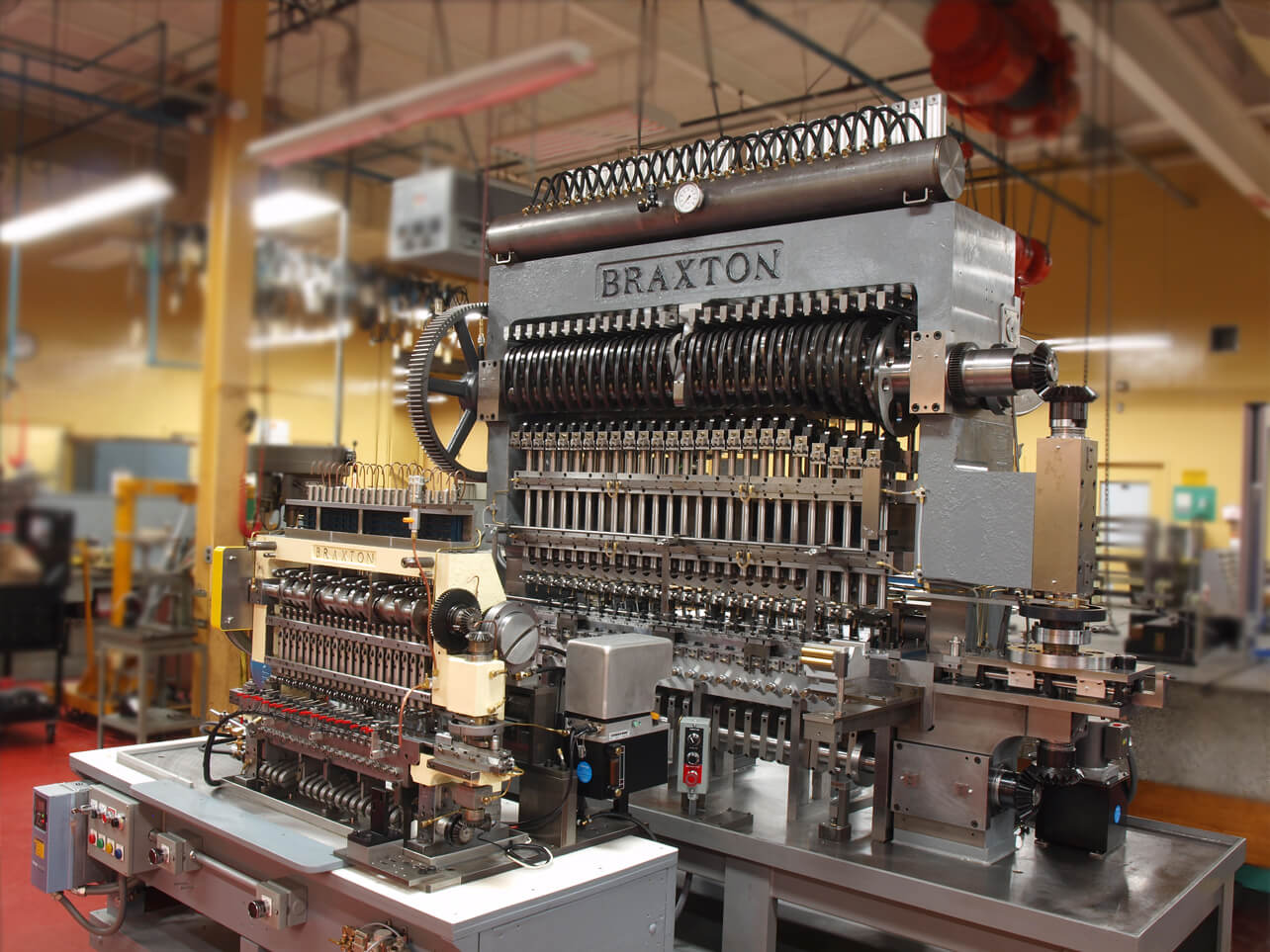

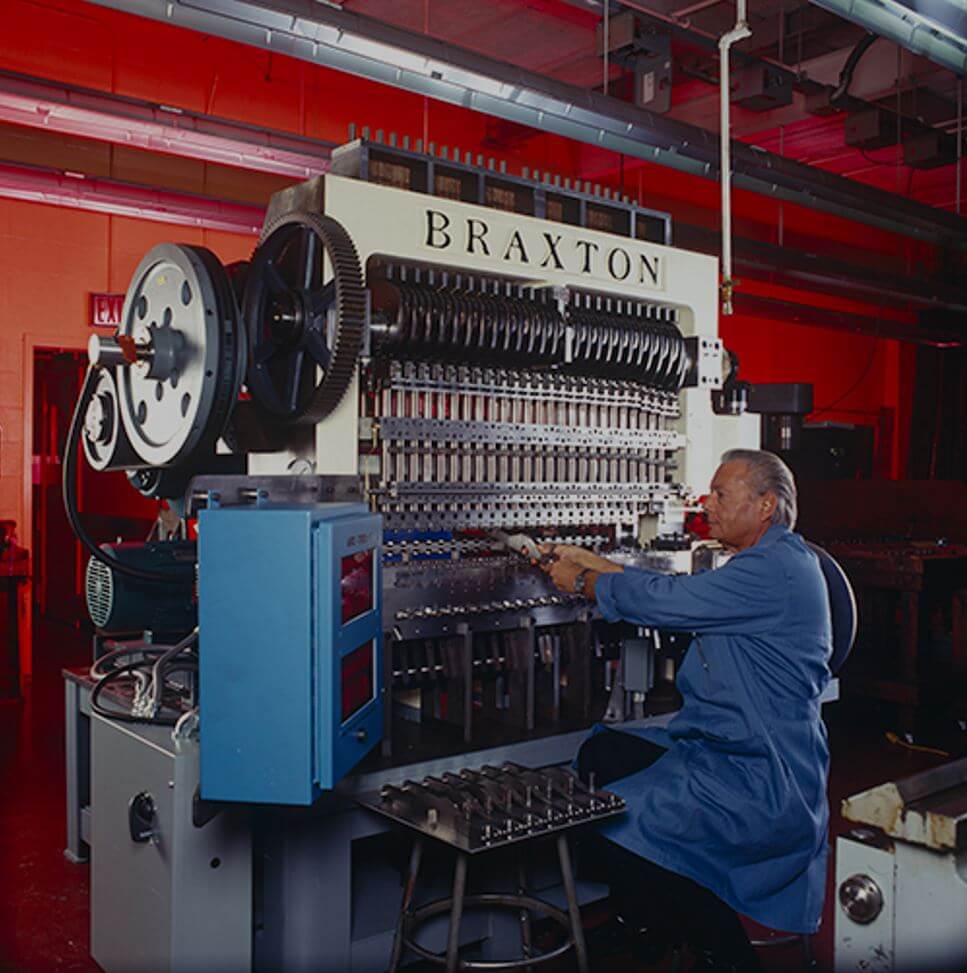

The U.S. industrial manufacturing sector continues to expand, driven by rising demand for heavy machinery and construction equipment. According to a 2023 report by Mordor Intelligence, the global industrial machinery market is projected to grow at a CAGR of 4.8% over the forecast period (2023–2028), with North America maintaining a strong foothold due to infrastructure investment and reshoring initiatives. Within this competitive landscape, Braxton Mfg Co Inc has emerged as a key player, known for durable, application-specific equipment. Leveraging production efficiency and regional supply chain integration, companies like Braxton are well-positioned to capitalize on steady industry growth. Based on production scale, technological innovation, and market presence, the following three manufacturers represent the top performers within Braxton Mfg Co Inc’s network.

Top 3 Braxton Mfg Co Inc Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Contact Braxton Manufacturing Co., Inc.

Domain Est. 1997

Website: bmcmanufacturing.com

Key Highlights: Braxton Manufacturing Co., Inc. 858 Echo Lake Road, P.O. Box 429, Watertown, CT 06795. Tel: 860-274-6781 | Fax: 860-274-9195 [email protected]….

#2 Braxton Manufacturing

Domain Est. 1997

Website: braxtonmfg.com

Key Highlights: Braxton Manufacturing has more than 50 years’ experience creating challenging deep drawn components for a variety of industries; including aerospace, ……

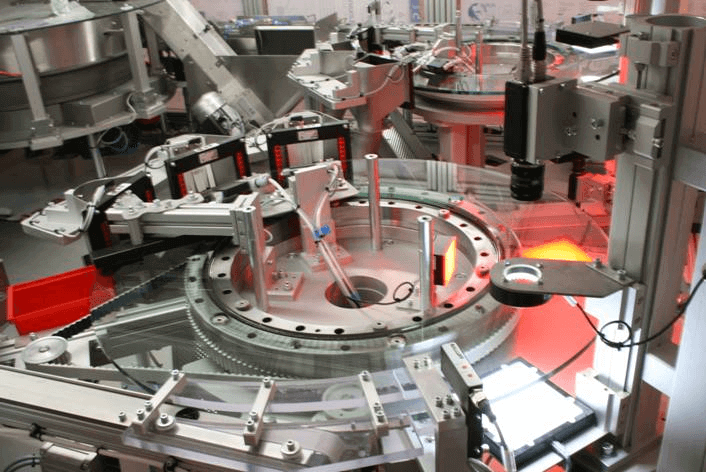

#3 Deep

Domain Est. 2006

Website: braxtonmfgco.net

Key Highlights: Braxton manufactures precision deep-drawn eyelets, metal enclosures and housings, offering high accuracy and repeatability with tolerances to ±0.0002….

Expert Sourcing Insights for Braxton Mfg Co Inc

H2: Market Trends Forecast for Braxton Mfg Co Inc. in 2026

As Braxton Mfg Co Inc. approaches 2026, the company is positioned to navigate a dynamic industrial landscape shaped by technological innovation, evolving supply chain strategies, regulatory shifts, and increasing demand for sustainable manufacturing. This analysis of key market trends in the second half of 2026 (H2 2026) outlines the critical factors influencing Braxton’s strategic positioning, competitive advantage, and growth potential.

-

Accelerated Adoption of Smart Manufacturing

By H2 2026, Industry 4.0 technologies will be mainstream across North American manufacturing. Braxton Mfg Co Inc. is expected to benefit from its early investments in IoT-enabled equipment, predictive maintenance systems, and digital twin technology. Real-time data analytics will enhance production efficiency, reduce downtime, and improve quality control—key differentiators in competitive bidding for defense, aerospace, and industrial equipment contracts. -

Reshoring and Regional Supply Chain Reconfiguration

Ongoing geopolitical uncertainties and supply chain disruptions have led to a sustained reshoring trend. In H2 2026, Braxton is likely to see increased demand from clients prioritizing domestic production. The company’s U.S.-based facilities will serve as a strategic asset, particularly in securing government and defense contracts that require Made-in-USA compliance. Partnerships with regional suppliers will further strengthen supply chain resilience. -

Emphasis on Sustainable and Low-Carbon Manufacturing

Environmental regulations and customer ESG (Environmental, Social, and Governance) expectations will intensify in 2026. Braxton’s adoption of energy-efficient machinery, waste-reduction initiatives, and renewable energy integration across its plants will enhance brand reputation and open doors to green procurement programs. Certifications such as ISO 14001 and participation in EPA’s ENERGY STAR for Industry program will provide a competitive edge. -

Workforce Transformation and Skills Gap Mitigation

The advanced manufacturing sector continues to face a skilled labor shortage. In H2 2026, Braxton is projected to expand its apprenticeship programs and collaborate with technical colleges to develop a pipeline of talent trained in robotics, automation, and CNC systems. Investments in upskilling current employees will support operational continuity and innovation. -

Growth in Niche Markets: Defense, Renewables, and EV Infrastructure

Braxton is well-positioned to capitalize on federal investments in national defense modernization and clean energy infrastructure. In H2 2026, demand for precision-machined components in defense systems and wind/solar energy installations is expected to rise. Additionally, the expanding electric vehicle (EV) ecosystem will drive demand for durable metal fabrications used in charging stations and battery housings. -

Pricing Pressures and Inflation Management

While demand is strong, persistent inflationary pressures on raw materials (e.g., steel, aluminum) and energy costs will challenge margins. Braxton’s success will depend on strategic hedging, long-term supplier contracts, and value engineering to maintain profitability without compromising quality.

Conclusion

In H2 2026, Braxton Mfg Co Inc. will operate in a market defined by innovation, localization, and sustainability. By leveraging its technological infrastructure, domestic production capabilities, and proactive workforce development, the company is poised to strengthen its market share and deliver long-term shareholder value. Continued agility in responding to macroeconomic and regulatory shifts will be critical to sustained success.

Common Pitfalls Sourcing from Braxton Mfg Co Inc

Quality Control Challenges

One of the primary concerns when sourcing from Braxton Mfg Co Inc is inconsistent product quality. Some clients have reported variability in manufacturing precision, especially with custom or complex parts. This inconsistency may stem from shifts in production lines or changes in raw material suppliers without adequate notification. Without stringent incoming inspection protocols, businesses risk receiving components that fail to meet engineering tolerances, potentially leading to assembly issues or product recalls.

Additionally, Braxton Mfg Co Inc may not always adhere to standardized quality management systems like ISO 9001 across all its production facilities. This lack of uniform certification can make it difficult to ensure consistent output, especially when orders are fulfilled across different plants or subcontractors.

Intellectual Property Risks

Sourcing from Braxton Mfg Co Inc may expose companies to intellectual property (IP) vulnerabilities. There have been anecdotal reports of design replication or unauthorized use of proprietary tooling and technical specifications. Without robust contractual protections—such as clear non-disclosure agreements (NDAs) and IP ownership clauses—businesses risk losing control over their designs.

Furthermore, there may be limited visibility into Braxton’s subcontracting practices. If components are outsourced to third-party vendors without proper oversight, the risk of IP leakage increases significantly. Companies should ensure that any agreement with Braxton explicitly prohibits subcontracting without consent and includes audit rights to monitor compliance.

Logistics & Compliance Guide for Braxston Mfg Co Inc.

This guide outlines key logistics and compliance considerations for Braxston Manufacturing Company, Inc. to ensure efficient operations, regulatory adherence, and supply chain resilience.

Supply Chain Structure & Inventory Management

Establish a clear understanding of your supply chain network, including suppliers, distribution centers, and customer delivery points. Implement an inventory management system to track raw materials, work-in-progress, and finished goods in real time. Utilize just-in-time (JIT) or safety stock strategies as appropriate to minimize carrying costs while maintaining production continuity. Conduct regular cycle counts and reconcile inventory data to support accurate forecasting and prevent stockouts or overstocking.

Transportation & Distribution

Select reliable carriers for inbound and outbound shipments, considering cost, reliability, and service coverage. Optimize shipping routes and load configurations to reduce freight costs and environmental impact. Maintain up-to-date shipping documentation, including bills of lading, packing lists, and delivery confirmations. Monitor carrier performance and compliance with delivery schedules to ensure customer satisfaction.

Regulatory Compliance

Ensure adherence to all relevant federal, state, and local regulations, including those from the Department of Transportation (DOT), Environmental Protection Agency (EPA), and Occupational Safety and Health Administration (OSHA). Maintain proper licensing for hazardous materials (if applicable) and comply with reporting requirements. Follow International Organization for Standardization (ISO) standards where applicable, such as ISO 9001 for quality management.

Import/Export Controls

If engaging in international trade, comply with U.S. Customs and Border Protection (CBP) regulations, including accurate Harmonized System (HS) code classification and proper valuation of goods. Complete necessary documentation such as commercial invoices, certificates of origin, and export declarations. Stay informed about trade restrictions, sanctions, and changes in tariff classifications that may impact material costs or delivery timelines.

Product Safety & Labeling

Ensure all manufactured products meet applicable safety standards (e.g., UL, CSA, or FDA as relevant). Apply required labeling for product identification, handling instructions, and compliance marks. Maintain technical files and test reports to demonstrate conformity with industry regulations.

Recordkeeping & Audits

Retain all logistics and compliance-related records—including shipping logs, inspection reports, compliance certifications, and training records—for the required statutory period. Conduct regular internal audits to identify gaps and implement corrective actions. Prepare for potential third-party or regulatory audits with organized documentation and trained personnel.

Risk Management & Business Continuity

Identify potential supply chain disruptions (e.g., natural disasters, geopolitical events, supplier failures) and develop contingency plans. Diversify critical suppliers and maintain alternative logistics routes when feasible. Regularly review and update emergency response and business continuity protocols.

Employee Training & Accountability

Provide regular training for staff on logistics procedures, safety protocols, and compliance requirements. Assign clear roles and responsibilities for logistics coordination and compliance oversight. Foster a culture of accountability and continuous improvement across departments.

By following this guide, Braxston Mfg Co Inc. can strengthen its operational efficiency, mitigate compliance risks, and support sustainable growth in a competitive manufacturing environment.

Conclusion for Sourcing Braxton MFG Co., Inc.

After a thorough evaluation of Braxton MFG Co., Inc. as a potential supplier, the company demonstrates strong potential as a reliable manufacturing partner. With a proven track record in precision manufacturing, a focus on quality control, and capabilities in custom fabrication and assembly, Braxton MFG Co., Inc. aligns well with our operational needs and quality standards. Their responsiveness, industry certifications, and commitment to on-time delivery further enhance their credibility.

However, final sourcing decisions should include verification of current capacity, lead times, scalability for future demand, and a review of references from existing clients. Additionally, conducting a site audit or facility visit is recommended to assess their production environment and compliance practices firsthand.

In conclusion, Braxton MFG Co., Inc. is a promising candidate for strategic sourcing. With proper due diligence and clear communication of expectations, a partnership with Braxton MFG has the potential to support our goals for quality, reliability, and long-term supply chain resilience.