The global brass alloy market is experiencing steady expansion, driven by rising demand across industrial, construction, plumbing, and electrical sectors. According to Grand View Research, the global brass alloys market was valued at USD 47.9 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.3% from 2023 to 2030. This growth is fueled by the metal’s excellent machinability, corrosion resistance, and antimicrobial properties—making it a preferred choice in critical applications such as marine hardware, heat exchangers, and sanitary installations. With Asia Pacific dominating both production and consumption, particularly due to rapid urbanization in China and India, the competitive landscape is increasingly shaped by innovation in lead-free brass formulations and sustainable manufacturing practices. As demand intensifies, a select group of manufacturers have emerged as industry leaders, combining scale, technical expertise, and R&D investment to maintain a strategic edge. Here’s a data-driven look at the top 10 brass alloy manufacturers shaping the future of the market.

Top 10 Brass Alloy Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Belmont Metals: Non

Domain Est. 1997

Website: belmontmetals.com

Key Highlights: Serving customers since 1896, Belmont Metals offers a greater variety of Non-Ferrous metal compositions and shapes than any other US Manufacturer….

#2 National Bronze Mfg. Co.

Domain Est. 1998

Website: nationalbronze.com

Key Highlights: We are manufacturers and distributors of bronze bushings, custom bronze bearings, precision machined parts and various non-ferrous alloys….

#3 Legacy

Domain Est. 2015

Website: muellerbrass.com

Key Highlights: Mueller Brass Co. is one of America’s leading manufacturers of standard and lead-free brass, operating the largest and longest-standing American-owned brass ……

#4 Aviva Metals

Domain Est. 2017

Website: avivametals.com

Key Highlights: Aviva Metals is the leading manufacturer of bronze, brass & copper alloys. We keep a ready stock of of these metals in a variety of shapes & sizes….

#5 Wieland Rolled Products (formerly Olin Brass)

Domain Est. 2019

Website: wieland-rolledproductsna.com

Key Highlights: Wieland Rolled Products NA is the leading manufacturer and converter of copper and copper-alloy sheet, strip, foil, tube and fabricated components in North ……

#6 Diehl Brass Solutions – High

Domain Est. 1996

Website: diehl.com

Key Highlights: Diehl Brass Solutions manufactures premium brass and copper semi-finished products—over 60 specialized alloys including lead-free and high-performance ……

#7 Lewis Brass

Domain Est. 1998

Website: lewisbrass.com

Key Highlights: Over 60 years of experience in brass tubing and alloy supply · Over 1 million pounds of metal materials in stock, ready to order from our New York City warehouse….

#8 Brass Alloys

Domain Est. 1998

Website: sequoia-brass-copper.com

Key Highlights: Sequoia Brass & Copper has been a leading domestic supplier of top-notch copper and brass alloys, serving the metal fabrication industry across North America….

#9 Rajhans Metals

Domain Est. 1999

Website: rajhans.com

Key Highlights: Based in Jamnagar, India, Rajhans manufactures quality Alloys Extrusion. An ISO 9001 certified company plays home to over 2400 customized shapes with ……

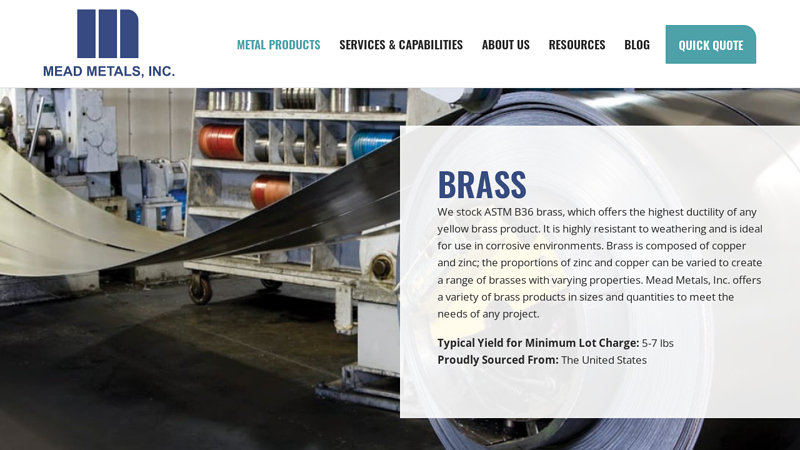

#10 Brass Supplier

Domain Est. 1999

Website: meadmetals.com

Key Highlights: Mead Metals stocks alloy 260 and ASTM B36 brass products in gauges from 0.005 up to 0.187. We offer annealed, quarter hard, half-hard, 3/4 hard, full-hard, and ……

Expert Sourcing Insights for Brass Alloy

As of now, detailed market data specifically for the year 2026 regarding brass alloy trends under the H2 (Second Half) timeframe is not yet available, as we are still in earlier years. However, based on current industry trajectories, technological advancements, and macroeconomic forecasts up to 2024, we can project plausible H2 2026 market trends for brass alloys with reasonable confidence.

Here is an analysis of expected H2 2026 brass alloy market trends:

- Increased Demand in Plumbing and HVAC Industries

- The global push for energy efficiency and sustainable building practices will continue to drive demand for brass alloys in plumbing fixtures, valves, and heat exchangers.

- In H2 2026, seasonal construction activity—especially in emerging markets (e.g., India, Southeast Asia, and parts of Africa)—will likely boost brass consumption during the latter half of the year.

-

Regulations favoring lead-free brass (e.g., <0.25% lead content in the U.S. under the Safe Drinking Water Act) will sustain demand for eco-friendly brass alloys like EnviroBrass or lead-free alternatives using bismuth or silicon.

-

Growth in Automotive and Electrical Applications

- The automotive sector, particularly in electric vehicles (EVs), will increasingly use brass in connectors, sensors, and locking systems due to its excellent conductivity and corrosion resistance.

- H2 2026 may see peak demand in EV production cycles, aligning with model refreshes and new launches, which will positively impact brass alloy usage.

-

Consumer electronics and industrial automation will further drive demand for precision brass components in connectors and relay systems.

-

Raw Material Price Volatility and Supply Chain Adjustments

- Copper and zinc—key constituents of brass—may experience price fluctuations in H2 2026 due to geopolitical tensions, mining output changes, or shifts in Chinese industrial policy.

- Recycling of brass will become more economically attractive, with increased investment in urban mining and closed-loop recycling systems, especially in Europe and North America.

-

Supply chain resilience will remain a priority; manufacturers may diversify sourcing or increase regional production to mitigate risks.

-

Technological and Material Innovations

- Advances in high-performance brass alloys (e.g., antimicrobial brass for healthcare applications) will gain traction, especially post-pandemic awareness of hygiene.

-

Adoption of additive manufacturing (3D printing) using brass powders may rise in niche industrial and artistic sectors by H2 2026, though still limited by cost and scalability.

-

Regional Market Dynamics

- Asia-Pacific (especially China and India) will remain the largest consumer and producer of brass alloys, driven by urbanization and infrastructure development.

- The European market may see steady demand, supported by green building standards and the transition to renewable energy systems requiring brass components.

-

North America could witness modest growth, with a focus on replacement markets and high-value engineered brass products.

-

Environmental and Regulatory Pressures

- Stricter environmental regulations on heavy metal emissions and waste management will push manufacturers toward cleaner production technologies and compliance with REACH, RoHS, and similar directives.

-

Carbon footprint reduction targets may influence energy-intensive brass production, potentially increasing adoption of low-emission furnaces and renewable energy in foundries.

-

Market Outlook for H2 2026

- Overall, H2 2026 is expected to show moderate growth in the global brass alloy market, with Q3 and Q4 traditionally stronger due to industrial and construction seasonality.

- Market size is projected to exceed USD 50 billion by 2026, with brass alloys maintaining a critical role in essential infrastructure and advanced manufacturing.

Conclusion

In H2 2026, the brass alloy market will likely be shaped by sustainability mandates, technological innovation, and resilient demand from construction, automotive, and electronics sectors. While price volatility and supply chain challenges may persist, the long-term outlook for brass remains positive due to its irreplaceable functional properties and growing adoption of eco-friendly variants. Stakeholders should focus on innovation, recycling, and regional diversification to capitalize on emerging opportunities.

Common Pitfalls in Sourcing Brass Alloy: Quality and Intellectual Property (IP) Concerns

Sourcing brass alloy components or raw materials presents several challenges, particularly regarding consistent quality and potential intellectual property (IP) risks. Being aware of these common pitfalls is crucial for maintaining product integrity, protecting proprietary designs, and ensuring supply chain reliability.

Quality-Related Pitfalls

Inconsistent Material Composition and Certification

One of the most frequent issues is receiving brass alloy that does not meet specified chemical compositions (e.g., varying copper, zinc, lead, or other additive percentages). Suppliers, especially in regions with lax regulatory oversight, may provide falsified or incomplete Material Test Reports (MTRs). This inconsistency can lead to performance failures, such as reduced corrosion resistance, mechanical weakness, or poor machinability. Always require certified mill test reports traceable to batch numbers and consider third-party lab verification for critical applications.

Poor Dimensional Accuracy and Tolerances

Brass components manufactured to substandard processes often exhibit dimensional inconsistencies. This is particularly problematic in high-precision industries like automotive or medical devices. Overlooking tolerance specifications or assuming uniform manufacturing standards across suppliers can result in assembly failures or increased scrap rates. Clearly define geometric dimensioning and tolerancing (GD&T) requirements and conduct initial sample inspections.

Inadequate Surface Finish and Defects

Surface imperfections such as porosity, pitting, cracks, or discoloration are common in low-quality brass. These defects can compromise both aesthetic and functional performance—especially in plumbing or decorative applications where leak integrity and appearance are critical. Implement strict visual and non-destructive testing (NDT) protocols during incoming inspection.

Heat Treatment and Work Hardening Variability

Brass alloys often require specific temper conditions (e.g., annealed, half-hard, full-hard) to achieve desired mechanical properties. Inconsistent or undocumented heat treatment processes can result in parts that are too brittle or too soft. Verify that suppliers follow proper annealing or cold-working procedures and validate hardness through Rockwell or Brinell testing.

Intellectual Property (IP)-Related Pitfalls

Unauthorized Reverse Engineering and Design Copying

When providing detailed technical drawings or samples to overseas manufacturers, there is a significant risk of IP theft. Unscrupulous suppliers may reverse engineer your components and sell identical or similar products to competitors. This is especially prevalent in regions with weak IP enforcement. Always use non-disclosure agreements (NDAs) and limit the release of sensitive design data.

Lack of IP Clauses in Contracts

Many procurement agreements fail to explicitly define ownership of tooling, molds, design modifications, or process innovations developed during manufacturing. Without clear IP clauses, suppliers may claim partial ownership or reuse proprietary tooling for third parties. Ensure contracts specify that all IP developed during production remains the buyer’s sole property.

Grey Market Resale and Diversion

Suppliers may exceed agreed production volumes and sell excess brass components on the grey market. This not only undermines pricing strategies but can also damage brand reputation if substandard versions appear elsewhere. Implement strict production monitoring, use serialized tracking, and conduct periodic audits of supplier output.

Patented Alloy Formulations

Some high-performance brass alloys (e.g., lead-free or antimicrobial brass) are protected by patents. Sourcing such materials from unauthorized producers could expose your company to infringement claims. Verify that the alloy and its manufacturing process do not violate existing patents, and source from licensed or certified producers when applicable.

Mitigation Strategies

- Conduct thorough supplier audits, including on-site factory visits.

- Require comprehensive and verifiable quality documentation.

- Use third-party inspection services for critical shipments.

- Protect designs with patents, trademarks, and contractual safeguards.

- Establish long-term partnerships with reputable suppliers under clear legal terms.

By proactively addressing these quality and IP pitfalls, companies can ensure reliable sourcing of brass alloy materials while protecting both product performance and intellectual assets.

Logistics & Compliance Guide for Brass Alloy

Overview

Brass alloy, a copper-zinc alloy often containing small amounts of elements such as lead, tin, or aluminum, is widely used in industrial, electrical, plumbing, and decorative applications. Proper logistics handling and compliance with international and local regulations are essential to ensure safe transportation, traceability, and environmental responsibility. This guide outlines key considerations for the logistics and regulatory compliance of brass alloy in raw, semi-finished, and finished forms.

Classification & Identification

Brass alloy is typically categorized under HS (Harmonized System) codes based on form and composition:

– 7407: Copper waste and scrap (if recycled brass)

– 7408: Copper wire

– 7410: Copper tubes and pipes

– 7415: Copper fittings for tubes or pipes

– 7412: Other copper tubes and pipes

– 7419: Other articles of copper (includes fabricated brass parts)

Specific alloy grades (e.g., C26000, C36000) should be documented with material test reports (MTRs) to support compliance and quality assurance.

International Shipping & Transportation

- Packaging: Brass products should be packed to prevent corrosion, mechanical damage, and contamination. Use moisture-resistant wrapping, wooden crates, or steel strapping as needed. For coils or bars, palletization is standard.

- Labeling: Packages must display:

- Product description and alloy type

- Net and gross weights

- Batch/lot numbers

- Handling instructions (e.g., “Do Not Stack,” “Protect from Moisture”)

- Shipper and consignee details

- Modes of Transport:

- Maritime: Compliant with IMDG Code (if applicable); generally non-hazardous but must follow general cargo stowage rules.

- Air: IATA regulations apply; brass is typically non-restricted but heavy, so weight and balance considerations are important.

- Road/Rail: Follow local transport regulations; secure loads to prevent shifting.

Regulatory Compliance

1. REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals – EU)

- Brass alloys containing more than trace amounts of restricted substances (e.g., lead > 0.1%) must comply with REACH Annex XVII.

- Suppliers must provide Safety Data Sheets (SDS) upon request.

- Registration may be required if importing significant volumes of alloy components.

2. RoHS (Restriction of Hazardous Substances – EU)

- Applies to electrical/electronic equipment. Brass used in such applications must not exceed:

- Lead: 0.1% (1000 ppm) by weight (with exemptions for certain brass alloys like C36000 under RoHS Exemption 6(c))

- Ensure compliance documentation and exemption references are maintained.

3. Conflict Minerals (U.S. SEC Rule 13p-1)

- Copper, a primary component of brass, is a “conflict mineral” under the Dodd-Frank Act.

- Companies must conduct due diligence and report if their brass contains tin, tungsten, tantalum, or gold (3TG) sourced from conflict-affected regions (e.g., DRC).

- Use of certified conflict-free smelters is recommended.

4. TSCA (Toxic Substances Control Act – USA)

- Brass is generally compliant, but lead content must be reported if above de minimis levels.

- Ensure no intentional addition of prohibited substances.

5. Customs & Import Regulations

- Accurate HS code classification is critical to avoid delays and duty miscalculations.

- Provide commercial invoice, packing list, bill of lading/air waybill, and certificate of origin.

- Some countries impose anti-dumping duties on brass products from specific origins (e.g., China, India); verify current trade measures.

Environmental & Recycling Compliance

- WEEE (Waste Electrical and Electronic Equipment – EU): Applies if brass is part of EEE; producers may have take-back obligations.

- End-of-Life Handling: Brass is highly recyclable. Waste brass is classified as non-hazardous in most jurisdictions but must be processed by licensed recyclers.

- EPA Regulations (USA): No hazardous waste designation under RCRA for pure brass scrap; lead-containing brass may be subject to toxicity characteristic leaching procedure (TCLP) testing.

Quality & Traceability

- Maintain full traceability from raw material to final product using batch tracking.

- Provide Material Test Reports (MTRs) certifying chemical composition and mechanical properties.

- Comply with ISO 9001, ISO 14001, and relevant ASTM/EN standards (e.g., ASTM B36/B36M for brass plate, sheet, and strip).

Best Practices

- Supplier Audits: Ensure upstream suppliers comply with environmental and ethical standards.

- Documentation Control: Keep updated SDS, compliance declarations, and customs paperwork.

- Training: Train logistics and procurement staff on brass-specific regulations and handling.

- Labeling for Recycling: Clearly mark brass alloy type (e.g., “C26000”) on scrap for efficient recycling.

Conclusion

Effective logistics and compliance management for brass alloy require attention to material composition, international regulations, and proper documentation. By adhering to this guide, businesses can ensure smooth cross-border movement, reduce compliance risks, and support sustainable practices in the brass supply chain.

Conclusion for Sourcing Brass Alloy:

Sourcing brass alloy requires a strategic approach that balances quality, cost, sustainability, and supply chain reliability. As a versatile material with excellent machinability, corrosion resistance, and aesthetic appeal, brass is essential across industries such as plumbing, electrical, automotive, and architectural design. When sourcing, it is critical to partner with reputable suppliers who adhere to international quality standards (such as ASTM, ISO, or EN) and provide consistent material certification.

Considerations such as the specific alloy composition (e.g., C26000, C36000), required form (rod, sheet, tube), and volume should guide procurement decisions. Additionally, evaluating suppliers based on lead times, geographical proximity, and environmental practices can enhance supply chain resilience and support corporate sustainability goals. With growing emphasis on traceability and responsible sourcing, engaging suppliers who offer transparent sourcing practices and recycled content can also provide competitive and ecological advantages.

In conclusion, effective sourcing of brass alloy hinges on a thorough understanding of technical requirements, market dynamics, and long-term strategic partnerships to ensure reliable supply, product performance, and cost efficiency.