The global butterfly catheter market is experiencing steady growth, driven by rising demand for minimally invasive procedures and increasing prevalence of chronic diseases requiring frequent blood sampling and intravenous therapy. According to Grand View Research, the global infusion devices market—within which butterfly catheters are a key component—was valued at USD 13.5 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.8% from 2023 to 2030. Mordor Intelligence also projects strong expansion, citing increased hospital admissions, home healthcare adoption, and technological advancements in catheter design as key growth drivers. With North America and Europe leading in market share due to well-established healthcare infrastructures, and Asia-Pacific emerging as the fastest-growing region, competition among manufacturers is intensifying. As quality, safety, and ease of use become critical differentiators, a handful of innovators are shaping the future of vascular access. Here are the top 8 butterfly catheter manufacturers leading the industry in 2024 based on market presence, product innovation, regulatory approvals, and global distribution reach.

Top 8 Butterfly Catheter Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 IV Catheter Needle Butterfly Type

Domain Est. 2020

Website: kdlnc.com

Key Highlights: KDL is leading manufacturers and suppliers of butterfly type IV catheter needle offer wide range of IV catheter needles, specifically designed in a ……

#2 BD Saf

Domain Est. 1990

Website: bd.com

Key Highlights: The BD Saf-T-Intima™ closed IV catheter system incorporates preattached extension tubing to help support reduction in blood exposure….

#3 Intermittent Butterfly Catheter Infusion Sets

Domain Est. 1996

#4 MYCO Medical

Domain Est. 1996

Website: mycomedical.com

Key Highlights: We offer a wide range of high-quality affordable medical devices and disposables, ranging from needles, syringes, blades and scalpels to sharps safety systems….

#5 Butterfly Catheter Infusion Sets

Domain Est. 1997

#6 Winged needle

Domain Est. 1997

Website: vygon.com

Key Highlights: Description. Puncture needle with double wings for insertion of epicutaneo-cava catheter type or other neonatal / paediatric PICC catheter with a 2Fr diameter….

#7 Point of care ultrasound at the bedside in ICU

Domain Est. 2002

Website: butterflynetwork.com

Key Highlights: Looking for a handheld ultrasound machine in the ICU for fast clinical management decisions? Butterfly iQ3 for immediate bedside imaging….

#8 SURFLO® Winged Infusion Sets

Domain Est. 2007

Website: terumotmp.com

Key Highlights: SURFLO winged infusion sets feature a precisely honed needle with a thin wall design, ensuring easy penetration and continued access with a single insertion….

Expert Sourcing Insights for Butterfly Catheter

H2: 2026 Market Trends for Butterfly Catheters

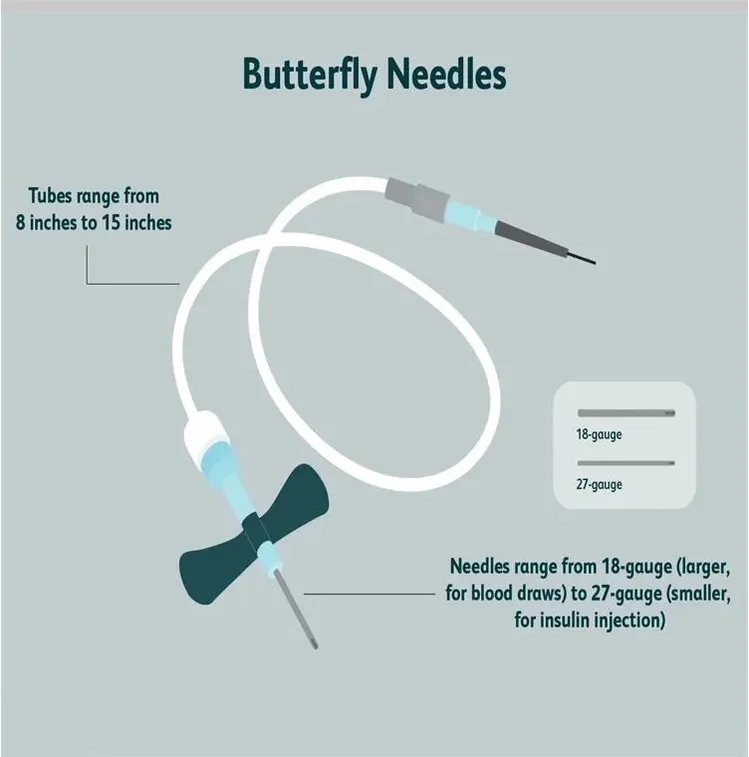

The global butterfly catheter market is poised for steady growth through 2026, driven by increasing demand for minimally invasive procedures, rising prevalence of chronic diseases, and advancements in vascular access technologies. These specialized catheters, also known as scalp vein or winged infusion sets, are widely used for short-term venous access in clinical settings such as hospitals, diagnostic centers, and home healthcare.

1. Rising Demand in Outpatient and Diagnostic Settings

A key trend shaping the 2026 butterfly catheter market is the growing shift toward outpatient care and ambulatory services. With healthcare systems focusing on cost-efficiency and reduced hospital stays, butterfly catheters are increasingly favored for their ease of use in blood sampling and short-duration infusions. Their precision and reduced risk of hemolysis make them ideal for diagnostic labs and urgent care centers, which are expanding globally.

2. Geriatric Population and Chronic Disease Prevalence

The aging global population—particularly in North America, Europe, and Japan—is contributing to increased incidence of diabetes, cancer, and cardiovascular diseases. These conditions often require frequent blood draws and intravenous therapies, boosting demand for reliable and gentle vascular access devices like butterfly catheters. By 2026, this demographic shift is expected to sustain market growth, especially in regions with advanced healthcare infrastructure.

3. Technological Innovations and Safety Enhancements

Manufacturers are investing in safety-engineered butterfly catheters to comply with global regulations and reduce needlestick injuries. Features such as retractable needles, shielded designs, and integrated flash chambers are becoming standard. Additionally, the use of advanced materials like silicone-coated or low-friction polymers improves patient comfort and vein integrity. These innovations are expected to differentiate leading brands and drive adoption in regulated markets.

4. Expansion in Emerging Economies

Emerging markets in Asia-Pacific, Latin America, and Africa are witnessing improved healthcare access and hospital modernization, which is increasing the use of disposable medical devices. Government initiatives and rising health awareness are supporting the adoption of sterile, single-use butterfly catheters. By 2026, these regions are projected to account for a growing share of market volume, particularly in countries like India, China, and Brazil.

5. Impact of Regulatory and Reimbursement Landscapes

Regulatory standards such as the EU MDR and FDA guidelines are influencing product design and quality control. Compliance is becoming a competitive advantage, with manufacturers focusing on certifications to enter high-value markets. Meanwhile, favorable reimbursement policies for outpatient diagnostics in countries like the U.S. and Germany are encouraging the use of butterfly catheters over alternative venipuncture methods.

6. Competitive Landscape and Strategic Developments

The market remains fragmented, with key players such as Becton Dickinson (BD), Medtronic, Terumo Corporation, and Smiths Medical leading through innovation and geographic expansion. Strategic partnerships, mergers, and product launches are common tactics. By 2026, companies that emphasize sustainability (e.g., eco-friendly packaging, reduced plastic use) and digital integration (e.g., smart labeling for traceability) are likely to gain market share.

Conclusion

By 2026, the butterfly catheter market is expected to witness moderate but consistent growth, supported by clinical demand, technological progress, and healthcare system evolution. While competition and pricing pressures remain challenges, opportunities in home care, emerging markets, and safety-focused design will define the industry’s trajectory. Stakeholders who align with these trends will be well-positioned to capture value in a maturing yet dynamic segment of the vascular access device market.

Common Pitfalls Sourcing Butterfly Catheters: Quality and Intellectual Property Risks

Sourcing butterfly catheters, especially from international suppliers, involves significant risks if due diligence is not thoroughly performed. Two critical areas where organizations often encounter problems are product quality and intellectual property (IP) compliance. Failing to address these pitfalls can lead to regulatory non-compliance, patient safety issues, financial losses, and reputational damage.

Quality-Related Pitfalls

-

Inconsistent Manufacturing Standards

Many low-cost suppliers, particularly in regions with less stringent regulatory oversight, may not consistently adhere to ISO 13485 (Quality Management Systems for Medical Devices) or FDA cGMP (current Good Manufacturing Practice) standards. This can result in variability in catheter performance, material integrity, and sterility. -

Substandard Materials and Biocompatibility Issues

Poor-quality plastics or incorrect material formulations can lead to catheter brittleness, kinking, or leaching of harmful substances. Suppliers may use non-medical-grade materials to cut costs, increasing risks of adverse patient reactions or device failure. -

Inadequate Sterilization and Packaging

Improper sterilization processes (e.g., incorrect EO or gamma radiation doses) or compromised packaging can result in non-sterile products reaching end users. This poses serious infection risks and potential recalls. -

Lack of Regulatory Documentation

Suppliers may provide falsified or incomplete documentation such as Certificates of Conformity, test reports, or sterilization validation. Without authentic regulatory paperwork, market authorization in regions like the EU (CE marking) or U.S. (FDA 510(k)) becomes impossible. -

Insufficient Quality Control and Testing

Inadequate in-process or final product testing—such as flow rate verification, needle sharpness, or hemolysis testing—can allow defective units to enter the supply chain, leading to clinical complications.

Intellectual Property-Related Pitfalls

-

Supply of Counterfeit or Copycat Devices

Some suppliers offer butterfly catheters that mimic well-known brand designs but are unauthorized replicas. These may infringe on patents, trademarks, or design rights, exposing the buyer to legal action even if they were unaware of the infringement. -

Patent Infringement Risks

Butterfly catheters often incorporate patented technologies (e.g., safety mechanisms, needle designs, or blood control features). Sourcing from manufacturers that do not license these technologies can result in IP litigation, shipment seizures, or injunctions in target markets. -

Lack of IP Due Diligence in Supplier Evaluation

Buyers may overlook verifying whether a supplier holds proper IP rights or licenses. Without this, there is no assurance that the product can be legally sold in key jurisdictions, especially in the U.S. or Europe where IP enforcement is strict. -

Grey Market Distribution and Trademark Violations

Sourcing through unauthorized distributors may result in products that are genuine but distributed outside intended channels. This can still trigger trademark issues and void warranties or regulatory approvals. -

Inadequate Contractual IP Protections

Procurement contracts that fail to include IP indemnification clauses leave buyers financially and legally exposed if the sourced products are later found to infringe third-party rights.

Conclusion

To mitigate these risks, organizations must conduct rigorous supplier audits, verify regulatory and quality certifications, perform product testing, and engage legal counsel to assess IP status. Partnering with reputable, transparent manufacturers and insisting on full traceability and compliance documentation are essential steps in safe and lawful butterfly catheter sourcing.

Logistics & Compliance Guide for Butterfly Catheter

This guide outlines the essential logistics and compliance considerations for the transportation, storage, handling, and regulatory adherence related to Butterfly Catheters—commonly used medical devices for venipuncture and short-term intravenous therapy.

Regulatory Classification and Approval

Butterfly Catheters are classified as medical devices, typically falling under Class II (in the United States per FDA classification) or Class IIa (under the EU MDR). They must comply with applicable regulatory standards, including:

- FDA 510(k) clearance (USA)

- CE Marking under Medical Device Regulation (EU MDR 2017/745)

- Compliance with ISO 13485 (Quality Management Systems for Medical Devices)

- Adherence to ISO 10993 (Biological Evaluation of Medical Devices)

Ensure all products are sourced from certified manufacturers with valid regulatory documentation before distribution.

Packaging and Labeling Requirements

Butterfly Catheters must be individually sterile-packaged and labeled in compliance with international standards:

- UDI (Unique Device Identification) compliance per FDA and EU regulations

- Labeling must include:

- Device name and model

- Sterility indication and expiration date

- Single-use statement

- Manufacturer name and address

- Lot number

- Intended use and warnings

- Labels must be legible, durable, and available in local languages for target markets

Storage Conditions

Proper storage is critical to maintaining sterility and device integrity:

- Temperature: Store between 15°C and 30°C (59°F to 86°F)

- Humidity: Maintain relative humidity below 60%

- Environment: Dry, clean, and well-ventilated area away from direct sunlight and contaminants

- Shelf Life: Monitor expiration dates; do not distribute expired devices

Transportation and Distribution

Ensure compliance throughout the supply chain:

- Use validated cold chain or ambient shipping methods as appropriate

- Packaging must protect against physical damage, moisture, and contamination

- Shipments must include temperature monitoring (if required) and tamper-evident seals

- Distributors and logistics partners must adhere to GDP (Good Distribution Practice) standards

- Maintain full traceability from manufacturer to end user

Import and Export Compliance

International shipments require strict adherence to customs and regulatory requirements:

- Obtain necessary import licenses and export permits

- Prepare accurate commercial invoices, packing lists, and certificates of origin

- Comply with customs classification (HS Code: typically 9018.39 for invasive medical instruments)

- Provide Certificates of Free Sale or Certificates of Conformity when requested by importing countries

- Follow IATA/ADR regulations for air and ground transport of medical devices

Inventory Management and Traceability

Implement systems to ensure product accountability:

- Maintain lot-number tracking and expiry date monitoring

- Use barcode or RFID systems for efficient inventory control

- Establish recall procedures in case of non-conformance or safety alerts

- Keep records for a minimum of 10 years (or as required by local regulations)

Post-Market Surveillance and Vigilance Reporting

Compliance extends beyond distribution:

- Monitor and report adverse events per FDA MedWatch and EU vigilance systems

- Maintain a post-market surveillance plan

- Respond promptly to field safety notices or recalls

- Keep updated technical documentation and periodic safety update reports (PSURs) as required

Training and Documentation

Ensure all personnel involved in logistics and handling are trained:

- Training on GDP, device handling, and emergency procedures

- Maintain training records and standard operating procedures (SOPs)

- Documentation must be readily available for audits or inspections

Adherence to this logistics and compliance guide ensures the safe, legal, and effective distribution of Butterfly Catheters worldwide.

Conclusion for Sourcing Butterfly Catheters:

In conclusion, sourcing butterfly catheters requires a strategic approach that balances quality, cost, regulatory compliance, and supply chain reliability. These essential medical devices play a critical role in venipuncture and short-term IV therapy, particularly in pediatric, geriatric, and sensitive clinical settings where precision and patient comfort are paramount.

A successful sourcing strategy involves evaluating suppliers based on product quality, adherence to international standards (such as ISO 13485 and FDA/CE certifications), material biocompatibility, and consistent performance. Additionally, considerations such as needle gauge options, wing design, patient safety features (e.g., retractable needles), and packaging sterility are crucial to ensure optimal clinical outcomes.

Establishing relationships with reputable manufacturers—whether domestic or international—can enhance supply continuity and reduce procurement risks. Furthermore, conducting regular quality audits, staying compliant with healthcare regulations, and incorporating feedback from end-users (nurses and clinicians) into the selection process will support informed decision-making.

Ultimately, effective sourcing of butterfly catheters not only ensures patient safety and care efficacy but also contributes to operational efficiency and cost-effectiveness within healthcare institutions. A well-structured procurement plan, aligned with clinical needs and industry best practices, is key to maintaining a reliable and high-quality supply of this vital medical device.