The global butt welding pipe fittings market is experiencing robust growth, driven by increasing demand across the oil & gas, petrochemical, power generation, and water treatment industries. According to Grand View Research, the global pipe fittings market size was valued at USD 37.8 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. Mordor Intelligence further supports this trajectory, reporting steady growth fueled by expanding infrastructure projects and industrialization in emerging economies. With stringent regulatory standards and a rising emphasis on system efficiency and leak prevention, butt welding pipe fittings—known for their durability and high-pressure tolerance—have become critical components in fluid transport systems. As demand intensifies, a select group of manufacturers have emerged as leaders, combining advanced manufacturing capabilities, strict quality compliance, and global supply chain reach to dominate the competitive landscape.

Top 9 Butt Welding Pipe Fitting Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Ezeflow

Domain Est. 1996

Website: ezeflow.com

Key Highlights: Ezeflow Group is a proud manufacturer of butt weld pipe fittings, offering 24 / 7 manufacturing and delivery worldwide, from a large inventory of all materials….

#2 Steel Forgings, Inc.

Domain Est. 1996

Website: steelforgings.com

Key Highlights: Steel Forgings manufactures Fleet-Line products including butt weld fittings, butt weld pipe, butt weld elbows, and more, faster than any competitor….

#3 Butt Weld Fittings

Domain Est. 1999

Website: pipefittingweb.com

Key Highlights: We offer an extensive selection of premium butt weld fittings, available in both welded and seamless types to meet diverse industrial needs….

#4 BT-FITTINGS-BW

Domain Est. 2000

Website: bola-tek.com.tw

Key Highlights: Explore BOLA-TEK’s butt weld fittings in stainless and carbon steel, available in seamless and welded types for reliable industrial piping solutions….

#5 BUTTWELD FITTINGS

Domain Est. 2018

Website: vishadforge.com

Key Highlights: Vishad Forge is one of the renowned manufacturers, exporter,s and suppliers of stainless steel buttweld fittings, carbon steel buttweld fittings, alloy steel ……

#6 Butt Weld Fittings

Domain Est. 1996

Website: products.swagelok.com

Key Highlights: Butt weld fitting straights, elbows, tees, and crosses feature a precisely finished diameter to match tube diameter and create high-integrity connections….

#7 Stainless Steel Butt Weld Fittings

Domain Est. 1999

Website: stainlessandalloy.com

Key Highlights: We have an extensive inventory of stainless steel elbows, caps, tees, reducers, crosses, stub ends and many other stainless steel butt welding fittings….

#8 Carbon Steel Butt Weld Fittings

Domain Est. 2005

Website: haywardpipe.com

Key Highlights: Discover our range of carbon steel butt weld fittings, ideal for high-pressure and high-temperature applications. Explore now!…

#9 Butt Weld Pipe Fittings,Elbow, Flanges Blog

Domain Est. 2013

Website: jsfittings.com

Key Highlights: JS FITTINGS specializes in seamless butt-weld pipe fittings and flanges, combining four decades of manufacturing expertise with certifications from NIOC and ……

Expert Sourcing Insights for Butt Welding Pipe Fitting

H2: Projected Market Trends for Butt Welding Pipe Fittings in 2026

The global market for butt welding pipe fittings is expected to experience significant growth and transformation by 2026, driven by advancements in industrial infrastructure, energy sector developments, and evolving manufacturing technologies. Several key trends are anticipated to shape the industry landscape in the coming years.

-

Increased Demand from Energy and Oil & Gas Sectors

The oil and gas industry remains one of the largest consumers of butt welding pipe fittings due to their reliability in high-pressure and high-temperature environments. As global energy demand continues to rise—especially in emerging economies—upstream, midstream, and downstream projects are expected to expand. Offshore drilling, LNG (liquefied natural gas) terminal construction, and pipeline infrastructure upgrades will fuel demand for high-quality, corrosion-resistant butt weld fittings made from stainless steel, carbon steel, and alloy materials. -

Growth in Renewable Energy and Hydrogen Infrastructure

By 2026, investments in renewable energy and clean fuel technologies—including hydrogen transportation and storage systems—are expected to create new opportunities for butt welding fittings. Hydrogen pipelines require fittings capable of handling embrittlement and high pressures, prompting innovation in material science and manufacturing standards. The adaptation of butt weld fittings for use in green hydrogen networks will become a growing niche market. -

Expansion in Asia-Pacific and Middle Eastern Markets

Asia-Pacific, particularly India, China, and Southeast Asia, will remain a hotspot for market growth due to rapid urbanization, industrialization, and government-led infrastructure projects. Similarly, the Middle East’s continued investment in petrochemical complexes and water desalination plants will drive regional demand. Local manufacturing hubs are expected to expand, reducing import dependency and increasing competitiveness. -

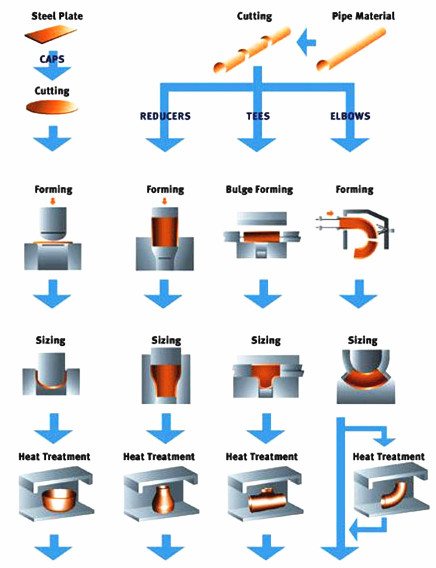

Adoption of Advanced Manufacturing Technologies

By 2026, the integration of automation, precision machining, and digital twin technologies in the production of butt welding fittings will enhance product consistency and reduce lead times. Additive manufacturing (3D printing) may begin to play a role in prototyping and custom-fitting solutions, especially for complex or large-diameter fittings used in specialized applications. -

Stricter Regulatory Standards and Quality Compliance

Global safety and environmental regulations are becoming more stringent, particularly in Europe and North America. Compliance with standards such as ASME B16.9, ISO 11960, and PED (Pressure Equipment Directive) will be critical for market access. Manufacturers will increasingly invest in certification processes and quality assurance systems to meet these requirements and gain a competitive edge. -

Sustainability and Material Efficiency

Sustainability concerns will influence material sourcing and production methods. The industry is expected to see a shift toward recycled metals and energy-efficient manufacturing processes. Additionally, lightweight yet durable alloy fittings will gain traction as industries prioritize reducing carbon footprints across supply chains. -

Supply Chain Resilience and Localization

Following disruptions caused by geopolitical tensions and global pandemics, companies are reevaluating supply chain strategies. Regionalization of production and strategic stockpiling of critical components like butt weld fittings are anticipated trends. This shift will support local vendors and reduce logistics dependencies.

In summary, the 2026 market for butt welding pipe fittings will be characterized by technological innovation, geographic expansion, and growing demand from both traditional and emerging energy sectors. Companies that invest in quality, compliance, and sustainable practices will be best positioned to capitalize on these evolving trends.

Common Pitfalls When Sourcing Butt Welding Pipe Fittings (Quality & IP)

Sourcing butt welding pipe fittings involves critical considerations beyond just price and delivery. Overlooking quality standards and intellectual property (IP) rights can lead to project delays, safety hazards, and legal liabilities. Below are common pitfalls to avoid:

Poor Material and Manufacturing Quality

One of the most frequent issues is receiving fittings that do not meet required material specifications or manufacturing standards. Suppliers may use substandard alloys, incorrect heat treatment, or inadequate welding procedures, leading to premature failure under pressure or in corrosive environments. Always verify compliance with recognized standards such as ASME B16.9, ASTM A234, or ISO 3419 through mill test certificates (MTCs) and third-party inspection reports.

Inadequate Dimensional Accuracy

Butt welding fittings must match pipe dimensions precisely to ensure proper alignment and weld integrity. Poorly manufactured fittings with incorrect bevel angles, out-of-tolerance diameters, or inconsistent wall thickness can cause weak joints, leaks, or rework during installation. Ensure suppliers adhere strictly to dimensional tolerances specified in relevant standards.

Lack of Traceability and Certification

Reputable suppliers provide full traceability, including heat numbers, material certifications, and NDT (non-destructive testing) reports. A common pitfall is accepting fittings without proper documentation, increasing the risk of counterfeit or non-compliant products entering the supply chain. Always demand complete certification packages and verify their authenticity.

Counterfeit or Non-Compliant Markings

Some suppliers falsify product markings—such as brand logos, material grades, or certification symbols—to mimic reputable manufacturers. This not only breaches intellectual property rights but also poses safety risks. Inspect physical markings upon receipt and cross-check with the supplier’s stated certifications.

Intellectual Property (IP) Infringement

Using or sourcing fittings that bear unauthorized trademarks, patented designs, or copyrighted technical specifications exposes buyers to legal action. Some manufacturers illegally replicate branded fittings (e.g.,模仿知名厂商设计). Ensure suppliers have legitimate rights to the products they offer and avoid “look-alike” fittings that may infringe on IP.

Insufficient Quality Assurance Processes

Suppliers without robust quality management systems (e.g., ISO 9001 certification) are more likely to deliver inconsistent products. Relying on such vendors increases the risk of non-conformances, especially in large orders. Prioritize suppliers with audited QA/QC procedures and a history of compliance in industrial applications.

Overlooking Third-Party Inspection

Skipping independent inspection (e.g., by SGS, Bureau Veritas, or customer-appointed inspectors) is a high-risk shortcut. On-site or pre-shipment inspections help catch defects early and ensure conformity before shipment. Always include inspection clauses in procurement contracts.

By addressing these pitfalls—focusing on material integrity, dimensional precision, documentation, and IP compliance—buyers can ensure reliable, safe, and legally sound sourcing of butt welding pipe fittings.

Logistics & Compliance Guide for Butt Welding Pipe Fittings

This guide outlines the essential logistics considerations and regulatory compliance requirements for the transportation, handling, storage, and use of butt welding pipe fittings across industrial supply chains.

Material Certification & Traceability

Ensure all butt welding pipe fittings are supplied with valid material test reports (MTRs) or certified mill test certificates (CMTRs) compliant with relevant standards such as ASTM, ASME, or EN. Each fitting must be traceable to its heat or batch number to meet quality assurance and regulatory audit requirements.

International Standards Compliance

Butt welding pipe fittings must conform to international standards including:

– ASME B16.9 (Factory-Made Wrought Buttwelding Fittings)

– ASME B16.28 (Wrought Steel Buttwelding Short Radius Elbows and Returns)

– MSS SP-75 (High-Test Wrought Butt-Welding Fittings)

– EN 10253 (Butt-welding pipe fittings)

Ensure compliance documentation is available for customs clearance and project specifications.

Packaging & Handling Requirements

Fittings should be packaged to prevent mechanical damage, corrosion, and contamination during transit. Protective caps are required for beveled ends. Use wooden crates, steel banding, or palletized loads based on size and quantity. Clearly label packages with product details, weight, handling instructions (e.g., “Do Not Drop”), and orientation markers.

Transportation Considerations

Use secure transport methods appropriate to the size and weight of fittings. Large or heavy fittings may require flatbed trucks or specialized freight. Comply with carrier regulations regarding load securing (e.g., US DOT, ADR in Europe). For international shipments, prepare accurate commercial invoices, packing lists, and ensure Harmonized System (HS) code classification (e.g., 7307.99 for steel pipe fittings).

Import/Export Regulations

Verify export control classifications (e.g., ECCN under the U.S. Commerce Control List) and ensure compliance with sanctions (e.g., OFAC). Some high-pressure or alloy fittings may be subject to additional scrutiny. Obtain required export licenses if applicable, especially for destinations under trade restrictions.

Storage & Inventory Management

Store fittings in a dry, covered environment to prevent corrosion. Keep off the ground using racks or pallets. Segregate materials by grade, size, and certification to avoid mix-ups. Implement a first-in, first-out (FIFO) inventory system and conduct periodic inspections for damage or rust.

Quality Inspections & Third-Party Verification

Prior to shipment or installation, conduct dimensional checks, visual inspections, and non-destructive testing (NDT) as required by project specifications (e.g., radiographic, ultrasonic, or dye penetrant testing). Engage accredited third-party inspectors (TPI) for critical applications or when mandated by codes such as API, PED, or ASME.

Pressure Equipment Directive (PED) Compliance (EU)

For fittings placed on the European market, compliance with the Pressure Equipment Directive 2014/68/EU is mandatory. Classify fittings according to fluid group, pressure, and volume (Categories I–IV), and affix the CE mark. Compile a technical construction file (TCF) and involve a notified body for conformity assessment when required.

Environmental & Safety Compliance

Handle cutting, beveling, and fitting operations in accordance with OSHA (or local equivalent) safety standards. Implement proper waste management for metal scraps and lubricants. Ensure compliance with environmental regulations such as REACH (EU) for substances in materials and RoHS for restricted hazardous substances.

Documentation & Record Retention

Maintain complete records including purchase orders, certificates of conformance, inspection reports, shipping documents, and customs filings. Retain documentation for a minimum of 10 years or as required by jurisdiction or client specifications to support audits and traceability.

Conclusion for Sourcing Butt Welding Pipe Fittings

In conclusion, sourcing butt welding pipe fittings requires a strategic approach that balances quality, cost, reliability, and compliance with industry standards. These critical components play a vital role in ensuring the integrity, safety, and efficiency of piping systems across industries such as oil and gas, petrochemical, power generation, and water treatment.

Key considerations in the sourcing process include selecting suppliers with proven certifications (e.g., ASME, ASTM, ISO), conducting thorough quality audits, and verifying material traceability and testing procedures. Additionally, evaluating supplier lead times, logistical capabilities, and after-sales support helps mitigate project delays and operational risks.

By partnering with reputable manufacturers and leveraging market intelligence, organizations can secure high-performance butt welding fittings that meet technical specifications and regulatory requirements. Ultimately, a well-executed sourcing strategy not only enhances system reliability and longevity but also contributes to long-term cost savings and operational excellence.