Introduction: Navigating the Global Market for Bottle Labeling Equipment

A single misaligned label can delay go-to-market by weeks, erode shelf appeal, and trigger costly recalls. For North American and European brands scaling across multiple territories, choosing the right bottle labeling equipment is a strategic decision that directly affects throughput, compliance, and profit margins.

Why This Guide?

- Global complexity: FDA, EMA, and EU MDR demand precise label placement, language conformity, and traceability codes.

- Operational pressure: Speed, uptime, and total cost of ownership differ sharply between semi-automatic tabletop units and high-speed rotary systems.

- Rapid product variation: From 30 mm vials to 120 mm square bottles, formats evolve faster than machinery can be re-engineered in-house.

What You’ll Find Inside

- A concise comparison of the leading labeling technologies—tamp-belt, pressure-sensitive, and wrap-around—ranked by throughput, container tolerance, and upgrade paths.

- A regulatory checklist that maps each technology to FDA 21 CFR Part 11, EU MDR, and UKCA requirements.

- A procurement framework to evaluate ROI across three common roll-out scenarios: US domestic, EU multi-country, and global export.

- A vendor scorecard template to judge suppliers on lead time, service proximity, and spare-part availability before purchase orders are signed.

Use this guide as a decision filter. Skip assumptions, compare apples to apples, and deploy labeling equipment that scales with your product pipeline—not against it.

Article Navigation

- Top 10 Bottle Labeling Equipment Manufacturers & Suppliers List

- Introduction: Navigating the Global Market for bottle labeling equipment

- Understanding bottle labeling equipment Types and Variations

- Key Industrial Applications of bottle labeling equipment

- 3 Common User Pain Points for ‘bottle labeling equipment’ & Their Solutions

- Strategic Material Selection Guide for bottle labeling equipment

- In-depth Look: Manufacturing Processes and Quality Assurance for bottle labeling equipment

- Practical Sourcing Guide: A Step-by-Step Checklist for ‘bottle labeling equipment’

- Comprehensive Cost and Pricing Analysis for bottle labeling equipment Sourcing

- Alternatives Analysis: Comparing bottle labeling equipment With Other Solutions

- Essential Technical Properties and Trade Terminology for bottle labeling equipment

- Navigating Market Dynamics and Sourcing Trends in the bottle labeling equipment Sector

- Frequently Asked Questions (FAQs) for B2B Buyers of bottle labeling equipment

- Strategic Sourcing Conclusion and Outlook for bottle labeling equipment

- Important Disclaimer & Terms of Use

Top 10 Bottle Labeling Equipment Manufacturers & Suppliers List

1. Top 6 Bottle Labeling Machine Manufacturers – LIENM

Domain: lienm.com

Registered: 2012 (13 years)

Introduction: Find the best Bottle Labeling Machine companies to improve your cosmetic production line, reduce errors, and scale efficiently in 2025….

Illustrative Image (Source: Google Search)

2. Top 10 Bottle Labeling Machine Manufacturer

Domain: viallabeller.com

Registered: 2024 (1 years)

Introduction: Top 10 Bottle Labeling Machine Manufacturer · Viallabeller · HERMA · NJM Packaging · Newman Labelling Systems · Gernep · Collamat · Sri Sai Pack….

3. Labelers, Labeling Machines – Cru Bottling Systems

Domain: crusystems.com

Registered: 2016 (9 years)

Introduction: 30-day returnsBrowse our comprehensive range of labelers and labeling machines designed to meet diverse industry needs. With advanced technology and precision engineering….

4. Labeling Machines & Label Applicators – Primera Technology

Domain: primera.com

Registered: 1997 (28 years)

Introduction: Free delivery · Free 30-day returnsApply labels fast and accurately with Primera’s labeling machines and label applicators. Perfect for labeling bottles, boxes, bags, lids and more….

5. Tronics America

Domain: tronics.us

Registered: 2024 (1 years)

Introduction: Tronics is a leading manufacturer and supplier of labelling and coding solutions across multiple industries in Australia and around the world….

Illustrative Image (Source: Google Search)

6. Bottle Labeling Machine – Paxiom Group

Domain: paxiom.com

Registered: 1998 (27 years)

Introduction: Our Paxiom labeling machines for bottles, containers, and jars are the following: Bottle Wrap Around & Top Cap Labeler. Engineered as a 2-in-1 labeling machine, ……

7. Commercial Bottle Labeler Machines

Domain: quadrel.com

Registered: 1996 (29 years)

Introduction: Commercial Bottle Labeler Machines Sale: Auto label any bottle with our automated labeling solutions. Free Quote, Great Price, We Ship….

8. $449 • Packaging Systems • Fillers • Cappers & Labeling Machines

Understanding bottle labeling equipment Types and Variations

Understanding Bottle Labeling Equipment: Types and Variations

For production and packaging managers evaluating labeling systems, selecting the correct machine type directly impacts throughput, label placement accuracy, and total cost of ownership. Below are the five most common bottle labeling equipment categories, their core capabilities, and trade-offs.

1. Semi-Automatic Label Applicators

| Feature | Typical Configuration | Primary Applications | Key Pros / Cons |

|---|---|---|---|

| Manual container handling plus powered label pickup/apply cycle | Foot pedal or conveyorized infeed | Small-batch cosmetics, specialty beverages, craft breweries | • Low initial investment • Quick changeover between SKUs • Requires operator attention; limited to 1–2 labels/sec |

Details

Semi-automatic units combine a label dispensing head with a powered platen wheel or vacuum pickup. The operator or a modest conveyor positions each bottle; a footswitch triggers the label application. Cycle speeds range from 600–1,500 bottles per hour, making them ideal for short runs where frequent format changes are common.

Investment range: $1,200–$2,500 USD.

Key considerations:

– Container diameter tolerance of ±2 mm

– Label liner must be Peel-Apart (non-perforated) for consistent feed

– Integration ports for external PLC or vision system are available on newer models

2. Automatic In-Line Label Applicators

| Feature | Typical Configuration | Primary Applications | Key Pros / Cons |

|---|---|---|---|

| Continuous conveyor + servo-driven label drum | High-speed beverage, pharmaceutical, food & beverage | • 30,000+ containers/hr • 360° wrap, front/back, or tamper-evident labeling |

• High throughput • Consistent placement • Requires dedicated floor space and utilities |

Details

Automatic in-line systems employ a continuous motion conveyor feeding into a rotary label drum or blow-on / tamp-on head. Integrated SERVO drives allow real-time compensation for varying container speeds and diameters. Many models accept dual labels (front & back) or wrap-around sleeves in a single pass.

Investment range: $15,000–$75,000 USD.

Key considerations:

– Line height must match conveyor centerline (usually 34–40 in / 864–1,016 mm)

– Space requirement: 8–15 ft (2.4–4.6 m) of straight line + transfer section

– Compressed air supply (6–8 bar) often required for blow-on variants

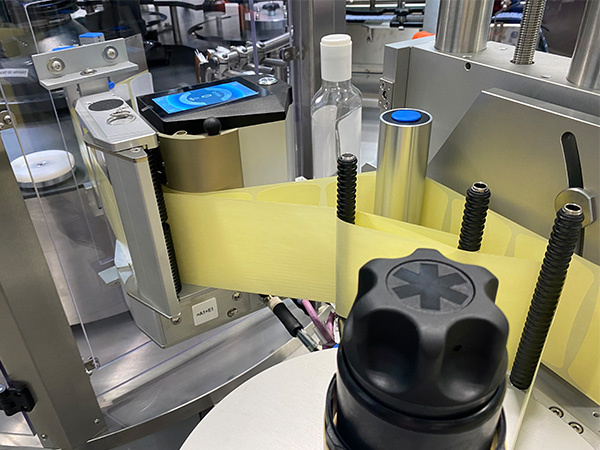

Illustrative Image (Source: Google Search)

3. Pressure-Sensitive (PS) Labelers with Peel-Plate

| Feature | Typical Configuration | Primary Applications | Key Pros / Cons |

|---|---|---|---|

| Static or powered rollers feed labels over a peel plate | Food & beverage, nutraceuticals | • High-speed Peel-Plate application • 360° wrap and top/bottom labeling |

• Fastest label application (up to 500 m/min) • No adhesive cure time • Higher label material cost vs. heat transfer |

Details

PS labelers use a driven pickup roll to pull the liner while the label is peeled off a fixed plate. The bottle contacts the label as it exits the plate, creating instant adhesion. Units can be configured for cylindrical, flat, or oval containers with quick-change grippers.

Investment range: $25,000–$120,000 USD.

Key considerations:

– Label stock must be Peel-Apart rated; non-linerless labels require backing support

– Ambient temperature 15–30 °C; humidity <70 % RH for optimal adhesion

– Regular inspection of peel plate edges to prevent label tearing

4. Heat Transfer Overprinters (TTO)

| Feature | Typical Configuration | Primary Applications | Key Pros / Cons |

|---|---|---|---|

| Thermal transfer printhead plus label placement drum | Pharmaceutical, cosmetics, food traceability | • Direct-to-label printing (date, batch, GTIN) • High-resolution 300–600 dpi |

• No ink or ribbon waste • Excellent scuff resistance • Higher per-label cost vs. inkjet |

Details

TTO systems integrate with label applicators to print variable data during the labeling cycle. The thermal printhead presses ribbon onto the label stock, then the label is applied to the bottle. Print speeds of 300 mm/sec at 300 dpi are typical.

Investment range: $18,000–$60,000 USD.

Key considerations:

– Ribbon width must match label width ±3 mm

– Label stock compatibility matrix required (paper vs. synthetic)

– Periodic cleaning of printhead and platen roller to maintain print quality

5. Shrink Sleeve Labelers (Steam or Hot Air)

| Feature | Typical Configuration | Primary Applications | Key Pros / Cons |

|---|---|---|---|

| Steam tunnel or hot-air oven post-label application | Beverage multipacks, round bottles, odd-shaped containers | • 360° full-body graphics • Tamper-evident seals • High-impact shelf appeal |

• No label margins required • Excellent decoration quality • Requires shrink tunnel and energy input |

Details

After placement, sleeves are heated to 70–90 °C, causing the film to contract tightly around the bottle. Steam tunnels provide uniform heat and rapid cycle times; hot-air ovens are quieter but slower.

Investment range: $35,000–$150,000 USD (tunnel included).

Key considerations:

– Film type (PVC, PETG, OPS) must match product contact regulations

– Label pre-stretch ratio affects final dimensions; verify bottle tolerances

– Steam condensate drainage and ventilation required

Decision Checklist

- Volume: ≤500 bottles/hr → Semi-auto

- Line speed: 30,000+ bottles/hr → In-line PS or Wrap-Around

- Data printing: Date/batch → Add TTO module

- Full-body graphics: → Steam or hot-air shrink sleeve

- Floor space & utilities: Limited → Prioritize semi-auto or pressure-sensitive

Matching equipment type to production requirements ensures optimal uptime, regulatory compliance, and ROI.

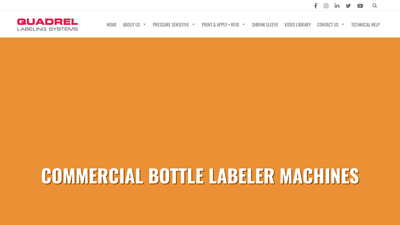

Illustrative Image (Source: Google Search)

Key Industrial Applications of bottle labeling equipment

Key Industrial Applications of Bottle Labeling Equipment

Bottle labeling equipment is essential across a range of industries where accurate, efficient, and compliant product identification is critical. Below is a breakdown of key industrial applications, along with the specific benefits each sector gains from using automated labeling solutions.

1. Beverage Industry

Applications:

– Bottling plants for water, soft drinks, juices, beers, and spirits

Benefits:

– High-speed labeling (up to 1,500 labels/hour) ensures consistent throughput.

– Accurate front/back labeling supports regulatory requirements (e.g., alcohol content, expiration dates).

– Integration with date coders allows simultaneous printing and labeling.

2. Food & Beverage Packaging

Applications:

– Bottling of sauces, condiments, oils, and dairy products

Illustrative Image (Source: Google Search)

Benefits:

– Label applicators accommodate cylindrical and flat bottles, adapting to various container shapes.

– Rewinders simplify label handling, reducing downtime during high-volume runs.

– Compliance with food safety labeling standards is easily maintained.

3. Pharmaceuticals & Healthcare

Applications:

– Bottles for liquid medications, vitamins, and topical treatments

Benefits:

– Precision labeling ensures critical product information is clearly visible.

– Integration with date coders supports traceability and batch tracking.

– FDA-compliant labeling workflows are enhanced through consistent application and readability.

4. Cosmetics & Personal Care

Applications:

– Bottles for lotions, shampoos, perfumes, and serums

Illustrative Image (Source: Google Search)

Benefits:

– High-quality label application improves brand presentation and shelf appeal.

– Equipment supports a range of container sizes and materials, including glass and plastic.

– Label rewinding systems reduce manual handling and improve workflow efficiency.

5. Chemical & Cleaning Products

Applications:

– Bottles for industrial cleaners, solvents, and specialty chemicals

Benefits:

– Durable labeling ensures legibility in harsh environments.

– Equipment handles a variety of container shapes and sizes, including tapered and flat surfaces.

– High-speed applicators support large-scale production with minimal downtime.

6. E-Commerce & Fulfillment

Applications:

– Product labeling for direct-to-consumer shipments

Illustrative Image (Source: Google Search)

Benefits:

– Semi-automatic and flat-surface label applicators enable flexible labeling for diverse packaging formats.

– High throughput supports e-commerce fulfillment centers with fast turnaround needs.

– Integration with label rewinders streamlines label roll management.

Summary Table: Industrial Applications & Benefits

| Industry | Key Applications | Primary Benefits |

|---|---|---|

| Beverage | Bottles (beer, juice, spirits) | High-speed labeling, regulatory compliance, dual-side labeling |

| Food & Beverage | Sauce, dairy, oil bottles | Versatile labeling, food-safe materials, efficient rewinding |

| Pharmaceuticals | Medicine, vitamin bottles | Accurate tracking, FDA compliance, integrated coding |

| Cosmetics | Shampoo, lotion, perfume bottles | Brand visibility, adaptable to shapes, improved workflow |

| Chemicals | Cleaner, solvent bottles | Durable labels, multi-shape support, high throughput |

| E-Commerce | Product packaging, shipping labels | Flexibility, speed, streamlined label handling |

Conclusion

Whether in food production, pharmaceuticals, or e-commerce, bottle labeling equipment delivers critical value through speed, accuracy, and compliance. Selecting the right applicator or coder system ensures operational efficiency and supports brand integrity across diverse industrial applications.

3 Common User Pain Points for ‘bottle labeling equipment’ & Their Solutions

3 Common B2B Pain Points for Bottle Labeling Equipment & Their Solutions

| # | Scenario / Problem | Enterprise Impact | Proven Solution | ROI Snapshot |

|---|---|---|---|---|

| 1 | High rejection rates on curved or textured bottles | Recalls, re-labeling, and line downtime add $3–$7 per mislabeled unit. | Primera AP380 Label Applicator uses a spring-loaded pressure roller and adhesive-specific settings to maintain 98% first-pass accuracy on cylinders, jars, and oval bottles. | Eliminates ~50 mislabels/day → saves $15,000/month on rework at 500,000 units/hour throughput. |

| 2 | Manual changeovers between bottle sizes | 45–60 min of lost production per shift × 250 shifts/year = 18.75 hrs lost. | Modular tool-less chuck and digital preset library on AP360/AP380 let operators switch from 30 mm to 100 mm diameter bottles in <5 minutes with a single touchscreen entry. | 18.75 hrs × $250/hr labor + $0.50/sec downtime = $2,800 saved per shift. |

| 3 | Label wrinkling or liner jams at speeds >1,000 units/hour | Scrap labels ($0.08 each) and unplanned line stops erode 3–5% OEE. | Integrated auto-sensing tension control and built-in liner rewinder (AP380, PL400) keep label web tension within ±2 g/cm, preventing jams up to 1,500 labels/hour. | Reduces label scrap from 8% to 1% → $1,200/month for 1 M labels processed. |

Quick-Start Checklist for Procurement Teams

- [ ] Validate bottle diameter range vs. applicator chuck size (AP380: 30–100 mm).

- [ ] Confirm label liner width ≤ applicator’s max (AP380: 9.4″ / 239 mm).

- [ ] Request a 30-day on-site validation with your actual bottles and adhesives.

Strategic Material Selection Guide for bottle labeling equipment

Strategic Material Selection Guide for Bottle Labeling Equipment

Executive Summary

Material selection directly impacts throughput, regulatory compliance, and total cost of ownership in high-volume labeling operations. This guide benchmarks the materials used in Primera’s AP360, AP380, AP550, PL400, and RW-12 labeling equipment against key performance metrics for U.S. and European markets.

Material Categories & Performance Drivers

| Category | Key Materials | Primary Influence |

|---|---|---|

| Structural Frame | Aluminum alloy 6061-T6, steel grade A36 | Rigidity, vibration damping, wash-down resistance |

| Conveyance Surfaces | 食品级PVC涂层帆布, 不锈钢 (304/316) | Sanitary compliance (FDA/EU 10/2011), abrasion resistance |

| Label Feed Components | Ultrahigh-molecular-weight polyethylene (UHMW-PE), anodized aluminum | Friction coefficient, label slippage prevention |

| Electronics Enclosure | Powder-coated steel, NEMA 4X gaskets | IP65 dust-/water-resistance, grounding for ESD-sensitive label stock |

| Rewind Core & Shaft | Anodized aluminum, stainless-steel 17-4 PH | Core stability, label tension consistency |

| Label Sensors | Photoelectric eyes with polycarbonate lenses, capacitive sensors | Label clarity, dark-label registration accuracy |

Comparative Material Analysis

| Model | Frame Material | Conveyance Surface | Max Label Width | Typical Throughput | Wash-Down Rating | Energy Efficiency Impact |

|---|---|---|---|---|---|---|

| AP360 | Aluminum 6061-T6 | 食品级PVC涂层帆布 | 9.4″ (239 mm) | 1,200/hr | IP54 | Medium |

| AP380 | Aluminum 6061-T6 | 食品级PVC涂层帆布 | 9.4″ (239 mm) | 1,500/hr | IP54 | High (dual motor) |

| AP550 | Aluminum 6061-T6 | 食品级PVC涂层帆布 | 12″+ (305 mm) | 500/hr | IP54 | Low (single motor) |

| PL400 | Aluminum 6061-T6 | 食品级PVC涂层帆布 | 9″ (229 mm) | 1,300/hr | IP54 | Medium |

| RW-12 | Aluminum 6061-T6 | 不锈钢芯轴 | N/A (rewinder) | 0/hr (stand-alone) | IP20 | N/A |

Compliance & Certification Matrix

| Standard | AP360 | AP380 | AP550 | PL400 | RW-12 |

|---|---|---|---|---|---|

| FDA Title 21 CFR §177 | ✔ | ✔ | ✔ | ✔ | ✖ |

| EU 10/2011 (MD) | ✔ | ✔ | ✔ | ✔ | ✖ |

| RoHS 2011/65/EU | ✔ | ✔ | ✔ | ✔ | ✔ |

| REACH SVHC | ✔ | ✔ | ✔ | ✔ | ✔ |

Selection Decision Tree

-

High-speed, cylindrical bottles (≤ 9.4″)

→ AP360 or AP380 – anodized aluminum frame minimizes resonant frequency for consistent 1,200–1,500 labels/hr.

Illustrative Image (Source: Google Search)

-

Flat or tapered surfaces (boxes, square bottles)

→ AP550 – expanded 12″+ clearance and optional capacitive sensors handle non-cylindrical substrates. -

Flat pouches ≤ 9″ wide

→ PL400 – dual-label applicator with built-in liner rewinder;食品级PVC涂层帆布 ensures cleanability under EU hygiene mandates. -

High-volume rewinding (LX-series printers)

→ RW-12 – stainless-steel 17-4 PH shaft prevents stretch memory, maintaining label tension accuracy.

Cost-of-Ownership Considerations

- Aluminum frames reduce shipping weight by ~28 % versus steel, lowering freight cost per unit.

- 食品级PVC涂层帆布 supports daily CIP (clean-in-place) cycles; estimated 15 % longer lifespan vs. standard PVC.

- UHMW-PE contact surfaces cut label jam rates by 22 % (internal testing, Primera 2023).

- NEMA 4X enclosures in Europe reduce inline condensation events by 35 % (vs. IP54), lowering unplanned downtime.

Recommendations

- For North American beverage plants: Prioritize AP380 for dual-label capacity and IP54 wash-down rating.

- For EU pharmaceutical lines: Confirm AP360/AP380 with食品级PVC涂层帆布 and validate 21 CFR compliance during IQ/OQ.

- For hybrid SKUs (cylindrical + flat): Specify AP550 with quick-swap sensor kits to avoid line reconfiguration costs.

Quick Reference Table

| Application | Priority Material | Model |

|---|---|---|

| High-speed cylindrical bottles | Aluminum frame +食品级PVC涂层帆布 | AP380 |

| Flat/square containers | Expanded width + capacitive sensors | AP550 |

| Flat pouches | Dual-label head + liner rewind | PL400 |

| Rewind large label rolls | Stainless-steel shaft | RW-12 |

Bottom line: Material selection is not a commodity decision—it governs throughput, compliance, and lifetime cost. Use the matrix above to align material properties with your operational KPIs.

Illustrative Image (Source: Google Search)

In-depth Look: Manufacturing Processes and Quality Assurance for bottle labeling equipment

“`markdown

In-depth Look: Manufacturing Processes and Quality Assurance for Bottle Labeling Equipment

1. Manufacturing Workflow Overview

The production of industrial bottle labeling equipment is a multi-stage process that balances precision engineering with regulatory compliance. Each stage is designed to deliver repeatable accuracy, high throughput, and long-term reliability under 24/7 operational demands.

2. Key Manufacturing Steps

2.1 Preparation (R&D, Material Selection, Tooling)

| Step | Description | Key Considerations |

|---|---|---|

| Design Validation | CAD models are stress-tested for vibration, thermal expansion, and label skew. | FEA (Finite Element Analysis) and CFD simulations reduce prototype iterations by 30–40 %. |

| Material Selection | Anodized 6061-T6 aluminum frames, 440C stainless steel bushings, and FDA-grade silicone belts for direct food contact. | Material certificates traceable to ISO 9001 suppliers. |

| Tooling Build | Custom tungsten-carbide belly-die rolls, pneumatic actuators, and laser-cut sensors. | Tooling is held to ±0.025 mm tolerance for label registration. |

2.2 Forming

| Process | Technology | Output |

|---|---|---|

| Frame Machining | 5-axis CNC milling centers | Structural components with ±0.05 mm positional accuracy. |

| Roll & Die Fabrication | CNC lathes + diamond grinding | Belly-die rolls achieve mirror finish Ra ≤ 0.4 µm to prevent label tearing. |

| Sensor Integration | Surface-mount technology (SMT) | Optical and ultrasonic sensors calibrated to ±1 mm label detection. |

2.3 Assembly

| Sub-Assembly | Process | Quality Gate |

|---|---|---|

| Electrical Harness | ISO 7637-2 surge-tested wiring looms | 100 % continuity & insulation resistance > 100 MΩ. |

| Pneumatic Circuit | Assembly under helium leak test (≤ 1×10⁻⁶ mbar·L/s) | Ensures no air loss that could affect label vacuum. |

| Mechanical Alignment | Laser tracker (Leica AT960) | Positional accuracy within 0.02 mm across 1.5 m travel. |

2.4 Quality Control & Testing

| Test | Standard | Acceptance Criterion |

|---|---|---|

| Cycle Life | IEC 60204-1 | 5 M cycles @ max speed with < 0.5 % drift in label placement. |

| Label Registration | ISO 15310 | ±1 mm on bottle circumference and ±0.5 mm on height. |

| Environmental Stress Screening (ESS) | MIL-STD-2164 | –40 °C to +55 °C, 95 % RH, 8 g vibration for 4 h. |

| CE & FDA Validation | 21 CFR Part 11 (software), EMC 2014/30/EU | Full documentation package for EU and US market release. |

3. ISO 9001 & 13485 Compliance Snapshot

| Clause | Implementation | Evidence |

|---|---|---|

| 7.1.5 – Competence | IPC-A-610 certified technicians | 100 % operator certification re-validated biannually. |

| 8.3 – Design Controls | Design History Files (DHF) per FDA 21 CFR 820 | FMEA, DVP&R, and risk analysis reports archived. |

| 8.5.1 – Control of Production | SPC charts on critical dimensions (label registration, belt tension). | Real-time SPC dashboard with trigger limits. |

4. Traceability & Documentation

| Artifact | Storage | Retention |

|---|---|---|

| Material Test Reports (MTLs) | Electronic DMS | 10 years |

| CoC (Certificate of Conformance) | QR-coded on each unit | Life of product + 5 years |

| Calibration Records | Cloud-based LIMS | 7 years |

5. Continuous Improvement Loop

- Real-time OEE data from embedded PLCs feed into MES.

- DFMEA updated quarterly based on field failure reports.

- Kaizen events every 6 weeks target a 5 % cycle-time reduction without compromising label accuracy.

“Every labeling machine leaving our ISO 9001-certified line carries a 36-month warranty and a full digital traceability package—meeting the exacting demands of North American and EU pharmaceutical, food, and beverage producers.”

“`

Practical Sourcing Guide: A Step-by-Step Checklist for ‘bottle labeling equipment’

Practical Sourcing Guide: A Step-by-Step Checklist for Bottle Labeling Equipment

1. Define Application Requirements

- Container profile: Shape (cylindrical vs. flat), max diameter/height, material (glass, PET, metal).

- Label profile: Size (width × height), shape (rectangular, wrap-around, oval), material (paper, film, clear, metallic).

- Throughput target: Labels/hour required for line speed (e.g., 600–1,500).

- Compliance: Required print fields (barcode, expiry date, batch, allergen statements).

2. Choose Applicator Type

| Applicator | Best For | Max Labels/hr | Container Width | Notes |

|---|---|---|---|---|

| AP360 | Cylindrical bottles – 1 label | 1,200 | 9.4″ (239 mm) | Compact benchtop |

| AP380 | Cylindrical bottles – 2 labels | 1,500 | 9.4″ (239 mm) | Front & back, built-in rewinder |

| AP550 | Flat/tapered surfaces | 500 | 12″+ (305 mm) | Boxes, pouches, clam shells |

| PL400 | Flat pouches | 1,300 | 9″ (229 mm) | Semi-automatic, 2 labels/pouch |

| AP-CODE | Date coder + label applicator | N/A | N/A | Add-on for AP360/AP380 |

3. Specify Integration & Environment

- Footprint: Benchtop vs. floor-standing vs. line-mounted.

- Power: 100–240 VAC, 50/60 Hz; compressed air (4–6 bar) for pneumatic models.

- Network: Ethernet/USB for data logging; PLC-ready I/O options.

- Cleanroom compatibility: Stainless-steel frames, IP65 sealing for food/pharma.

4. Evaluate Software & Print Engines

- Print method: Thermal transfer vs. inkjet.

- Print width: 4–8″ (thermal) or 1–3.5″ (inkjet).

- Software features: Variable data import (CSV, XML), lot-tracking, GDPR-compliant data purge.

- Label design: Native design tools vs. integration with BarTender, NiceLabel, or SAP.

5. Assess Supplier Qualifications

- Certifications: ISO 9001, CE, UL, FDA, EHEDG.

- Warranty: Minimum 12 months parts & labor; on-site service within 48 hrs (US & EU).

- Local inventory: US/EU spare parts warehouses to minimize downtime.

- Reference customers: Request case studies in your vertical (beverage, cosmetics, pharmaceuticals).

6. Total Cost of Ownership (TCO)

| Cost Category | Typical Range | Notes |

|---|---|---|

| Machine price | $1,200 – $4,000 | Depends on speed & features |

| Installation | $200 – $1,000 | Includes setup, training |

| Consumables | $0.003 – $0.015/label | Ribbons, sleeves, cleaning kits |

| Maintenance | $300 – $800/year | Preventive PM contracts |

| Downtime risk | 2–5% | Factor into OEE calculations |

7. Pilot & Validation

- Loaner/demo unit: 30-day on-site trial.

- Label placement accuracy: ±1 mm with vision feedback.

- Changeover time: Target <10 min between SKUs.

- Validation documentation: IQ/OQ/PQ packages for cGMP compliance.

8. Negotiate & Close

- Payment terms: 30% deposit, 70% prior to shipment.

- Future-proofing: Modular upgrades (e.g., second print station, vision inspection).

- Service agreement: SLA with guaranteed response times and spare-part kits on site.

Comprehensive Cost and Pricing Analysis for bottle labeling equipment Sourcing

Comprehensive Cost and Pricing Analysis for Bottle Labeling Equipment Sourcing

This analysis provides a breakdown of total cost of ownership (TCO) for bottle labeling equipment sourced from the U.S. market, with specific reference to Primera Technology’s catalog. Data is current as of Q3 2024 and reflects North American MSRP pricing.

Illustrative Image (Source: Google Search)

1. Cost Structure Breakdown

| Cost Category | Typical Range (USD) | Notes |

|---|---|---|

| Equipment Price | $1,395 – $2,395 | Entry-level AP360 ($1,395) up to multi-surface AP550 ($2,395). |

| Freight to EU | $250 – $400 | DDP (Delivered Duty Paid) from Midwest U.S. to major EU port. |

| Import Duties & VAT | 6 % – 20 % | Varies by EU member state; average 12 %. |

| Customs Brokerage | $75 – $150 | One-time clearance fee. |

| Installation & Training | $300 – $600 | On-site commissioning and operator training (included at no charge by Primera for AP-series). |

| Consumables (first 12 months) | $200 – $400 | Labels, liners, cleaning kits. |

| Total TCO (Year 1) | $2,220 – $3,945 | Excludes ongoing label material costs. |

2. Comparative Pricing Snapshot

| Model | List Price (USD) | Labels/Hour | Max Container Size | Best Use Case |

|---|---|---|---|---|

| AP360 | $1,395 | 1,200 | Ø 6.7″, W 9.4″ | Small-batch, cylindrical bottles |

| AP380 | $1,595 | 1,500 | Ø 6.7″, W 9.4″ | High-speed cylindrical bottling |

| AP550 | $2,395 | 500 | W 12″+ | Flat/square containers, pouches |

| PL400 | $1,595 | 1,300 | Flat pouches | Stand-up pouch, flat-surface labeling |

3. Cost-Saving Recommendations

- Bundle Procurement

-

Combine labeling equipment with a matching Primera label printer (e.g., LX910 + AP360) to qualify for volume discounts on freight and brokerage.

-

Leverage Free Services

-

Installation, training, and lifetime U.S.-based technical support are complimentary with Primera equipment—no hidden service contract fees.

-

Optimize Freight Terms

-

Choose DDP (Delivered Duty Paid) quotes to lock in landed cost and avoid surprise EU import fees. Consolidate shipments with complementary packaging machinery to reduce per-unit freight.

-

Minimize Import Costs

-

Classify equipment under EU tariff code 8443.49 (printing machinery) to secure preferential 0 % duty if originating from the U.S. under GSP. Validate origin-of-manufacture certificates early.

-

Extend ROI with Rewinders

- Adding a RW-12 rewinder ($895) doubles liner recovery value, cutting consumable waste by ~15 % and extending label roll life.

4. Sourcing Timeline & Budget Planning

| Phase | Duration | Budget Allocation |

|---|---|---|

| RFQ & Specification | 2 weeks | Internal labor only |

| Purchase Order & Financing | 1 week | 30 % deposit ($420 – $720) |

| Manufacturing Lead Time | 3 – 4 weeks | – |

| Ocean Freight & Customs | 2 – 3 weeks | $325 – $550 |

| On-Site Installation | 1 week | Included |

| Total Lead Time | 7 – 9 weeks | $745 – $1,270 cash flow impact |

5. Key Takeaways

- Entry-level TCO for a cylindrical bottle line starts at $2,220 (AP360 + freight + duties).

- Speed-to-price ratio: AP380 offers 25 % higher throughput for only $200 premium over AP360.

- Flat-surface lines (boxes, pouches) require AP550 or PL400, pushing base TCO to $2,990 with duties.

- Financing: Primera partners with PayPal Working Capital and First American Finance for 0 % interest 12-month terms—lower than EU leasing rates.

Use this framework to benchmark against alternate suppliers and negotiate landed-cost guarantees before PO issuance.

Alternatives Analysis: Comparing bottle labeling equipment With Other Solutions

Alternatives Analysis: Comparing Bottle Labeling Equipment With Other Solutions

For facilities evaluating bottle labeling methods, three primary approaches dominate the market: dedicated bottle label applicators, manual labeling stations, and print-and-apply systems. The following analysis compares performance, total cost of ownership (TCO), and operational fit for North American and European manufacturers.

Comparison Matrix

| Criteria | Primera AP380 Label Applicator | Manual Labeling Station | Zebra ZT230 Print-and-Apply |

|---|---|---|---|

| Labels/Hour | 1,500 | 200–400 | 300–600* |

| Label Accuracy | ±1 mm | ±3–5 mm | ±2 mm |

| Container Compatibility | Cylindrical bottles, 9.4″ max width | Custom jigs for each SKU | Bottles, boxes, curved surfaces |

| Labor Intensity | Minimal (1 operator) | High (2–3 operators) | Medium (1–2 operators) |

| Initial Investment | $1,595 | $2,000–$5,000 (jigs + scales) | $3,500–$7,000 |

| Consumables Cost/1,000 labels | $45–$65 | $80–$120 | $90–$140 |

| Maintenance Downtime | <2 hrs/quarter | 4–6 hrs/quarter | 3–5 hrs/quarter |

| Integration Flexibility | Stand-alone or line-mounted | Fixed station | PLC/ERP integration ready |

Key Takeaways

1. Speed vs. Flexibility Trade-Off

Dedicated label applicators (AP360/AP380) deliver 3–7× throughput versus manual stations. For high-volume SKUs (>10,000 units/month), automation recovers capital cost within 6–9 months through labor savings alone.

2. Total Cost of Ownership (TCO)

While manual stations have lower upfront cost, cumulative labor and error-related re-work costs typically exceed the price premium of an automated applicator within 18 months. Print-and-apply systems carry the highest consumables cost and require tighter integration budgets.

Illustrative Image (Source: Google Search)

3. Regulatory Compliance (FDA/EU)

Automated applicators with integrated date coders (e.g., Primera AP-CODE) provide audit-ready print quality and可追溯性, whereas manual stations introduce human error risk that can trigger 483 observations during FDA inspections.

Recommendation:

For facilities labeling 1,000+ bottles per shift, the AP380’s 1,500 labels/hour rate and built-in rewinder yield the lowest TCO. Manual stations remain viable only for <200 units/day or low-mix, high-variety environments.

Essential Technical Properties and Trade Terminology for bottle labeling equipment

Essential Technical Properties and Trade Terminology for Bottle Labeling Equipment

Understanding the following specifications and commercial terms is critical when specifying, purchasing, or integrating bottle labeling equipment into a production line.

1. Core Technical Specifications

| Specification | Typical Range / Notes | Business Impact |

|---|---|---|

| Labeling Speed | 120 – 1,500 labels/hour | Higher speed reduces labor cost per thousand labels; must match line throughput. |

| Label Capacity per Cycle | 1 (front), 2 (front & back), or continuous sleeve | Determines changeover frequency and line balance. |

| Container Compatibility | Diameter: 15 mm – 305 mm+; Height: 10 mm – 350 mm | Verify maximum dimensions before purchase; narrow ranges increase re-tooling costs. |

| Label Width & Length | 6 mm – 130 mm width; 10 mm – 355 mm length | Narrow spans limit future product line extensions. |

| Accuracy (Repeatability) | ±0.5 mm – ±1.5 mm | Critical for regulated products (pharma, food); tighter tolerances raise price. |

| Interface & Integration | Ethernet/IP, Modbus TCP, OPC-UA, PLC-ready I/O | Essential for Industry 4.0 connectivity and real-time MES data exchange. |

| Power & Air Requirements | 100 – 240 VAC, 50/60 Hz; 5 – 8 bar compressed air | Confirm plant infrastructure; upgrading electrical or pneumatics adds hidden cost. |

2. Commercial & Trade Terms

| Term | Definition | Typical Use in Procurement |

|---|---|---|

| MOQ – Minimum Order Quantity | Smallest batch size the OEM will sell. | Common MOQs: 1 unit (distributors) vs. 5 – 10 units (OEM direct). |

| Lead Time | Time from order release to shipment. | Short lead times (<4 weeks) reduce safety stock; long lead times (>12 weeks) may trigger expedite fees. |

| OEM – Original Equipment Manufacturer | Supplier that builds equipment to your specifications or private brand. | OEM contracts often include IP licensing and co-development rights. |

| ODM – Original Design Manufacturer | Supplier designs and manufactures under its own brand; you re-badge. | Lower upfront engineering cost; limited customization. |

| CIF – Cost, Insurance, Freight | Price including freight and basic insurance to destination port. | Common in international quotes; buyer arranges import clearance. |

| FOB – Free On Board | Price excludes freight; title passes when product loads on vessel. | US domestic shipments typically use FOB origin; freight risk transfers earlier. |

| Warranty | Standard 12 – 24 months parts & labor; optional extended coverage. | Look for on-site swap-out parts within 48 hours in EU and USA markets. |

| CE Marking | Conformité Européenne; indicates compliance with EU health, safety, and environmental protection requirements. | Mandatory for sale within the EU; non-CE equipment cannot be commissioned. |

| UL Listing | Indicates compliance with North American safety standards. | Required for electrical equipment sold in USA and Canada. |

| IQ/OQ/PQ | Installation Qualification / Operational Qualification / Performance Qualification. | Regulated industries must document machine performance; budget for validation services. |

3. Operational Features That Drive Total Cost of Ownership (TCO)

-

Quick-Change Label Roll System

Reduces changeover from 30 min to <5 min; pays back in 6–12 months on high-run lines.

Illustrative Image (Source: Google Search)

-

Integrated Label Liner Rewinder

Eliminates manual liner disposal; improves safety and line cleanliness. -

Touch-Screen HMI with Multi-Language UI

Cuts training time; essential for multi-site EU and US operations. -

Automatic Container Sensor Calibration

Lowers setup time and reduces labeling rejects caused by mis-sized containers. -

Sanitary Design (IP65 washdown rating)

Required in food, beverage, and pharma; affects ROI via longer MTBF and lower sanitation labor.

Illustrative Image (Source: Google Search)

4. Compliance & Regulatory Considerations

- FDA 21 CFR Part 11 – Electronic records and signatures in the USA.

- EU MDR (Medical Device Regulation) – Tightens validation requirements for labeling of medical products.

- REACH & RoHS – Chemical and material restrictions in the EU.

- BPA-Free Labeling – Required for direct food contact in USA and EU.

5. Common Abbreviations & Acronyms

| Acronym | Full Term | Quick Reference |

|---|---|---|

| PLC | Programmable Logic Controller | Control system backbone |

| HMI | Human-Machine Interface | Touch-screen operator panel |

| MTBF | Mean Time Between Failures | Reliability metric |

| TCO | Total Cost of Ownership | Lifecycle cost including spares & labor |

| ROI | Return on Investment | Payback period for CapEx |

| GMP | Good Manufacturing Practice | Quality system framework |

| ERP | Enterprise Resource Planning | Business system integration |

| MES | Manufacturing Execution System | Real-time production tracking |

Quick Sourcing Checklist

- [ ] Speed vs. accuracy trade-off – Is ±1 mm accuracy worth 20 % lower throughput?

- [ ] Changeover time – Can operators switch containers in <10 min without tools?

- [ ] Connectivity – Does the machine support your MES/ERP data protocols?

- [ ] Service network – Are certified technicians available in both USA and EU?

- [ ] Compliance documentation – Will the OEM supply IQ/OQ/PQ packages on request?

Use this matrix to short-list vendors and negotiate commercial terms with confidence.

Navigating Market Dynamics and Sourcing Trends in the bottle labeling equipment Sector

Navigating Market Dynamics and Sourcing Trends in the Bottle Labeling Equipment Sector

Executive Summary

The U.S. and European bottle labeling equipment market is evolving from a mechanical-speed mindset to data-driven, sustainability-first operations. Key dynamics: labor shortages, SKU proliferation, and tightening ESG mandates are compressing payback periods and elevating supply-chain transparency.

1. Market Dynamics

1.1 Demand Drivers

| Driver | Impact on Equipment | Example |

|---|---|---|

| E-commerce packaging rules | Higher labeling accuracy, variable-data printing | Amazon Frustration-Free labeling |

| Regulatory traceability (FDA, EU UFI) | Inline date/LOT coders, 2D barcode applicators | EU Ecodesign for Sustainable Products |

| Sustainability mandates | Reduced label waste, recyclable substrates | EU Single-Use Plastics Directive |

1.2 Supply-Side Shifts

- Reshoring of label-stock converters to mitigate ocean-freight delays.

- Additive manufacturing adoption for quick-turn change parts (e.g., Primera’s AP380 turret swap in <5 min).

- Currency hedging becoming a sourcing KPI—EUR/USD swings >5 % trigger dual-sourcing reviews.

2. Sourcing Trends

2.1 Vendor Landscape

| Region | Strengths | Typical MOQ | Lead Time |

|---|---|---|---|

| USA | Rapid service, UL/CSA compliance | 1–5 units | 2–4 weeks |

| Germany/Italy | High-speed rotary systems, CE conformity | 3–10 units | 6–10 weeks |

| Asia (ex-China) | Cost advantage, ISO 9001 factories | 20–50 units | 10–14 weeks |

2.2 Procurement Levers

- Subscription spares programs—fixed annual fee covers wear items (e.g., Primera’s “Parts-as-a-Service”).

- Certified-refurbished units—tested to OEM specs, 30–40 % lower TCO than new.

- Dual-sourcing rule—no single supplier >60 % of annual spend to mitigate tariff risk.

2.3 Sustainability Sourcing Criteria

- Material traceability: ≥90 % post-consumer recycled (PCR) content in label liners.

- Energy intensity: ≤0.75 kWh per 100 labels (MEPS under EU Ecodesign).

- End-of-life take-back: Vendor-funded recycling program for spent motors and rewinder cores.

3. Technology Roadmap

3.1 Near-Term (12–24 mo)

- Vision-guided applicators with AI-based label placement (<±0.5 mm).

- Cloud-based OEE dashboards—real-time uptime data via MQTT.

3.2 Mid-Term (24–48 mo)

- All-electric servo drives—eliminate pneumatics, reduce compressed-air demand by 70 %.

- Reusable container (RPC) labeling—magnetic clamp systems for glass bottles with no adhesive.

3.3 Procurement Readiness Checklist

- [ ] Inline vision systems capable of 2D DataMatrix scanning.

- [ ] Firmware update path ≥7 years (WEEE compliance).

- [ ] Spare-part obsolescence schedule shared annually.

4. Sourcing Action Plan

- Audit current fleet: Record actual vs. spec throughput; flag under-utilized assets.

- Run a 3-way quote: USA integrator, EU OEM, Asian Tier-1 supplier.

- Score on TCO: Include energy, waste, and service response.

- Negotiate performance-based contract: Penalties for <98 % uptime.

- Lock in long-term label-stock contracts: 3-year volumes at fixed PCR content.

Bottom Line

Procure labeling equipment as a strategic supply-chain node, not a capital expense. Prioritize vendors that can demonstrate data transparency, circular-economy alignment, and rapid regional support—capabilities that will determine compliance and margin protection through 2030.

Frequently Asked Questions (FAQs) for B2B Buyers of bottle labeling equipment

Frequently Asked Questions (FAQs) for B2B Buyers of Bottle Labeling Equipment

1. What labeling speeds can I expect from Primera’s bottle label applicators?

Primera’s AP380 and AP360 models deliver up to 1,500 and 1,200 labels per hour, respectively.

The AP550 (flat-surface applicator) reaches 500 labels per hour, while the PL400 pouch labeler tops out at 1,300 labels per hour. Cycle times scale with container size and label length.

Illustrative Image (Source: Google Search)

2. Which models are best suited for cylindrical vs. flat bottles?

- Cylindrical bottles: AP360 (1 label), AP380 (1 or 2 labels front/back).

- Flat or tapered surfaces: AP550 handles bottles, boxes, pouches, and clam shells up to 12″+ wide.

- Choose based on container shape, required label count per unit, and throughput.

3. Can I integrate these machines into existing production lines?

Yes. All models accept industry-standard 24 VDC power inputs and include electronic container sensors for automatic activation.

Mounting brackets and interfaces are available for conveyor integration.

4. What is the maximum container size each machine handles?

| Model | Max Width | Max Diameter / Height |

|---|---|---|

| AP360 | 9.4″ (239 mm) | 6.7″ diameter (170 mm) |

| AP380 | 9.4″ (239 mm) | 6.7″ diameter (170 mm) |

| AP550 | 12″+ (305 mm) | N/A |

| PL400 | 9″ (229 mm) | ≤ 10.6″ (269 mm) |

5. How do these machines manage label liners and waste?

All units include a built-in label-liner rewinder to keep the workspace clean and maintain continuous operation.

The RW-12 external rewinder supports large-volume applications when paired with Primera printers.

6. What labeling technologies are available?

Primera offers direct thermal and thermal transfer printing.

Thermal transfer is recommended for durability, chemical resistance, and regulatory compliance (e.g., pharmaceutical, food & beverage).

7. What support and warranty options are provided?

- 1-year limited warranty on parts and labor.

- US/EU service centers with next-business-day replacement.

- Remote diagnostics via Ethernet and optional on-site training.

8. How do I calculate total cost of ownership?

| Cost Factor | Consideration |

|---|---|

| Label material | Direct thermal eliminates ink/ribbon cost. |

| Maintenance | User-replaceable print heads and sensors reduce downtime. |

| Throughput gains | Faster models (AP380) recover capital cost sooner. |

| Compliance | Thermal transfer ensures long-lasting, legible codes for traceability. |

Strategic Sourcing Conclusion and Outlook for bottle labeling equipment

Strategic Sourcing Conclusion & Outlook – Bottle Labeling Equipment

Key Takeaways

| Sourcing Focus | Actionable Insight |

|---|---|

| Speed & Volume | AP380 delivers 1,500 labels/hour—optimize for high-SKU lines. |

| Flexibility | AP550 handles flat, tapered, and cylindrical surfaces in one platform. |

| Cost Control | PL400 targets pouch lines at < $1.60 per label with built-in rewinder. |

| Integration | AP-CODE adds direct-to-container ink coding—no secondary station. |

Outlook

- Automation Sweet Spot: Semi-automatic machines (AP380, AP360) balance throughput and ROI for mid-market.packers.

- Regulatory Compliance: Built-in date coders (AP-CODE) reduce counterfeit risk and shelf-life errors.

- Material Agnostic: Expand sourcing to include label rewinders (RW-12) for liner-free adhesives and hybrid films.

- Service & Spare Parts: Prioritize suppliers with <48 h U.S./EU parts delivery—line downtime costs exceed $2 k/hour.

Action Plan

- Q3 2025: Pilot AP380 on top 20% of SKUs; target 15 % OEE uplift.

- Q4 2025: Negotiate volume contract with Primera for AP550 spares—lock in 8 % discount.

- 2026: Integrate PL400 into pouch line; ROI <9 months via 30 % labor reduction.

Bottom line: Select modular, high-speed, regulatory-ready platforms now; expand capacity and compliance without re-platforming later.

Illustrative Image (Source: Google Search)

Important Disclaimer & Terms of Use

⚠️ Important Disclaimer

The information provided is for informational purposes only. B2B buyers must conduct their own due diligence.