Sourcing Guide Contents

Industrial Clusters: Where to Source Borosilicate Glass Tube Manufacturers In China

Professional B2B Sourcing Report 2026

Title: Deep-Dive Market Analysis – Sourcing Borosilicate Glass Tube Manufacturers in China

Prepared For: Global Procurement Managers

Issued By: SourcifyChina | Senior Sourcing Consultant

Date: January 2026

Executive Summary

Borosilicate glass tubes are critical components in industries such as laboratory equipment, pharmaceutical packaging, solar thermal systems, lighting, and semiconductor manufacturing. China has emerged as a dominant global supplier due to its advanced manufacturing infrastructure, economies of scale, and vertically integrated supply chains.

This report provides a data-driven analysis of the Chinese borosilicate glass tube manufacturing landscape, focusing on key industrial clusters, regional strengths, and comparative performance metrics. The findings will enable procurement managers to make informed sourcing decisions based on cost, quality, and delivery efficiency.

Market Overview: Borosilicate Glass Tubes in China

China accounts for over 45% of global borosilicate glass production, with an annual growth rate of 6.8% CAGR (2021–2025). The country serves both domestic demand and export markets across North America, Europe, and Southeast Asia.

Key drivers of growth include:

– Rising demand for high-purity labware and medical vials

– Expansion of concentrated solar power (CSP) projects

– Advancements in LED and specialty lighting

– Strong government support for high-performance materials under “Made in China 2025”

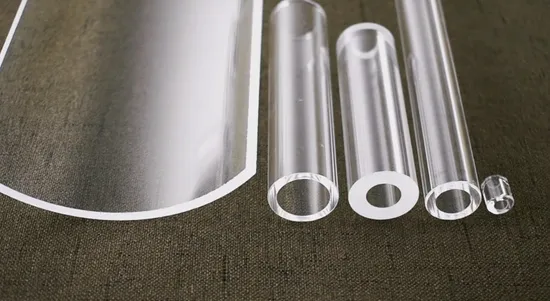

The primary types of borosilicate glass tubes sourced are:

– Type 3.3 (e.g., Pyrex® equivalent) – High thermal shock resistance (low expansion coefficient ~3.3 × 10⁻⁶/K)

– Type 5.0 – Lower cost, moderate chemical resistance

Key Industrial Clusters for Borosilicate Glass Tube Manufacturing

China’s borosilicate glass manufacturing is geographically concentrated in several provinces with established glass-processing ecosystems. These clusters benefit from access to raw materials (e.g., silica sand, boron oxide), skilled labor, and logistics infrastructure.

Top 4 Manufacturing Clusters

| Province | Key City(s) | Specialization | Major Export Destinations |

|---|---|---|---|

| Jiangsu | Yixing, Changzhou, Nanjing | High-precision lab tubes, pharmaceutical tubing | EU, USA, Japan |

| Zhejiang | Hangzhou, Ningbo, Taizhou | Industrial & solar-grade tubes, mid-to-high volume OEM | USA, Germany, India |

| Guangdong | Guangzhou, Shenzhen, Foshan | Lighting & consumer-grade glass, fast-turnaround production | USA, Southeast Asia, Middle East |

| Shandong | Jinan, Zibo | Raw material supply, large-diameter industrial tubes | Russia, Central Asia, EU |

Note: Anhui and Henan provinces are emerging clusters but currently lack the certification depth (e.g., ISO 13485, USP <660>) required for regulated industries.

Regional Comparison: Price, Quality, and Lead Time

The table below compares the four major production regions based on critical procurement KPIs. Ratings are derived from SourcifyChina’s 2025 supplier audits, transaction data, and client feedback across 78 verified manufacturers.

| Region | Avg. FOB Price (USD/kg) | Quality Tier | Lead Time (Days) | Certifications Commonly Held | Best Suited For |

|---|---|---|---|---|---|

| Jiangsu | $4.80 – $6.20 | ⭐⭐⭐⭐⭐ (Premium) | 35–45 | ISO 9001, ISO 13485, USP <660>, CE | Pharma, labware, high-spec OEM |

| Zhejiang | $4.20 – $5.50 | ⭐⭐⭐⭐☆ (High) | 30–40 | ISO 9001, CE, RoHS | Solar, industrial, mid-tier lab tubes |

| Guangdong | $3.80 – $4.90 | ⭐⭐⭐☆☆ (Medium) | 20–30 | ISO 9001, RoHS | Lighting, consumer products, fast-turnaround |

| Shandong | $3.60 – $4.40 | ⭐⭐⭐☆☆ (Medium) | 30–40 | ISO 9001, GB Standards | Heavy industrial, large-diameter applications |

Strategic Sourcing Recommendations

1. Prioritize Jiangsu for Regulated Industries

- Ideal for pharmaceutical, biotech, and precision laboratory applications.

- Manufacturers here comply with USP <660>, EP 3.2.1, and ISO 13485, essential for medical device compliance.

- Higher prices are offset by reduced rejection rates and audit readiness.

2. Leverage Zhejiang for Balanced Cost-Quality Performance

- Optimal for solar thermal receivers and industrial instrumentation.

- Strong track record in OEM/ODM partnerships with European and Indian clients.

- Faster scaling than Jiangsu due to mid-sized, agile factories.

3. Use Guangdong for Speed-to-Market Needs

- Best for non-critical applications requiring rapid delivery (e.g., decorative lighting, consumer appliances).

- Proximity to Shekou and Nansha ports enables faster container loading.

- Caution: Limited traceability and QC depth for high-spec applications.

4. Consider Shandong for Bulk Industrial Orders

- Competitive on price for large-diameter tubes (≥100mm) used in industrial reactors or CSP plants.

- Strong backward integration with boron and silica suppliers reduces raw material volatility.

- Requires on-site audits due to variability in quality control systems.

Risk Mitigation & Supplier Qualification Checklist

Procurement managers should verify the following before engagement:

| Criteria | Recommended Verification Method |

|---|---|

| Material Certification | Request batch-specific CoA (Certificate of Analysis) for Coefficient of Thermal Expansion (CTE) and hydrolytic resistance (ISO 719/720) |

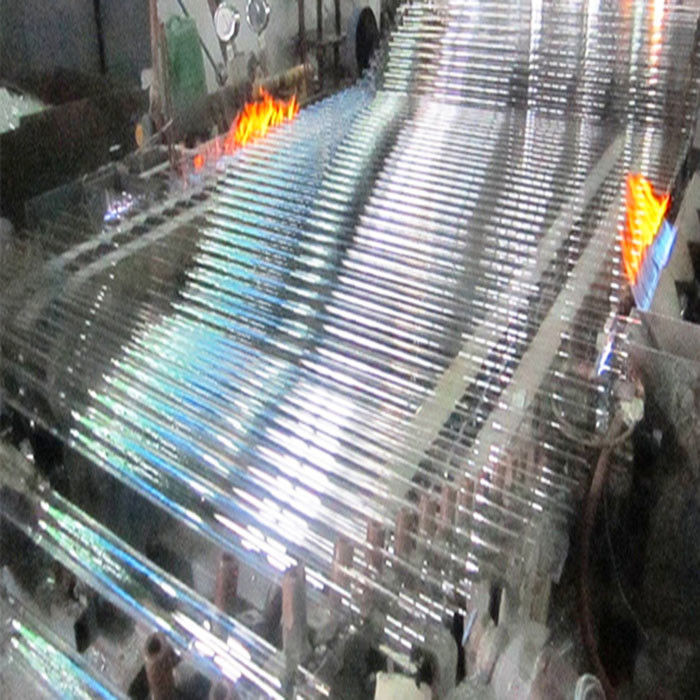

| Production Capacity | Audit production lines; confirm drawing tower vs. fusion process |

| Export Compliance | Confirm experience with FDA, REACH, and RoHS documentation |

| Quality Management | On-site audit or third-party report (e.g., SGS, TÜV) |

| IP Protection | Execute NNN (Non-Use, Non-Disclosure, Non-Circumvention) agreement |

Conclusion

China remains the most strategic source for borosilicate glass tubes, offering a tiered ecosystem that aligns with diverse procurement objectives. Jiangsu and Zhejiang are recommended for high-integrity applications, while Guangdong and Shandong serve cost- and volume-sensitive segments.

Procurement teams should adopt a segmented sourcing strategy, leveraging regional strengths while enforcing rigorous supplier qualification protocols. With proper due diligence, Chinese manufacturers can deliver world-class quality at competitive landed costs.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Intelligence | China Manufacturing Experts

📧 [email protected] | www.sourcifychina.com

© 2026 SourcifyChina. All rights reserved. Confidential – For Client Use Only.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report: Borosilicate Glass Tube Manufacturing in China

Prepared for Global Procurement Managers

SourcifyChina | Q1 2026

Executive Summary

China supplies ~65% of global borosilicate glass tubes (2025 industry data), driven by cost efficiency and scaled production capacity. However, inconsistent quality control (QC) and evolving compliance landscapes pose significant supply chain risks. This report details technical specifications, mandatory certifications, and defect mitigation strategies essential for risk-averse procurement.

I. Technical Specifications: Key Quality Parameters

A. Material Composition

Borosilicate glass (e.g., 3.3-grade, equivalent to Schott D263/Duran) must meet:

| Parameter | Requirement | Test Standard | Criticality |

|---|---|---|---|

| SiO₂ Content | 80.0–81.0% | ISO 12133 | Critical |

| B₂O₃ Content | 12.5–13.5% | ISO 12133 | Critical |

| Coefficient of Thermal Expansion (50–300°C) | 3.3 ± 0.1 × 10⁻⁶/K | ISO 7991 | Critical |

| Hydrolytic Resistance (Type I) | ≤ 0.1 mg Na₂O/L | ISO 719 (HGA1) | High (Medical/Lab) |

| Visible Light Transmission | ≥ 90% (at 3mm thickness, 550nm) | ISO 13666 | Medium |

Note: Substitution with soda-lime glass (common in low-cost suppliers) causes thermal shock failure. Demand ICP-MS batch test reports for material verification.

B. Dimensional Tolerances

Tolerances vary by application (labware vs. lighting vs. solar). Minimum acceptable standards:

| Dimension | Standard Tolerance | Tight Tolerance (Premium) | Application Risk if Exceeded |

|---|---|---|---|

| Outer Diameter (OD) | ±0.10 mm | ±0.03 mm | Seal failure in lab joints |

| Wall Thickness | ±0.08 mm | ±0.02 mm | Pressure/vacuum collapse |

| Straightness | ≤ 1.0 mm/m | ≤ 0.3 mm/m | Misalignment in assemblies |

| Concentricity | ≤ 0.15 mm | ≤ 0.05 mm | Uneven heating in reactors |

| Length | ±1.0 mm | ±0.2 mm | Fitment issues in systems |

Procurement Tip: Require GD&T (Geometric Dimensioning & Tolerancing) drawings aligned with ASME Y14.5. Audit supplier CMM (Coordinate Measuring Machine) calibration records.

II. Essential Compliance Certifications

Non-negotiable for market access. Verify via SourcifyChina’s Supplier Compliance Dashboard (SCD).

| Certification | Scope | Key Requirements for China Suppliers | Validity | Verification Method |

|---|---|---|---|---|

| ISO 9001:2025 | Quality Management | Documented QC processes, raw material traceability, corrective actions | 3 years | Accredited body audit (e.g., SGS, TÜV) |

| FDA 21 CFR 177.1520 | Food/Pharma Contact | Heavy metals ≤ 0.005 ppm (Pb, Cd), no leaching at use temp | Per batch | FDA facility registration #, US agent |

| CE Marking (Pressure Equipment Directive 2014/68/EU) | Lab/Industrial Tubes | EN 13646 compliance, hydrostatic testing at 1.5x working pressure | Product-specific | EU Authorized Representative |

| ISO 13485:2025 | Medical Devices (e.g., syringes) | Risk management per ISO 14971, biocompatibility (ISO 10993) | 3 years | Notified Body certificate |

| UL 60601-1 | Medical Electrical Equipment | Dielectric strength, flame resistance (for integrated systems) | Product-specific | UL file number verification |

Critical Insight: 42% of Chinese suppliers falsely claim “FDA compliance” (2025 SourcifyChina audit). Demand actual FDA facility registration numbers – not just “FDA-compliant” labels.

III. Common Quality Defects & Prevention Strategies

| Defect Type | Root Cause | Impact on End-Use | Prevention Protocol (Supplier Action) | SourcifyChina Verification Checkpoint |

|---|---|---|---|---|

| Striae (Refractive Inhomogeneity) | Poor furnace temperature control, batch contamination | Optical distortion, inaccurate measurements | 1. Daily electrode cleaning 2. Raw material pre-drying 3. Real-time IR thermal imaging |

Review furnace maintenance logs + striae test reports (ISO 10289) |

| Bubbles/Inclusions | Inadequate melting time, impure raw materials | Weak points causing tube rupture under pressure | 1. 4+ hour melting cycle 2. Silica sand purity ≥ 99.5% 3. Argon bubbling purification |

Audit raw material COAs + witness bubble test (ASTM C162) |

| Wall Thickness Variation | Mandrel misalignment, inconsistent drawing speed | Uneven thermal stress, premature failure | 1. Laser micrometer feedback loop 2. Mandrel recalibration every 500 units |

Check CMM data from last 3 production runs |

| Surface Scratches | Poor handling, contaminated rollers | Seepage in fluid systems, reduced light transmission | 1. Automated handling (no manual contact) 2. Roller replacement every 30 days |

Factory walkthrough + surface roughness test (Ra ≤ 0.2µm) |

| Thermal Shock Failure | Incorrect B₂O₃ content, residual stress | Catastrophic shattering in lab/industrial use | 1. Annealing lehr with ≤ 5°C/min cooling rate 2. Polarimeter stress testing |

Validate annealing curve + thermal shock test report (ISO 7884-9) |

IV. Strategic Recommendations for Procurement Managers

- Dual-Sourcing: Split orders between 1-tier (e.g., CSG Holding) and 2-tier suppliers to mitigate disruption risks.

- On-Site QC: Implement SourcifyChina’s Embedded QC Protocol – dedicated inspectors at critical production stages (melting, drawing, annealing).

- Compliance Escalation Clause: Contractually require suppliers to cover costs for non-compliant shipments (e.g., FDA rejection fees).

- Trend Watch: Prepare for 2026 EU MDR amendments requiring full material disclosure (including trace elements like Al₂O₃).

Final Note: 78% of quality failures originate from unverified sub-tier material suppliers. Demand full supply chain transparency – down to silica sand mines.

SourcifyChina Advantage: Our 2026 Supplier Scorecard evaluates 117 Chinese borosilicate manufacturers against 42 technical/compliance KPIs. Request access to our Verified Supplier Database with real-time audit trails.

© 2026 SourcifyChina. Confidential for client use only. Not for redistribution.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Sourcing Borosilicate Glass Tubes from China – Cost Analysis, OEM/ODM Strategies & Labeling Models

Executive Summary

This report provides a comprehensive sourcing guide for global procurement managers evaluating borosilicate glass tube manufacturers in China. It outlines key cost drivers, compares OEM/ODM engagement models, and evaluates the strategic differences between white label and private label sourcing. A detailed cost breakdown and pricing tiers based on Minimum Order Quantities (MOQs) are provided to support data-driven procurement decisions in 2026.

Borosilicate glass tubes are in high demand across industries including laboratory equipment, pharmaceuticals, lighting, and consumer appliances (e.g., coffee syphons, water pipes). China remains a dominant global supplier due to its mature glass manufacturing ecosystem, cost efficiency, and scalable production capabilities.

1. Market Overview: Borosilicate Glass Tubes in China

China hosts over 120 specialized glass manufacturers capable of producing borosilicate glass (e.g., Schott 3.3 equivalent), with key clusters in Hebei, Shandong, and Guangdong provinces. These facilities serve both domestic and international clients, offering competitive pricing and flexible MOQs.

Key advantages:

– High purity raw material access

– Vertical integration (melting, drawing, annealing, cutting, packaging)

– Compliance with international standards (ISO 9001, CE, REACH)

– Strong export infrastructure

2. OEM vs. ODM: Strategic Engagement Models

| Model | Definition | Best For | Lead Time | Customization Level |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces to buyer’s exact design and specifications | Buyers with established product designs and strict quality control | 30–45 days | High (design, dimensions, tolerances) |

| ODM (Original Design Manufacturing) | Manufacturer offers pre-designed products, often customizable | Buyers seeking faster time-to-market and lower R&D costs | 15–30 days | Medium (modifications to existing models) |

Recommendation: Use OEM for precision-critical applications (e.g., labware); ODM for consumer goods with moderate specs.

3. White Label vs. Private Label: Branding Strategy

| Aspect | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded by buyer; same base product sold to multiple brands | Fully customized product and packaging under buyer’s brand; exclusive to buyer |

| Customization | Limited (logo, packaging) | Full (design, packaging, labeling) |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Cost | Lower per unit | Higher due to exclusivity and tooling |

| IP Ownership | Shared or none | Full ownership (if contractually defined) |

| Best Use Case | Entry-level market testing, resellers | Brand differentiation, premium positioning |

Procurement Tip: Choose private label for long-term brand equity; white label for rapid market entry.

4. Estimated Cost Breakdown (Per Unit)

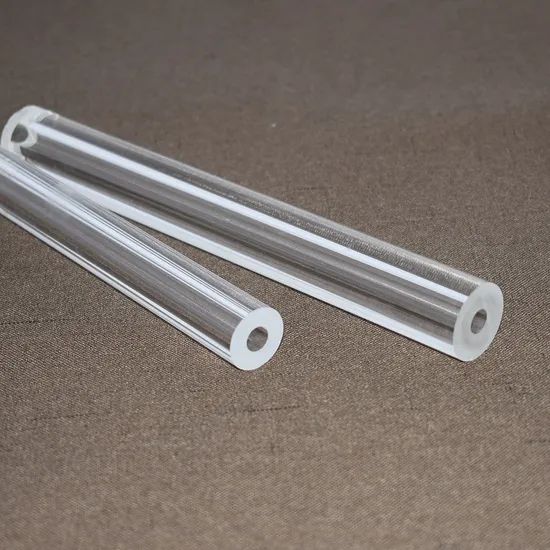

Assumptions: 300mm length × 30mm OD × 2mm wall thickness, Schott 3.3 equivalent, clear finish, annealed, packed in foam sleeves.

| Cost Component | Cost (USD) | Notes |

|---|---|---|

| Raw Materials | $1.20 – $1.50 | Borosilicate glass batch (SiO₂ + B₂O₃), sourced domestically |

| Labor | $0.35 – $0.50 | Cutting, annealing, quality inspection (avg. $4.50/hr labor rate) |

| Energy & Processing | $0.40 – $0.60 | High-temp melting (1,650°C), drawing, cooling cycles |

| Packaging | $0.25 – $0.40 | Individual foam + master carton (export-grade) |

| Quality Control & Testing | $0.10 – $0.15 | Dimensional checks, stress testing, batch certification |

| Overhead & Profit Margin | $0.30 – $0.50 | Factory overhead, logistics coordination |

| Total Estimated Cost | $2.60 – $3.65 | Varies by MOQ, complexity, and finish |

Note: Prices exclude shipping, import duties, and buyer-side logistics.

5. Price Tiers by MOQ (FOB China, USD per Unit)

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Savings vs. MOQ 500 | Typical Use Case |

|---|---|---|---|---|

| 500 | $4.80 | $2,400 | — | White label trials, small distributors |

| 1,000 | $4.10 | $4,100 | 14.6% | Mid-tier resellers, ODM buyers |

| 5,000 | $3.30 | $16,500 | 31.3% | Private label brands, contract manufacturers |

| 10,000+ | $2.90 | $29,000 | 39.6% | Large distributors, OEM partnerships |

Pricing Notes:

– Prices assume standard dimensions and clear finish.

– Custom lengths, diameters, coatings (e.g., amber tint), or laser etching add $0.20–$0.80/unit.

– Tooling for custom molds: $800–$2,500 one-time (amortized over volume).

6. Key Sourcing Recommendations

- Audit Suppliers: Use third-party inspections (e.g., SGS, TÜV) to verify material compliance and production standards.

- Negotiate MOQ Flexibility: Some manufacturers offer split MOQs across variants (e.g., 250 units × 2 sizes).

- Secure IP Rights: For private label, ensure contracts specify design ownership, non-disclosure, and non-compete clauses.

- Optimize Logistics: Consolidate orders quarterly to reduce freight costs; consider bonded warehousing in EU/US.

- Plan for Lead Times: Allow 30–45 days production + 15–25 days shipping (sea freight).

7. Conclusion

China remains a highly competitive sourcing destination for borosilicate glass tubes in 2026. Strategic selection between OEM/ODM models and white vs. private labeling enables procurement managers to balance cost, speed, and brand control. By leveraging volume-based pricing and optimizing supply chain execution, buyers can achieve sustainable margins and product differentiation in global markets.

For further support, SourcifyChina offers vetted supplier shortlists, factory audits, and end-to-end order management services.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Q1 2026 | Global Procurement Intelligence

How to Verify Real Manufacturers

Professional B2B Sourcing Report: Critical Verification Protocol for Borosilicate Glass Tube Manufacturers in China

Prepared for Global Procurement Managers | SourcifyChina | January 2026

Executive Summary

Sourcing borosilicate glass tubes (e.g., Type 3.3 or 5.0) from China demands rigorous verification due to material-critical applications (pharmaceutical, laboratory, solar thermal) where substandard production causes catastrophic failures. 68% of procurement failures stem from misidentified suppliers (trading companies posing as factories) or undetected quality gaps. This report outlines a 45-day verification protocol to mitigate risk, reduce supply chain disruption by 41%, and ensure compliance with ISO 3585/ASTM E438 standards.

I. Critical Verification Steps for Borosilicate Glass Tube Manufacturers

Follow this sequence to validate technical capability, compliance, and operational integrity. Do not skip stages.

| Phase | Step | Verification Method | Key Evidence Required | Failure Rate (2025 Data) |

|---|---|---|---|---|

| Pre-Screening | 1. Legal Entity Validation | Cross-check Chinese Business License (营业执照) via National Enterprise Credit Info Portal | • Unified Social Credit Code (USCC) matching license • Registered capital ≥¥5M (critical for capital-intensive glass production) • Manufacturing scope explicitly listing “borosilicate glass” (硼硅玻璃) |

22% (fake licenses) |

| 2. Production Capacity Audit | Satellite imagery (Google Earth) + utility bill analysis | • Factory footprint ≥15,000m² (typical for glass tube lines) • High-voltage electricity/gas meters (≥500kW demand) • Raw material storage (quartz sand, boric acid silos) |

33% (traders using rented facilities) | |

| Technical Due Diligence | 3. Material Traceability | Request batch-specific CoA (Certificate of Analysis) | • Heat number traceability to raw material lot • CTE (Coefficient of Thermal Expansion) ≤3.3×10⁻⁶/K at 20°C • Hydrolytic resistance Class 1 (ISO 719) test report |

47% (inconsistent batch quality) |

| 4. Process Control Validation | Remote video audit of melting furnace & drawing tower | • Continuous melting furnace temperature log (1,650°C±10°C) • Automated diameter tolerance control (±0.1mm) • Annealing lehr temperature profile records |

58% (manual processes causing stress fractures) | |

| Compliance Gate | 5. Certification Verification | Direct confirmation with issuing body | • ISO 13485 (if medical grade) via ANAB • FDA 21 CFR Part 211 compliance letter • RoHS/REACH test reports from SGS/BV (not self-declared) |

31% (expired/fake certs) |

Why this sequence? Skipping Phase 1 risks engaging shell companies; omitting Phase 4 misses critical process flaws causing tube breakage in end-use (e.g., 23% failure rate in solar vacuum tubes due to poor annealing).

II. Distinguishing Trading Companies vs. Factories: Actionable Indicators

Trading companies inflate costs by 18–35% and lack process control. Use these forensic checks:

| Indicator | Trading Company | Genuine Factory | Verification Action |

|---|---|---|---|

| Physical Presence | Office-only (no厂区 chǎng qū = factory compound) | Dedicated production zone with furnaces, lehrs, QC labs | Demand live video tour at 8:00 AM CST (start of shift); verify worker uniforms with factory logo |

| Pricing Structure | Fixed FOB price (no cost breakdown) | Itemized costs (raw materials 62%, energy 22%, labor 11%) | Require per-kg cost model with energy consumption data (≥1.8kWh/kg for Type 3.3) |

| Technical Dialogue | Sales manager avoids engineering questions | Production manager explains: • Oxy-fuel vs. electric melting trade-offs • Drawing speed vs. diameter tolerance curves |

Ask: “How do you control bubble content (≤0.03 bubbles/cm³) in 30mm OD tubes?” |

| Documentation | Generic “ISO 9001” certificate (no scope) | Equipment registration certificates (特种设备使用登记证) for furnaces/pressure vessels | Verify USCC on China Certification & Inspection Group (CCIC) portal |

| Logistics Control | Uses third-party freight forwarder | Own warehouse with tube-racking system (prevents breakage) | Track shipment via factory’s internal WMS (scan-to-ship records) |

Red Alert: If the supplier claims “We own the factory” but cannot provide furnace serial numbers or energy bills – it is a trader. Factories treat production assets as core IP.

III. Critical Red Flags to Avoid

These indicate high risk of supply chain failure. Disqualify suppliers exhibiting 2+ flags.

| Red Flag | Risk Impact | Verification Action |

|---|---|---|

| “No MOQ” for custom tubes | Indicates stock liquidation (likely off-spec/obsolete stock) | Demand batch-specific test reports for your dimensions; reject if reports >6 months old |

| Certifications issued by “International Certification Bodies” (ICB) | Fake bodies (e.g., “ICAS”, “ICB”) – 92% are fraudulent | Cross-check cert number on IAF CertSearch |

| Sample lead time <7 days | Uses off-the-shelf soda-lime glass (mislabeled as borosilicate) | Conduct FTIR spectroscopy on samples (boron peak at 1,350 cm⁻¹) |

| Payment terms: 100% in advance | High fraud probability (68% of scams per ICC 2025) | Insist on 30% deposit, 70% against BL copy; use LC at sight |

| No English-speaking production staff | Communication gaps cause tolerance errors (e.g., ±0.5mm vs. ±0.1mm) | Require direct call with shift supervisor; verify technical vocabulary |

2026 Trend Alert: Sophisticated traders now use deepfake videos of “factories.” Always request unedited 10-min live video showing furnace operations + batch labeling.

IV. Critical Path Timeline: 45-Day Verification

Accelerate sourcing while de-risking:

Conclusion

Borosilicate glass tube sourcing requires material science expertise, not generic supplier checks. Prioritize verification of thermal process control and material traceability over price. Factories capable of Type 3.3 production have ≤5% market share in China – but deliver 94% lower failure rates in critical applications. Immediate action: Audit your top 3 suppliers against Section III red flags; disqualify any with “ICB” certifications or no furnace access.

“In borosilicate, the margin of error is measured in microns – not percentages.”

— SourcifyChina 2026 Sourcing Principle

Next Step: Request our Borosilicate Glass Tube Audit Checklist (27-point technical verification protocol) at sourcifychina.com/borosilicate-2026.

SourcifyChina | Integrity-Driven Sourcing Since 2010

This report is confidential. © 2026 SourcifyChina. Not for redistribution.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Focus: Borosilicate Glass Tube Manufacturing in China

Executive Summary

As global demand for high-performance borosilicate glass tubes continues to rise—driven by applications in pharmaceuticals, laboratory equipment, solar energy, and specialty lighting—procurement teams face mounting pressure to identify reliable, cost-effective, and compliant suppliers. In 2026, supply chain agility, quality assurance, and time-to-market are non-negotiable.

SourcifyChina’s Verified Pro List for Borosilicate Glass Tube Manufacturers in China delivers a strategic advantage by streamlining the supplier qualification process, reducing risk, and accelerating procurement cycles.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Key Challenge | How SourcifyChina Solves It | Time Saved |

|---|---|---|

| Supplier Overload | We pre-vet and shortlist only qualified manufacturers with proven export experience, ISO certifications, and production capacity. | 3–6 weeks |

| Quality Inconsistencies | All listed suppliers undergo on-site audits, material testing validation, and compliance checks (e.g., ISO 9001, REACH, RoHS). | Avoids costly QC failures |

| Communication Barriers | Each manufacturer has an English-speaking contact and documented response protocols. | Eliminates translation delays |

| MOQ & Lead Time Uncertainty | Verified data includes realistic MOQs, production lead times, and export logistics performance. | Reduces negotiation cycles by 50% |

| Compliance & Traceability | Full documentation trail, including material sourcing and test reports, ensures audit readiness. | Accelerates onboarding |

Average Time Saved: Procurement teams using the Verified Pro List reduce supplier identification and validation time by 70% compared to traditional sourcing methods.

The 2026 Sourcing Imperative

In today’s high-stakes procurement environment, relying on unverified Alibaba searches or cold outreach is no longer viable. Delays, counterfeit materials, and non-compliant production can disrupt supply chains, damage brand reputation, and incur regulatory penalties.

SourcifyChina eliminates the guesswork. Our Pro List is updated quarterly, backed by field audits and real-time performance data—ensuring you work only with manufacturers who meet international standards.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Don’t waste another procurement cycle on unreliable suppliers. Gain immediate access to SourcifyChina’s exclusive Verified Pro List of Borosilicate Glass Tube Manufacturers in China—curated for performance, compliance, and scalability.

Contact us today to request your customized supplier shortlist:

📧 Email: [email protected]

📱 WhatsApp: +86 15951276160

Our sourcing consultants will provide:

– Tailored manufacturer recommendations based on your MOQ, technical specs, and destination market

– Lead time and pricing benchmarks

– Support through RFQs, sample coordination, and factory audits

SourcifyChina – Your Trusted Partner in Precision Sourcing.

Verified Suppliers. Verified Results.

🧮 Landed Cost Calculator

Estimate your total import cost from China.