The U.S. brick manufacturing industry is experiencing steady resurgence, fueled by growth in residential construction, infrastructure investments, and demand for sustainable building materials. According to Grand View Research, the U.S. masonry market—encompassing brick, block, and stone—was valued at USD 13.8 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.2% from 2023 to 2030. Similarly, Mordor Intelligence projects the North American construction bricks market to grow at a CAGR of over 4.8% during the same period, driven by urbanization and increasing preference for durable, energy-efficient façades. As demand rises, a handful of manufacturers are leading the way in innovation, production volume, and sustainability. Here are the top 10 brick manufacturers in the U.S. shaping the future of American construction.

Top 10 Brick In Usa Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Pine Hall Brick

Domain Est. 1996

Website: pinehallbrick.com

Key Highlights: Pine Hall Brick is a century-old family-owned brick manufacturer headquartered in Winston-Salem, NC making facebrick, pavers, and thin brick veneers….

#2 Triangle Brick: Leading Brick Manufacturer Since 1959

Domain Est. 1998

Website: trianglebrick.com

Key Highlights: From our soil to your site, Triangle Brick, a leading brick manufacturer in the United States, delivers 500M+ bricks for sale annually nationwide….

#3 Whitacre Greer Dry

Domain Est. 1998

Website: wgpaver.com

Key Highlights: Whitacre Greer is a small, boutique-type manufacturer of fired-clay paving brick and fire brick. The company utilizes the dry-pressed manufacturing process….

#4 Glen-Gery

Domain Est. 1999

Website: glengery.com

Key Highlights: Glen-Gery is the superior choice among architects, builders & homeowners who require high-quality building products that meet design challenges ……

#5 Hebron Brick

Domain Est. 1999 | Founded: 1904

Website: hebronbrick.com

Key Highlights: At Hebron Brick, we’re proud of our legacy since 1904 as the only brick manufacturer in North Dakota and one of the leading suppliers in the Upper Midwest….

#6 US Brick

Domain Est. 2003

Website: usbrick.com

Key Highlights: Welcome to US Brick, the leading manufacturer of residential and commercial brick and supplier of stone, pavers, and building supplies….

#7 The Belden Brick Company

Domain Est. 1995

Website: beldenbrick.com

Key Highlights: Belden Masonry Studio. Real brick, real textures, real-time decisions. Design with the clarity you need and the quality you expect. Learn More….

#8 Mangum Brick

Domain Est. 1998 | Founded: 1902

Website: mangumbrick.com

Key Highlights: Mangum Brick Company has been manufacturing the highest quality brick and clay products for both residential and commercial construction since 1902….

#9 Henry Brick

Domain Est. 1998

Website: henrybrick.com

Key Highlights: Products · Brick by Color · Brick by Series · Thin Brick · Special Shapes · Painter Brick · Technical Resources · Project Gallery….

#10 BrickCraft

Domain Est. 2004

Website: brickcraft.com

Key Highlights: Located in South Central Indiana, BrickCraft is one of the few American owned and American operated independent brick plants….

Expert Sourcing Insights for Brick In Usa

2026 Market Trends for Brick in the USA

The brick manufacturing and construction materials sector in the United States is poised for notable shifts by 2026, driven by evolving construction practices, sustainability demands, supply chain dynamics, and economic factors. This analysis explores key trends expected to shape the brick market in the U.S. over the coming years.

Increasing Demand in Residential Construction

The U.S. housing market is projected to remain robust through 2026, with steady demand for single-family homes and multifamily developments. Brick remains a preferred material in many regions—particularly the South and Midwest—due to its durability, aesthetic appeal, and resistance to extreme weather. As builders emphasize long-term value and curb appeal, brick siding and accents are expected to see increased adoption, especially in mid-to-high-end residential projects.

Sustainability and Energy Efficiency Drivers

Environmental regulations and green building standards are influencing material choices in construction. By 2026, brick is gaining favor due to its low environmental impact during use, high thermal mass (which contributes to energy efficiency), and recyclability. The U.S. Green Building Council’s LEED certification system increasingly recognizes brick for sustainable construction, encouraging its use in eco-conscious developments. Additionally, manufacturers are investing in cleaner kiln technologies and alternative fuels to reduce carbon emissions, aligning with federal climate goals.

Shift Toward Architectural and Thin Brick Solutions

While traditional clay brick remains prevalent, architectural brick and thin brick veneers are expected to grow significantly by 2026. These lightweight alternatives offer the aesthetic benefits of brick with lower material and transportation costs, making them ideal for retrofitting, multifamily buildings, and commercial facades. The trend is supported by urban infill projects and modern design preferences that blend industrial and traditional elements.

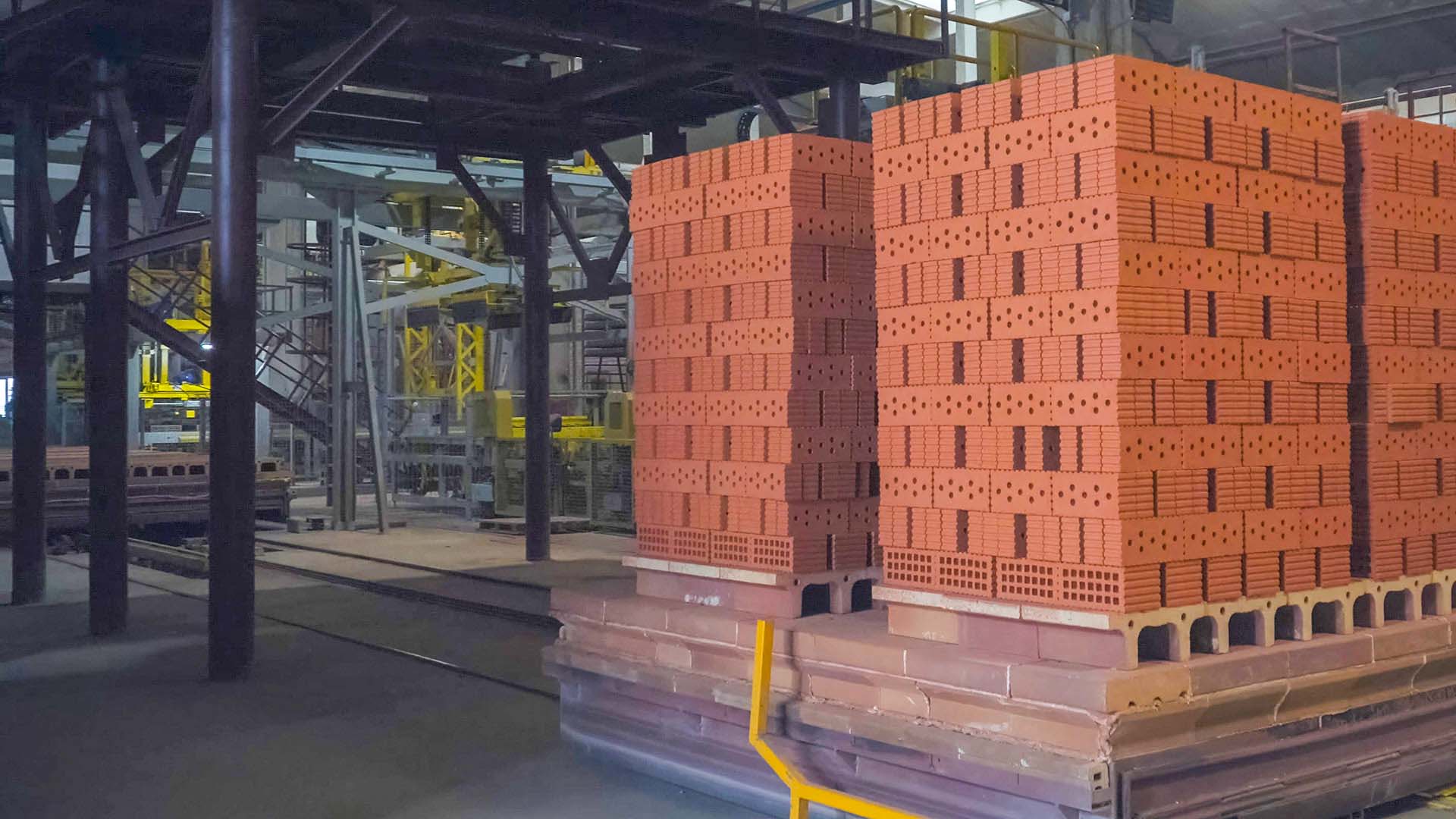

Supply Chain Resilience and Domestic Production

Recent disruptions in global supply chains have prompted a reevaluation of material sourcing. The U.S. brick industry, which already relies heavily on domestic production, is expected to strengthen further by 2026. Investments in regional manufacturing facilities and automation are improving production efficiency and reducing lead times. Additionally, trade policies and transportation cost fluctuations are making locally produced brick more competitive against imported alternatives.

Labor and Installation Challenges

Despite strong demand, the brick market faces challenges related to skilled labor shortages. Masonry trades have seen declining workforce participation, potentially slowing installation rates and increasing labor costs. By 2026, industry stakeholders are likely to respond with increased training programs, prefabricated brick panels, and modular construction techniques to mitigate delays and improve cost predictability.

Regional Market Variations

Brick demand remains geographically uneven. The Southern U.S. continues to lead in brick usage due to cultural preferences and climate suitability, while the Northeast and West Coast show more mixed adoption due to higher costs and alternative materials. However, gentrification and historic preservation efforts in urban areas are creating pockets of strong demand across regions.

Price Volatility and Raw Material Costs

Energy prices, particularly natural gas used in kilns, and clay availability will influence brick pricing through 2026. Inflationary pressures and input cost fluctuations may lead to moderate price increases, though economies of scale and efficiency improvements could help stabilize margins. Buyers are expected to adopt longer-term procurement strategies to hedge against volatility.

Conclusion

By 2026, the U.S. brick market is expected to experience steady growth, supported by resilient housing demand, sustainability trends, and technological advancements in production and design. While challenges around labor and costs persist, the enduring appeal and functional benefits of brick ensure its continued relevance in American construction. Stakeholders who adapt to changing preferences and invest in innovation will be best positioned to capitalize on emerging opportunities.

Common Pitfalls Sourcing Bricks in the USA (Quality, IP)

Sourcing bricks in the United States can present several challenges, particularly concerning material quality and intellectual property (IP) considerations. Being aware of these pitfalls helps ensure project success and compliance.

Quality Variability and Consistency Issues

One of the most significant pitfalls when sourcing bricks in the USA is inconsistent quality across suppliers and batches. Bricks can vary in compressive strength, water absorption, color, texture, and dimensional accuracy. These variations often stem from differences in raw materials, manufacturing processes, and regional climatic conditions affecting clay composition. Buyers may receive bricks that do not meet ASTM C62, C216, or other applicable standards, leading to structural or aesthetic failures. Additionally, lack of rigorous third-party testing or certification from some manufacturers increases the risk of substandard products entering construction projects.

Limited Availability of Specialty or Historic Reproduction Bricks

Many architectural or restoration projects require specific brick types that match historical styles or have unique dimensions and colors. A common pitfall is assuming that such specialty bricks are readily available. Many traditional brick manufacturers have consolidated or ceased operations, reducing diversity in product offerings. Sourcing accurate reproductions may involve custom manufacturing, which can be costly and time-consuming. Moreover, inconsistencies in color matching between production runs can compromise the visual integrity of a facade, especially in phased construction.

Intellectual Property and Design Infringement Risks

While bricks themselves are generally functional building components, certain molded shapes, textures, or proprietary designs may be protected under design patents or trade dress. A critical pitfall arises when sourcing non-original or “look-alike” bricks that imitate a patented design. For example, some manufacturers hold design patents on distinctive brick profiles used in high-profile architectural projects. Unauthorized replication—even if functionally similar—can lead to IP infringement claims, legal disputes, and costly project delays. Buyers may unknowingly source counterfeit or imitation products, particularly through third-party distributors or online marketplaces lacking proper documentation.

Lack of Transparency in Supply Chain and Origin

Another risk involves opacity in the supply chain. Some suppliers may source bricks from overseas under a domestic brand name, leading to unexpected quality issues or compliance gaps with US building codes. These imported bricks might not undergo the same environmental or structural performance testing as US-made products. Furthermore, falsely labeled “American-made” bricks can mislead buyers and potentially violate “Buy America” provisions in public projects, resulting in contractual and legal complications.

Inadequate Documentation and Certification

Failing to obtain proper documentation—such as mill test reports, certificates of compliance, or IP clearance statements—is a frequent oversight. Without these, project teams cannot verify whether bricks meet required performance standards or if their use infringes on protected designs. This lack of due diligence can delay inspections, compromise warranty claims, or expose developers to liability.

In summary, sourcing bricks in the USA requires careful vetting of suppliers, verification of product standards, and attention to potential IP constraints—especially for architecturally sensitive or custom projects. Due diligence in quality assurance and legal compliance helps avoid costly rework, delays, and legal exposure.

Logistics & Compliance Guide for Brick Imports into the USA

Importing bricks into the United States involves navigating a complex network of logistics, regulatory requirements, and compliance standards. This guide outlines the key steps and considerations for successfully importing bricks while meeting all U.S. legal and safety requirements.

1. Understand Product Classification

Bricks are typically classified under the Harmonized Tariff Schedule (HTS) of the United States. The correct HTS code determines the applicable duty rate and regulatory requirements.

- Common HTS codes for bricks:

- 6904.10.00 – Fired bricks of magnesia, chromite, quartz, or similar refractory materials

- 6904.90.00 – Other fired bricks, blocks, and similar construction units of refractory materials

- 6905.10.00 – Unglazed ceramic roofing tiles, flooring blocks, and bricks

- Verify the correct classification with U.S. Customs and Border Protection (CBP) or a licensed customs broker.

2. Partner with Reliable Suppliers

Choose suppliers with proven experience in exporting to the U.S. Ensure they provide:

- Certifications (e.g., ISO, ASTM compliance)

- Consistent quality control

- Proper documentation (commercial invoice, packing list, bill of lading)

- Packaging that meets U.S. transit and handling standards

3. Shipping & Logistics Planning

Plan the transportation of bricks from the point of origin to the U.S. destination.

- Transport Mode: Most bricks are shipped via ocean freight due to weight and volume.

- Container Type: Use dry van containers (20’ or 40’) or flat racks for oversized or heavy loads.

- Incoterms: Clearly define responsibilities (e.g., FOB, CIF) with your supplier.

- Freight Forwarder: Engage a U.S.-experienced freight forwarder for customs clearance and inland delivery.

- Port of Entry: Select a port with infrastructure for handling heavy goods (e.g., Los Angeles, Savannah, New York/New Jersey).

4. Customs Clearance Process

All imported goods must clear U.S. Customs and Border Protection (CBP).

Required documents:

– Commercial invoice

– Bill of lading or air waybill

– Packing list

– Entry summary (CBP Form 7501)

– ISF (Importer Security Filing, submitted 24 hours before loading)

- Duties and Fees: Pay applicable tariffs based on HTS code. Check for trade agreements that may reduce rates.

- Bond: Secure a customs bond (single transaction or continuous) to guarantee payment of duties and compliance.

5. Compliance with U.S. Standards & Regulations

Bricks must meet relevant U.S. construction and safety standards.

- ASTM Standards:

- ASTM C62: Standard Specification for Building Brick (Solid Masonry Units Made from Clay or Shale)

- ASTM C216: Standard Specification for Facing Brick (Facing Brick Made from Clay or Shale)

- ASTM C652: Standard Specification for Hollow Brick (Hollow Masonry Units Made from Clay or Shale)

- Testing & Certification: Some importers conduct third-party lab testing to verify compliance.

- Labeling: Ensure products are clearly labeled with manufacturer, country of origin, and compliance marks (if applicable).

6. Environmental & Safety Regulations

- EPA & DOT: While bricks are not typically hazardous, ensure no toxic materials (e.g., lead, asbestos) are present.

- OSHA: Comply with workplace safety standards during handling and storage.

- State Regulations: Some states (e.g., California) have additional environmental or building code requirements (e.g., California Green Building Standards Code).

7. Importer of Record Responsibilities

As the Importer of Record (IOR), you are legally responsible for:

- Ensuring accurate declarations

- Paying duties and taxes

- Maintaining import records for at least 5 years

- Responding to CBP inquiries or audits

8. Work with a Licensed Customs Broker

A licensed customs broker can:

- Classify goods correctly

- Prepare and submit documentation

- Liaise with CBP

- Advise on duty savings and compliance risks

9. Monitor Trade Developments

Stay informed about:

- Changes in tariff rates (e.g., Section 301 tariffs)

- Anti-dumping or countervailing duties on construction materials

- Updates to building codes or environmental regulations

10. After-Importation Considerations

- Warehousing & Distribution: Use bonded or free warehouses depending on your distribution model.

- Quality Inspection: Conduct post-arrival quality checks before distribution.

- Recordkeeping: Maintain all import documents for audit and compliance purposes.

Conclusion

Importing bricks into the U.S. requires careful planning, regulatory compliance, and coordination with logistics partners. By understanding classification, customs procedures, and product standards, importers can ensure smooth entry and avoid costly delays or penalties. Always consult with a customs broker, freight forwarder, and legal advisor to stay compliant.

In conclusion, sourcing brick manufacturers in the USA offers numerous advantages, including access to high-quality, durable construction materials that meet stringent industry standards. With a well-established network of manufacturers across the country, buyers can benefit from regional diversity, reduced transportation costs, and support for local economies. American brick producers utilize advanced manufacturing technologies and sustainable practices, ensuring environmentally responsible production. Additionally, domestic sourcing enhances supply chain reliability and reduces lead times, which is crucial for timely project completion. By partnering with reputable U.S. brick manufacturers, construction firms, architects, and developers can ensure product consistency, compliance with building codes, and excellent technical support. Overall, sourcing bricks domestically is a strategic choice that combines quality, sustainability, and efficiency in the construction supply chain.