The global broiler boiler market is experiencing robust growth, driven by increasing demand for efficient and sustainable heating solutions across residential, commercial, and industrial sectors. According to a 2023 report by Mordor Intelligence, the global boiler market was valued at USD 54.2 billion in 2022 and is projected to grow at a CAGR of 4.8% from 2023 to 2028, fueled by energy efficiency regulations and the adoption of high-performance heating systems. With a specific rise in demand for broiler turbo models—known for superior thermal efficiency, lower emissions, and compact design—manufacturers are innovating rapidly to capture market share. As energy costs rise and environmental standards tighten, end users are increasingly turning to advanced turbo-charged broiler systems that optimize fuel use and reduce carbon footprints. This growing shift underscores the importance of identifying the leading manufacturers at the forefront of technology, reliability, and performance in the broiler turbo segment.

Top 7 Broiler Turbo Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Dhumal Industries

Domain Est. 2000

Website: dhumal.com

Key Highlights: Dhumal Industries specializes in high-quality poultry equipment designed to boost your farm’s efficiency. Explore our innovative range for optimal ……

#2 Roxell

Domain Est. 1996

Website: roxell.com

Key Highlights: Discover high-quality poultry & pig equipment, chicken supplies & livestock solutions. Roxell offers reliable poultry supplies for optimal farm performance….

#3 Products

Domain Est. 1998

Website: turboairinc.com

Key Highlights: Restaurant Ranges+. 24″ · 36″ · 48″ · 60″ · Salamander Broilers · Cheesemelters · Countertop Hot Plates · Countertop Radiant Broilers · Countertop Griddles+….

#4 Chore

Domain Est. 1999

Website: choretime.com

Key Highlights: Chore-Time develops and manufactures complete solutions to maximize poultry and egg production. We offer a full range of feeding and drinking systems….

#5 Support

Domain Est. 2002

Website: evoamerica.com

Key Highlights: Request service, identify parts, or troubleshoot with our technical support team. Call, email, or submit the service request form linked below….

#6 Hanabishi Turbo Broiler HTB140SS

Domain Est. 2007

#7 American Heritage Turbo Broiler Lightwave AHTB

Expert Sourcing Insights for Broiler Turbo

H2: Market Trends for Broiler Turbos in 2026

The global market for broiler turkeys (commonly referred to as “broiler turbos” in some industry contexts, though more accurately termed meat-type turkeys) is expected to undergo significant transformation by 2026, driven by evolving consumer preferences, technological advancements, sustainability pressures, and shifts in global trade dynamics. Below is an analysis of key market trends shaping the broiler turkey industry in 2026:

1. Increased Demand for High-Yield, Efficient Breeds

By 2026, the focus on feed conversion ratios (FCR) and growth rates will intensify. Leading genetics companies such as Hybrid Turkeys (a division of Hendrix Genetics) and Aviagen Turkeys are expected to dominate the market with high-performance broiler turkey lines—often informally called “turbo” strains due to their rapid growth and muscle yield. These breeds are optimized for lean meat production, with improved breast yield and resilience, meeting processor demands for efficiency.

2. Rising Global Protein Demand

Population growth, particularly in emerging markets in Asia, the Middle East, and Africa, is fueling demand for affordable protein sources. While chicken remains dominant, turkey is gaining traction as a healthier alternative due to its lower fat content and higher protein density. Broiler turkeys are increasingly positioned as a premium yet sustainable poultry option, especially in urban centers with health-conscious consumers.

3. Sustainability and Welfare-Driven Production

Regulatory and consumer pressure is pushing producers toward more sustainable and humane farming practices. By 2026, major markets such as the EU and North America are expected to enforce stricter welfare standards, including reduced stocking densities, improved lighting, and slower-growing genotypes in some segments. However, “turbo” breeds will coexist in conventional systems where efficiency remains paramount, especially in regions with cost-sensitive markets.

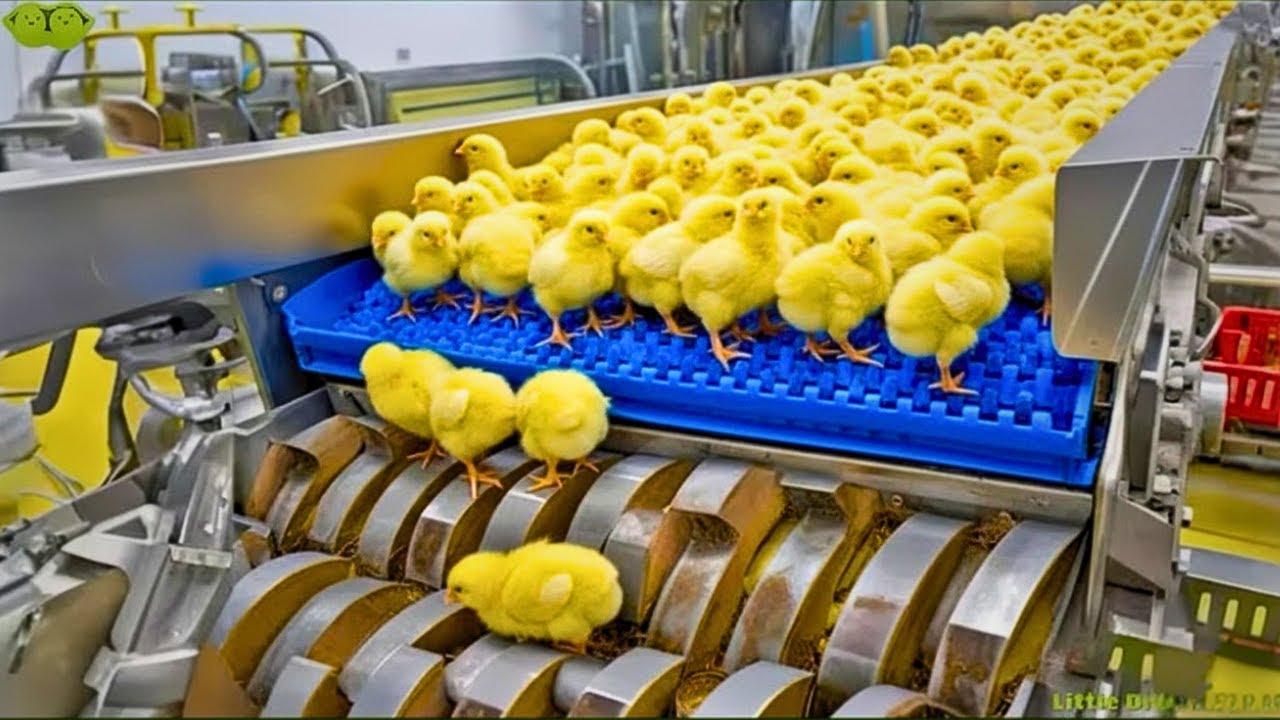

4. Technological Integration in Farming

Precision livestock farming (PLF) technologies—such as AI-powered monitoring systems, automated feeding, and climate control—are becoming standard in large-scale broiler turkey operations. These technologies optimize growth performance, reduce mortality, and enhance traceability. The “turbo” production model is increasingly supported by data analytics to maximize output without compromising flock health.

5. Alternative Proteins and Market Competition

The rise of plant-based and cultivated meat alternatives poses both a challenge and an opportunity. While some consumers may shift away from traditional meat, others are turning to high-quality, naturally raised poultry as a “clean label” alternative. Broiler turkey producers are responding by emphasizing natural diets, antibiotic-free production, and transparent sourcing—enhancing the premium positioning of turkey meat.

6. Trade Dynamics and Export Opportunities

The U.S. and Brazil remain key exporters of turkey meat, while the EU focuses more on internal consumption. In 2026, geopolitical factors and trade agreements (e.g., Mercosur-EU deal, U.S.-Asia trade relations) will influence export flows. Countries with cost-efficient “turbo” turkey production systems will gain competitive advantages in global markets, particularly in regions with import demand for frozen turkey products.

7. Focus on Value-Added and Convenience Products

Retail and foodservice sectors are driving demand for further-processed turkey items—such as ready-to-eat meals, deli meats, and plant-turkey hybrids. Broiler turkeys with high meat yields are ideal for such applications. Innovation in processing technology will allow producers to extract maximum value from each bird, reducing waste and improving margins.

Conclusion:

By 2026, the broiler turkey (“turbo”) market will be characterized by a dual trajectory: high-efficiency, genetically advanced breeds dominating large-scale production, while niche segments embrace slower-growing, welfare-focused alternatives. Success will depend on balancing productivity with sustainability, leveraging technology, and responding to shifting consumer demands for health, transparency, and environmental responsibility. Producers who adapt to these trends will be well-positioned to capture value in a competitive global protein landscape.

Common Pitfalls Sourcing Broiler Turbos (Quality, IP)

Sourcing Broiler Turbos—critical components in poultry processing equipment for rapid chilling—can be fraught with challenges, especially concerning quality assurance and intellectual property (IP) protection. Falling into these common pitfalls can lead to operational inefficiencies, legal risks, and reputational damage.

Poor Quality Control and Inconsistent Performance

One of the most frequent issues when sourcing Broiler Turbos is receiving units that fail to meet performance or durability standards. Low-cost suppliers, particularly from regions with lax manufacturing oversight, may use substandard materials or imprecise engineering, resulting in:

- Reduced airflow efficiency and inconsistent chilling

- Higher energy consumption and maintenance costs

- Premature wear and frequent breakdowns

- Contamination risks due to non-food-grade materials or poor sealing

Without rigorous quality audits, factory inspections, or third-party testing, buyers risk integrating unreliable components into their processing lines.

Lack of Authenticity and Counterfeit Components

The demand for high-performance Broiler Turbos has led to a rise in counterfeit or imitation products. These replicas often mimic the design and branding of reputable OEM (Original Equipment Manufacturer) parts but lack the engineering precision and certified materials. Risks include:

- Voided warranties on original equipment

- Safety hazards due to structural failure

- Non-compliance with food safety standards (e.g., USDA, FDA, HACCP)

Buyers must verify authenticity through documentation, traceability, and direct engagement with authorized distributors.

Intellectual Property Infringement

Sourcing Broiler Turbos from unauthorized manufacturers often involves IP violations. Many turbo designs are protected by patents, trademarks, or trade secrets. Using or purchasing copied components—even unknowingly—can expose companies to:

- Legal liability and costly litigation

- Import bans or customs seizures

- Damage to brand reputation and business relationships

Procurement teams must perform due diligence to ensure suppliers are licensed or produce non-infringing designs, especially when sourcing from overseas.

Inadequate Documentation and Compliance

Reliable Broiler Turbos should come with full technical documentation, certifications (e.g., ISO, CE, 3-A Sanitary Standards), and material traceability. Pitfalls arise when suppliers provide incomplete or falsified paperwork, leading to:

- Non-compliance during regulatory audits

- Inability to validate food-grade safety

- Challenges in maintenance and part replacement

Always require and verify compliance documentation before finalizing procurement.

Supply Chain Opacity and Lack of Traceability

Many low-cost suppliers operate through opaque supply chains, making it difficult to trace component origins or verify manufacturing practices. This lack of transparency increases the risk of:

- Unethical labor practices or environmental violations

- Unreliable lead times and quality inconsistencies

- Limited recourse in case of defects or disputes

Establishing direct relationships with reputable suppliers and conducting on-site audits can mitigate these risks.

Conclusion

To avoid these pitfalls, companies should prioritize supplier vetting, demand full compliance documentation, and partner with trusted OEMs or certified manufacturers. Protecting both quality standards and intellectual property rights ensures long-term operational efficiency and legal compliance in the competitive poultry processing industry.

Logistics & Compliance Guide for Broiler Turbo

This guide outlines key logistics and compliance considerations for the handling, transportation, and regulatory adherence related to Broiler Turbo—a high-performance feed additive designed to enhance growth and feed efficiency in broiler chickens.

Product Overview and Classification

Broiler Turbo is classified as a non-medicated animal feed additive containing enzymatic and nutritional components. It is intended for inclusion in broiler poultry rations and is not classified as a veterinary medicinal product under most jurisdictions. Proper classification ensures alignment with regional feed safety and agricultural regulations.

Storage Requirements

Store Broiler Turbo in a cool, dry place between 15°C and 25°C. Keep containers sealed to prevent moisture absorption and contamination. Protect from direct sunlight and extreme temperatures. Retain original labeling and ensure storage areas are pest-free and accessible only to authorized personnel.

Packaging and Handling

Broiler Turbo is supplied in food-grade, tamper-evident packaging (e.g., 25 kg multi-wall paper bags with polyethylene liner). Use appropriate personal protective equipment (PPE), including gloves and dust masks, when handling bulk quantities to minimize inhalation or skin contact. Follow first-in, first-out (FIFO) inventory practices to ensure product efficacy.

Transportation Guidelines

Transport Broiler Turbo in covered, clean vehicles to prevent exposure to weather, contaminants, or cross-contact with hazardous materials. Ensure loads are secured to avoid shifting during transit. Maintain segregation from human foodstuffs, pharmaceuticals, and toxic substances. For international shipments, comply with IATA, IMDG (if applicable), and local transport authority requirements.

Regulatory Compliance

Ensure compliance with relevant regulatory frameworks, including but not limited to:

– EU: Regulation (EC) No 1831/2003 on feed additives (authorization status to be verified)

– USA: FDA 21 CFR Part 573 – Food Additives Permitted in Feed and Drinking Water of Animals

– Codex Alimentarius: Guidelines for the use of feed additives

– Local National Feed Authorities: Registration and labeling requirements

Verify that Broiler Turbo is registered or approved for use in the destination country prior to import or distribution.

Labeling and Documentation

All packaging must display: product name, batch number, net weight, manufacturer details, expiration date, storage instructions, and safety information. Shipping documentation should include a Certificate of Analysis (CoA), Safety Data Sheet (SDS) in compliance with GHS standards, and, where required, a Certificate of Free Sale or export health certificate.

Import and Export Procedures

For cross-border shipments:

– Confirm import permits or notifications with the destination country’s agricultural or feed safety authority.

– Use Harmonized System (HS) code 2309.90 (Other feeding stuff for animals) unless specified otherwise.

– Retain records of customs declarations, bills of lading, and regulatory correspondence for a minimum of five years.

Quality Assurance and Traceability

Implement a traceability system to track Broiler Turbo from raw material sourcing to final delivery. Conduct routine quality audits and maintain batch-specific records to support recall readiness. All manufacturing and distribution partners must comply with GMP+ or equivalent feed safety standards.

Environmental and Disposal Considerations

Dispose of empty containers and expired product in accordance with local environmental regulations. Do not dispose of in waterways or soil. Unused product may require incineration or licensed waste handling; consult local waste management authorities for approved methods.

Emergency Response

In case of spillage, contain material using non-combustible absorbents and dispose of as hazardous waste if required. In case of accidental ingestion or exposure, refer to the SDS and contact medical or veterinary professionals immediately. Keep emergency contact details of the manufacturer and local poison control center readily available.

Training and Personnel Compliance

Ensure all logistics and handling personnel are trained in safe handling procedures, regulatory requirements, and emergency response protocols. Maintain training records and conduct annual refresher courses to ensure ongoing compliance.

Conclusion for Sourcing Broiler Turbos

Sourcing broiler turbos requires a strategic approach that balances performance, reliability, cost-efficiency, and long-term maintenance considerations. As high-efficiency air impingement systems that significantly reduce cooking times and improve consistency, broiler turbos are a critical investment for commercial kitchens in the food service and hospitality industries.

After evaluating key suppliers, product specifications, energy efficiency ratings, warranty terms, and after-sales support, it is evident that selecting the right broiler turbo involves more than just upfront cost. Prioritizing quality components, advanced temperature control, ease of cleaning, and compatibility with existing kitchen operations ensures optimal performance and return on investment.

Furthermore, partnering with reputable manufacturers or distributors who offer technical expertise and responsive service support is essential for minimizing downtime and maintaining food safety standards. Sourcing from suppliers with a proven track record in the commercial kitchen equipment industry enhances reliability and operational continuity.

In conclusion, a well-informed sourcing decision—based on thorough market research, lifecycle cost analysis, and alignment with operational needs—will ensure the successful integration of broiler turbos into the kitchen setup, driving efficiency, productivity, and customer satisfaction in the long term.