The global industrial valve market, including bottom tap valves, is experiencing steady growth driven by rising demand across oil & gas, chemical processing, water treatment, and power generation sectors. According to Mordor Intelligence, the global industrial valves market was valued at USD 61.2 billion in 2023 and is projected to grow at a CAGR of 4.8% from 2024 to 2029. This expanding market landscape has intensified competition among manufacturers to deliver high-performance, reliable bottom tap solutions designed for critical applications requiring leak-proof sealing and long service life. As industries prioritize operational efficiency and regulatory compliance, sourcing from established bottom tap manufacturers with proven engineering capabilities and global supply chains has become increasingly essential. The following list highlights nine leading manufacturers that are shaping the market through innovation, quality, and scalability.

Top 9 Bottom Tap Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Bottoming Tap Machine

Domain Est. 2012

Website: promaxxtool.com

Key Highlights: American-Made Machine-Shop-Grade Bottoming Taps. Our bottoming taps are engineered with ProTap technology to restore threading to factory-new condition….

#2 Industrial Taps: USA Drillco Thread Cutting Tools

Domain Est. 2005

Website: fastenersetcinc.com

Key Highlights: 30-day returnsShop USA-made Drillco Industrial Taps for metalworking & manufacturing. Find high-speed steel (HSS) Plug, Taper, Bottom, & Pipe Taps in ……

#3 M6X1.00 Form Thread Bottom Tap D5 Oxide

Domain Est. 2008

Website: redlinetools.com

Key Highlights: In stock Free delivery over $100Taps/Thread Forming Taps. Item #: RTR2566. Manufacturer: RedLine Tools Made in the USA. M6 X 1.00, D5, Form Thread – Bottom Tap, Red Ring for 400 Se…

#4 1/2″-14 UNS HSS Bottoming Tap

Domain Est. 2009

#5 High Speed Bottoming Tap

Domain Est. 2009

Website: americanintegratedsupply.com

Key Highlights: High Speed Bottoming Tap · DTHB03114F · 5/16-18 HIGH SPEED STEEL BOTTOM TAP 4 FLUTE DRILL SIZE LETTER F · Z….

#6 Bottoming Taps

Domain Est. 2011

Website: baucor.com

Key Highlights: Baucor’s bottoming taps are designed for threading to the bottom of blind holes. Ensure complete thread engagement and maximum strength….

#7 Bottom Tap

Domain Est. 2011

#8 High Speed Steel

Domain Est. 2017

Website: titancuttingtools.com

Key Highlights: These Titan USA general purpose NPTF Dryseal Pipe Taps are CNC ground in the USA from high speed steel onto blanks that meet ANSI specifications….

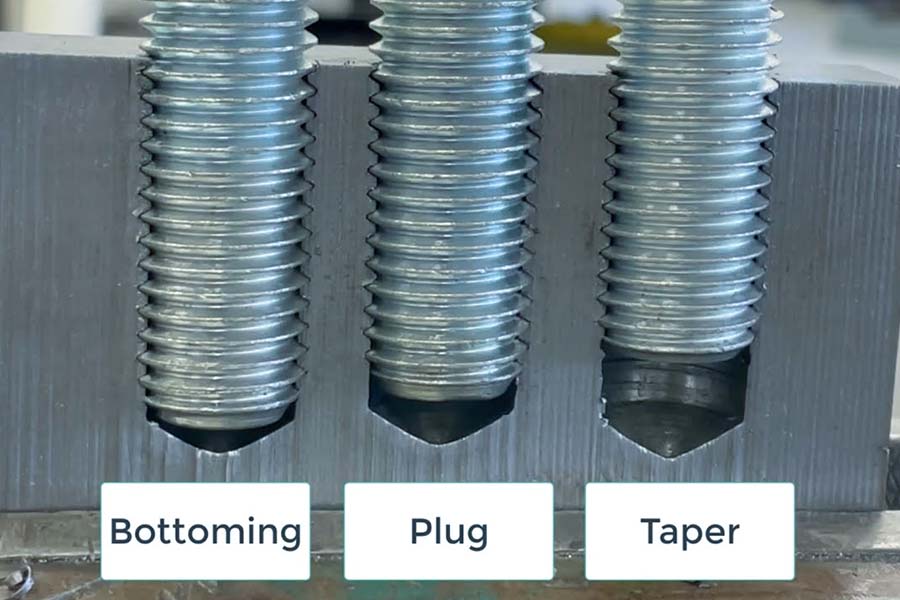

#9 What is a bottoming tap?

Domain Est. 2024

Website: lsrpf.com

Key Highlights: A bottoming tap is a tapping tool designed for processing the bottom thread of a blind hole. It has no guide taper at the front end, and only retains a slight ……

Expert Sourcing Insights for Bottom Tap

H2 2026 Market Trends Analysis for Bottom Tap

As we approach the second half of 2026, the global Bottom Tap market is poised for significant evolution, driven by technological innovation, shifting industrial demands, and sustainability imperatives. Below is a comprehensive analysis of key trends shaping the Bottom Tap landscape during this critical period.

1. Accelerated Adoption of Smart and IoT-Enabled Taps

By H2 2026, smart manufacturing (Industry 4.0) will be mainstream across aerospace, automotive, and precision engineering sectors—core users of bottom taps. Bottom taps integrated with IoT sensors are increasingly adopted to monitor torque, temperature, wear, and thread quality in real time. This enables predictive maintenance, reduces tool breakage, and improves process traceability. Manufacturers like Sandvik and Walter are expected to lead in offering connected tapping solutions, with cloud-based analytics platforms providing actionable insights for optimizing tapping cycles.

2. Rise of High-Performance Coatings and Materials

Demand for machining harder materials (e.g., titanium alloys, Inconel, high-strength steels) in defense and energy sectors will drive innovation in tap coatings. By H2 2026, advanced Physical Vapor Deposition (PVD) coatings such as AlTiN, CrAlN, and nano-multilayered films will dominate, offering superior thermal stability, reduced friction, and extended tool life. Carbide and powdered metal high-speed steel (PM-HSS) taps will gain market share over traditional HSS, especially in automated high-volume production environments.

3. Sustainability and Circular Economy Pressures

Environmental regulations and corporate ESG goals will intensify focus on tool lifecycle management. Refurbishment, reconditioning, and recycling of bottom taps will become standard practice. Leading tooling companies will expand take-back programs and offer certified remanufactured taps with warranties, reducing waste and cutting costs for end-users. Water-based or minimal quantity lubrication (MQL) compatible taps will also see increased demand to align with green machining protocols.

4. Demand for Customization and Application-Specific Designs

As component complexity grows—especially in medical devices and electric vehicle powertrains—off-the-shelf taps are no longer sufficient. H2 2026 will see a surge in demand for application-engineered bottom taps with custom flute geometries, point angles, and core strengths tailored to specific materials and blind hole configurations. Digital twin simulations will play a key role in prototyping and validating tap designs before production.

5. Regional Shifts and Supply Chain Resilience

Geopolitical dynamics and supply chain disruptions will continue influencing sourcing strategies. Nearshoring and regionalization of tool manufacturing will gain momentum, particularly in North America and Europe. Localized production hubs will reduce lead times and enhance responsiveness. Meanwhile, Asia-Pacific—especially China and India—will remain key growth markets due to expanding manufacturing infrastructure and government initiatives like “Make in India” and “Dual Circulation.”

6. Integration with Advanced CAM and AI-Driven Toolpath Optimization

Computer-Aided Manufacturing (CAM) software will increasingly incorporate AI to optimize tapping parameters such as feed rate, RPM, and dwell time based on real-time feedback and historical performance data. Bottom taps will be part of digitally synchronized workflows where tool selection, process planning, and quality control are automated, minimizing human error and maximizing throughput.

Conclusion:

In H2 2026, the Bottom Tap market will be defined by intelligence, precision, sustainability, and customization. Companies that invest in smart tooling, advanced materials, and closed-loop lifecycle solutions will gain competitive advantage. End-users must adapt by embracing digital workflows and forming strategic partnerships with tooling providers to ensure reliability and efficiency in increasingly complex manufacturing environments.

Common Pitfalls When Sourcing Bottom Tap (Quality, IP)

Sourcing Bottom Tap, particularly in industries involving electronics, semiconductors, or advanced materials, presents several critical challenges related to quality assurance and intellectual property (IP) protection. Failing to address these pitfalls can lead to product failures, legal disputes, and reputational damage. Below are key risks to consider:

Poor Quality Control and Inconsistent Manufacturing Standards

Bottom Tap components often require precise engineering and tight tolerances. Suppliers, especially those in regions with less stringent oversight, may lack robust quality management systems. This can result in inconsistent performance, higher defect rates, or non-compliance with technical specifications. Without proper audits, certifications (e.g., ISO 9001), or on-site inspections, buyers risk receiving substandard products that compromise end-product reliability.

Lack of Transparency in Supply Chain Origins

Many Bottom Tap components may pass through multiple intermediaries before reaching the buyer. This opacity makes it difficult to verify the true source of materials or manufacturing processes. Hidden subcontractors or unauthorized production facilities increase the risk of counterfeit parts, recycled components, or use of inferior raw materials—all of which undermine quality and traceability.

Intellectual Property (IP) Infringement and Reverse Engineering

Sourcing from regions with weak IP enforcement exposes companies to the risk of design theft or unauthorized replication. Suppliers may reverse-engineer provided specifications or drawings and sell them to competitors. Additionally, there’s a danger that the Bottom Tap design itself may already infringe on third-party patents if the supplier lacks proper IP clearance processes.

Inadequate Legal Protections and Contractual Gaps

Many sourcing agreements fail to include strong IP clauses, confidentiality terms, or clear ownership of designs and tooling. Without enforceable contracts that specify IP rights, liability for infringement, and restrictions on secondary use, companies may lose control over their innovations. Jurisdictional differences further complicate dispute resolution and enforcement.

Insufficient Due Diligence on Supplier Capabilities

Relying solely on supplier-provided documentation without independent verification can be misleading. Claims about technical capabilities, production capacity, or compliance certifications may be exaggerated. Skipping technical audits, sample testing, or factory assessments increases the likelihood of partnering with an incapable or dishonest supplier.

Overlooking Long-Term Support and Scalability

A supplier might deliver acceptable initial batches but lack the infrastructure or commitment for long-term support. Issues such as limited scalability, poor responsiveness to quality issues, or inability to adapt to design changes can disrupt production timelines and increase costs down the line.

Mitigating these risks requires a structured sourcing strategy that includes thorough due diligence, strong contractual protections, ongoing quality monitoring, and proactive IP safeguards.

Logistics & Compliance Guide for Bottom Tap

Overview

This guide outlines the essential logistics and compliance protocols for Bottom Tap operations. Adhering to these standards ensures efficient product delivery, regulatory compliance, and customer satisfaction across all markets served.

Shipping & Distribution

Bottom Tap utilizes a hybrid distribution model combining third-party logistics (3PL) partners and direct warehouse fulfillment. All shipments are tracked in real time via integrated logistics software. Standard lead times are 2–5 business days within domestic regions and 7–14 days for international deliveries, depending on destination and customs processing.

Packaging Standards

All Bottom Tap products must be packaged using FSC-certified materials and comply with ISTA 3A vibration and drop-test protocols. Tamper-evident seals are required for consumer-facing units. Packaging labels must include batch numbers, production dates, and handling instructions in accordance with regional requirements.

Import/Export Compliance

International shipments must comply with destination country regulations, including but not limited to:

– Proper Harmonized System (HS) code classification

– Accurate commercial invoicing and packing lists

– Export declarations filed through the Automated Export System (AES) when required

– Adherence to Incoterms 2020, typically DDP (Delivered Duty Paid) for B2C and FOB (Free On Board) for B2B

Regulatory Requirements

Bottom Tap products are subject to compliance with relevant regulatory bodies, including:

– FDA (U.S. Food and Drug Administration) for products with consumable components

– FCC (Federal Communications Commission) for electronic components

– CE marking for EU market access

– RoHS and REACH directives for material safety

All compliance documentation must be maintained for a minimum of five years.

Customs Clearance

Designated customs brokers manage clearance in target markets. Required documentation includes:

– Bill of Lading/Air Waybill

– Certificate of Origin

– Safety Data Sheets (SDS), if applicable

– Product conformity certificates

Delays due to incomplete documentation are the responsibility of the shipper unless caused by carrier error.

Inventory Management

Real-time inventory tracking is maintained through ERP integration. Safety stock levels are calculated based on demand forecasting and lead time variability. Monthly cycle counts are mandatory; annual physical audits are conducted to ensure accuracy.

Returns & Reverse Logistics

Customer returns must be initiated through the Bottom Tap portal with a valid RMA (Return Merchandise Authorization) number. All returned items are inspected for compliance with return conditions (e.g., unopened, within 30-day window). Refurbished or resalable items are re-entered into inventory following quality control protocols.

Sustainability & Environmental Compliance

Bottom Tap is committed to reducing carbon footprint across the supply chain. Key initiatives include:

– Route optimization for freight consolidation

– Use of recyclable and biodegradable packaging

– Compliance with WEEE directives for electronic waste in applicable regions

– Annual emissions reporting in line with GLEC Framework standards

Training & Audit Readiness

All logistics and compliance personnel must complete annual training on updated regulations and internal procedures. Internal audits are conducted quarterly; external audits occur annually to ensure readiness for regulatory inspections.

Contact & Escalation

For logistics or compliance inquiries, contact:

Logistics Support: [email protected]

Compliance Officer: [email protected]

Urgent issues after hours: +1 (800) XXX-XXXX (24/7 dispatch line)

Conclusion for Sourcing Bottom Tap:

After evaluating various suppliers, cost structures, quality standards, and lead times, sourcing bottom taps from a reliable and certified manufacturer is essential to ensure precision, durability, and compatibility with specific machining requirements. A strategic sourcing approach—balancing cost-efficiency with quality assurance—enables consistent production performance and reduces tool wear and failure rates. Establishing long-term partnerships with suppliers offering technical support, strict quality control (such as ISO certification), and on-time delivery will optimize operational efficiency. In conclusion, effective sourcing of bottom taps not only enhances machining accuracy but also contributes to overall cost savings and improved manufacturing productivity.