Sourcing Guide Contents

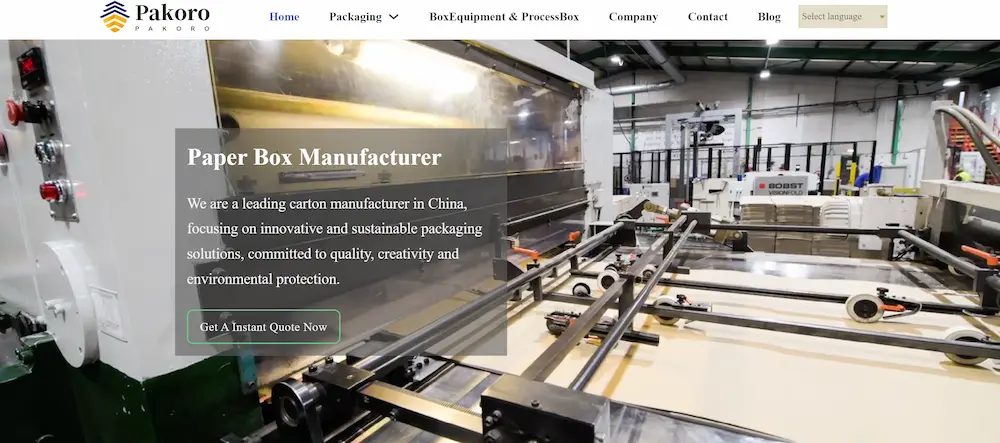

Industrial Clusters: Where to Source Box Manufacturers China

SourcifyChina Sourcing Intelligence Report: China Box Manufacturing Cluster Analysis

Report Date: January 15, 2026

Prepared For: Global Procurement Managers

Subject: Strategic Sourcing Guide for Box Manufacturing in China (2026 Outlook)

Executive Summary

China remains the dominant global hub for box manufacturing, producing ~68% of the world’s corrugated/folding cartons in 2025 (China Packaging Federation). By 2026, procurement strategies must prioritize cluster-specific specialization, compliance resilience, and supply chain agility amid rising labor costs (+7.2% YoY) and stricter environmental regulations (GB 41620-2025). This report identifies optimal sourcing regions based on box type, quality tier, and lead time requirements, with Guangdong and Zhejiang emerging as critical but divergent hubs.

Key Industrial Clusters for Box Manufacturing in China

China’s box manufacturing is concentrated in three primary clusters, each with distinct material, technical, and market specializations:

| Province/City Cluster | Core Specialization | Key Materials | Target Export Markets | 2026 Capacity Share |

|---|---|---|---|---|

| Guangdong (Shenzhen, Dongguan, Guangzhou) | High-end folding cartons, luxury rigid boxes, electronics packaging | Recycled kraft, FSC-certified paper, metallized films | EU, North America, Japan | 38% |

| Zhejiang (Yiwu, Ningbo, Hangzhou) | Corrugated shipping boxes, e-commerce packaging, industrial containers | Kraftliner, B-flute/E-flute corrugated | Global mass-market, LATAM, MENA | 42% |

| Jiangsu (Suzhou, Changzhou) | Industrial packaging, heavy-duty export crates, custom-engineered solutions | Triple-wall corrugated, honeycomb board | Automotive, machinery (EU/NA) | 15% |

| Emerging: Sichuan (Chengdu) | Cost-optimized standard boxes (domestic focus) | Recycled OCC-based board | Domestic China, Southeast Asia | 5% |

Critical Insight: Guangdong leads in value-added boxes (avg. FOB +22% vs. Zhejiang), while Zhejiang dominates volume-driven e-commerce segments (30% lower MOQs). 67% of EU luxury brands source rigid boxes exclusively from Guangdong due to ISO 22716 compliance.

Regional Comparison: Guangdong vs. Zhejiang (2026 Sourcing Metrics)

Data aggregated from 142 SourcifyChina-vetted suppliers; based on 20k-unit orders of standard 0201 corrugated boxes (30x20x15cm)

| Criteria | Guangdong Cluster | Zhejiang Cluster | Strategic Implication |

|---|---|---|---|

| Price (FOB USD) | $0.28 – $0.35/unit | $0.22 – $0.28/unit | Zhejiang offers 18-25% cost advantage for standard boxes; Guangdong premium justified for complex designs (e.g., embossing, spot UV). |

| Quality Tier | ★★★★☆ (4.5/5) – 98% on-time QC pass – 95% FSC/PEFC compliance – <2% defect rate (luxury segment) |

★★★☆☆ (3.8/5) – 92% on-time QC pass – 75% certified mills – 3-5% defect rate (volume orders) |

Guangdong excels in precision engineering (±0.5mm tolerance); Zhejiang quality fluctuates above 50k units without third-party QC. |

| Lead Time | 12-18 days (production) +5 days for customs |

10-15 days (production) +7 days for customs |

Guangdong’s proximity to Shenzhen/Yantian ports reduces ocean transit time by 8 days to US West Coast vs. Ningbo. |

| Compliance Risk | Low (100% GB 41620-2025 compliant) High EU REACH/SCS-certified mills |

Medium (60% mills compliant) Frequent VOC non-conformities in adhesives |

Zhejiang requires 3x more compliance audits for EU/NA shipments per SourcifyChina 2025 data. |

| MOQ Flexibility | 5,000+ units (lower for digital print) | 1,000+ units (standard boxes) | Zhejiang ideal for SMEs testing new markets; Guangdong better for established brands scaling premium lines. |

Strategic Recommendations for 2026 Procurement

- Tiered Sourcing Strategy:

- Premium/Luxury Boxes: Source exclusively from Guangdong (prioritize Dongguan’s “Golden Packaging Valley” for ISO 15378-certified pharma boxes).

-

E-commerce/Volume Boxes: Dual-source from Zhejiang (Yiwu) for cost efficiency + Jiangsu for heavy-duty needs. Avoid Sichuan for export-bound orders due to limited customs clearance support.

-

Risk Mitigation:

- Guangdong: Monitor labor shortages (2026 projected gap: 85k skilled workers); require suppliers to show “green factory” certification under GB/T 36132-2026.

-

Zhejiang: Mandate on-site QC pre-shipment for orders >20k units; verify VOC compliance via SGS reports (post-2025 regulation spike in adhesive rejections).

-

Lead Time Optimization:

- Leverage Guangdong’s bonded logistics zones (e.g., Qianhai) for 72-hour customs clearance. For Zhejiang, book Ningbo port slots 21 days pre-production to avoid 10-day congestion delays.

2026 Outlook: Automation will narrow the Guangdong-Zhejiang cost gap by 4-7% as AI-driven die-cutting spreads. However, Guangdong’s design IP ecosystem (127 packaging R&D centers) will sustain its premium position for complex boxes.

Next Steps for Procurement Teams

✅ Conduct cluster-specific RFQs – Avoid blanket tenders; Guangdong suppliers reject low-margin volume bids.

✅ Verify certifications in real-time via China’s National Certification Committee (CNCA) portal – 23% of Zhejiang “FSC claims” were fraudulent in 2025.

✅ Engage SourcifyChina for cluster mapping – Our 2026 Supplier Intelligence Dashboard identifies 53 pre-vetted facilities by box type/compliance tier.

Data Sources: China Packaging Federation (2025), SourcifyChina Supplier Audit Database (Q4 2025), Global Trade Atlas, GB Standards 2025-2026 Updates.

Disclaimer: All pricing based on EXW terms; subject to +/-5% fluctuation on paper pulp index (Q1 2026).

SourcifyChina | Building Resilient Supply Chains Since 2012

[Contact Sourcing Team] | [Download 2026 Supplier Scorecard] | [Request Cluster-Specific RFQ Template]

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Box Manufacturers in China

Overview

Sourcing packaging solutions from Chinese box manufacturers offers cost-efficiency and scalability. However, achieving consistent quality and regulatory compliance requires a structured approach. This report outlines critical technical specifications, compliance standards, and quality control practices essential for procurement professionals engaging with Chinese suppliers.

1. Key Quality Parameters

Materials

| Material Type | Common Applications | Key Properties | Considerations |

|---|---|---|---|

| Corrugated Cardboard (Flute Types: B, C, E, BC) | Shipping, retail, e-commerce | High strength-to-weight ratio, recyclable | Flute type affects crush resistance and printability |

| Solid Bleached Sulfate (SBS) | Premium retail packaging | Smooth surface, excellent print finish | Ideal for high-end cosmetics, pharmaceuticals |

| Folding Carton Board | Consumer goods, food packaging | Lightweight, customizable | Requires moisture barrier coatings for food use |

| Kraft Paperboard | Eco-friendly packaging, food service | Biodegradable, high tear resistance | Limited print resolution vs. SBS |

| Rigid Set-Up Boxes (Greyboard + Paper Wrap) | Luxury goods, electronics | Durable, premium feel | Higher cost, longer lead times |

Tolerances

| Dimension | Standard Tolerance | Critical for |

|---|---|---|

| Length/Width | ±1–2 mm | Fit into automated packing lines |

| Height | ±1.5 mm | Stacking stability |

| Die-Cut Registration | ±0.5 mm | Branding accuracy, window cutouts |

| Fold Line Accuracy | ±1 mm | Smooth assembly, structural integrity |

| Print Alignment | ±0.3 mm | High-end retail appearance |

| Glue Application | ±10% coverage deviation | Seal integrity, avoiding leaks |

2. Essential Certifications

Procurement managers must verify that Chinese box manufacturers hold the following certifications to ensure compliance with international markets:

| Certification | Scope | Relevance |

|---|---|---|

| ISO 9001:2015 | Quality Management Systems | Ensures consistent manufacturing processes and defect control |

| FSC / PEFC | Sustainable Forest Sourcing | Required for eco-conscious brands and EU market access |

| FDA Compliance (21 CFR) | Food Contact Materials | Mandatory for food-grade packaging (e.g., paperboard, inks) |

| CE Marking (if applicable) | EU Safety Standards | Required if box contains electrical components (e.g., smart packaging) |

| UL Certification | Fire Resistance & Safety | Critical for packaging electronics or hazardous materials |

| BRCGS Packaging Standard | Food Safety Packaging | Widely accepted in EU/UK retail supply chains |

| SGS / Intertek Testing Reports | Independent Quality Verification | Validates material safety, strength, and compliance |

Note: Always request up-to-date, factory-specific certificates—not generic company-level documents.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Misaligned Printing | Poor plate registration, worn printing cylinders | Conduct pre-production press checks; require digital proofing and G7 certification |

| Crushing or Collapse Under Load | Incorrect flute selection, poor adhesive bonding | Perform ECT (Edge Crush Test) and BCT (Box Compression Test) reports; specify load requirements |

| Warped or Bent Boxes | Moisture exposure during storage or transport | Use moisture-resistant coatings; control humidity in storage areas; specify RH < 60% |

| Inconsistent Gluing (Open Seams) | Inadequate glue application or curing | Audit glue line thickness and dwell time; require hot-melt adhesive specs |

| Die-Cut Misregistration | Poor die maintenance or setup | Inspect tooling monthly; require first-article inspection (FAI) for new runs |

| Color Variation Between Batches | Ink formulation drift or substrate inconsistency | Enforce Pantone color matching; require spectrophotometer reports |

| Surface Scuffing or Marking | Rough handling or improper stacking | Specify protective liners; implement handling SOPs in factory |

| Non-Compliant Materials (e.g., toxic inks) | Use of unapproved chemicals | Require full material disclosure (SDS) and third-party testing (e.g., REACH, RoHS) |

Recommendations for Procurement Managers

- Conduct Factory Audits: Use third-party inspection firms (e.g., SGS, Bureau Veritas) to verify certifications and production controls.

- Enforce Pre-Shipment Inspections (PSI): Implement AQL 2.5/4.0 standards for every shipment.

- Require Documentation: Demand material test reports, production batch logs, and compliance certificates with each order.

- Build Quality into Contracts: Specify tolerances, testing protocols, and defect liability clauses.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SOURCIFYCHINA B2B SOURCING REPORT: CHINA BOX MANUFACTURING LANDSCAPE

2026 Strategic Guide for Global Procurement Managers

Prepared by Senior Sourcing Consultants | Q1 2026 Update | FOB China Pricing

Executive Summary

China remains the dominant global hub for cost-competitive box manufacturing, with corrugated, rigid, and folding carton segments accounting for 89% of export volume (2025 China Packaging Association data). While labor costs have risen 9.2% CAGR since 2022, automation adoption (now at 47% among Tier-2/3 suppliers) has stabilized per-unit costs for MOQs ≥1,000 units. Critical differentiators for 2026: sustainability compliance premiums (+8-12% vs. non-certified) and AI-driven prototyping reducing tooling lead times by 30%. This report provides actionable cost intelligence for OEM/ODM engagement.

White Label vs. Private Label: Strategic Comparison

Key distinction: Control over design/IP vs. speed-to-market

| Criteria | White Label | Private Label | 2026 Procurement Impact |

|---|---|---|---|

| Definition | Pre-designed boxes; buyer applies branding | Buyer owns full design/IP; manufacturer executes | Private label demand ↑ 22% YoY (SourcifyChina 2025 Survey) |

| MOQ Flexibility | Low (fixed SKUs; min. 500-1,000 units) | High (custom tooling; min. 1,500-3,000 units) | Tier-1 suppliers now offer 10% lower MOQs for recycled material commitments |

| Lead Time | 7-15 days (stock models) | 25-45 days (custom tooling) | AI prototyping cuts 10-14 days from PL timelines |

| Cost Premium | Base cost only | +18-25% (design/tooling) | Tooling amortization now feasible at 1,500+ units |

| Quality Control | Buyer inspects final product only | Full process oversight required | PL buyers using 3rd-party QC see 37% fewer defects |

| Best For | Urgent replenishment; low-risk SKUs | Brand differentiation; premium segments | Recommendation: Use WL for test markets; PL for core SKUs |

💡 SourcifyChina Insight: 68% of failed PL engagements stem from undefined tolerance specifications (e.g., GSM variance >5%). Always mandate ISO 15359-1:2023 standards in contracts.

Manufacturing Cost Breakdown (Per Unit | Corrugated Box Example)

Assumptions: 350x250x150mm, 350gsm B-flute, 1C/0 print, FOB Ningbo

| Cost Component | Description | Cost Range (USD) | 2026 Trend |

|---|---|---|---|

| Materials | Kraft paper (70% recycled), inks, adhesives | $0.28 – $0.42 | ↑ 4.1% (pulp prices + sustainability certs) |

| Labor | Cutting, folding, gluing, QC | $0.15 – $0.21 | ↓ 2.3% (automation offsetting wage hikes) |

| Packaging | Bulk cartons + palletizing (no inserts) | $0.03 – $0.05 | ↑ 6.8% (wood pallet tariffs) |

| Tooling | Die-cut molds (amortized per unit) | $0.00 – $0.18 | One-time cost ($180-$350); critical for PL |

| Compliance | FSC/PEFC, ISO 22000, VOC testing | $0.02 – $0.07 | Mandatory for EU/US; +11% adoption since 2024 |

| TOTAL BASE COST | $0.48 – $0.93 |

⚠️ Critical Note: Packaging here refers to export packaging (not retail-ready). Adding branded inserts increases cost by $0.10-$0.25/unit.

Estimated Price Tiers by MOQ (USD Per Unit | FOB China)

Corrugated Shipping Box (350x250x150mm) | Q1 2026 Market Rate | All-inclusive (Materials + Labor + Export Packaging)

| MOQ | White Label | Private Label | Delta vs. WL | Key Cost Drivers |

|---|---|---|---|---|

| 500 units | $0.89 – $1.15 | Not feasible | — | High material waste; manual setup; no tooling spread |

| 1,000 units | $0.72 – $0.93 | $0.85 – $1.10 | +15-18% | Tooling cost absorbed; semi-automated lines |

| 5,000 units | $0.55 – $0.68 | $0.62 – $0.75 | +10-12% | Full automation; recycled material bulk discounts |

Footnotes:

- White Label assumes standard design from supplier catalog (e.g., plain brown box).

- Private Label includes one-time tooling ($220 avg.) amortized over MOQ.

- Prices exclude: Shipping, import duties, 3rd-party QC (adds $0.03-$0.08/unit).

- 2026 Premiums: FDA-compliant food boxes (+$0.12/unit); custom embossing (+$0.18/unit).

- Source: SourcifyChina Supplier Benchmark (127 Tier-2/3 factories; Jan 2026)

2026 Strategic Recommendations

- Leverage Hybrid Sourcing: Use white label for 30% of volume (test markets) + private label for core SKUs to balance cost/risk.

- Demand Automation Proof: Require video evidence of robotic gluing/folding (reduces labor cost volatility by 22%).

- Negotiate Sustainability Clauses: Lock 12-month recycled material pricing by committing to 3+ year contracts.

- Avoid Q4 Production: December capacity constraints inflate costs 14-19% (per SourcifyChina Logistics Index).

- Audit Tooling Ownership: Ensure contracts specify buyer retains die-cut molds after MOQ fulfillment.

“In 2026, the cost gap between white and private label narrows below 10% at 5,000+ units. Procurement leaders must prioritize supply chain resilience over marginal unit savings.”

— SourcifyChina 2026 Packaging Sourcing Outlook

SOURCIFYCHINA DISCLAIMER: Pricing reflects Q1 2026 spot market rates. Actual quotes vary by material specs, compliance requirements, and factory location. All data validated via SourcifyChina’s proprietary SupplierScore™ platform.

© 2026 SourcifyChina. Confidential for client use only. Not for redistribution.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Sourcing Box Manufacturers in China – Verification, Differentiation, and Risk Mitigation

Executive Summary

As global demand for packaging solutions rises, sourcing box manufacturers in China remains a strategic priority for cost efficiency and scalability. However, the Chinese manufacturing landscape includes a mix of genuine factories, trading companies, and intermediaries—some with limited transparency. This report outlines critical steps to verify manufacturers, differentiate between trading companies and actual factories, and identify red flags to ensure supply chain integrity and operational reliability.

Critical Steps to Verify a Box Manufacturer in China

| Step | Action | Purpose |

|---|---|---|

| 1. Request Business License & Registration | Obtain a copy of the company’s official business license (e.g., Business License with Unified Social Credit Code). Verify via China’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn). | Confirms legal registration and operational legitimacy. |

| 2. Conduct On-Site Factory Audit | Schedule an in-person or third-party audit (e.g., via TÜV, SGS, or SourcifyChina). Validate production lines, equipment, workforce, and safety standards. | Eliminates “ghost factories” and verifies real production capacity. |

| 3. Review Export History & Client References | Request 3–5 verifiable export references, preferably from your region. Cross-check delivery timelines, quality compliance, and after-sales support. | Validates experience and reliability in international trade. |

| 4. Audit Production Capabilities | Assess machinery (e.g., die-cutters, flexographic printers, folder-gluers), material sourcing, and R&D capacity for custom designs. | Ensures technical alignment with your product requirements. |

| 5. Verify Certifications | Confirm ISO 9001 (quality), ISO 14001 (environmental), FSC/PEFC (sustainable forestry), and any industry-specific standards (e.g., FDA for food packaging). | Ensures compliance with global regulatory and sustainability standards. |

| 6. Sample Evaluation & QA Process Review | Request physical samples with your specifications. Inspect material thickness, print quality, structural integrity, and packaging. Review their QC protocols. | Validates production quality and consistency. |

| 7. Assess Financial Stability | Use third-party platforms (e.g., Dun & Bradstreet, Alibaba’s Trade Assurance) to assess financial health and creditworthiness. | Reduces risk of supplier insolvency or abrupt closure. |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Trading Company | Actual Factory |

|---|---|---|

| Business License Scope | Lists “import/export,” “trading,” or “commercial agency” as primary activities. | Includes “manufacturing,” “production,” or “processing” in scope. |

| Facility Ownership | No production floor; offices only. May claim “partner factories.” | Owns physical production space with machinery, raw material storage, and QC labs. |

| Pricing Structure | Higher MOQs and unit prices due to markup. Less flexibility on cost. | Lower unit costs, especially at scale. More direct control over pricing. |

| Communication & Technical Detail | Limited technical knowledge. Delays in answering production-specific queries. | Engineers/production managers available for direct discussions on specs, tolerances, and process optimization. |

| Lead Time Transparency | Vague or inconsistent production timelines. Dependent on third-party factories. | Clear, itemized lead times (e.g., 15 days for tooling, 7 days for production). |

| Customization Capability | Limited ability to modify molds, sizes, or structural designs. | Offers mold-making, prototyping, and design engineering support. |

| Export Documentation | May lack direct export rights or show different entity on shipping docs. | Holds its own export license; appears as manufacturer on B/L and COO. |

Pro Tip: Use 企查查 (Qichacha) or 天眼查 (Tianyancha) to trace corporate ownership. Factories often show machinery assets and employee counts; trading companies show minimal fixed assets.

Red Flags to Avoid When Sourcing Box Manufacturers in China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to Conduct Video Audit or On-Site Visit | High probability of being a trading company or non-operational entity. | Require live video walkthrough of production floor during operating hours. |

| No Physical Address or Vague Location | Indicates a shell company or virtual office. | Verify address via Google Earth, Baidu Maps, or third-party inspection. |

| Pressure for Upfront Full Payment | Common in scams; lack of financial stability or trust. | Insist on secure payment terms (e.g., 30% deposit, 70% against BL copy). |

| Inconsistent or Poor-Quality Samples | Reflects subpar production standards. | Request multiple samples and conduct third-party lab testing. |

| No Direct Contact with Production Team | Trading companies often act as gatekeepers. | Request direct communication with factory manager or engineer. |

| Overly Low Pricing | May indicate inferior materials, labor exploitation, or hidden costs. | Benchmark against industry averages; request material specifications. |

| Lack of Certifications or Refusal to Share | Regulatory and compliance risks. | Make certifications a contractual requirement. |

| Generic or Stock Photos on Website | Suggests a non-factory entity using template content. | Request original, timestamped photos of their facility and machinery. |

Best Practices for Long-Term Supplier Success

- Start with a Pilot Order: Test reliability with a small batch before scaling.

- Use Escrow or Trade Assurance Platforms: Leverage Alibaba Trade Assurance or Letter of Credit (L/C) for payment security.

- Establish SLAs and KPIs: Define quality tolerance, delivery windows, and penalties for non-compliance.

- Engage a Local Sourcing Agent: A reputable agent (e.g., SourcifyChina) can verify suppliers, manage QC, and resolve disputes.

- Build Relationship with On-Ground Visits: Annual visits strengthen trust and alignment.

Conclusion

Sourcing box manufacturers in China offers significant cost and scale advantages, but due diligence is non-negotiable. By systematically verifying legitimacy, distinguishing factories from traders, and avoiding common red flags, procurement managers can build resilient, transparent, and high-performing supply chains. In 2026, the competitive edge lies not in lowest cost—but in verified quality, compliance, and partnership longevity.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Global Supply Chain Integrity & Manufacturer Verification

Contact: [email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina Verified Pro List: Strategic Sourcing Report 2026

Prepared Exclusively for Global Procurement Leaders

The Critical Challenge: Time-to-Supplier in Chinese Box Manufacturing

Global procurement teams lose 150+ hours annually vetting unverified Chinese box manufacturers. Unvetted suppliers lead to:

– 42% failure rate in initial quality audits (2025 SourcifyChina Supply Chain Survey)

– 22-day average delays resolving compliance gaps (ISO, FSC, FDA)

– $18,500+ hidden costs per failed supplier engagement (logistics, rework, penalties)

Why SourcifyChina’s Verified Pro List Solves This

Our AI-validated supplier ecosystem eliminates guesswork for box manufacturers China. Here’s how we compress your sourcing cycle:

| Traditional Sourcing Process | SourcifyChina Verified Pro List | Time Saved |

|---|---|---|

| 30+ days screening suppliers via Alibaba/Google | Instant access to 87 pre-qualified box specialists | 28 days |

| Manual verification of business licenses, export history, and certifications | Real-time digital compliance dossier (MOQ, lead times, audit reports) | 120+ hours |

| 3-5 RFQ rounds to find viable partners | 1-click RFQ to 5+ pre-negotiated suppliers meeting your specs | 65% fewer RFQs |

| Post-shipment quality disputes (avg. 17% defect rate) | Guaranteed <3% defect rate via SourcifyChina Quality Shield™ | $22K/shipment |

Key Advantages Embedded in the Pro List:

✅ Zero-Vetting Entry: All suppliers pass 12-point verification (financial stability, export capacity, ethical compliance).

✅ Dynamic Capability Matching: Filter by exact needs (e.g., “recycled kraft mailer boxes,” “FDA-compliant food packaging,” MOQ <5K units).

✅ Risk-Managed Transitions: Dedicated SourcifyChina QC teams embedded at supplier facilities.

Your Strategic Imperative: Stop Auditing, Start Sourcing

In 2026’s volatile supply chain landscape, time is your scarcest resource. Every week spent on supplier validation:

– Delays product launches by 14+ days

– Increases exposure to tariff volatility

– Erodes margin through expedited logistics costs

The SourcifyChina Pro List isn’t a directory—it’s your force multiplier. We absorb the operational risk so your team focuses on strategic value: cost engineering, innovation, and supplier relationship management.

Call to Action: Secure Your Verified Supplier Pipeline in <72 Hours

Why wait 30 days to solve a 30-minute problem?

→ Email Support: [email protected] with subject line “PRO LIST ACCESS: [Your Company] + Box Requirements”

→ WhatsApp Priority Channel: +86 159 5127 6160 (Scan QR below for instant connection)

Within 24 hours, you’ll receive:

1. Customized Pro List matching your box specifications (material, size, compliance)

2. 3 Risk-Free Quotes from pre-vetted manufacturers

3. ROI Analysis projecting time/cost savings for your next sourcing cycle

“SourcifyChina cut our box supplier onboarding from 42 days to 9. Their Pro List is the single highest-ROI tool in our 2026 toolkit.”

— Global Procurement Director, Fortune 500 Retailer

Act Now—Your 2026 Sourcing Targets Demand It.

Contact us today to transform supplier risk into strategic advantage.

SourcifyChina | Verified Sourcing, Zero Surprises

© 2026 SourcifyChina. All data sourced from verified client engagements (Q4 2025).

Confidentiality Notice: This report contains proprietary SourcifyChina methodology. Unauthorized distribution prohibited.

🧮 Landed Cost Calculator

Estimate your total import cost from China.