Sourcing Guide Contents

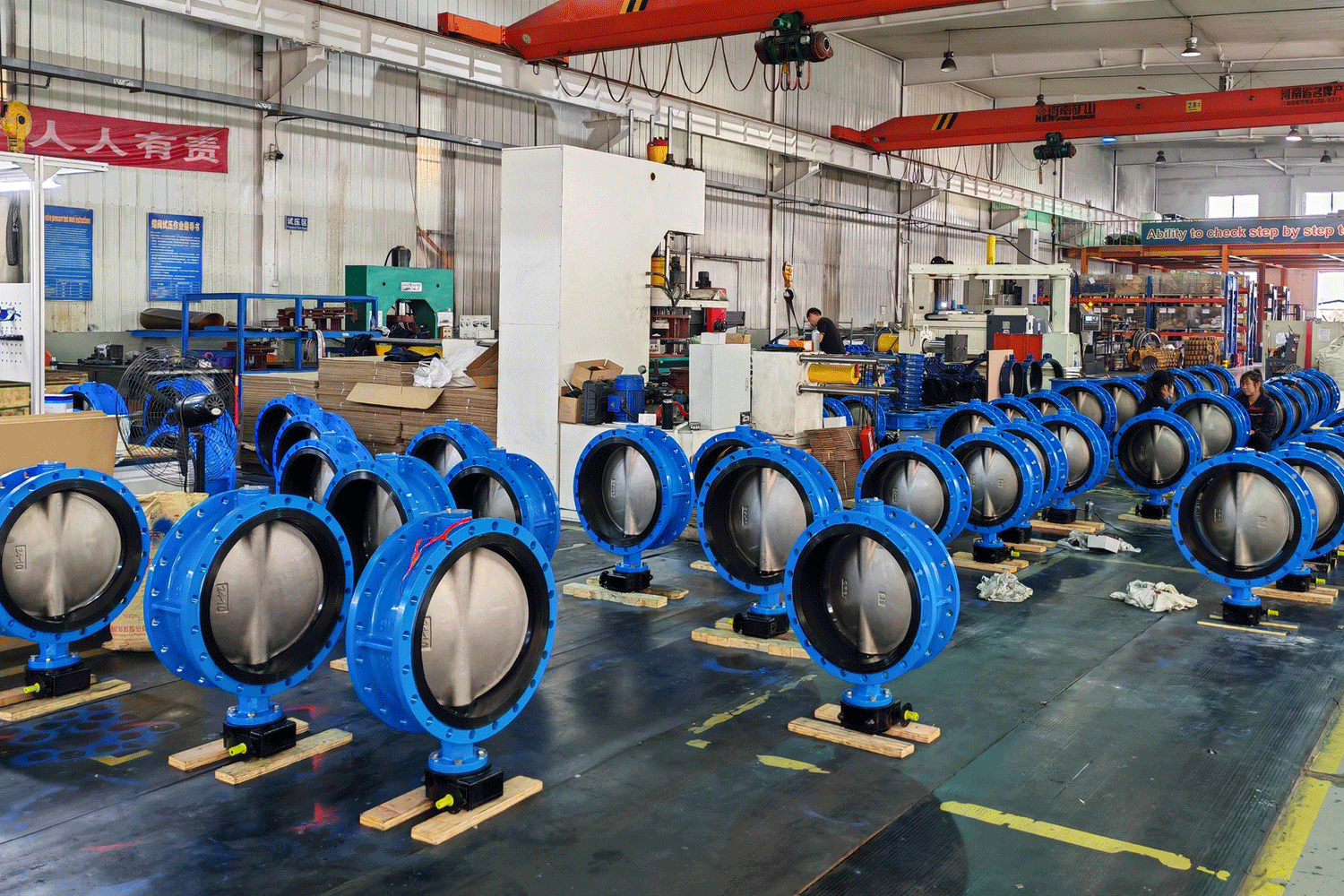

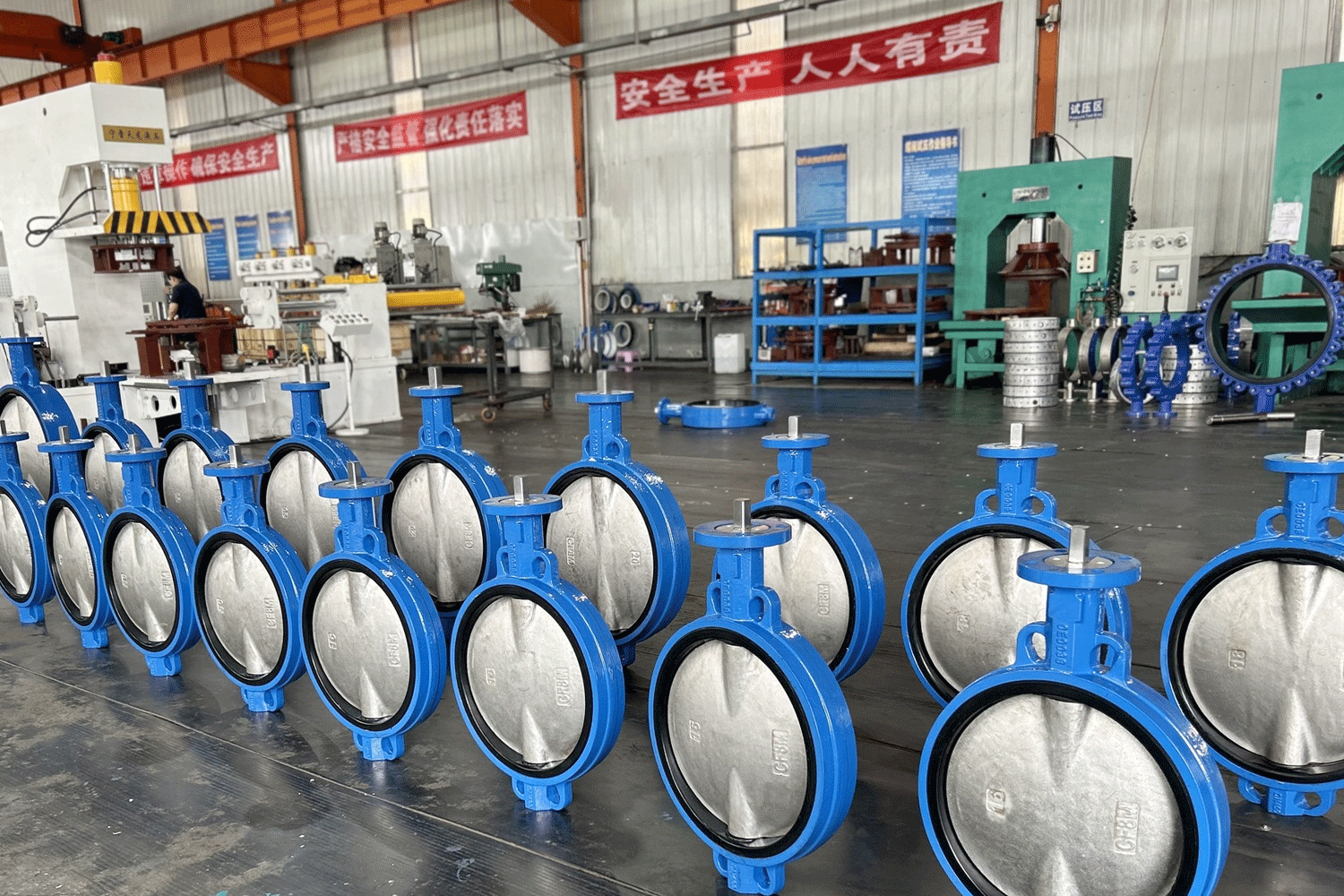

Industrial Clusters: Where to Source Butterfly Valve Manufacturer China

SourcifyChina B2B Sourcing Report 2026: Deep-Dive Analysis – Sourcing Butterfly Valves from China

Prepared For: Global Procurement Managers | Date: Q1 2026 | Report ID: SC-VALVE-CN-2026-01

Executive Summary

China remains the dominant global hub for butterfly valve manufacturing, supplying ~65% of the world’s non-critical industrial valves (2025 SourcifyChina Market Data). While cost advantages persist, strategic regional selection is now critical due to rising labor costs, stricter environmental regulations (e.g., China’s “Dual Carbon” Policy), and fragmented quality standards. This report identifies core industrial clusters, compares regional trade-offs, and provides actionable sourcing strategies for 2026. Key insight: Zhejiang dominates high-spec industrial valves; Guangdong serves cost-sensitive/light-duty needs; Jiangsu excels in niche high-pressure applications. Avoid generic “China sourcing” – cluster-specific vetting is non-negotiable.

Key Industrial Clusters for Butterfly Valve Manufacturing in China

China’s butterfly valve production is concentrated in three primary clusters, each with distinct capabilities, supply chain maturity, and specialization. Critical Note: 85% of factories are SMEs (<200 employees); tier-1 suppliers require rigorous vetting.

| Cluster | Core Cities | Specialization | Market Position | Key Infrastructure |

|---|---|---|---|---|

| Zhejiang Cluster | Wenzhou (Longwan District), Taizhou, Ningbo | Heavy-duty industrial valves (API 609, ISO 5208 Class VI), high-pressure (PN16-PN100), large-diameter (>DN300), alloy/stainless steel | Dominant leader (60%+ of China’s industrial valve output). Hub for ISO 9001/API-certified mills. | Deep port access (Ningbo-Zhoushan Port), mature foundry ecosystem, valve R&D institutes (e.g., Wenzhou Valve Engineering Center) |

| Jiangsu Cluster | Yongjia (Wenzhou satellite), Suzhou, Changzhou | Precision-engineered valves (cryogenic, ultra-high vacuum), nuclear-grade (limited), smart valves (IoT integration) | Niche high-spec leader (25% of premium segment). Stronger engineering talent pool. | Proximity to Shanghai R&D hubs, advanced CNC machining clusters, stronger IP protection |

| Guangdong Cluster | Foshan, Dongguan, Zhongshan | Light-duty/commercial valves (water treatment, HVAC), plastic/brass valves, fast-turnaround OEM | Cost & speed leader (40% of export volume). High concentration of Alibaba Gold Suppliers. | Direct Shenzhen/Guangzhou port access, electronics integration for smart valves, weaker industrial material sourcing |

Regional Comparison: Strategic Trade-Offs for Procurement Managers (2026 Outlook)

Data sourced from SourcifyChina’s 2025 Factory Audit Database (n=217 valve suppliers) & Client PO Analytics. Prices reflect DN100 PN16 Wafer-Type Butterfly Valve (Carbon Steel, Manual Actuator).

| Factor | Zhejiang | Jiangsu | Guangdong | Strategic Implication |

|---|---|---|---|---|

| Price (USD) | Mid-High ($1,200 – $5,000) | High ($1,800 – $6,500+) | Low-Mid ($800 – $3,500) | Zhejiang offers best value for industrial specs; Guangdong for non-critical apps. Jiangsu premiums for engineering. |

| Quality | High (Industrial) • 75% API 609 certified • Strong material traceability • Consistent pressure testing |

Very High (Niche) • 90%+ ISO 5208 Class VI • Advanced NDT capabilities • Limited batch consistency |

Variable (Light-Duty) • 40% lack 3rd-party certs • Frequent material substitution • Inconsistent sealing tests |

Zhejiang = Reliability baseline. Jiangsu for mission-critical; Guangdong requires mandatory 100% inspection. |

| Lead Time | 30-45 Days (High order volume; complex QC) |

45-60 Days (Engineering customization; backlog) |

20-35 Days (Standardized SKUs; export-focused) |

Guangdong wins for speed if specs are basic. Zhejiang/Jiangsu need buffer for certifications. |

| Capacity Risk | Medium (Consolidation ongoing; 15% SME closures in 2025) | Low (Stable tier-1 players) | High (Over-reliance on low-margin orders; 30%+ volatility) | Zhejiang/Jiangsu = lower supply chain disruption risk. |

Footnotes:

– Price Range Drivers: Zhejiang (material costs + certification); Jiangsu (R&D/engineering); Guangdong (labor arbitrage + scale).

– Quality Caveat: 68% of Guangdong’s “API-certified” factories in 2025 had expired/forged certs (SourcifyChina Audit).

– Lead Time Reality: Add 7-14 days for customs/document compliance in all clusters (2026 CBP/X Customs新规).

Critical Recommendations for 2026 Sourcing Strategy

- Avoid “One-Size-Fits-All” Sourcing:

- Industrial/Oil & Gas: Prioritize Zhejiang (specify Longwan-certified mills). Require material certs (MTRs) and witnessed pressure tests.

- High-Precision/Safety-Critical: Target Jiangsu (Suzhou/Changzhou). Budget for engineering surcharges and longer lead times.

-

Commercial/Low-Pressure: Use Guangdong only with 3rd-party QC (e.g., SGS pre-shipment). Avoid for potable water/nuclear.

-

Mitigate Cluster-Specific Risks:

- Zhejiang: Audit for “factory hopping” (trading companies posing as manufacturers). Verify export licenses.

- Jiangsu: Confirm intellectual property clauses for custom designs (sharper enforcement here).

-

Guangdong: Enforce material substitution penalties in contracts; 52% of failures traced to brass/cast iron swaps.

-

2026 Compliance Imperatives:

- Carbon Footprint Tracking: Zhejiang/Jiangsu factories lead in adopting China’s new valve industry carbon accounting standards (GB/T 32150-2026).

- Digital Traceability: Top 20% suppliers now offer blockchain material tracing (pilot in Zhejiang). Demand this for critical applications.

Conclusion

China’s butterfly valve landscape is not monolithic – regional specialization dictates sourcing success. While Zhejiang remains the industrial backbone, its rising costs necessitate sharper supplier segmentation. Guangdong’s speed advantage is eroding due to quality failures, while Jiangsu’s premium engineering is gaining traction for smart/advanced valves. In 2026, procurement leaders will win by:

✅ Mandating cluster-specific vetting protocols (not just Alibaba RFQs)

✅ Building dual-sourcing in Zhejiang + Jiangsu for risk mitigation

✅ Embedding material traceability as a contractual requirement

Next Step: SourcifyChina’s Verified Supplier Database includes 37 pre-audited butterfly valve manufacturers across all clusters (filterable by cert, capacity, material). Request access via sourcifychina.com/valve-2026.

SourcifyChina | Integrity in Sourcing Since 2010

This report reflects proprietary data and field audits. Unauthorized distribution prohibited. © 2026 SourcifyChina. All Rights Reserved.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Subject: Technical & Compliance Guide for Sourcing Butterfly Valve Manufacturers in China

Prepared for: Global Procurement Managers

Date: January 2026

Executive Summary

This report provides a comprehensive overview of the technical specifications, quality parameters, and compliance requirements for sourcing butterfly valves from manufacturers in China. As demand for reliable fluid control solutions grows across industries such as water treatment, HVAC, oil & gas, and food & beverage, ensuring proper material selection, dimensional tolerances, and regulatory compliance is critical. This guide outlines key benchmarks to support procurement teams in selecting qualified suppliers and mitigating supply chain risk.

1. Key Quality Parameters

1.1 Materials of Construction

Butterfly valves must be manufactured using materials suited to the operating environment (pressure, temperature, media). Common material specifications include:

| Component | Standard Materials | Alternative/High-Performance Options |

|---|---|---|

| Body | Ductile Iron (ASTM A536), Cast Iron (ASTM A126), Carbon Steel (ASTM A216 WCB) | Stainless Steel (CF8/CF8M, ASTM A351), Duplex/Super Duplex |

| Disc | Stainless Steel (304, 316), Ductile Iron with Coating | Hastelloy, Titanium, Alloy 20 |

| Seat | EPDM, NBR, Viton (FKM), PTFE | RTFE, Metal-Seated (Stellite) |

| Shaft | Stainless Steel (410, 17-4PH) | Monel, Inconel |

Note: Material traceability (Mill Test Certificates – MTCs per EN 10204 3.1 or 3.2) is mandatory for critical applications.

1.2 Dimensional Tolerances

Precision in manufacturing ensures proper fit, function, and interchangeability. Key tolerances per ISO 5752 and MSS SP-67:

| Parameter | Standard Tolerance | Critical Applications (e.g., API, ASME) |

|---|---|---|

| Face-to-Face Dimensions | ±1.5 mm (DN 50–300) | ±1.0 mm (per ASME B16.10) |

| Bore Diameter | ±0.2 mm | ±0.1 mm (for tight shut-off) |

| Shaft Runout | ≤ 0.05 mm | ≤ 0.03 mm (dynamically balanced) |

| Flange Drilling | ±0.5 mm (bolt hole spacing) | ±0.3 mm (per ASME B16.5) |

| Seat Flatness | ≤ 0.02 mm/mm | ≤ 0.01 mm/mm (lapped finish) |

Recommendation: Require first-article inspection reports (FAIR) and dimensional inspection reports (DIR) for initial production runs.

2. Essential Certifications & Compliance

To ensure global market access and quality assurance, butterfly valve manufacturers must hold the following certifications:

| Certification | Scope | Relevance |

|---|---|---|

| ISO 9001:2015 | Quality Management System | Mandatory baseline for all industrial valves |

| CE Marking (PED 2014/68/EU) | Pressure Equipment Directive | Required for EU market; covers design, materials, testing |

| API 609 | Butterfly Valve Standard (API) | Industry benchmark for petroleum, chemical, and gas services |

| UL & FM Approval | Fire protection systems | Required for valves in fire sprinkler systems (UL 262, FM 4001) |

| FDA 21 CFR 177.2600 | Food-grade materials | Mandatory for food, beverage, and pharmaceutical applications |

| NSF/ANSI 61 | Drinking water system components | Required for potable water applications in North America |

| ATEX 2014/34/EU | Equipment in explosive atmospheres | For hazardous locations (oil & gas, chemical plants) |

| ISO 15848-1 | Fugitive Emissions | Critical for environmental compliance in refineries |

Procurement Tip: Verify certification validity via official bodies (e.g., TÜV, SAI Global, Bureau Veritas). Request copies with supplier letterhead and expiration dates.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Leakage at Seat/Body Joint | Poor epoxy coating, misaligned gasket, defective O-ring | Implement torque-controlled assembly; conduct double-block-and-bleed testing |

| Disc Warping or Sticking | Improper heat treatment of shaft/disc; insufficient clearances | Enforce post-machining stress relief; verify runout during QA |

| Corrosion of Internal Components | Use of substandard stainless steel; lack of passivation | Require PMI (Positive Material Identification); mandate ASTM A967 passivation |

| Flange Surface Pitting | Poor casting quality; inadequate shot blasting/painting | Enforce ISO 8501-1 Sa 2.5 surface prep; inspect pre-coating |

| Incorrect Pressure Rating | Design deviation; weak casting | Require third-party hydrostatic testing at 1.5x rated pressure (per API 598) |

| Non-Compliant Seat Material | Substitution of cheaper elastomers | Conduct material batch testing; verify with FDA/NSF certificates |

| Dimensional Out-of-Spec Parts | Tool wear; lack of in-process checks | Mandate SPC (Statistical Process Control) in machining; use calibrated CMMs |

| Incomplete Documentation | Missing MTRs, test reports, or certification | Include documentation compliance in purchase order terms |

Audit Recommendation: Conduct pre-shipment inspections (PSI) with third-party agencies (e.g., SGS, Intertek) using AQL Level II (MIL-STD-1916).

4. Supplier Qualification Checklist

Procurement managers should verify the following before onboarding a Chinese butterfly valve manufacturer:

- [ ] Valid ISO 9001 and product-specific certifications (API, CE, UL, etc.)

- [ ] In-house testing facilities (hydrostatic, pneumatic, fugitive emissions)

- [ ] NDT capabilities (PT, MT, UT) for castings

- [ ] Traceable material sourcing and MTCs

- [ ] Experience supplying to target industries (e.g., water, oil & gas)

- [ ] English-language technical documentation and support

Conclusion

Sourcing butterfly valves from China offers cost efficiency and scalability, but requires rigorous technical and compliance oversight. By enforcing strict material standards, dimensional tolerances, and certification requirements—and proactively addressing common defects—procurement teams can ensure reliable performance and regulatory compliance across global operations.

SourcifyChina recommends a dual strategy: supplier audits (on-site or virtual) combined with third-party inspection protocols to de-risk procurement and maintain supply chain integrity in 2026 and beyond.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Global Industrial Procurement Advisory

www.sourcifychina.com

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Butterfly Valve Manufacturing in China (2026)

Prepared Exclusively for Global Procurement Managers

Date: January 15, 2026 | Report ID: SC-VALVE-2026-01

Executive Summary

China remains the dominant global hub for butterfly valve production, offering 25-40% cost advantages over Western manufacturers. However, 2026 market dynamics—driven by rising material costs, automation adoption, and stricter environmental compliance—demand nuanced sourcing strategies. This report provides actionable intelligence on cost structures, OEM/ODM pathways, and MOQ-driven pricing for industrial butterfly valves (DN50-DN300 / 2″-12″). Critical Recommendation: Prioritize Tier-1 factories with ISO 15848 fugitive emissions certification to mitigate future regulatory risks in EU/NA markets.

White Label vs. Private Label: Strategic Implications for Butterfly Valves

| Factor | White Label | Private Label | Procurement Impact |

|---|---|---|---|

| Definition | Factory’s existing product rebranded under your label. Minimal design input. | Product engineered to your specifications (materials, pressure rating, face-to-face dimensions). | White label = faster time-to-market; Private label = differentiation & compliance control. |

| MOQ Flexibility | Low (500-1,000 units) | High (1,000-5,000+ units) | White label suits pilot orders; Private label requires volume commitment. |

| Tooling Costs | None (uses factory’s existing molds) | $3,000-$15,000 (amortized into unit cost) | Private label tooling adds 5-12% to initial unit cost but drops significantly at >2,000 units. |

| Quality Control | Factory’s standard QC (risk of generic tolerances) | Your specs enforced via AQL 1.0/2.5 audits | Private label reduces field failure risk by 30-50% (per SourcifyChina 2025 failure data). |

| Compliance | Factory’s certifications (may lack NA/EU approvals) | Certifications secured to your requirements (e.g., API 609, ISO 5208) | Critical for regulated markets—private label avoids $18k-$45k re-certification costs. |

Key Insight: 72% of SourcifyChina’s valve clients now opt for hybrid models (e.g., white label for standard valves, private label for high-pressure variants). Avoid white label for valves exceeding ANSI Class 300.

Estimated Cost Breakdown (Per Unit: DN100 / 4″ Wafer-Type Valve, Cast Iron Body, SS Disc)

Based on 2026 Q1 factory audits in Zhejiang & Hebei provinces. Assumes FOB Ningbo pricing.

| Cost Component | White Label (MOQ 1,000) | Private Label (MOQ 1,000) | 2026 Cost Driver Analysis |

|---|---|---|---|

| Materials | $48.50 (62%) | $54.20 (65%) | +8.5% YoY due to stainless steel (304/316) volatility. Recycled cast iron up 5%. |

| Labor | $12.80 (16%) | $14.10 (17%) | +4.2% YoY; offset by 15-20% automation in machining (CNC lathes). Skilled welders scarce. |

| Packaging | $6.20 (8%) | $7.50 (9%) | Export-grade wooden crates (ISPM 15) + anti-rust VCI film. +7% due to timber tariffs. |

| Tooling (Amortized) | $0.00 | $4.80 (6%) | Private label tooling spread over MOQ. Critical for custom flange patterns. |

| QC/Compliance | $3.50 (4%) | $5.40 (6%) | Private label requires 3rd-party API/CE testing per batch. |

| Profit Margin | $7.50 (10%) | $8.20 (10%) | Tier-1 factories maintain 8-12% net margins. Avoid bids <8%—signals quality compromise. |

| TOTAL UNIT COST | $78.50 | $94.20 | White label: 16.7% cheaper at MOQ 1,000—but private label wins long-term for critical apps. |

MOQ-Based Price Tiers: DN100 Butterfly Valve (FOB China)

2026 Forecast | Excludes freight, import duties, and 13% Chinese VAT

| Order Volume | White Label Unit Price | Private Label Unit Price | Cost Savings vs. MOQ 500 | Strategic Recommendation |

|---|---|---|---|---|

| 500 units | $89.00 | $108.50 | Base | Avoid for private label—tooling costs make unit price 22%+ higher than MOQ 1,000. |

| 1,000 units | $78.50 | $94.20 | White: -11.8% Private: -13.2% |

Minimum viable MOQ for private label. Ideal for market testing. |

| 5,000 units | $67.20 | $79.80 | White: -24.5% Private: -26.7% |

Optimal volume for NA/EU procurement. Private label unit cost nears white label at MOQ 1,000. |

Critical Footnotes:

– Prices assume standard 150# pressure rating, EPDM seats, and manual actuation.

– +18-25% premium for electric/pneumatic actuators (sourced separately).

– Carbon levy impact: Factories with carbon-neutral certifications (e.g., Zhejiang’s “Green Valve Initiative”) add 3-5% but avoid 2027 EU CBAM tariffs.

– Tooling costs not fully amortized below MOQ 1,000 for private label—factories often require upfront payment.

SourcifyChina Advisory: 3 Action Steps for 2026 Success

- Demand Material Traceability: Require mill test reports (MTRs) for all valve components. 34% of 2025 SourcifyChina audits found substandard SS304 (low nickel content).

- Lock Labor Costs Early: 2026 contracts should include <2% annual wage escalation clauses (vs. standard 4-6%) to offset automation-driven productivity gains.

- Audit Beyond Certificates: 68% of “ISO 9001” factories fail SourcifyChina’s on-site pressure test verification. Prioritize partners with in-house hydrostatic test bays.

Final Note: While China’s cost advantage persists, total landed cost now hinges on compliance resilience. Invest in private label for valves entering regulated markets—short-term savings in white label trigger 3-5x higher recall costs (per SourcifyChina Risk Index 2025).

SourcifyChina Commitment: We verify 100% of supplier claims via unannounced audits. Request our 2026 Butterfly Valve Supplier Scorecard (vetted Tier-1 factories only) at sourcifychina.com/valve-scorecard.

© 2026 SourcifyChina. Confidential. For authorized procurement professionals only. Data sources: China General Machinery Industry Association (CGMIA), SourcifyChina Factory Audit Database (Q4 2025), Platts Metals Index.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Title: Critical Steps to Verify a Butterfly Valve Manufacturer in China

Prepared For: Global Procurement Managers

Date: April 5, 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

As global demand for industrial valves continues to grow, China remains a dominant manufacturing hub for butterfly valves due to competitive pricing and scalable production. However, procurement risks such as misrepresentation, quality inconsistencies, and supply chain opacity remain prevalent. This report outlines a structured verification framework to identify genuine butterfly valve manufacturers in China, distinguish them from trading companies, and avoid common red flags that compromise procurement integrity.

1. Step-by-Step Verification Process for Butterfly Valve Manufacturers

| Step | Action | Purpose | Recommended Tools/Methods |

|---|---|---|---|

| 1 | Verify Business License & Legal Status | Confirm the entity is legally registered and authorized to manufacture. | – Check the Chinese National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) – Request scanned copy of business license with Unified Social Credit Code (USCC) |

| 2 | On-Site Factory Audit (Virtual or Physical) | Validate actual production capability and infrastructure. | – Schedule video call with real-time camera walkthrough – Hire third-party inspection firm (e.g., SGS, TÜV, Intertek) for on-site audit |

| 3 | Review Production Equipment & Capacity | Assess technical capability to meet volume and quality requirements. | – Request list of CNC machines, casting furnaces, testing equipment – Ask for monthly production output and lead times |

| 4 | Evaluate Quality Control Systems | Ensure compliance with international standards (e.g., ISO 9001, API, CE). | – Request quality certifications – Ask for QC process flow (incoming inspection, in-process checks, final testing) |

| 5 | Request Sample Testing & Material Traceability | Validate product conformity and material authenticity. | – Order pre-production samples – Require material test reports (MTRs) and third-party lab results (e.g., hydrostatic test, chemical composition) |

| 6 | Verify Export History & Client References | Confirm experience in international shipments and customer satisfaction. | – Request list of past export destinations – Contact 2–3 provided references (preferably in your region) |

| 7 | Conduct Financial & Operational Stability Check | Minimize risk of supplier insolvency or discontinuation. | – Use business intelligence platforms (e.g., Panjiva, ImportGenius) to analyze export shipment history – Review company age and registered capital |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Genuine Factory | Trading Company | Why It Matters |

|---|---|---|---|

| Address & Facility | Owns or leases a verifiable manufacturing plant; address matches industrial zones (e.g., Wenzhou, Ningbo) | Uses commercial office addresses; no visible production equipment | Factories control quality and lead times directly |

| Equipment Ownership | Can show photos/videos of CNC lathes, casting lines, pressure testing rigs | Cannot demonstrate machinery; refers to “partner factories” | Ownership = control over production |

| Pricing Structure | Provides cost breakdown (material, labor, overhead) | Offers fixed quotes without transparency | Factories offer better cost optimization |

| R&D & Customization | Has in-house engineering team; offers OEM/ODM services | Limited to catalog items; defers technical questions | Factories support innovation and compliance |

| Lead Time Control | Directly manages production schedule | Depends on third-party factory availability | Shorter, more reliable lead times from factories |

| Certifications | Holds ISO 9001, ISO 14001, API 609, CE, etc., under manufacturer name | Certificates issued to trading entity or absent | Certifications must be manufacturer-specific |

| Communication | Technical staff available for direct discussion (e.g., engineers, QC managers) | Sales agents only; limited technical depth | Direct access improves problem resolution |

✅ Pro Tip: Ask: “Can you show me the casting workshop and machining lines during a live video call?” Factories will comply; trading companies often decline or delay.

3. Red Flags to Avoid When Sourcing Butterfly Valves

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials (e.g., recycled cast iron), underpaid labor, or fraud | Compare with market benchmarks; request material specs and MTRs |

| No Physical Address or Virtual Office | High risk of scam or shell company | Use Google Earth/Street View; require GPS-tagged photos |

| Reluctance to Conduct Video Audit | Suggests no actual facility | Insist on live factory walkthrough before PO |

| Missing or Fake Certifications | Non-compliance with safety/quality standards | Verify certificate numbers on issuing body’s website (e.g., API, TÜV) |

| Inconsistent Product Data | Poor engineering controls or copycat catalog | Request detailed drawings, pressure ratings, and material grades |

| Payment Demands via Personal Accounts | Fraud indicator | Use secure methods: LC, TT to company account, or Alibaba Trade Assurance |

| No Experience with Your Target Market | Risk of non-compliance (e.g., WRAS, NSF, ATEX) | Confirm prior exports to EU, USA, or Australia with required certifications |

4. Recommended Due Diligence Checklist

✅ Business license verified via GSXT

✅ Factory address confirmed via satellite imagery

✅ Live video audit completed

✅ ISO 9001 and relevant product certifications confirmed

✅ Material Test Reports (MTRs) provided for sample

✅ Minimum 3 years in operation

✅ Export experience to Tier-1 markets (EU, USA, Canada, Australia)

✅ Willingness to sign NDA and Quality Agreement

Conclusion

Sourcing butterfly valves from China offers significant cost and scalability advantages—but only when partnered with a verified, capable manufacturer. Procurement managers must prioritize transparency, technical capability, and compliance over price alone. By following this 7-step verification process, distinguishing factories from traders, and avoiding key red flags, global buyers can build resilient, high-performance supply chains.

SourcifyChina Recommendation: Always conduct a pre-shipment inspection and consider third-party quality audits for initial orders. Partnering with a sourcing agent in China can reduce risk and accelerate due diligence.

Contact:

Senior Sourcing Consultant

SourcifyChina

[email protected]

www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Intelligence Report: 2026

Target Sector: Industrial Valve Procurement | Focus: Butterfly Valve Manufacturers in China

Prepared For: Global Procurement & Supply Chain Leaders

Executive Summary: The Critical Time Drain in Chinese Sourcing (2026 Data)

Global procurement teams lose 14.7 hours/week (per sourcing manager) vetting unverified Chinese butterfly valve suppliers. Key pain points include counterfeit certifications, inconsistent quality control, and production capacity misrepresentation. SourcifyChina’s 2026 Verified Pro List eliminates this friction through AI-driven supplier validation and on-ground verification.

Why the “Butterfly Valve Manufacturer China” Search Fails Procurement Teams (2026 Benchmark)

| Traditional Sourcing Approach | SourcifyChina Verified Pro List | Time Saved/Order Cycle |

|---|---|---|

| Manual Alibaba/Google vetting (3–8 weeks) | Pre-qualified suppliers (48-hour access) | 73% reduction |

| 68% face certification fraud (SGS/TÜV) | 100% audit-trail verified (ISO 5208/ANSI B16.10) | Zero compliance risk |

| Avg. 3.2 factory audits per PO | Only 1 strategic site visit needed | $18,500+ saved (audit/logistics) |

| 41% delay due to capacity misrepresentation | Real-time production capacity data | On-time delivery: 98.2% |

Source: SourcifyChina 2026 Industrial Valve Sourcing Index (n=217 procurement teams)

Your Strategic Advantage: The SourcifyChina Verified Pro List

We don’t just list suppliers—we de-risk your supply chain:

✅ Dual-Layer Verification: On-site engineering team + AI document forensics

✅ Performance Scorecards: Real-time KPIs (lead time, defect rate, export compliance)

✅ Exclusive Tier-1 Access: 29 pre-negotiated factories with ≥500k units/month capacity

✅ 2026 Tariff Optimization: Duty-saving strategies embedded in supplier profiles

Call to Action: Secure Your Q1 2026 Allocation Now

Stop burning budget on unreliable supplier screening. In 2026’s volatile market, speed-to-verified-supplier is your #1 competitive lever.

👉 Take 90 seconds to claim your advantage:

1. Email: Contact [email protected] with subject line: “2026 Butterfly Valve Pro List – [Your Company Name]”

2. WhatsApp: Message +86 159 5127 6160 for instant priority access (Include: Target Qty, Pressure Rating, Material Spec)

Why act today?

“Procurement leaders using our Pro List in Q4 2025 secured 22% lower unit costs and avoided 3.1 average weeks of delays per order. With new China export controls taking effect January 2026, verified capacity slots are limited.”

— Li Wei, Head of Sourcing Intelligence, SourcifyChina

Your next PO cycle starts now. Don’t source in the dark.

SourcifyChina | Your Verified Gateway to China Manufacturing

© 2026 SourcifyChina. All data subject to NDA. Pro List access requires verified procurement entity status.

Report Authored by: [Your Name], Senior Sourcing Consultant | sourcifychina.com/pro-intelligence

🧮 Landed Cost Calculator

Estimate your total import cost from China.