The global brazing alloys market is experiencing robust growth, driven by increasing demand from industries such as automotive, aerospace, HVAC, and electronics. According to Grand View Research, the market was valued at USD 2.1 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. This growth is fueled by the rising need for efficient, high-strength joining solutions in lightweight and high-performance applications. Additionally, advancements in alloy formulations—particularly in silver, copper, aluminum, and nickel-based brazing materials—are enhancing thermal and mechanical performance across critical manufacturing processes. As automation and electrification trends accelerate, particularly in electric vehicles and renewable energy systems, the demand for reliable, precision brazing solutions continues to climb. In this evolving landscape, a select group of manufacturers has emerged as leaders, combining innovation, global reach, and technical expertise to capture significant market share. Here, we present the top 10 brazing alloys manufacturers shaping the future of industrial joining technologies.

Top 10 Brazing Alloys Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Brazing, Welding, Soldering & Metallizing Filler Metals

Domain Est. 1995

Website: brazing.com

Key Highlights: Aufhauser: a renowned source of information and products for brazing, soldering, welding and metal joining in general. Scientific, industrial and commerial ……

#2 NOCOLOK®Flux Aluminium Brazing

Domain Est. 1995

Website: solvay.com

Key Highlights: The NOCOLOK® flux brazing technology is the industry standard for brazing aluminium heat exchangers and other components….

#3 Stella welding

Domain Est. 2000

Website: stella-welding.com

Key Highlights: STELLA srl is an Italian manufacturer of brazing alloys, specialized in providing complete solutions in Brazing, Soldering and Welding applications. Our ……

#4 Braze Alloys

Domain Est. 2014

Website: morganbrazealloys.com

Key Highlights: We offer value added solutions with precious and non precious alloy manufacturing, active brazing technology (including turnkey braze services) and pre-sintered ……

#5 Brazing materials|Tokyo Braze Co., Ltd.

Website: tokyobraze.co.jp

Key Highlights: Nickel based brazing alloys are typically used in stainless steels, which show high joint strength and corrosion resistance. We have 3types of brazing alloys….

#6 Lucas Milhaupt

Domain Est. 1998

Website: lucasmilhaupt.com

Key Highlights: Lucas Milhaupt delivers next-generation metal-joining solutions and custom brazing alloys for industries from aerospace to EV….

#7 Prince & Izant

Domain Est. 1998

Website: princeizant.com

Key Highlights: We can produce various preforms from silverphos and silver-based brazing alloys for HVAC/R applications (coils, return bends, etc.) with our extensive inventory ……

#8 High

Domain Est. 1998

Website: selectarc.com

Key Highlights: Selectarc is the French leader in the production of brazing filler metals and offers innovative products such as silver tubular brazing wire….

#9 Materion Ultra

Domain Est. 1999

Website: materion.com

Key Highlights: We manufacture ultra-clean braze alloys with contamination-free base metals to produce strong joints with high integrity….

#10 Brazing Alloys and Solder

Domain Est. 2006

Website: harrisproductsgroup.com

Key Highlights: Harris is the world leader in developing a complete line of brazing and soldering products to meet the industry needs for metal joining methods….

Expert Sourcing Insights for Brazing Alloys

H2: Projected Market Trends for Brazing Alloys in 2026

The global brazing alloys market is poised for steady growth by 2026, driven by increasing demand across key industrial sectors, technological advancements, and evolving manufacturing practices. Several macroeconomic and sector-specific trends are expected to shape the market landscape in the coming years.

-

Rising Demand from Automotive and Aerospace Industries

The automotive sector, particularly in electric vehicle (EV) production, is anticipated to be a major driver for brazing alloys. As automakers shift toward lightweight materials and efficient thermal management systems—such as in battery cooling units and power electronics—copper- and silver-based brazing alloys are seeing increased adoption. Similarly, the aerospace industry’s focus on high-performance, heat-resistant components supports the use of nickel- and aluminum-based brazing alloys in turbine engines and airframe assemblies. -

Expansion in HVAC and Refrigeration Applications

With growing energy efficiency standards and increased construction activity, especially in Asia-Pacific and emerging economies, the HVAC&R (Heating, Ventilation, Air Conditioning, and Refrigeration) sector will continue to rely heavily on brazing for assembling heat exchangers and refrigerant lines. Copper-phosphorus and silver-based alloys are expected to maintain dominance due to their reliability and compatibility with copper tubing. -

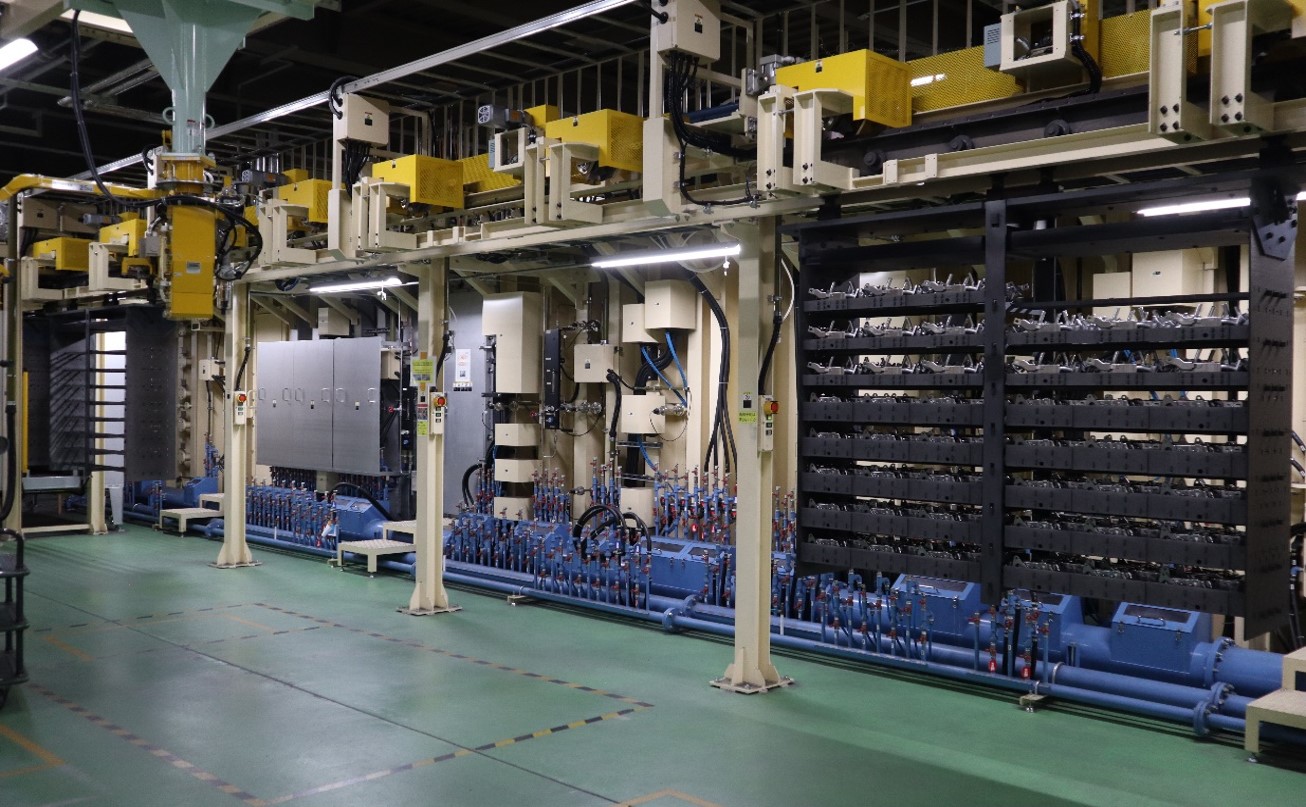

Technological Advancements and Automation

The integration of automated brazing systems in manufacturing is enhancing precision and throughput, particularly in electronics and appliance production. This trend is encouraging the development of pre-formed brazing alloys (rings, foils, and pastes) tailored for robotic application. By 2026, demand for such engineered solutions is projected to rise, especially in high-volume industries like consumer electronics and white goods. -

Shift Toward Environmentally Friendly Alloys

Environmental regulations, such as those restricting the use of cadmium in brazing alloys due to toxicity concerns, are pushing manufacturers to develop lead- and cadmium-free alternatives. Silver-copper-zinc and silver-copper-tin formulations are gaining traction as sustainable options. Additionally, recycling initiatives for silver-rich scrap are expected to influence raw material sourcing and pricing dynamics. -

Regional Market Dynamics

Asia-Pacific is expected to lead global consumption of brazing alloys by 2026, fueled by industrial expansion in China, India, and Southeast Asia. North America and Europe will maintain steady demand, supported by aerospace modernization and green technology investments. However, supply chain resilience and raw material availability—especially for silver and copper—could pose challenges, prompting regional diversification of supply sources. -

Price Volatility and Raw Material Constraints

Fluctuations in the prices of key metals, particularly silver, may impact brazing alloy costs. Manufacturers are responding by optimizing alloy formulations to reduce precious metal content without compromising performance. This trend is likely to accelerate R&D efforts in alloy substitution and composite materials.

In summary, the 2026 brazing alloys market will be shaped by growing industrial demand, technological innovation, regulatory pressures, and sustainability imperatives. Companies that invest in eco-friendly products, automation-compatible solutions, and efficient supply chains are expected to gain a competitive edge in this evolving landscape.

When sourcing brazing alloys using hydrogen (H₂) as a reducing atmosphere or as part of the brazing process environment, several common pitfalls related to quality and intellectual property (IP) must be carefully managed to ensure process reliability, product integrity, and legal compliance. Below is a breakdown of these pitfalls:

1. Quality-Related Pitfalls

a. Inadequate Purity of Hydrogen Gas

- Pitfall: Contaminated H₂ (e.g., moisture, oxygen, oil, hydrocarbons) can cause oxidation, porosity, or incomplete wetting during brazing, even in controlled atmospheres.

- Impact: Poor joint strength, reduced corrosion resistance, and unreliable performance.

- Mitigation: Ensure H₂ supply meets high-purity standards (e.g., 99.999% pure, dew point < -40°C). Use gas purifiers and monitor in-line with sensors.

b. Improper Alloy Composition or Certification

- Pitfall: Sourcing from unreliable suppliers may lead to off-spec brazing alloys (e.g., incorrect Ag, Cu, Ni, or P content) that don’t perform as expected under H₂ atmosphere.

- Impact: Inconsistent flow, poor capillary action, or brittle joints.

- Mitigation: Require certified material test reports (MTRs), perform incoming inspections, and audit supplier quality systems (e.g., ISO 9001, AS9100).

c. Oxidation Despite H₂ Atmosphere

- Pitfall: Inadequate H₂ flow, leaks in the furnace, or insufficient dew point control can allow oxidation on base metals or filler alloys.

- Impact: Reduced brazeability, need for additional flux (defeating H₂’s purpose), and weak joints.

- Mitigation: Maintain tight furnace seals, ensure proper H₂ flow rates, and pre-treat parts to remove surface contaminants.

d. Hydrogen Embrittlement of Base Materials

- Pitfall: Certain high-strength steels or alloys may absorb hydrogen during brazing, leading to embrittlement.

- Impact: Premature failure of components under stress.

- Mitigation: Avoid H₂ brazing for susceptible alloys or implement post-braze baking to diffuse hydrogen.

e. Inconsistent Brazing Alloy Form (foil, preform, paste)

- Pitfall: Poor dimensional tolerances or inconsistent alloy distribution in preforms or pastes.

- Impact: Uneven filler metal distribution, voids, or insufficient joint filling.

- Mitigation: Work with qualified suppliers using precision manufacturing and statistical process control (SPC).

2. Intellectual Property (IP)-Related Pitfalls

a. Use of Proprietary Alloys Without Licensing

- Pitfall: Sourcing or replicating patented brazing alloys (e.g., specific Ni-based or Ag-based formulations) without authorization.

- Impact: Risk of IP infringement lawsuits, financial penalties, and supply chain disruption.

- Mitigation: Conduct freedom-to-operate (FTO) analyses; source only from licensed suppliers or use generic, non-patented alloys.

b. Reverse Engineering Risks

- Pitfall: Attempting to reverse-engineer a competitor’s brazing alloy performance in H₂ environments to replicate it.

- Impact: Potential violation of trade secrets or utility patents, even if composition is independently derived.

- Mitigation: Avoid disassembly or testing of competitor products without legal review; focus on open innovation or licensed technologies.

c. Lack of Clear IP Ownership in Supplier Contracts

- Pitfall: Custom-developed alloys or processes created with a supplier may result in ambiguous IP rights.

- Impact: Disputes over ownership, inability to use or modify the alloy, or forced royalty payments.

- Mitigation: Define IP ownership explicitly in contracts (e.g., “work-for-hire” clauses); ensure background vs. foreground IP is delineated.

d. Disclosure of Sensitive Process Parameters

- Pitfall: Sharing H₂ brazing process details (temperature profiles, gas mixtures, cycle times) with suppliers who lack NDAs or IP safeguards.

- Impact: Loss of competitive advantage or misappropriation of proprietary know-how.

- Mitigation: Use strong NDAs; limit technical disclosures to what is strictly necessary.

Best Practices Summary

| Area | Best Practice |

|——|—————-|

| Quality | Use high-purity H₂ with continuous monitoring; verify alloy certifications; control furnace environment tightly. |

| Hydrogen Safety | Ensure leak detection, ventilation, and explosion-proof equipment when using H₂. |

| Supplier Selection | Audit suppliers for quality systems, traceability, and compliance with industry standards (e.g., AWS, DIN, AMS). |

| IP Protection | Conduct IP due diligence; use clear contracts; avoid reverse engineering; protect process know-how. |

Conclusion

Sourcing brazing alloys for use with H₂ atmospheres demands rigorous attention to gas and material quality as well as IP compliance. By addressing contamination risks, ensuring alloy consistency, and respecting intellectual property rights, companies can achieve reliable, high-performance brazed joints while avoiding legal and operational pitfalls.

Logistics & Compliance Guide for Brazing Alloys

Brazing alloys are widely used in manufacturing, HVAC, automotive, and aerospace industries for joining metal components. Due to their material composition—often containing metals such as silver, copper, zinc, nickel, or aluminum—these alloys may be subject to specific logistics, safety, environmental, and trade compliance regulations. This guide outlines key considerations for the safe and compliant handling, transportation, storage, and documentation of brazing alloys.

H2: Regulatory Classification & Material Identification

Proper classification of brazing alloys is essential for regulatory compliance and safe handling. Key steps include:

- Identify Alloy Composition

- Review the Safety Data Sheet (SDS) provided by the manufacturer.

- Confirm the presence of hazardous components (e.g., cadmium, lead, or beryllium), which may trigger additional regulations.

-

Common classifications include:

- Silver-bearing brazing alloys (e.g., BAg-8)

- Copper-phosphorus alloys (e.g., BCuP-5)

- Aluminum-silicon alloys (e.g., BAlSi-4)

-

UN Number & Hazard Class Determination

- Most brazing alloys in solid form (rods, rings, preforms) are not classified as hazardous under transport regulations (e.g., UN TDG, IATA, IMDG) when shipped in non-reactive forms.

- Exception: Alloys containing regulated substances such as cadmium (UN 3206, Class 6.1 Toxic) or lithium (in some aluminum brazing alloys) may require hazardous materials classification.

-

Check for reactive forms (e.g., brazing paste with flammable solvents), which may fall under Class 3 (Flammable Liquids) or Class 4.1 (Flammable Solids).

-

GHS Classification (Globally Harmonized System)

-

Classify based on physical and health hazards:

- May include labels for “Harmful if inhaled” (dust during machining).

- Metal fumes during brazing may pose health risks, but this applies to use—not transport.

-

Customs Tariff Classification (HS Code)

- Typical HS codes for brazing alloys:

- 7408.29 – Copper-based brazing alloys (non-waste)

- 8112.99 – Other base metal alloys (e.g., aluminum-silicon)

- 7106.92 – Silver-based brazing alloys

- Accurate HS codes are critical for import/export duties, trade agreements, and country-specific restrictions.

H2: Transportation & Packaging Requirements

Safety and compliance in transport depend on physical form, quantity, and destination.

- Packaging Standards

- Use moisture-resistant, sealed packaging to prevent oxidation (especially for aluminum and copper-phosphorus alloys).

- For powders or flux-coated alloys, use containers that prevent dust leakage (UN-certified if classified as hazardous).

-

Label packages with:

- Product name

- Net weight

- Manufacturer details

- Batch/lot number

- Relevant hazard symbols (if applicable)

-

Transport Mode Considerations

- Air (IATA): Generally non-restricted if non-hazardous; pastes/solders with flammable carriers require IATA DG approval.

- Sea (IMDG Code): Declare accurately; alloys with toxic metals (e.g., cadmium) require proper stowage and documentation.

-

Road (ADR in Europe): Solid brazing alloys typically exempt unless hazardous components present.

-

Temperature & Environmental Controls

- Store and transport away from extreme heat or moisture to prevent degradation.

- Avoid direct sunlight for flux-coated or resin-based alloys.

H2: Storage & Handling Best Practices

Safe storage ensures product integrity and worker safety.

- Storage Conditions

- Keep in a dry, well-ventilated area with stable temperatures (15–25°C recommended).

- Use original sealed packaging until use.

-

Separate from acids, oxidizers, and flammable materials.

-

Handling Procedures

- Use gloves and safety glasses when handling fine powders or machining brazing rods.

- Avoid generating dust; use local exhaust ventilation if cutting or grinding.

-

Wash hands after handling, especially before eating or drinking.

-

Inventory Management

- Implement FIFO (First In, First Out) rotation.

- Track lot numbers for traceability, especially in aerospace or medical applications.

H2: Regulatory Compliance & Documentation

Ensure all legal requirements are met for domestic and international shipments.

- Safety Data Sheet (SDS)

- Provide up-to-date SDS (GHS-compliant) with every shipment.

-

Include exposure controls, PPE recommendations, and disposal considerations.

-

Export Controls

- Some high-performance brazing alloys (e.g., nickel-based superalloys) may be subject to export control regimes:

- EAR (Export Administration Regulations) – U.S. Department of Commerce

- ITAR (International Traffic in Arms Regulations) – if used in defense applications

-

Verify ECCN (Export Control Classification Number); many standard alloys fall under EAR99 (low concern).

-

Import Requirements

- Check for country-specific restrictions (e.g., REACH in EU, TSCA in U.S.).

-

Ensure compliance with RoHS if used in electrical/electronic equipment (limits on lead, cadmium, etc.).

-

Recordkeeping

- Maintain records of:

- SDS copies

- Shipping manifests

- Export licenses (if applicable)

- Certificates of Conformance (CoC)

H2: Environmental, Health & Safety (EHS) Considerations

Mitigate risks during use and disposal.

- Worker Protection

- Train personnel on safe brazing practices and fume extraction.

-

Provide respiratory protection when brazing generates metal fumes (e.g., zinc oxide fume fever).

-

Waste Disposal

- Scrap brazing alloy is generally non-hazardous but may require recycling through metal reclamation.

-

Contaminated waste (e.g., flux residues) may be classified as hazardous depending on local regulations.

-

Sustainability & Recycling

- Promote closed-loop recycling of alloy scraps.

- Choose cadmium-free and lead-free alloys where possible to meet environmental standards.

By adhering to this logistics and compliance framework, businesses can ensure the safe, legal, and efficient handling of brazing alloys across the supply chain. Always consult local regulations and update procedures as standards evolve.

Conclusion on Sourcing Brazing Alloys

Sourcing brazing alloys requires a strategic approach that balances quality, cost, availability, and technical compatibility. The choice of alloy depends heavily on the specific application, including base metals, service conditions, joint design, and required mechanical and thermal properties. It is essential to partner with reliable suppliers who provide certified, consistent materials and technical support to ensure optimal performance.

Key considerations in sourcing brazing alloys include understanding alloy composition (e.g., silver, copper, aluminum, nickel-based), form (e.g., paste, wire, preforms), and compliance with industry standards (such as AWS or ISO). Additionally, evaluating long-term supply chain stability, lead times, and the supplier’s ability to customize solutions can significantly impact manufacturing efficiency and product quality.

In conclusion, a well-informed sourcing strategy—rooted in technical requirements, supplier reliability, and total cost of ownership—ensures successful brazing operations, enhances product integrity, and supports production continuity in industries ranging from aerospace and automotive to HVAC and electronics.