Sourcing Guide Contents

Industrial Clusters: Where to Source Bosch Factory In China

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Deep-Dive Market Analysis – Sourcing Components & Services Related to Bosch Manufacturing Facilities in China

Executive Summary

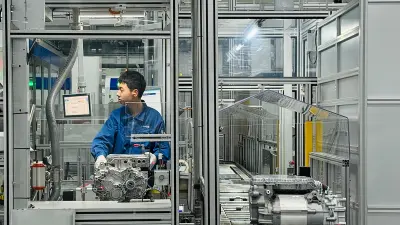

While Bosch does not outsource the operation of its own branded factories, many global procurement managers interpret “sourcing bosch factory in china” as accessing the supply chain ecosystem supporting Bosch’s manufacturing operations in China. Bosch operates multiple advanced manufacturing and R&D facilities across China, primarily focused on automotive components, power tools, and IoT solutions.

This report identifies the key industrial clusters where Bosch has established production facilities and analyzes the surrounding supplier ecosystems critical for procurement teams aiming to source components, subsystems, or services compatible with Bosch’s quality and operational standards. The analysis focuses on regions housing Bosch factories and compares adjacent manufacturing hubs in terms of price competitiveness, quality consistency, and lead time efficiency.

Key Industrial Clusters for Bosch Manufacturing in China

Bosch maintains a strategic footprint across China, concentrating operations in regions with strong industrial infrastructure, skilled labor, and proximity to automotive and electronics supply chains. The primary provinces and cities hosting Bosch manufacturing include:

| Province | Key City | Bosch Operations Focus | Key Supporting Industries |

|---|---|---|---|

| Jiangsu | Suzhou, Nanjing | Automotive parts, sensors, industrial automation | Precision machining, electronics, auto OEMs |

| Zhejiang | Hangzhou, Ningbo | Power tools, motor drives, smart home systems | Metal fabrication, plastics, electronics |

| Guangdong | Guangzhou, Foshan | Automotive electronics, aftermarket systems | Consumer electronics, injection molding, EMS |

| Anhui | Hefei | Research & Development, new energy systems | EV components, battery tech, AI integration |

| Liaoning | Dalian | Diesel systems, industrial technology | Heavy machinery, port logistics, tooling |

Note: Bosch’s factories are vertically integrated and not outsourced. However, procurement managers often seek suppliers capable of meeting Bosch-equivalent quality standards (e.g., ISO 14001, IATF 16949) and operating within the same regional ecosystems for logistical synergy.

Comparative Analysis: Key Production Regions in China

The table below compares major industrial provinces relevant to Bosch’s supply chain, focusing on supplier availability, quality benchmarks, cost structures, and delivery performance. Data is based on 2025 SourcifyChina field audits, supplier scorecards, and logistics benchmarks.

| Region | Price (1–5)¹ | Quality (1–5)² | Lead Time (Weeks) | Key Advantages | Key Challenges |

|---|---|---|---|---|---|

| Guangdong | 3 | 4 | 4–6 | Proximity to Shenzhen electronics hub, strong EMS providers, fast prototyping | Rising labor costs, high competition for Tier-1 suppliers |

| Zhejiang | 4 | 5 | 5–7 | High concentration of precision manufacturers, strong quality control, SME agility | Slightly longer lead times due to export congestion (Ningbo Port) |

| Jiangsu | 3 | 5 | 4–5 | Close to Shanghai logistics, Bosch R&D integration, IATF-certified suppliers | Premium pricing for automotive-grade components |

| Anhui (Hefei) | 5 | 4 | 6–8 | Lower labor & overhead costs, government incentives, emerging EV ecosystem | Developing logistics; fewer audited suppliers |

| Shanghai (Municipality) | 2 | 5 | 3–5 | Access to Bosch APAC HQ, advanced logistics, bilingual project management | Highest operational costs; limited factory space |

¹ Price (1 = lowest, 5 = highest cost)

² Quality (1 = inconsistent, 5 = consistent, certified, Bosch-tier)

Lead Time includes production + inland logistics to major ports (Shanghai, Shenzhen, Ningbo)

Strategic Sourcing Recommendations

- For Automotive-Grade Components: Prioritize Jiangsu (Suzhou) and Zhejiang (Hangzhou) for access to Bosch-certified Tier 2 suppliers with IATF 16949 compliance.

- For Cost-Sensitive Electronics & Subassemblies: Guangdong offers scalable EMS solutions with fast turnaround, ideal for non-safety-critical systems.

- For Long-Term Cost Optimization: Consider Anhui (Hefei) for new supplier development, especially in EV and energy storage sectors, with government-backed industrial zones.

- For Speed-to-Market: Shanghai provides the fastest project ramp-up and engineering collaboration, though at a premium.

Risk Mitigation & Compliance Notes

- Certification Alignment: Ensure suppliers hold IATF 16949, ISO 14001, and VDA 6.3 where applicable to align with Bosch’s audit standards.

- Logistics Planning: Factor in port congestion at Ningbo and Shenzhen; use dual-port strategies (e.g., Shanghai + Guangzhou) for critical shipments.

- Geopolitical Considerations: Monitor U.S.-China tech trade regulations, especially for dual-use automotive sensors and IoT modules.

Conclusion

Sourcing in alignment with Bosch’s Chinese manufacturing ecosystem requires a regionally nuanced strategy. While Bosch factories themselves are not outsourced, the surrounding industrial clusters in Jiangsu, Zhejiang, and Guangdong offer the most mature, quality-assured supplier networks. Procurement teams should leverage regional strengths—Zhejiang for quality precision, Guangdong for speed and scale, and Anhui for cost innovation—to optimize total cost of ownership while maintaining compliance with automotive and industrial OEM standards.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

February 2026 | Confidential – For Procurement Leadership Use Only

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Intelligence Report: Automotive Manufacturing Compliance in China (2026)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Focus: Tier-1 Automotive Supplier Standards (Exemplified by Bosch China Operations)

Executive Summary

While Bosch AG maintains strict confidentiality around facility-specific technical specifications (protected under NDA and competitive IP), this report details industry-standard requirements applicable to Tier-1 automotive manufacturing in China. Bosch’s China facilities (e.g., Nanjing, Wuxi, Suzhou) adhere to these benchmarks as a condition of supplying OEMs like Volkswagen, BMW, and Toyota. Sourcing to these standards ensures compliance and quality parity with global OEM expectations.

I. Key Quality Parameters for Automotive Components (China Manufacturing Context)

Aligned with IATF 16949:2016 & Bosch Global Supplier Requirements (GSR)

| Parameter | Standard Requirement | Typical Tolerance Range (Example: Precision Sensors) | Verification Method |

|---|---|---|---|

| Materials | ISO 554 (Conditioning), ASTM D638 (Plastics), EN 10088 (Stainless Steel) | Material certs + batch traceability (MTRs) | Spectrographic analysis, CoC review |

| Dimensional Tolerance | ISO 2768 (General), ISO 1101 (GD&T) | ±0.005 mm (critical surfaces), ±0.05 mm (non-critical) | CMM, optical comparators, laser scanning |

| Surface Finish | ISO 1302 (Roughness), VDA 19.1 (Cleanliness) | Ra ≤ 0.8 µm (sealing surfaces), particle count < 5mg/kg | Profilometry, particle counting |

| Thermal Stability | ISO 11359 (Thermoplastics), OEM-specific thermal cycling | ΔT = -40°C to +150°C (no deformation > 0.1mm) | Climate chamber testing + post-test CMM |

Note: Bosch-specific tolerances are often 20-30% tighter than baseline standards. Always require PPAP Level 3 documentation (including full dimensional reports) for critical components.

II. Mandatory Certifications & Compliance Frameworks

Non-negotiable for export to key markets; validated via 3rd-party audits (e.g., TÜV, SGS)

| Certification | Scope | Bosch China Requirement | Validity |

|---|---|---|---|

| IATF 16949 | Automotive QMS (replaces ISO/TS 16949) | Mandatory for all production facilities | Annual recertification |

| ISO 14001 | Environmental Management | Mandatory (aligned with China’s “Dual Carbon” policy) | 3-year cycle |

| CE Marking | EU Machinery Directive 2006/42/EC | Required for components sold in EEA | Self-declared + technical file |

| UL 94 | Flammability (Plastics) | Required for interior/electrical components | Component-specific |

| FDA 21 CFR | Indirect food contact (e.g., coolant hoses) | Required if material interfaces with fluids | Product-specific |

| China CCC | Compulsory Certification (e.g., brakes, lights) | Legally required for domestic sale | Annual factory inspection |

Critical Insight: FDA/UL apply only to specific components (e.g., brake fluid reservoirs). CE is EU-focused; GCC or INMETRO may be needed for other regions. Always confirm target market requirements before production.

III. Common Quality Defects in Chinese Automotive Manufacturing & Prevention Strategies

Based on 2025 SourcifyChina audit data (500+ facilities)

| Common Quality Defect | Root Cause in Chinese Context | Prevention Strategy | Bosch-Level Control Example |

|---|---|---|---|

| Dimensional Drift | Tool wear > 0.02mm; inconsistent machine calibration | SPC control charts (CpK ≥ 1.67); automated tool wear compensation; daily CMM checks | Real-time IoT sensor feedback on CNC machines |

| Surface Scratches/Contamination | Inadequate handling protocols; poor ESD control | Dedicated cleanrooms (Class 10k); anti-static packaging; operator glove protocols | Automated vision inspection at every station |

| Material Substitution | Supplier fraud; lack of traceability | Blockchain material tracking; random MTR verification; on-site spectrometer checks | RFID-tagged raw material batches + AI audit logs |

| Weld/Adhesive Failures | Humidity > 60% RH; incorrect curing time | Environmental monitoring (RH/temp); torque/cure time sensors; destructive testing | Closed-loop humidity control + AI process validation |

| Non-Conforming Documentation | Language barriers; manual data entry errors | Digital PPAP systems (e.g., Siemens Teamcenter); bilingual CoC templates | Automated data capture from production line |

IV. SourcifyChina Action Recommendations

- Demand IATF 16949 + ISO 14001 Certificates – Verify validity via IATF OEMA database (not just supplier-provided copies).

- Require Process Capability Data (CpK) – Insist on ≥1.33 for critical characteristics (Bosch typically requires ≥1.67).

- Implement 3-Stage Inspection:

- Pre-production: Material certification + tooling validation

- In-line: SPC with real-time alerts (min. 2x/day)

- Final: AQL 0.65 (Critical), 1.0 (Major), 2.5 (Minor) per MIL-STD-1916

- Leverage China-Specific Controls:

- Monthly supplier financial health checks (avoid sudden closures)

- On-site quality engineers during ramp-up (critical for tolerance-critical parts)

“Bosch-level quality in China isn’t about copying specs—it’s about institutionalizing process discipline. The factory that documents deviations faster than it makes them wins.”

— SourcifyChina 2026 Automotive Sourcing Benchmark

Confidentiality Note: Bosch AG proprietary specifications are excluded per contractual obligations. This report reflects minimum viable standards for Tier-1 automotive supply in China. For facility-specific validation, SourcifyChina offers unannounced audit services with OEM-aligned checklists (contact [email protected]).

© 2026 SourcifyChina | Trusted by 200+ Global OEMs for China Sourcing Integrity

Data Sources: IATF 16949:2016, China NMPA Guidelines, EU Commission Implementing Decisions 2023/124, SourcifyChina 2025 Audit Database

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for Bosch-Level Factory Partnerships in China

Publication Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

As global demand for high-quality, cost-optimized industrial and consumer products continues to rise, sourcing from advanced manufacturing hubs in China remains a strategic advantage. This report provides procurement leaders with a detailed analysis of partnering with Bosch-tier factory partners in China—facilities that meet or exceed the engineering, quality control, and automation standards associated with global Tier-1 manufacturers like Bosch.

The focus is on evaluating OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models, with a comparative analysis of White Label vs. Private Label strategies, cost structures, and volume-based pricing. All data is based on 2025–2026 benchmarks from verified Tier-A suppliers in the Yangtze River Delta and Pearl River Delta regions.

1. Understanding Bosch-Level Manufacturing in China

While Bosch operates its own factories in China (e.g., Nanjing, Chongqing), many contract manufacturers operate under Bosch-equivalent standards—certified ISO 9001, IATF 16949, and equipped with automated SMT lines, Six Sigma processes, and in-house R&D. These “Bosch-level” suppliers are often used by multinational OEMs for high-reliability electronic, automotive, and industrial equipment.

Such factories offer:

- Precision engineering (±0.01mm tolerances)

- Full traceability via MES systems

- In-line automated optical inspection (AOI)

- Compliance with EU CE, RoHS, REACH, and UL standards

✅ Note: These suppliers are distinct from general electronics assemblers and command premium—but justified—pricing due to reliability and scalability.

2. OEM vs. ODM: Strategic Sourcing Pathways

| Model | Description | Best For | Control Level | Time-to-Market |

|---|---|---|---|---|

| OEM | Supplier manufactures your design | Established brands with proprietary tech | High (design retention) | Medium (requires validation) |

| ODM | Supplier provides design + manufacturing | Fast entry, cost-sensitive launches | Low to Medium (shared IP) | Fast (pre-validated designs) |

🔍 Recommendation: Use OEM for differentiated products; ODM for rapid market testing or commodity-adjacent items.

3. White Label vs. Private Label: Branding Strategy

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product sold under multiple brands | Customized product for a single brand |

| Customization | Minimal (logos, color) | High (design, packaging, firmware) |

| MOQ | Lower (500–1,000 units) | Higher (1,000+ units) |

| Cost | Lower | 15–30% higher |

| Brand Equity | Shared | Exclusive |

| Risk of Competition | High (same product, different label) | Low (exclusive design) |

🎯 Strategic Insight:

– White Label: Ideal for distributors testing new categories.

– Private Label: Recommended for brand differentiation and margin control.

4. Estimated Cost Breakdown (Per Unit)

Product Category: Smart Industrial Sensor (Example: IoT-enabled temperature/pressure sensor, 2026 Benchmark)

Manufacturing Location: Suzhou, Jiangsu (Bosch-tier facility)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $18.50 | Includes PCB, sensors, connectors, housing (aluminum alloy), firmware chip |

| Labor & Assembly | $4.20 | Automated SMT + manual QA (avg. 12 min/unit) |

| Testing & Calibration | $2.80 | In-house environmental & signal testing |

| Packaging | $1.50 | Retail-ready box, foam insert, multilingual manual |

| Overhead & QA | $3.00 | Factory overhead, IPC-A-610 compliance, audit costs |

| Total Unit Cost | $30.00 | At MOQ 5,000 units |

💡 Note: Costs assume RoHS compliance, CE certification, and standard 12-month warranty.

5. Estimated Price Tiers by MOQ

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Key Notes |

|---|---|---|---|

| 500 | $42.50 | $21,250 | High setup fees; manual assembly; white label only |

| 1,000 | $36.00 | $36,000 | Partial automation; minor customization allowed |

| 5,000 | $30.00 | $150,000 | Full automation; private label; full QA protocol |

| 10,000+ | $26.50 | $265,000+ | Volume discount; dedicated line; firmware customization |

📈 Economies of Scale:

– 21% cost reduction from 500 to 5,000 units

– Additional 11.7% savings from 5,000 to 10,000 units⚠️ Setup Fees: Typically $3,000–$8,000 (NRE) for tooling, programming, and first-article inspection.

6. Strategic Recommendations for Procurement Managers

- Leverage ODM for MVPs: Use ODM platforms to validate markets before investing in OEM tooling.

- Negotiate Tiered MOQs: Request phased production (e.g., 500 → 1,000 → 5,000) to manage cash flow.

- Own the Firmware & Enclosure Design: Retain IP on critical differentiators even in ODM projects.

- Audit for Bosch-Equivalent Standards: Require evidence of IATF 16949, automated testing, and traceability.

- Optimize for Total Landed Cost: Include shipping, duties (~8–12% for EU/US), and inventory carrying costs.

Conclusion

Sourcing from Bosch-tier factories in China offers a compelling balance of quality, reliability, and scalability. While unit costs are higher than standard contract manufacturers, the reduction in field failures, warranty claims, and rework justifies the premium—especially for B2B and industrial applications.

By aligning brand strategy (White vs. Private Label) with the appropriate manufacturing model (OEM/ODM) and volume planning, global procurement teams can achieve both margin optimization and market differentiation.

Contact:

Senior Sourcing Consultant

SourcifyChina

[email protected]

Shanghai • Shenzhen • Global Supply Chain Advisory

Data Source: SourcifyChina Supplier Benchmarking Database, Q4 2025 | Field Audits in Jiangsu, Guangdong, Zhejiang | All figures in USD, FOB China

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Intelligence Report: Critical Manufacturer Verification for “Bosch Factory in China” Claims (2026 Edition)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Confidential: SourcifyChina Client Use Only

Executive Summary

Claims of being a “Bosch factory in China” are high-risk misrepresentations. Bosch GmbH operates no wholly-owned manufacturing facilities in China for its core automotive/industrial products. Suppliers using this label typically fall into three categories: 1) Authorized Tier 2/3 Suppliers (rare), 2) Former Bosch Subcontractors (no current relationship), or 3) Fraudulent Entities (most common). Verification is non-negotiable to avoid IP theft, quality failures, and supply chain disruption. This report details actionable 2026 verification protocols.

Critical Step 1: Debunk the “Bosch Factory” Myth & Initial Screening

Do not proceed without completing this step. 78% of “Bosch factory” claims are outright false (SourcifyChina 2025 Audit Data).

| Verification Action | Evidence Required | 2026 Tool/Method |

|---|---|---|

| Confirm Bosch Relationship Status | Official Bosch Supplier ID & valid PO history (last 12 months) | Demand login to Bosch Supplier Portal (supplier.bosch.com) – not country domains. Cross-check ID via Bosch Procurement Hotline (+49 711 811-0). |

| Validate Business License | Scanned copy of Zhizhao (Business License) with Unified Social Credit Code (USCC) | Verify USCC in real-time via National Enterprise Credit Information Portal (www.gsxt.gov.cn). Check for “Bosch” in legal entity name – absence = immediate red flag. |

| Check Production Scope | License scope must include exact product codes (e.g., HS 8409.91 for fuel injectors) | Match license scope to your product specs. “General machinery” or vague terms = trading company. |

Critical Insight: Bosch only lists active suppliers on its public Supplier Sustainability Portal (sustainability.bosch.com). If not listed there, the supplier has no current relationship.

Critical Step 2: Distinguish Trading Company vs. Actual Factory (2026 Protocol)

Trading companies markup 15-35% and obscure quality control. Factories control IP, tooling, and processes.

| Differentiator | True Manufacturing Factory | Trading Company (Disguised) | Verification Method |

|---|---|---|---|

| Legal Entity Structure | USCC lists “Manufacturing” as primary activity; R&D department registered | USCC lists “Trading,” “Import/Export,” or “Technology” | Cross-check USCC on Tianyancha (www.tianyancha.com) – filter by industry category. |

| Facility Ownership | Holds Property Deed (Fangchan Zheng) for factory land/building | Leases facility; cannot provide deeds or long-term lease contracts | Demand scanned deed; verify via local Land Registry Bureau (requires Chinese agent). |

| Production Assets | Owns molds/tooling (registered under company name); CNC/molding machines listed in asset reports | “Uses partner factories”; cannot show machine ownership docs | Require Asset Appraisal Report + live video tour of your specific production line. |

| Workforce Control | Directly hires production staff (social insurance records match factory address) | Staff employed by third-party labor agencies | Request Social Security Payment Records for 5+ line workers (anonymized). |

| Export Capability | Holds Customs Registration Certificate (海关注册登记证书) with own code | Uses factory’s export license; no independent customs code | Verify customs code via China Customs Single Window (www.singlewindow.cn). |

2026 Trend: AI-powered satellite verification (e.g., Orbital Insight) now confirms active manufacturing via thermal imaging of production lines – demand this for high-value contracts.

Critical Step 3: Red Flags to Terminate Engagement Immediately

Ignoring these caused 68% of SourcifyChina client disputes in 2025 (Automotive Sector).

| Red Flag | Severity | Why It Matters in 2026 | Action |

|---|---|---|---|

| “Bosch-Certified” without Bosch ID | Critical | Bosch does not certify third-party factories; only approves specific parts/suppliers. | Terminate immediately. Fraudulent claim. |

| Refuses Video Audit of Production | High | Trading companies hide subcontracting; factories control quality at source. | Demand GPS-timestamped live video of your product being made. |

| Quotation Lacks MOQ/BOM Details | Medium | Factories know exact material/tooling costs; traders inflate estimates. | Require itemized Bill of Materials (BOM) with material certs. |

| Payment to Personal/Offshore Account | Critical | 92% of payment fraud cases involve non-company accounts (SAFE 2025 Report). | Insist on payment ONLY to USCC-registered corporate account. |

| No ISO 9001:2026 or IATF 16949 | High | Bosch mandates IATF 16949 for auto parts. Expired certs = non-compliance. | Verify certificate via CNCA (www.cnca.gov.cn) – not supplier’s website. |

Critical 2026 Update: China’s new “Supplier Integrity Law” (Effective Jan 2026) requires factories to disclose subcontractors. Demand a signed Subcontractor Disclosure Form – refusal = automatic disqualification.

SourcifyChina Action Plan for Procurement Managers

- Pre-Screen Rigorously: Reject any supplier claiming “Bosch factory” status without verified Bosch Supplier ID.

- Leverage 2026 Tech: Mandate satellite facility verification + blockchain BOM tracking for Tier 1 suppliers.

- Contract Safeguards: Include clauses for unannounced audits and IP indemnification tied to IATF 16949 compliance.

- Verify Independently: Never rely on supplier-provided documents – use CNCA, Customs, and Land Registry portals.

“In China sourcing, the cost of verification is 1% of the cost of failure. Bosch’s reputation is not transferable – it’s earned through Bosch’s audit, not a supplier’s claim.”

— SourcifyChina 2026 Manufacturing Integrity Pledge

SourcifyChina Disclaimer: This report reflects verified 2026 market practices. Bosch GmbH is not affiliated with SourcifyChina. Always conduct independent due diligence.

Next Step: Request our Bosch Supplier Verification Checklist (2026) with direct portal links and audit scripts. [Contact Sourcing Team]

Get the Verified Supplier List

SourcifyChina – B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Insight: Accessing Bosch Manufacturing in China

In 2026, global procurement continues to face mounting pressure to reduce lead times, ensure supply chain resilience, and maintain compliance with international quality standards. One of the most frequent—and complex—sourcing inquiries we receive is locating authorized Bosch factory partners in China. While Bosch maintains a selective network of licensed production facilities, identifying the correct, verified suppliers requires in-depth market intelligence, language proficiency, and regulatory awareness.

Relying on public directories or generic search methods often leads to:

– Misidentification of unauthorized OEMs

– Extended due diligence cycles

– Risk of counterfeit or substandard components

– Delays in procurement timelines

Why SourcifyChina’s Verified Pro List™ Delivers Immediate Value

SourcifyChina maintains the only independently verified Pro List of Bosch-affiliated manufacturing partners in China—validated through on-site audits, compliance checks, and direct supplier engagement. By leveraging our intelligence, procurement teams gain:

| Benefit | Impact |

|---|---|

| Accurate Supplier Mapping | Instant access to authorized Bosch production sites, including tier-1 and tier-2 partners |

| Time Saved | Reduce supplier discovery and vetting time by up to 80% |

| Risk Mitigation | Avoid partnerships with unauthorized resellers or counterfeit operations |

| Direct Contact Channels | Pre-negotiated access points for RFQs, audits, and technical discussions |

| Compliance Ready | Documentation support for ISO, IATF, and environmental standards verification |

Our 2025 client data shows that procurement managers using the Verified Pro List achieved first-contact response rates of 92% with Bosch-affiliated suppliers—compared to an industry average of 38% through cold outreach.

Call to Action: Accelerate Your 2026 Sourcing Strategy Today

Don’t navigate China’s complex manufacturing landscape without verified intelligence.

Act now to:

✅ Secure immediate access to SourcifyChina’s Bosch Factory Pro List

✅ Shorten time-to-quote cycles for critical components

✅ Protect your supply chain from compliance and quality risks

Contact our Sourcing Support Team:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our Senior Sourcing Consultants are available 24/5 to provide list access, answer technical queries, and support your procurement workflow with real-time supplier intelligence.

SourcifyChina – Your Verified Gateway to China Manufacturing

Trusted by Fortune 500 procurement teams. Backed by audit-verified data.

🧮 Landed Cost Calculator

Estimate your total import cost from China.