The global bike helmets market is experiencing robust growth, driven by rising cycling adoption for recreation, commuting, and competitive sports, along with increasing safety regulations across key regions. According to a report by Mordor Intelligence, the global bicycle helmets market was valued at USD 1.08 billion in 2023 and is projected to grow at a CAGR of over 5.8% from 2024 to 2029. This expansion is fueled by heightened consumer awareness around head injury prevention, growing participation in e-bike and mountain biking segments, and government mandates promoting helmet use in countries across North America and Europe. As demand surges, bulk procurement from reliable manufacturers has become a strategic priority for distributors, retailers, and cycling brands aiming to balance quality, compliance, and cost-efficiency. In this landscape, identifying high-capacity manufacturers with proven production scalability, international certifications (such as CE, CPSC, and EN 1078), and a track record of innovation is essential. The following list highlights the top 10 bulk bike helmet manufacturers positioned to meet global supply needs, based on production volume, export reach, market reputation, and alignment with evolving safety and design trends.

Top 10 Bulk Bike Helmets Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 STUDDS

Domain Est. 1999

Website: studds.com

Key Highlights: STUDDS, the leading wholesale manufacturer and exporter of helmets, motorcycle accessories & riding gear in India and all over the world, offers a wide ……

#2 Biltwell Inc.

Domain Est. 2005

Website: biltwellinc.com

Key Highlights: Free delivery over $149 30-day returnsToday, Biltwell helmets, hard parts, and riding gear can be found everywhere fun on two wheels is happening. SHOP. Find A Dealer · Helmets · O…

#3 Over A Century of Helmet Innovation

Domain Est. 2016

Website: lazersport.us

Key Highlights: The most iconic Lazer helmet has been refined and it’s ready for the front of the race. The Z1, now with KinetiCore technology. More lightweight. More ……

#4 Road Bike Helmets

Domain Est. 1995

Website: abus.com

Key Highlights: From beginners to professionals ABUS offers attractive road helmets of the highest quality at an excellent price-performance ratio….

#5 Daytona Helmets

Domain Est. 1998

#6 Helmet House

Domain Est. 1998

Website: helmethouse.com

Key Highlights: Helmet House is a leading distributor in the motorcycle and powersports industry. Proudly representing Shoei, HJC, Cortech, Tourmaster, NORU, Alpinestars, ……

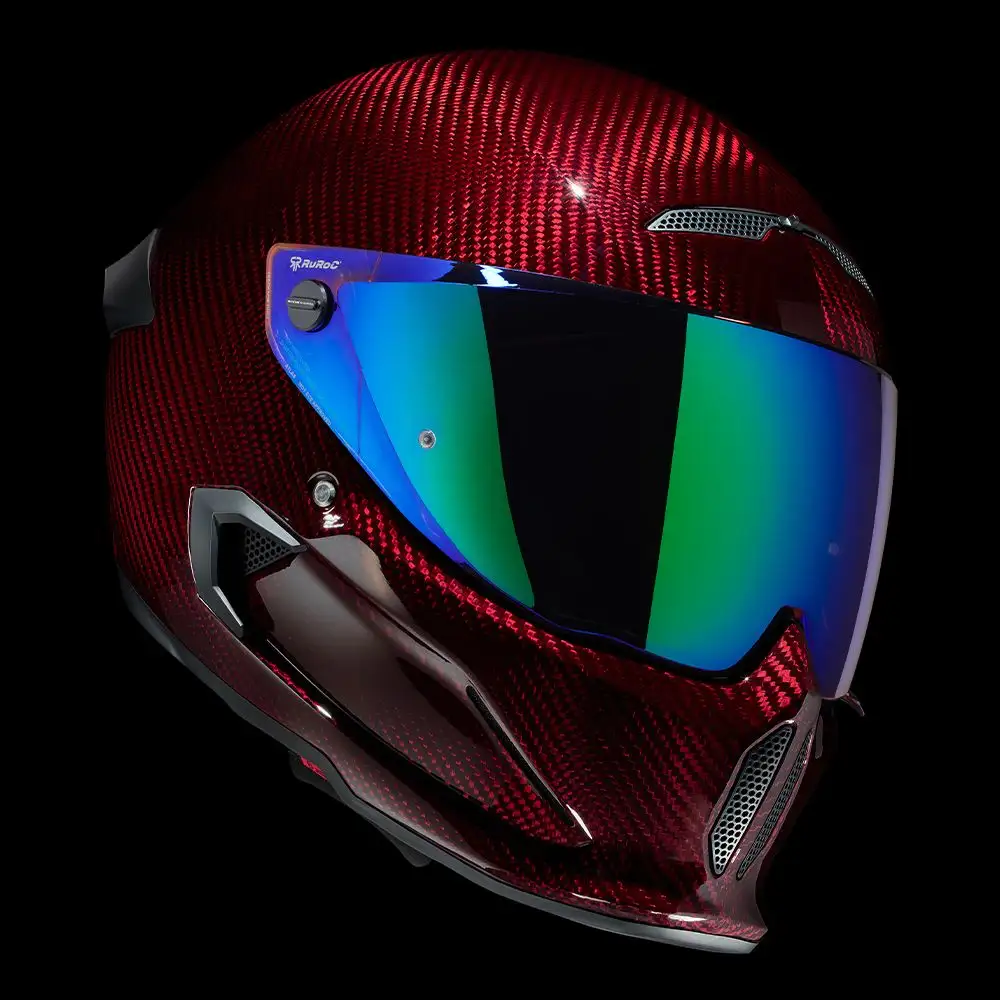

#7 Ruroc (US)

Domain Est. 2006

Website: ruroc.com

Key Highlights: Ruroc designs premium ski and motorcycle helmets for extreme performance and protection. Explore our full range of gear for riders and snow sports….

#8 Kali Protectives

Domain Est. 2007

#9 CLOSCA™ I Collapsible Helmets I US Official Store

Domain Est. 2007

Website: closca.com

Key Highlights: CLOSCA™ collapsible helmets, the best-in-class for safety, comfort, and modern style. Ideal for urban commuters, our award-winning design combines ……

#10 Adult Cycling Helmets

Domain Est. 2023

Website: rockbrosbike.us

Key Highlights: Free delivery over $29.99Adult cycling helmets with 360° custom fit, dual microshell EPS construction, and CPSC-certified protection….

Expert Sourcing Insights for Bulk Bike Helmets

H2: 2026 Market Trends for Bulk Bike Helmets

The global market for bulk bike helmets is projected to experience robust growth by 2026, driven by rising cycling participation, increased safety regulations, and the expansion of urban mobility solutions. This analysis explores key trends shaping the bulk bike helmet market in the coming years.

1. Rising Demand from Urban Mobility and Micromobility Sectors

With cities worldwide promoting sustainable transportation, bike-sharing programs and e-bike rentals are expanding rapidly. These services require large-scale procurement of helmets, fueling demand in the bulk segment. As micromobility infrastructure develops—especially in North America, Europe, and parts of Asia—operators are under pressure to meet safety standards, making bulk helmet purchases a priority.

2. Stricter Safety Regulations and Compliance Standards

Governments and transportation authorities are enacting stricter helmet laws for cyclists, particularly for riders under 18 and commercial riders (e.g., delivery personnel). In regions like the EU and Australia, mandatory helmet use is already enforced, and similar regulations are emerging in developing markets. These policies are compelling municipalities, schools, and rental companies to source compliant helmets in bulk, often favoring models with updated safety certifications (e.g., CPSC, CE, or MIPS).

3. Growth in Institutional and Educational Procurement

Schools, universities, and recreational centers are increasingly integrating cycling into physical education and transportation programs. This institutional adoption requires cost-effective, durable helmets in large quantities. Bulk ordering allows these organizations to reduce per-unit costs while ensuring standardization and safety across student and staff populations.

4. E-Commerce and Direct-to-Business (B2B) Platforms

Online platforms specializing in bulk safety gear are streamlining procurement for organizations. Manufacturers and distributors are enhancing B2B interfaces, offering customization (e.g., branded logos), volume discounts, and faster logistics. This shift improves accessibility and reduces lead times, encouraging larger orders from both public and private sectors.

5. Sustainability and Eco-Friendly Materials

Environmental consciousness is influencing purchasing decisions. By 2026, buyers are expected to favor suppliers using recycled plastics, biodegradable padding, and sustainable packaging. Bulk purchasers—especially government agencies and eco-conscious enterprises—are likely to prioritize vendors with transparent, green supply chains.

6. Technological Integration and Smart Helmets

While still a niche segment, smart helmets with features like integrated lights, Bluetooth connectivity, and impact sensors are gaining attention. In bulk markets, early adoption may occur in professional delivery fleets and law enforcement cycling units. Though cost remains a barrier, advancements could make smart helmets more affordable for mass deployment by 2026.

7. Competitive Pricing and Market Consolidation

Increased competition among manufacturers—particularly from China and Southeast Asia—is driving down prices for basic helmet models. This benefits bulk buyers but pressures smaller suppliers. Market consolidation is expected, with larger players acquiring niche brands to expand product portfolios and distribution networks.

8. Emerging Markets as Growth Engines

Regions like Southeast Asia, Latin America, and Africa are witnessing increased cycling adoption due to traffic congestion and infrastructure development. As safety awareness grows, these regions will become key markets for bulk helmet suppliers. Localized production and partnerships with NGOs or governments could unlock significant volume opportunities.

Conclusion

By 2026, the bulk bike helmet market will be shaped by regulatory mandates, institutional demand, technological innovation, and sustainability trends. Suppliers who offer compliant, cost-effective, and environmentally responsible solutions will be best positioned to capture market share. Strategic partnerships with urban mobility providers and educational institutions will be critical for sustained growth in this evolving landscape.

Common Pitfalls When Sourcing Bulk Bike Helmets (Quality and Intellectual Property)

Sourcing bulk bike helmets can be cost-effective, but it comes with significant risks if not managed carefully. Two of the most critical areas where buyers stumble are quality assurance and intellectual property (IP) compliance. Overlooking these aspects can lead to safety issues, legal liabilities, and reputational damage.

Quality-Related Pitfalls

Inadequate Safety Certification Verification

Many suppliers claim their helmets meet safety standards like CPSC (U.S.), EN 1078 (Europe), or AS/NZS 2063 (Australia), but falsified or outdated certifications are common. Buyers often accept documentation at face value without third-party verification, risking non-compliant products that endanger users and expose the buyer to liability.

Poor Materials and Construction

Low-cost helmets may use substandard EPS foam, weak chin straps, or flimsy outer shells. These materials degrade faster and offer insufficient impact protection. Bulk orders magnify these issues, making entire shipments unsafe and difficult to return or replace.

Inconsistent Manufacturing Standards

Mass production across multiple factory lines can result in inconsistent helmet quality. Variations in foam density, strap anchoring, or shell molding may go unnoticed without rigorous batch testing, leading to unpredictable performance during real-world impacts.

Lack of On-Site Quality Audits

Relying solely on product samples or remote inspections increases the risk of receiving inferior goods. Without visiting the factory or hiring independent inspectors, defects in production processes or materials may remain hidden until after shipment.

Intellectual Property (IP) Pitfalls

Sourcing Counterfeit or Knock-Off Designs

Some suppliers offer helmets that closely resemble popular branded models (e.g., mimicking Giro or Specialized designs). These may infringe on trademarks or design patents, exposing the buyer to legal action, customs seizures, or forced destruction of inventory.

Unauthorized Use of Brand Logos and Trademarks

Even if the helmet design is original, using branded logos, colors, or names without licensing agreements constitutes trademark infringement. Buyers may unknowingly receive products with counterfeit branding, especially when ordering “look-alike” items.

Patent Infringement on Helmet Technology

Advanced features like MIPS (Multi-directional Impact Protection System) or specific ventilation systems are often patented. Sourcing helmets with these technologies from unauthorized manufacturers can result in IP litigation, particularly in markets with strong enforcement like the U.S. or EU.

Weak or Absent IP Clauses in Contracts

Many sourcing agreements fail to include clear terms assigning IP ownership or requiring supplier warranties against infringement. This leaves the buyer vulnerable if third parties claim rights over the design or technology used in the helmets.

Mitigation Strategies

To avoid these pitfalls, conduct due diligence: verify certifications with accredited labs, perform factory audits, test random samples, consult IP attorneys, and ensure contracts include robust quality and IP protections. Partnering with reputable suppliers and using trade assurance platforms can further reduce risks.

Logistics & Compliance Guide for Bulk Bike Helmets

Product Classification and Regulatory Requirements

Bike helmets shipped in bulk are classified as personal protective equipment (PPE) and are subject to safety regulations in most markets. In the United States, helmets must comply with the Consumer Product Safety Commission (CPSC) standard 16 CFR Part 1203. In the European Union, they require CE marking under the Personal Protective Equipment Regulation (EU) 2016/425, typically meeting EN 1078. Other regions (e.g., Canada, Australia) have their own standards (e.g., CSA, AS/NZS). Ensure all helmets in bulk shipments are certified and labeled accordingly to avoid customs delays or penalties.

Packaging and Labeling Guidelines

Bulk bike helmets should be securely packaged to prevent damage during transit. Use sturdy, stackable cartons with internal dividers or protective materials to minimize movement. Each package must include:

– Product name and model number

– Manufacturer or supplier details

– Compliance markings (e.g., CPSC, CE, AS/NZS)

– Size and quantity per box

– Batch or lot number for traceability

– Handling symbols (e.g., “This Side Up,” “Fragile”)

Avoid misleading claims and ensure multilingual labeling where required by the destination country.

Shipping and Transportation Considerations

Due to their size and bulk, efficient logistics planning is essential. Helmets are non-hazardous and can be shipped via standard freight methods (air, ocean, or ground). Optimize palletization to maximize container or truck space while adhering to weight and dimensional limits. Use pallets that meet ISPM 15 standards if shipping internationally to prevent issues with wood packaging materials. Coordinate with carriers experienced in handling durable consumer goods to ensure timely delivery and reduce risk of damage.

Import/Export Documentation

Accurate documentation is crucial for customs clearance. Required documents typically include:

– Commercial invoice with detailed product description, value, and Harmonized System (HS) code (e.g., 8518.30 for helmets in many countries)

– Packing list specifying quantities, weights, and dimensions

– Bill of lading or air waybill

– Certificate of conformity or test reports from accredited laboratories

– Import permits or declarations if required by the destination country

Ensure all documents reflect consistent data to prevent delays or audits.

Quality Assurance and Inspection

Conduct pre-shipment inspections to verify compliance with safety standards and detect defects (e.g., cracked shells, faulty straps). Random sampling based on ISO 2859-1 or AQL standards is recommended for bulk orders. Maintain records of inspections and certifications for audit purposes. Partner with third-party inspection agencies if necessary, especially when sourcing from overseas suppliers.

Storage and Handling

Store bulk helmets in a clean, dry, temperature-controlled environment away from direct sunlight and chemicals that may degrade materials (e.g., plastics, foam liners). Stack cartons no higher than recommended to prevent crushing. Follow a first-in, first-out (FIFO) inventory system to ensure product freshness and compliance with shelf-life expectations, even though helmets do not expire, long-term storage may affect material integrity.

Returns and Warranty Management

Establish a clear policy for handling defective or non-compliant helmets. Include procedures for:

– Customer reporting and verification

– Return logistics and restocking

– Warranty claims and replacements

Retain data on returns to identify recurring issues and improve supplier quality. Ensure compliance with local consumer protection laws regarding refunds and recalls.

Sustainability and Disposal Compliance

Dispose of damaged or unsellable helmets responsibly. Many components (e.g., EPS foam, plastic shells) are recyclable but require specialized processing. Partner with certified e-waste or plastics recyclers where available. Avoid landfill when possible and document disposal procedures to meet environmental compliance standards in regions with extended producer responsibility (EPR) laws.

In conclusion, sourcing bulk bike helmets requires careful consideration of quality, safety certifications, pricing, supplier reliability, and customization options. Prioritizing helmets that meet recognized safety standards—such as CPSC, CE, or ASTM—ensures user protection and compliance with regulations. Establishing relationships with reputable manufacturers or distributors can lead to cost savings, consistent supply, and better terms for large orders. Additionally, evaluating factors like helmet design, sizing variety, and branding opportunities enhances the value and suitability for your specific needs, whether for retail, corporate events, or community programs. A strategic, well-researched sourcing approach ultimately results in a cost-effective, reliable, and high-quality bulk purchase that meets both safety and operational goals.