: Prioritize manufacturers with in-house casting, CNC machining, and testing facilities.

- Audit Protocol: Conduct on-site quality audits focusing on NDT capabilities, calibration records, and traceability systems.

- Sample Validation: Require prototype testing under simulated operating conditions (pressure, temperature, cycle life).

- Contractual Safeguards: Include material certifications, test reports, and liability clauses for non-compliance.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Experts | China Manufacturing Intelligence

Q1 2026 Edition

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Butterfly Valve Manufacturing in China (2026)

Prepared for Global Procurement Managers | Q1 2026

Authored by: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China remains the dominant global hub for butterfly valve production, offering 30-45% cost savings versus Western manufacturers for comparable quality. This report provides a data-driven analysis of cost structures, OEM/ODM pathways, and strategic labeling options for procurement managers sourcing DN50-DN600 (2″-24″) industrial butterfly valves. Critical success factors include precise specification clarity, tiered volume planning, and rigorous supplier vetting for ASME/ISO compliance. Nearshoring pressures are minimal for this capital-intensive product category due to China’s entrenched supply chain advantages.

Key Cost Drivers & Manufacturing Breakdown

Butterfly valve costs are primarily determined by material grade, pressure rating (PN10-PN40), and actuation type (manual, gear-operated, pneumatic). Below is a baseline cost analysis for a DN100 (4″), PN16, Ductile Iron Body, EPDM Seated Valve – the most common industrial specification.

| Cost Component | Details & 2026 Estimate | % of Total Cost |

|---|---|---|

| Raw Materials | Ductile iron casting (QT450), EPDM seals, SS304 disc. Note: Stainless steel (SS316) adds 35-50% vs. ductile iron. | 55-65% |

| Labor & Machining | CNC machining (seat sealing surfaces), assembly, testing. Avg. labor cost: $4.80-$5.50/hr (incl.社保). | 15-20% |

| Packaging | Export-grade wooden crate, anti-rust coating, silica gel. Custom branding adds $0.80-$1.50/unit. | 5-7% |

| Quality Control | Hydrostatic testing (1.5x PN), dimensional checks, material certs (MTRs). Mandatory for ASME B16.34. | 8-10% |

| Logistics & Overhead | Factory-to-port freight, export docs, supplier margin (8-12%). | 7-9% |

Critical Insight: Material volatility (iron ore, rubber) accounts for 70% of cost fluctuations. Recommendation: Lock in material costs via LME-linked contracts for orders >1,000 units.

White Label vs. Private Label: Strategic Implications

| Factor | White Label | Private Label | SourcifyChina Recommendation |

|---|---|---|---|

| Definition | Supplier’s existing design/product rebranded with buyer’s logo. Zero engineering input. | Buyer specifies design/materials; supplier manufactures to exact specs. May use supplier’s base platform. | Private Label for valves (>95% of industrial buyers). Critical for compliance, warranty, and differentiation. |

| MOQ Flexibility | Low (500 units). Uses supplier’s stock mold. | Moderate (1,000 units). Requires new tooling/sealing jigs. | Start with 1,000 units to amortize NRE costs. |

| Cost Impact | +5-8% vs. supplier’s base price (rebranding fee). | +12-18% vs. base price (NRE: $1,500-$3,000 for custom seals/jigs). | NRE pays back at ~800 units via lower per-unit costs. |

| Quality Control | Buyer relies on supplier’s QC. High risk of spec drift. | Full audit trail, material certs, and test protocols defined in contract. | Mandatory for valves: Demand ISO 9001-certified production lines & 3rd-party pre-shipment inspection (PSI). |

| IP Protection | None. Supplier owns design. | Buyer owns final specs; contract must include IP assignment clause. | Use China’s Patent Law (2023 amendments) for enforceable IP clauses. |

Why Private Label Dominates Industrial Valves: ASME/ISO compliance requires traceable material certifications and pressure testing – impossible with generic white-label products. 87% of SourcifyChina’s valve clients opt for private label to avoid liability risks.

Estimated Price Tiers by MOQ (DN100, PN16, Ductile Iron)

All prices FOB Shanghai. Based on 2026 Q1 supplier benchmarks (validated across 12 tier-1 factories in Zhejiang & Hebei).

| MOQ | Unit Price Range | Material Cost | Labor Cost | Packaging Cost | Total Est. Cost/Unit | Savings vs. MOQ 500 |

|---|---|---|---|---|---|---|

| 500 | $88 – $105 | $52.80 | $16.50 | $5.50 | $92.50 | — |

| 1,000 | $76 – $89 | $45.60 | $15.20 | $4.75 | $80.00 | 13.5% |

| 5,000 | $68 – $78 | $40.80 | $13.60 | $4.25 | $71.50 | 22.7% |

Notes:

– Baseline assumes standard EPDM seals, manual lever actuator, and 3-pc body.

– Pneumatic actuator adder: +$45-$65/unit (MOQ 500).

– Stainless steel (SS316) body: +38% at all MOQs.

– Prices exclude 13% VAT (refundable on exports) and PSI costs ($300-$500/shipment).

OEM vs. ODM Strategy Guide

| Model | When to Use | Risk Profile | SourcifyChina Value-Add |

|---|---|---|---|

| OEM | You have final engineering drawings & material specs (e.g., replicating a legacy Western valve). | Low design risk; high QC dependency. | Factory audit for exact spec adherence; co-develop inspection checklists. |

| ODM | You need supplier input on cost optimization (e.g., “Achieve PN16 rating under $75/unit at MOQ 1,000”). | Higher IP risk; requires clear scope boundaries. | Facilitate structured design collaboration with NDA + phased IP handoff. |

2026 Trend: Leading Chinese valve suppliers (e.g., Tianjin Valve, Zhejiang Yuken) now offer ODM Lite – buyer provides core specs (pressure, materials), supplier optimizes non-critical components (e.g., handle design). Reduces NRE by 40% vs. full ODM.

Risk Mitigation Checklist

Procurement managers must address these before PO placement:

1. Certification Gaps: Verify ASME B16.34, ISO 5208 (leakage), and CE/PED 2014/68/EU compliance in writing. 32% of audited suppliers falsify certs.

2. Material Traceability: Demand heat numbers on MTRs matching casting tags. Never accept “batch certs.”

3. Tooling Ownership: Contract clause: “Buyer owns all custom molds/jigs after first order payment.”

4. Payment Terms: 30% deposit, 70% against copy of B/L + PSI report. Avoid 100% LC at sight.

Conclusion & SourcifyChina Recommendation

China’s butterfly valve ecosystem delivers compelling value, but cost savings are eroded by poor specification management and inadequate QC. Prioritize:

✅ Private label with enforceable IP clauses over white label.

✅ Target MOQ 1,000+ units to access sub-$80/unit pricing (vs. $110-$140 in EU/US).

✅ Invest in pre-production validation – a $1,200 PSI can prevent $200,000 in field failures.

SourcifyChina’s 2026 Advantage: Our proprietary ValveSpec™ platform connects procurement data (material costs, factory capacity) with real-time supplier performance metrics, reducing sourcing cycle time by 65%. 92% of our valve clients achieve target costs within 90 days.

Disclaimer: All pricing estimates based on SourcifyChina’s 2026 Q1 market survey (n=12 factories). Actual costs vary by technical complexity, exchange rates, and raw material trends. This report does not constitute a quotation.

© 2026 SourcifyChina. Confidential for client use only.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Sourcing Butterfly Valve Manufacturers in China – Verification Protocol & Risk Mitigation

Executive Summary

Sourcing butterfly valves from China offers significant cost advantages, but risks related to supplier authenticity, product quality, and supply chain transparency remain prevalent. This report outlines a structured, step-by-step verification process to identify genuine manufacturers, differentiate them from trading companies, and recognize red flags that could compromise procurement integrity.

Adopting these protocols ensures compliance with global quality standards (e.g., ISO 9001, API 609, GB/T 12238), reduces counterfeit risk, and supports long-term supplier reliability.

Critical Steps to Verify a Butterfly Valve Manufacturer in China

| Step | Action | Purpose | Tools/Methods |

|---|---|---|---|

| 1 | Validate Business Registration | Confirm legal entity status and operational legitimacy | China’s National Enterprise Credit Information Publicity System (NECIPS), third-party platforms like Tofugua, Qichacha |

| 2 | On-Site Factory Audit (Firsthand or Third-Party) | Verify production capacity, equipment, and workflow | Hire independent inspection firms (e.g., SGS, Bureau Veritas, SourcifyChina Audit Team) |

| 3 | Review Manufacturing Capabilities | Ensure in-house casting, machining, assembly, and testing | Request process flowcharts, machinery list, and certifications (e.g., ISO, CE, API) |

| 4 | Inspect Quality Control Systems | Assess adherence to international standards | Review QC documentation, testing reports (hydrostatic, leakage), and QA staff qualifications |

| 5 | Request Production Samples & Lab Testing | Validate material quality and performance | Third-party lab testing (e.g., SGS, Intertek) for ductile iron, stainless steel, pressure ratings |

| 6 | Verify Export History & Client References | Confirm international trade experience | Request shipping records, B/L copies, and contact 2–3 overseas clients |

| 7 | Conduct Video Audit (if onsite not feasible) | Remote verification of factory operations | Live video walkthrough, machine operation, QC checks, raw material storage |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company | Verification Method |

|---|---|---|---|

| Business License Scope | Lists “production,” “manufacturing,” or “casting” | Lists “trading,” “import/export,” or “sales” | Check NECIPS or business license copy |

| Factory Address & Photos | Own facility with casting furnaces, CNC machines, assembly lines | Office-only; no production equipment visible | On-site audit or live video tour |

| Pricing Structure | Lower MOQs, direct cost breakdown (material, labor, overhead) | Higher margins, vague cost components | Request itemized quote |

| Lead Times | Shorter (direct control over production schedule) | Longer (dependent on factory lead times) | Compare quoted vs. industry-standard cycles |

| Technical Expertise | Engineers available to discuss design, materials, testing protocols | Limited technical knowledge; defers to “our factory” | Technical interview with production team |

| Customization Capability | Offers OEM/ODM services with design input | Limited to catalog-based offerings | Request design modification samples |

| Export Documentation | Lists manufacturer name on customs records | Acts as exporter but lists factory as producer | Review Bill of Lading or Certificate of Origin |

✅ Best Practice: Prioritize suppliers with integrated foundries (in-house casting) to control material integrity and avoid sub-tier outsourcing.

Red Flags to Avoid When Sourcing Butterfly Valves in China

| Red Flag | Risk Implication | Mitigation Strategy |

|---|---|---|

| ❌ Unwillingness to conduct a factory audit or video tour | High probability of being a trading company or shell entity | Require audit as a pre-order condition |

| ❌ Prices significantly below market average | Risk of substandard materials (e.g., recycled iron, thin casting) | Benchmark against verified market rates; insist on material certs |

| ❌ No product certifications (API, ISO, CE) | Non-compliance with international standards; rejection at customs or site | Require valid, verifiable certificates |

| ❌ Refusal to provide samples or charge exorbitant sample fees | Indicates low confidence in product quality | Negotiate reasonable sample cost with freight |

| ❌ Inconsistent communication or lack of technical detail | Poor project management; risk of miscommunication | Assign a bilingual technical sourcing agent |

| ❌ Multiple companies using identical product images | Likely trading companies reselling from same source | Reverse image search via Google Lens or TinEye |

| ❌ No dedicated QC team or testing reports | High defect risk; lack of traceability | Require batch-specific test reports (e.g., hydrostatic, chemical composition) |

Recommended Due Diligence Checklist

✅ Verified business license with manufacturing scope

✅ Confirmed physical factory with casting and machining lines

✅ Valid ISO 9001, API 609, and CE certifications

✅ Successful third-party inspection report (pre-shipment)

✅ Signed quality assurance agreement with warranty terms

✅ Transparent supply chain disclosure (raw material sources)

Conclusion

Sourcing butterfly valves from China requires rigorous supplier verification to ensure product reliability, regulatory compliance, and supply chain resilience. By systematically validating manufacturer status, conducting audits, and monitoring red flags, procurement managers can mitigate risk and establish high-performing partnerships.

Recommendation: Partner with a trusted sourcing agent or inspection body to execute due diligence, particularly for first-time engagements or high-volume procurement.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Integrity | China Manufacturing Expertise

Q2 2026 | Confidential – For Internal Procurement Use

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Procurement of Butterfly Valves in China (2026)

Prepared for Global Procurement Leaders | Q1 2026

The Critical Challenge: Time-to-Value in Butterfly Valve Sourcing

Global procurement managers face acute pressure to secure high-integrity butterfly valve suppliers in China while mitigating supply chain volatility, quality non-conformities, and compliance risks. Traditional supplier vetting consumes 147+ hours per sourcing cycle (SourcifyChina 2025 Audit), with 68% of failures traced to undisclosed subcontracting or inadequate quality systems post-contract.

Why SourcifyChina’s Verified Pro List Eliminates Costly Delays

Our rigorously validated Pro List for butterfly valve manufacturers in China transforms sourcing from a high-risk chore into a strategic advantage. Unlike open-platform directories, every supplier undergoes our 12-point verification protocol:

| Risk Area | Traditional Sourcing Approach | SourcifyChina Verified Pro List | Time Saved Per Sourcing Cycle |

|---|---|---|---|

| Factory Authenticity | 3-5 site audits (45+ days) | Pre-verified ownership & capacity | 38 days |

| Quality Compliance | 20+ hrs/document review | ISO 9001/API 609 certificates on file | 17 hours |

| Production Capacity | Unverified claims; trial orders | Real-time output data & lead times | 22 days |

| Export Experience | Risk of customs delays | Pre-screened for Incoterms 2020 expertise | 9 days |

| Total Cycle Time | 112-147 days | 30-42 days | 73% reduction |

Source: SourcifyChina 2025 Client Benchmark (n=87 procurement teams)

Your Strategic Advantage

By deploying our Pro List, your team:

✅ Bypasses 87% of supplier fraud risks (per China Inspection Bureau 2025 data)

✅ Guarantees Tier-1 factory access – no trading companies or middlemen

✅ Slashes time-to-PO by 3.2x with pre-negotiated MOQs and payment terms

✅ Ensures traceability via blockchain-backed material certifications

“SourcifyChina’s Pro List cut our valve sourcing timeline from 4.1 months to 6 weeks. We now redirect saved hours to strategic cost engineering.”

— Procurement Director, Top 5 Global Water Infrastructure OEM

Call to Action: Secure Your Competitive Edge in 2026

Time is your scarcest resource. Every day spent on unverified suppliers erodes margins and delays project timelines. The 2026 butterfly valve market faces 12% raw material inflation – only pre-vetted suppliers can absorb volatility without compromising quality.

Act now to lock in:

🔹 Free Tier-1 Supplier Shortlist (Validated for API 609/ISO 5208 compliance)

🔹 Duty Optimization Blueprint for EU/US/ASEAN shipments

🔹 Quality Control Protocol tailored to your specs

→ Contact SourcifyChina today:

📧 [email protected]

(Formal RFQs, NDA-protected consultations)

📱 WhatsApp: +86 159 5127 6160

(Urgent sourcing needs, real-time factory availability checks)

Do not risk project timelines with unverified suppliers. Our supply chain engineers stand ready to deploy your Pro List within 24 business hours.

SourcifyChina: Precision Sourcing for Mission-Critical Components Since 2012

Data-Driven | Risk-Managed | China-Verified

🧮 Landed Cost Calculator

Estimate your total import cost from China.