The global smoked salmon market is experiencing robust growth, driven by rising consumer demand for premium protein sources and ready-to-eat seafood products. According to Grand View Research, the global salmon market was valued at USD 20.8 billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 6.2% from 2024 to 2030, fueled by increasing aquaculture production and expanding distribution channels. Mordor Intelligence projects similar momentum, noting that growing health consciousness and the popularity of Nordic and Mediterranean diets are accelerating demand, particularly in North America and Europe. As the appetite for high-quality, sustainably sourced smoked salmon grows, bulk procurement from reliable manufacturers has become critical for retailers, foodservice providers, and private-label brands. This list highlights the top 10 bulk smoked salmon manufacturers leveraging scale, innovation, and traceability to lead in an increasingly competitive landscape.

Top 10 Bulk Smoked Salmon Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 The Santa Barbara Smokehouse

Domain Est. 2004

Website: sbsmokehouse.com

Key Highlights: A classical masterpiece in beautiful Santa Barbara, CA. Home of the world’s finest wild and farmed smoked salmon. Learn about our products.Missing: bulk manufacturer…

#2 Haifa Smoked Fish, Inc.

Domain Est. 2016

Website: haifasmokedfish.com

Key Highlights: We are the leading brand of full line extraordinary and great-tasting smoked fish in North America….

#3 Echo Falls Seafoods

Domain Est. 2024

Website: echofallsseafoods.com

Key Highlights: Browse the Echo Falls collection of smoked and cured seafood products today. Discover who carries our products near you on our website now!Missing: bulk manufacturer…

#4

Domain Est. 1996

Website: mowi.com

Key Highlights: Our products range from whole fish, to plain or marinated fillets and steaks, to hot- and cold-smoked salmon, all the way through to succulent burgers and ……

#5 Smoked Organic Salmon

Domain Est. 1996

Website: citarella.com

Key Highlights: In stock $60 deliveryOrder our Smoked Organic Salmon and enjoy its sublime flavor, subtle smokiness, and buttery texture. Shop for nationwide shipping….

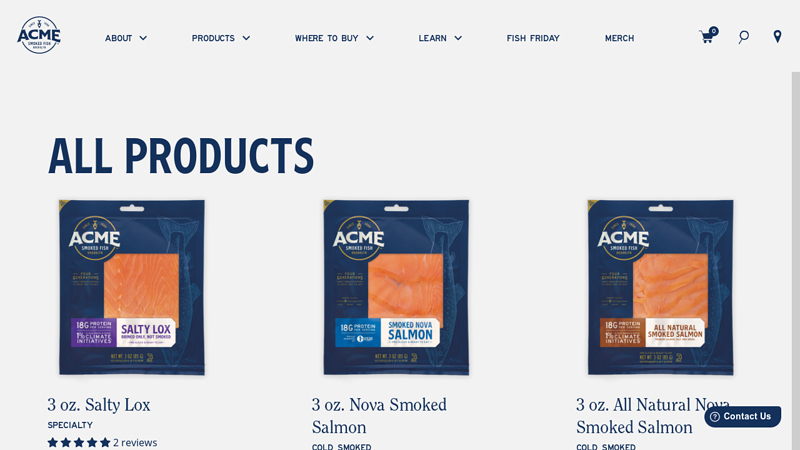

#6 All Products

Domain Est. 1996

Website: acmesmokedfish.com

Key Highlights: Acme Smoked Fish is the premier American smoked fish purveyor. Our smoked salmon, and other fish delicacies, use the finest and freshest fish available….

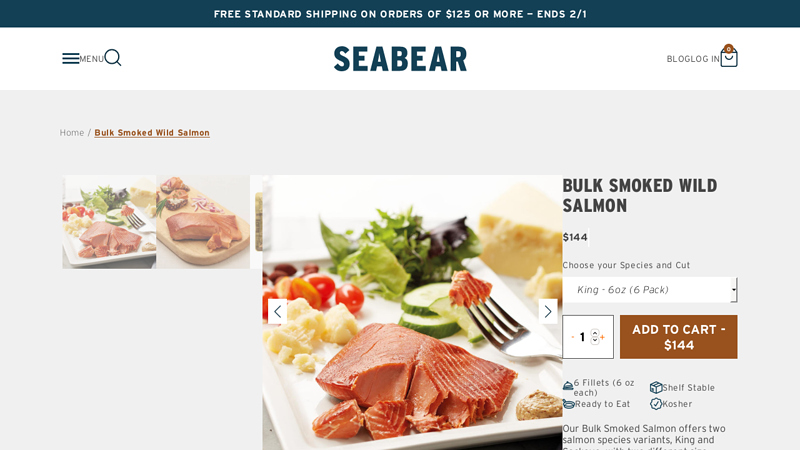

#7 Bulk Smoked Wild Salmon

Domain Est. 1997

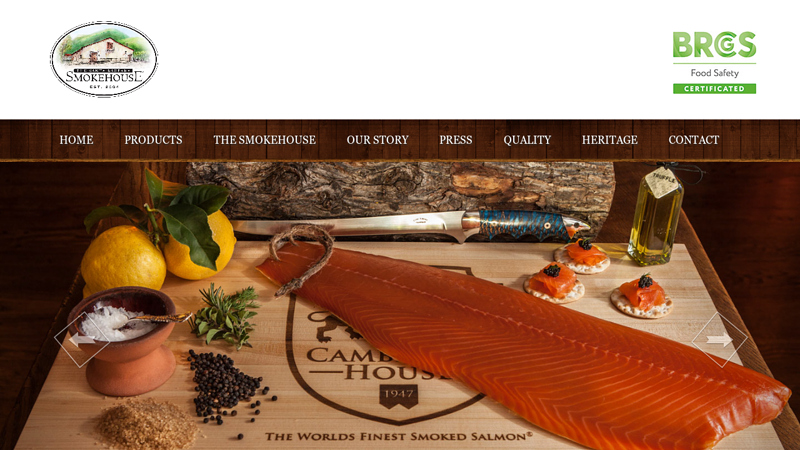

#8 Traditional Smoked Salmon Side

Domain Est. 1999

Website: brownetrading.com

Key Highlights: Our Traditional Smoked Salmon Side offer a classic, nova style smoked salmon. Using a simple recipe of seaweed, salt, and sugar, this cold smoked salmon is ……

#9 Wholesale

Domain Est. 2001

#10 St. James Smokehouse

Domain Est. 2003

Website: stjamessmokehouse.com

Key Highlights: St. James Smokehouse specializes in producing superior quality smoked salmon retail and wholesale products. Locations in Miami, Florida, USA and Scotland….

Expert Sourcing Insights for Bulk Smoked Salmon

H2: 2026 Market Trends for Bulk Smoked Salmon

The global bulk smoked salmon market is poised for continued evolution by 2026, driven by shifting consumer demands, sustainability imperatives, geopolitical factors, and technological advancements. Here’s a breakdown of key trends shaping the market:

1. Sustained Demand Growth with Evolving Preferences:

* Health & Premiumization: Demand for premium protein sources rich in Omega-3s will remain strong. Bulk smoked salmon caters to foodservice (restaurants, hotels, caterers) and value-conscious retailers, but the type of bulk matters. Expect growth in high-quality, traceable, and sustainably sourced product even in bulk formats, as institutions prioritize brand reputation.

* Convenience & Diversification: Bulk demand will be fueled by the rise of pre-portioned, ready-to-use smoked salmon (e.g., slices, cubes, lox-style) for salads, bagels, and appetizers. Foodservice seeks efficiency, driving demand for consistent, easy-to-handle bulk packs. Flavored varieties (dill, pepper, citrus, honey) in bulk will see increased popularity.

* Plant-Based Competition (Indirect Pressure): While not a direct substitute, the growth of sophisticated plant-based seafood alternatives will push traditional producers to emphasize the unique nutritional benefits, taste, and natural origin of real salmon, even when sold in bulk.

2. Intensified Focus on Sustainability & Traceability:

* Certification as Standard: By 2026, credible certifications (ASC, BAP, MSC for wild-caught) will become non-negotiable for major bulk buyers, especially large retailers and ethical foodservice chains. “Sustainable” will be a baseline expectation, not a premium differentiator.

* Transparency & Provenance: Blockchain and digital traceability platforms will gain traction, allowing bulk buyers to verify origin, farming practices, feed sources, and environmental impact. This builds trust and mitigates reputational risk.

* Feed Innovation & Environmental Impact: Pressure will mount to reduce reliance on wild-caught fish oil/meal in feed. Bulk suppliers investing in alternative feeds (algae, insect protein, plant-based) will gain a competitive edge and meet stricter sustainability criteria.

3. Geopolitical & Supply Chain Dynamics:

* Norway’s Dominance & Competition: Norway will remain the dominant bulk supplier, but faces challenges like sea lice management, regulatory scrutiny, and potential production caps. Increased competition from Chile (rebounding from environmental issues), Scotland (facing challenges but holding premium status), and emerging producers (e.g., Canada, Faroe Islands, potentially land-based) will create a more diverse, but potentially volatile, supply landscape.

* Supply Chain Resilience: Lessons from recent disruptions (pandemic, logistics) will drive investment in diversified sourcing, nearshoring (where feasible), and more robust logistics. Bulk buyers will prioritize suppliers with proven supply chain stability.

* Trade Policies & Tariffs: Ongoing trade relationships (e.g., UK-EU post-Brexit, US-China) will significantly impact costs and availability. Bulk buyers will need agile sourcing strategies to navigate potential tariffs or trade barriers.

4. Technological Advancements & Efficiency:

* Processing Automation: Increased automation in slicing, packaging, and quality control within bulk production facilities will improve consistency, reduce labor costs, and enhance food safety – critical for large-volume buyers.

* Cold Chain Innovation: Advancements in refrigerated transport and storage (e.g., more efficient refrigerants, real-time monitoring) will be crucial for maintaining quality and reducing spoilage in bulk shipments over long distances.

* Alternative Production: While still a niche, investments in land-based Recirculating Aquaculture Systems (RAS) for salmon will grow. By 2026, RAS-produced smoked salmon, potentially offering hyper-local and highly controlled production, may begin to capture a small but significant share of the premium bulk market, particularly in regions with high import costs.

5. Price Volatility & Cost Pressures:

* Input Cost Fluctuations: Bulk prices will remain sensitive to feed costs (linked to global agriculture), energy prices (for farming and processing), and labor costs. Inflationary pressures may persist.

* Disease & Environmental Events: Outbreaks of sea lice, algal blooms, or extreme weather events impacting key producing regions will cause supply shocks and price spikes, affecting bulk contracts.

* Value vs. Premium Trade-Off: Economic conditions will influence buyer behavior. While demand for premium bulk exists, there may also be increased pressure for value-oriented options, potentially impacting margins for producers.

Conclusion:

The 2026 bulk smoked salmon market will be characterized by consolidation around sustainability, transparency, and quality, even within large-volume sales. Success will depend on suppliers’ ability to offer traceable, responsibly sourced product with consistent quality and reliable supply chains, while managing cost pressures and adapting to evolving foodservice and retail needs for convenience and variety. Technological innovation and navigating geopolitical complexities will be key differentiators. Bulk will remain a vital channel, but the definition of “bulk” will increasingly include expectations of premium attributes and ethical production.

Common Pitfalls When Sourcing Bulk Smoked Salmon (Quality and Intellectual Property)

Sourcing bulk smoked salmon can be a cost-effective strategy for foodservice providers, retailers, and manufacturers. However, businesses often encounter significant challenges related to product quality and intellectual property (IP) considerations. Being aware of these pitfalls is essential to ensure consistency, compliance, and customer satisfaction.

Quality-Related Pitfalls

Inconsistent Product Freshness and Shelf Life

One of the most common issues when sourcing in bulk is variability in freshness. Smoked salmon is a perishable product, and inconsistent cold chain management during shipping and storage can lead to shortened shelf life, spoilage, or off-flavors. Buyers should verify suppliers’ cold chain logistics and request documentation on harvest and smoking dates.

Variable Smoking Techniques and Flavor Profiles

Smoked salmon can be cold-smoked, hot-smoked, or cured using different brines and wood types. Inconsistent smoking methods across batches can result in mismatched color, texture, and taste. Without clear specifications, bulk orders may not meet brand standards, leading to customer dissatisfaction.

Poor Traceability and Lack of Origin Transparency

Low-quality suppliers may obscure the origin of their salmon, making it difficult to verify if the fish is farmed or wild-caught, and whether sustainable practices were followed. This lack of traceability can pose risks related to environmental claims, allergens, and regulatory compliance.

Mislabeling and Adulteration Risks

Bulk products are more susceptible to mislabeling—such as substituting lower-grade fish or inflating weight with excess brine. Third-party testing and supplier audits can help mitigate the risk of adulteration and ensure accurate labeling.

Intellectual Property-Related Pitfalls

Unauthorized Use of Branding or Trade Secrets

When working with co-packers or private-label manufacturers, there’s a risk that proprietary recipes, packaging designs, or brand names may be used without authorization for other clients. Contracts should include clear IP clauses protecting branding, formulations, and confidential information.

Replication of Signature Products by Suppliers

Some suppliers may reverse-engineer a buyer’s unique smoked salmon recipe and sell similar products to competitors. This is especially common in private-label arrangements. Non-disclosure agreements (NDAs) and strict IP ownership terms in supply contracts are essential safeguards.

Trademark Infringement in Product Naming

Using evocative names like “Scandinavian Style” or “Nova Lox” without proper rights or geographical indication compliance can lead to trademark disputes. Businesses must ensure their product names do not infringe on existing trademarks or mislead consumers about origin.

Lack of Protection for Packaging and Design

Distinctive packaging is often a key differentiator in retail. Without registering trademarks or design patents, competitors—or even suppliers—could replicate visual elements. Investing in IP protection for logos, labels, and packaging designs is critical when sourcing at scale.

Conclusion

Sourcing bulk smoked salmon requires due diligence beyond price and volume. Prioritizing quality control, supply chain transparency, and robust IP agreements helps mitigate risks and supports long-term brand integrity. Businesses should conduct supplier audits, enforce contractual safeguards, and invest in traceability and legal protections to avoid common pitfalls.

Logistics & Compliance Guide for Bulk Smoked Salmon

Overview of Bulk Smoked Salmon Transportation

Bulk smoked salmon is a high-value, perishable seafood product requiring stringent handling throughout the supply chain. Effective logistics ensure product freshness, safety, and compliance with food safety regulations. This guide outlines best practices for the transportation, storage, and regulatory compliance of bulk smoked salmon.

Temperature Control and Cold Chain Management

Maintaining a consistent cold chain is critical for preserving the quality and safety of smoked salmon. The product must be stored and transported at or below 3°C (38°F) at all times. Use refrigerated containers (reefers) or insulated trucks equipped with temperature monitoring systems. Regular temperature logging and real-time alerts help detect and respond to deviations promptly.

Packaging Requirements for Bulk Shipments

Bulk smoked salmon should be packed in food-grade, moisture-resistant materials to prevent contamination and freezer burn. Common packaging includes vacuum-sealed bags, vacuum skin packs, or modified atmosphere packaging (MAP), placed in polystyrene or corrugated boxes with ice or gel packs as needed. Each container must be clearly labeled with product details, lot numbers, and handling instructions.

Import and Export Regulations

International shipments of smoked salmon are subject to import/export regulations in both origin and destination countries. Key requirements include:

- Health Certificates: Issued by national food safety authorities (e.g., USDA, CFIA, or EU equivalents), certifying the product meets sanitary standards.

- Customs Documentation: Commercial invoices, packing lists, bills of lading, and certificates of origin must be accurate and complete.

- Veterinary or Sanitary Inspections: Required in many markets, especially within the EU, China, and the USA.

Always verify destination-specific import rules, including allowable additives, labeling standards, and permitted processing methods.

Food Safety and HACCP Compliance

Smoked salmon processors and distributors must adhere to Hazard Analysis and Critical Control Points (HACCP) principles. Key control points include raw material sourcing, smoking processes, post-process handling, and storage. Facilities must be certified to recognized food safety standards (e.g., BRCGS, SQF, or IFS) and maintain detailed records for traceability.

Labeling and Traceability

Compliant labeling is essential for bulk smoked salmon. Labels must include:

- Product name (e.g., “Cold-Smoked Atlantic Salmon”)

- Net weight

- Name and address of manufacturer/packer

- Lot or batch number

- Best-before or use-by date

- Storage conditions

- Allergen declaration (“Contains: Fish”)

Traceability systems must enable full product tracking from harvest to delivery, supporting rapid recalls if necessary.

Transportation Modes and Best Practices

Bulk smoked salmon can be shipped via air, sea, or overland transport. Choice depends on distance, cost, and urgency:

- Air Freight: Ideal for long distances and time-sensitive deliveries. Requires expedited customs clearance.

- Reefer Containers (Sea): Cost-effective for large volumes, but longer transit times require robust cold chain integrity.

- Refrigerated Trucks (Road): Used for regional distribution; ensure pre-cooling of vehicles and sealed, tamper-evident loads.

Always use carriers with experience in perishable seafood logistics and valid food transport certifications.

Regulatory Agencies and Standards

Key regulatory bodies overseeing smoked salmon trade include:

- FDA (U.S. Food and Drug Administration): Enforces seafood HACCP and import regulations.

- EFSA and DG SANTÉ (European Union): Regulate hygiene, labeling, and import conditions.

- CFIA (Canadian Food Inspection Agency): Oversees processing, export certification, and import controls.

- Codex Alimentarius: Provides international food standards influencing national regulations.

Ensure compliance with these agencies’ guidelines to avoid shipment rejections or delays.

Documentation and Recordkeeping

Maintain comprehensive records for a minimum of two years, including:

- HACCP plans and monitoring logs

- Temperature records during storage and transit

- Supplier certifications and test results (e.g., histamine, Listeria)

- Export health certificates

- Shipping and customs documentation

Digital record systems improve accuracy and audit readiness.

Risk Mitigation and Contingency Planning

Potential risks include power failures, port delays, customs holds, and pathogen contamination. Mitigation strategies include:

- Backup refrigeration systems

- Diversified shipping routes

- Insurance covering spoilage and delays

- Rapid response protocols for non-conformities

Regular audits and staff training ensure preparedness.

Conclusion

Proper logistics and compliance management are essential for the safe and legal distribution of bulk smoked salmon. Adhering to cold chain standards, regulatory requirements, and food safety protocols safeguards product integrity and consumer health while minimizing operational risks. Regular updates to procedures in line with evolving regulations ensure continued market access and competitiveness.

In conclusion, sourcing bulk smoked salmon requires careful consideration of several key factors to ensure quality, consistency, and value. Establishing partnerships with reputable suppliers who adhere to sustainable fishing practices and stringent food safety standards is essential. Evaluating aspects such as salmon origin, smoking methods (cold vs. hot smoked), packaging, shelf life, and storage requirements will help maintain product integrity. Additionally, negotiating favorable pricing, minimum order quantities, and reliable delivery logistics contributes to a cost-effective and efficient supply chain. Whether for retail distribution, food service operations, or further processing, a well-vetted sourcing strategy ensures a premium product that meets customer expectations and supports long-term business success.