The global brake spider market is witnessing steady expansion, driven by increasing demand for heavy-duty vehicles and growing investments in railway infrastructure. According to Mordor Intelligence, the global commercial vehicle brake system market—which includes critical components like brake spiders—is projected to grow at a CAGR of over 4.5% from 2024 to 2029. Brake spiders, as load-bearing components in drum brake systems, play a pivotal role in ensuring safety and performance in trucks, trailers, and rail applications. With rising vehicle production and stricter safety regulations, especially in North America and Asia-Pacific, the demand for high-strength, precision-engineered brake spiders is on the rise. This growth, supported by advancements in material technology and manufacturing processes, has intensified competition among key players in the space. Based on market presence, production capacity, innovation, and global reach, the following nine manufacturers have emerged as leading suppliers in the brake spider industry.

Top 9 Brake Spider Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 BRAKE SPIDER

Founded: 2008

Website: moniva.com.tr

Key Highlights: Our company was established in 2008 in Konya. Konya Organized Industrial Zone, is on the way to Ankara. Products. SPRING BRAKE CHAMBER D/P · SPRING BRAKE ……

#2 Dayton Parts – Heavy

Domain Est. 1996

Website: daytonparts.com

Key Highlights: Welcome to Dayton Parts – your trusted partner for heavy-duty truck aftermarket parts. From springs to suspension, brakes, steering and more – we deliver ……

#3 Brake Spider, Cast

Domain Est. 1997

Website: egefren.com.tr

Key Highlights: Brake Spider, Cast – S Cam Type · Air Disc Brake · Z-Cam Type Brake · S-Cam Type Brake · All Wedge Type Brakes….

#4 Brake Spider

Domain Est. 1997

Website: fleetpride.com

Key Highlights: Free delivery over $200 · Free in-store returnsEuclid Camshaft Seal Spider Brake Assembly Kit. Part #E957. $236.99 ; Meritor Brake Spider. Part #A3211D4060. $280.99 ; Meritor Brak…

#5 Brake Spider Replaces 02

Domain Est. 1998

Website: 4statetrucks.com

Key Highlights: In stock Free deliveryHigh Quality Brake Spider * Dimensions: – 16.5 Inch Brake Size – 1.75 Inch Offset – 8.125 Inch Bolt Circle – 6.75 Inch Pilot Diameter * Drive Axle * Number …..

#6 Brake Spider Harness

Domain Est. 2008

Website: ctmmixers.com

Key Highlights: Description. Brake Spider Harness for lighting. mtm specific. mtm 1133815. SKU: 715259; MTM#:: 1133815….

#7 Brake Spider

Domain Est. 2013

Website: pentagonforge.co.in

Key Highlights: Pentagon Forge & Machine Ltd. Works: Survey No.19-20-21, Nr. Shaktiman, NH-27, At Bharudi. Dist.: Rajkot (Guj.) INDIA….

#8 Brake Spiders & Hardware

Domain Est. 2016

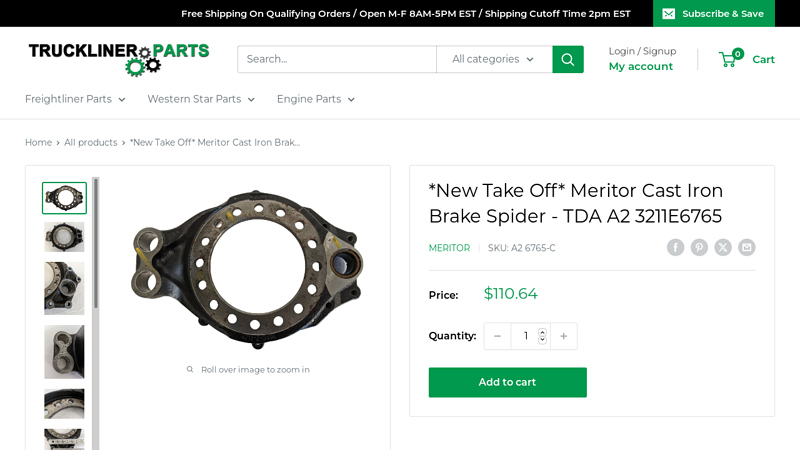

#9 Meritor Cast Iron Brake Spider

Domain Est. 2019

Website: trucklinerparts.com

Key Highlights: In stock Free delivery*New Take Off* Meritor Cast Iron Brake Spider. New Take-Off, Signs of Wear – See Photos. Brake Spider Assembly – Rear Brake. P/N: A2 6765 / TDA A2 3211E6765 ….

Expert Sourcing Insights for Brake Spider

H2: Market Trends for Brake Spiders in 2026

The global brake spider market is expected to undergo significant transformation by 2026, driven by advancements in automotive technology, increasing demand for electric and autonomous vehicles, and stringent safety and emission regulations. The brake spider—a critical structural component in drum brake systems that supports brake shoes and integrates with the wheel hub—is evolving in design and material composition to meet the performance demands of next-generation vehicles.

1. Growth in Commercial and Heavy-Duty Vehicle Segments

Despite the global shift toward electric passenger vehicles, the commercial, trucking, and off-highway vehicle sectors continue to rely heavily on drum brake systems, where brake spiders are most commonly used. In emerging markets such as India, Southeast Asia, and Africa, cost-effective drum brake systems remain prevalent due to their durability and lower maintenance costs. This sustained demand in freight and logistics sectors is projected to drive steady growth for brake spider manufacturers through 2026.

2. Material Innovation and Lightweighting

Automakers are increasingly focused on vehicle weight reduction to improve fuel efficiency and extend electric vehicle (EV) range. This trend is pushing manufacturers to adopt high-strength, lightweight materials such as ductile cast iron, forged steel, and even composite alloys in brake spider construction. By 2026, expect wider adoption of advanced metallurgical treatments and modular designs that enhance performance while reducing unsprung mass.

3. Integration with Electrified and Autonomous Braking Systems

While EVs predominantly use disc brakes, certain EV trucks and commercial EVs still employ drum brakes for rear axle applications. Brake spiders are being redesigned to accommodate integration with electronic braking systems (EBS), regenerative braking, and automated parking functions. Enhanced compatibility with sensors and ABS modules is becoming a key differentiator, ensuring brake spiders support broader vehicle connectivity and safety ecosystems.

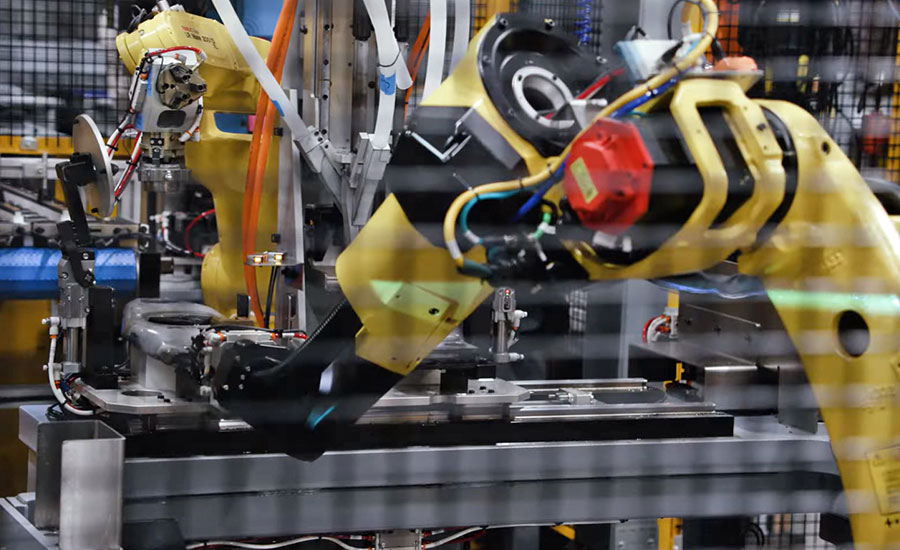

4. Regional Manufacturing Shifts and Supply Chain Localization

Geopolitical factors and supply chain resilience concerns are prompting OEMs to localize production. By 2026, North America and Europe are expected to see increased reshoring of brake component manufacturing, including brake spiders, to reduce dependency on Asian suppliers. Meanwhile, China and India remain dominant in volume production, with growing investments in automation and smart manufacturing to maintain competitiveness.

5. Sustainability and Circular Economy Initiatives

Environmental regulations are pushing manufacturers to adopt sustainable practices, including recyclable materials and energy-efficient casting processes. Foundries producing brake spiders are investing in green technologies such as induction melting and closed-loop cooling systems. Additionally, remanufacturing and recycling of brake spiders are gaining traction, supported by regulatory frameworks in the EU and North America.

6. Competitive Landscape and Consolidation

The brake spider market is moderately consolidated, with key players such as Meritor (now part of Cummins), Haldex, ZF Friedrichshafen, and Bharat Forge leading innovation. Smaller suppliers are focusing on niche applications and regional markets. By 2026, further consolidation is anticipated as OEMs demand integrated braking solutions, pushing suppliers to expand capabilities through mergers, partnerships, or vertical integration.

Conclusion

By 2026, the brake spider market will remain a vital segment within the commercial and heavy-duty braking ecosystem. While facing long-term pressure from disc brake adoption in light vehicles, the component’s relevance in cost-sensitive and high-durability applications ensures continued demand. Success will depend on innovation in materials, integration with smart braking technologies, and alignment with sustainability goals across the automotive value chain.

Common Pitfalls Sourcing Brake Spider: Quality and Intellectual Property (IP) Risks

Sourcing brake spiders—critical components in heavy-duty braking systems—presents several challenges, particularly concerning quality assurance and intellectual property protection. Falling into these common pitfalls can lead to safety issues, supply chain disruptions, legal liabilities, and reputational damage.

Quality-Related Pitfalls

Inadequate Material Specifications and Testing

Suppliers may use substandard materials or fail to meet required metallurgical properties (e.g., tensile strength, hardness, fatigue resistance). Without strict adherence to OEM material specifications and third-party certification (e.g., ASTM, ISO), brake spiders can fail prematurely under operational stress.

Poor Manufacturing Process Control

Inconsistent casting, machining, or heat treatment processes can result in dimensional inaccuracies, porosity, or internal defects. These flaws compromise structural integrity and increase the risk of catastrophic brake failure. Suppliers lacking proper process validation (e.g., PPAP, First Article Inspection) pose significant risks.

Lack of Traceability and Documentation

Reputable suppliers provide full traceability, including material test reports (MTRs), heat numbers, and inspection records. Sourcing from vendors without proper documentation makes it difficult to verify quality or investigate failures, exposing buyers to liability.

Non-Compliance with OEM or Industry Standards

Brake spiders must meet stringent standards such as SAE J2936 or manufacturer-specific requirements. Sourcing from suppliers unfamiliar with or unwilling to comply with these standards increases the likelihood of non-conformance and field failures.

Intellectual Property (IP) Pitfalls

Risk of Sourcing Counterfeit or Reverse-Engineered Parts

Some suppliers may offer “compatible” brake spiders that are unauthorized copies of patented OEM designs. These parts infringe on intellectual property rights and may not meet performance or safety standards, exposing the buyer to legal action and warranty claims.

Lack of IP Indemnification in Contracts

Procurement agreements that omit IP indemnification clauses leave buyers vulnerable. If a sourced brake spider is found to infringe on a patent, the buyer—not the supplier—may be held liable for damages, legal fees, and recalls.

Insufficient Supplier Vetting for IP Compliance

Failing to audit suppliers for design legitimacy and licensing agreements increases the risk of inadvertently sourcing pirated components. Buyers should verify whether the supplier has rights to produce the part or if it’s a legitimate licensed manufacturer.

Grey Market or Unauthorized Distribution Channels

Purchasing through unauthorized distributors increases exposure to counterfeit goods and IP violations. These channels often lack transparency, making it difficult to ensure authenticity or trace the origin of components.

To mitigate these risks, buyers should conduct thorough supplier qualification audits, require full documentation and certifications, include IP protection clauses in contracts, and source only from authorized or OEM-approved manufacturers.

Logistics & Compliance Guide for Brake Spider

This guide outlines the essential logistics and compliance considerations for the handling, transportation, storage, and regulatory adherence related to Brake Spider components in automotive manufacturing and distribution.

Product Overview

The brake spider is a critical structural component in drum brake systems, typically mounted on the axle hub and serving as the foundation for brake shoes, anchors, and other hardware. Due to its load-bearing function and safety implications, proper logistics and compliance procedures are vital.

Regulatory Compliance Requirements

Brake spiders must meet several regulatory and industry standards to ensure safety and performance. Key compliance areas include:

- FMVSS 121 (Federal Motor Vehicle Safety Standard) – Governs air brake systems in commercial vehicles; brake components must perform reliably under specified conditions.

- SAE J1409/J1410 – Standards for brake lining and drum brake performance; brake spiders must support compliant friction materials and alignment.

- DOT Certification – Required for components used in vehicles operating in the United States; manufacturers must maintain traceability and certification records.

- REACH & RoHS Compliance – Applies to material composition, especially for export to the EU; restricts hazardous substances in cast iron or coated brake components.

- IATF 16949 – Quality management standard for automotive production; mandates process controls, documentation, and traceability.

Material Handling & Storage

Proper handling and storage prevent damage and ensure component integrity:

- Storage Environment: Store in a dry, temperature-controlled area to prevent rust and corrosion, especially for cast iron spiders.

- Stacking & Racking: Use designated racks; avoid stacking without protective layers to prevent surface damage or deformation.

- Labeling: Clearly label each unit with part number, batch/lot number, date of manufacture, and compliance markings (e.g., DOT, ISO).

- Handling Equipment: Use appropriate forklifts, pallet jacks, or conveyors with non-marring attachments to avoid impact damage.

Packaging Standards

Packaging must protect brake spiders during transit and support traceability:

- Inner Packaging: Use anti-corrosion paper or VCI (Vapor Corrosion Inhibitor) wraps for individual or grouped components.

- Outer Packaging: Sturdy corrugated boxes or steel/wooden crates based on weight and shipment volume. Ensure adequate cushioning.

- Palletization: Securely fasten packages to standard-sized pallets (e.g., 48″x40″) using stretch wrap or strapping. Include dunnage where needed.

- Marking: Include hazard labels (if applicable), handling instructions (“Do Not Stack”, “Fragile”), and shipping labels with barcodes for tracking.

Transportation & Distribution

Ensure safe and compliant shipping across domestic and international channels:

- Carrier Qualifications: Use carriers experienced in automotive parts logistics, with appropriate insurance and compliance documentation.

- Temperature & Humidity Control: For long-distance or overseas shipments, consider climate-controlled containers if corrosion is a concern.

- Documentation: Include commercial invoices, packing lists, certificates of compliance (CoC), and material test reports (MTRs) with each shipment.

- Incoterms: Clearly define responsibilities using standard Incoterms (e.g., FOB, EXW, DDP) in all international transactions.

Traceability & Recordkeeping

Maintain full traceability from raw material to end customer:

- Batch/Lot Tracking: Assign unique identifiers to each production batch; record melt data for cast components.

- Digital Systems: Use ERP or MES systems to track production, inspection, packaging, and shipment data.

- Retention Period: Retain compliance and quality records for a minimum of 10 years, as required by IATF 16949 and OEM specifications.

Returns & Non-Conformance Handling

Establish procedures for defective or non-compliant units:

- Quarantine Area: Designate a secure location for suspect or returned brake spiders.

- Root Cause Analysis: Investigate failures using 8D or similar methodologies; document findings and corrective actions.

- Regulatory Reporting: Notify relevant authorities (e.g., NHTSA) if defects could impact vehicle safety and warrant a recall.

Supplier & OEM Coordination

Collaborate closely with suppliers and customers to ensure alignment:

- Advanced Shipping Notices (ASNs): Transmit electronic ASNs prior to delivery for efficient receiving.

- OEM Requirements: Adhere to specific packaging, labeling, and compliance formats required by major OEMs (e.g., Ford, Volvo, Daimler).

- Audits & Certifications: Prepare for periodic customer or third-party audits to verify compliance with quality and logistics standards.

Sustainability & Environmental Compliance

Address environmental responsibilities in logistics operations:

- Waste Management: Recycle packaging materials (cardboard, plastic, wood) and manage metal scrap responsibly.

- Carbon Footprint: Optimize transport routes and consolidate shipments to reduce emissions.

- Chemical Handling: Safely manage any coatings or rust inhibitors used in storage/packaging per local environmental regulations.

Following this guide ensures that brake spider logistics operations meet global safety, quality, and compliance standards while maintaining efficiency and traceability across the supply chain.

Conclusion for Sourcing Brake Spider:

After a thorough evaluation of available suppliers, technical specifications, quality standards, and cost considerations, it is concluded that sourcing the brake spider should be prioritized from a supplier that demonstrates proven expertise in heavy-duty braking components, complies with relevant industry certifications (such as ISO, ASME, or customer-specific standards), and offers consistent quality control and timely delivery.

The selected supplier should provide materials traceability, robust testing procedures (including non-destructive testing and load validation), and the capability for long-term support and scalability. Total cost of ownership—factoring in reliability, maintenance intervals, and failure risks—should take precedence over initial unit price.

Ultimately, partnering with a technically vetted and reliable manufacturer will ensure operational safety, minimize downtime, and support the overall integrity of the braking system in demanding applications. A finalized sourcing decision should be accompanied by sample testing and a pilot run before full-scale procurement.