The global mechanical components market, particularly for specialized products like brown mechanical parts used in industrial machinery and power transmission systems, has experienced steady expansion driven by increasing automation, infrastructure development, and demand from end-use sectors such as manufacturing, automotive, and energy. According to Grand View Research, the global industrial machinery market size was valued at USD 544.7 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. Similarly, Mordor Intelligence forecasts the mechanical power transmission equipment market to witness robust growth, with a CAGR of over 6.2% during the 2023–2028 period, fueled by rising adoption of energy-efficient systems and advancements in industrial automation. Amid this expanding landscape, several manufacturers have emerged as leaders in producing high-performance brown mechanical components—known for durability, corrosion resistance, and reliability in heavy-duty applications. The following analysis highlights the top six manufacturers shaping innovation and market competitiveness in this space.

Top 6 Brown Mechanical Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Brown Mechanical Service Inc.

Domain Est. 2016

Website: brownmechanicaltn.com

Key Highlights: Brown Mechanical has been proudly serving Portland, TN and the surrounding areas with air conditioning service, repair and installation….

#2 Brown Mechanical Contractors

Domain Est. 2001

Website: brownmechanical.com

Key Highlights: PROJECTS & SERVICES: HVAC PLUMBING SITE UTILITIES WATER FEATURES MEDICAL GAS SYSTEMS PROCESS PIPING CENTRAL ENERGY PLANTS WATER TREATMENT PLANTS…

#3 Jupiter AC Repair: Brown Mechanical Services

Domain Est. 2015

Website: brownmechanicalservices.com

Key Highlights: We offer air conditioning maintenance services throughout Jupiter, Palm Beach Gardens, Tequesta North Palm Beach and Surrounding Areas….

#4 Brown’s Mechanical: HVAC

Domain Est. 2019

Website: brownsmechanicalllc.com

Key Highlights: Our specialty is HVAC repair and installations. From repair to replacement and adding complete new systems, including duct installation, we do it all….

#5 Brown Mechanical Services

Domain Est. 2021

Website: brown-mechanical.com

Key Highlights: Expert HVAC, plumbing & electrical services in Vernon. Reliable solutions for homes & businesses. Call (250) 545-4211 for service today!…

#6 Brown Mechanical Services

Domain Est. 2023

Website: brownmechanicalservices.net

Key Highlights: We specialize in Residential HVAC systems, Commercial HVAC & Refrigeration systems, duct work installation & repair, ice machines & more….

Expert Sourcing Insights for Brown Mechanical

H2: Market Trends Shaping Brown Mechanical’s Outlook for 2026

As we approach 2026, Brown Mechanical is positioned to navigate a dynamic industrial landscape influenced by technological innovation, sustainability mandates, labor shifts, and evolving customer demands. Below is an analysis of key market trends expected to shape the company’s operations, strategy, and competitive positioning in the second half of the decade.

1. Increased Adoption of Smart Manufacturing and IoT Integration

The industrial sector is rapidly embracing Industry 4.0 technologies. By 2026, Brown Mechanical can expect heightened demand for smart HVAC systems, predictive maintenance solutions, and integrated building management systems. Investments in IoT-enabled sensors and data analytics will allow Brown Mechanical to offer value-added services such as remote diagnostics and energy optimization, improving client retention and service margins.

2. Regulatory Pressure Driving Energy Efficiency and Decarbonization

Federal and state-level environmental regulations—particularly those targeting commercial building emissions—are accelerating the shift toward high-efficiency mechanical systems. In 2026, Brown Mechanical will likely see increased demand for electrified heating solutions (e.g., heat pumps), low-GWP refrigerants, and retrofits aligned with new energy codes. Compliance with standards like ASHRAE 90.1-2022 and local decarbonization ordinances will become a core component of project specifications.

3. Growth in Retrofit and Building Modernization Projects

With new construction facing economic headwinds due to interest rates and material costs, the retrofit market is expected to outpace new builds. Brown Mechanical is well-positioned to capitalize on aging infrastructure in commercial, institutional, and multifamily sectors. Energy performance contracts (EPCs) and incentive programs (e.g., IRA tax credits) will drive clients to upgrade mechanical systems for efficiency and resilience.

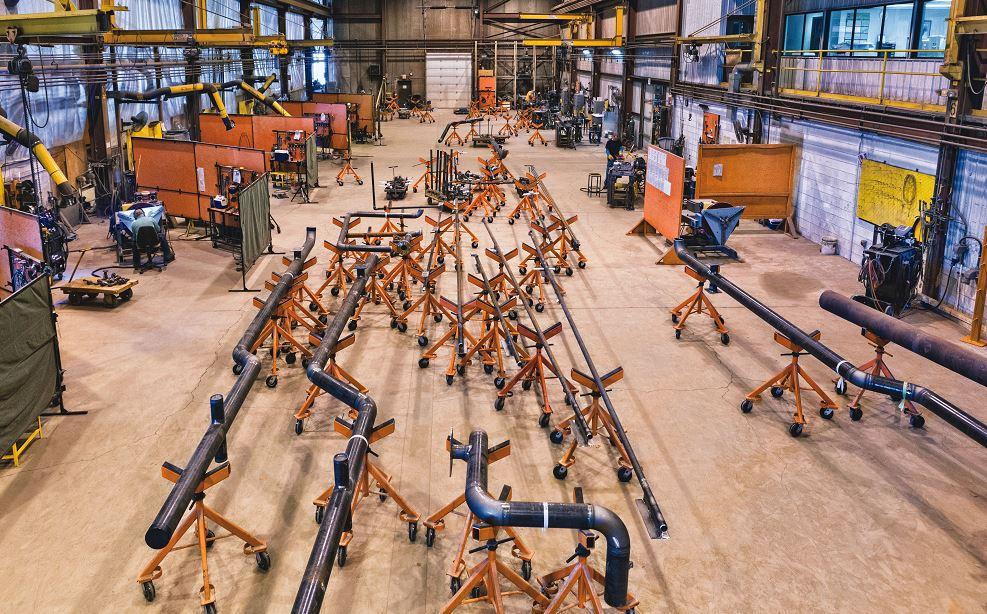

4. Labor Shortages and the Need for Upskilling

The skilled trades gap remains a critical challenge. By 2026, Brown Mechanical must prioritize workforce development through apprenticeship programs, partnerships with trade schools, and adoption of prefabrication techniques to offset labor constraints. Firms leveraging automation in fabrication and project management will gain a competitive edge in delivery speed and quality control.

5. Supply Chain Resilience and Localization

Global supply chain volatility has prompted a shift toward regional sourcing and inventory buffering. Brown Mechanical should strengthen relationships with domestic suppliers of HVAC components and explore modular system designs that reduce dependency on single-source imports. Localized supply chains will improve project timelines and customer satisfaction.

6. Rising Client Focus on ESG and Building Certifications

Commercial clients are increasingly prioritizing ESG (Environmental, Social, and Governance) goals. Brown Mechanical can differentiate itself by supporting LEED, WELL, and ENERGY STAR certifications through sustainable design practices and transparent reporting on carbon reduction impacts. This trend opens opportunities in the healthcare, education, and corporate campus sectors.

7. Expansion of Service-Led Revenue Models

Maintenance, repair, and operations (MRO) services are becoming a larger share of total revenue for mechanical contractors. By 2026, Brown Mechanical should expand its service division with subscription-based maintenance plans, digital service portals, and performance-based contracts to generate recurring revenue and deepen client relationships.

Conclusion

The 2026 market environment presents both challenges and opportunities for Brown Mechanical. Success will depend on agility in adopting new technologies, compliance with evolving regulations, strategic workforce development, and a shift toward sustainable, service-oriented business models. By proactively aligning with these trends, Brown Mechanical can strengthen its market position as a forward-thinking leader in the mechanical contracting industry.

Common Pitfalls Sourcing Brown Mechanical (Quality, IP)

Poor Quality Control and Inconsistent Manufacturing Standards

One of the most significant risks when sourcing from Brown Mechanical is inconsistent product quality. Without rigorous quality assurance processes, parts may deviate from specifications, leading to fit, function, or durability issues. This is especially critical in precision mechanical components where tolerances are tight. Buyers often face rework, delays, or field failures due to substandard materials or poor machining practices.

Intellectual Property (IP) Exposure and Lack of Protection

Sourcing from Brown Mechanical—or any third-party manufacturer—poses a substantial IP risk. Without strong contractual safeguards, technical drawings, proprietary designs, and innovative mechanisms can be copied, reverse-engineered, or shared with competitors. Many suppliers operate in jurisdictions with weak IP enforcement, making legal recourse difficult if designs are misused or replicated without authorization.

Inadequate Documentation and Traceability

Brown Mechanical may fail to provide comprehensive documentation, such as material certifications, inspection reports, or process validation records. This lack of traceability complicates compliance with industry standards (e.g., ISO, AS9100) and increases liability in regulated sectors like aerospace or medical devices.

Misalignment on Design Intent and Engineering Collaboration

Without clear communication channels, Brown Mechanical may interpret design specifications incorrectly, leading to functional flaws. A lack of collaborative engineering support can result in manufacturability issues, unanticipated costs, or delays—especially if design for manufacturing (DFM) input is not integrated early.

Supply Chain Transparency and Sub-Tier Supplier Risks

Brown Mechanical may subcontract critical processes (e.g., heat treatment, plating) without disclosing suppliers. This opacity hides quality and compliance risks in the extended supply chain, potentially introducing counterfeit materials or non-compliant processes that impact final product integrity.

Absence of Long-Term IP Ownership Clauses

Even with NDAs, contracts may not explicitly assign IP ownership of custom tooling, fixtures, or design modifications. This can lead to disputes over rights to reuse or transfer designs, limiting flexibility and control for the buyer in future production or sourcing decisions.

Logistics & Compliance Guide for Brown Mechanical

This guide outlines the essential logistics and compliance procedures for Brown Mechanical to ensure efficient operations, regulatory adherence, and customer satisfaction.

Logistics Operations

Order Processing and Scheduling

All customer orders must be entered into the company’s ERP system within 24 hours of receipt. Coordinate with project managers to confirm scope, materials, and labor requirements. Schedule jobs based on equipment availability, technician expertise, and delivery timelines.

Inventory Management

Maintain accurate inventory records for all mechanical components, tools, and consumables. Conduct quarterly physical audits and reconcile discrepancies promptly. Utilize barcode scanning for real-time tracking and automated reordering of critical items.

Shipping and Receiving

Inspect all incoming materials for damage or non-conformance upon receipt. Document and report issues immediately to suppliers. For outbound shipments, ensure proper packaging, labeling, and freight documentation. Use only approved carriers and obtain delivery confirmation for all jobs.

Field Service Logistics

Equip service vehicles with necessary tools, safety gear, and common replacement parts. Technicians must log travel time, parts used, and job completion in the field service app daily. Optimize routing to reduce fuel costs and improve response times.

Regulatory Compliance

OSHA Safety Standards

All employees must complete annual OSHA 30-hour training. Maintain up-to-date safety data sheets (SDS) for hazardous materials. Conduct weekly safety meetings and document all incidents using the incident reporting system.

Environmental Regulations

Comply with EPA guidelines regarding refrigerant handling, disposal of oils, and chemical waste. Only EPA-certified technicians may handle refrigerants; maintain logs of all Section 608 certifications. Dispose of waste through licensed vendors and retain disposal records for seven years.

DOT and Transportation Compliance

Drivers must hold valid commercial driver’s licenses (CDL) where required and comply with FMCSA hours-of-service rules. Conduct pre-trip vehicle inspections and maintain logbooks electronically via approved ELD systems.

Licensing and Permits

Ensure all technicians hold current state and local mechanical, plumbing, or HVAC licenses as required. Verify permits are obtained before starting work on regulated projects such as gas line installations or boiler retrofits.

Documentation and Recordkeeping

Job Records

Archive all job documentation—including work orders, inspection reports, and customer approvals—for a minimum of seven years. Store digital copies in the secure cloud-based document management system.

Compliance Audits

Conduct internal compliance audits semi-annually. Address findings within 30 days and report resolution to senior management. Prepare for external audits by maintaining organized, accessible records.

Training and Accountability

Employee Training

New hires must complete onboarding covering logistics procedures, safety protocols, and compliance requirements. Provide ongoing training on regulatory updates and equipment use.

Compliance Oversight

The Operations Manager is responsible for monitoring adherence to this guide. Non-compliance must be reported through the company’s ethics hotline and addressed per the disciplinary policy.

By following this guide, Brown Mechanical ensures reliable service delivery while maintaining full compliance with industry regulations and legal requirements.

In conclusion, sourcing brown mechanical components requires a strategic approach that balances material specifications, supplier reliability, cost-efficiency, and long-term sustainability. Brown mechanical parts—whether referring to components with a brown finish, made from specific alloys or polymers, or associated with a particular brand or legacy system—demand careful vetting of suppliers to ensure compatibility, durability, and adherence to industry standards. By conducting thorough market research, evaluating supplier credentials, prioritizing quality control, and considering logistical factors such as lead times and scalability, businesses can secure a consistent and reliable supply chain. Additionally, building strong supplier relationships and maintaining flexibility in sourcing options will support operational resilience and adaptability in the face of market fluctuations or supply disruptions. Ultimately, a well-structured sourcing strategy for brown mechanical components contributes significantly to overall system performance, cost management, and long-term project success.