The global construction materials market is experiencing robust growth, driven by rapid urbanization, infrastructure development, and rising residential demand across emerging economies. According to Grand View Research, the global construction materials market size was valued at USD 1.47 trillion in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 6.2% from 2024 to 2030. This sustained expansion reflects increasing investments in green building technologies, government-led infrastructure initiatives, and a shift toward sustainable and high-performance materials. As demand intensifies, a select group of manufacturers are leading innovation, scalability, and market share across key product categories including cement, steel, insulation, and engineered wood. These top players not only benefit from economies of scale but are also shaping the future of construction through R&D and strategic global expansion. The following list highlights the top 10 building materials manufacturers driving industry transformation.

Top 10 Builders Materials Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Eagle Materials Inc.

Domain Est. 2003

Website: eaglematerials.com

Key Highlights: Eagle Materials produces high-quality building materials, including cement, gypsum, and concrete, supporting construction and infrastructure….

#2 American Building Supply, Inc.

Domain Est. 1997

Website: abs-abs.com

Key Highlights: We proudly manufacture products under the registered trademarks of Millennium Door® and Doormerica® Products. The Doormerica brand includes MDF (simulated Stile ……

#3 Building Products Inc.

Domain Est. 2014

Website: bpi.build

Key Highlights: Premium Siding Solutions · Stocking Smarter, Delivering More · Ag Products · Decking & Railing · Engineered Wood · Fasteners · Insulation & Accessories · Millwork & ……

#4 CRH is North America’s largest manufacturer of building materials

Domain Est. 2017

Website: crhamericas.com

Key Highlights: We manufacture a diverse range of solutions for construction projects of all sizes, across North America. · Providing infrastructure, connecting families, ……

#5 Cornerstone Building Brands

Domain Est. 2019

Website: cornerstonebuildingbrands.com

Key Highlights: A Premier Manufacturer of Exterior Building Solutions ; SIDING & ACCESSORIES. VINYL SIDING, STONE VENEER, METAL & RAINWARE, TRIM & ACCESSORIES ; WINDOWS & DOORS….

#6 Builders FirstSource

Domain Est. 1998

Website: bldr.com

Key Highlights: Builders FirstSource is the nation’s largest supplier of structural building products, value-added components and services to the professional market….

#7 L&W Supply

Domain Est. 1999

Website: lwsupply.com

Key Highlights: Explore our wide range of high-quality construction materials. We stock the brands you trust. Our extensive inventory and nationwide distribution…

#8 Builders Suppliers

Domain Est. 2008

Website: myfbm.com

Key Highlights: Looking for a specialist in building and construction materials? With FBM, find industry-leading tools, accessories and PPE for your next project. Shop now….

#9 Drexel Building Supply

Domain Est. 2012

Website: drexelteam.com

Key Highlights: materials · building materials · cabinets · countertops · decks · millwork & doors · truss systems · flooring · offsite construction · pole buildings ……

#10 Construction & Building Materials Directory

Domain Est. 1997

Website: sweets.construction.com

Key Highlights: Looking for construction and building materials? Sweets provides product and manufacturer directories. Download CAD details, specs & green product ……

Expert Sourcing Insights for Builders Materials

H2 2026 Market Trends for Building Materials

As we move through the second half of 2026, the global building materials market is navigating a complex landscape shaped by economic stabilization, technological acceleration, and evolving regulatory pressures. After a period of volatility in 2024 and gradual recovery in 2025, H2 2026 is characterized by cautious optimism, strategic innovation, and a strong emphasis on sustainability and efficiency.

1. Moderating Price Pressures with Persistent Cost Management Focus:

* Stabilization, Not Decline: After significant price fluctuations driven by supply chain disruptions, energy shocks, and high interest rates earlier in the decade, material prices (lumber, steel, concrete) have largely stabilized in H2 2026. However, they remain elevated compared to pre-2022 levels.

* Cost Efficiency Paramount: With construction financing costs still relatively high (though moderating), builders and developers are intensely focused on value engineering and supply chain optimization. Demand for cost-effective, standardized, and prefabricated solutions is strong. This drives adoption of materials offering long-term savings (e.g., energy-efficient insulation, durable cladding).

2. Accelerated Adoption of Sustainable and Low-Carbon Materials:

* Regulatory Driver: Stricter building codes (e.g., updated versions of IECC, regional net-zero mandates) and embodied carbon regulations (like Buy Clean policies expanding beyond California and the EU) are the primary force. Compliance is non-negotiable for major projects.

* Market Demand: ESG investing and corporate sustainability goals push developers towards green certifications (LEED v5, BREEAM, etc.). This fuels demand for:

* Low-Carbon Concrete: Widespread use of supplementary cementitious materials (SCMs), carbon capture utilization and storage (CCUS) concrete, and alternative binders.

* Mass Timber: Increased use in mid-rise and even high-rise construction, driven by speed of build, lower embodied carbon, and aesthetic appeal.

* Recycled & Bio-based Materials: Growth in recycled steel, reclaimed wood, recycled plastic composites, and insulation made from agricultural waste (hemp, straw).

* Durability & Longevity: Emphasis on materials that reduce lifecycle emissions through longer service life and lower maintenance.

3. Digitalization and Supply Chain Resilience:

* End-to-End Visibility: Building Information Modeling (BIM) is now standard, extending into supply chain management. Digital twins and blockchain are gaining traction for tracking material provenance, sustainability credentials, and delivery logistics, enhancing transparency and reducing delays.

* Nearshoring & Diversification: Lessons from past disruptions lead companies to diversify suppliers and prioritize regional sourcing where feasible. Investments in local manufacturing (e.g., prefab components, cladding) increase to reduce lead times and geopolitical risk.

* AI-Driven Optimization: AI is used for predictive demand forecasting, optimizing material ordering, and minimizing waste on-site through precise cut lists and logistics planning.

4. Growth in Repair, Remodeling, and Resilience:

* RMI (Repair, Maintenance, Improvement) Boom: With new single-family construction still somewhat constrained by financing costs, the RMI sector is a major growth driver. This fuels demand for efficient renovation materials: easy-to-install insulation, durable exterior cladding, moisture-resistant drywall, and energy-efficient windows/doors.

* Climate Resilience: Increasing frequency of extreme weather events drives demand for resilient materials: impact-resistant roofing, flood-resistant foundations and barriers, fire-resistant cladding (especially in WUI zones), and advanced moisture management systems.

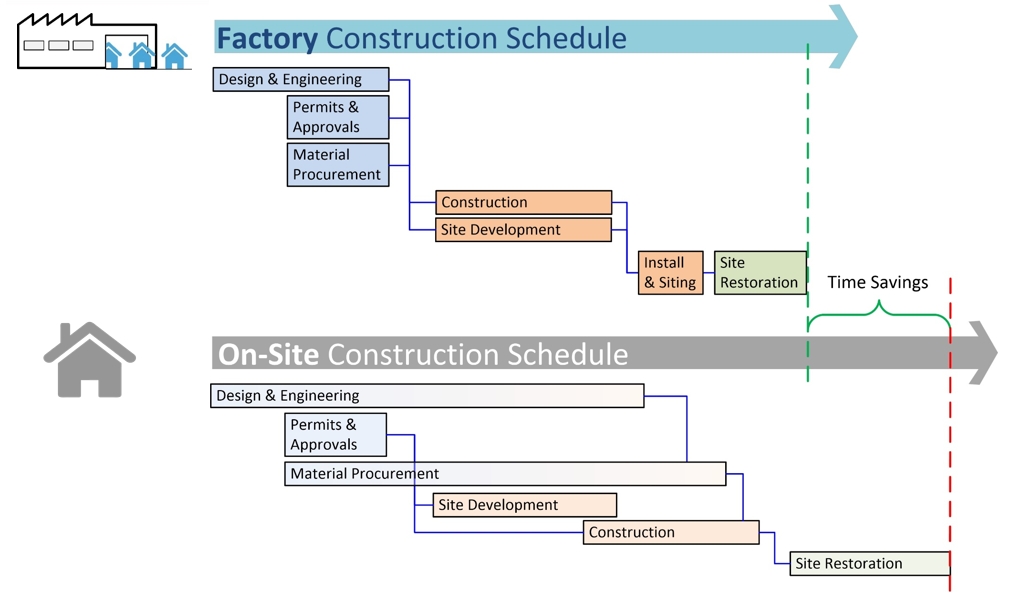

5. Labor Shortages Driving Off-Site and Simplified Construction:

* Prefab & Modular Expansion: To combat persistent skilled labor shortages, the industry heavily adopts prefabricated wall panels, floor cassettes, and volumetric modules. This drives demand for materials optimized for factory production (standardized dimensions, lightweight composites) and easy on-site assembly.

* Simplified Systems: Growth in integrated building envelope systems (e.g., structural insulated panels – SIPs, insulated concrete forms – ICFs) that reduce the number of trades and on-site complexity.

6. Technology-Enabled Materials:

* Smart Materials: Gradual integration of materials with embedded sensors (e.g., concrete with strain/corrosion sensors, smart glass for dynamic tinting) for building performance monitoring, though widespread adoption is still early.

* Advanced Insulation: Increased use of high-performance insulations (vacuum insulated panels – VIPs, aerogels) in high-efficiency and passive house projects, despite higher upfront cost.

Key Challenges:

* Financing Costs: While moderating, interest rates remain a headwind for new construction starts.

* Policy Uncertainty: Navigating evolving and sometimes conflicting regional sustainability regulations.

* Material Innovation Cost: Scaling and cost-competitiveness of next-gen low-carbon materials (e.g., green steel, novel binders).

* Supply Chain Fragility: Ongoing geopolitical tensions and climate impacts pose risks.

Conclusion for H2 2026:

The building materials market in H2 2026 is defined by adaptation and maturation. The focus has shifted decisively from crisis response to strategic implementation of sustainability, digitalization, and efficiency. Companies leading in low-carbon solutions, modular construction technologies, and resilient product offerings are best positioned. Success hinges on navigating the regulatory landscape, leveraging digital tools for supply chain and cost control, and meeting the dual demands of performance and environmental responsibility from both the market and policymakers. Stability is returning, but the era of “business as usual” is over, replaced by an industry fundamentally reshaped by sustainability imperatives and technological integration.

Common Pitfalls When Sourcing Building Materials (Quality, IP)

Sourcing building materials involves more than just finding the lowest price—overlooking quality standards and intellectual property (IP) considerations can lead to significant project delays, safety risks, legal liabilities, and reputational damage. Below are common pitfalls to avoid.

Poor Material Quality and Non-Compliance

One of the most frequent issues in construction sourcing is receiving substandard materials that fail to meet required specifications or regulatory standards. This can include using counterfeit steel, under-spec concrete, or uncertified insulation. These materials may compromise structural integrity, reduce energy efficiency, or fail fire safety tests. Relying on unverified suppliers without proper quality control processes increases the risk of receiving inconsistent or unsafe products.

Inadequate Supplier Vetting

Failing to conduct thorough due diligence on suppliers—especially international or new vendors—can result in unreliable delivery schedules, poor communication, and inconsistent quality. Many contractors skip audits, certifications checks (e.g., ISO, CE, or LEED compliance), or reference validation, opening the door to supply chain disruptions and material defects.

Ignoring Intellectual Property in Building Systems

Modern construction increasingly involves proprietary building systems, patented designs, or branded technologies (e.g., smart glass, modular systems, or patented cladding methods). Sourcing materials without verifying proper licensing or authorization can lead to IP infringement. Using such materials without permission may result in legal action, project stoppages, or forced removal of installed components.

Counterfeit or Gray Market Materials

The procurement of counterfeit or gray market products—such as fake branded fixtures, unauthorized electrical components, or imitation architectural finishes—poses serious safety and legal risks. These materials often lack proper testing and certification, and their use can void warranties or insurance coverage. Additionally, distributing or installing IP-protected materials without authorization breaches intellectual property laws.

Lack of Traceability and Documentation

Failing to maintain clear documentation—such as material test reports, certificates of conformance, chain of custody records, or IP licensing agreements—can lead to compliance issues during inspections or audits. In the event of a failure or legal dispute, the absence of verifiable records makes it difficult to assign liability or prove due diligence.

Overlooking Regional and Environmental Standards

Materials compliant in one region may not meet local building codes or environmental regulations elsewhere. For example, sourcing timber without verifying FSC certification or using adhesives with high VOC levels in jurisdictions with strict air quality laws can result in non-compliance, fines, or rework.

Conclusion

To mitigate these risks, procurement teams should establish rigorous vetting procedures, insist on full documentation, verify IP rights for proprietary systems, and partner with reputable, certified suppliers. Investing time upfront in proper sourcing safeguards both project quality and legal integrity.

Logistics & Compliance Guide for Builders Materials

Overview

The transportation and handling of builders materials involve a complex network of logistical considerations and stringent regulatory compliance requirements. From sourcing raw materials to delivering finished products to construction sites, every stage must adhere to safety, environmental, and legal standards. This guide outlines best practices and key compliance obligations for managing the logistics of builders materials such as cement, timber, steel, insulation, roofing, and aggregates.

Regulatory Compliance Requirements

Transportation Regulations

All builders materials must be transported in accordance with local, national, and international transportation laws. Key regulations include:

– Weight and Dimension Limits: Vehicles must comply with axle weight limits and size restrictions on roads and bridges. Oversized loads (e.g., steel beams, precast concrete) require special permits.

– Hazardous Materials Handling: Materials like solvents, adhesives, or treated timber may be classified as hazardous. Compliance with OSHA (Occupational Safety and Health Administration) and DOT (Department of Transportation) regulations—including proper labeling, documentation (e.g., SDS), and containment—is mandatory.

– Environmental Regulations: Dust-generating materials (e.g., cement, aggregates) must be covered during transport to comply with air quality regulations such as EPA’s Clean Air Act. Spill prevention and stormwater runoff controls are required under the Clean Water Act.

Storage and Handling Compliance

- OSHA Standards: Storage areas must follow OSHA guidelines for material handling, including stacking limits (e.g., lumber, bricks), use of PPE, and fall protection.

- Fire Safety: Flammable materials (e.g., insulation foams, paints) must be stored in designated fire-rated cabinets or areas with proper ventilation, in line with NFPA (National Fire Protection Association) codes.

- Environmental Protection: Spill containment and secondary containment systems are required for liquid materials (e.g., adhesives, sealants). Secondary containment must be capable of holding 110% of the largest container volume.

Logistics Best Practices

Planning and Scheduling

- Just-in-Time (JIT) Delivery: Coordinate deliveries to match construction timelines, minimizing on-site storage needs and reducing theft or damage risks.

- Route Optimization: Use GPS and logistics software to plan efficient delivery routes, avoiding low bridges, narrow roads, or restricted zones (e.g., urban low-emission zones).

- Seasonal Considerations: Account for weather impacts—e.g., freezing temperatures can affect concrete curing; wet conditions may delay deliveries or damage untreated lumber.

Packaging and Load Securing

- Weather Protection: Use waterproof tarps or sealed containers for moisture-sensitive materials (e.g., drywall, insulation).

- Load Stability: Secure loads using straps, dunnage, and load bars to prevent shifting during transit. Comply with FMCSA (Federal Motor Carrier Safety Administration) load securement rules.

- Stacking and Labeling: Clearly label packages with material type, handling instructions (e.g., “This Side Up”), and safety warnings. Stack materials to prevent collapse and ensure easy access.

Inventory and Tracking

- Barcoding and RFID: Implement tracking systems to monitor material flow from warehouse to site, improving accountability and reducing loss.

- Digital Documentation: Use electronic bills of lading, delivery notes, and compliance certificates to streamline audits and traceability.

- Inventory Audits: Conduct regular audits to reconcile stock levels, identify discrepancies, and ensure compliance with ordering protocols.

Environmental and Sustainability Compliance

Waste Management

- Construction and Demolition (C&D) Waste: Comply with local waste disposal regulations. Recycle materials such as metal, concrete, and wood where possible.

- Spill Response Plans: Maintain spill kits and train personnel in spill response procedures. Report significant spills to relevant environmental agencies as required.

Sustainable Sourcing and Carbon Footprint

- Material Certification: Source materials with environmental product declarations (EPDs), FSC-certified timber, or recycled content to meet green building standards (e.g., LEED, BREEAM).

- Low-Emission Transport: Use fuel-efficient or electric vehicles where feasible. Optimize load consolidation to reduce trips and associated emissions.

Documentation and Recordkeeping

Required Documents

- Safety Data Sheets (SDS) for all chemical or hazardous materials

- Transport permits (for oversized or hazardous loads)

- Proof of training (e.g., forklift operators, hazmat handlers)

- Delivery manifests and material certifications (e.g., mill test reports for steel)

- Environmental compliance records (e.g., waste disposal receipts, spill logs)

Audit Preparedness

Maintain organized digital and physical records for a minimum of 3–7 years, depending on jurisdiction. Regular internal audits help ensure continuous compliance and readiness for regulatory inspections.

Conclusion

Effective logistics and compliance management for builders materials is essential for project efficiency, worker safety, legal adherence, and environmental protection. By integrating regulatory knowledge with modern logistics tools and sustainable practices, companies can reduce risk, lower costs, and enhance their reputation in the construction industry. Regular training, monitoring, and process improvement are key to maintaining compliance in a dynamic regulatory landscape.

Conclusion: Sourcing Building Materials

In conclusion, sourcing building materials effectively requires a strategic balance between cost, quality, availability, sustainability, and project-specific requirements. The selection of suppliers and materials significantly impacts the overall success, timeline, and budget of a construction project. By evaluating local versus international suppliers, comparing material durability and environmental impact, and leveraging strong supply chain relationships, builders can ensure the timely delivery of high-quality materials.

Additionally, embracing sustainable sourcing practices not only supports environmental goals but also enhances the long-term value and reputation of construction projects. As the industry evolves with advancements in materials technology and green building standards, staying informed and adaptable in material sourcing strategies is essential.

Ultimately, a well-planned and thoroughly researched approach to sourcing building materials leads to improved efficiency, reduced waste, and successful project outcomes—laying a solid foundation for both present and future construction endeavors.