The global brushless DC (BLDC) motor market is experiencing robust expansion, driven by rising demand for energy-efficient solutions across automotive, industrial automation, consumer electronics, and HVAC systems. According to a 2023 report by Mordor Intelligence, the market was valued at USD 18.67 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 8.1% from 2023 to 2028, reaching an estimated USD 29.7 billion by the end of the forecast period. Similarly, Grand View Research highlights the accelerating adoption of BLDC motors in electric vehicles and drones, citing their superior efficiency, reliability, and lower maintenance compared to brushed counterparts. As innovation intensifies and manufacturers invest in compact, high-performance motor designs, the competitive landscape is led by a select group of global players excelling in precision engineering and scalable production. Here’s a data-driven look at the top nine brushless motor manufacturers shaping the future of motion control.

Top 9 Brushless Motor Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 X

Domain Est. 2011

Website: x-teamrc.com

Key Highlights: X-TEAM was created in 2007.Is a leader in DC brushless motor & drives for hobby, military and industrial markets. Factory established in Dongguan city of China….

#2 EC Motors (Brushless)

Domain Est. 1996

Website: johnsonelectric.com

Key Highlights: Johnson Electric, an industry leader in brushless motor technology has customized EC motors for many applications in Automotive and Industrial segments. Inquiry….

#3 Flash Hobby

Domain Est. 2019

Website: flashhobby.com

Key Highlights: Flash Hobby is one of the leading manufacturers who specializing in the producing and marketing of brushless motors,Industrial Motors, gimbal motors, ……

#4 Oriental Motor U.S.A. Corp.

Domain Est. 1997

Website: orientalmotor.com

Key Highlights: BMU Series Brushless Motors 400 W Single-Phase 200-240 VAC The BMU Series Brushless Motors now include 400 W single-phase 200-240 VAC drivers….

#5 Lin Engineering

Domain Est. 1998

Website: linengineering.com

Key Highlights: We engineer and manufacture a variety of precision DC motors and motion control components. We have the capability, capacity, and expertise to supply a small ……

#6 MABUCHI MOTOR CO., LTD.

Domain Est. 2004

Website: mabuchi-motor.com

Key Highlights: We create motive power, to make the world revolve. Actuating Your Dreams MABUCHI MOTOR · PRODUCTS · PICK UP · NEWS….

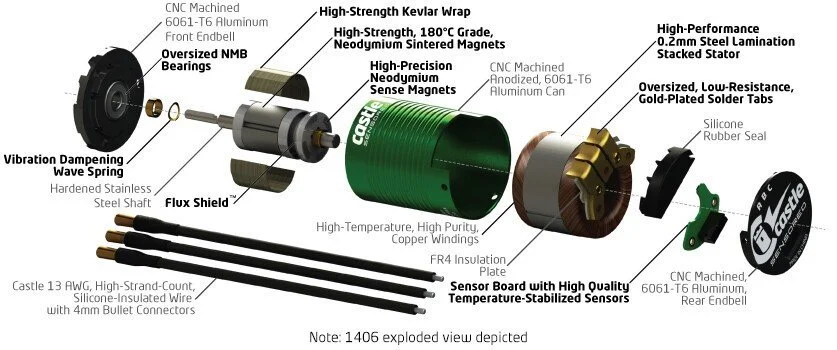

#7 Castle Homepage

Domain Est. 2000

Website: home.castlecreations.com

Key Highlights: Brushless motors and ESCs for RC, UAVs, robotics, and more—engineered in the USA for high power, precision control, and lasting reliability….

#8 BRUSHLESS MOTOR ENGINEERING

Domain Est. 2004

Website: neumotors.com

Key Highlights: Neumotors offers brushless motor engineering and manufacturing. Our product line includes brushless motors and controllers from 50 watts to 50kW output….

#9 Brushless DC Motors

Domain Est. 2008

Website: moonsindustries.com

Key Highlights: Free delivery over $100Brushless DC motors offer several advantages over brushed motors, including a high power-to-weight ratio, high speed, instant control of speed and torque, …..

Expert Sourcing Insights for Brushless Motor

H2: Market Trends in Brushless Motors for 2026

The global brushless motor market is poised for substantial growth and transformation by 2026, driven by technological advancements, rising energy efficiency standards, and expanding applications across multiple industries. Several key trends are expected to shape the market landscape during this period:

-

Increased Adoption in Electric Vehicles (EVs)

The global push toward electrification of transportation is a primary catalyst for brushless motor demand. By 2026, electric vehicles—including passenger cars, two-wheelers, and commercial fleets—are anticipated to account for a significant share of brushless motor applications. Brushless DC (BLDC) motors offer superior efficiency, reliability, and power-to-weight ratios compared to traditional brushed motors, making them ideal for EV drivetrains and auxiliary systems. Government emission regulations and incentives for EV adoption in regions like Europe, North America, and China will continue to accelerate this trend. -

Growth in Industrial Automation and Robotics

As industries embrace Industry 4.0 and smart manufacturing, the need for high-performance, low-maintenance motors is surging. Brushless motors are increasingly used in robotics, CNC machines, automated guided vehicles (AGVs), and precision motion control systems. Their ability to deliver consistent torque, high-speed operation, and digital controllability makes them a preferred choice. The integration of IoT and AI in industrial systems further enhances demand for intelligent motors with real-time monitoring capabilities, which brushless motors are well-suited to support. -

Expansion in Consumer Electronics and Drones

The consumer electronics sector, particularly drones, wearable devices, and high-end appliances, is a growing application area. By 2026, the drone market—used for delivery, surveillance, agriculture, and recreation—is expected to rely heavily on compact, efficient brushless motors for propulsion. Similarly, smart home devices such as robotic vacuum cleaners and HVAC systems are incorporating brushless technology to improve energy efficiency and reduce noise. -

Advancements in Motor Control Technologies

The development of advanced motor control algorithms, sensorless control techniques, and integrated driver electronics is enhancing the performance and affordability of brushless motors. By 2026, wider adoption of field-oriented control (FOC) and digital signal processors (DSPs) will enable smoother operation and greater energy savings. These innovations are lowering the entry barrier for small and medium-sized enterprises, broadening market reach. -

Regional Shifts and Supply Chain Optimization

Asia-Pacific, led by China, Japan, and South Korea, will remain the largest producer and consumer of brushless motors due to strong manufacturing bases and domestic demand. However, geopolitical factors and supply chain resilience concerns are prompting diversification, with increased investment in motor production in India, Vietnam, and Eastern Europe. Localized manufacturing and nearshoring strategies are expected to gain traction by 2026. -

Sustainability and Regulatory Pressure

Stricter energy efficiency standards—such as IE4 and upcoming IE5 classifications under the IEC 60034-30-1 standard—are pushing manufacturers to adopt brushless motors across industrial and commercial applications. These motors align with global decarbonization goals and ESG (Environmental, Social, and Governance) initiatives, making them a strategic choice for environmentally conscious companies. -

Cost Reduction and Market Democratization

As production scales and component costs (such as rare-earth magnets and power electronics) stabilize, the price gap between brushed and brushless motors is expected to narrow. This cost competitiveness will drive adoption in price-sensitive markets and emerging economies, expanding the total addressable market for brushless motors.

In summary, by 2026, the brushless motor market will be defined by innovation, diversification, and sustainability. Continued advancements in materials, control systems, and manufacturing efficiency will solidify brushless motors as the technology of choice across transportation, industrial, and consumer sectors, positioning the market for robust and sustained growth.

Common Pitfalls When Sourcing Brushless Motors (Quality & IP)

Logistics & Compliance Guide for Brushless Motors

Brushless motors are widely used in industries ranging from drones and electric vehicles to industrial automation and consumer electronics. Due to their electrical components, magnetic properties, and potential lithium battery integration (in some cases), shipping and importing/exporting brushless motors require adherence to specific logistics and regulatory standards. This guide outlines essential considerations for the safe and compliant transportation of brushless motors globally.

Classification and Harmonized System (HS) Code

Brushless motors are typically classified under the Harmonized System (HS) for international trade. The most common HS code is:

- 8501.32 – Electric motors of an output not exceeding 37.5 W (small motors, commonly used in drones, RC models, and small appliances)

- 8501.31 – Electric motors of an output exceeding 37.5 W but not exceeding 750 W

- 8501.34 – Electric motors of an output exceeding 750 W but not exceeding 75 kW

- 8501.35 – Electric motors of an output exceeding 75 kW

Note: Exact classification may vary by country and specific motor specifications. Consult local customs authorities or a trade compliance expert for precise categorization.

International Air Transport Association (IATA) & Dangerous Goods Regulations

While brushless motors themselves are generally not classified as dangerous goods, certain factors may trigger additional scrutiny:

- Lithium Batteries: If the motor is shipped with an integrated lithium-ion or lithium-polymer battery (common in drone motors), IATA Dangerous Goods Regulations (DGR) apply. Batteries must be:

- Properly installed and protected from short circuits

- Packed per UN 38.3 testing requirements

- Labeled with appropriate lithium battery marks

-

Declared on the Shipper’s Declaration for Dangerous Goods if shipped standalone

-

Magnetized Materials: Brushless motors contain strong permanent magnets. If the magnetic field strength exceeds 0.159 A/m (0.002 Gauss) at a distance of 2.1 meters (7 ft) from the package, they are classified as magnetized materials (UN2807) and subject to IATA Special Provision A104.

-

Testing: Use a gauss meter to measure field strength

- Packaging Requirements: Shielding (e.g., steel plates) or increased separation distance in packaging may be needed

- Labeling: “Magnetized Material” label required if threshold is exceeded

Sea Freight (IMDG Code)

Under the International Maritime Dangerous Goods (IMDG) Code:

- Brushless motors without batteries are generally non-regulated.

- Motors with integrated lithium batteries fall under UN3481 (PI 966) or UN3091 (PI 969) depending on configuration.

- Magnetized materials exceeding the threshold must be declared as UN2807 with proper documentation and stowage.

Export Controls and Trade Compliance

Brushless motors may be subject to export control regulations due to potential dual-use applications (civilian and military):

- U.S. Export Administration Regulations (EAR):

- Brushless motors may fall under ECCN 6A002 (specially designed for aerospace or missile applications) or EAR99 (low-risk, general-purpose motors)

- Check if the motor exceeds performance thresholds (e.g., power density, RPM) that trigger control

-

Export to embargoed countries (e.g., Iran, North Korea) may be restricted

-

Wassenaar Arrangement: High-performance motors may be listed due to potential use in unmanned systems

-

EU Dual-Use Regulation (EC 428/2009): Similar to EAR; verify classification before export from the EU

Customs Documentation

Ensure accurate and complete documentation for customs clearance:

- Commercial Invoice: Must include:

- Full motor specifications (voltage, power, RPM, weight, dimensions)

- HS code

- Country of origin

- Value and currency

- Packing List: Itemized list of contents per package

- Certificate of Origin: May be required for preferential tariffs (e.g., USMCA, ASEAN)

- Dangerous Goods Declaration: If applicable (batteries or magnetized materials)

Packaging and Labeling

- Anti-static and Moisture Protection: Use anti-static bags and desiccants to protect electronic components

- Shock and Vibration Protection: Use cushioning (foam, bubble wrap) to prevent damage

- Secure Fastening: Prevent movement within the package

- Labels:

- “Fragile”

- “This Side Up”

- “Do Not Stack” (if applicable)

- Magnetized Material label (if required)

- Lithium battery handling labels (if applicable)

Country-Specific Regulations

- China: May require CCC (China Compulsory Certification) for certain motor types

- EU: CE marking may be required under the Machinery Directive or Low Voltage Directive depending on application

- USA: FCC compliance may be needed if the motor generates electromagnetic interference (EMI)

- India: May require BIS (Bureau of Indian Standards) certification for certain applications

Recommended Best Practices

- Classify Correctly: Determine HS code, ECCN/EAR99, and transport classification early

- Test for Magnetism: Measure magnetic field strength before air shipment

- Separate Batteries: Ship motors and batteries separately when possible to simplify compliance

- Use Certified Packaging: For dangerous goods, use UN-certified packaging

- Train Staff: Ensure logistics and export teams are trained on IATA, IMDG, and export controls

- Consult Experts: Engage freight forwarders and compliance consultants familiar with electromechanical components

By following this guide, businesses can ensure smooth, compliant, and safe global shipment of brushless motors while minimizing delays, fines, or shipment rejections.

Conclusion for Sourcing Brushless Motors

In conclusion, sourcing brushless motors requires a strategic approach that balances performance requirements, cost efficiency, reliability, and supplier credibility. Brushless motors offer significant advantages over brushed motors, including higher efficiency, longer lifespan, reduced maintenance, and better performance across a range of applications—from consumer electronics and drones to industrial automation and electric vehicles.

When sourcing, it is essential to clearly define technical specifications such as voltage, power output, torque, speed, size, and operating environment. Evaluating potential suppliers based on quality certifications, manufacturing capabilities, scalability, and after-sales support ensures long-term supply chain stability. Engaging with reputable manufacturers—whether domestic or international—can provide cost benefits without compromising on performance and compliance standards.

Additionally, considering trends such as energy efficiency regulations, integration with control electronics, and demand for compact, high-power-density motors will future-proof sourcing decisions. Building strong supplier relationships, conducting sample testing, and performing regular quality audits further mitigate risks.

Ultimately, a well-informed sourcing strategy for brushless motors enhances product reliability, reduces lifecycle costs, and supports innovation and competitiveness in the market.